If this is the start of a pullback or deeper correction, keep track of relative strength: 1. RS-line trending up and making new highs 2. Stocks that are building higher lows and higher highs vs market lower highs and lower lows 3. Stocks that are holding above KMAs while…

The easy money is over. • VIX rising • Gold blowing off • Crypto getting killing • Leadership narrowing • Market breadth weakening • Momentum stocks rolling over • Sell-offs on good earnings • Multiple distribution days • No actionable setups • Closes near the lows…

Indexes down today, but the carnage in individual stocks was much worse. The correction was already in progress weeks ago.

I shorted $SPY on Wednesday. The long-term trend remains up, but breadth is weakening — fewer stocks above their 50-day lines; a divergence that has been worsening for months. Rate cuts are priced in, and with the Fed hinting at a pause, a pullback looks likely.…

Today is one of those days: Just about every asset class is trading lower today and all intra-day rally attempts are being sold. It's simply widespread profit-taking. In our view, nothing has changed fundamentally speaking. That said, the most healthy bull markets experience…

Quantum, rare earth, crypto treasuries, drones, air taxis, nuclear … all these baskets peaked two weeks ago. Now steady leakage continues.

Honored to have reached the top of the 1M+ division in Q3 with a 250% return at the US Investing Championship. These are the 5 principles that guided me through another triple-digit year — and might help you see markets with greater clarity.👇🏼

Leaders at the end of September in the million+ division. (579 entrants in all divisions.) Join us for the 2026 competition. Enter at Financial-competitions.com.

I shorted $SPY on Wednesday. The long-term trend remains up, but breadth is weakening — fewer stocks above their 50-day lines; a divergence that has been worsening for months. Rate cuts are priced in, and with the Fed hinting at a pause, a pullback looks likely.…

The market is feeling tired, it has a lot to digest with all the earnings, Fed and other macro news. Corrections can occur sideways thru time or pullback by price. Time corrections are more bullish because they show underlying demand at higher prices than a pullback $SPY…

THE MOST INSANE MENTION MARKET MOMENT JUST HAPPENED HAHAHA The CEO of Coinbase just rugged so many people 🤣

Important part from the NEE call: Data center developers need massive power capacity (1 gigawatt per 1,000 acres) and are willing to pay very high returns to renewable energy providers who can quickly supply the generation needed to secure grid interconnection approvals for their…

Next week's lineup is INSANE. • FOMC decision • Powell presser • $AAPL earnings • $MSFT earnings • $META earnings • $AMZN earnings • $GOOG earnings

Your brain doesn't care about your intentions. It cares about your repetitions. Repetition shapes your reality.

Cool

We've built a really nice in-app experience for the upcoming TSLA shareholder vote. Check it out!

There’s a reason we say, “Don’t fight the Fed and don’t fight the trend.” Right now, both are bullish. The market has shrugged off its typical July–October seasonal and cyclical tendencies, showing impressive resilience. The catalyst and fuel behind this strength are the…

What I learned from Dan Sundheim's rare podcast appearance (didn't even feed this through ChatGPT): - Buy before research: Initiate position before fully vet an idea (Stan Druckenmiller style) - Don't hire lateral stock pickers: D1 doesn't hire from other public shops, prefers…

Dan Sundheim is one of the smartest stock pickers in the public markets. He joins @danielgross and me on Cheeky Pint to discuss their way of analysing businesses, how he makes 95% of the decisions on their $25 billion AUM, waking up at 3am, his career advice for new investors,…

Stanley Druckenmiller once said that the way he latches onto the next big themes EARLY is to constantly listen to and observe what the smartest people in the world are working on and talking about. What would you say that is right now from your own experiences and observations?

BREAKING: The governor of the Bank of England, Andrew Bailey, has said that recent events in US private credit markets have worrying echoes of the sub-prime mortgage crisis in 2008

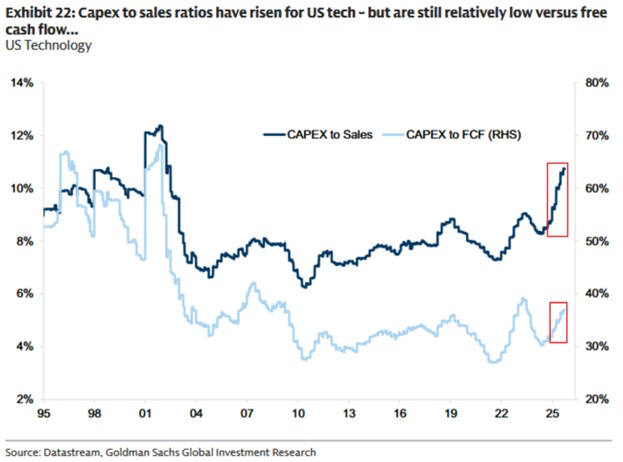

US technology CapEx spending has rarely ever been this high: The CapEx-to-Sales ratio of US tech firms has reached 11%, the highest since 2000. This percentage has risen +4 points since 2022, marking one of the largest increases on record. At the same time, the CapEx-to-Free…

United States Trends

- 1. #FanCashDropPromotion 2,061 posts

- 2. Summer Walker 26.4K posts

- 3. Wale 39K posts

- 4. Good Friday 59.7K posts

- 5. #FridayVibes 5,172 posts

- 6. #NXXT_Earnings N/A

- 7. #FinallyOverIt 8,763 posts

- 8. Go Girl 26.1K posts

- 9. #FridayFeeling 2,493 posts

- 10. Happy Friyay 1,675 posts

- 11. Saylor 46K posts

- 12. Doug McMillon N/A

- 13. SINGSA LATAI EP3 73.7K posts

- 14. Bill Clinton 63.4K posts

- 15. Meek 6,671 posts

- 16. Bubba 12K posts

- 17. Robbed You 5,433 posts

- 18. Thomas Crooks 41.8K posts

- 19. Red Friday 3,979 posts

- 20. $BTC 123K posts

Something went wrong.

Something went wrong.