Viczmándi Viktória

@matthew__sigell

Head of digital assets research @VanEck_us . PM, VanEck Onchain Economy ETF ($NODE). Disclosures https://bit.ly/3kn4hQW http://bit.ly/

I've spoken to many investors who want exposure to crypto via equities but are spooked, understandably, by portfolios full of pure-play miners and exchanges that have seen repeated blowups and bankruptcies. If that sounds like you, we designed the VanEck Onchain Economy ETF…

🚨Now Effective: VanEck Onchain Economy ETF ($NODE) Actively managed, $NODE will aim to hold 30–60 names from a 130+ stock universe tied to the digital asset economy: >Exchanges, miners, data centers >Energy infra, semis/hardware, TradFi rails >Consumer/gaming & asset managers…

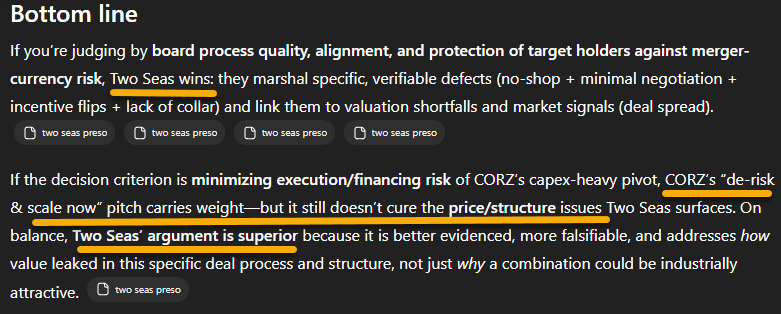

$CRWV / $CORZ

DAT innovation™: sell equity “at a premium”… by stapling a free option worth more than the premium. Premium headline, discount reality.

We’ve raised $76.5M by issuing equity at $17 per share (12% premium to market), with the potential for ~$79M more though a novel 90-day premium purchase contract at $17.50 per share (19% premium) – the first of its kind in the DAT ecosystem. - SharpLink sold equity at both a…

Dear CT, Consider actively managed ETFs w/ exposure to your space … literally this man is actively working for your bags to find asymmetric bets. You should factor the value of your time, energy, and mental health. Don’t forget to factor in your personal shortcomings such as…

Poolside AI, reportedly raising $2B at $14B valuation, announces 2GW behind-the-meter AI campus in West TX with CRWV as core infra provider.

GS: "We are not concerned about the total amount of AI investment. AI investment as a share of US GDP is smaller today (<1%) than in prior large technology cycles (2-5%). Furthermore, we estimate an $8tn present-discounted value for the capital revenue unlocked by AI productivity…

An exciting milestone for AI in science: Our C2S-Scale 27B foundation model, built with @Yale and based on Gemma, generated a novel hypothesis about cancer cellular behavior, which scientists experimentally validated in living cells. With more preclinical and clinical tests,…

$ETR own it ✅️

$ETR 52-week high after CEO says the Louisiana utility has a "robust pipeline" of hyperscalers interested in 100-Plus MW up to Gigawatt-scale projects. Held in $NODE 🫡

Capped calls: where companies pay bankers millions to make dilution look smaller. Just raise the capital and move on.

.@JanvanEck3 and I will take your questions on Bitcoin next Monday at 10am. Registration link in replies

DXY is up just 3% from its low and both India & China are already defending their currencies. They’re selling dollars to slow the move, which adds liquidity. The message is clear: even small USD moves cause tremors now. Fragile fiat = long Bitcoin.

Assets added to the roadmap today: BNB (BNB) coinbase.com/blog/increasin…

We don’t lean too much on technicals, but BTC/XAU looks to be testing the lower bound of a two-year ascending pennant, defined by rising lows since late 2022 (support ≈ 26) and an upper trendline near 38. Will be interesting to see if support holds. @n_frankovitz

Overheard from Gold mining analyst sitting next to me: "These miners are trading at 0.5x NAV and the highest free cash flow yield of any sector"

A few of the reasons we have been underweight DATs in $NODE, from our just-published monthly: "One issue that many new DATs are encountering is the lack of deep and liquid markets for the secondary trading of their securities (particularly options). As a result, DATs without a…

Poolside AI, reportedly raising $2B at $14B valuation, announces 2GW behind-the-meter AI campus in West TX with CRWV as core infra provider.

We believe that to compete at the frontier, you have to own the full stack: from dirt to intelligence. Today we’re announcing two major unlocks for our mission to AGI: 1. We're partnering with @CoreWeave and have 40,000+ NVIDIA GB300s secured. First capacity comes online…

wsj.com

Exclusive | A Giant New AI Data Center Is Coming to the Epicenter of America’s Fracking Boom

CoreWeave and Poolside announce partnership for a data center built on a sprawling ranch in West Texas.

Crypto Equities: 52-week highs: AEP, BITF, CEG, CIFR, CLSK, CORZ, HUT, IREN, LEU, MIR, $NODE, OGE, OGLO, SEI 52-week lows: none

United States Trends

- 1. Thanksgiving 352K posts

- 2. Trumplican 1,701 posts

- 3. Fani Willis 2,566 posts

- 4. #wednesdaymotivation 5,813 posts

- 5. Hong Kong 13.8K posts

- 6. Good Wednesday 33.7K posts

- 7. #Wednesdayvibe 3,030 posts

- 8. Mora 22.4K posts

- 9. Karoline Leavitt 27K posts

- 10. Gretzky N/A

- 11. Golesh N/A

- 12. #StrangerThings5 18.6K posts

- 13. #puebloenbatallayvictoria 2,868 posts

- 14. Ruth 13.8K posts

- 15. Nuns 9,285 posts

- 16. #WednesdayWisdom N/A

- 17. BYOB N/A

- 18. Colorado State 3,807 posts

- 19. 28 Years Later 2,301 posts

- 20. Ribs 11.3K posts

Something went wrong.

Something went wrong.