Mr. Powers

@michaelspowers8

CPA, investor, pessimist & Munger disciple. Delayer of gratification.

No one talks about how Schopenhauer hits harder than most philosophers.

People wearing "freeze the rent" pins while saying they want more housing built--why would any builder build apartments in a city prone to arbitrary rent freezes?--is yet another sign of America's descent into Idiocracy.

Yes to Zohran & @YesOnAffHousing because I want Mayor Mamdani to build lottttssss of housing and you should too!

Every man secretly wants to build a HoldCo with his friends that owns boring high-margin cash-flowing assets.

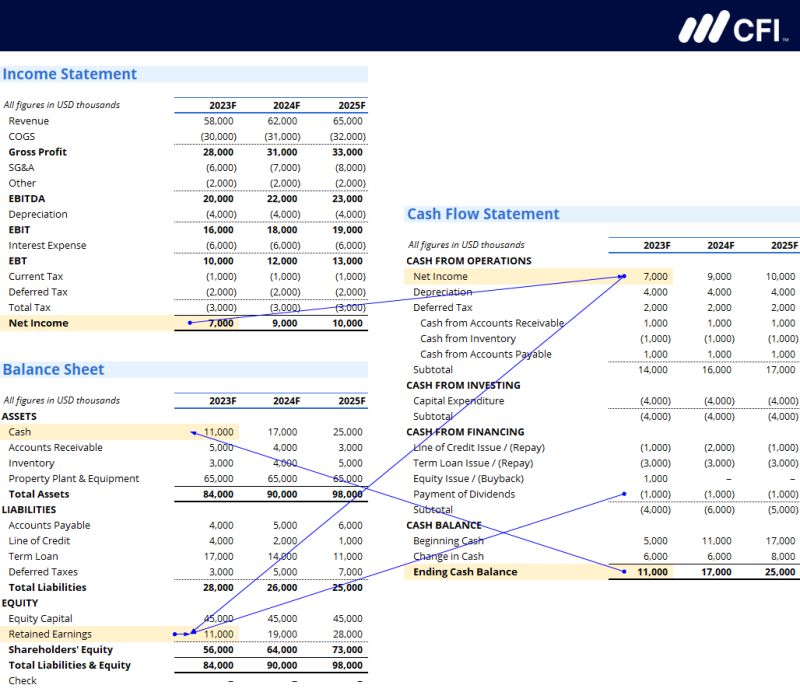

One of the key skills in finance is: Linking the 3 financial statements. Sharing great insights from my friend Tim Vipond, FMVA®. It all comes down to understanding a few key connection points: The real glue between the statements: A) Net Income B) Retained Earnings C) Cash…

"In order to succeed you must first survive." — Warren Buffett "If we as investors fixate on downside protection, the upside, in many cases, takes care of itself. If you can put floors on the downside, then you've got a huge advantage." — Mohnish Pabrai

This goes so hard

Larry Ellison literally explained the mindset that built Oracle into an $800B+ empire:

“I’m a great believer in luck, and I find the harder I work the more I have of it.” — Thomas Jefferson

Jack Dorsey's advice to all entrepreneurs.

4 brutally honest reminders from Seneca: 1. Most suffering is self-inflicted 2. Stop putting things off 3. Stop acting like you’re going to live forever 4. Seek out challenges

The best way to be paid is based on outcomes, not hours worked.

It’s crazy how the step up in basis can wipe out so much tax. Your dad bought $100k of stocks in a brokerage account that are now worth $1M. He passed it down to you. You sell it for $1M and pay $0 in tax. So powerful.

“It’s all about deferred gratification. When you look at the mistakes you make in life, private and professional, it’s almost always because you reached for some short-term fix or some short-term high—and that’s the overwhelming habit of people in the stock market.” — N. Sleep

"Spend less than you make and always be saving something. Put it into a tax-deferred account. Over time, it will begin to amount to something. This is such a no-brainer." — Charlie Munger

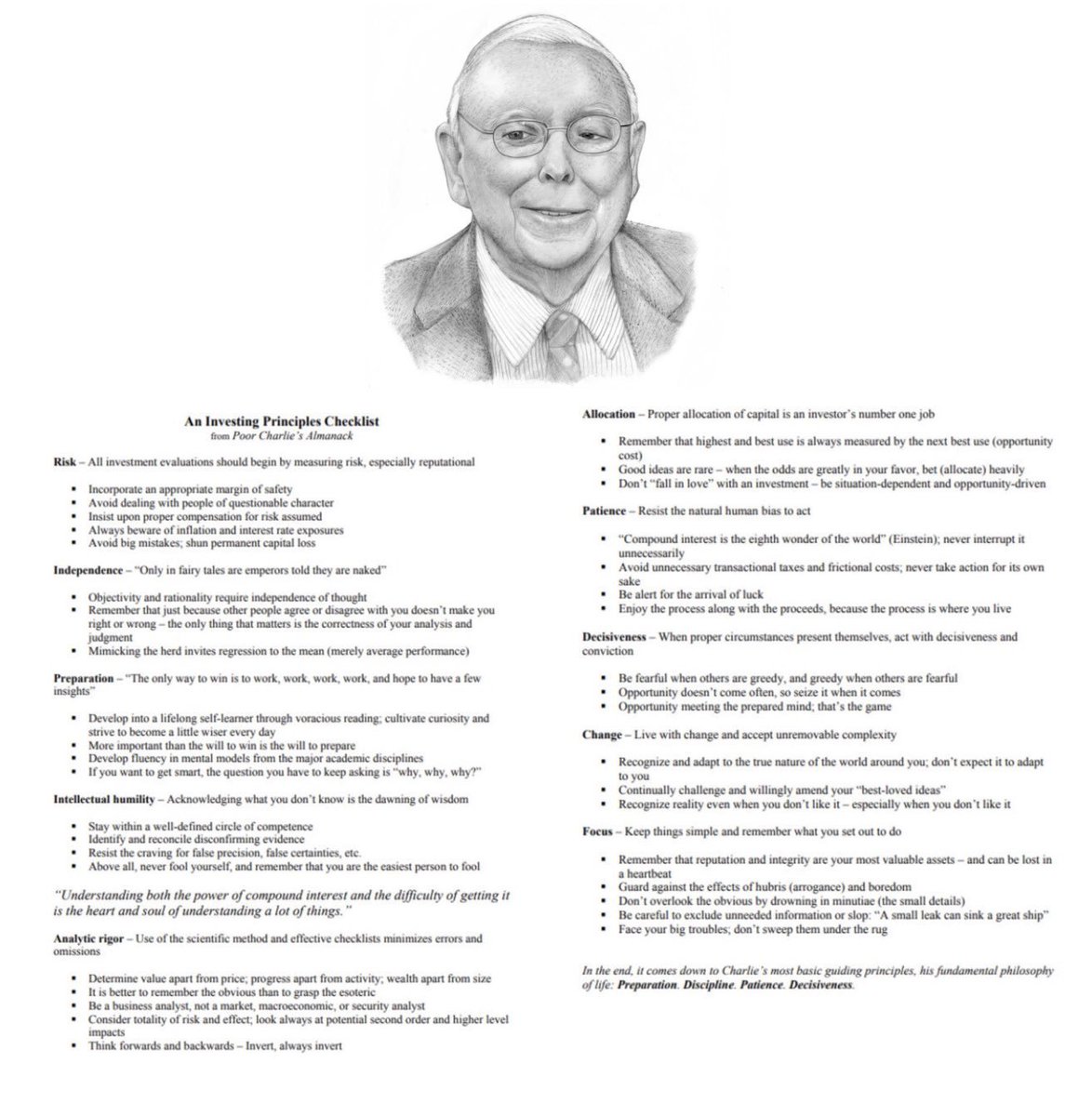

Charlie Munger's Investing Checklist

Real estate investors often make the mistake of buying gamier assets, which backfires during downturns True wealth creation is in long term ownership of high quality properties in dynamic, supply constrained MSAs For example, EQR is the same price today as it was 19 years ago

What's the relationship between cap rate, return on cost, and stabilized yield? This is arguably the most important relationship in real estate and most people don’t understand it at all It’s actually really simple Let’s start with the basics - The cap rate is the NOI divided…

It’s surprisingly common for commercial tenants to neglect their upcoming lease expiration and be forced to ask the landlord for a short-term extension while they figure out what to do next. When this happens, I like to tell the tenant they’ll need to pay holdover rent, but that…

Charlie Munger: "The opportunities that were important, that were going to come to me, were few. And the trick was to prepare myself for seizing the few that came." "[Investment firms] think if they study a million things, they can know a million things. And the result is that…

United States Trends

- 1. #RHOP 3,172 posts

- 2. Rams 26.7K posts

- 3. Chargers 12.4K posts

- 4. Jassi 1,052 posts

- 5. Seahawks 32.5K posts

- 6. Commanders 115K posts

- 7. #HereWeGo 2,829 posts

- 8. Canada Dry 1,481 posts

- 9. 49ers 21.9K posts

- 10. Lions 92.1K posts

- 11. DO NOT CAVE 14.5K posts

- 12. Jordan Walsh N/A

- 13. Stafford 10.1K posts

- 14. Niners 5,449 posts

- 15. Dan Campbell 3,786 posts

- 16. Lenny Wilkens 3,993 posts

- 17. #OnePride 5,007 posts

- 18. Gizelle N/A

- 19. Chris Boswell N/A

- 20. Bills 147K posts

Something went wrong.

Something went wrong.