You might like

Markets go up, markets go down... 📈📉 $LQ stakers always earn 2.5% + revenue share. 💧🪙

$NIGHT will be supported as a collateral asset on Liqwid at launch💧 Liqwid will be a Midnight validator🕛

Cardanians will be a Midnight validator! 🕛 $ADA holders delegated to Cardano stake pools running Midnight validators will receive both $ADA and $NIGHT as staking rewards. Delegate to Cardanians to maximize your staking rewards. More details to follow.

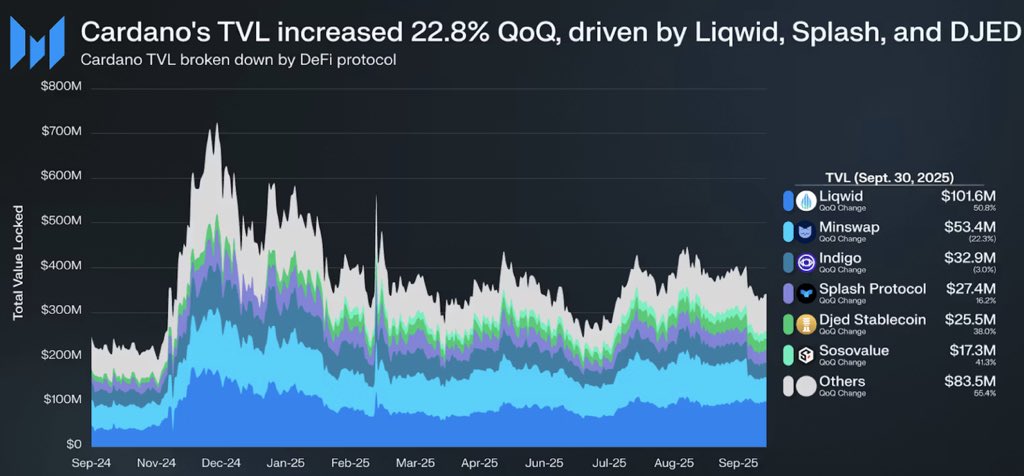

1️⃣ Cardano’s DeFi comeback is official. According to Messari’s State of Cardano Q3 2025 report, ecosystem TVL grew +22.8 % QoQ → $341.7 M, its highest level since 2022. And Liqwid Finance led the charge. 💧 Read the source: 📘 Messari – State of Cardano Q3 2025 🔗…

@Cardano TVL increased 22.8% in Q3 2025 Growth was mainly driven by: 💠@liqwidfinance (Lending & Borrowing) 💠@splashprotocol ( Liquidity & yield) 💠@DjedStablecoin ( Stablecoin) Top protocols as of Sep 30, 2025 💠@liqwidfinance $101.6M (+50.8%) 💠@MinswapDEX…

Liqwid Prime is following the same route as Horizon on Cardano. Well connected product team with V3 accelerating this RWA path💧💧💧

Aave Horizon plays a particularly important role in DeFi. Horizon is using Aave's battle-tested lending technology and applies it to RWAs and will cater: - Equities - Bonds - Credit - ETFs - Funds - Commodities etc etc. Aave will tap into $500T+ market over the next 5 years.

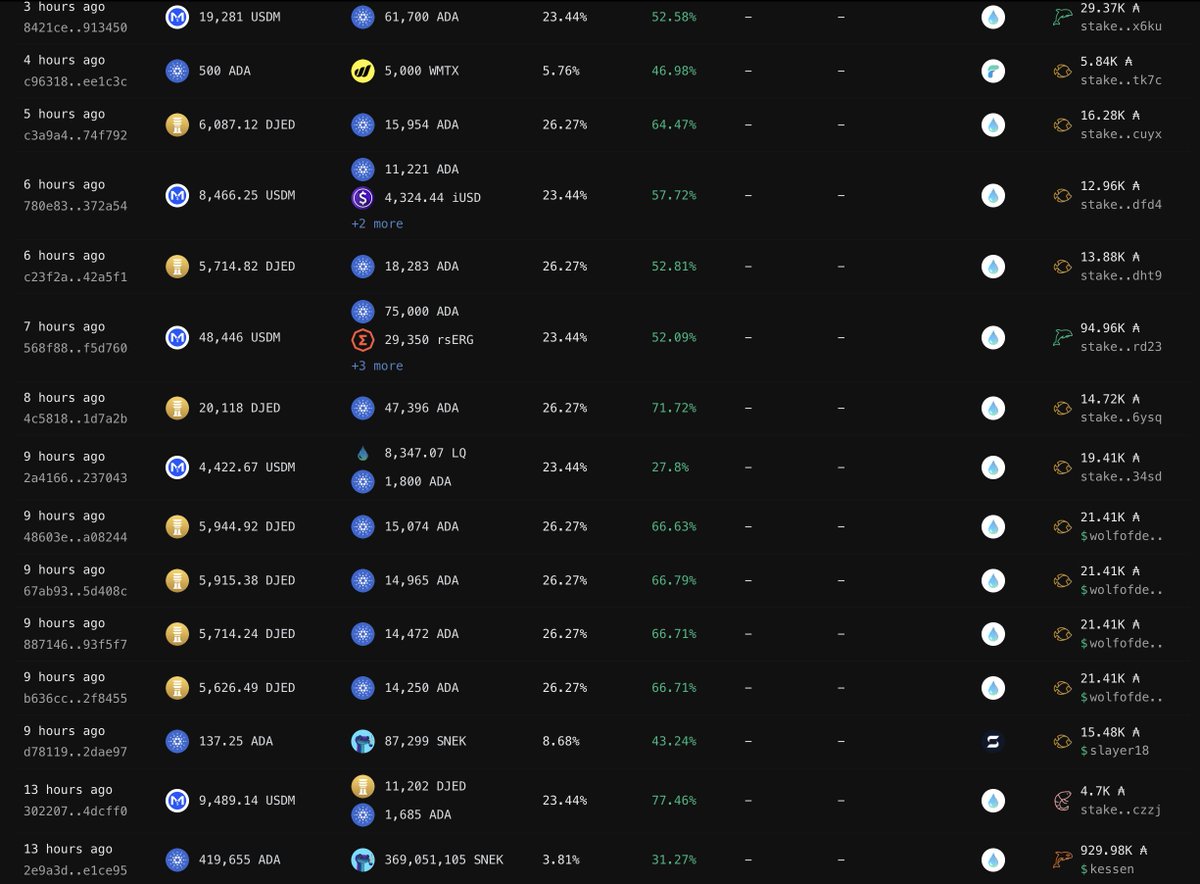

of the last 20 loans taken on Cardano, 15 were done via @liqwidfinance borrows include $USDM $USDA $DJED $ADA it looks $LQ users are ready to take advantage of the dip

Liqwid will continue to dominate ADA and stablecoin lending on Cardano✅ V3 Institutional-grade RWA platform Bitcoin DeFi

$USDM supply has surpassed 3,500,000 after a slight pullback from the recent market crash. 🪙

Great Liqwid thread @Vicious_055 💧 Liqwid also allows borrowers to: ✅ Modify their loan at anytime ✅ Complete partial repayments ✅ Earn interest on collateral as you borrow

What does Liqwid do? Think of it like this: ✅ You deposit your crypto ✅ You earn interest ✅ You can borrow other assets using your deposit as collateral Basically, it’s Cardano’s version of Aave/Compound.

What are you expecting from Cardano DeFi once deeper, stable liquidity arrives? 👀

The data is clear: Liqwid dominates stablecoin lending and borrowing on Cardano💧 This growth will only accelerate with additional stable liquidity🚀

What are you expecting from Cardano DeFi once deeper, stable liquidity arrives? 👀

Yes, this is exactly why Liqwid Finance is preparing to use its platform to offer Direct Lending pools, enabling the real-world economy to access financing backed by real-world asset (RWA) collateral. I believe this could become a substantial new source of income for the…

RWAs are going to be one of the fastest growing segments of the crypto space in the coming years. @liqwidfinance will be well positioned to ride this wave with the launch of direct lending $LQ stakers will benefit not only from V2 markets (soon V3) but also RWA prime and…

💼 Governance Vote Live — Direct Lending Markets Liqwid DAO is voting on the launch of Direct Lending Markets, enabling verified borrowers to access dedicated capital from lenders. Key Highlights: • Peer-to-Entity lending via on-chain verification • Secure RWA &…

Cardano maxed congestion, oracles are not mature, 50-60% flash crash volatility on ADA, major cexes pausing with price feed issues. Coupled with low liquidity. Liqwid took community authorized action to prevent catasrophic ecosystem-wide cascading liquidations that would have…

Liqwid Finance Emergency Protocol Activation (October 10-11th 2025) Overview Last night the Liqwid Labs engineering team activated its emergency response process following a sudden market-wide price crash affecting ADA and all other crypto-assets. The price alert system notified…

v2.liqwid.finance

Liqwid Finance - Lending and Borrowing protocol

Liqwid is a non-custodial liquidity market protocol for lending and borrowing on Cardano, offering fast, affordable, and transparent liquidity solutions.

🤟Yo Guys! A few days ago, I did an in-depth review of @liqwidfinance #LCIMP Wisdom Course module 2 ⛓️link ; x.com/Opa007i/status… 📺Today, to make learning easy and unlock the rich potential of #LiqwidFinance Wisdom Course Module 2, I decided to make a 2mins+ video review…

Exciting Times Ahead! 🚀 Welcome to #LCIMP Cycle 3! 🌟 I'm thrilled to share insights on @liqwidfinance's Wisdom Course Promotion 🔗 wisdom.courses/courses/liqwid… What to Expect 🎯 In-depth review of this month's #LCIMP Course content 🎯Honest critique of its strengths and…

Our sole objective is to 100x these numbers. We are just getting started.

right now the @liqwidfinance platform is generating $82,000 a week in interest after playing suppliers thats $16,400 USD a week for the DAO & $LQ stakers that doesn't include loan origination fees Cardano doesn't have 100M in stables yet 💧🚀

the @liqwidfinance front end is done & is only waiting on the bridging solutions to go live going to be a massive boost for Cardano Defi & Bitcoin HODLers $LQ $BTC 🟠💧

"That alone will get us into the 10-15 billion for TVL and a lot more transaction volume" @IOHK_Charles breaks down how Bitcoin DeFi will reshape Cardano. Once these solutions go live, $ADA and CNTs will skyrocket!

💡Did you know? You can add, withdraw, or modify your collateral at any time. Manage up to 5 collaterals dynamically within a single position. 🔗 v2.liqwid.finance/?utm_source=li…

v2.liqwid.finance

Liqwid Finance - Lending and Borrowing protocol

Liqwid is a non-custodial liquidity market protocol for lending and borrowing on Cardano, offering fast, affordable, and transparent liquidity solutions.

Hold on a second. You’re telling me Cardano has: - “Hydra” scaling mechanism that can do 1 million TX per second. - Leios for increased throughput without compromising decentralization. - @MidnightNtwrk for privacy and zero knowledge proofs safeguarding our data while also…

🔔🐳 Total Value Locked surged +$6.1M (+5.17%) since yesterday — now at $124M. v2.liqwid.finance/?utm_source=li… $LQ #CardanoDefi

if the stablecoin proposal passes with only 20% deployed into @liqwidfinance split evenly between $USDA / $USDM the Cardano treasury would earn $1,200,000 yearly based on the current rate

United States Trends

- 1. Thanksgiving 324K posts

- 2. Good Wednesday 28.9K posts

- 3. #wednesdaymotivation 4,668 posts

- 4. #PuebloEnBatallaYVictoria 1,854 posts

- 5. #Wednesdayvibe 2,333 posts

- 6. Trumplican N/A

- 7. Colorado State 3,324 posts

- 8. Mora 21.9K posts

- 9. Nuns 7,835 posts

- 10. Stranger Things Day 3,274 posts

- 11. Hong Kong 10.6K posts

- 12. Hump Day 11.6K posts

- 13. Food Network N/A

- 14. Gretzky N/A

- 15. Karoline Leavitt 26.3K posts

- 16. Happy Hump 7,820 posts

- 17. Brett Favre 1,088 posts

- 18. Witkoff 186K posts

- 19. El Salvador 49.7K posts

- 20. Crimea 12.7K posts

Something went wrong.

Something went wrong.