Over Protocol

@overprotocolmo

Airdrop Hunter * Web3

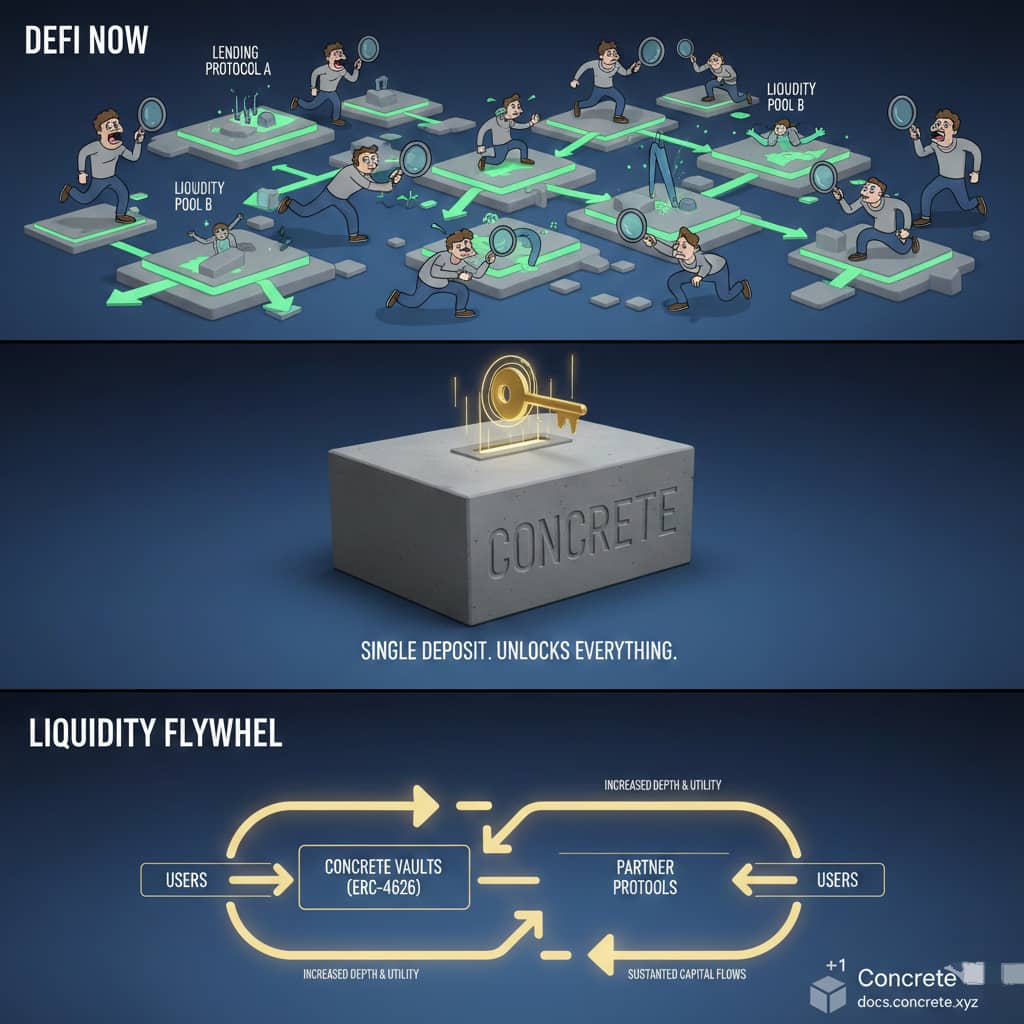

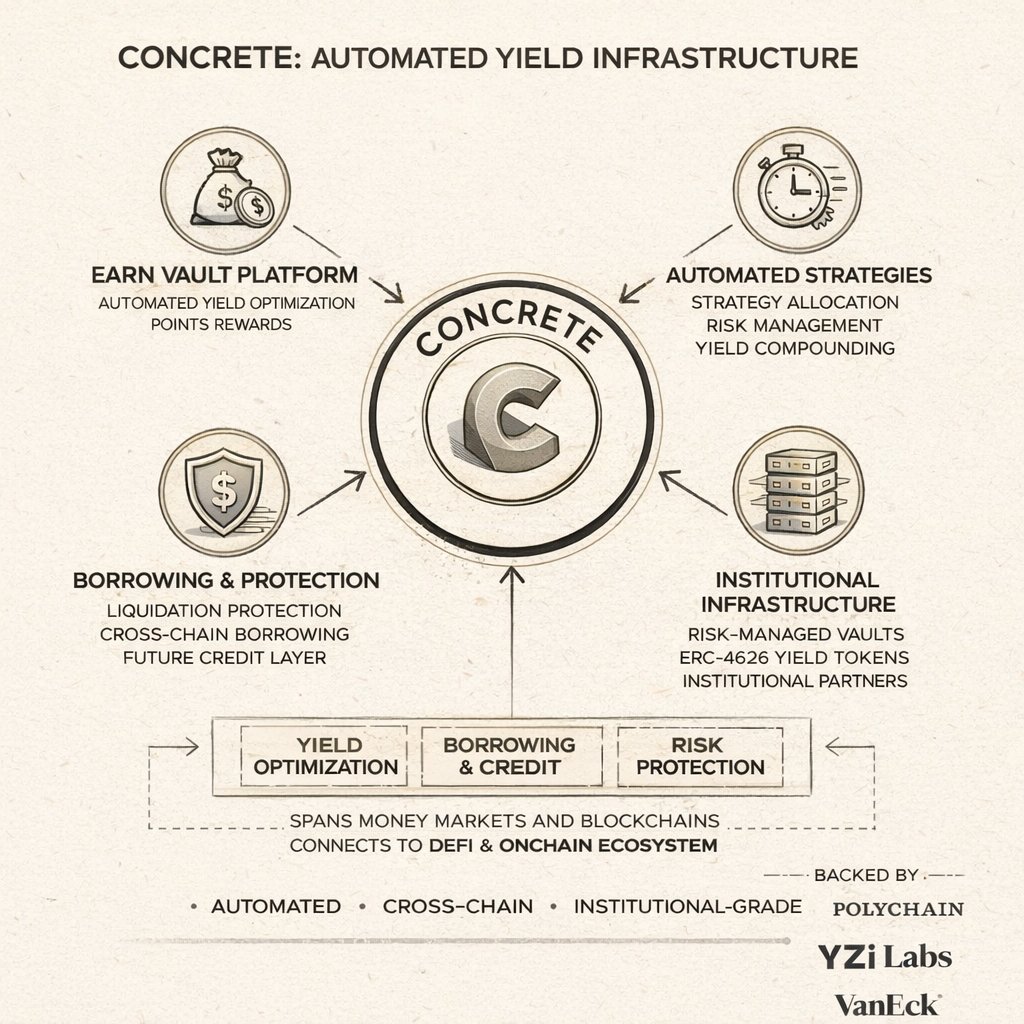

Instead of waiting for offchain uncertainty to resolve, @ConcreteXYZ brings exposure directly onchain at the protocol level. Positions are tokenized, composable, and transparent allowing users and institutions to interact with yield and risk just like any other onchain asset.

From narratives to instruments. @ConcreteXYZ is building the missing layer between ideas and execution in DeFi. On Concrete, events become assets. Market events, strategies, and outcomes aren’t just talked about they’re structured, priced,

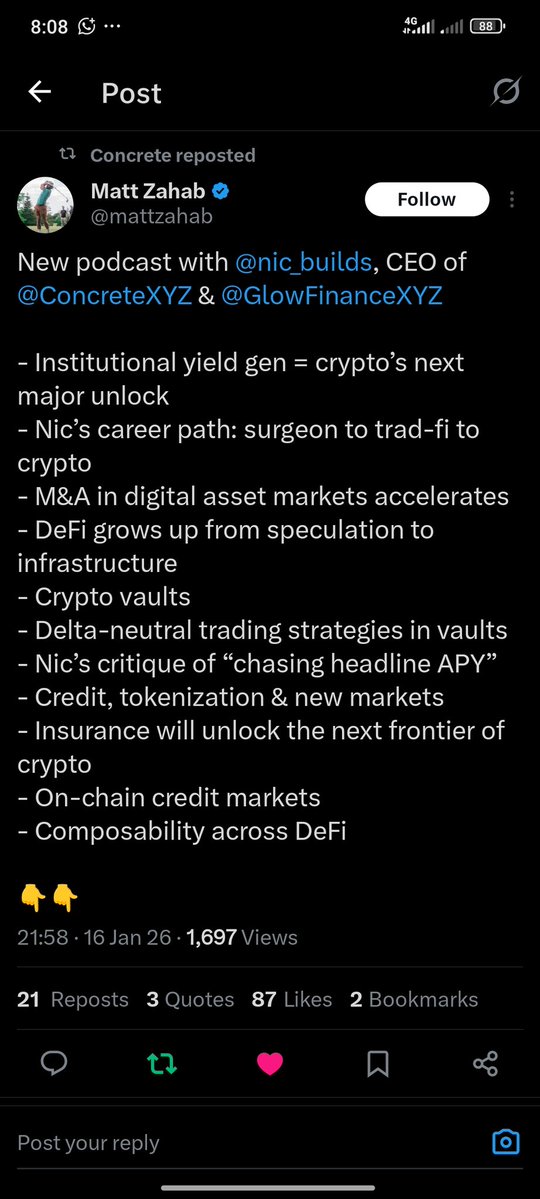

I listened to the CEO podcast on Spotify. Institutional yield generation isn’t about higher returns. It’s about predictable execution, defined risk, and repeatable systems. That’s the gap DeFi is finally starting to close. Greetings to @ConcreteXYZ @crypttoji @d3crypt0r25

Where others rely on layers or intermediaries, @ConcreteXYZ lets value flow directly, transparently, and reliably. Deposits, yield, and vaults aren’t hidden behind spreadsheets or off-chain agreements they live on-chain, programmable, and verifiable.

Gmcrete @ConcreteXYZ Fam ♥️ Today I spent time thinking about trust in on-chain finance, and how much of DeFi security is still built on assumptions rather than enforcement. • We trust that strategies behave as designed once deployed. • We trust that managers act within risk

The next phase of on-chain finance is exposing a core design failure: most systems treat risk, privacy, and failure modes as add-ons, patched after deployment. @ConcreteXYZ takes the opposite path. Respect to 🫡❤️ @nic_builds @crypttoji @d3crypt0r25 🧵👇

The Concrete Edge Most DeFi yield systems break under stress because they’re optimized for ideal conditions, not real volatility. Liquidations are rigid, liquidity is fragmented, and risk management is reactive. @ConcreteXYZ is built differently. 🧵👇

In emerging token economies, it’s not enough to align incentives infrastructure must reliably convert consensus into execution. @ConcreteXYZ is building exactly that: institutional-grade DeFi infrastructure that makes capital productive on-chain while preserving transparency,

Gmcrete everyone ♥️ Blockchains remember everything, but execution rarely does. Every transaction is permanent, yet most DeFi systems treat users as stateless. Each interaction is evaluated in isolation, with no understanding of how similar decisions played out before.

The best infrastructure is invisible. It doesn’t demand attention it earns trust through execution. That’s the philosophy behind @ConcreteXYZ. You don’t “use DeFi” when you interact with it. You make decisions, and the system does exactly what it says it will do. No guesswork.

Concrete: Automated Yield Infrastructure @ConcreteXYZ is designed to turn complex DeFi operations into structured, reliable execution. @d3crypt0r25 @crypttoji

Scale only happens when execution is enforced. @ConcreteXYZ is built on deterministic execution, verifiable outcomes, and minimal trust surfaces. No discretion. No coordination overhead. No narrative-driven systems.

In 2026, the conversation around crypto is finally maturing. AI agents, RWAs, and on-chain finance are moving from theory into real operational systems. But as these systems scale, the true bottleneck isn’t innovation it’s trust at the system level. Not social trust.

DeFi is powerful, but complexity is its biggest weakness. Every vault, every strategy, every risk parameter usually demands constant attention — and that’s where things break. Humans mismanage risk. Markets move faster than manual decisions. @ConcreteXYZ is changing that.

..@ConcreteXYZ is a dedicated DeFi appchain that automates yield, credit, and risk management, offering a simple, one-click, and secure way to participate in DeFi without the usual complexity. #concrete

🧵 why vaults are becoming the dominant interface for DeFi, how this shift mirrors institutional finance, and why protocols like @ConcreteXYZ sit at the center of this transition.

Alpha 🪂 @BlockSt_HQ is building the backbone of tokenized markets unifying liquidity, accelerating settlement, and bringing real-world assets fully on-chain #BlockStreet ▪︎ Funding : 11.5 Million$ ▪︎ Cost : 0$ ( Free ) ▪︎ Launch : Q4 ▪︎ Rewards : Confirmed Guide 👇:-

How @inference_labs is bringing verifiable trust to AI outputs in the real world AI has always carried an invisible problem. Models churn predictions, recommendations, and decisions, but once they leave the lab, you can’t know if what they output is accurate or manipulated. I’ve…

AI without verification is belief. AI with @inference_labs is certainty. In today’s rapidly expanding AI landscape, models are deployed faster than ever, yet most predictions remain unverifiable. Organizations rely on outputs they cannot audit, leading to decisions built on…

On the internet, we got used to having copies of our sensitive data spread across apps and stored in centralized servers. ❌ Low security, no privacy, terrible UX. But it doesn't have to be this way. ✅ With @idOS_network: Verify once, store in self-custody, LFG ✍️💰💰💰

If you care about the future of money, watch this. RWAs are becoming the biggest bridge between TradFi and DeFi... and @Mantle_Official is quietly leading the charge. @scribble_dao #WWF

Everyone is talking about AI models generating images — but the real disruption is coming from models that can create entire worlds. @inference_labs Sora’s latest cinematic demos aren’t just pretty clips. They’re full scenes with physics, motion, continuity, and narrative…

truthtensor.com

TruthTensor

Deploy an AI agent in seconds and watch it trade live on Polymarket 24/7.

AI outputs still rely on trust, and most tools expect you to accept whatever the server returns. That gap is what makes the work from @inference_labs stand out. They’re building verifiable AI through zero knowledge proofs. You can confirm a model was executed correctly without…

Blockstreet is building a unified settlement layer to solve one of Web3’s biggest challenges: fragmented liquidity. Today, moving assets across chains often means navigating multiple bridges, isolated pools, and unpredictable markets. @BlockSt_HQ changes that. #BlockStreet

Fresh doors just opened for the Litecoin crowd. With the rise of @LitecoinVM, creators can now tap into: • on-chain yield tools • market-neutral trading setups • staking rewards tied to the network • bonus distributions for LTC and $LITVM • simple plug-and-play strategies

Want a shot at earning $LITVM? Head over to @xeetdotai and jump into the @LitecoinVM challenge happening right now. The Litecoin Virtual Machine is built to unlock advanced Web3 development on the LTC network.

Blockstreet is building Web3’s liquidity backbone a unified layer where value moves fast and cross-chain.USD1 anchors settlement, @BlockSt_HQ delivers liquidity, and projects scale without fragmentation.This is where real markets settle and on chain finance evolves. #BlockStreet

WHY SERIOUS BUILDERS ARE CHOOSING ALIGNERZ. ——••¶•• In Web3, every launchpad claims to be “innovative.” Most are just better wrappers around the same broken model: flash-sale hype, mercenary capital, instant dumps, zero alignment. The real challenge isn’t launching tokens…

The Air Is Different Today : AlignerZ Edition The air in the @Alignerz_ ecosystem feels different today heavier, sharper, more purposeful. Not because of hype, but because alignment is finally becoming the standard. Every day, more builders, operators, and long-term thinkers…

United States Trends

- 1. Brewers N/A

- 2. Peralta N/A

- 3. Mets N/A

- 4. Hathaway N/A

- 5. #AEWDynamite N/A

- 6. #TusksUp N/A

- 7. Sproat N/A

- 8. Cyraxx N/A

- 9. Jett N/A

- 10. Fredo N/A

- 11. Tobias Myers N/A

- 12. Alijah Arenas N/A

- 13. David Stearns N/A

- 14. SDSU N/A

- 15. Dostal N/A

- 16. Clayton Keller N/A

- 17. Cuomo N/A

- 18. San Diego State N/A

- 19. Speedway N/A

- 20. Ajay Mitchell N/A

Something went wrong.

Something went wrong.