Barrick to Spin Off North American Gold Assets Through IPO bloomberg.com/news/articles/…

*RIO TINTO, GLENCORE SAID TO DECIDE AGAINST PURSUING MERGER

BREAKING: Glencore and Rio Tinto end merger talks.

Record shareholder returns and another record quarterly financial performance mark successful delivery of 2025 operating plan. Barrick Q4 2025 Results 🔵 $1.43 net EPS ⬆️ 151% y/y 🔵 $3.08B attributable EBITDA ⬆️ 82% y/y 🔵 $2.73B operating cash flow ⬆️ 96% y/y 🔵 $0.42/share…

Barrick Mining Corporation $B beats on adj EPS, $1.04 vs .88, beats on EPS, $1.43 vs .89, beats on Revenue, $6B vs $5.16B, beat on OCF, $2.73B vs $2.07B, and beat on FCF, $1.62B vs $1.42B. Quarterly dividend boosted to .42, new div policy targeting 50% payout of attributable FCF.…

Record shareholder returns and another record quarterly financial performance mark successful delivery of 2025 operating plan. Barrick Q4 2025 Results 🔵 $1.43 net EPS ⬆️ 151% y/y 🔵 $3.08B attributable EBITDA ⬆️ 82% y/y 🔵 $2.73B operating cash flow ⬆️ 96% y/y 🔵 $0.42/share…

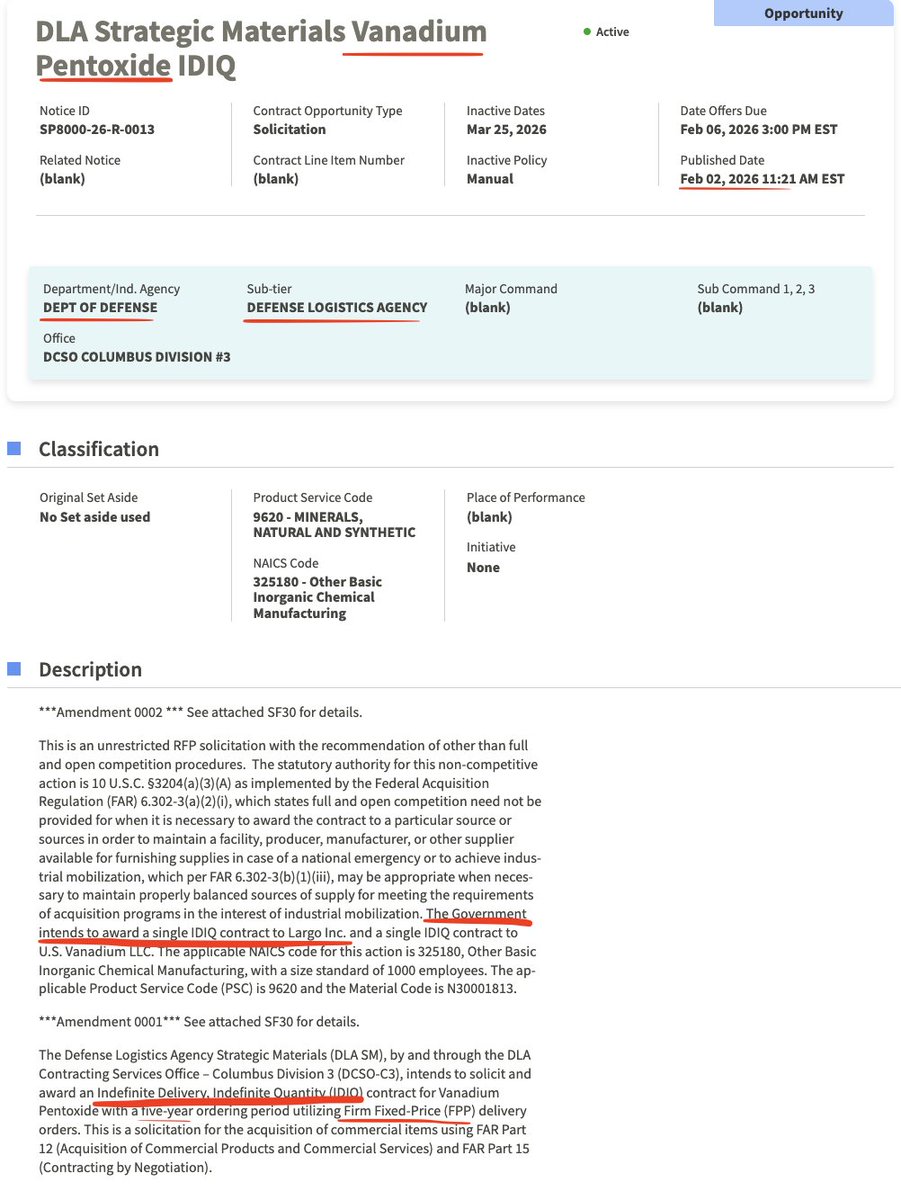

Largo $LGO is about halfway through their turnaround Extend the debt & lower opex 👍 Iron ore contract for $56m 👍 US government contract in the works Ilmenite ramp up tbd To do list: Monetize value from the tungsten assets Copper & PGM contract EU contract for stockpiling

$lgo I still cant get why we are still below 2 bucks but let the algos trade it and give more shares to retail. 56 mil from iron ire that nobody knew about, US government contract, no risk of bankrupcy and so on. I am pretty sure EU, UK, Chinese... will also make stockpiles.

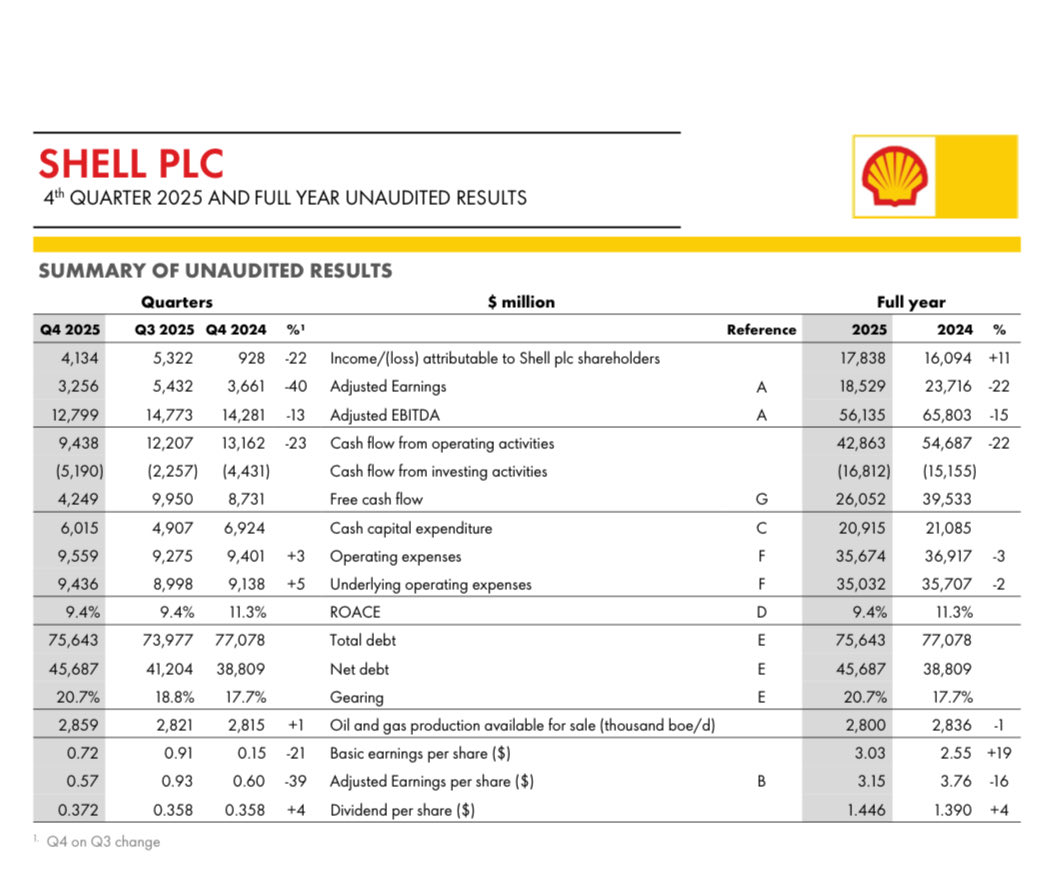

BIG OIL 4Q EARNINGS: Shell misses expectations dragged by its struggling chemical business and weak oil trading. The oil major maintained its quarterly share buyback at $3.5 billion (defying expectations of a cut) but at the cost of taking debt. It doesn’t look sustainable.

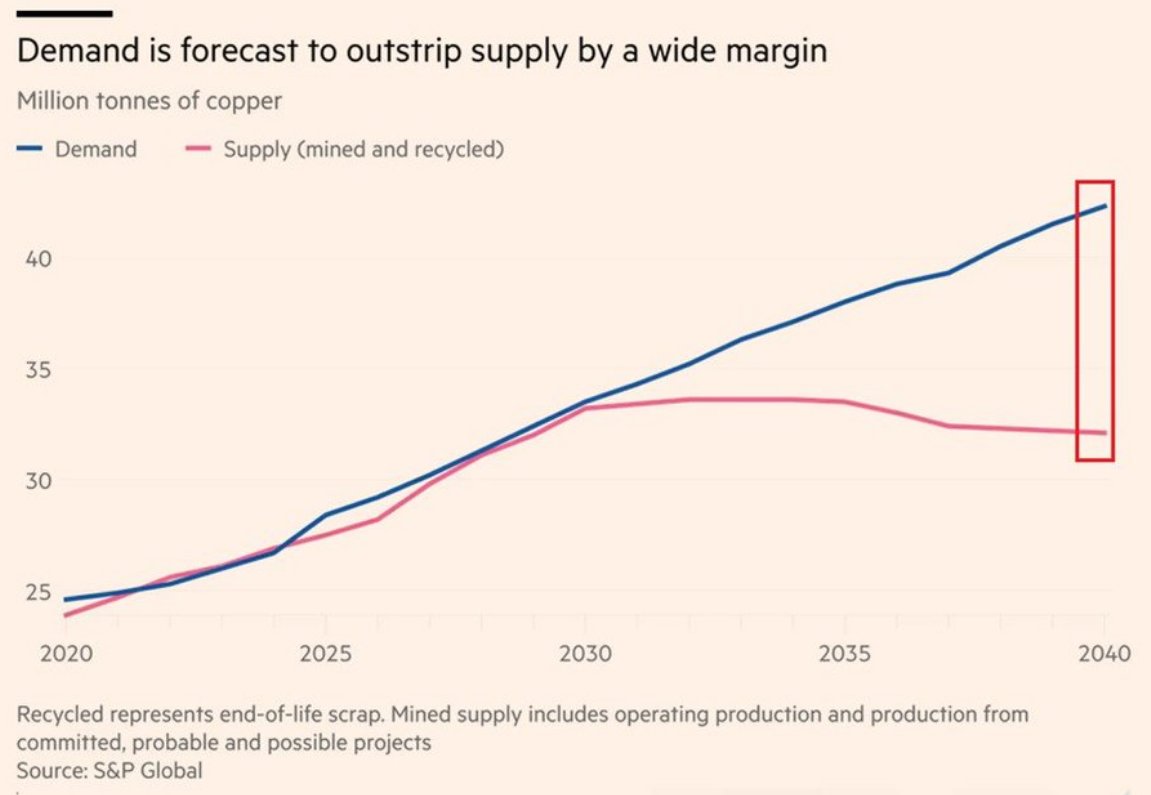

Copper deficits are increasing. By 2040, demand is set to jump by around 9 million tonnes, while supply is expected to drop by about 1 million tonnes...a shortfall of roughly 10 million tonnes. Our Kamoa-Kakula Copper Complex in the DRC is the fastest growing, highest-grade and…

OIL MARKET: Shell CEO Wael Sawan says there's "a bit of oversupply" in the oil market at the moment, but that's balanced by geopolitical risk. "There's a premium with that [political] uncertainty," he says.

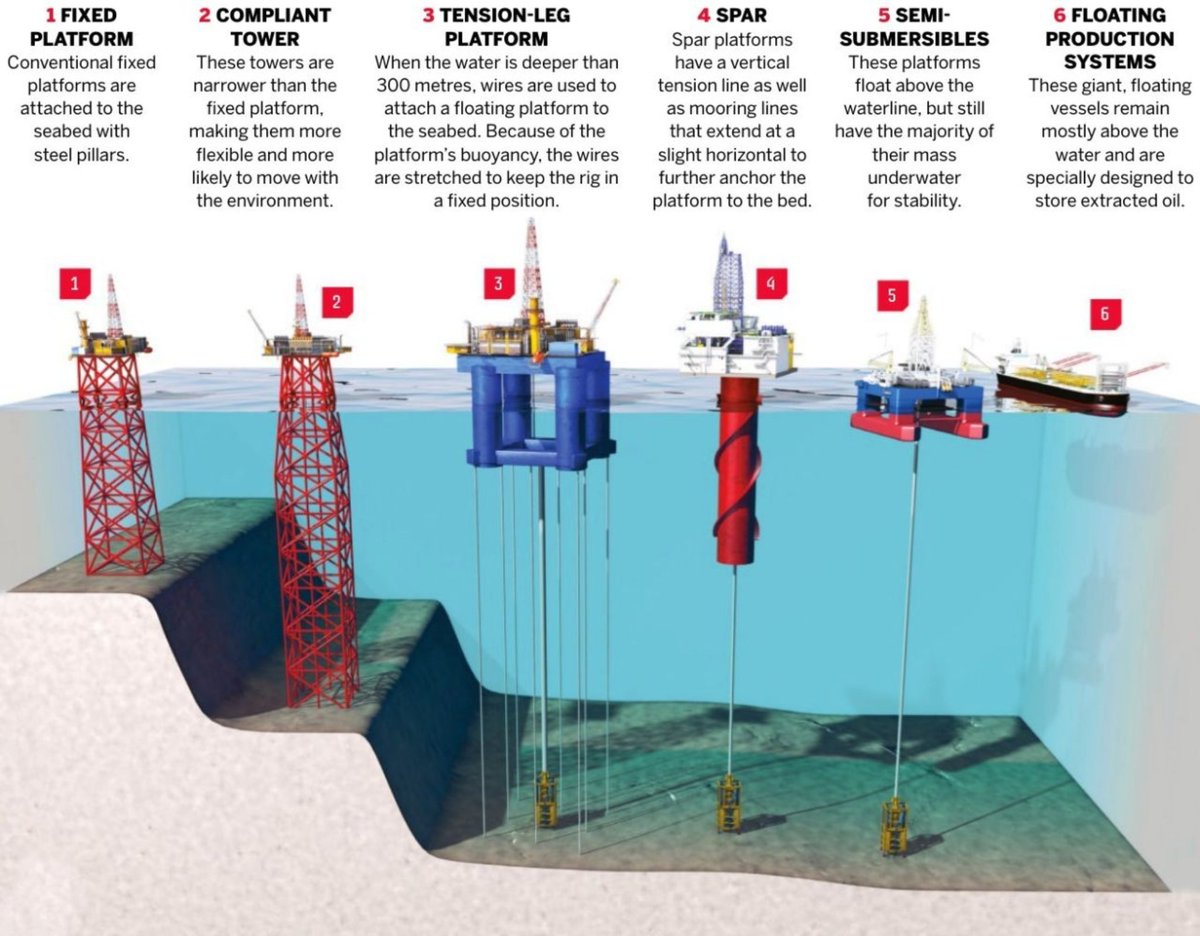

🛢️ Offshore Oil Isn’t 1 Thing It’s 6... The deeper the water, the higher the cost. And the higher the geopolitical value. How offshore really works? Fixed platforms → shallow water, lowest cost Compliant towers → deeper, more flexible Tension-leg platforms → >300m,…

🛢️ Shell Q4 Results Shell just delivered a very clear message to the market. Earnings are softer Cash returns are not. • Q4 2025 adjusted earnings: $3.3bn (-11% y/y) • Missed consensus on weaker oil prices, taxes, and trading • $3.5bn new buyback announced for the next 3…

Huge news $MAI.V $MAIFF. They're going faster than I modeled & thus the NPV8 given in my thread are too low. They're talking about bringing Gold Rock online in 2027, I discounted it to 2028. For Pan: I used $2000 AISC w 35k production prediction on 🎯 juniorminingnetwork.com/junior-miner-n…

COLUMN: Buyers of Russian and Iranian oil are switching (to a point) to non-sanctioned alternatives. That has big implications for the price of crude. @Opinion bloomberg.com/opinion/articl…

im surprised this didnt make the rounds more. if you read the fine print you will understand why i am very long

A fixed price US DoD contract for vanadium pentoxide coming to $LGO. The price better be good 😉

Pemex Slashes Debt to 11-Year Low as Mexico Eyes Oil Turnaround #oott bloomberg.com/news/articles/…

January job cuts soared 118% YoY to 108,435, the highest for the month since 2009, according to Challenger. Artificial Intelligence was cited for 7,624 job cuts in January, 7% of total. AI-linked layoffs are rapidly accelerating. When does the UBI conversation start?

Initial Jobless Claims Unexpectedly Jumped Last Week As YTD Job Cuts Hit Highest Since 2009 zerohedge.com/personal-finan…

Initial Jobless Claims Unexpectedly Jumped Last Week As YTD Job Cuts Hit Highest Since 2009 zerohedge.com/personal-finan…

GR Silver Reports Successful Metallurgical Test Work Results for the Bulk Sampling Test Mining Program at Plomosas Project $GRSL.V tinyurl.com/226f3orm

BARRICK MINING Q4 ADJUSTED NET INCOME USD 1,754 MILLION || Q4 ADJUSTED EPS USD 1.04 VS ESTIMATE USD 0.9 || GOLD PRODUCTION GUIDANCE FOR 2026 IS 2.90–3.25 MILLION OUNCES || BOARD HAS DECIDED TO MOVE FORWARD WITH PREPARATIONS FOR AN INITIAL PUBLIC OFFERING OF BARRICK'S NORTH…

Barrick just reported blowout earnings and…

United States Trends

- 1. Cam Thomas N/A

- 2. Pacers N/A

- 3. Zubac N/A

- 4. Clippers N/A

- 5. Opus 4.6 N/A

- 6. Kawhi N/A

- 7. Mathurin N/A

- 8. $AMZN N/A

- 9. Pat Riley N/A

- 10. Lookman N/A

- 11. Hali N/A

- 12. Milwaukee N/A

- 13. Shams N/A

- 14. Josh Harris N/A

- 15. Heat N/A

- 16. Lakers N/A

- 17. Jose N/A

- 18. Blaze Alexander N/A

- 19. Eric Gordon N/A

- 20. Bucks N/A

Something went wrong.

Something went wrong.