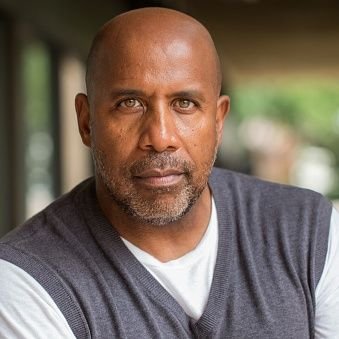

Mitch Moore

@mooremitchd

Jesus is yy | Financial Planner for Bitcoiners | HODLing is not a financial plan, only step 1 to building anti-fragile wealth.

Joined July 2009

United States Trends

- 1. Thanksgiving 355K posts

- 2. Trumplican 1,775 posts

- 3. Fani Willis 3,098 posts

- 4. #wednesdaymotivation 5,870 posts

- 5. Hong Kong 14.1K posts

- 6. Good Wednesday 33.9K posts

- 7. #Wednesdayvibe 3,054 posts

- 8. Mora 22.5K posts

- 9. Ruth 13.9K posts

- 10. Karoline Leavitt 27.2K posts

- 11. Golesh N/A

- 12. Gretzky N/A

- 13. #puebloenbatallayvictoria 2,881 posts

- 14. Nuns 9,361 posts

- 15. #StrangerThings5 18.8K posts

- 16. #BurnoutSyndromeSeriesEP1 248K posts

- 17. Colorado State 3,845 posts

- 18. BYOB N/A

- 19. 28 Years Later 2,343 posts

- 20. Ribs 11.3K posts

Loading...

Something went wrong.

Something went wrong.