Himanshu sharma

@pheonix_trader

Telegram link - https://t.me/berlin_trader

Gurgaon , India

Joined January 2018

You might like

United States Trends

- 1. Caleb 52.9K posts

- 2. Bears 75.9K posts

- 3. Packers 62.8K posts

- 4. #GoPackGo 11.1K posts

- 5. Jeff Kent 4,253 posts

- 6. Ben Johnson 6,178 posts

- 7. Notre Dame 164K posts

- 8. Nixon 13.6K posts

- 9. DJ Moore 2,845 posts

- 10. Raiders 33.7K posts

- 11. Browns 78.2K posts

- 12. Shedeur 108K posts

- 13. ESPN 119K posts

- 14. Kmet 1,425 posts

- 15. Parsons 6,422 posts

- 16. Ravens 50.4K posts

- 17. Stefanski 31.8K posts

- 18. Josh Jacobs 4,285 posts

- 19. Mattingly 2,781 posts

- 20. Jordan Love 12.7K posts

You might like

-

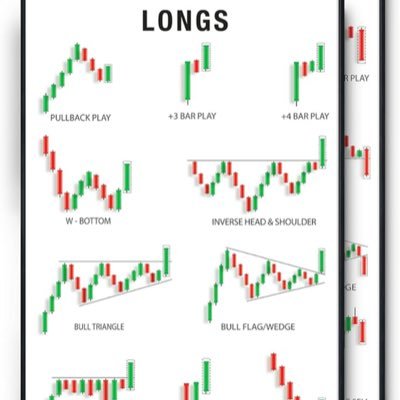

Visual Guide

Visual Guide

@VisualGuide_ -

Sudhir Jain (SJ)

Sudhir Jain (SJ)

@sj_learner4life -

Harshit Bothra

Harshit Bothra

@Breakout_trades -

Kartik Srinivasan

Kartik Srinivasan

@eyesofmaya -

The Chartians

The Chartians

@chartians -

UremO 👑

UremO 👑

@UremO_24 -

CA Arpit Goyal

CA Arpit Goyal

@Arpit1223 -

Shubham Mishra🇮🇳⚡

Shubham Mishra🇮🇳⚡

@shubhfin -

Arpit Goel

Arpit Goel

@arpit_goel_ -

Buy Before Breakout

Buy Before Breakout

@VCPSwing -

Dharmendr Klal

Dharmendr Klal

@Thekalal -

Dhanesh Gianani

Dhanesh Gianani

@dhanesh500 -

Breakouts Freak 🇮🇳

Breakouts Freak 🇮🇳

@Breakoutsfreak -

StarlightTrader

StarlightTrader

@Starlight_T1 -

Souradeep Sanatani

Souradeep Sanatani

@Trader_souradep

Loading...

Something went wrong.

Something went wrong.