techstockDB

@techstockDB

techstockDB | the largest repository of tech stock information on the internet

You might like

If you're not saying "HELL YEAH!" about something, say "no."

$ETN is playing in the right space Huge opportunity in data center power and cooling with orders up 70% and sales up 40% Acquisition of Boyd Thermal which adds $1.7B in sales looks very smart liquid cooling market is growing 35% annually

$LITE stock popping on headline 64% revenue growth Dig a little deeper and you'll see operating metrics aren't nearly as impressive Meteoric rise has been fueled by multiple expansion, trading at an eye popping 132x EV/OFC No thanks.

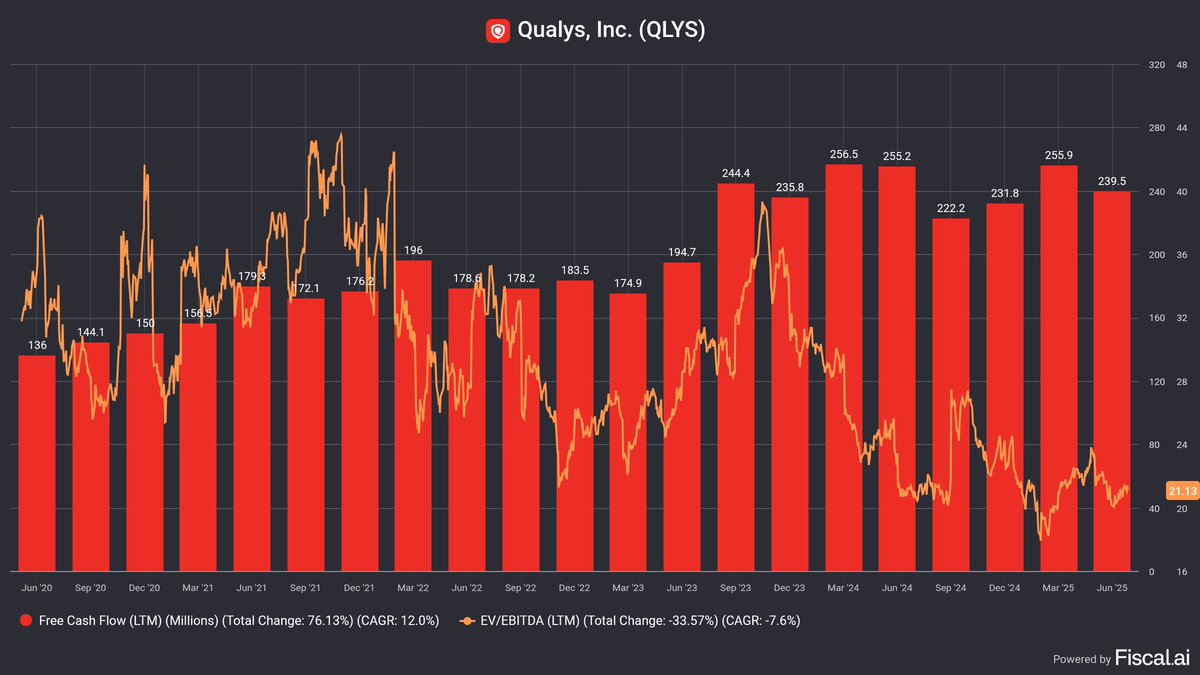

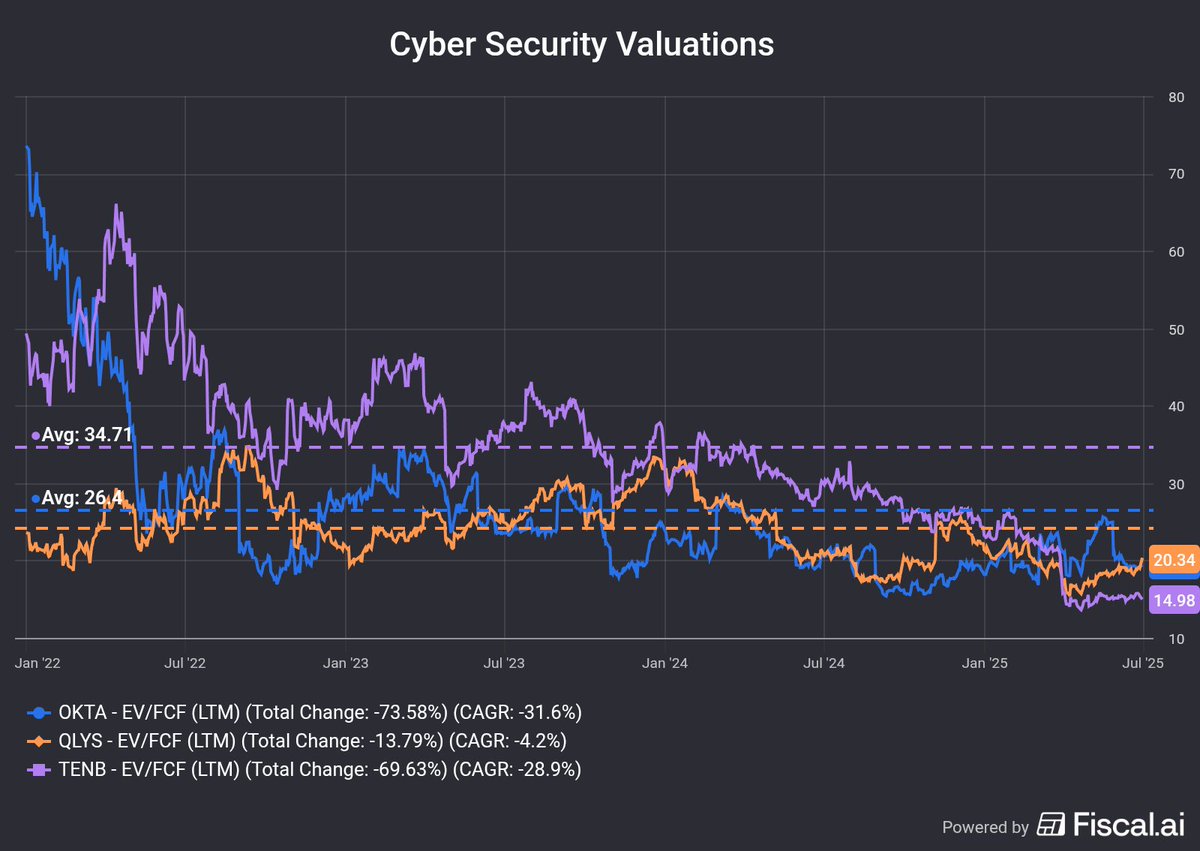

$QLYS up +20% today Operating free cash flow grew +48% Received FedRAMP high authorization status, making it one of the few cyber security firms to meet federal security and compliance standards Increased guidance Still cheap

I keep pounding the table on Qualsys $QLYS. Very consistently growing cash flows, pure operational excellence. Cyber security is a huge and growing market. 12% of the market cap is cash. Trading at a 35% drawdown and valuation multiples not seen in a decade.

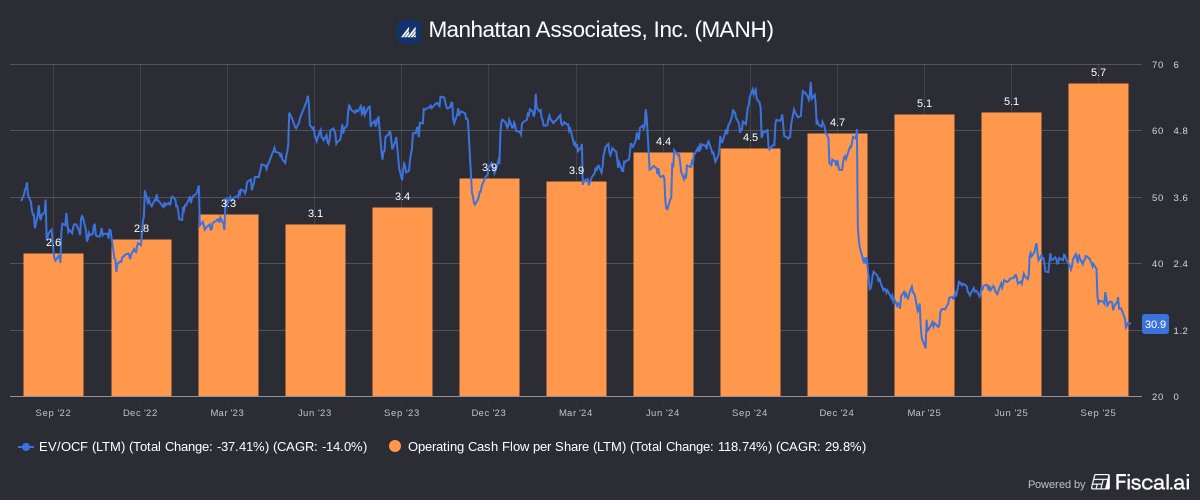

$MANH is a compounding machine It's stock is off -40% Last Q they bought back $200M of shares

Tech enabled cancer screener $EXAS delivered •revenue +20% •adj. EBITDA+37% Cancer rates are on the rise globally

$PAY with a nice pop on earnings •revenue up 34.2% •adj. EBITDA up 45.9% Debt free, founder led company The most attractive software payments company in the market right now

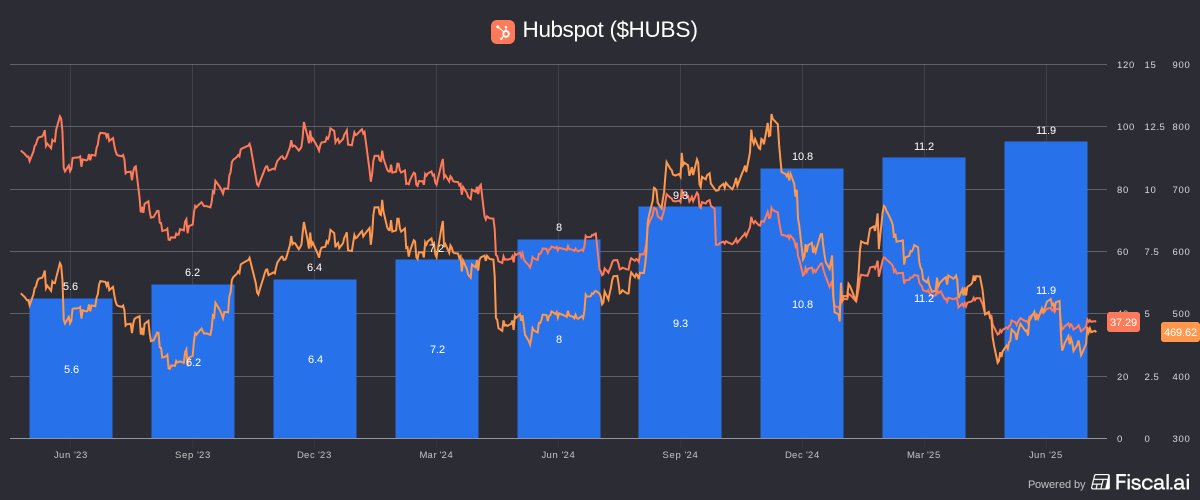

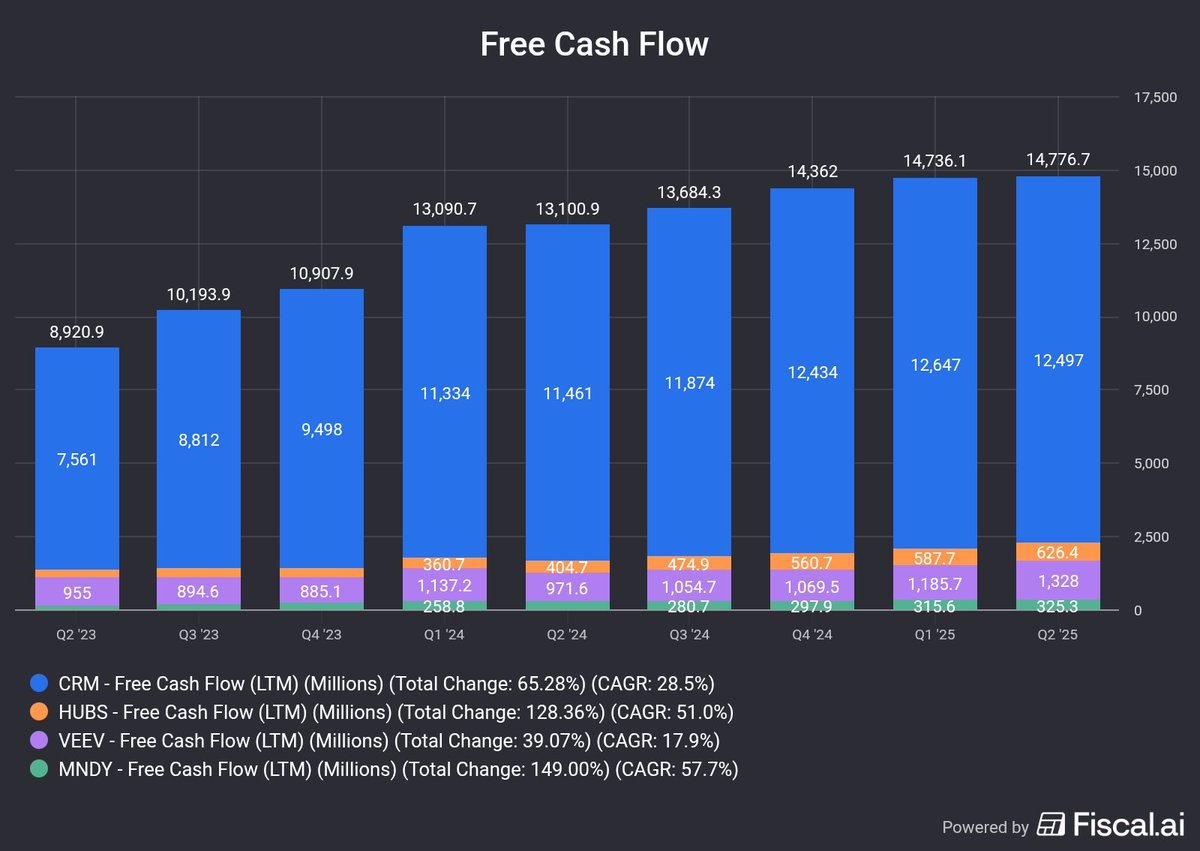

this shouldn't happen 💭 hubspot $HUBS has doubled free cash flow in 2 years while its stock has traded lower: •stock price DOWN -12% •free cash flow UP +112% (45% CAGR) •valuation near lows lots of interesting setups in software right now

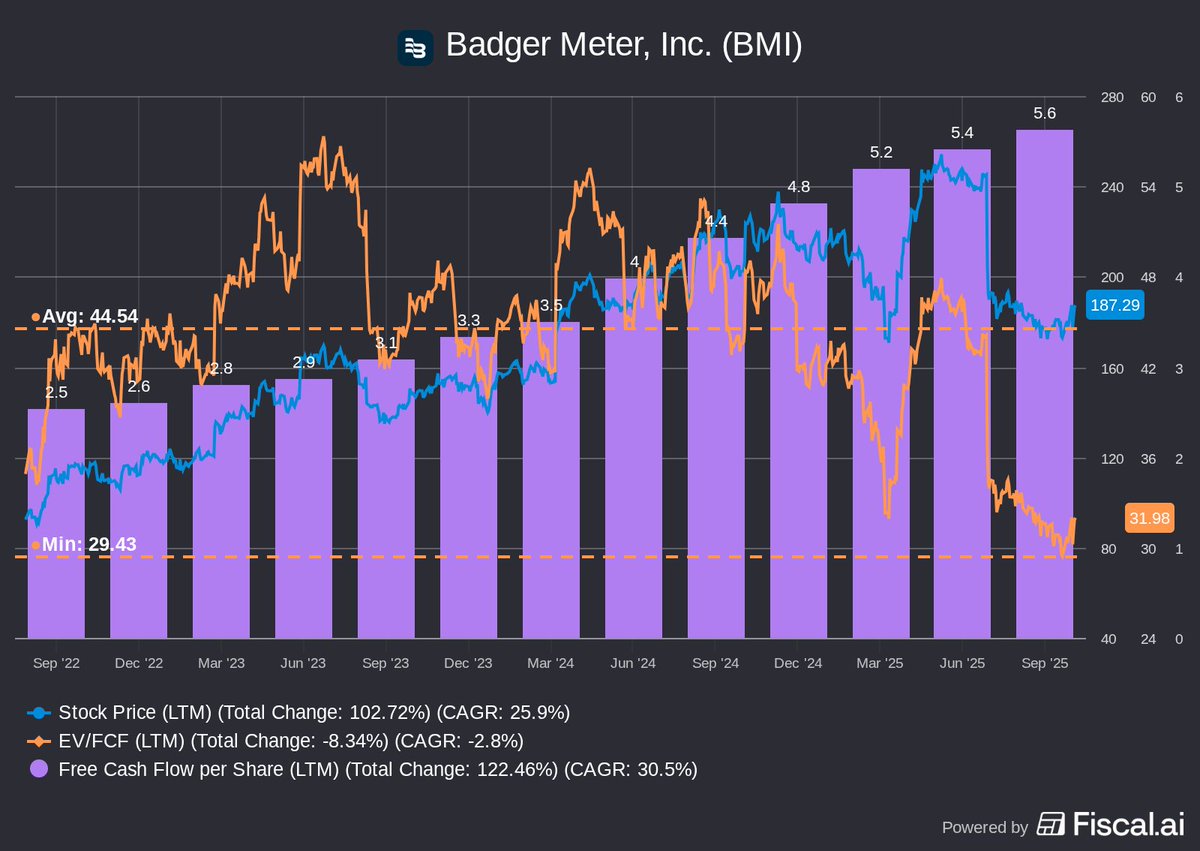

A sneaky good company, on sale. Hardware enabled software can be a beautiful thing. Badger Meter $BMI has robust demand for its industry-leading cellular Advanced Metering Infrastructure. Consistent, growing cash flows. -30% draw down, at the low end of historical valuations.

Roper Technologies $ROP is posting fine results. Free cash flow +17%. Debt is high. Better options.

I've changed my thinking somewhat on the importance of capital efficiencies. $VRSN does have extremely high ROIC and ROCE because of its asset light model and aggressive share buy backs. But it's a slow growth business. Better options out there.

The highest quality tech companies that compound returns over long periods almost always have top tier capital efficiencies. That is, high returns on capital employed and high returns on invested capital. VeriSign $VRSN is a unicorn among unicorns in this regard.

$SSNC is a solid software company providing solutions to the financial services industry. Debt is a bit high and growth isn't super high. Better options out there.

Data Center play Comfort Systems $FIX is on a roll. "Only" up 19% today after reporting 101.7% EPS growth. Backlog swelled to $9.4B.

No good reason to buy STMicroelectronics $STM. No semi conductor company should be shrinking revenues in this environment.

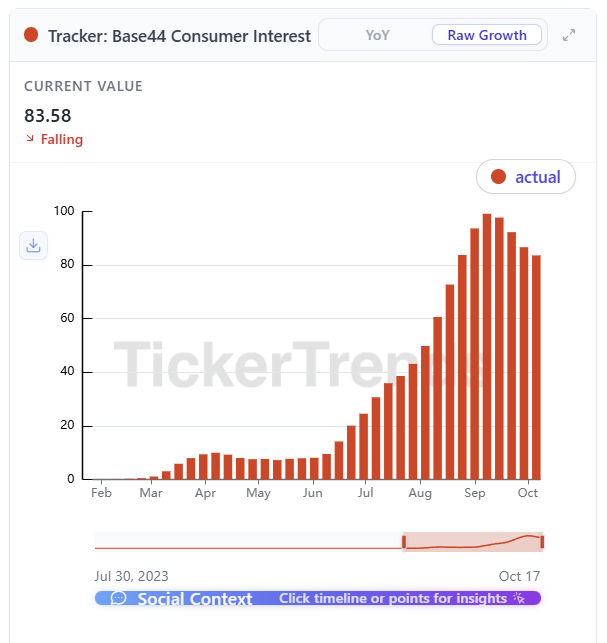

$WIX Base44 website traffic is still holding up steady, albeit not growing yet from the August peak. Consumer Interest has slipped slightly over the last few weeks but worth watching for signs of stabilization!

$WIX grew cash flow 627% in 3 years. With its base44 acquisition, it is now competing with replit, lovable, cursor and bolt in the fast growing vibe coding (AI agent assisted web development) space. Historically low valuation after a 47% drawdown so far this year.

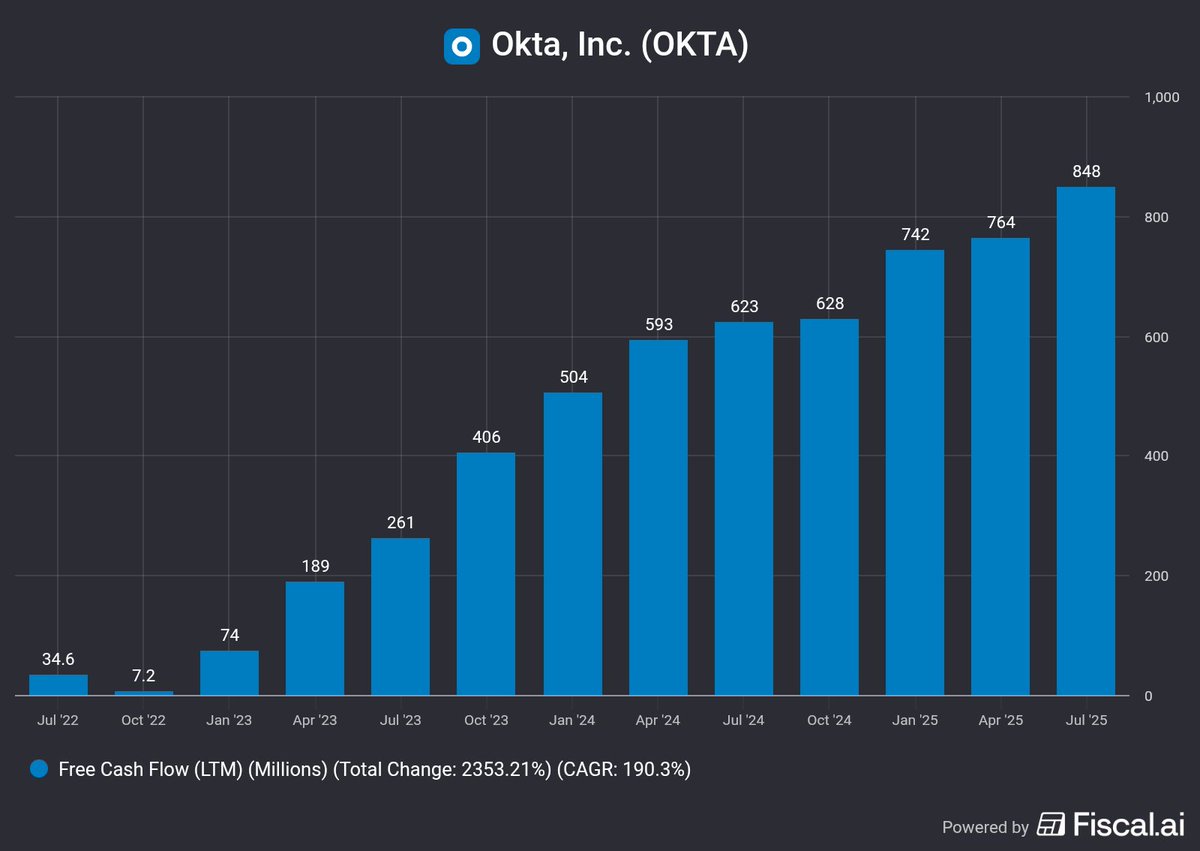

$OKTA free cash flow has exploded the past 3 years Up 2,353% (from a small base)

I keep coming back to $OKTA The proliferation of AI agents is a fundamental identity security challenge for most companies Okta is introducing native support for AI agents as a new identity type across its product suite Sitting on $1.9B cash (12% of $16B mkt cap)

Cyber security companies that are cheap: $TENB $QLYS $OKTA All trading well below average FCF multiples despite growing nicely

Customer Relationship Management isn't just $CRM $HUBS $VEEV $MNDY An interesting group of companies which have performed poorly (except $VEEV) despite growing free cash flows

United States Trends

- 1. #WWERaw 38K posts

- 2. Giants 56.7K posts

- 3. Giants 56.7K posts

- 4. Patriots 84.2K posts

- 5. Drake Maye 13.4K posts

- 6. Dart 23.9K posts

- 7. Younghoe Koo 2,214 posts

- 8. Marcus Jones 5,074 posts

- 9. Abdul Carter 6,060 posts

- 10. Kyle Williams 3,240 posts

- 11. Diaz 30.4K posts

- 12. Theo Johnson 1,595 posts

- 13. Devin Williams 2,372 posts

- 14. #NYGvsNE 1,406 posts

- 15. LA Knight 8,822 posts

- 16. #RawOnNetflix 1,260 posts

- 17. Elliss 2,454 posts

- 18. #MondayNightFootball N/A

- 19. Bron Breakker 4,179 posts

- 20. Ty Lue 1,063 posts

Something went wrong.

Something went wrong.