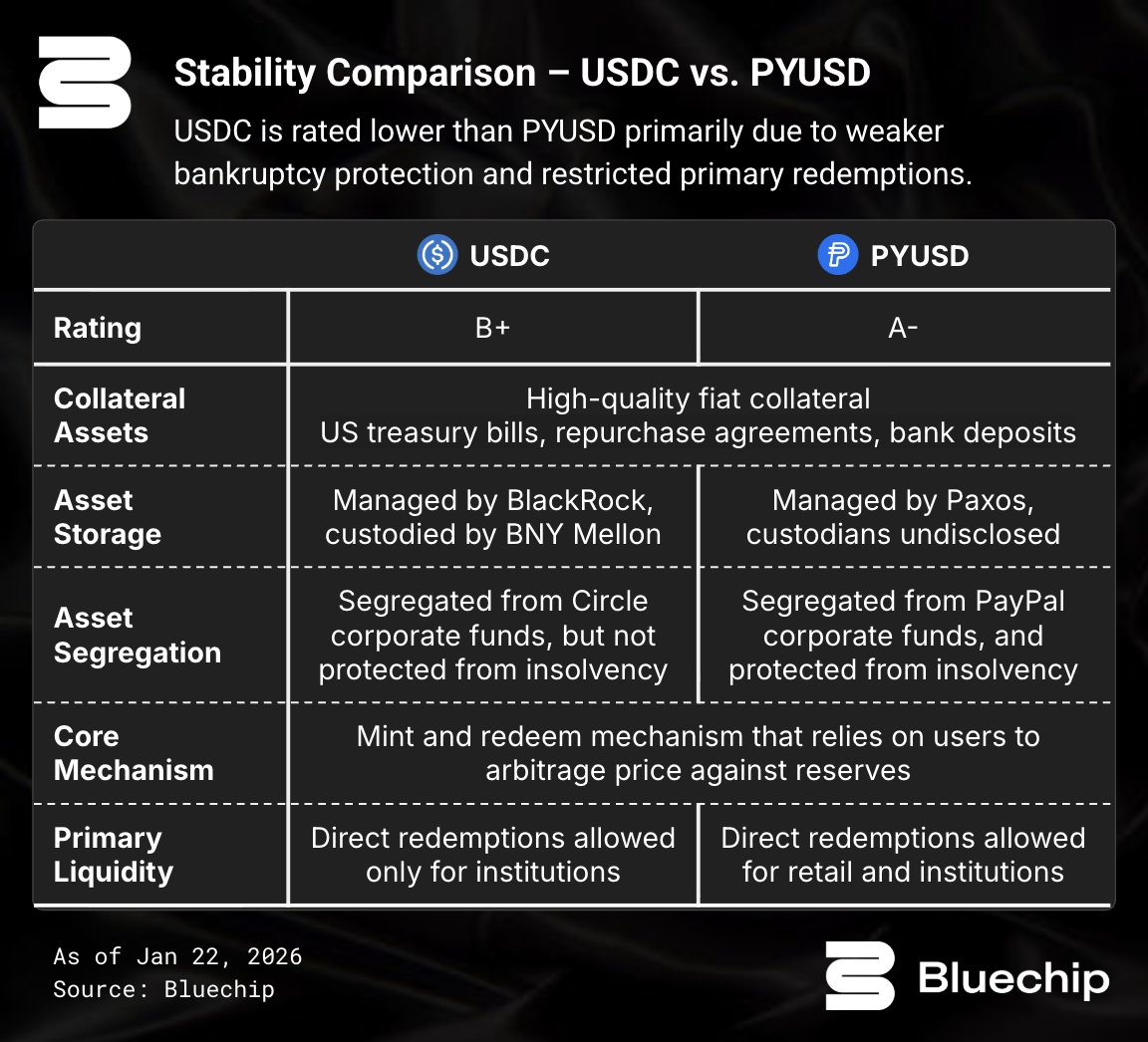

USDC vs. PYUSD – same dollar peg, but different risk profiles. Both are backed by high-quality collateral but they differ on bankruptcy protection, custodian disclosures, and redemption design. Here is a side by side comparison of factors under our SMIDGE rating framework.

Octane has earned more than 150k from bug bounties in the last ~3 months + saved 8 figures in live TVL 2026 is going to be a great year

We are thrilled to win the Startup of the Year Award from @TrendingTopicsA under the FinTech category. Trending Topics, the "TechCrunch of Austria", is an independent tech media company known for award-winning startup journalism. Thank you to everyone who voted for Bluechip!

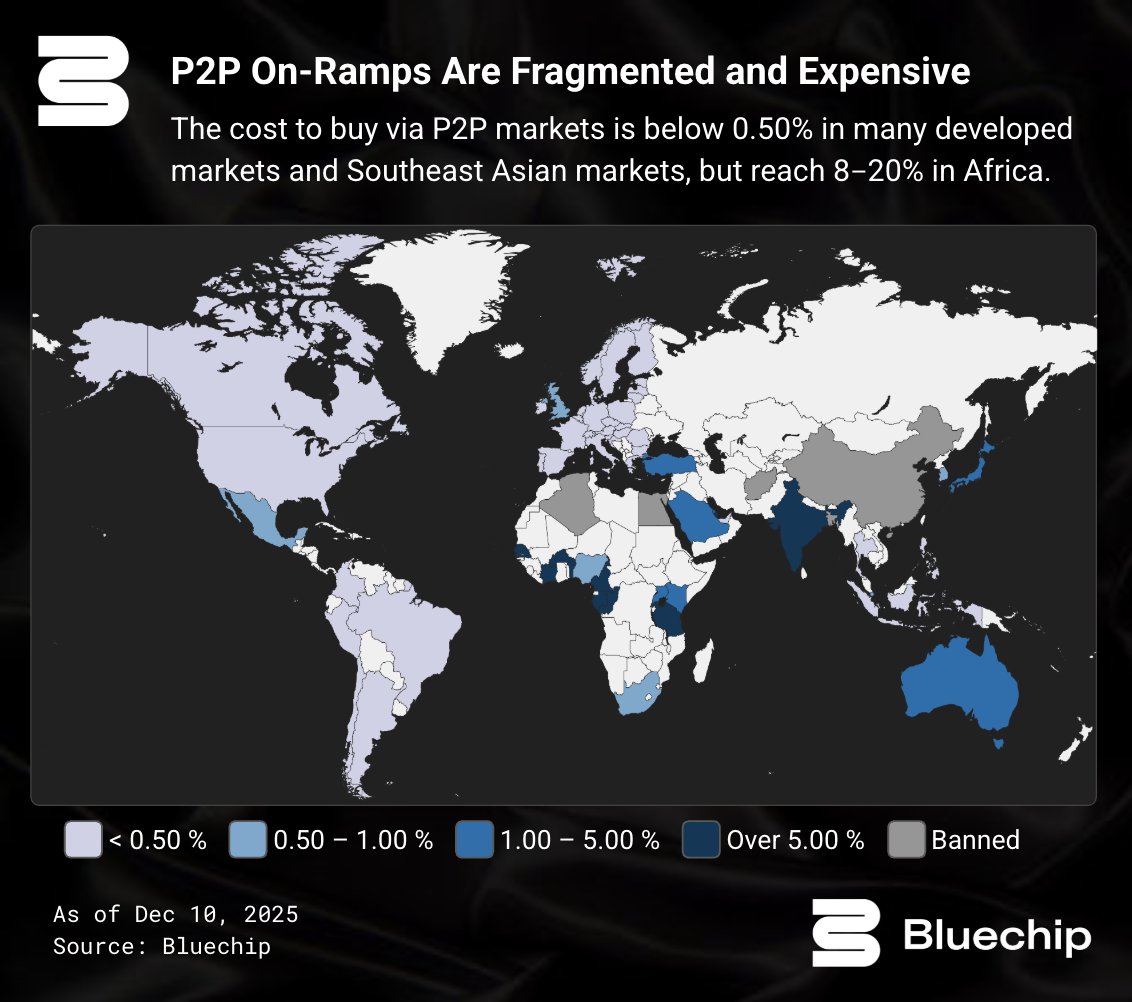

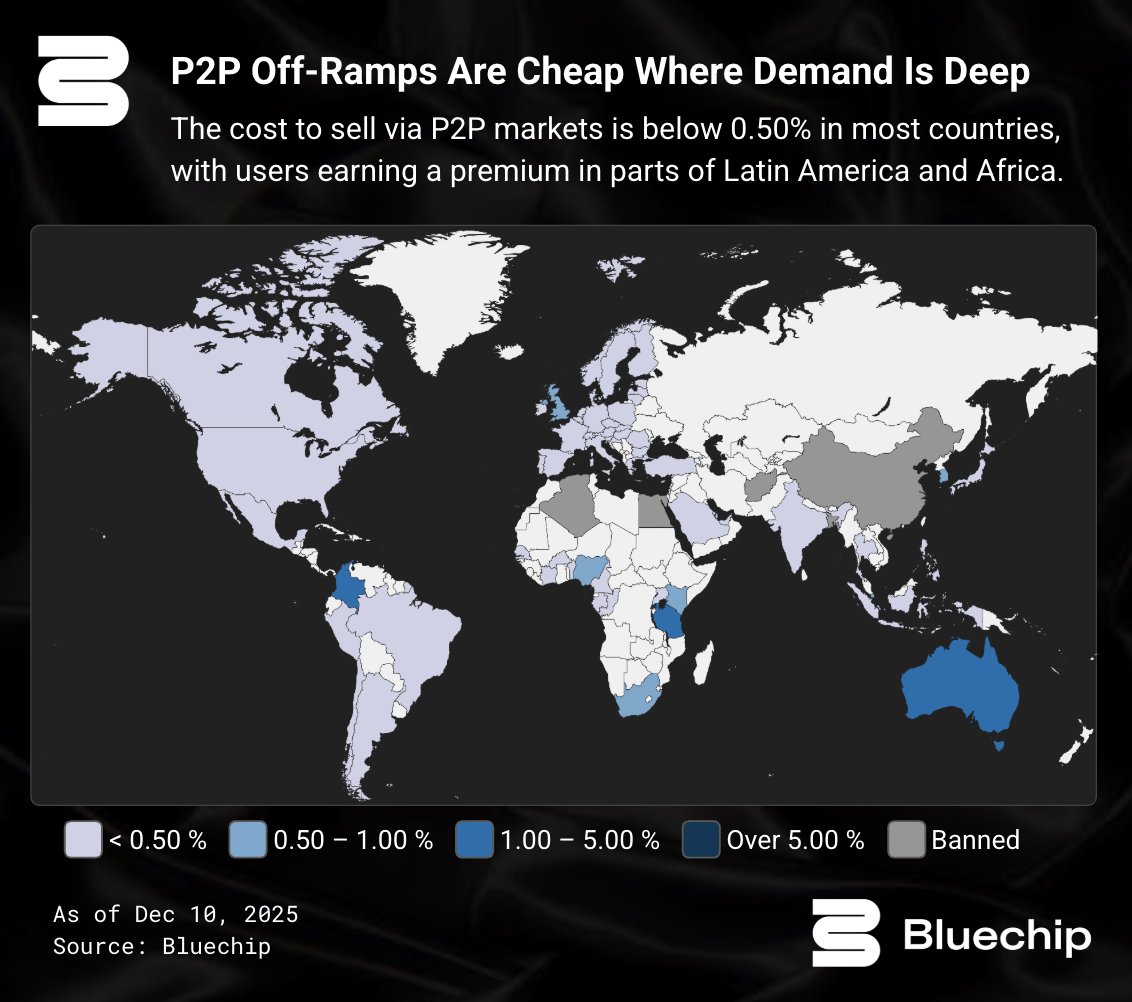

In much of Africa, the stablecoin economy runs via P2P platforms and WhatsApp groups. As @Chuk_XYZ notes in our new report, corner shops & kiosks act as central points for ramps, setting prices and executing trades. Buying is expensive, but users earn a premium while selling.

The easiest way to buy stablecoins is also the most costly: payment cards. Fees are 3–5% even in developed markets, rising to 7–10% in emerging markets. Without margins to absorb MDR charges and fraud losses, fees are directly passed to users. Our new report maps these costs.

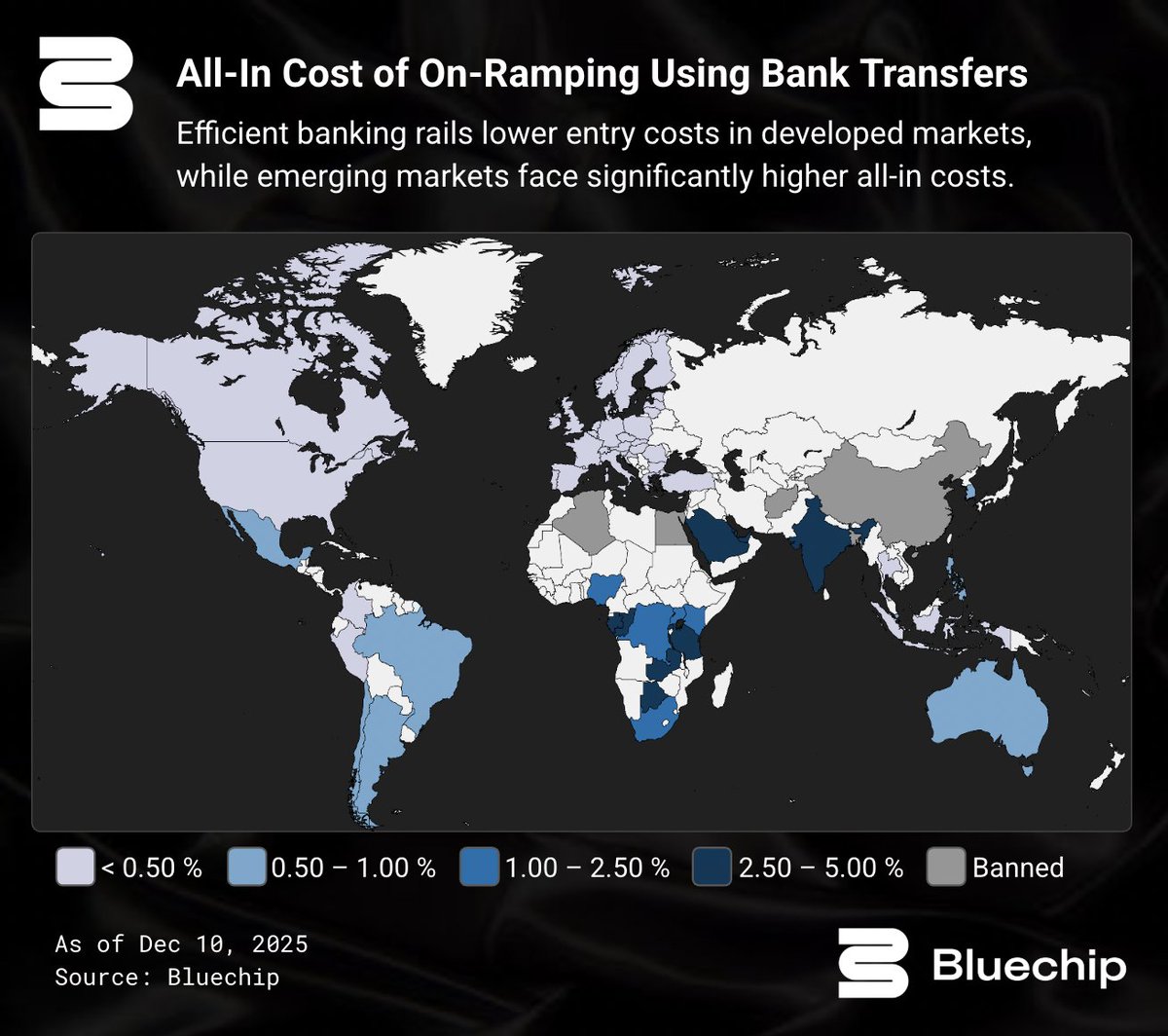

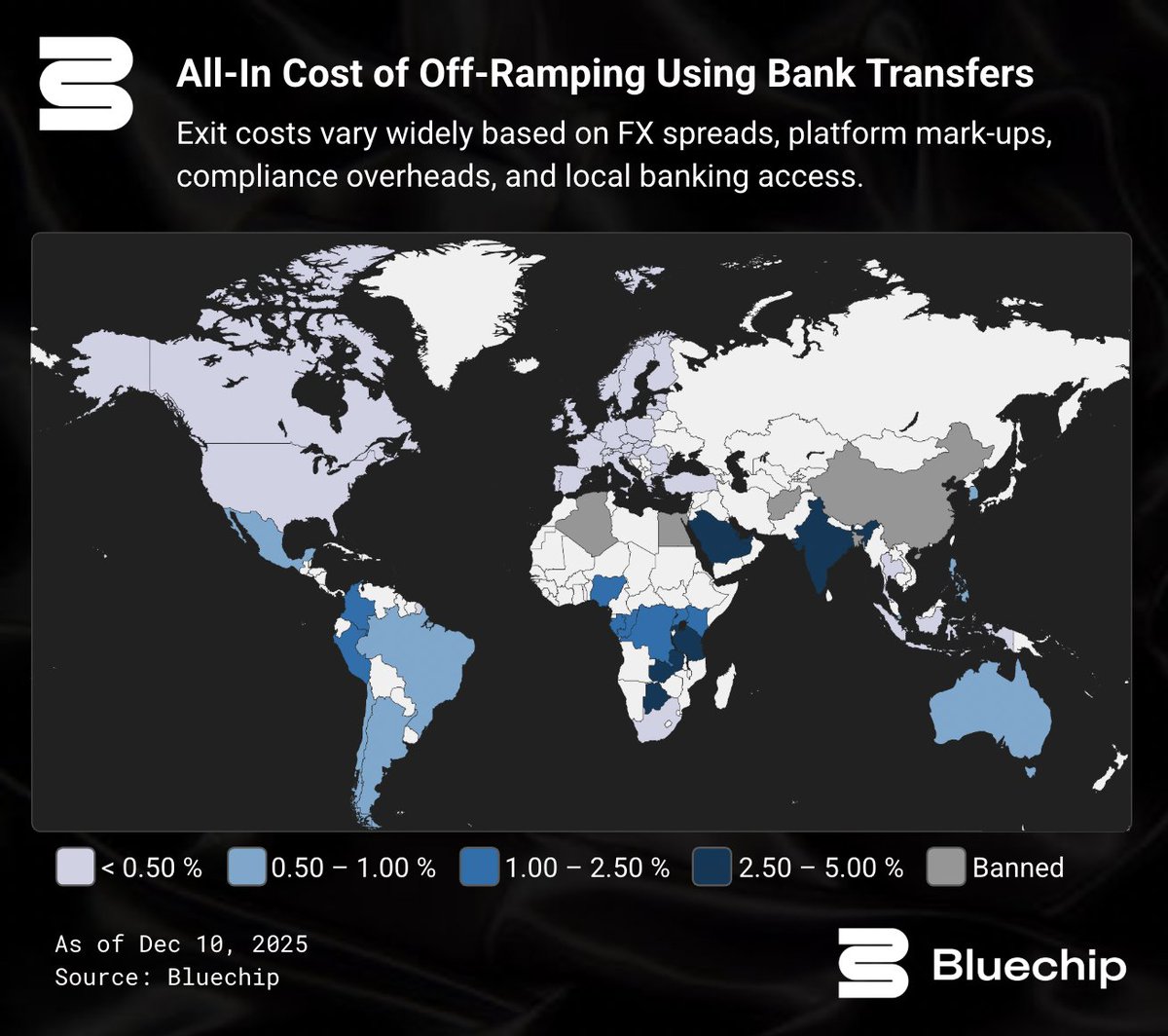

“All on/off-ramp fees are going to zero,” claims the founder of a company building on Bridge. That future is already here for on/off-ramping using bank transfers in developed markets, where all-in costs now sit below 0.30%. Our new report maps this cost across markets.

Who actually powers fiat-to-stablecoin access? We mapped the companies, featured in our new report, into a live directory via @TheGridData. OTC desks, market makers, KYC providers, and more – all in one place. Scan the QR code in the image or click the link below.

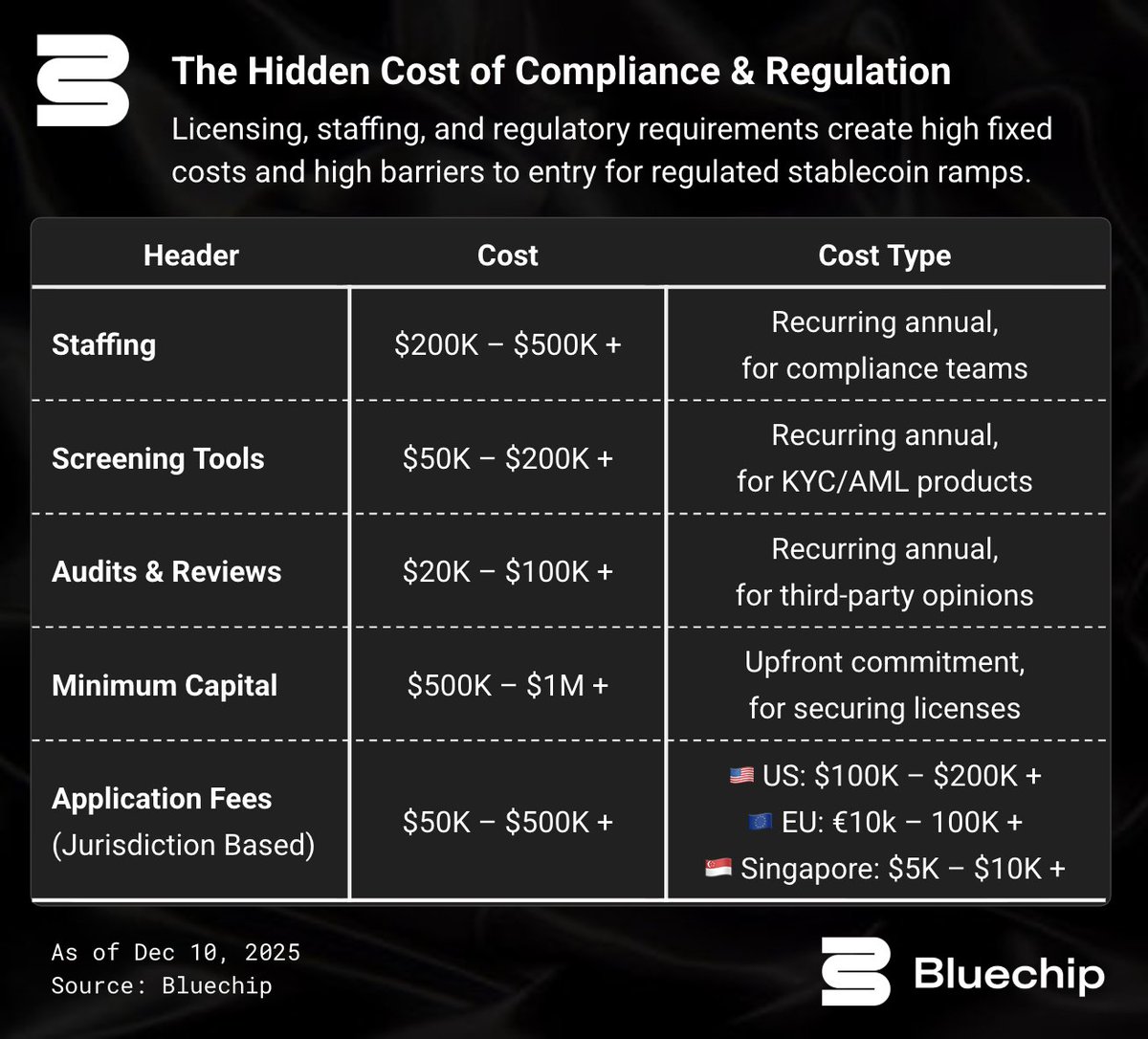

Regulations are expensive. Compliance is one of the largest structural costs for stablecoin ramps. These expenses mean high barriers to entry that prevent new entrants and create moats for incumbent players. Our new report tracks these costs.

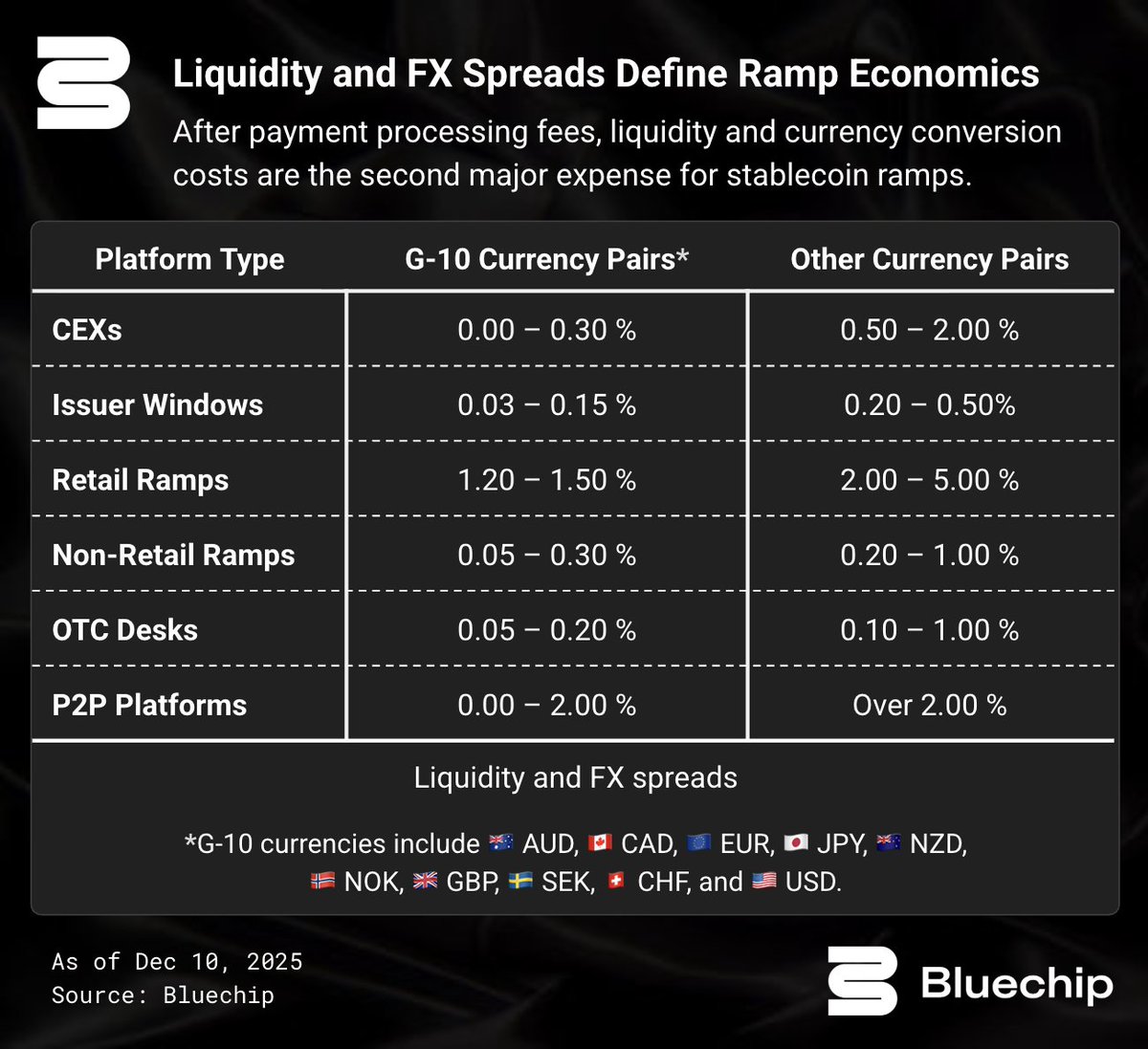

Stablecoin transfers are cheap onchain, but getting in and out is where costs add up. Liquidity and FX spreads drive pricing, with costs varied by platform & currency – basis points for institutions but over 2% for retail in non-G10 markets. Our new report tracks these costs.

look into @bluechip_org reports before depositing into any stablecoin. They're an EF grantees

Stablecoin ramps operate at the intersection of global demand and local regulation. Across jurisdictions, ramps face fragmented regulatory regimes. In order to scale, they must assemble market access, one country at a time. Our new report maps this regulatory patchwork.

Merry Christmas from Bluechip! 🎄

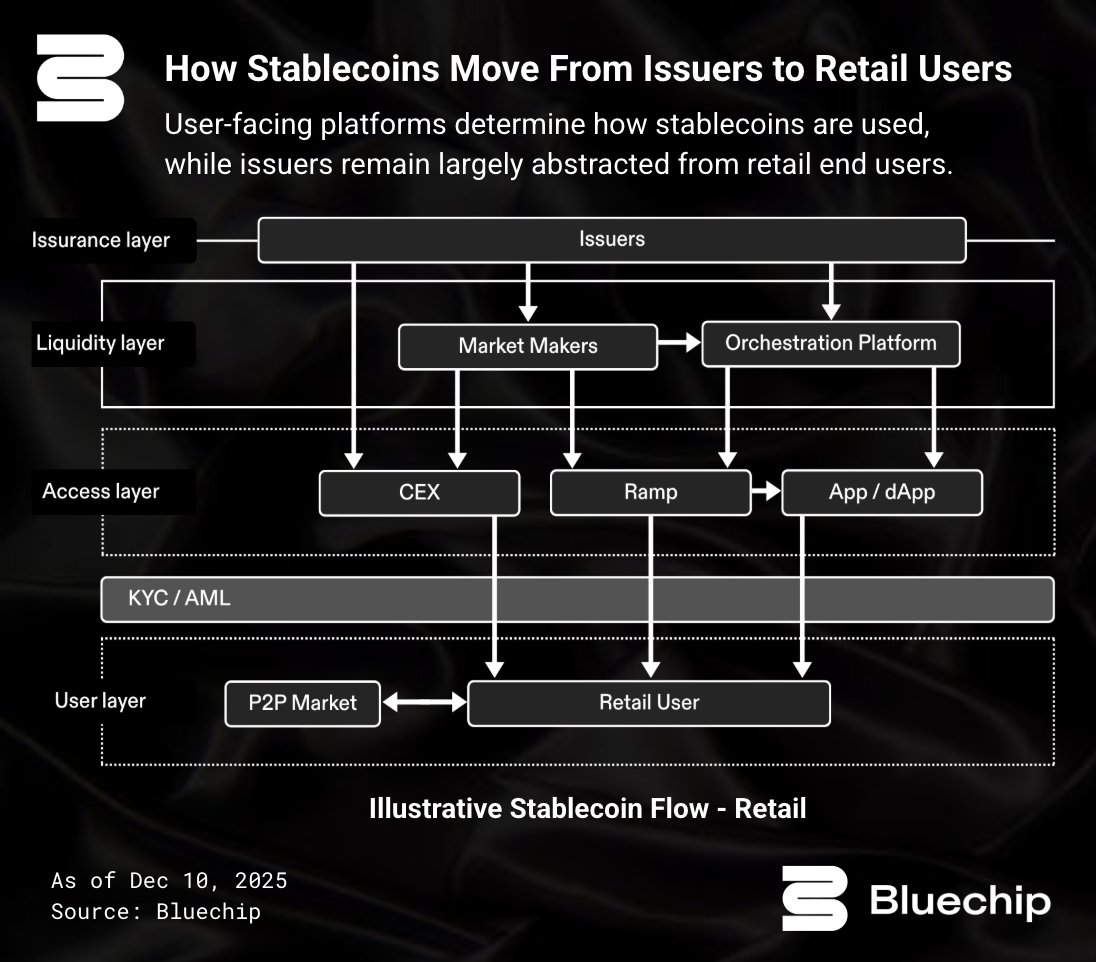

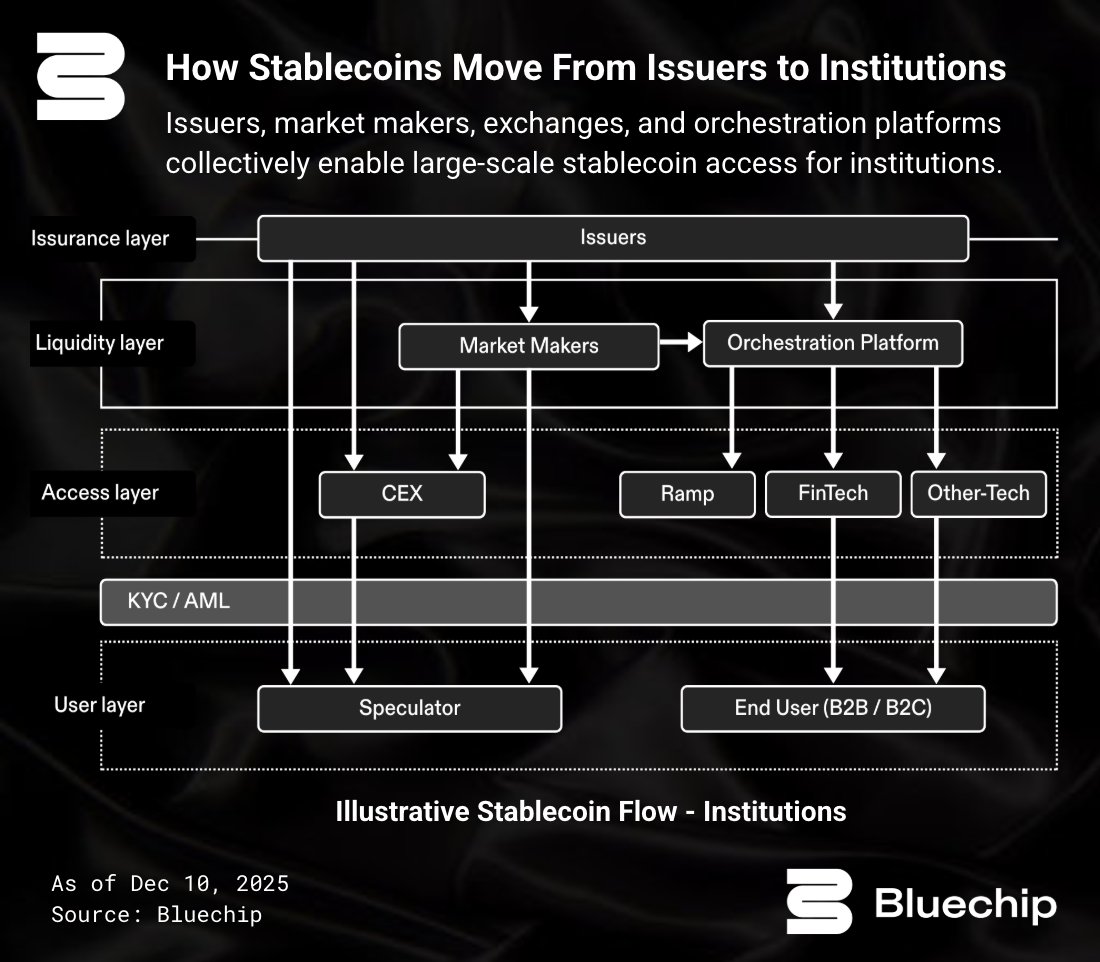

The same stablecoin reaches retail users or institutional users through very different paths. Retail access is driven by front-end interfaces, while institutional access is driven by liquidity. Our new report maps stablecoin flow across layers, from issuers to end users.

Today, we are releasing The 2025 Stablecoin Year-End Report, a comprehensive guide to the protocols, policies, and players that redefined stablecoin adoption this year. 2025 will be remembered as the year stablecoins stopped being a crypto side story and became the fundamental…

We're thrilled to be nominated for Startup of the Year Award by @TrendingTopicsA. Trending Topics, the "TechCrunch of Austria", is an independent tech media company known for award-winning startup journalism. Vote for Bluechip in the link below. ⬇️ trendingtopics.eu/das-grosse-tre…

Not all stablecoin ramps are built the same. Each method of ramping offers a trade off. For example, issuer windows have the lowest cost but also high friction and gated access. Our new report breaks down the six types of stablecoin ramps, based on size, speed, cost.

Stablecoins move money faster & cheaper. But the real bottlenecks are the ramps. We need banks as first-class ramps, simple user experiences, reusable ID verifications, and institutional-grade privacy. Our new report maps the true cost & quality of ramps. Read the summary. ⬇️

@bluechip_org announced on December 18, 2025, the release of its new report: “The ramping bottleneck: cost & quality constraints in stablecoin adoption.” The report lands at a moment of accelerating institutional interest in stablecoins, marked by Stripe’s acquisition of…

Was a pleasure contributing to this report on stablecoin adoption by @bluechip_org - a must read for anyone seriously diving into the frontiers of what’s going on with stablecoins in real world settings.

We are excited to share our new report on stablecoin ramps – published under a grant from @EthereumFndn. Stablecoins move money faster & cheaper than traditional channels. But the real bottleneck to adoption is the cost & quality of on/off ramps. Read the report below. ⬇️

the last mile will have the last word in stablecoin payments onchain rails are largely solved adoption is decided at the edges: on/off-ramps, cost, UX, coverage strong report from @bluechip_org

We are excited to share our new report on stablecoin ramps – published under a grant from @EthereumFndn. Stablecoins move money faster & cheaper than traditional channels. But the real bottleneck to adoption is the cost & quality of on/off ramps. Read the report below. ⬇️

United States Trends

- 1. Giannis N/A

- 2. #SmackDown N/A

- 3. Sinner N/A

- 4. Adam 22 N/A

- 5. Bucks N/A

- 6. Trans N/A

- 7. #DragRace N/A

- 8. #OPLive N/A

- 9. Jason Luv N/A

- 10. Pacers N/A

- 11. Spizzirri N/A

- 12. Kuzma N/A

- 13. Dabo N/A

- 14. Aaron Gordon N/A

- 15. Antarctica N/A

- 16. Doc Rivers N/A

- 17. Attitude Era N/A

- 18. #ZuffaBoxing01 N/A

- 19. Callum Walsh N/A

- 20. Vacherot N/A

Something went wrong.

Something went wrong.