Anda mungkin suka

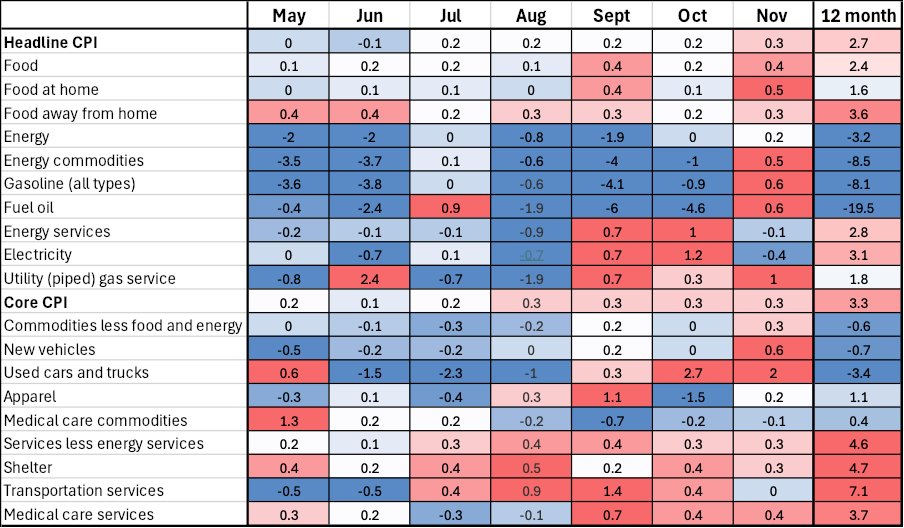

US CPI SUMMARY⚠️ Whatever way you want to look at it, inflation progress as measured by CPI seems to have stalled. 3 month annualized rates for both core and headline inflation are well above the 2% target (and rising) and 6 month annualized readings are also picking up. Was…

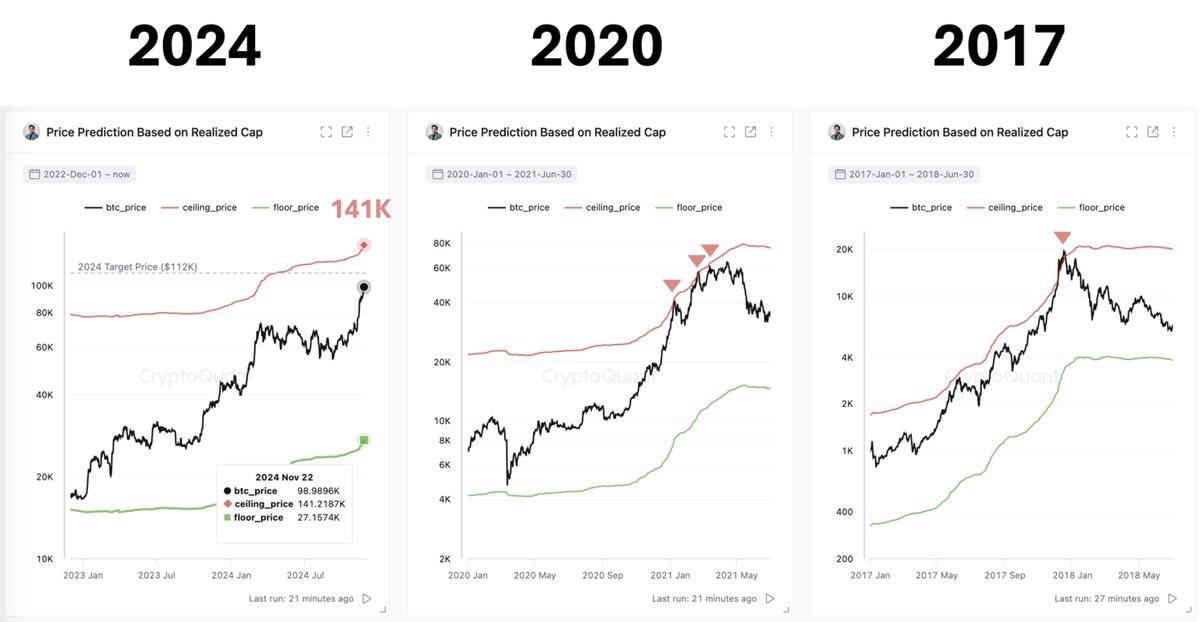

#Bitcoin market seems too early to call a bubble. The market cap hasn’t increased significantly relative to cumulative on-chain capital inflows. Based on the current realized cap, it could rise to $141K. The realized cap has been steadily increasing every day.

When Bitcoin hits $100,000 I will give 1 BTC to one person who follows me. The rules are simple: - like this tweet, follow me and RT - comment “100k incoming” Let’s go! $BTC #bitcoin

Tonight or tomorrow morning, think of a decision you’ve been putting off, and challenge the fuzzy “what ifs” holding you hostage. If not now, when? If left at the status quo, what will your life and stress look like in 6 months? In 1 year? In 3 years? Who around you will also…

What is Stock to Flow? - explained simple Imagine you have a collection of baseball cards. The S2F model is like a way to measure how rare and valuable your cards might be. Stock: This is the total number of cards you have in your collection (all the baseball cards you own).…

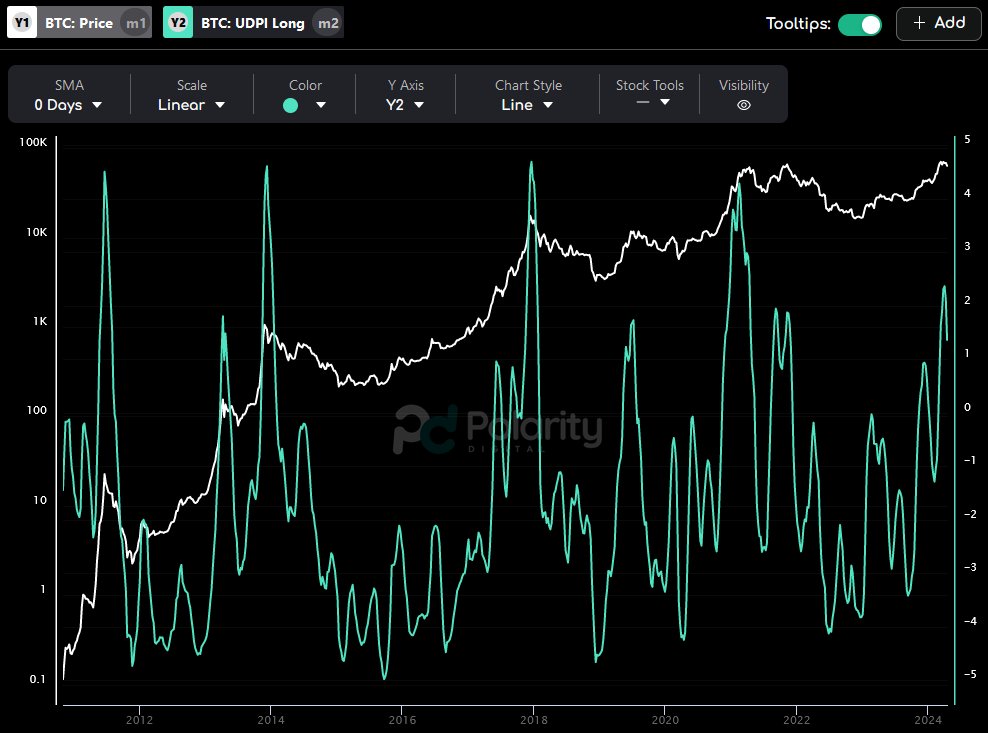

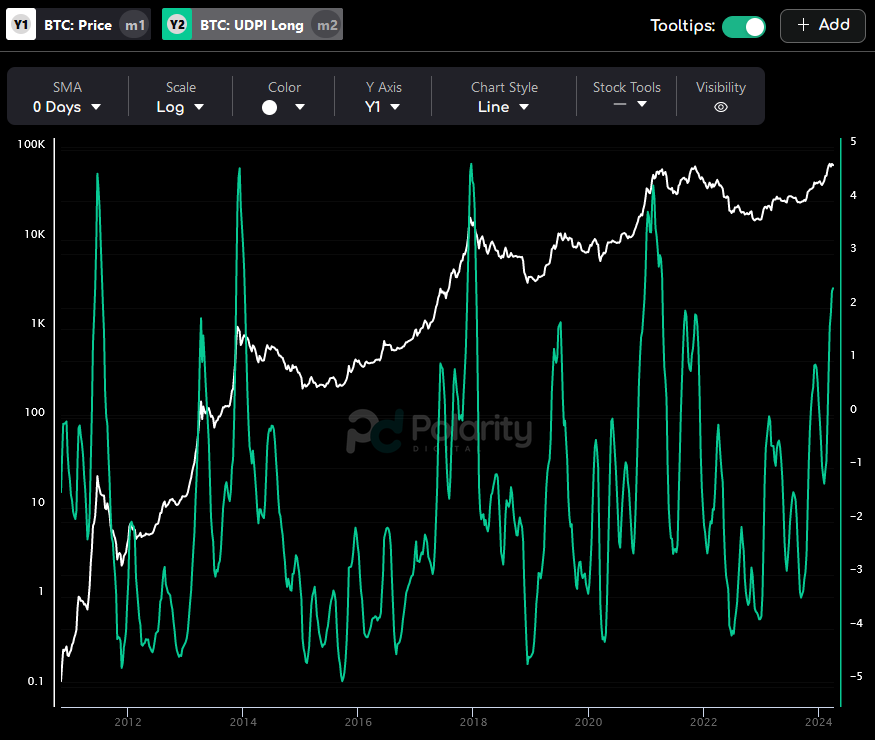

$BTC's long-term risk continues to cool off according to our UDPI risk model. Definitely good to see, though I'd personally like to see it cool off further before getting too confident about another sustainable push up. #Bitcoin

New: The Week in Charts📈 -Inflation Heating Up -Most Absurd # in CPI -The Higher for Longer Impact -Fast Food Isn't Cheap Anymore -The Start of a Correction? -And More... youtube.com/watch?v=C-Ddoo…

youtube.com

YouTube

The Start of a Correction? | The Week in Charts (4/12/24) | Charlie...

The mechanics of a #Bitcoin correction can be visualised, in full colour using onchain data. We can see smart money taking profits, and lettuce hands buying high, and selling low. A quick and fun video covering yesterdays dip 👇 youtu.be/3m2y1EtFinU?fe…

youtube.com

YouTube

Bitcoin Retests 60k Support Level Before The 2024 Halving (Onchain...

#Bitcoin Pre-halving Dip or Doom? In this market check-in, we will investigate whether the strong hands are holding firm, and if the fast money lettuce hands are panic selling the lows. Newsletter: newsletter.checkonchain.com/p/dip-or-doom

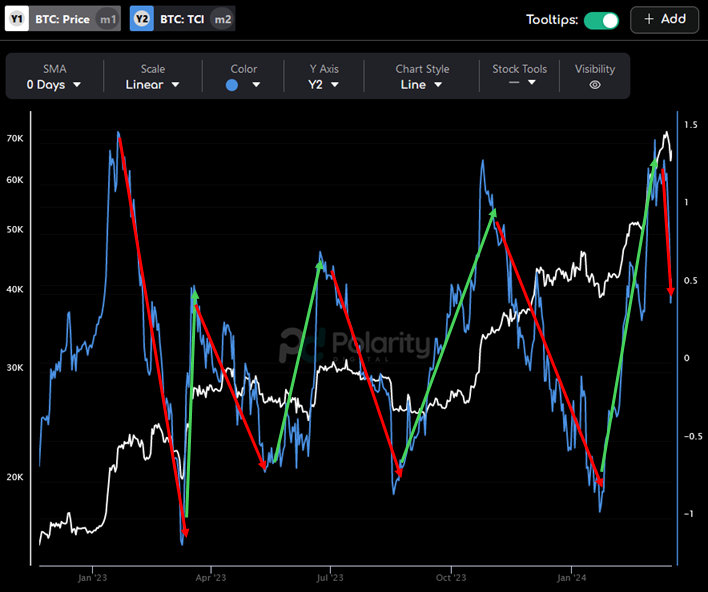

$BTC's Trend Confidence Indicator (TCI) is still trending down, suggesting continued weakness. Until we see it reverse, I won't be getting too excited. If we avoid further downside, more sideways consolidation is probably the best we can hope for. #Bitcoin

$BTC's Trend Confidence Indicator (TCI) has started to trend back down aggressively. This suggests that the recent #Bitcoin uptrend is weakening or has started to reverse. Until we see the TCI start to trend back up I would not be surprised to see $BTC continue to consolidate.

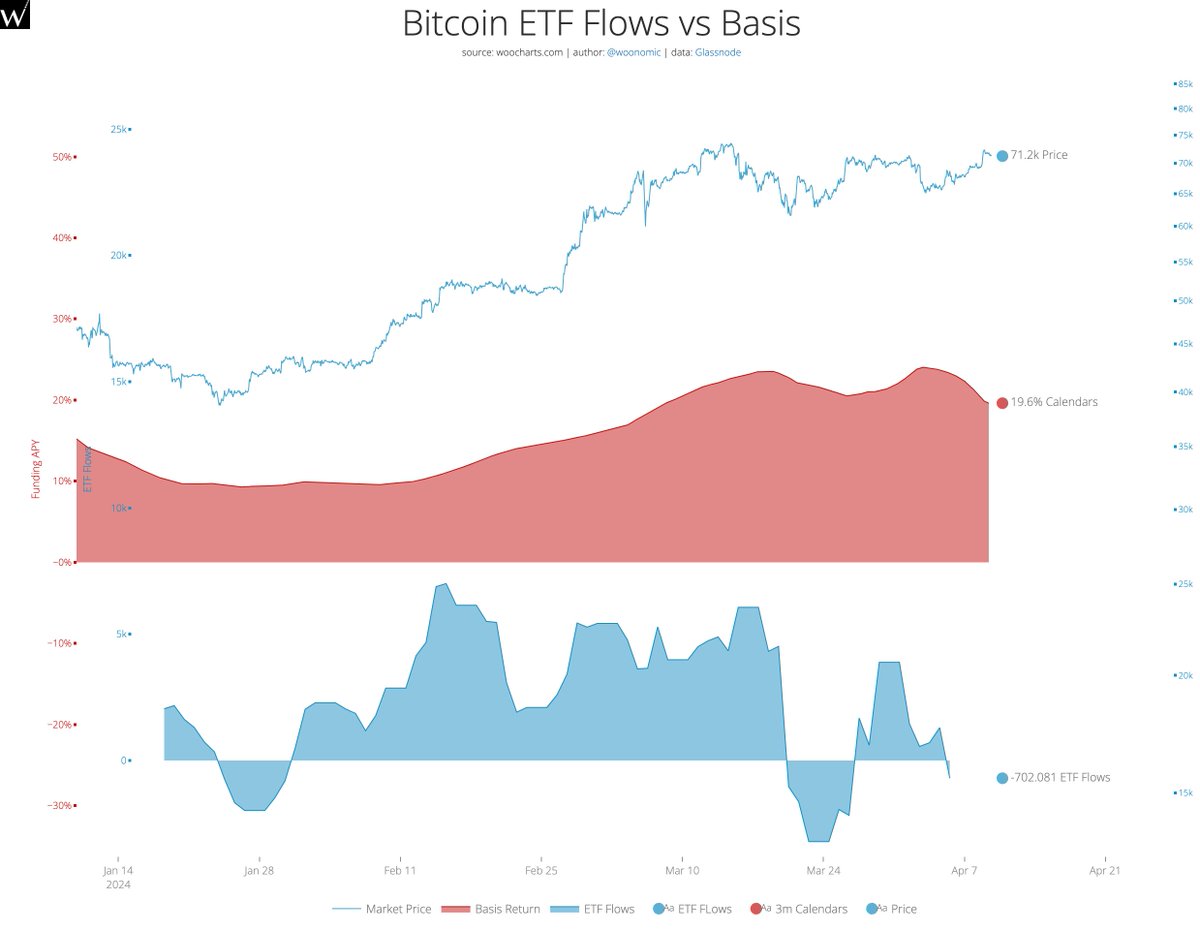

Everyone gets excited over ETF inflows thinking they are new investors, this is incorrect. There's a carry trade between CME futures and Spot ETFs. Hedge funds temporarily buy the ETF to hedge their carry trade. There's outflows when they unwind their positions as yields drop

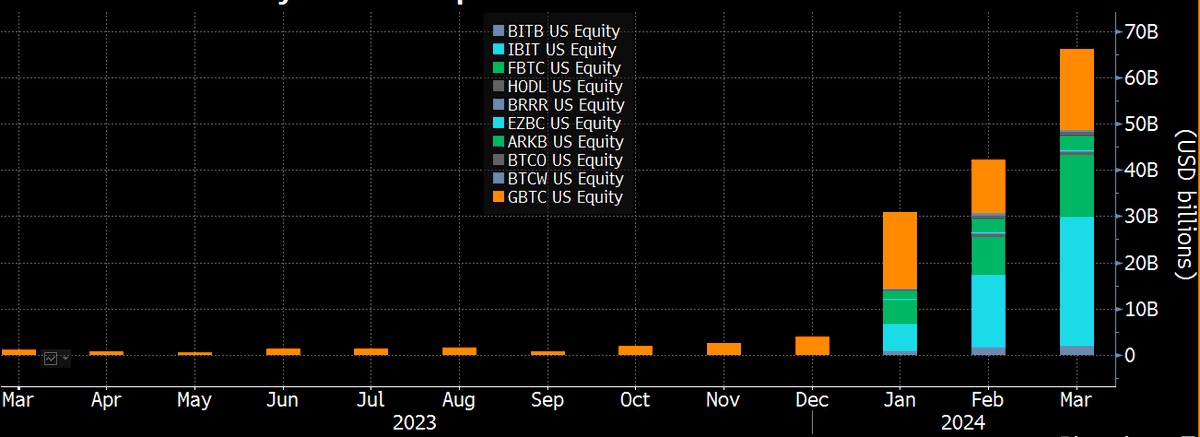

How Big are the #Bitcoin ETFs Anyway? Latest @_checkonchain analysis is live, and we're addressing two key questions I've received a lot lately: 1) How big is the impact of the ETFs? 2) Is $GBTC really Long-Term Holder supply? Enjoy folks! youtube.com/watch?v=ExF8Nq…

For all of you that really want to understand the #Bitcoin ETF flows and ignore the narratives, no one does it better than @_Checkmatey_. I highly recommend you watch this video.

How Big are the #Bitcoin ETFs Anyway? Latest @_checkonchain analysis is live, and we're addressing two key questions I've received a lot lately: 1) How big is the impact of the ETFs? 2) Is $GBTC really Long-Term Holder supply? Enjoy folks! youtube.com/watch?v=ExF8Nq…

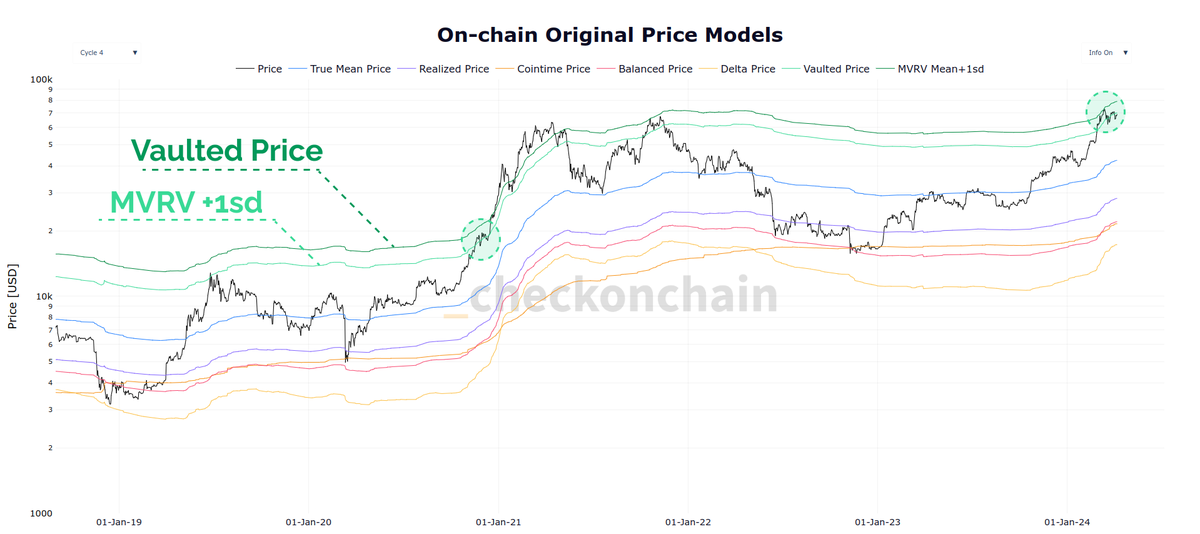

#Bitcoin is trading just below the upper pricing bands of the Onchain Originals, defined by MVRV+1sd and Vaulted Price. The last time we were at these levels was December 2020...and...well...we all know where this goes. This chart is collection of many of the OG Onchain pricing…

We're still in wait and see mode for #Bitcoin I think. Long-term risk remains elevated. I'd like to see this fall before thinking another push up is likely to be sustainable.

Tracking #Bitcoin market momentum can be challenging given the volatility Many moons ago, I developed the MVRV Gradient Oscillators, which track how 'vertical' price is relative to capital inflows Fresh @_checkonchain video, hot off the press! youtube.com/watch?v=OMVV2t…

ICYMI: we just released our latest @_checkonchain video exploring the tools I watch to turn #Bitcoin dips into opportunities. A combination of funding rates, SOPR and MVRV helps identify when things have cooled off, and STHs are selling at the wrong time youtu.be/M9_a-H06YBc?si…

youtube.com

YouTube

Tools To Track Bitcoin Dips | Futures Funding Rates, MVRV, SOPR,...

According to $BTC Net Taker Volume, the selling power is reducing, which gives room for a bounce. cryptoquant.com/community/dash…

Episode 1! The #Bitcoin thesis. All feedback is welcomed. Likes/shares are appreciated.

Here's monthly volume for the ten btc ETFs. March is only half over but has already smashed the numbers from Feb and Jan w/ $65b.

United States Tren

- 1. #SmackDown N/A

- 2. #DragRace N/A

- 3. UConn N/A

- 4. St. John N/A

- 5. #TheLastDriveIn N/A

- 6. Olympics N/A

- 7. #OPLive N/A

- 8. Pistons N/A

- 9. Kit Wilson N/A

- 10. #MutantFam N/A

- 11. Celtics N/A

- 12. Obamas N/A

- 13. Brunson N/A

- 14. Jordynne N/A

- 15. Athena N/A

- 16. $BULLISH N/A

- 17. Lion King N/A

- 18. Rick Pitino N/A

- 19. Giulia N/A

- 20. Mariah Carey N/A

Anda mungkin suka

-

Light_the_Way

Light_the_Way

@Light_the_Way73 -

ChallengeDAC

ChallengeDAC

@ChallengeDac -

Tyler Johnson

Tyler Johnson

@Crypto2424 -

tolikfox

tolikfox

@tolikfox -

IVASON GALLOWAY

IVASON GALLOWAY

@IVASON -

Maynard Maleon

Maynard Maleon

@MaynMan1 -

Jαy

Jαy

@Jayden_Hanna_ -

Pyro_Abstract 🔥⚖️

Pyro_Abstract 🔥⚖️

@cncrtecstle -

MMD 🔶 BNB

MMD 🔶 BNB

@ceyloncredit -

p

p

@Crypt0logist -

Peppered Cat

Peppered Cat

@Peppered_cat -

Amanchestech

Amanchestech

@frostymanzoo -

John Riddle

John Riddle

@cheapspacers -

Ahmed

Ahmed

@King_Sexyyy

Something went wrong.

Something went wrong.