You might like

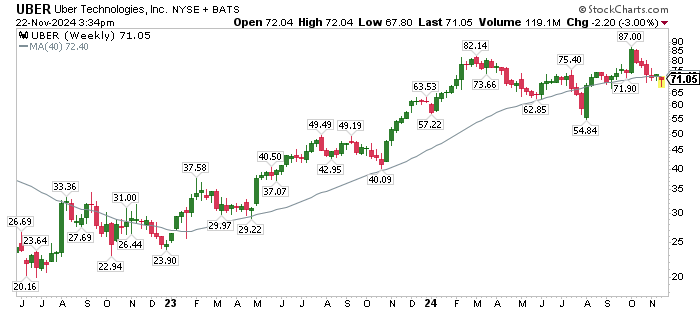

The $UBER chart is something to watch, technically speaking. Let's see how it reacts in the AM. Stage 3 currently and trading below the 200 day moving average. Does it go back to stage 2 or drop into stage 4.

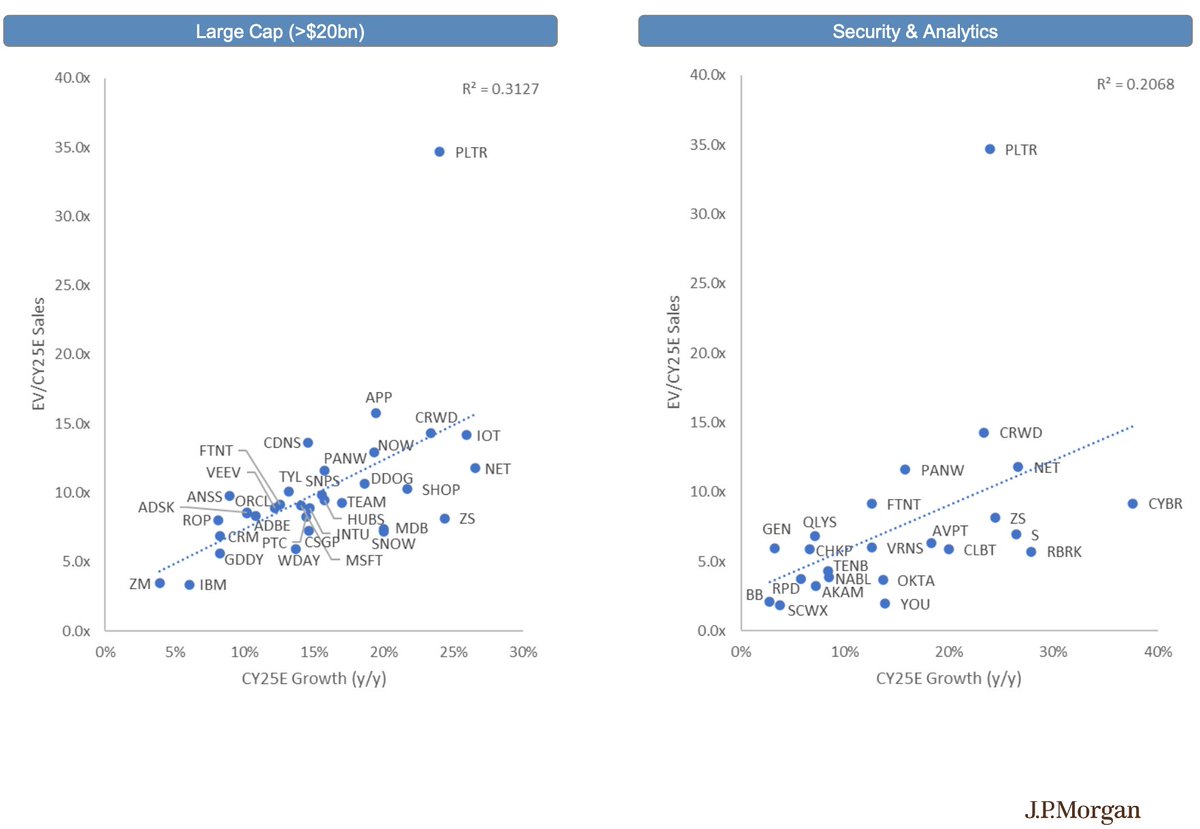

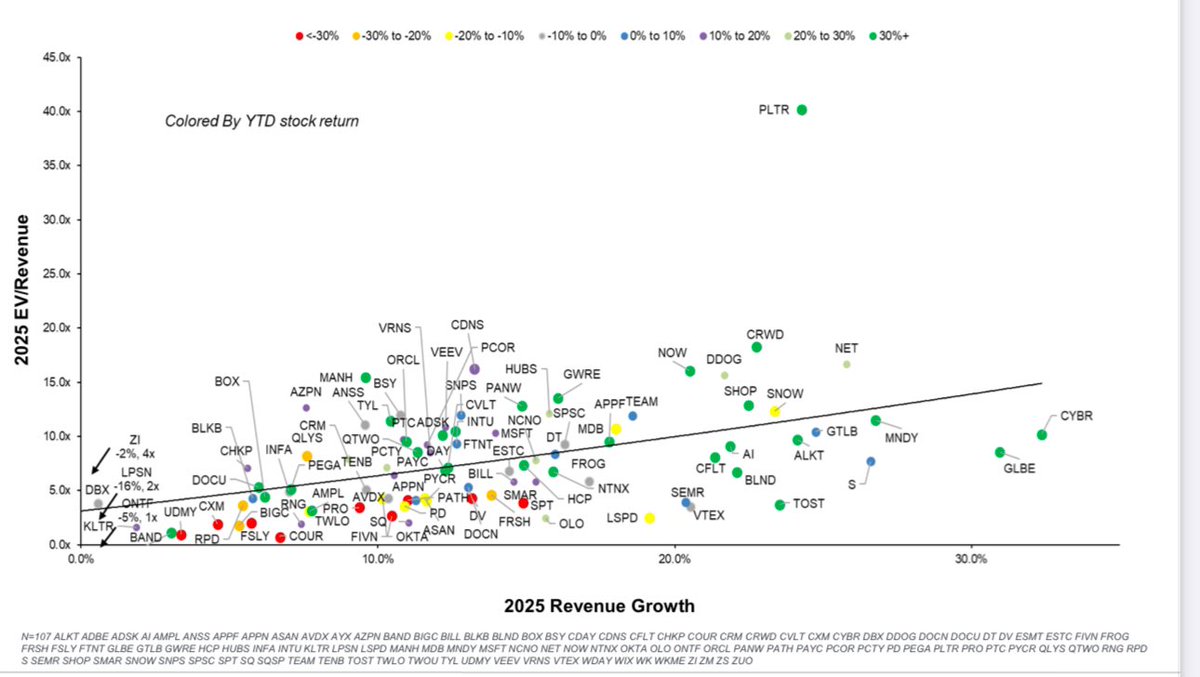

$PLTR just vanished from this valuation chart and heading to mars

Software Valuations: EV/Revenue-to-Growth - KeyBanc

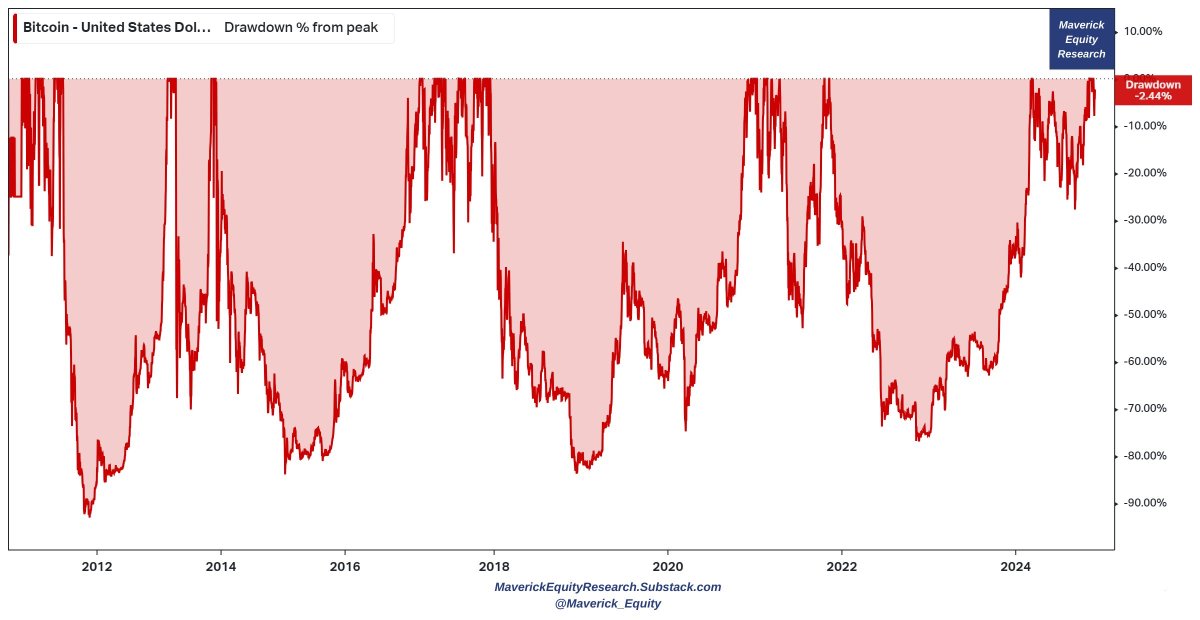

Never, ever forget. Long-term track records on an asset class that implodes every few years are total BS. Anyone stating them needs to be called out as a pumper looking for a greater fool. Last 10 Years - Largest Drawdowns Gold: -22% Bitcoin: -78%, -82%, -55%. #StoreOfValue

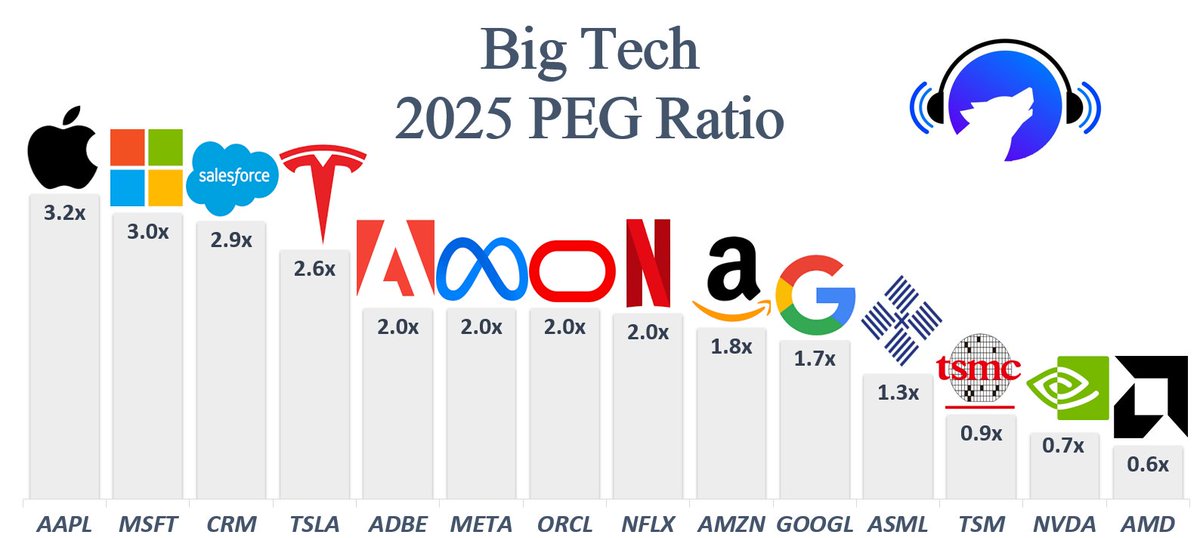

Ever heard of the PEG ratio? Peter Lynch’s go-to metric: under 1.0 signals a bargain, over 2.0 looks pricey -- let’s see how Big Tech measures up as we enter 2025 🧐 $AMZN, $MSFT, $GOOGL, $AAPL, $NVDA, $TSLA, $META, $CRM, $AMD, $ADBE, $QQQ

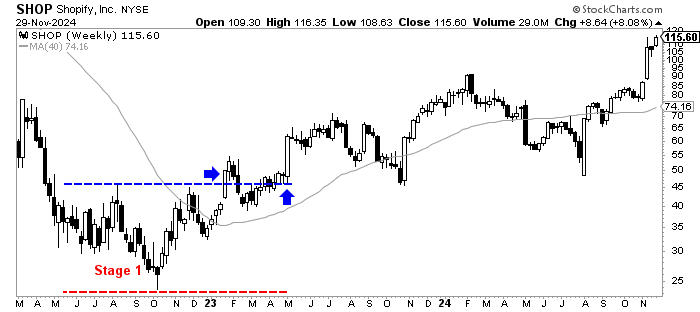

$SHOP stage 1 identified in January 2023. The top of the range was ~$45 The result: A 155% move since the breakout to a stage 2 run. #HoldingShares

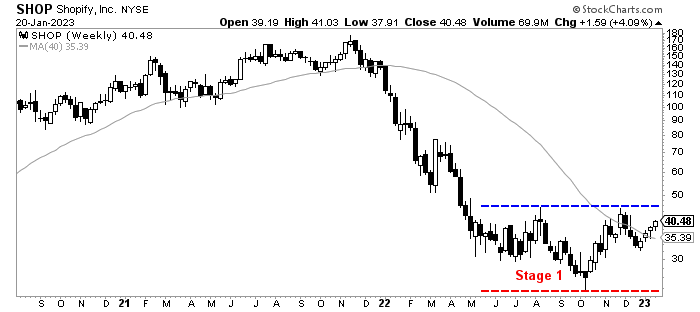

$SHOP is up 3% pre-market ($42) as it continues to build the stage one base. #HoldingShares

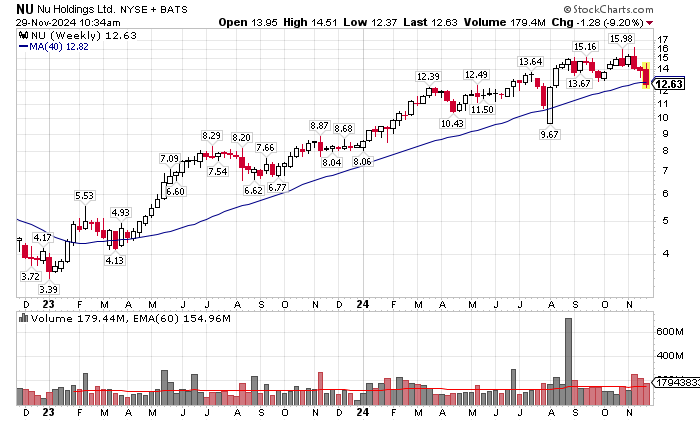

$NU - $12.63, is down on Brazil's income tax news. The fundamentals and technicals have been solid for 2 years. This could be a buying opportunity near the 200d ma.

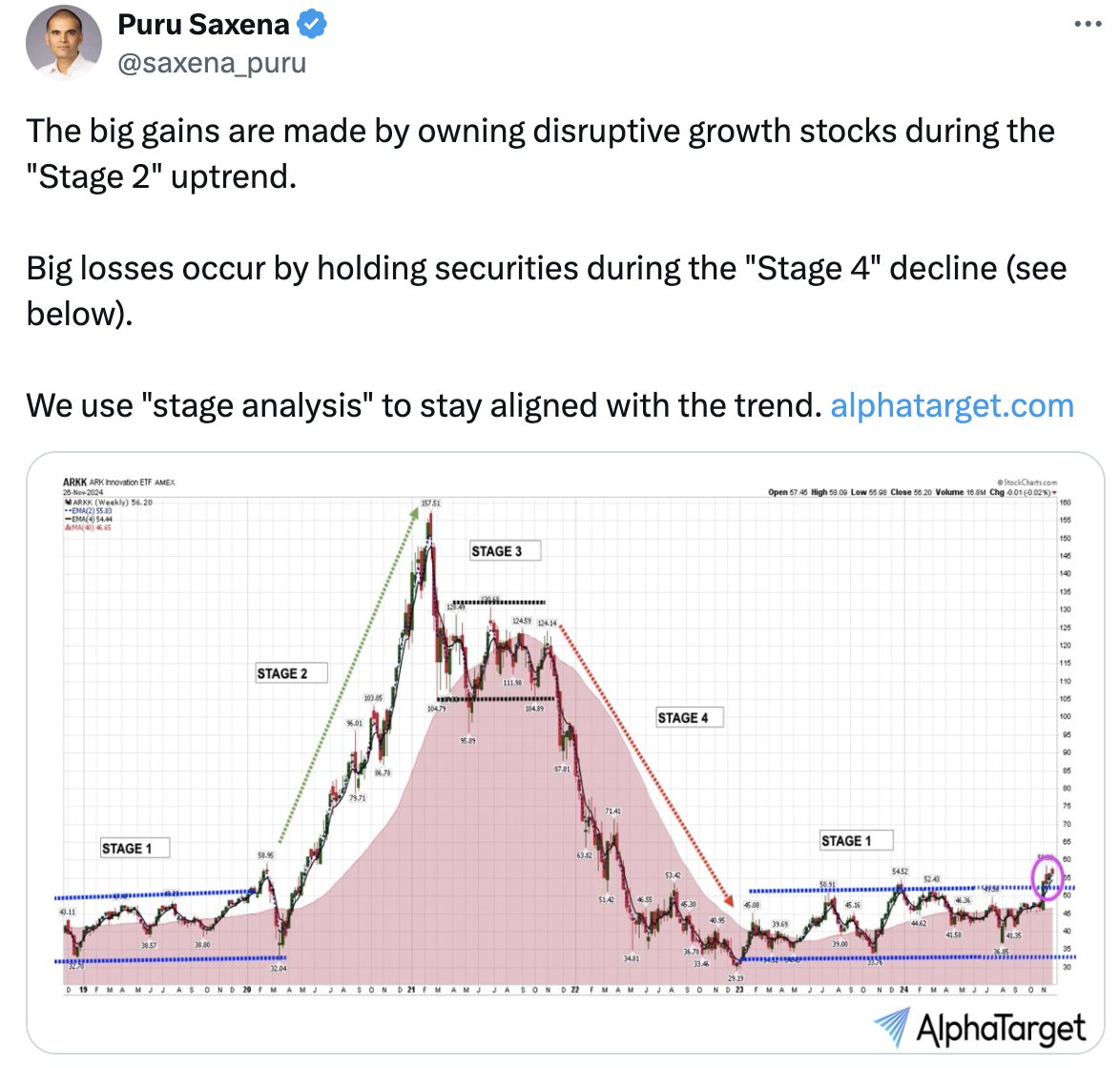

Clarification - We don't own ARK ETFs in our portfolio, the below chart was used as a real-world example to show how "stage analysis" works. We only invest in and publish research on disruptive, rapidly growing companies. alphatarget.com

The new US Treasury secretary Scott Bessent is pro-growth and the market views him as a fiscal hawk. This is likely to be positive for US stocks and negative for US Treasury yields and the US Dollar. Declining bond yields likely to be a major tailwind for long duration stocks.

Lots of people saying $TSLA is the next to make an $NVDA like run but the financials between the two are miles apart: $NVDA is trading at 36x NTM earnings & 30x EV/EBITDA 3 yr Revenue CAGR of 63.84% 3 yr FCF CAGR of 91.47% NTM PEG ratio of: 0.96 $TSLA is at 116x NTM earnings &…

$UBER is in a flat 10-month range. The fundamentals are solid. I can see this one making a run to $100 when it breaks out.

Here are the 12 steps that outline what the new digital economy will look like 🧐 1. $ASML designs and manufactures advanced photolithography machines essential for semiconductor chip production, which are used by $TSM to fabricate high-performance semiconductor chips. 2.…

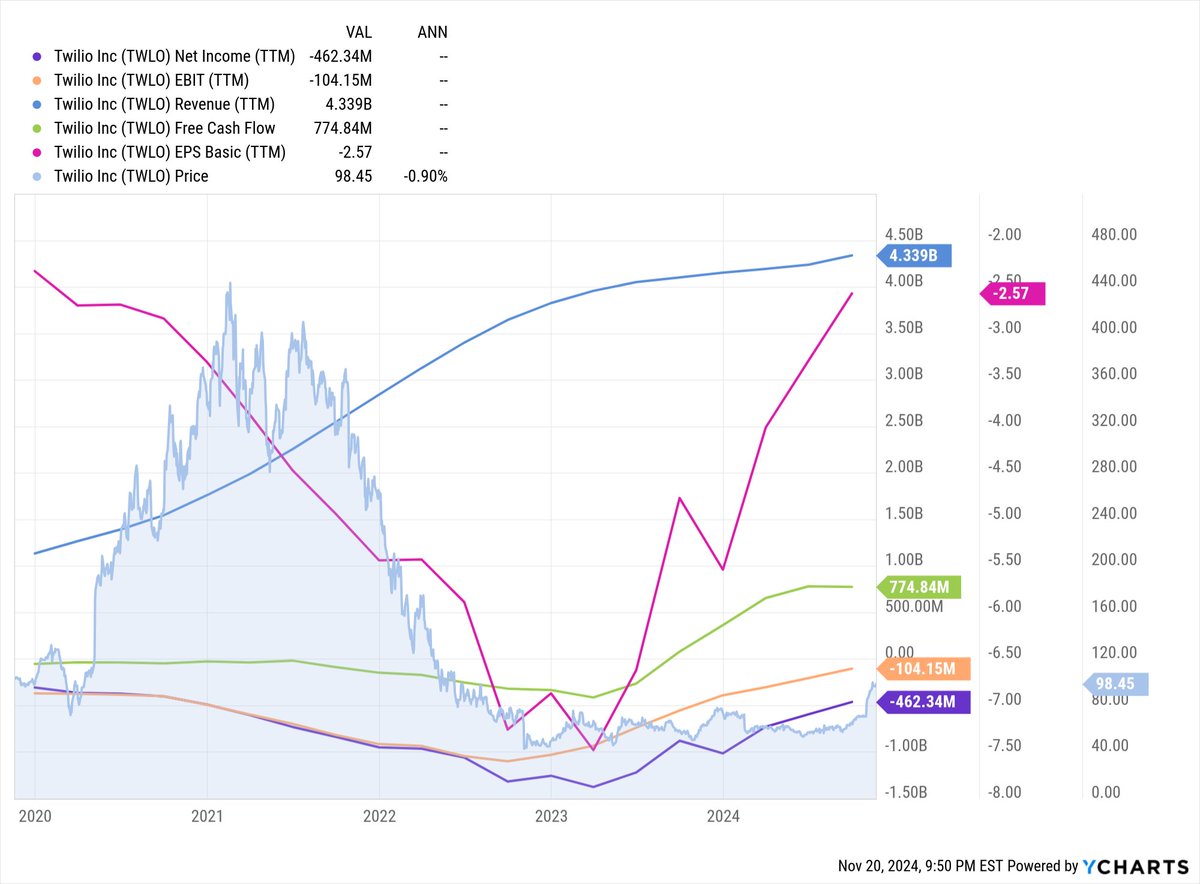

Is $TWLO waking up? The fundamentals are improving, but key metrics are still negative: EPS, net income and EBIT). It's still 77% off highs so overhead resistance will be a challenge. No position.

bible for beginner traders: - scan charts after close - check pre-market data - keep your watchlists short - limit your indicators - overthinking a trade is the death of it - avoid averaging down - volume equals price - raise cash is best hedge - trade leaders only know this

$SNOW just reported 28%YoY revenue growth After 13% post-ER pop, trading ~11x NTM revenue $PLTR grew 30%YoY and trading at ~42x NTM revenue! We locked in 92% gain in $PLTR but still long $SNOW alphatarget.com

$PLTR This is wild! - 41x NTM revenue for ~25% revenue growth - Now ~100% above 40-week moving average This is not going to end well.

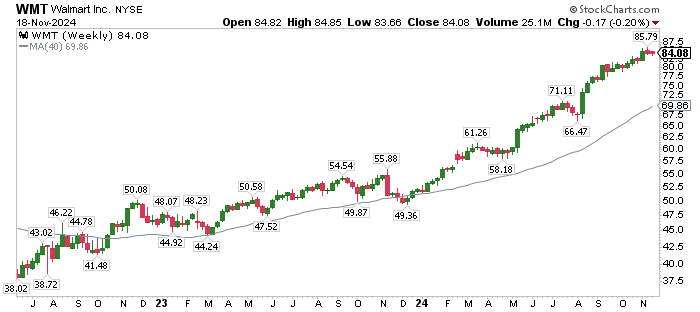

$WMT +4% in pre-market, following earnings. Will open 65%+ the past year. Keep it simple works. #HoldingShares

I have started a position in $DDOG in the spec account.

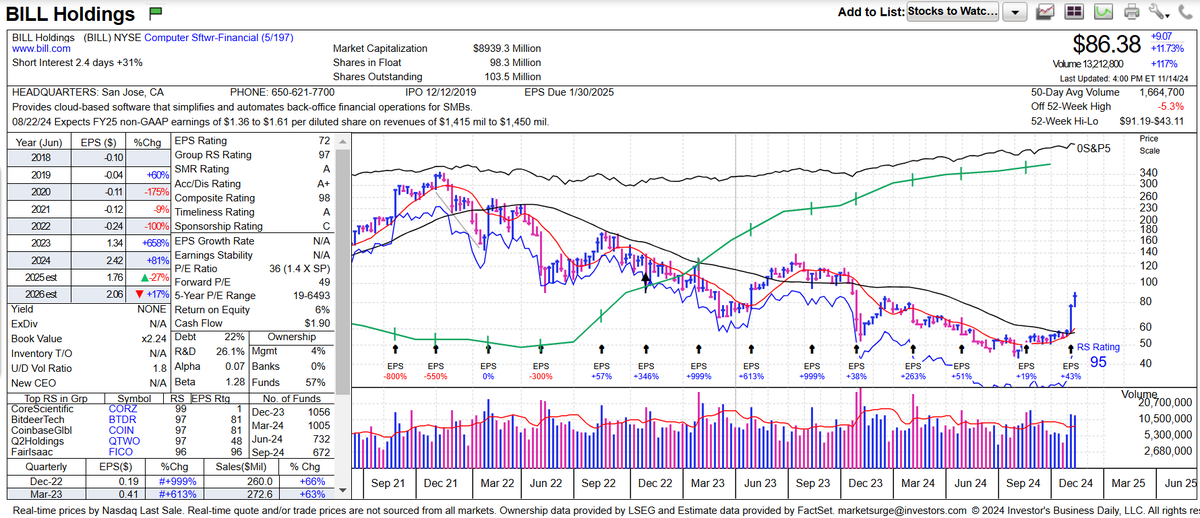

$BILL - $86.38 The key fundamentals are all positive and growing now (EPS, net income, FCF). The stock is up big the past two week with the 50d ma crossing above the 200d ma. No position.

Viking Therapeutics $VKTX lost the 200 day moving average for the first time since December 2023

United States Trends

- 1. Ellison N/A

- 2. Real ID N/A

- 3. Macklin Celebrini N/A

- 4. Marner N/A

- 5. madison wisconsin N/A

- 6. #thursdayvibes N/A

- 7. Czechia N/A

- 8. Bo Horvat N/A

- 9. Augusta N/A

- 10. Brody King N/A

- 11. Mark Stone N/A

- 12. #SpiderNoir N/A

- 13. Sakkari N/A

- 14. Gemini 3 Deep Think N/A

- 15. Ron Johnson N/A

- 16. Dostal N/A

- 17. McDavid N/A

- 18. Max Muncy N/A

- 19. ATMs N/A

- 20. Rotisserie N/A

Something went wrong.

Something went wrong.