You might like

Some new Methodology Changes... This thing is getting complicated, so I think I am starting to lean towards not explaining all the methodology changes and starting to call it proprietary logic. But here's what I did and why I did this go around. Currently methodology score,…

8 WAYS ROBOTICS IS GETTING BUILT OUT ACROSS SECTORS 1. $PLTR & $PATH are the traffic controllers for the whole fleet while $NVDA, $AVGO & $QCOM are the engines & nervous system that let the robots sense and act. 2. $AVAV, $ONDS, $RCAT & $UMAC are building the UAV drone fleets…

The next big theme will be robotics. Here's a list...(bookmark this puppy): Logistics $AMZN Amazon $SYM Symbotic $SERV Serve Robotics $AUTO AutoStore $GXO GXO Logistics Robotics Software $NVDA NVIDIA $PTC PTC Healthcare Robotics $MDT Medtronic $SYK Stryker $ARAY Accuray…

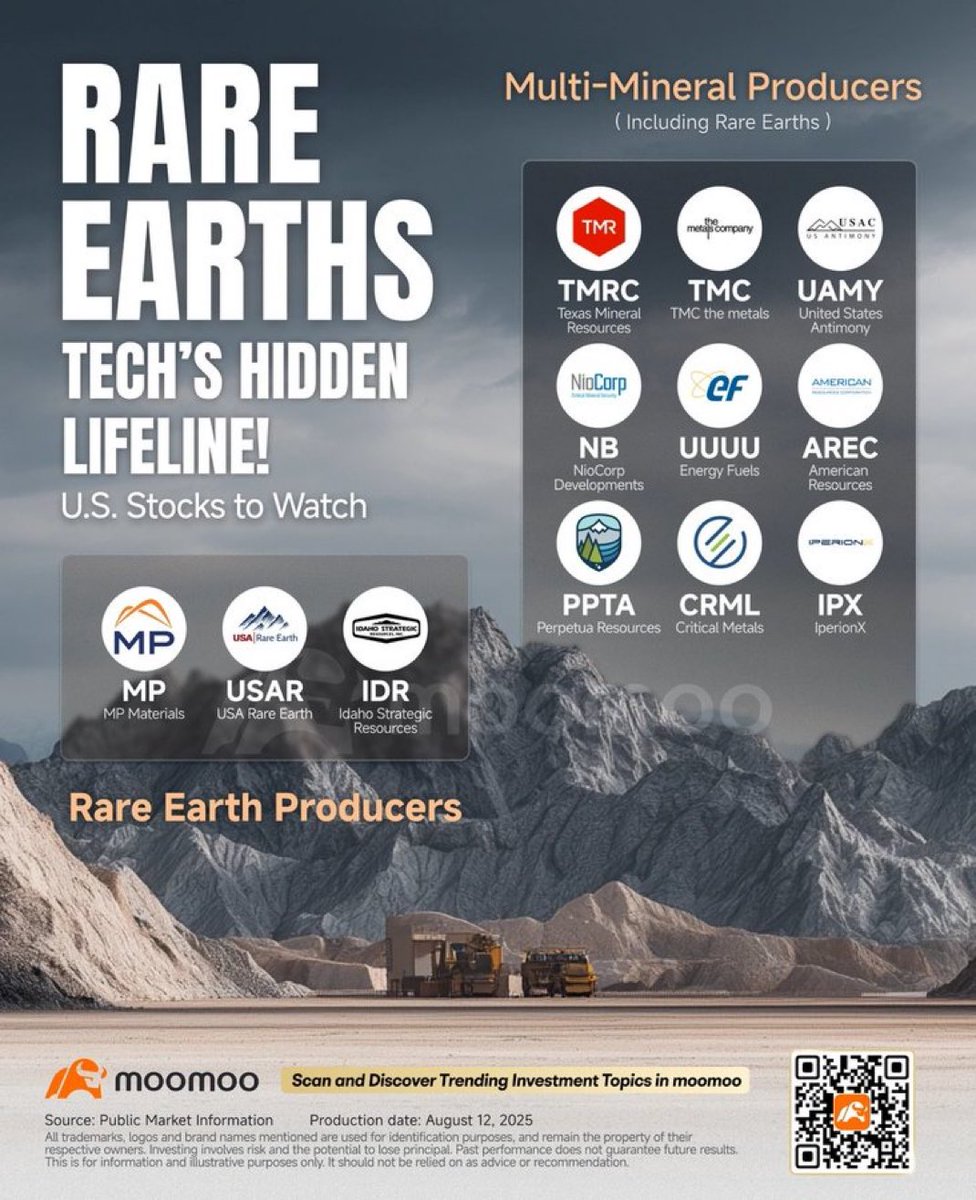

Themes To Monitor. Genomic (ARKG)/Biotech - $NTLA $CRSP $TEM $BEAM $NTRA $PSNL $GH $ABSI $ABCL $GRAL $QURE $CLPT Rare Earth - $MP $NB $USAR $METC $CRML $UAMY $PPTA $UUUU $AREC Nuclear - $OKLO $LTBR $LEU $CCJ $BWXT $UEC $ASPI $NNE Batteries - $TSLA $EOSE $SEI $AMPX $MVST…

THE TOP 15 GROWTH PERFORMERS OF 2025 1. $OKLO +669% 2. $IREN +518% 3. $MP +418% 4. $QBTS +356% 5. $OPEN +348% 6. $NVTS +311% 7. $NBIS +310% 8. $CIFR +304% 9. $ASTS +296% 10. $HOOD +249% 11. $PL +224% 12. $EOSE +209% 13. $RGTI +204% 14. $ONDS +197% 15. $PGY +185%

$CRML up 811% in 6M, $UUUU +369%, $MP +248%. Sector avg +270%. These names crushed it while China still controls 80%+ of global refining. Momentum staying hot: $CRML +191% just last month 📊🚀

China still controls almost all rare earth production & refining but the U.S. is starting to rebuild its own chain: • $UUUU separating oxides at commercial scale • $IPX developing new refining tech to lift throughput • $MP leading U.S. output & expanding into full-cycle…

JUST RELEASED: "Episode 6: Brad Freeman on Riding Out Market Trends and Finding Winners" of Shooting the Bull With Drowsy and Bear. We chat with @StockMarketNerd on staying sane in this market, and dive in on $RBRK, $UBER, $DUOL, $HOOD, $SOFI and More. open.spotify.com/episode/5PxRKz…

A guy from Reddit just dropped the most practical guide to building your first AI Agent 👇

JUST RELEASED: "Episode 5: Olivia Newton John, Inundated, and Monthly Portfolio Updates" of Shooting the Bull With Drowsy and Bear. We chat hyper scalers, Bear hates on $CRWV and $NBIS, answer a listener question, and monthly portfolio updates. creators.spotify.com/pod/profile/dr…

Been awhile since I've shared the portfolio! Here it is as of today, from highest to lowest allocation. Some have very high multiples (PE and even PS), some very low. From the expensive ones I expect a lot of revenue/profit growth. Others will grow slower but are undervalued IMO.

JUST RELEASED: "Episode 4: John Rotonti on Long Term Winners and AI Infrastructure Playbook" on Shooting the Bull With Drowsy and Bear. A must listen to special episode. We chat investing in a high-valuation market and AI infrastructure investing. creators.spotify.com/pod/profile/dr…

Moving Averages - Understanding VS Application The attached reply is my view on the use of moving averages, which I think should be basic knowledge, but probably still a blind spot to some. In summary they are a great tool when you understand them and know when (not) to refer…

Basically we have to understand first on what they are (technically how they are derived), then know when and why are they useful (and hence when not useful). It is useful only when there is a trend, AND when other traders use that as a reference. The more traders use that as a…

JUST RELEASED: "Episode 1: Origin Stories, Monthly Portfolio Updates, and Saltine Crackers" by Shooting the Bull With Drowsy and Bear. We chat the genesis of the pod, monthly updates, and investing strategy. $APP, $RBRK, $RDDT, $NVDA, $AXON, and more. creators.spotify.com/pod/show/drows…

Precarious position in the $SPY -- we could absolutely find support here at the top of value for 2025 🤞 But if we don't, the bearish 80% rule will trigger (meaning 80% chance of tagging the bottom of value before end of year) with a downside target of 475 😳

Jan ‘25 - Port. Review Port: +2.3% S&P: +2.8% 10yr CAGR: 18% Top ten: $NVDA $AXON $CRWD $AMZN $TTD $MELI $MSFT $MA $AAPL Cash Buys: N/A Sales: N/A Commentary: Slow start to the year. Ready for earnings. Hope you all are off to a good start and keeping your head.

Dec ‘24 - Port. Review 2024 Returns: +65.4% S&P Returns: +24% 10 Yr CAGR +17.6% Top ten: $NVDA $AXON $CRWD $AMZN $TTD $MELI $MSFT $AAPL $MA Cash Buys: $MELI Sales: $PLTR Commentary: Another solid year after that abysmal 2022. Wishing you and yours a happy & healthy 2025.

Here are the Top 25 cash-generators in the tech sector, ranked by their impressive Free Cash Flow Margins 📊💸. These companies are highly efficient at generating cash! 🤑🚀 1. $NVDA - Nvidia - 46.0% 2. $ANET - Arista Networks - 43.0% 3. $MELI - MercadoLibre - 32.1% 4. $APP -…

The 2025 preview. This is a very long read so feel free scroll past if you don’t want to take a few minutes. 2024 was a great year, if I had to grade myself I’d give a B+. Only because I think I could’ve been even better, I sold some of the biggest winners of the year far too…

Updated, my custom @Deepvue dashboard thematics tracker. According to @AmeetRai_, there will come a time where Deepvue users can follow watchlists in real-time.

Companies that interest me most, sorted by my current price evaluation based on growth prospects and my guess at future cash flows: Overvalued, would love to own again at a lower price RDDT HOOD AXON Fairly Valued, I own IOT Undervalued, I own MELI MNDY ROOT What are yours??

United States Trends

- 1. Northern Lights 38K posts

- 2. #DWTS 50.6K posts

- 3. #Aurora 7,795 posts

- 4. Justin Edwards 2,105 posts

- 5. Louisville 17.4K posts

- 6. #RHOSLC 6,463 posts

- 7. #OlandriaxHarpersBazaar 4,820 posts

- 8. Creighton 2,029 posts

- 9. Gonzaga 2,697 posts

- 10. Andy 59.9K posts

- 11. Lowe 12.5K posts

- 12. #GoAvsGo 1,468 posts

- 13. Oweh 2,061 posts

- 14. JT Toppin N/A

- 15. Kentucky 25.2K posts

- 16. H-1B 28.9K posts

- 17. Elaine 36.1K posts

- 18. Celtics 12.3K posts

- 19. Zags N/A

- 20. Sabonis 5,736 posts

Something went wrong.

Something went wrong.