jay

@ftjaych3

2ND ACCOUNT- im not a writer, but i write sometimes… a booktrovert - love arts & anime

Chatting with a couple of fav interviewers @CultishCreative and @bogumil_nyc - as always great questions!

People I want to talk to when the world is trying to end: @chriswmayer Me and @bogumil_nyc shared our talk with him yesterday for @excessreturnpod. We talk finding 100 baggers in the recent wreckage, concentrated investing, and the power of patience: youtu.be/nLqAvzppU-4?si…

youtube.com

YouTube

The Hidden Fingerprints of 100 Baggers | Chris Mayer on How to Find...

100 Gånger! Tak Eddie!

En ära för mig att översätta @chriswmayer's klassiker 100 Baggers. I boken passar jag också på att titta på svenska aktier där 10 000 kronor blivit 1 miljon. Nästa onsdag 19 mars är Chris på Redeye i Stockholm för bokrelease, signering & samtal. Fåtal platser kvar. DM för info.

Matt has an interesting format, two guests bouncing ideas off each other. Here I am with @neuranne talking creativity, writing and more. (Also rare look at me clean shaven. Heh.)

What's a neuroscience blogger have in common with an investment/philosophy nerd? Come find out, as Anne-Laure Le Cunff (@neuranne) meets Chris Mayer (@chriswmayer) for the first time ever, only on JUST PRESS RECORD! Burnout, the creative process, life - it's all here, watch:

Excellent job here by @Invesquotes on $CPRT

Was a pleasure to talk about $CPRT with @Clay_Finck in We Study Billionaires. Had a great time as always! youtu.be/RqKjkXeL9cM?si…

youtube.com

YouTube

Copart Stock Deep Dive w/ Leandro from Best Anchor Stocks

Talking quality with Bogumil! @bogumil_nyc with the thoughtful questions as always. Fun conversation and always a pleasure!

THIRD TIME ON TALKING BILLIONS: Chris Mayer: 100 Baggers and General Semantics Revisited & Expanded It's his third time on the show, and it's our best one yet. It's a deep, thoughtful discussion about investing in quality businesses over the long run and so much more. Take a…

Good write-up by @SeekingWinners_ on $CMG.TO

New write-up is now published over on my substack on $CMG.TO. Give it a read this weekend and let me know what you think! seekingwinners.substack.com/welcome

I realized my first tweet on this didn't take you to the article, but this one does.

We've got the perfect weekend read for you. In this exclusive interview with @chriswmayer, the author of 100 Baggers, he shares insights on what drives long-term shareholder value, one of his current holdings, and the most common mistakes investors make. quartr.com/insights/inves…

Interview with @Quartr_App where I also mention a new addition to the portfolio for 2024:

We had the opportunity to sit down with @chriswmayer, the author of 100 Baggers. In this exclusive interview, he shares insights on what drives long-term shareholder value, the power of reinvestment, one of his current holdings, and the most common mistakes investors make.

Nice collection of quotes on Brown & Brown's $BRO winning corporate culture. by @mastersinvest mastersinvest.com/newblog/2024/1…

Thank you Mark! I expect to own the names for a long time yet.

Shoutout to @chriswmayer in the latest instalment of Diary of a Hedgeye User. mbunting.substack.com/p/warning-dont… The PM of the Woodlock House Family Capital fund and author of 100 Baggers holds the likes of @HEICOCORP very long-term and that #investing style definitely works for him.

Chatting with Steven about drawdowns and other matters - check it out 👇

In this month's episode, we reconnect with Chris Mayer of Woodlock House Family Capital and author of 100 Baggers. Chris shares his compelling insights on drawdowns. open.spotify.com/episode/09avdO… Thank you @chriswmayer for your expertise on a topic that is key for all investors!

On 100 baggers: "You’re just trying to find the great compounders and let all the other noise filter itself out. You try to find 10 or 12 of these businesses; I’m not sure you’ll find 10 or 12 in a career. So you have 10 or 12, what you hope will be compounders in the portfolio.…

Sygnity's return since Topicus ($TOI.V) announced it completed the purchase of 72.68% of the company for $44,161,254 on May 16, 2022: +515%. (About a +123% CAGR!)

Deadly drawdowns - lots to learn from these. by @InvestmentTalkk investmenttalk.co/p/pandemic-dar…

🧵 Here's everything I've learned about mastering emotions in investing (and life) 🧠💼 A Thread: 1/ 💡 Emotional stability is crucial for successful investing. Emotions like FOMO, fear, and overconfidence can cloud judgment. Let's dive into how to manage them effectively.

"Nothing nettled him more..."

Sometimes I feel that the power of reinvestment doesn't get its due credit for wealth creation. Here is John D. Rockefeller, the richest man on earth then, who didn't go to college, on how he felt about dividends. Source: Titan by Ron Chernow

It was fun to flip through these tables - for example take a look at "Highest Annualized Returns" for stocks with over 20 years of data: Source: papers.ssrn.com/sol3/papers.cf…

They can and do happen.

1/ Real Life 100 Baggers: To win at investing, you either have to do something others aren't able to do, or something others aren’t willing to do. In today’s fast paced world, investors find it hard to be patient. Patience therefore, may just be an investor’s greatest edge.

Good place to fish for those wonderful 100 baggers...

Asset LIGHT businesses generally outperform capital INTENSIVE businesses. Some of the best ratios for screening for asset light businesses are: - high return on tangible assets - high operating leverage - low fixed asset as a percentage of total assets - low asset turnover…

My friend Jon Boyar out with some ideas to consider -- $ALSN among others 👇

In a market near all-time highs, uncovering undervalued opportunities is crucial. Our "Fresh Looks 2024 Edition" reveals 12 stock ideas trading below intrinsic value. Part 1 is out now!🏷️ Click below to purchase hubs.ly/Q02HYRRf0 #Investing #StockMarket #ValueInvesting

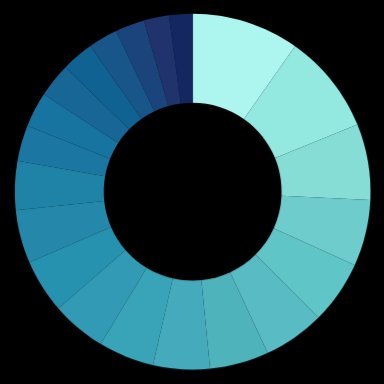

United States Trends

- 1. Epstein 682K posts

- 2. Steam Machine 32.8K posts

- 3. Bradley Beal 2,792 posts

- 4. Boebert 22.2K posts

- 5. Valve 23K posts

- 6. Virginia Giuffre 37.8K posts

- 7. Anthony Joshua 1,726 posts

- 8. Scott Boras N/A

- 9. #BLACKROCK_NXXT N/A

- 10. GabeCube 2,124 posts

- 11. Rosalina 63.9K posts

- 12. Mel Tucker N/A

- 13. Clinton 105K posts

- 14. H-1B 94.1K posts

- 15. Jordan Humphrey N/A

- 16. #NASDAQ_NXXT N/A

- 17. Zverev 2,828 posts

- 18. Michael Wolff 16.6K posts

- 19. AJ Brown 8,558 posts

- 20. The Devil Wears Prada 2 48.4K posts

Something went wrong.

Something went wrong.