Paradise Mint

@paradisemint1

Official account of Paradise Mint, Inc. Precious Metals, Dividend Stocks, Crypto and Entrepreneur. Page run by CEO Kevin Campbell. Not investment advice.

You might like

Interesting take on todays events. What are everyone’s thoughts? We had positive Job numbers in the AM. But I am not seeing negative headlines.

Another day and another crazy run! Each time these happen they look more and more planned. From 4.5% up in premarket to 4.5% down. Another 9% run.

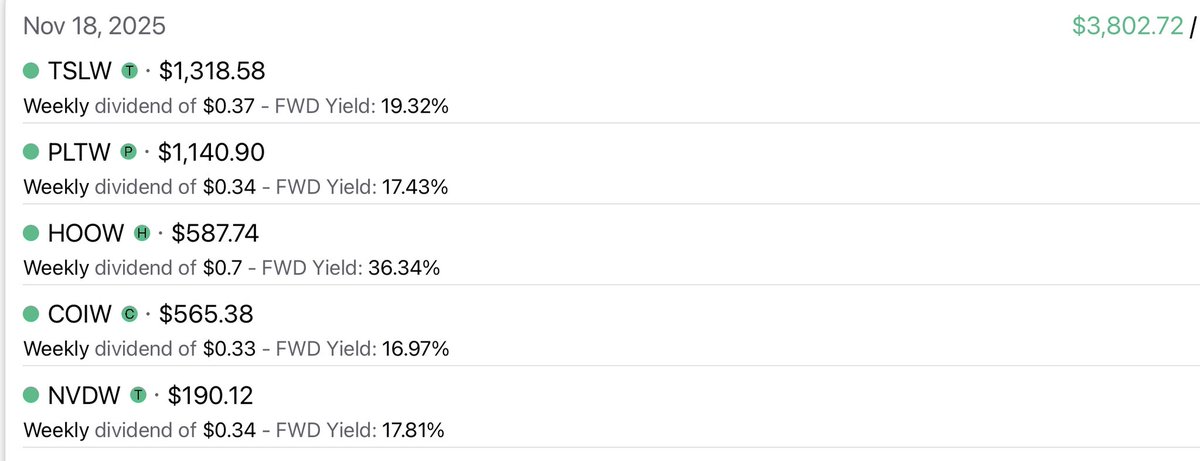

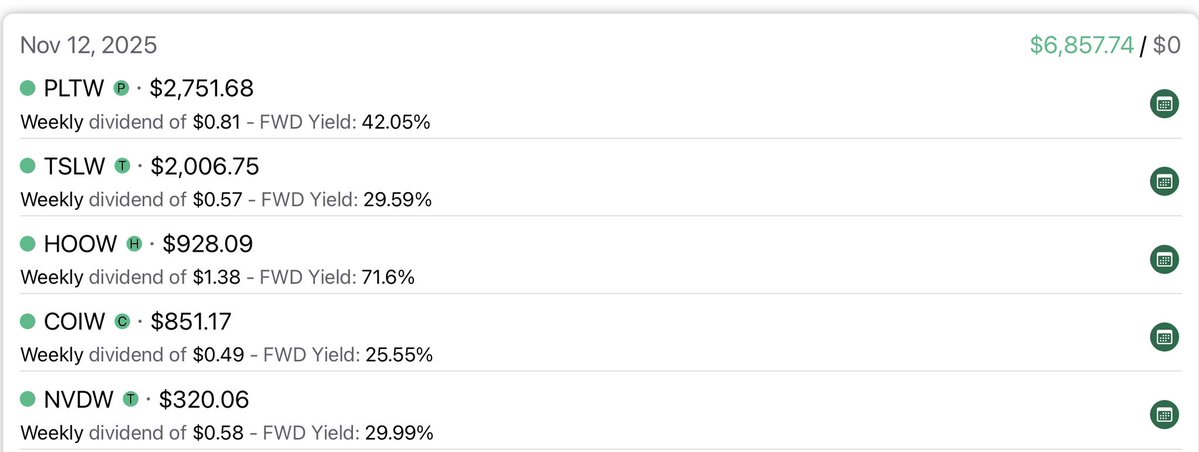

Incoming dividends from Tuesday Nov 18th $3,802 I also included the graphic from the previous weeks payouts on the same funds a week ago ($6,857) I wanted to show everyone how quickly distributions can change in a down market. In my case that was just over a $3,000 decrease in…

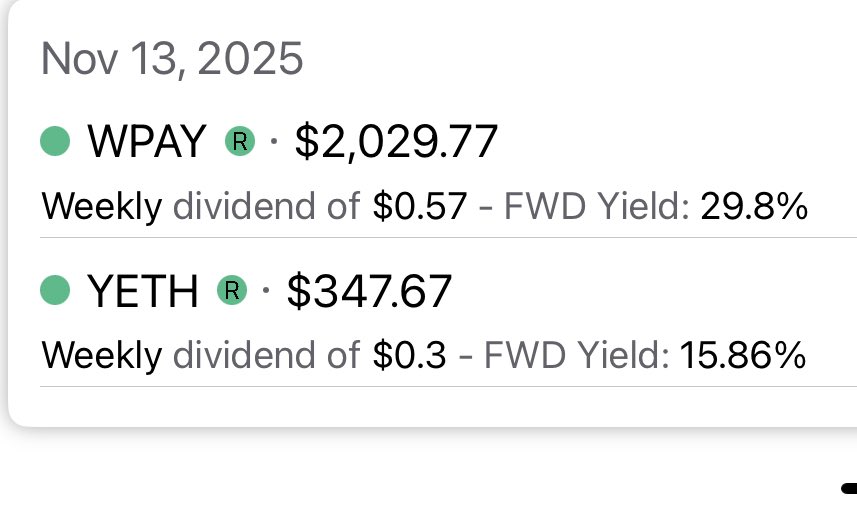

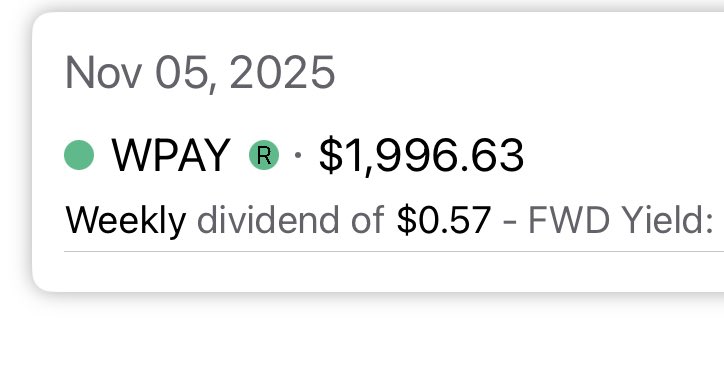

Only 1 incoming dividend today. $WPAY. Market is down and I can respect roundhill cutting the distribution rather than paying out an unrealistic payout. This equates out to a $38.29% APR which is still one hell of a return. For me, even if it stayed at this payout it would…

Every day the charts look like this. Never seen anything like this happen on a daily basis with over 30 years of following the market. It just feels like they are trying to get people to panic sell. I’m not biting. Just been slowly buying more.

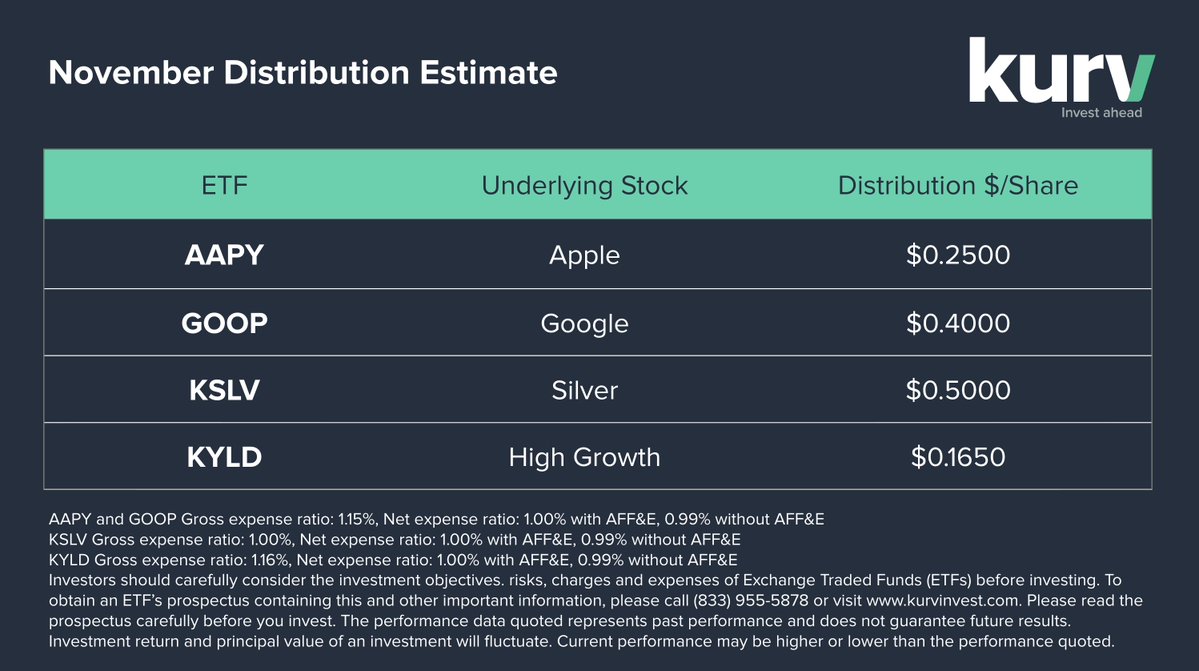

$KYLD is running strong for such a tough market. $KSLV has definitely got my attention. I currently do not own it but I do own $KGLD

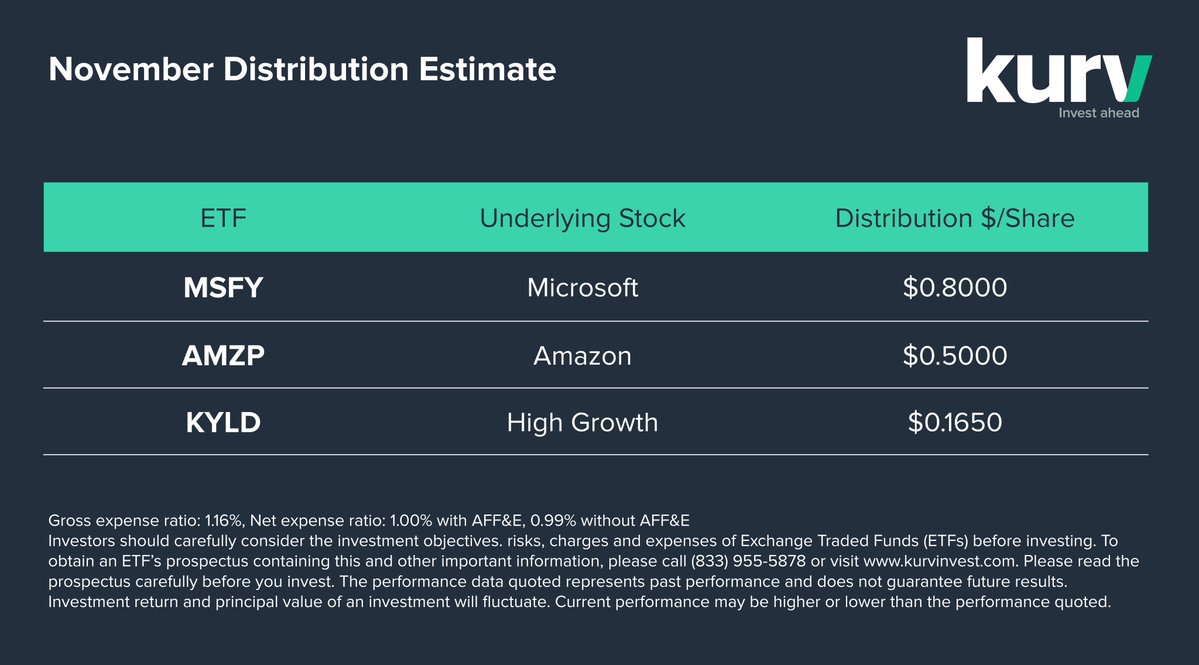

Week 3 distribution estimates are in: $AAPY $0.2500 (monthly) $GOOP $0.4000 (monthly) $KSLV $0.5000 (monthly) $KYLD $.1650 per Share (weekly) Markets move. Strategies react. You get the receipts every Tuesday. Ex-Div / Record: 11/19/25 Payable: 11/20/25 Kurv Yield Premium…

No doubt the market has been brutal the last few days. Any leveraged funds you are probably considerably down in. Now is a good time to learn from your portfolio. rather than name the ones that I am down in. I think it is a good time to highlight the funds that are shining…

Incoming dividends per Div Tracker app today is $2377.44 But also have incoming dividends from $KYLD of $412.99 that won’t show on the div tracker app yet as this is the funds first distribution. So a total of $2790.43 incoming today. Not bad while in the middle of a 10 day…

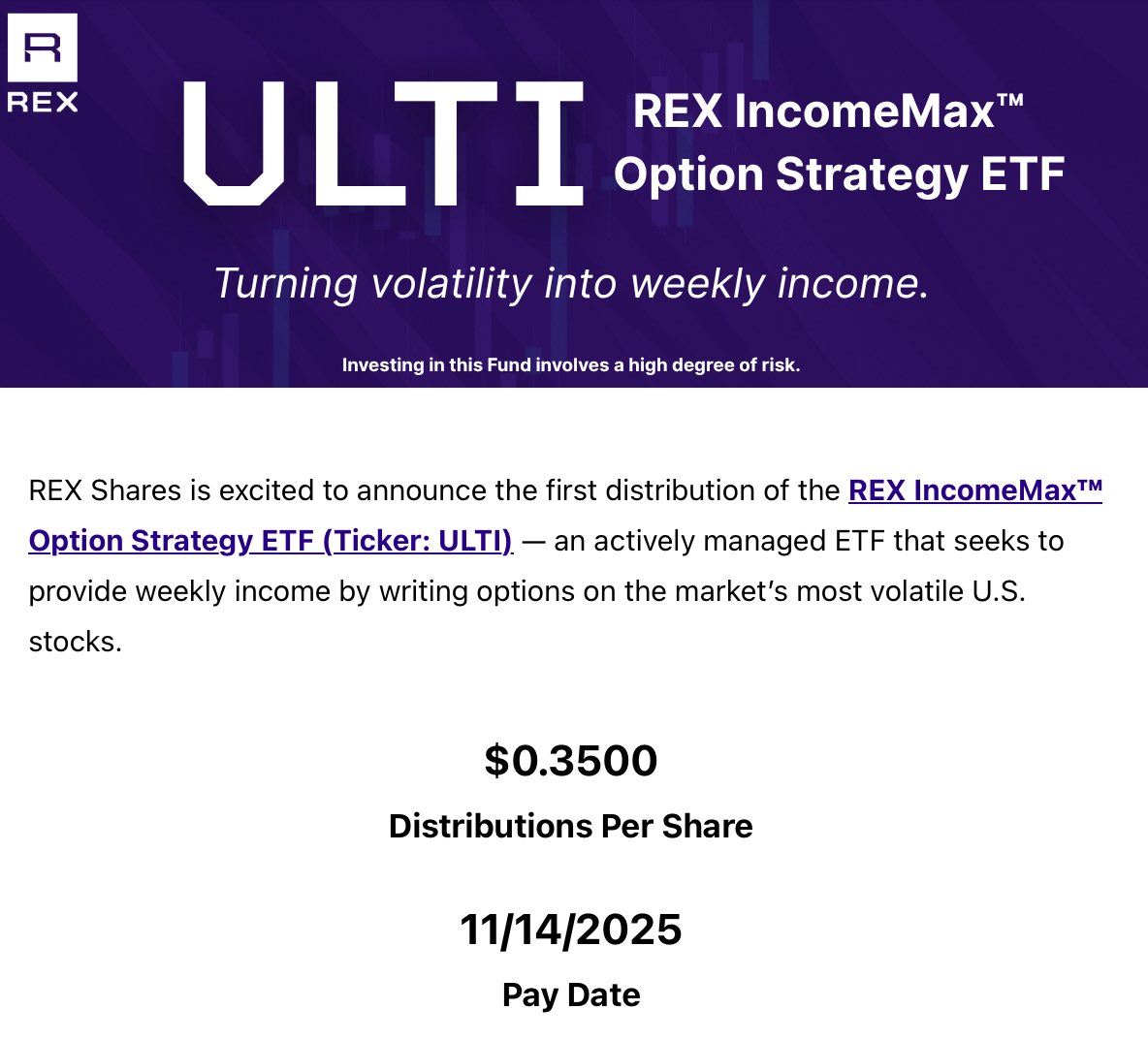

$ULTI by @rexshares just announced their first distribution of .35 cents per share. This is a new weekly pay fund by Rex Shares. If it stays at this payout rate it equates out to 77.34% APR. I will be giving regular updates as the fund progresses.

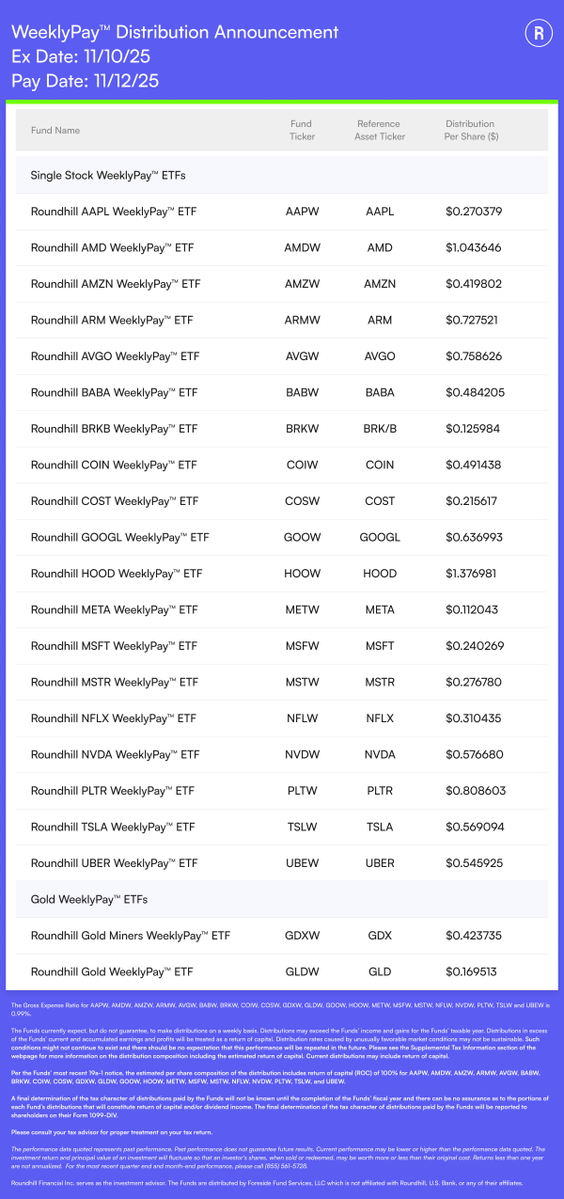

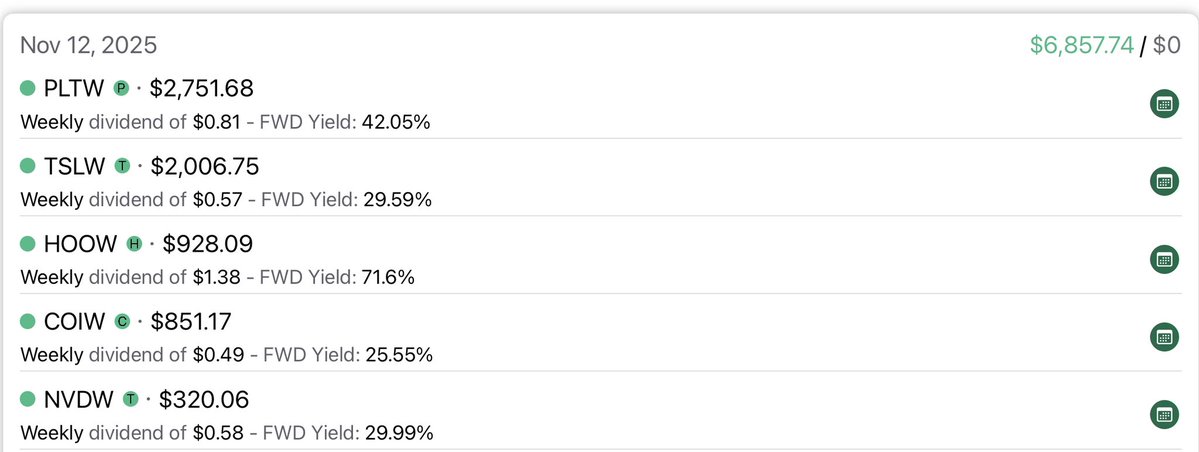

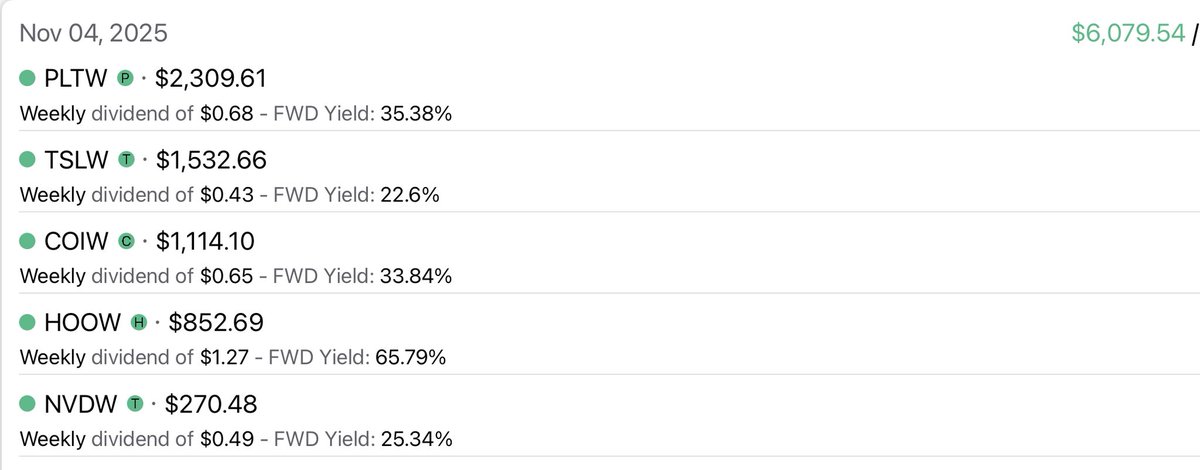

Incoming dividends today. $6,857.74 $PLTW, #TSLW, $HOOW, $COIW and $NVDW These are all weekly pay from @roundhill This is up from last weeks $6.079 payment.

First distribution for $KYLD comes in at $.1650 per share which I think is pretty solid. If you watched that 45 minute interview I posted on the fund he stated the first few distributions would most likely be lighter while they built up reserves. The current distribution equals…

Kurv announces Week 2 November Distribution Estimate $AMZP $0.5000 (monthly) $MSFY $0.8000 (monthly) $KYLD $0.1650 per share (weekly) Ex-dividend / Record: 11/12/2025 Payable: 11/13/2025 Kurv implements #OptionsTrading strategies and institutional discipline to seek…

Note, payouts for Roundhill weekly pay ETFs will be on Wednesday instead of Tuesday this week.

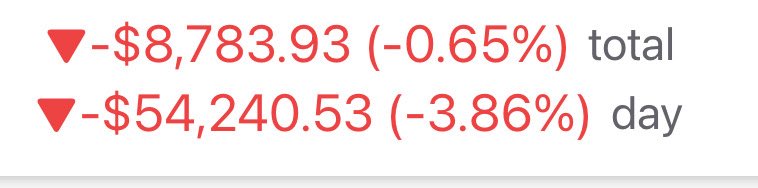

Tough day in the market. But I share the good and the bad. Besides my portfolio losing over 54K today for the first time in a few years my portfolio is actually worth less than I paid for it. Actually down $8793.00 that is just how it looks on paper on some of these pull backs.…

Just one incoming dividend today. Weekly pay dividend from Roundhill. Tomorrow we have TSLP, KGLD and YETH as incoming dividends.

Yesterday’s income dividends. $6,079.54 (charts finally updated) This is down from $8049 on the same funds a week ago. This will show you how quickly a dividend amount can go up and down as the market changes. Still a fantastic return. No complaints. Love Tuesdays!

I don’t think YieldMax expected the cold responses they received on this post. Your solution is to just open more new funds claiming problem solved didn’t go over very well! Whoever thought this was the solution should be fired immediately!

We asked, you answered. Investors wanted income solutions built for more than yield alone, designed to deliver consistent cash flow and preserve greater upside potential. Coming soon: the YieldMax® Target 25™ ETF family, including $MSTT, $NVIT, and $TEST #Target25…

Good Morning Everyone. Nice to see some green this AM. Did a little shopping this am. After viewing the video about $KYLD that I posted yesterday, I decided to up my position. Also I know that Kurv does a great job of managing the NAVs on their funds. And when you look at the…

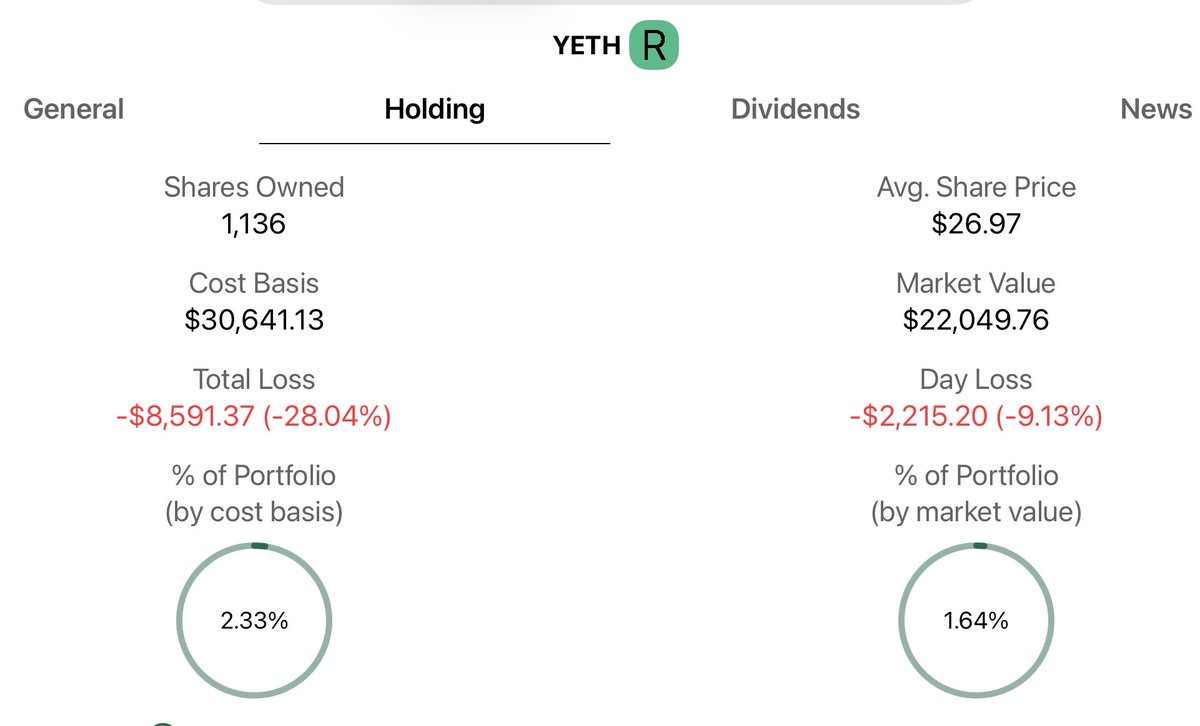

I already covered the best preforming fund through this downturn. Now let’s cover the worst…and the loser is: YETH Crypto getting hammered right now. YETH down 9.13% today and 28.04% total. A close runner up was COIW. I own more of it and I’m down about $20K on that one.…

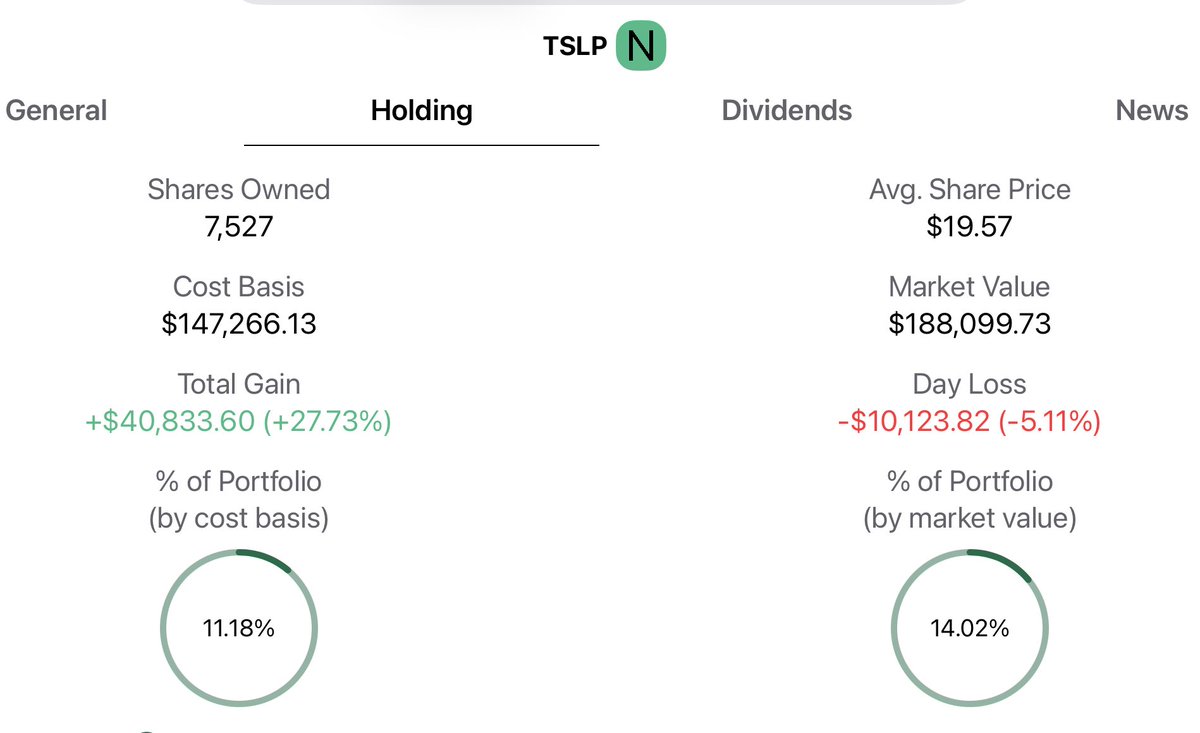

You’re gonna have days that suck! That is just how this game is played. On days like these it is very important to go through your portfolio and look at each fund and evaluate it. @HowardFChan of Kurv will be proud to know that the top preforming fund in my portfolio was $TSLP.…

Well today sucked! But the good news is overall my portfolio is still above water. Days like these are a good day to look over your portfolio and see which stocks did well and which ones didn’t. I’ll cover that more on the next post.

United States Trends

- 1. Thanksgiving 370K posts

- 2. Golesh 2,051 posts

- 3. Fani Willis 11.7K posts

- 4. Trumplican 2,763 posts

- 5. Hong Kong 77.4K posts

- 6. #WipersDayGiveaway N/A

- 7. Khabib 6,423 posts

- 8. stranger things 157K posts

- 9. Africans 25.9K posts

- 10. Riker N/A

- 11. NextNRG Inc N/A

- 12. #TejRan 4,001 posts

- 13. Tom Hardy 1,170 posts

- 14. Ruth 13.6K posts

- 15. Elijah Moore N/A

- 16. #Wednesdayvibe 3,581 posts

- 17. #wednesdaymotivation 6,668 posts

- 18. Camp Haven 6,691 posts

- 19. Karoline Leavitt 28K posts

- 20. Nuns 10.4K posts

Something went wrong.

Something went wrong.