You might like

Quad 1-2 Screen portfolio123.com/app/screen/sum… Quad 3 Screen portfolio123.com/app/screen/sum… Quad 4 Screen portfolio123.com/app/screen/sum…

hedged strategy book example 2) Sim: portfolio123.com/port_summary.j… Live: portfolio123.com/port_summary.j…

Employment at US small businesses is falling: US small businesses shed -10,000 jobs in October, according to the ADP Employment Report. This marks the 5th monthly decline over the last 6 months. As a result, the 3-month average of job losses fell to -29,333, the highest since…

The chart plots forward P/E ratios (price / next-12-month expected earnings) for two US small-cap indexes from 2002–2025: Russell 2000 (red): Broader, includes many unprofitable companies S&P 600 Small Cap (blue): Profitability-screened, higher quality Current readings (Oct…

S&P 500 (top panel) Investors are paying 22–24x forward earnings, significantly above long-term averages (~16–18x). S&P 400 (mid caps) Closer to fair value or slightly undervalued versus history. Valuations are more reasonable, reflecting less investor enthusiasm than large…

Lol, Took me a fight with ChatGPT to find this out: "For LightGBM/ExtraTrees “lean & de-collinear” instinct can backfire because of how forests are built: Greedy early splits need strong anchors. If those few “obvious” features (rel-momentum, revisions, basic risk/liquidity)…

O.k. this took me a while sorry for the delay: Small Cap Base Model shared in my group: portfolio123.com/app/group/317 Here is the AI Factor Model: portfolio123.com/sv/aiFactor/19… --> This design choice is a good start. HPs for the predictors: ExtraTrees: Hyperparams: { "n_estimators": 600,…

一个月前,青池找到我,说他用了一年多的时间一篇一篇地啃完了200多篇AI论文,从开始全然不得要领,到后来逐渐入门——而他希望将他的论文探索之旅开源给大家。就这样,我们有了今天这集特别的节目。 他从200多篇论文中精选了36篇经典,4小时讲解,带你穿越AI变迁史。🤓🤓…

I applied my Blay Timing Indicator. More about it here:thedowtheory.com/indicators/bla…

Some investors will do anything to run away from the volatility. Other investors will develop models to take advantage of it. Here is on example of limiting your investable universe to the highest beta half of the Russell 2000 index. I use the Small and Micro Cap Focus ranking…

Best performing group YTD? . . . Nasdaq no revenues Not a joke (via @TheIdeaFarm) mybrand.schroders.com/m/5db2e4a1536c…

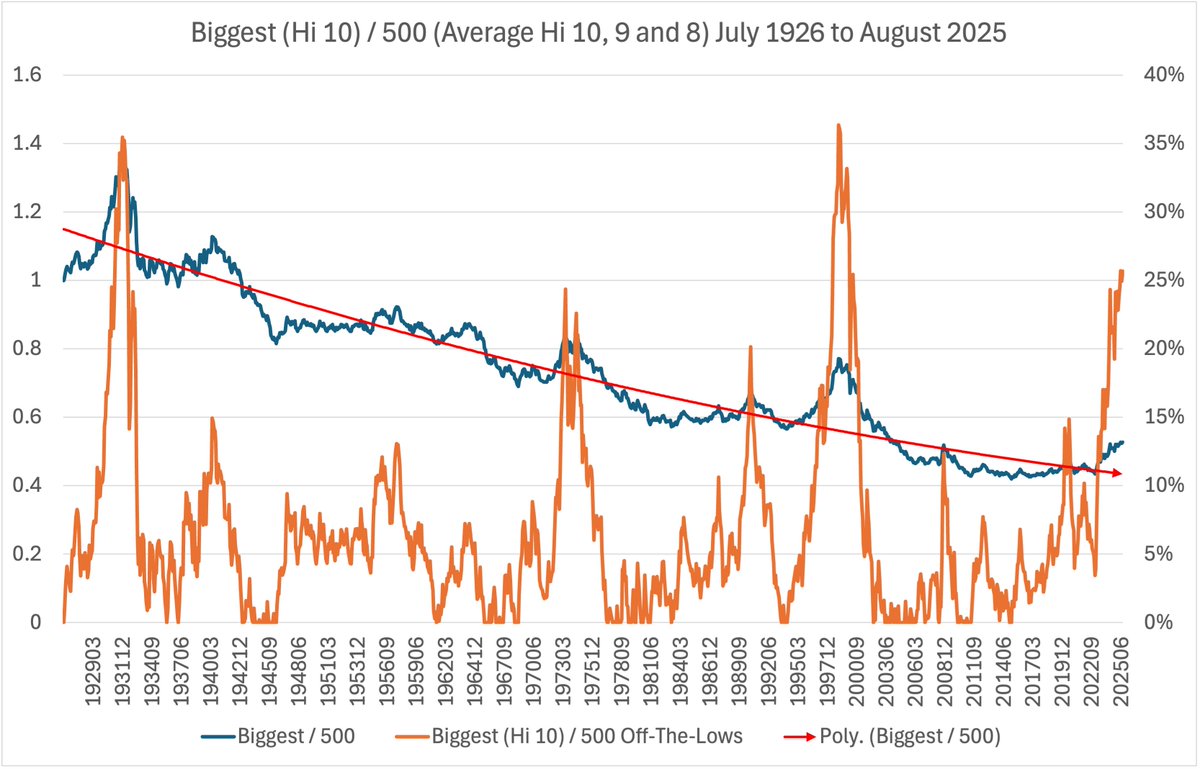

The largest stocks have underperformed over the last century by about 0.8 percent per year. Periodically, the largest stocks outperform. In the last century, this has happened: * 5 years or more, 7x * 10 years of more, 3x * 15 years of more, 1x (1946 to 1961) The current…

From time to time, investors tend to rotate between financial assets and hard assets — and vice versa. Much has been made of gold’s recent rally, but what’s less appreciated is how early this move could be. When priced in gold, the S&P 500 is only now retesting levels last…

想转行的朋友注意了! 最近最火的方向——AI Agent,机会非常大。 我给大家整理了一份干货资料,建议先收藏、慢慢学。 第一阶段:基础概念入门 适合人群:完全初学者,对 AI Agent 概念不熟悉 推荐课程: 1. 微软 AI Agents for Beginners 课程内容:10节课,从概念到代码…

The blue line (market cap weight/equal weight) compares the standard S&P 500 (where bigger companies matter more) to an equal-weighted version (where each company counts the same) The red line (S&P 100/S&P 500) shows how the 100 largest companies perform versus the full 500.…

* Mid caps (S&P 400) trade at only 71% of large cap (S&P 500) valuations * Small caps (S&P 600) trade at only 68% of large cap valuations * These are at or near the lowest levels in 25 years (except briefly in 2000-2002) * From 2004-2020, smaller caps typically traded at a…

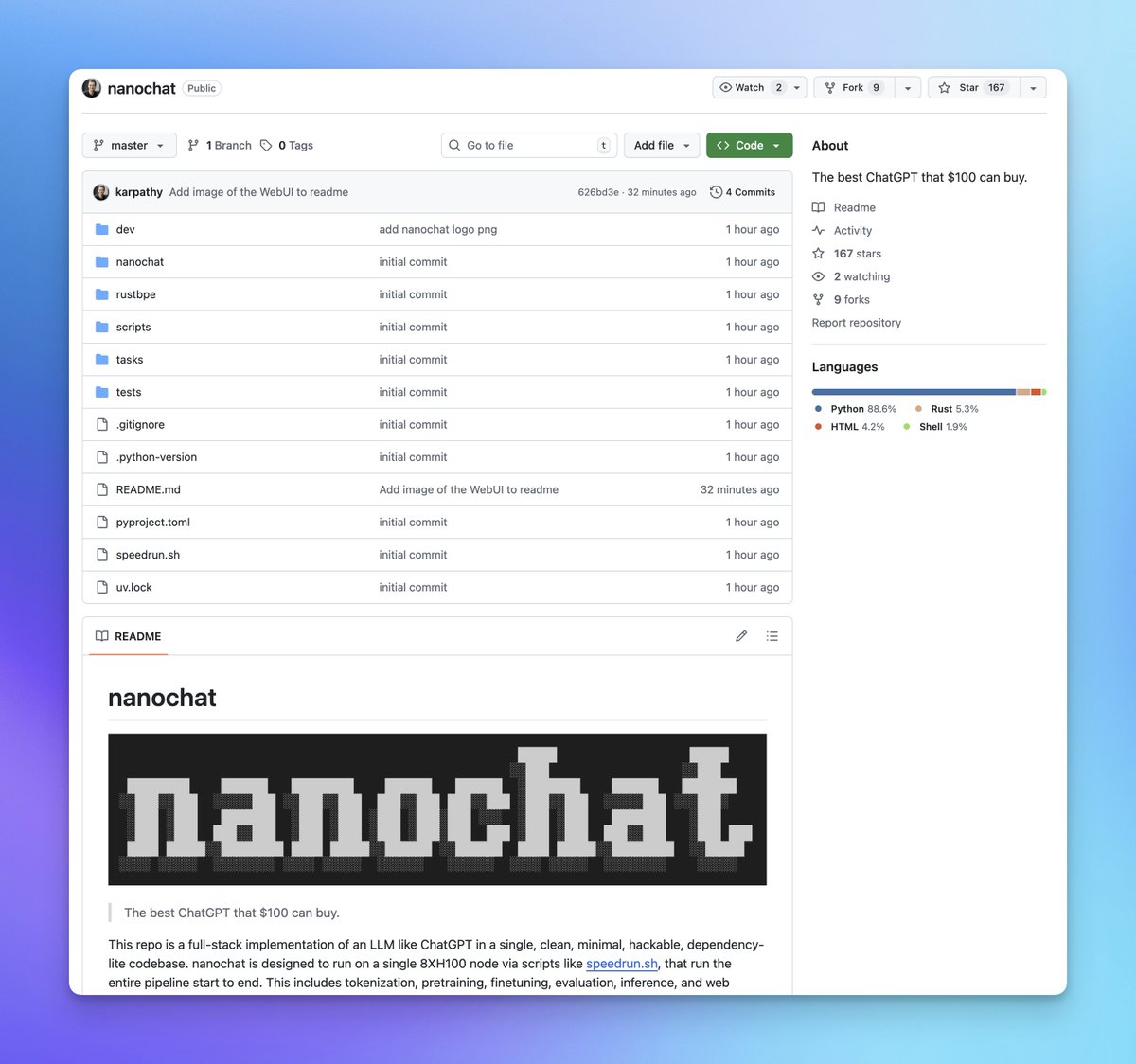

牛皮!Andrej Karpathy 发布了一个从零构建 LLM 训练和推理的项目:nanochat 基本上跟着学就可以了解 LLM 训练的所有步骤了 只需要 100 美元的算力成本就可以训练出可以对话的模型,而且会带有一个 UI 界面,只有 8000 行代码 项目覆盖从分词、预训练、对齐到推理与 WebUI 的完整闭环,会是他 LLM…

Excited to release new repo: nanochat! (it's among the most unhinged I've written). Unlike my earlier similar repo nanoGPT which only covered pretraining, nanochat is a minimal, from scratch, full-stack training/inference pipeline of a simple ChatGPT clone in a single,…

United States Trends

- 1. Megyn Kelly 26.9K posts

- 2. Blue Origin 4,969 posts

- 3. Vine 30.4K posts

- 4. Senator Fetterman 16.4K posts

- 5. New Glenn 6,426 posts

- 6. CarPlay 4,137 posts

- 7. #NXXT_JPMorgan N/A

- 8. Padres 28.7K posts

- 9. Black Mirror 4,983 posts

- 10. Cynthia 109K posts

- 11. World Cup 92.6K posts

- 12. Osimhen 96K posts

- 13. Katie Couric 9,009 posts

- 14. Portugal 54.7K posts

- 15. GeForce Season N/A

- 16. #WorldKindnessDay 16.5K posts

- 17. Eric Swalwell 21.3K posts

- 18. Gaetz 13K posts

- 19. Cameroon 11.7K posts

- 20. V-fib N/A

Something went wrong.

Something went wrong.