You might like

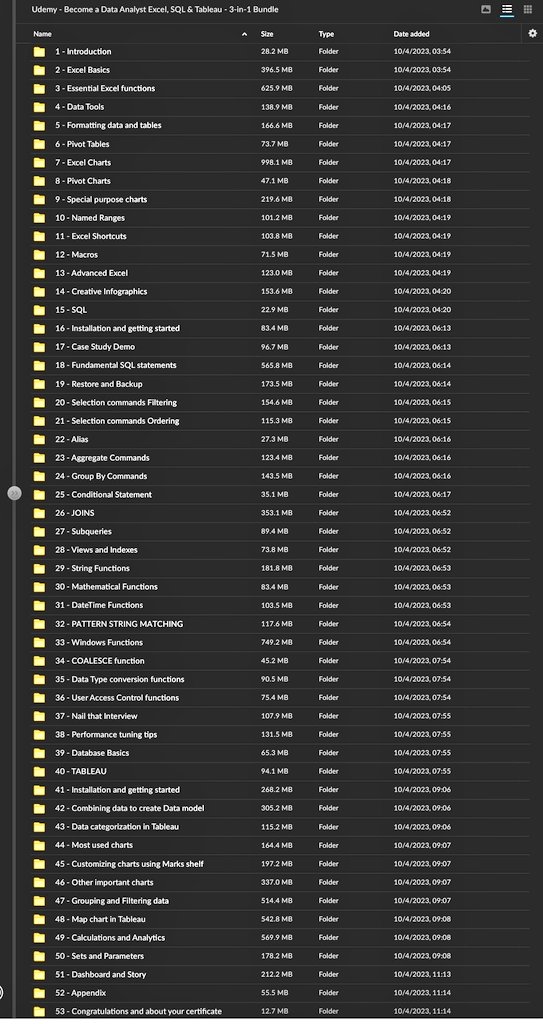

🔰 Data Analytics from Zero to Expert Free Course 🔰 A Udemy Complete Paid Course for Free. This Course covers; - Excel - SQL - Python - Tableau → Many more.. To get it simply Dm 1. Must follow @atulkumarzz to get Link 2. Like and Repost 3. Type "course" in to get Link in DM

[VIDEO] Simple Strategy for Becoming a Consistently Profitable #Futures Trader (the Zone Fade setup) As always, I'd appreciate it if you would Like ❤️ and Share/Repost 🔁 (regardless of how many followers you have). Help spread the word! 🙏🏻 $ES_F $MES_F $SPY $NQ_F $MNQ_F

The NYSE Advance/Decline is more helpful and effective in the first half of the day and starts to become less and less relevant as we approach the current day's Close. That's because the A/D is based on the Previous Day's Closing Price, and as we head into the afternoon (and…

If you're a developing trader working on becoming profitable (or even an experienced trader for that matter), instead of over-analyzing the market where it is RIGHT NOW and trying to make a trading decision RIGHT NOW...look 10-20 points out in both directions and Pre-plan trade…

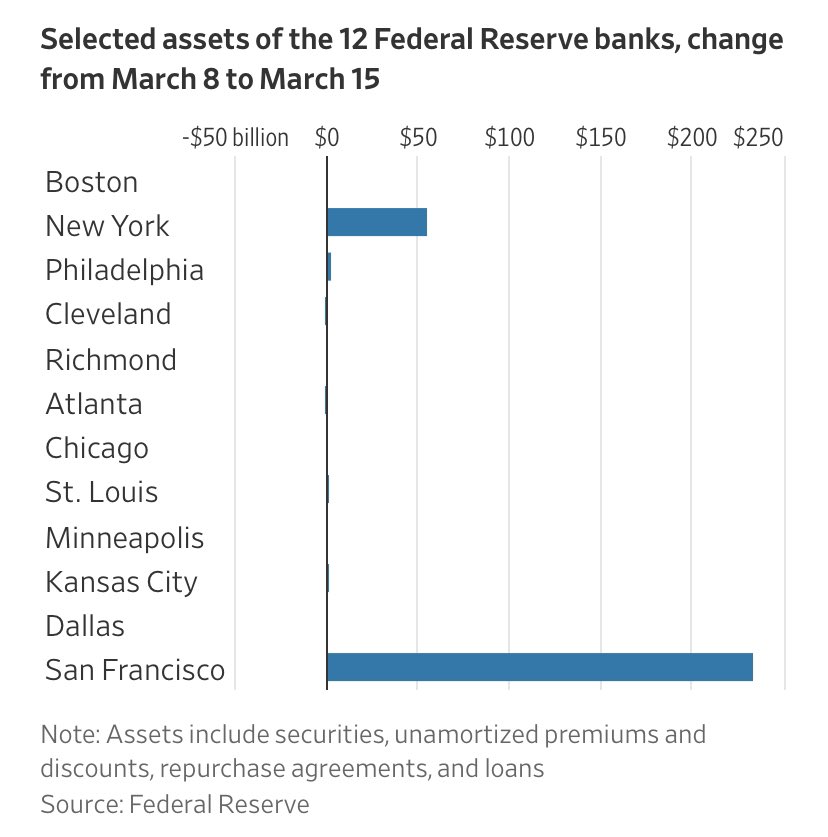

Most of the net increase in emergency lending from the Fed last week was out west. A further breakdown. Of the net $297 billion increase in reserve bank assets, $233 billion comes from the SF district, and $55 billion is from the NY district 1/ wsj.com/livecoverage/s…

NEW: Borrowing at the Fed this week +$148.3 billion – net discount window borrowing +$11.9 billion – the new Bank Term Funding Program Subtotal: $160.2 billion +$142.8 billion – borrowing for banks seized by FDIC Total: $303 billion federalreserve.gov/releases/h41/2…

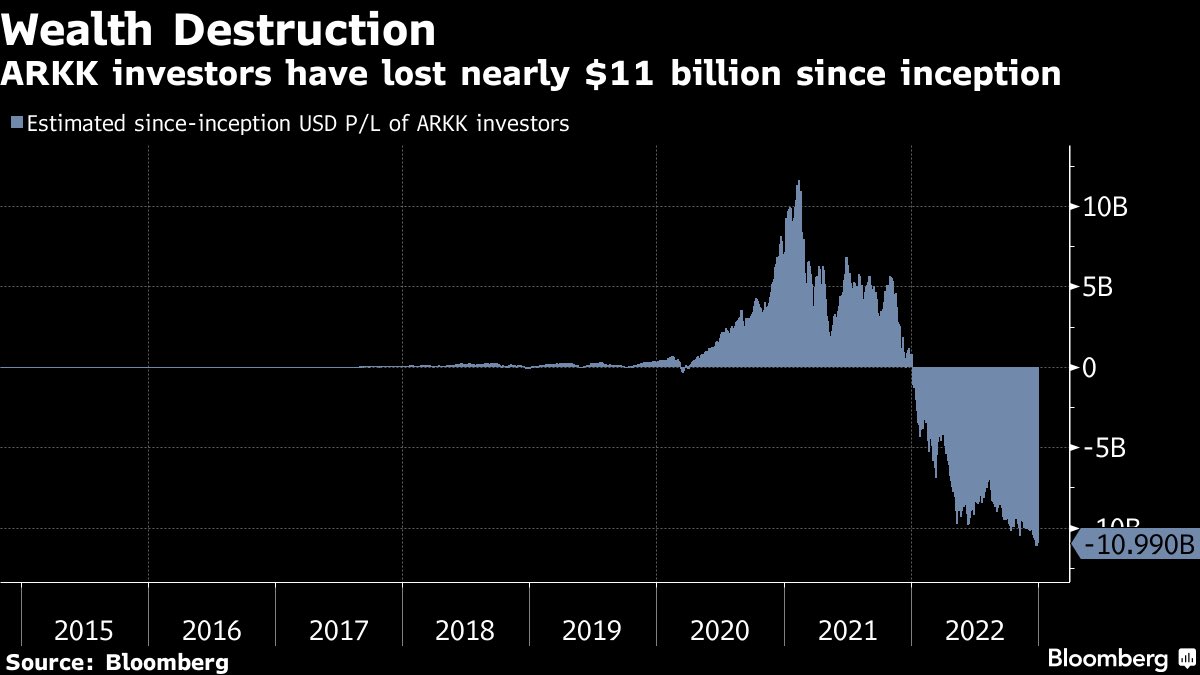

ARKK investors lost $11B since inception. Brutal 👇

Something magic happened in July 2020. Since then, you can predict the future. With 95% accuracy. It's worked perfectly for over 2 years. The 1% who know have made billions betting on it. But nobody else is paying attention. Here's how you can use this too 👇

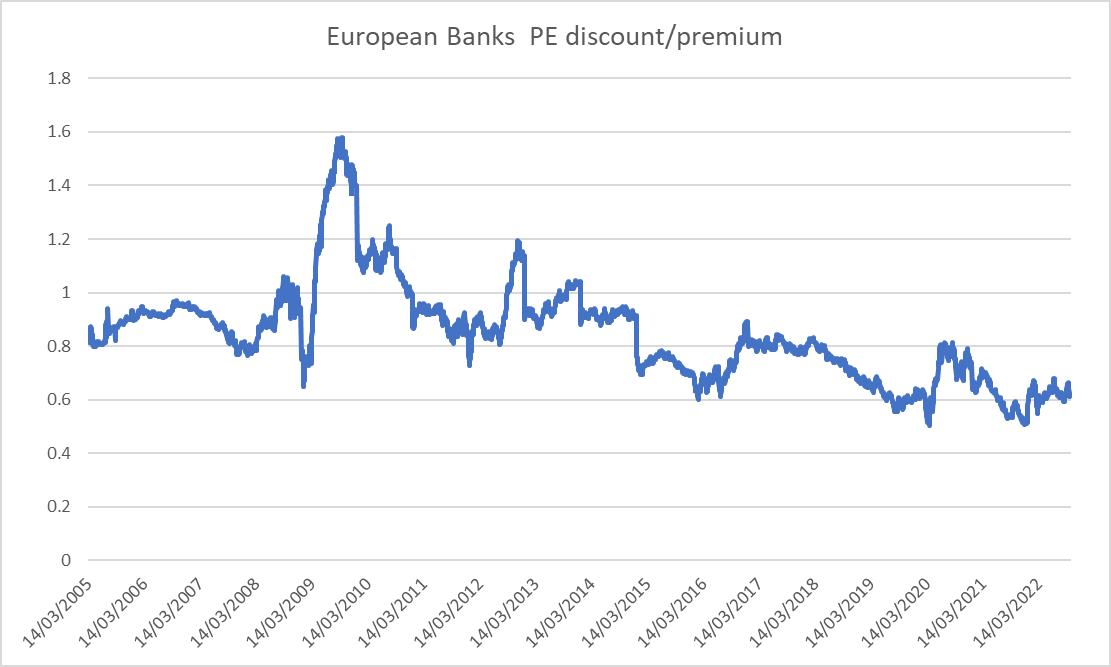

This says a lot about how nervous the market is: European banks are close to an all-time low relative to global market (P/E discount close to 40%) & at the same time the consensus upgrade / downgrade ratio is at 2.4x for banks when the global market is below 1x (0.85x)...

The biggest US banks will signal their worries about the US economy in third-quarter earnings reports starting next week, with analysts expecting they will set aside more than $4bn to cover potential losses from bad loans - Financial Times ft.com/content/dded71…

ft.com

US banks to set aside $4bn for potential losses from bad loans

Wall Street will signal its concerns about the US economy in Q3 earnings this week

Let's talk about the Tether scandal, why recent disclosures about it are such a big deal, and why it represents a form of systemic risk for the already shady crypto market. (1/) 🧵

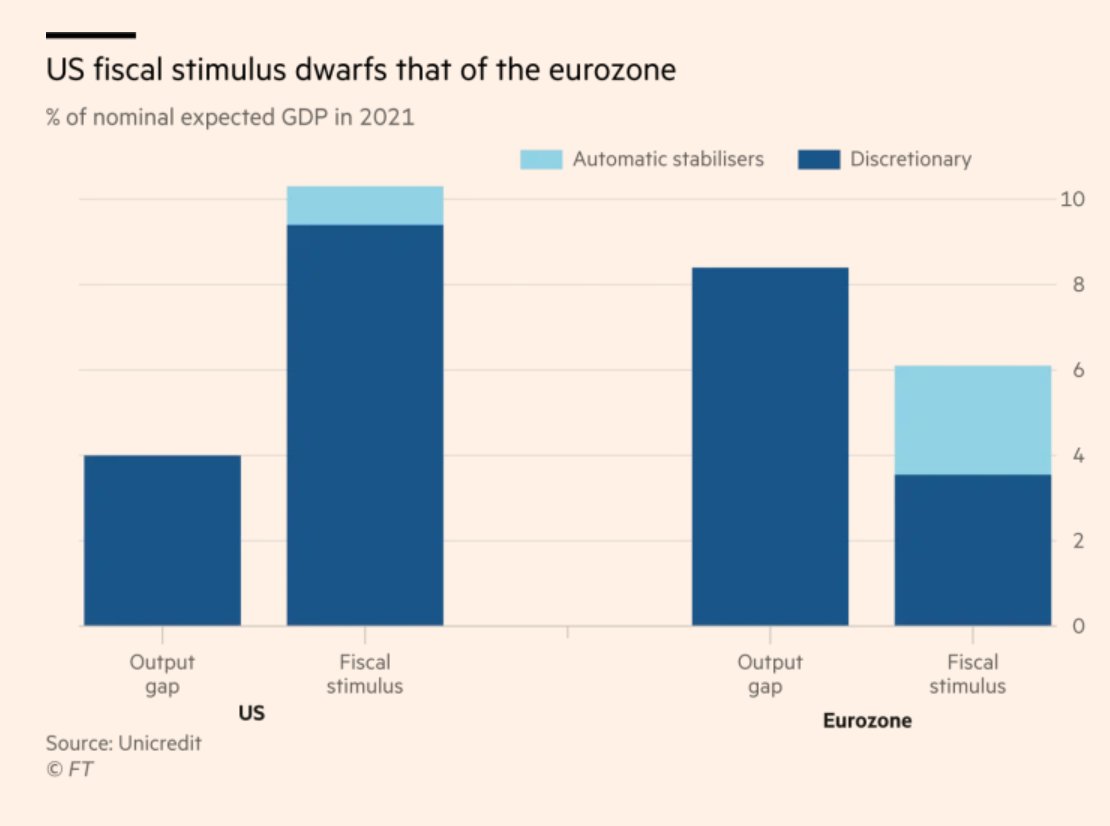

EU’s stimulus is just not big enough! One cannot retweet this graph by @ErikFossing and team at Unicredit often enough. From excellent article by @ChrisGiles_ ft.com/content/49ca17… See also Chartbook Newsletter #13 adamtooze.substack.com/p/chartbook-ne…

🇩🇪 German PMI beats, too, amid growing optimism about the vaccine, but this was less good news: "latest data showed a renewed decline in private sector employment in December, following the first – albeit marginal – rise for nine months in November."

#ES_F Traders: If you'd like to learn about my trading methodology, check out this webinar recording where I teach the basics of my method and how to best use the EminiPlayer daily analysis to consistently find quality setups in the E-mini S&P: awa.is/2OjmOrG -- Pls RT!

Asia mkts calm amid regional holidays & as investors await US jobs report. Payroll forecasts at 188k, wages number (+0.3% exp) most in focus after FOMC. Bonds flat w/US 10y at 2.54%. Dollar a tad stronger w/Euro at $1.1170. Oil near 1mth low on fears of supply glut. Bitcoin $5.5k

#Pétrole : l'Arabie Saoudite ne se plie plus à la volonté de son allié américain (refus d'augmenter sa production) et le menace même de ne plus utiliser le $ pour ses ventes de pétrole ! Il va falloir que je revois mon petit manuel de #géopolitique ...

BREAKING: ‘Saudi Arabia is threatening to sell its oil in currencies other than the dollar’ - Reuters exclusive #petrodollar reuters.com/article/us-sau…

reuters.com

Exclusive: Saudi Arabia threatens to ditch dollar oil trades to stop 'NOPEC' - sources

Saudi Arabia is threatening to sell its oil in currencies other than the dollar if Washington passes a bill exposing OPEC members to U.S. antitrust lawsuits, three sources familiar with Saudi energy...

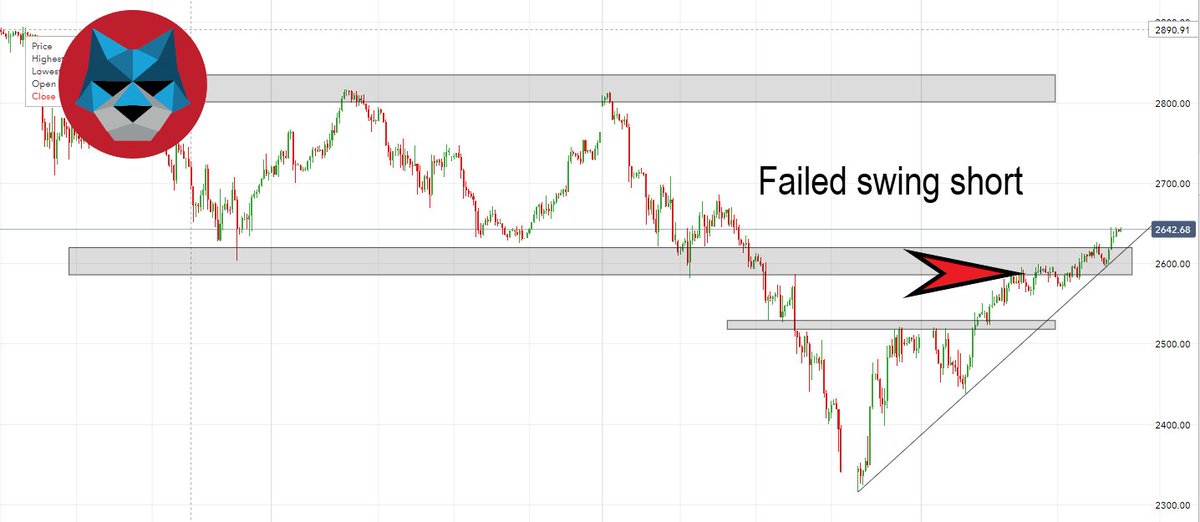

$SPX $DAX How to combine swing and daytrades Article + charts from it. /This is what I do, and it may not work for you. For informational and educational purposes. RT if you like it./ #spx #dax

JPM: Risk Parity funds have underperformed a hypothetical benchmark by 3.7% since the start of the equity market correction, an even bigger underperformance than that seen during the Fed 2013 taper tantrum

JPM: CTAs lost 6.9% in four days from Feb 1st to Feb 7th. Pure trend following CTAs did even worse, losing 9.2% during these four days. These negative 4-day returns are unprecedented, pointing to severe position unwindin

Swiss 10-year note yields there just touched a record low at -0.382%. Who the heck is buying that?

United States Trends

- 1. #AEWDynamite N/A

- 2. Ciampa N/A

- 3. Ciampa N/A

- 4. Cam Thomas N/A

- 5. Thekla N/A

- 6. Bondi N/A

- 7. Private Party N/A

- 8. Northwestern N/A

- 9. Jose Alvarado N/A

- 10. Kyle Busch N/A

- 11. Sam Merrill N/A

- 12. Senate N/A

- 13. Briscoe N/A

- 14. Silver Spring N/A

- 15. #SistasOnBET N/A

- 16. Bates N/A

- 17. LJ Cason N/A

- 18. Kris Statlander N/A

- 19. Mara N/A

- 20. #LoveIsBlindSeason10 N/A

Something went wrong.

Something went wrong.