📈 Len Kiefer📊

@lenk1efer

Economist, I make charts sometimes.

You might like

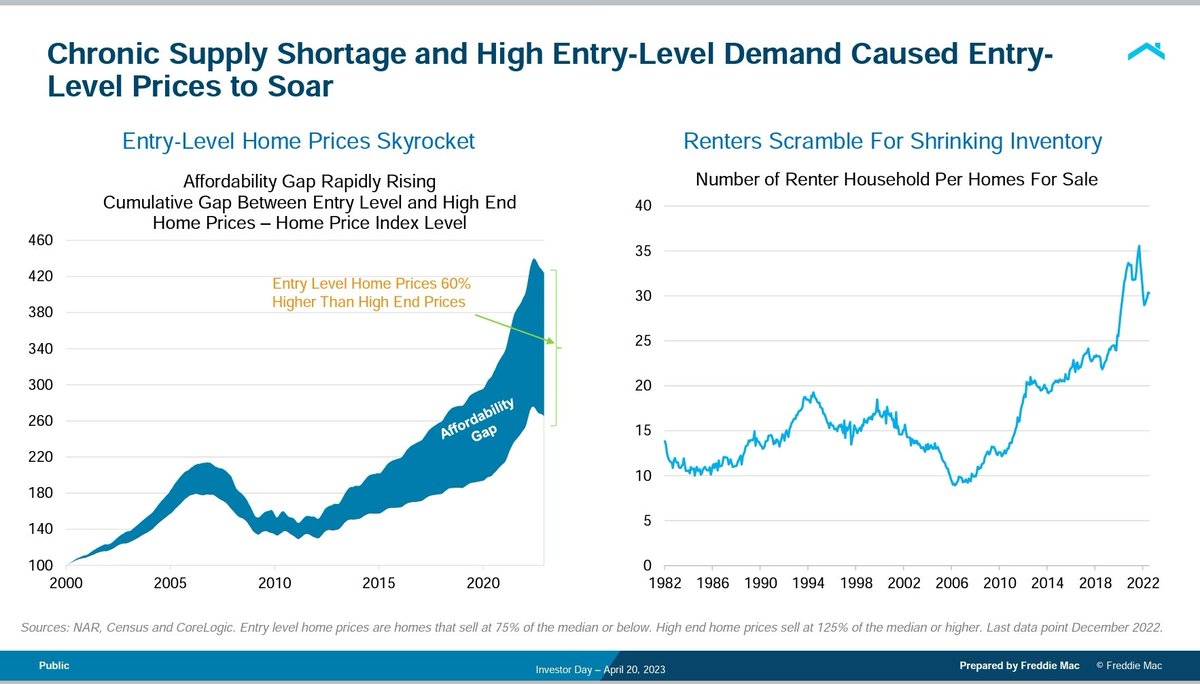

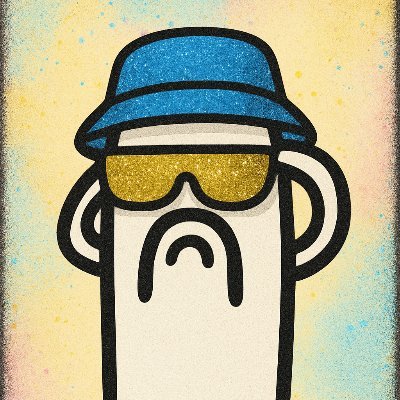

a consequence of the lack of new entry-level housing is that in many markets housing doesn't filter down to lower-income households over time. instead if filters up as higher income replace lower income households in markets like LA, DC

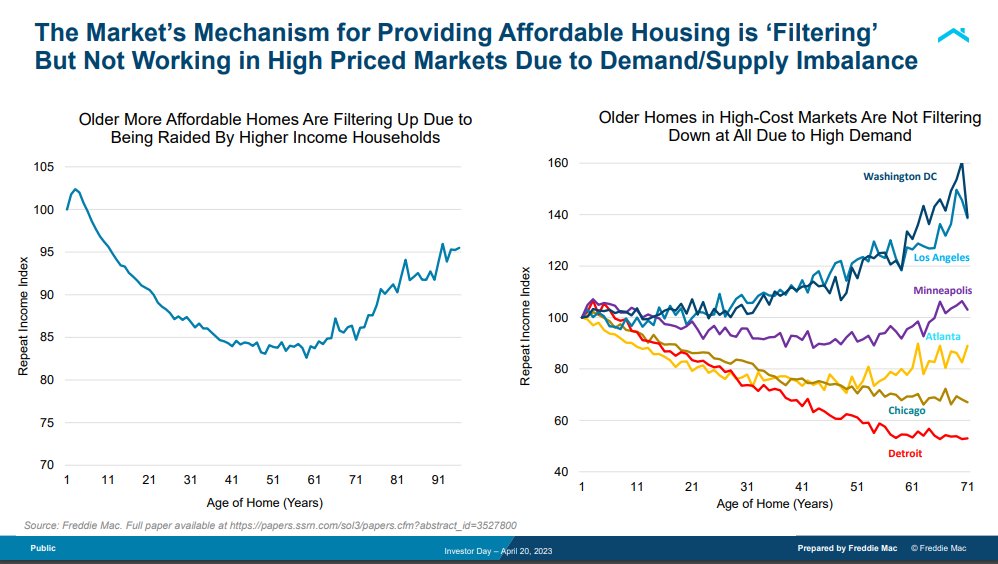

also talked about housing supply challenges and the lack of new entry level housing in the U.S.

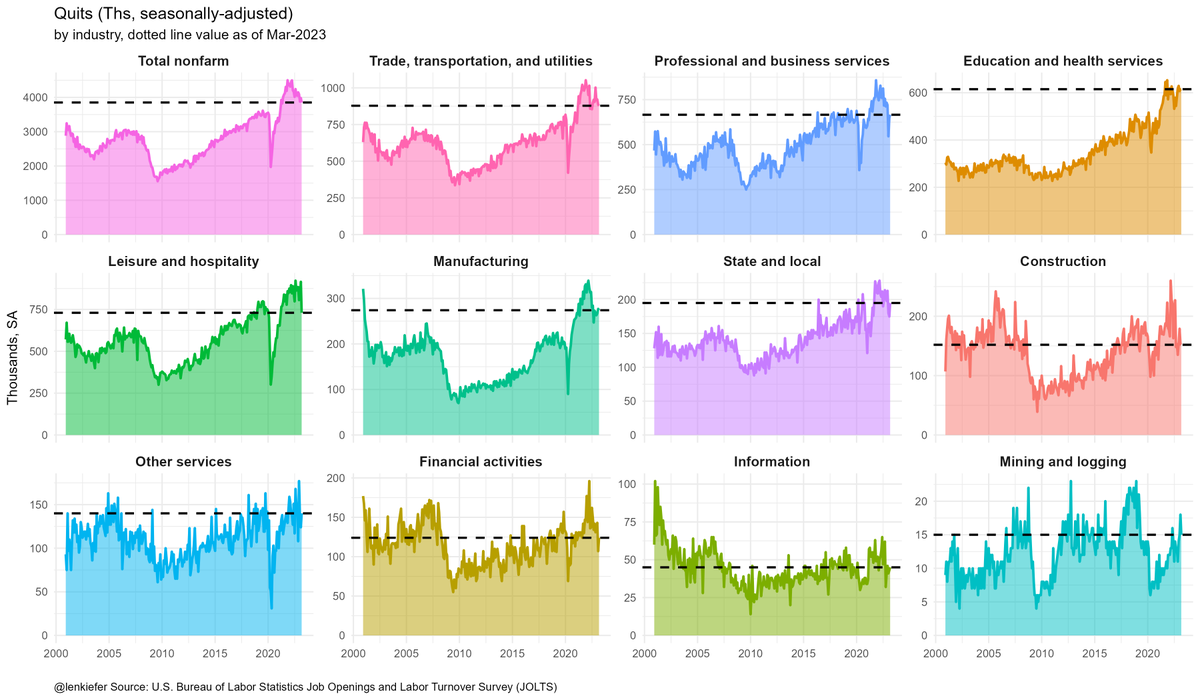

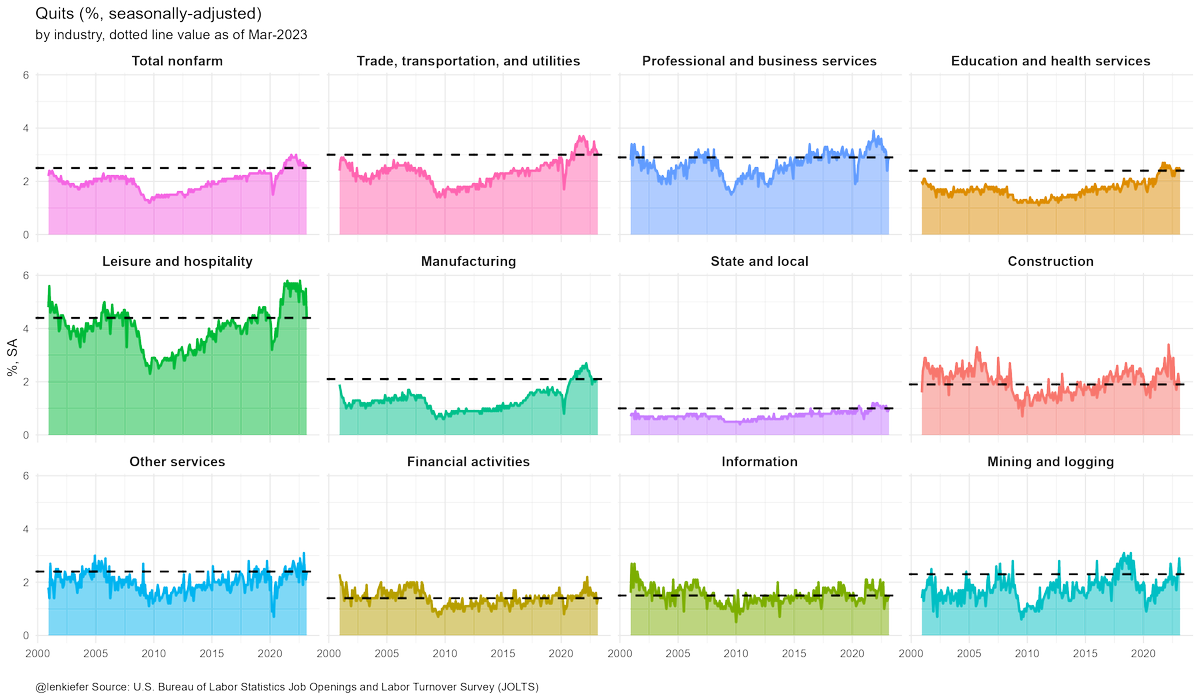

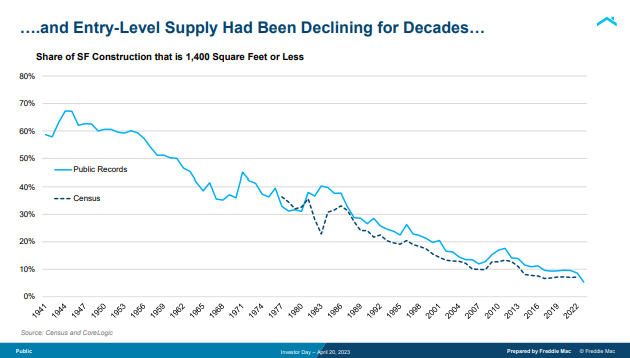

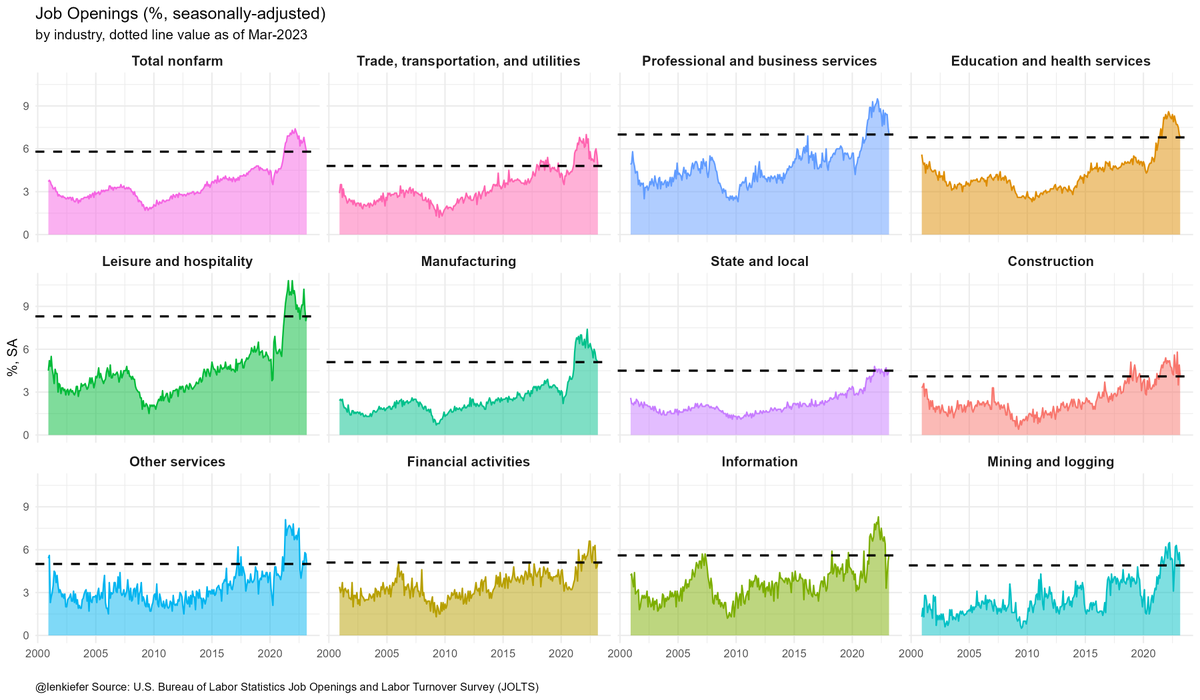

US job openings by industry in JOLTS

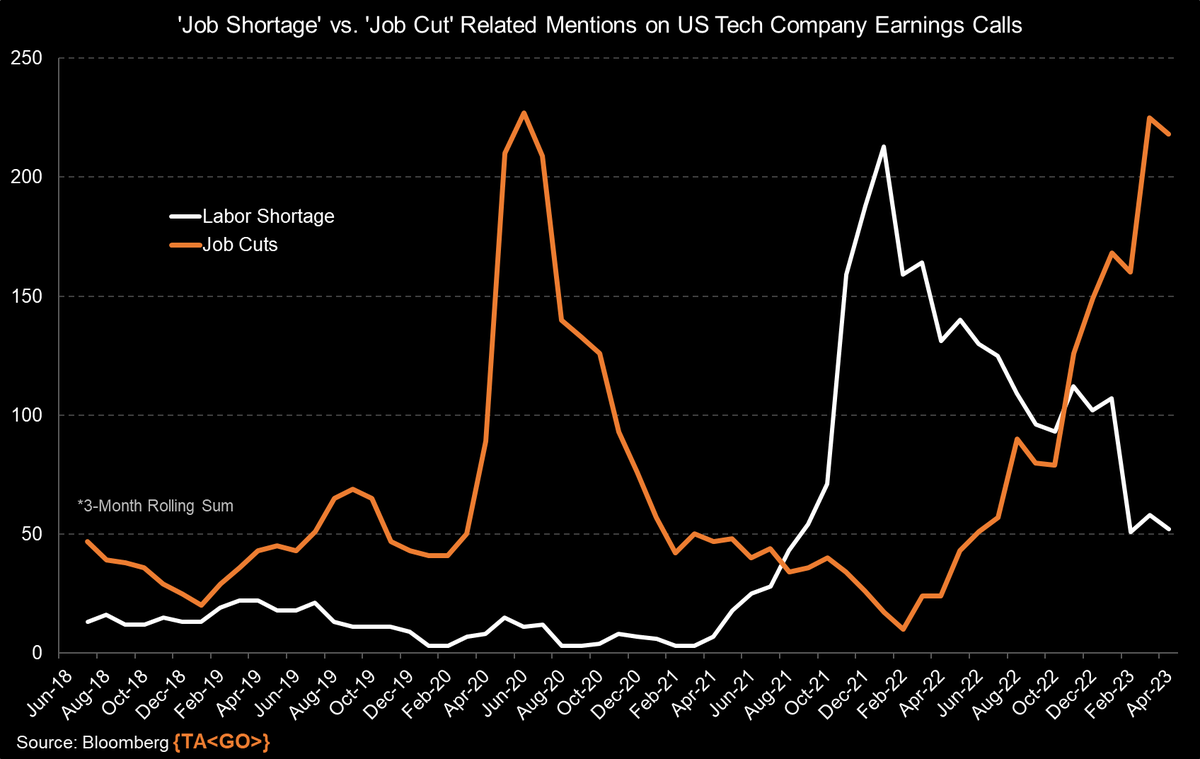

Yesterday, I presented an analysis illustrating that discussions surrounding 'job cuts' surpassed those of 'labor shortages' on S&P 500 company earnings calls. Today, I offer a refined examination, specifically concentrating on US Technology firms: {Data from TA<Go>}

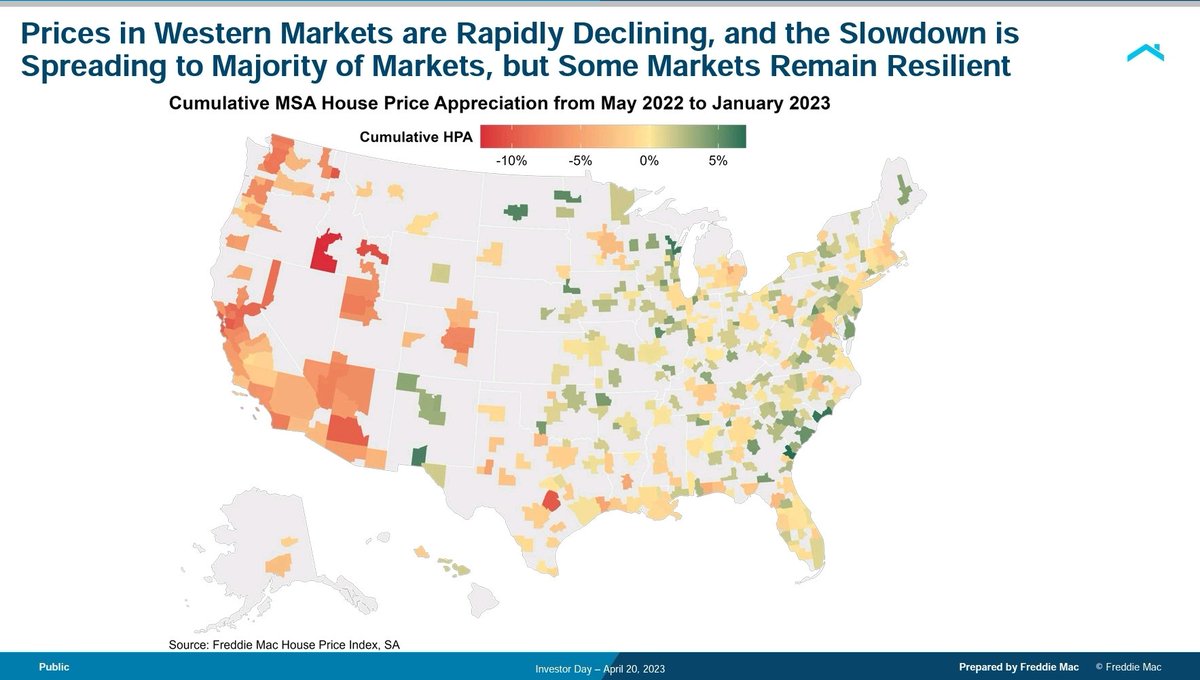

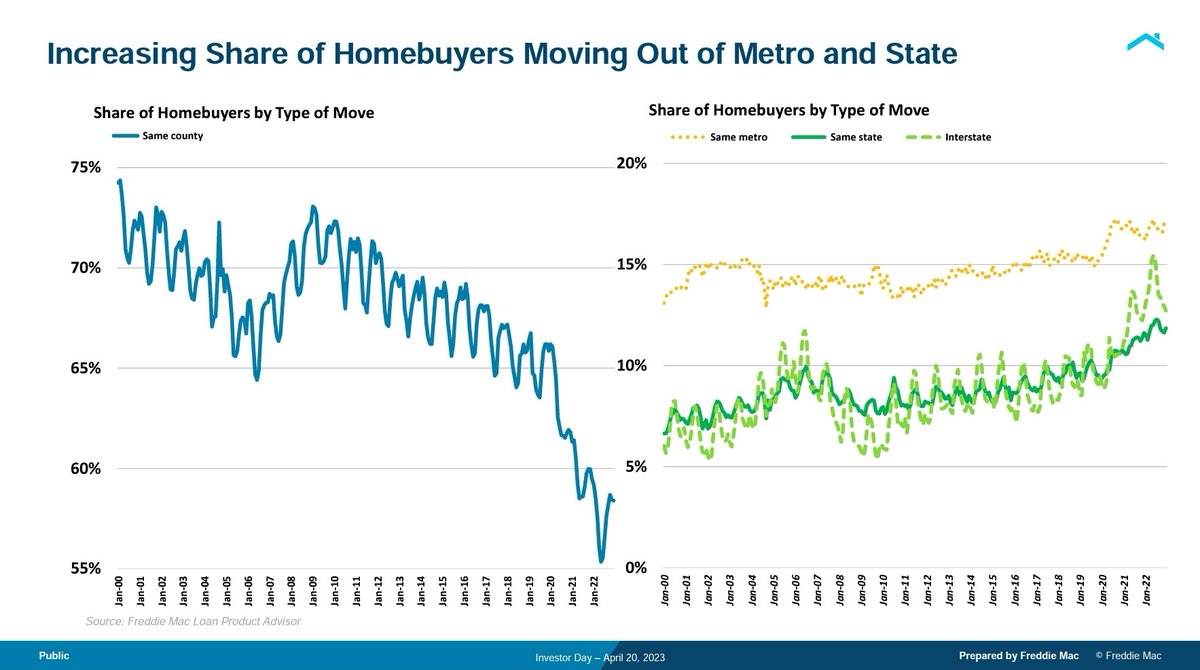

...finished up talking house prices and the impact of domestic migration on local markets

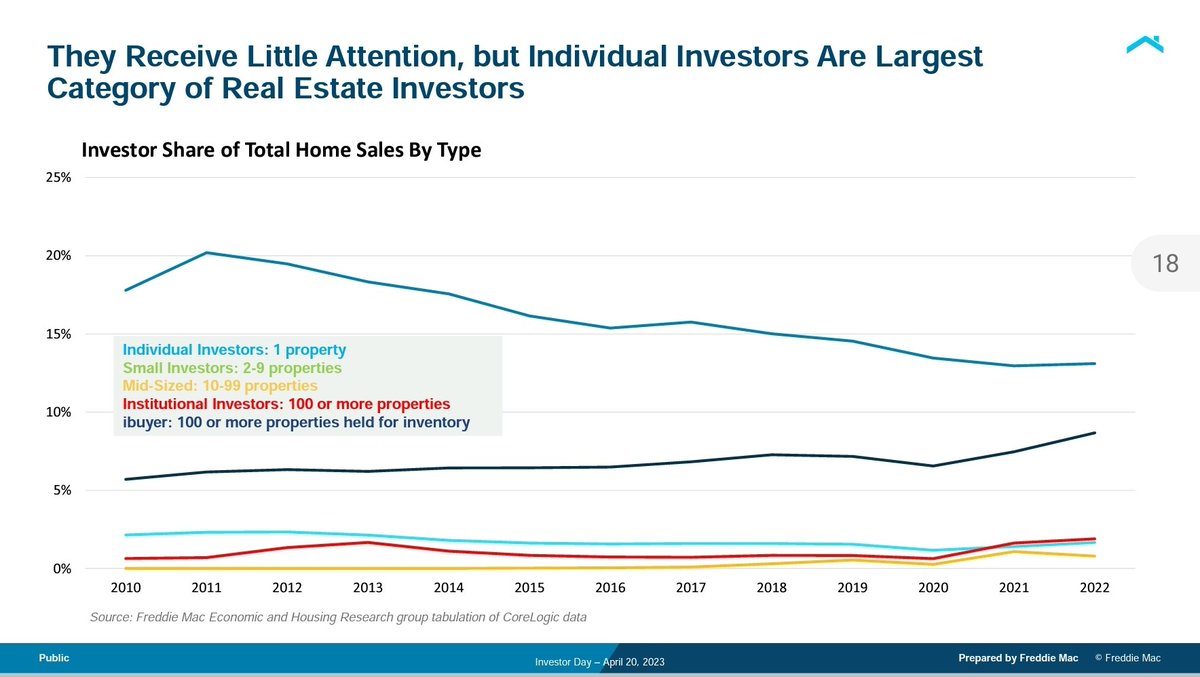

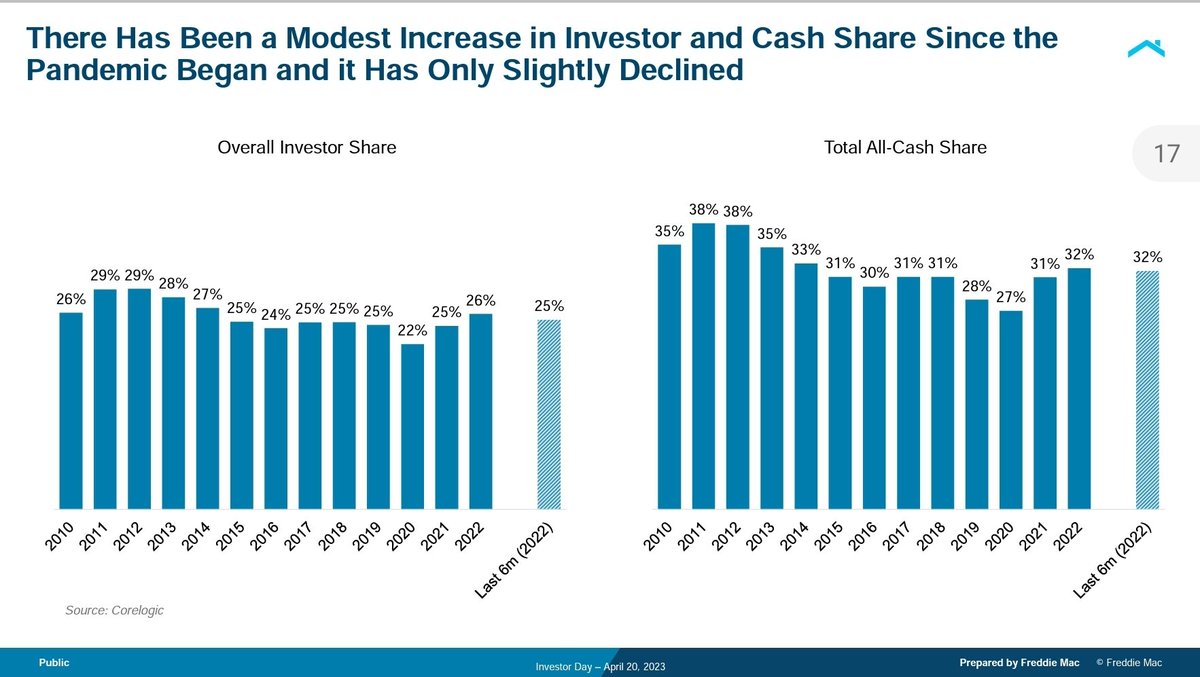

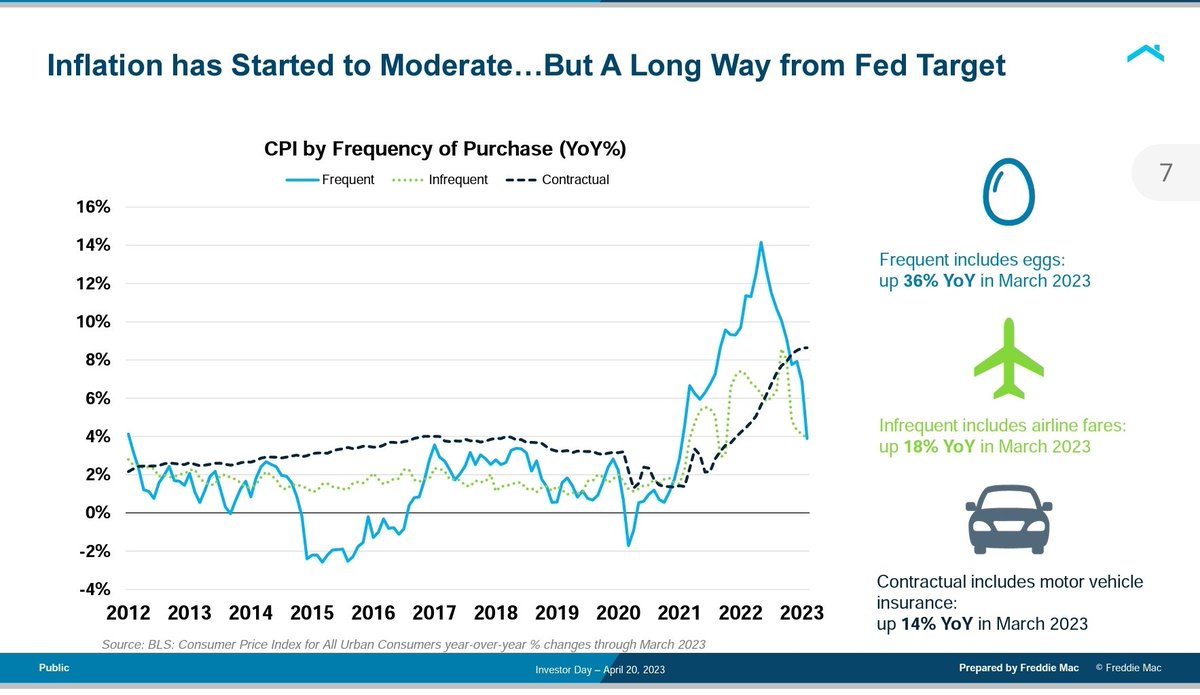

Late last month spoke on the economy and housing market at @FreddieMac Investor Day 2023 capitalmarkets.freddiemac.com/crt/news-insig…

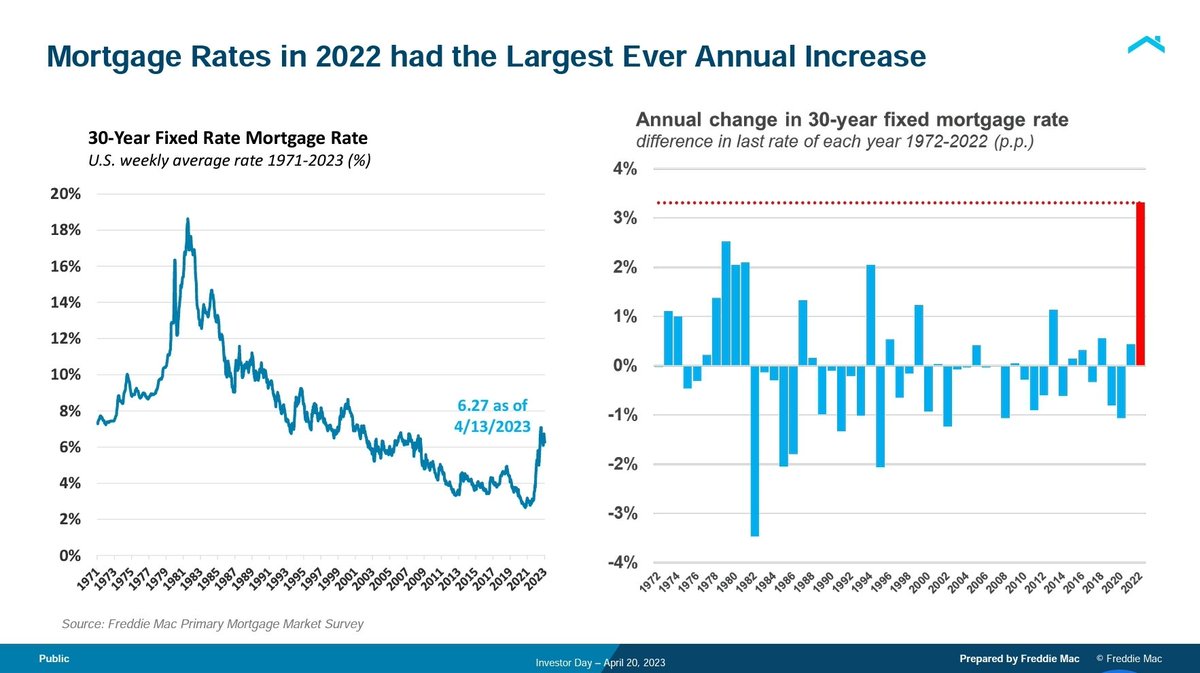

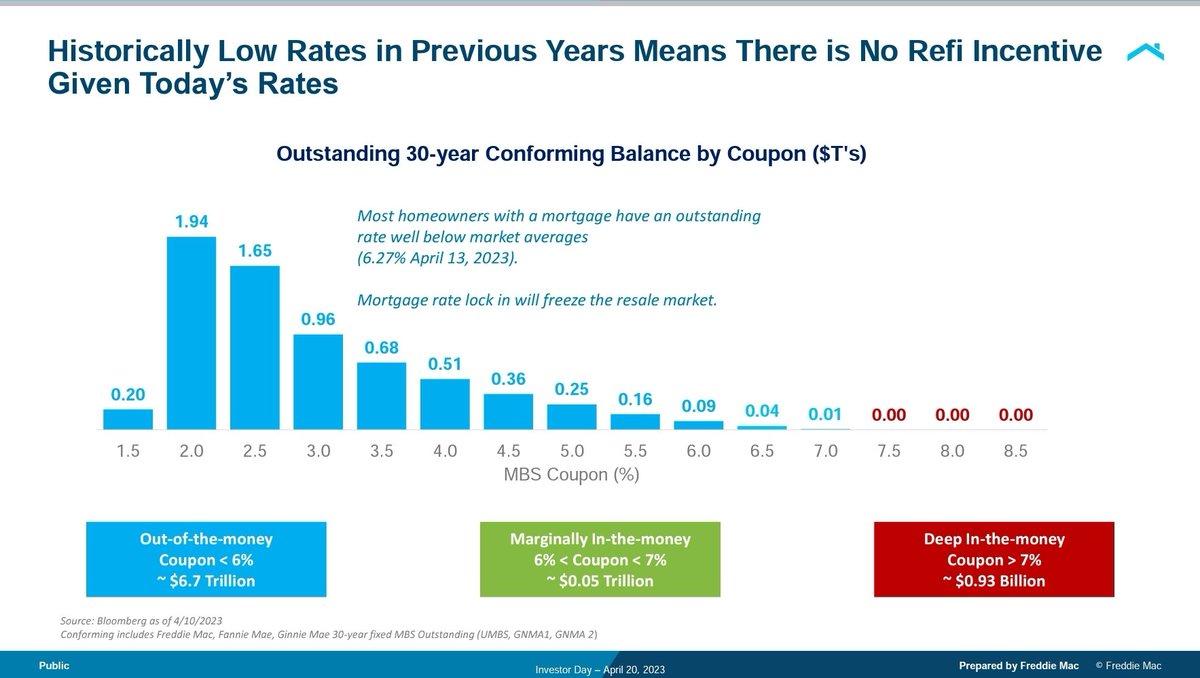

...and of course mortgage rates...

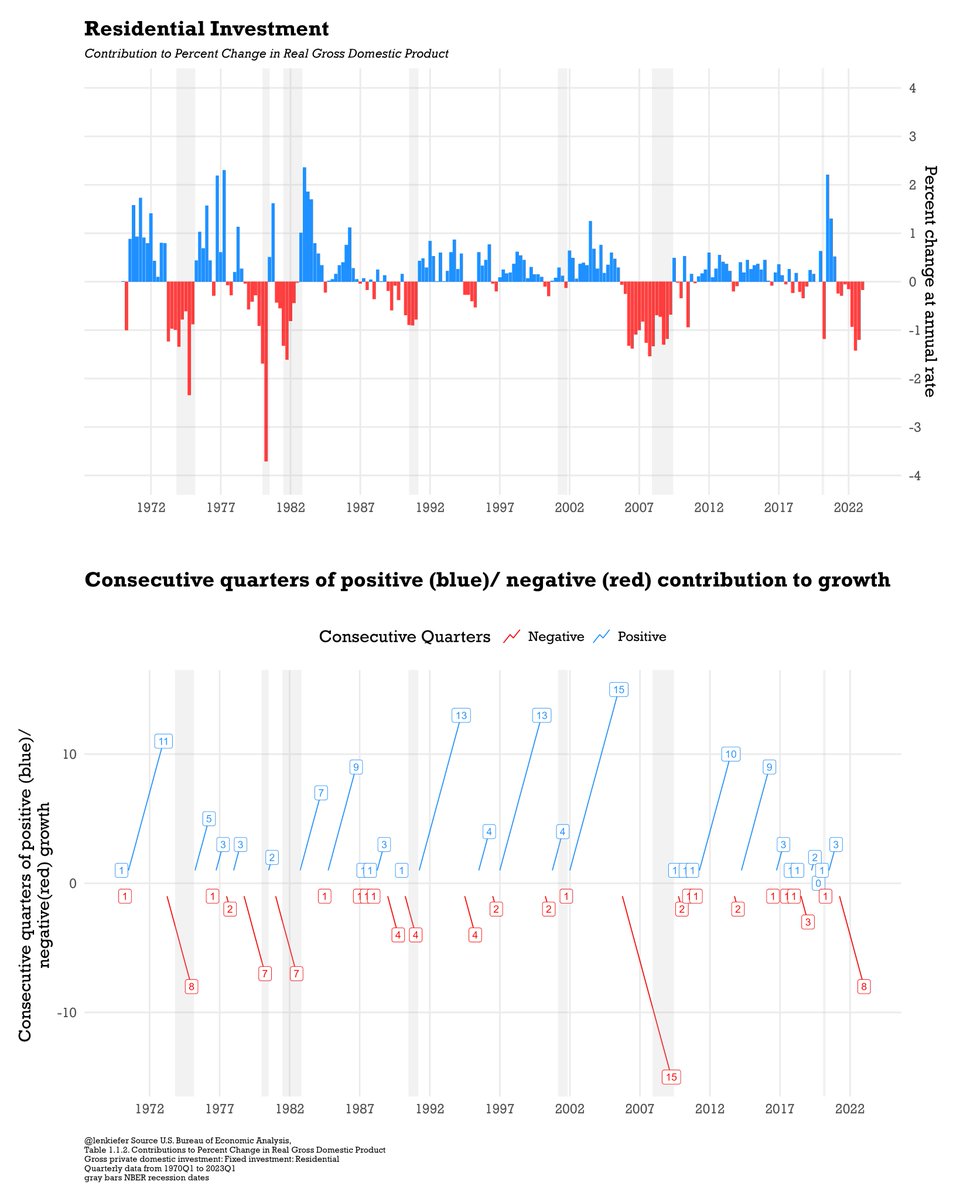

Residential investment subtracted from US GDP growth again in the first quarter of 2023. That's 8 consecutive quarters of negative contribution, the second longest streak of negative prints since 1970

the double dip recession in the early 80s had two streaks of 7 quarters interupted by just 2 positive quarters though

as we approach the halfway point of 2023, housing is starting to show some signs of a modest bounce back. Perhaps the market is turning the quarter. Quite remarkable, the housing market contraction over the past 8 quarters historically would be associated with recession

May now, so I guess it's time to transition from talking about how things are going "at the start of this year" to how things are looking "as we approach the halfway point" of 2023

last millenium, back when I was in high school people wore jackets with little two-digit numbers that symbolized the year they would graduate. found it amazing when they ticked over to 00 now 2023 is 1/3 over, this is ridiculous

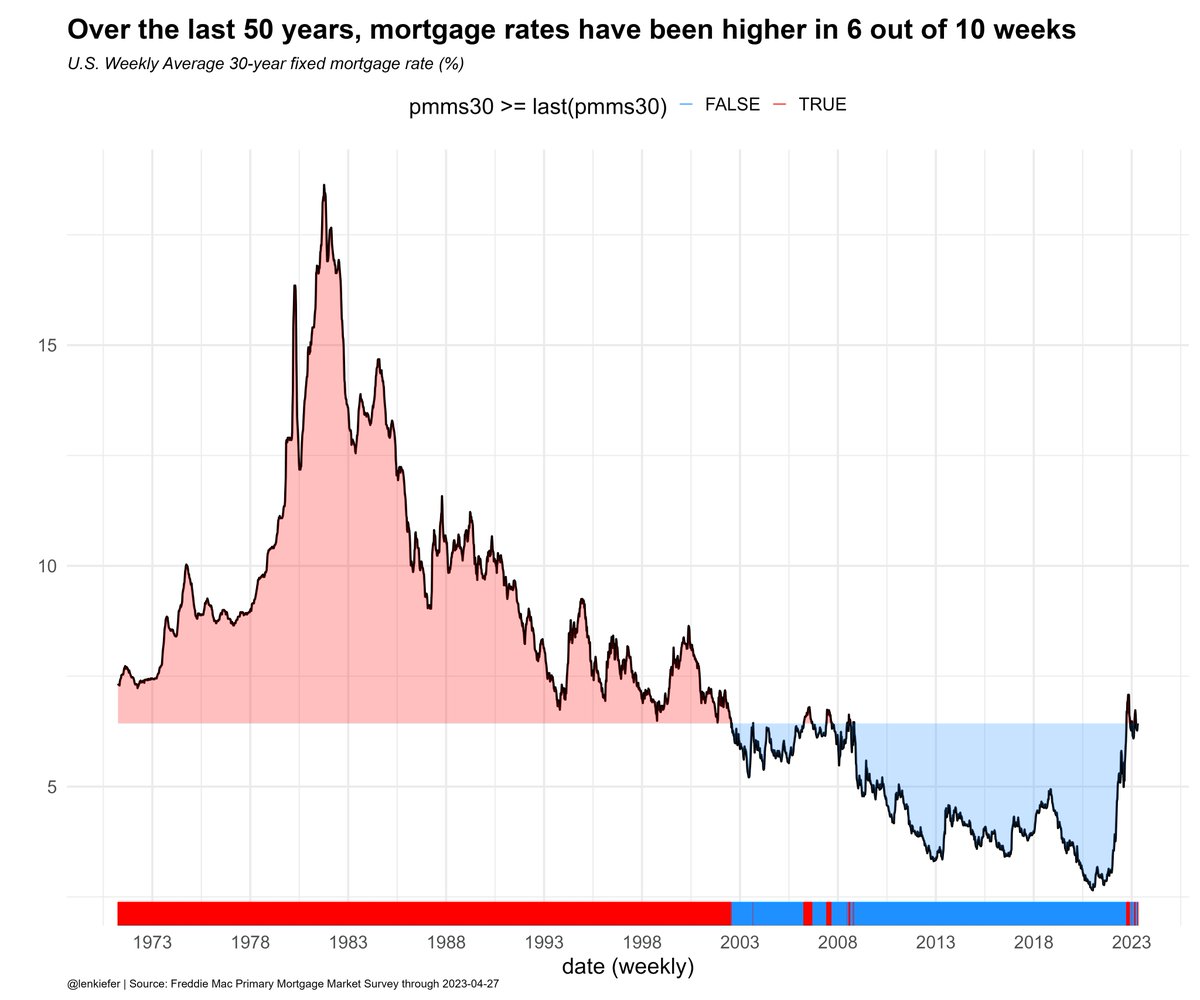

however, the vast majority of those dates have been 2+ decades ago

Over the last 50+ years, Freddie Mac has conducted 2,718 weekly surveys calcluating a U.S. weekly average rate. Last week rates averaged 6.43% for the 30-year fixed. Rates have been lower in 37.5% (1020) of the weeks, at least that high in 62.5% (1698) weeks

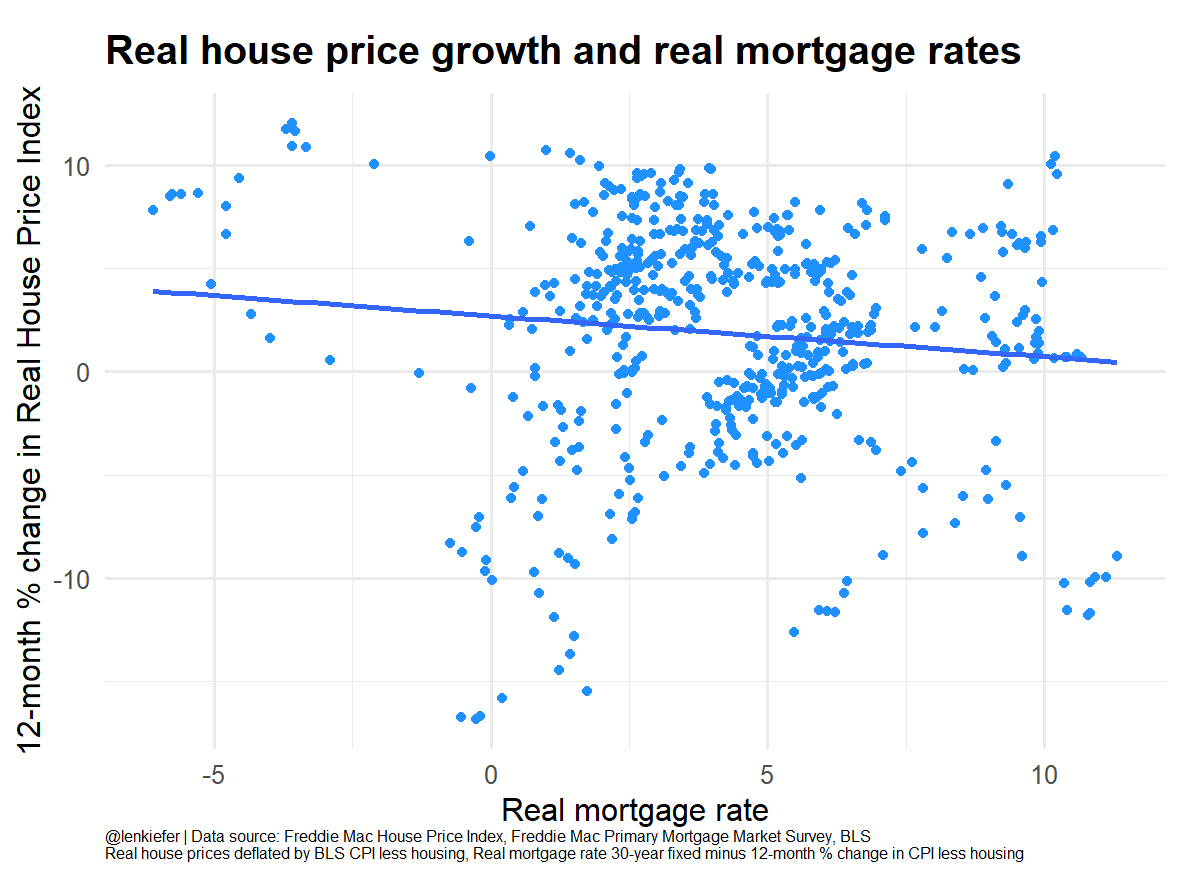

if you take out inflation, increase in real mortgage rates correlated with decrease in real house price growth:

that's probably mostly picking up inflation

United States Trends

- 1. Christmas 3M posts

- 2. Happy Holidays 447K posts

- 3. Feliz Navidad 378K posts

- 4. Santa 1.12M posts

- 5. Colbert 22.6K posts

- 6. Marlins 1,751 posts

- 7. Merry Xmas 170K posts

- 8. Fairbanks 1,851 posts

- 9. Mike Preston N/A

- 10. Unions 9,468 posts

- 11. New Year 366K posts

- 12. Adebayor 4,922 posts

- 13. #BCSpoilers 5,691 posts

- 14. SABRINA CLAUS N/A

- 15. Ivory Coast 5,650 posts

- 16. Brock Bowers 1,875 posts

- 17. Such a Funny Way 9,455 posts

- 18. Hawaii Bowl 1,084 posts

- 19. Tabata 3,066 posts

- 20. The Vault 10.9K posts

Something went wrong.

Something went wrong.