Ernesto

@eboadom

Contributor to the Aave ecosystem. Co-founder of @bgdlabs. Previously CTO at @aave

คุณอาจชื่นชอบ

Friday could have one of DeFi's worst black swan events. On paper, over $19 billion in liquidations hit across CEXs and perp DEXs. The real figure was likely higher. Many were surprised that on-chain lending markets came out mostly untouched, but outcomes can be misleading.…

In days like these, it's a good time to study why we put focus on the Aave DAO on Umbrella and Aave <> @chainlink SVR, and what happens when they are strategically aligned. Aside from the DAO continuously taking very difficult (and frequently controversial) pricing decisions

Particularly proud of this one, with all Aave systems (protocol, safety module Umbrella, governance, bridging, tooling, etc) reaching very optimal maturity levels

Aave DAO <> BGD Phase 5 is ending! Check out a summary of our contribution during these last 6 months 👻 governance.aave.com/t/bgd-aave-bgd…

Always a pleasure to talk with @jack__sanford, this time on @sherlockdefi Web3 security podcast

Episode 3 of The Web3 Security Podcast is now live! This week, @eboadom, Co-founder of @bgdlabs and former CTO of @aave, joins @jack__sanford to discuss managing $70Billion in assets, major protocol upgrade challenges, and more! Full episode below 👇

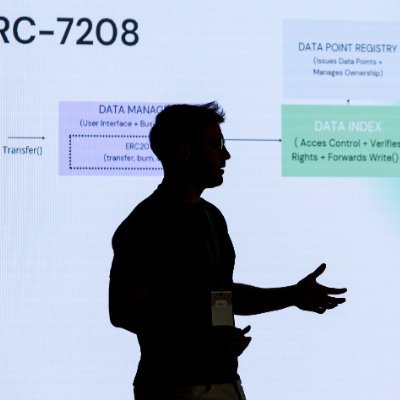

With Aave v3 more than 3 years in production, countless improvements done & ongoing, and v4 approaching its latest stage of development, we have published our vision regarding the Aave v3.X product going forward, and its relation with v4. Link and a summary below ⬇️

Aave Umbrella facts. Staking on Umbrella aTokens is a very yield market-aware. If staking for example aUSDT, you will get a yield component from Umbrella on a relatively limited range (e.g., optimised to ~3.50% at the defined target of $104m) plus the underlying rate on Aave.…

Aave Umbrella facts. Umbrella has two slashing phases: the slashing itself, and the deficit coverage on the Pool. Slashing is automated and occurs immediately after deficit is accrued on any asset covered by the Umbrella in the connected Aave; first reducing the deficit offset…

Aave Umbrella facts. Each asset on Umbrella has a deficit offset parameter, indicating how much bad debt the Aave DAO itself would cover before any single asset is slashed from stakers. On the initial activation of Umbrella, this parameter was set to levels above the aggregated…

Aave Umbrella facts. If supplying USDC, USDT, or ETH on Aave in Ethereum, planning to keep it for 20 days or more, and trust that Aave will not accrue bad debt, staking aTokens on Umbrella has exactly the same assumptions, but earns extra yield on top: cooldown (time to unstake)…

Considering its nature and how deeply linked it is with the biggest DeFi protocol, Aave Umbrella's 👻☂️ activation will be worth following

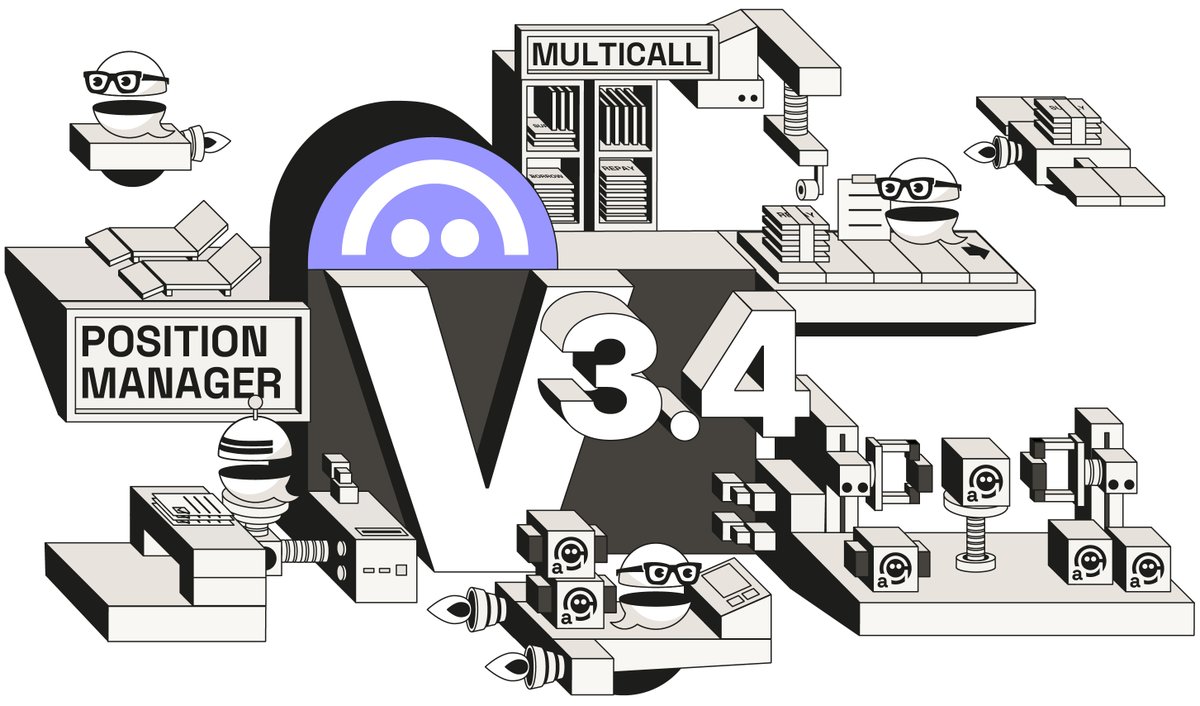

Introducing Aave v3.4 👻 (link to forum below 🔽)

You Can (Not) Feel the Rain

The high activity rate of DeFi users and the public (even if possible to curate) nature of blockchain data can easily be an explosive moment for the usage of AI in our industry

Introducing: ChaosAI In crypto, sophisticated traders, institutions, and insiders have always had an unfair advantage. While you rely on public dashboards and Twitter sentiment, they analyze proprietary datasets and signals you can't access. Today, we're changing that with…

Very glad to see this Aave governance proposal passed with full support: Aave v3 Polygon stays as functional as it always has been, and there is no plan for that to change in the future. No matter the noise around, users of Aave on Polygon have been there for years, and if they…

Impressive progress in the crossroads of web3 governance systems and AI features. I would say that now covering Aave on-chain governance too, it is the only venue unifying visibility of forum, snapshot, and on-chain gov

I think there is even one more interesting and more powerful metric related to the 1 billion stablecoin. You can actually borrow ~900m of USDT, ~700m of USDC, and ~350m USDS, and not spike the borrow rate even 2%. Let that sink for a moment, borrowing +$2b from 1 single pool…

EF allocating to Aave majority of the capital make sense. Aave been running for years now, enough liquidity to offer the sizing EF needs (Aave is the only place to be able to borrow 1 billion in stablecoins in one shot).

Time passes and I’m more convinced that the most important aspect of blockchain’s/DeFi's technology/development principles is tokenization as a first-class citizen of systems. Together with atomic execution of transactions, tokenization is arguably why this industry has a big…

United States เทรนด์

- 1. Good Sunday 61.3K posts

- 2. #sundayvibes 4,945 posts

- 3. Nigeria 872K posts

- 4. Scott Adams 3,439 posts

- 5. Talus 20.1K posts

- 6. Yankees 17.7K posts

- 7. #sundaymotivation 1,496 posts

- 8. #sundayfunday N/A

- 9. Blessed Sunday 17.3K posts

- 10. Standard Time 9,782 posts

- 11. Daylight Savings 11.6K posts

- 12. Carlos Manzo 393K posts

- 13. #AllSoulsDay 1,103 posts

- 14. Oakley 2,332 posts

- 15. #NYCMarathon N/A

- 16. Full PPR N/A

- 17. Harrison Ford 12.1K posts

- 18. Lord's Day 2,131 posts

- 19. Will Smith 57.9K posts

- 20. jungkook 395K posts

คุณอาจชื่นชอบ

-

bgdlabs

bgdlabs

@bgdlabs -

Aave-Chan Initiative {ACI}

Aave-Chan Initiative {ACI}

@AaveChan -

Herodotus 🛰

Herodotus 🛰

@HerodotusDev -

Louis Guthmann zk/acc

Louis Guthmann zk/acc

@GuthL -

hazelstar.eth | 🦇🔊

hazelstar.eth | 🦇🔊

@Hazelstar_ -

MempoolSurfer(.eth|.stark)

MempoolSurfer(.eth|.stark)

@mempoolsurfer -

alizk.eth 🍉

alizk.eth 🍉

@0xalizk -

Merlin Egalite 🦋

Merlin Egalite 🦋

@MerlinEgalite -

Odysseus | phylax.systems

Odysseus | phylax.systems

@odysseas_eth -

Zer0dot

Zer0dot

@Zer0dots -

Mark Hinschberger (👻,👻)

Mark Hinschberger (👻,👻)

@mark_is_here -

Josh

Josh

@devjoshstevens -

GFX Labs

GFX Labs

@labsGFX -

Emilio^

Emilio^

@The3D_ -

FIG

FIG

@francisgowen

Something went wrong.

Something went wrong.