Graddahy.|. TA. Expert

@grddaybpc

29y in markets, commodities sector investor/swing trader, unique combination of cycles + technicals = leading edge, 20y in mgmt consulting

You might like

Knowing when to trade and knowing when to sit is important. I called the March 2020 crash low for #preciousmetals (plus in general) and then said one should just SIT. I really do hope you listened back then as many leading stocks went more than a 1000% in that historical upmove.

As I hope you have understood from my posts on pm since middle March, this is not the time to trade and try to outsmart. This is the time to practice what Livermore teaches - to sit. These are historical, generational moves that one does not want to fuck up by overtrading.

This precious metals bull will last many more years, so do not get beat down by the declines, or lose interest during them. Understand them, be ready for them. And whatever one does, keep your eyes on the big picture. Silver is now at pink resistance line. #joinus

The general narrative now is that inflation is backing down. This chart for wheat below says it is now ramping up again. Called the bear market low for agriculture and the start of the whole commodities bull market in the linked post below. And, that´s a proper call, not some…

$DBA monthly As said for a long time now, we are going into a massive commodities bull market. And we got the very LT bear market low back in March/April for the whole asset class. Here we have the sector agriculture making its historical low. invesco.com/us/financial-p…

This inflation vs deflation index chart was in a range for eight years. Then it broke down for a very probable blue false breakout. Now it is breaking upwards out of a pink bullish falling wedge. Getting prepared for a 2nd inflationary wave is now imperative. #commodities #joinus

Been saying lately that good times for silver miners are now coming. Posted this ratio chart 1.5 months ago in linked post saying it had a good setup. It did, as since then we saw a big upmove in the silver miners. And, at the service, we sold the very extended large gold miners…

The ratio silver miners vs silver shows a very nice setup now. The 9-year blue triangle should hold some serious energy. #silver

GOLD miners are bottoming very big picture vs gold. Means gold miners are about to outperform gold long term. Means the real bull in miners is about to start. That is an 11-year base => "the bigger the base, the higher in space". Big gains so far which are about to get bigger.

$SILVER This chart is what contrarian investing is all about. Blue breakout is now confirmed, as the chart now has a higher high above pink line breakout high. Also means blue backtest is finished. A true lifetime opportunity, if made use of. The tide is turning. #gotsilver

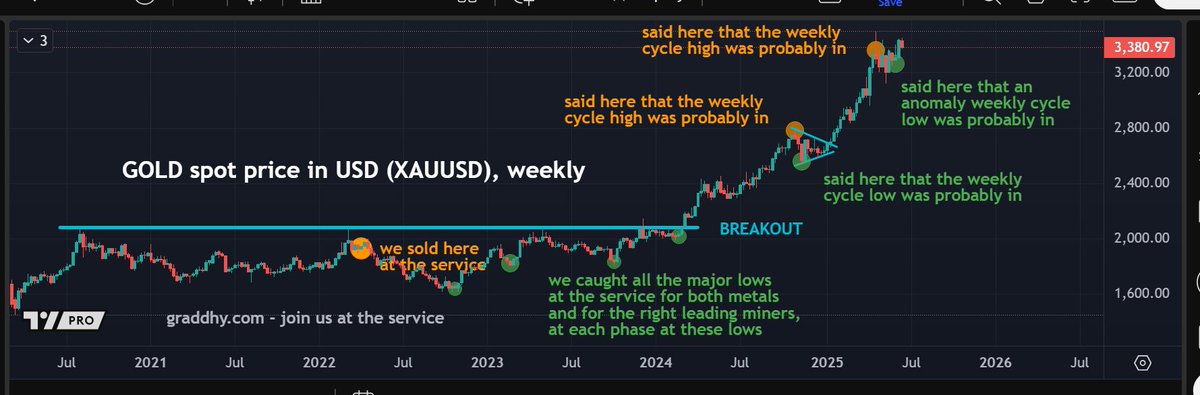

Gold had a strong weekly close last week. Now back up close to the ATHs again. Still holding the for 15 months posted parabolic uptrend line. Silver has broken out above important 35 level. Fed FOMC meeting today, again. #joinus

The chart for this combined gold & silver ETF is now going parabolic. Posted the chart at both green plus orange dot. Posted the chart at both blue plus pink line breakout. Posted the chart on breakout plus also backtest of black line. Posted the chart on the higher high after…

The chart was finally ready. $SILVER is now breaking out. I am certain about that silver will be a fully endorsed monetary metal once again. Many are still in a bearish mindset and sell as soon as they have some profit. If one can not change mindset when the market changes…

Large gold producer Barrick Gold is a laggard at present, but it has a setup very big picture which I think shows the potential here for the sector. Odds are very high that this massive pattern will play out. And, Barrick is now breaking out on lower time frames, so it is now on…

Gold is back up at the ATHs again. Silver has broken out above 35 level. This would be a strong weekly close for gold. #joinus

Posted this setup first time at blue breakout. Few believed. Still on track. If the red parabolic trend line is to hold on the next backtest, the way is still up. #joinus

Posted on gold´s 13-year breakout in the linked post below 17 months ago, in real-time. Said silver would follow, and it did. Then said it looked likely that gold would just blow through the 45-year blue below. And it did. Then said silver is to follow gold for the 45-year…

$GOLD That´s a blue quarterly breakout. $SILVER Should follow.

Below is a comment made by a subscriber a few months after we had caught gold´s & silver´s historical breakouts in real-time, plus the very start of the huge miner´s move that started in Feb 2024. I offer the service because I want to, not because I need to. It lets me combine…

I highly recommend Graddhys paid service. We bought the lows, as he has said using his excellent timing and buy setups. Great great info for those seeking extraordinary gains.

Silver is now on a mission back to ATHs. And this time, silver will break out of a 45-year cup & handle, so the over-shoot this time around should be massive, maybe reaching $60 - $70. Silver is now catching up to gold, and last week it broke out above 35 level (a move I called…

This is the kind of quality you can expect at the service = clean, clear, to the point technicals with huge value Posted HUI in linked post below at 280.00, it bottomed 4 days later at 271.46. Then it had a very strong move to 418.39 so far, a 49.4% move in 5 months up from…

This chart is now backtesting the blue huge support trend line. Note what happened after the last big blue breakout. Forget the nonsense from uninitiated analysts talking about miners not being the place to be now. The metals AND the miners is the right place to be now. Gold…

Been saying lately that the secular bull for junior commodities companies is about to resume. And it now is. Smaller companies are now moving. Posted 6 months ago on what was coming in this article: sprottmoney.com/blog/tsx-ventu… Then posted 1.5 months ago in the post linked below,…

The secular bull for junior commodities companies is about to resume. The previous purple weekly pattern has morphed into a blue pattern. And the blue pattern now looks to have finished up its backtest, since TSX Venture is now trying to break out above red line. It should be…

Been saying palladium is about to start its bull market, e.g. in the linked post below. And now, with the weekly breakout just below, we have confirmation of that palladium is now on its way. Another 21x move while going parabolic looks very likely. The commodities bull is a…

The big picture charts I post shows the life-changing opportunity this commodities bull really is. Below shows #palladium starting its bull market. Many will now wake up to platinum & palladium, but go with us, I have played these sectors for decades. graddhy.com

$SILVER is now in historical breakout-mode. Many are still in a bearish mindset and sell as soon as they have some profit. If one can not change mindset when the market changes character, making life-changing money is not possible. And most need help with that. #joinus

United States Trends

- 1. Auburn 45.4K posts

- 2. Brewers 64.2K posts

- 3. Georgia 67.5K posts

- 4. Cubs 55.7K posts

- 5. Kirby 23.9K posts

- 6. Utah 24.7K posts

- 7. Arizona 41.4K posts

- 8. #byucpl N/A

- 9. Gilligan 5,943 posts

- 10. #AcexRedbull 3,849 posts

- 11. #BYUFootball 1,008 posts

- 12. Michigan 62.6K posts

- 13. Hugh Freeze 3,235 posts

- 14. #Toonami 2,725 posts

- 15. Boots 50K posts

- 16. Amy Poehler 4,489 posts

- 17. Dissidia 5,794 posts

- 18. Wordle 1,576 X N/A

- 19. Kyle Tucker 3,180 posts

- 20. #GoDawgs 5,562 posts

Something went wrong.

Something went wrong.