Todd Moerman

@toddmoerman

Fee-Only Advisor, Fiduciary for Clients. Founder/ Managing Partner of Integrity Investment Advisors, DFA Advisor, AQR Flex SMA, Blogger, #investing, #retirement

내가 좋아할 만한 콘텐츠

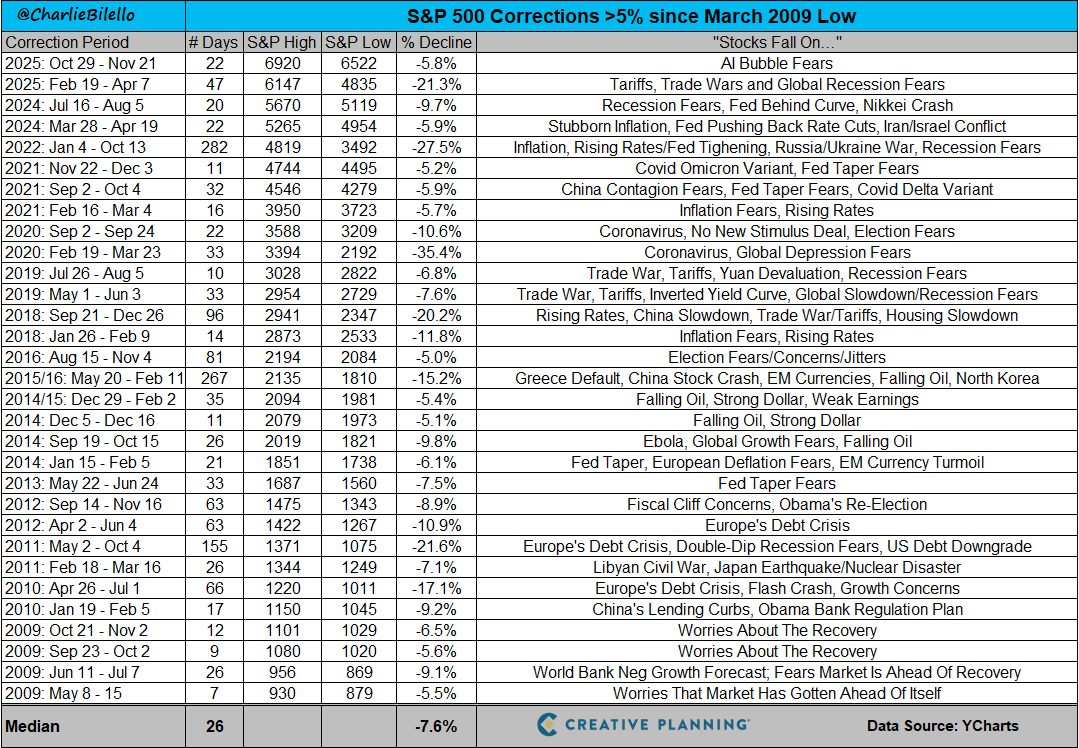

Including dividends, the S&P 500 has gained over 1,300% since the March 2009 low, despite 31 corrections >5%. “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter Lynch…

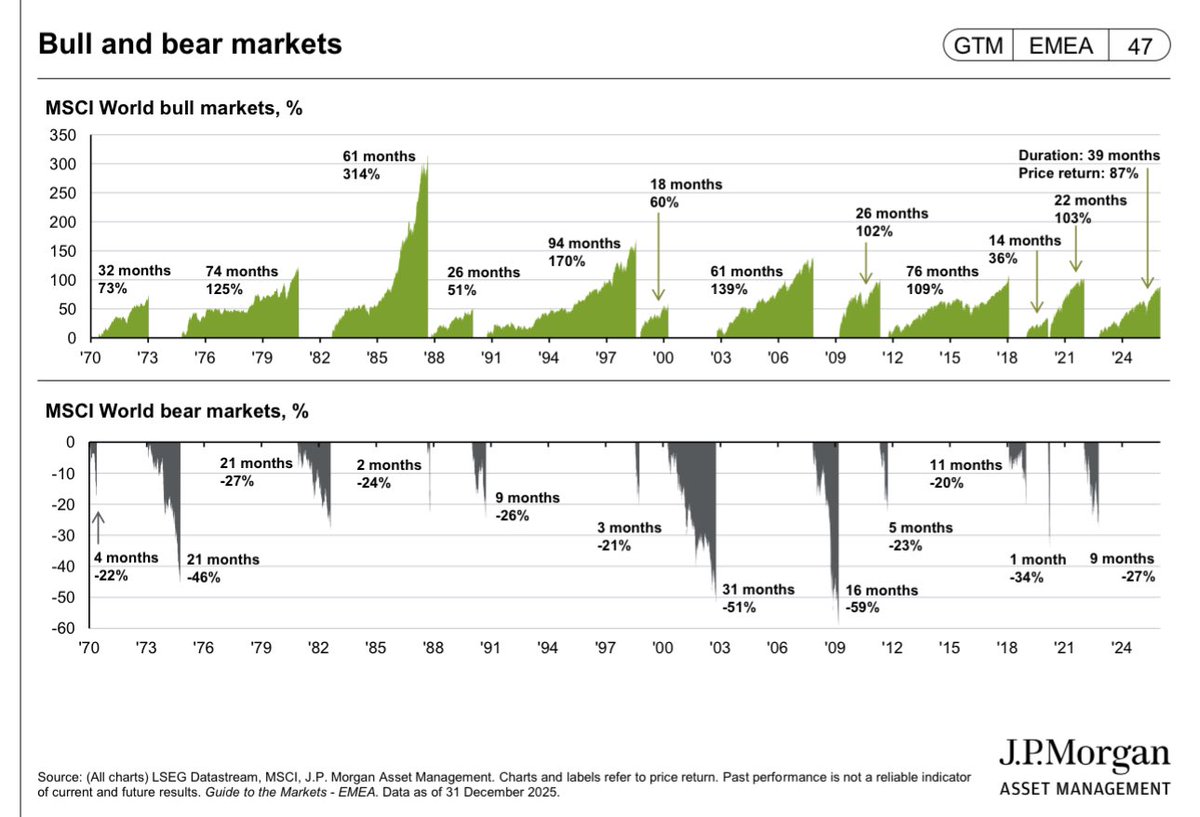

Bull markets have lasted 5x longer than bear markets on average. Bulls: +254% over 5 years 🐂 Bears: –31% over 1 year 🐻 Markets spend far more time growing wealth than destroying it. Why interrupting compounding is the biggest risk of all. Video: youtube.com/watch?v=mUGb8h…

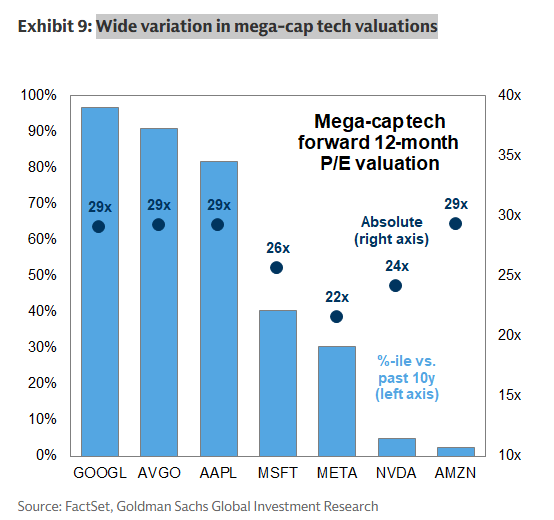

GS: Wide variation in mega-cap tech valuations $MAGS

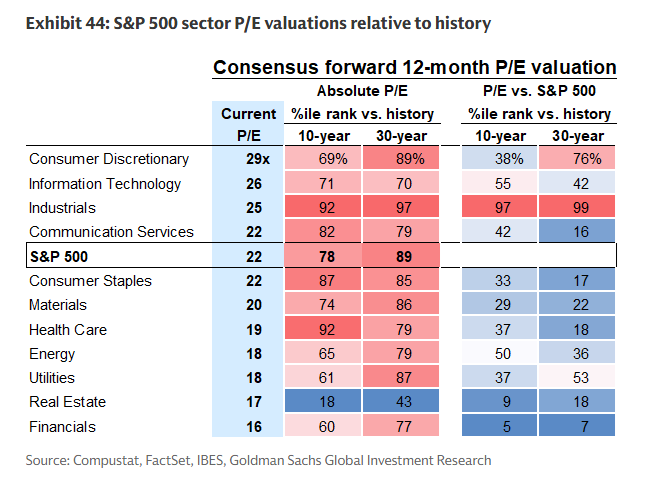

S&P 500 sector valuations.. Tech now 3 figures below Discretionary! GS

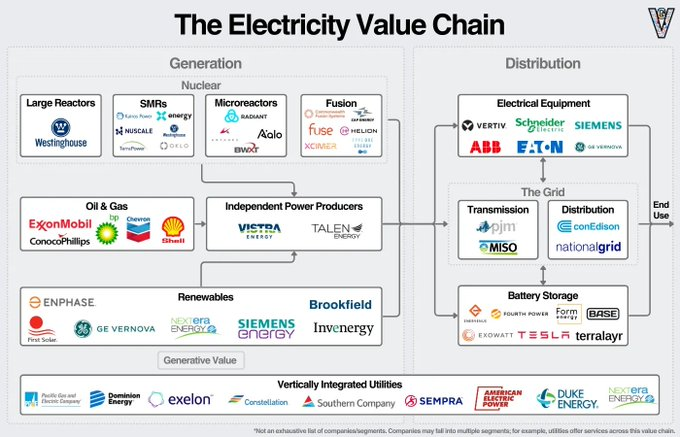

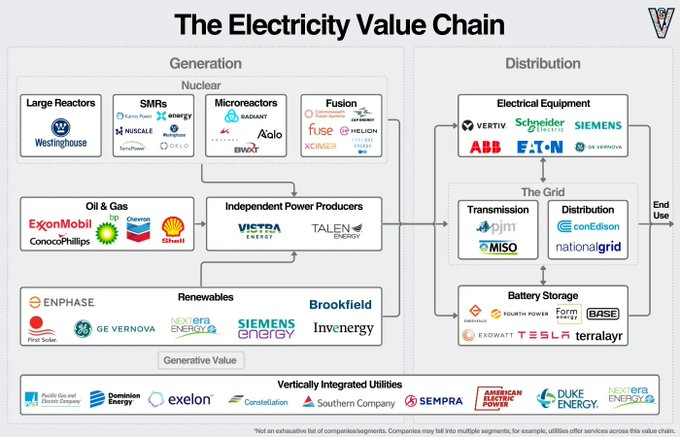

The electricity value chain visualized

ENERGY IS THE BIGGEST BOTTLENECK FOR AI DATA CENTERS Microreactors: $BWXT SMRs: $SMR, $OKLO Battery Storage: $FLNC, $TSLA Transmission/Grid: $NEE, $NGG Oil & Gas: $XOM, $CVX, $BP, $SHEL, $COP Independent Power Producers: $VST, $TLN Renewables: $FSLR, $ENPH, $GEV, $NEE, $SMEGF,…

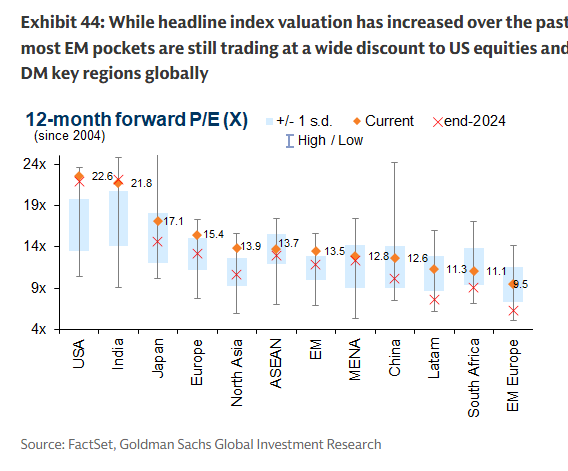

EM just a 13.5x P/E GS

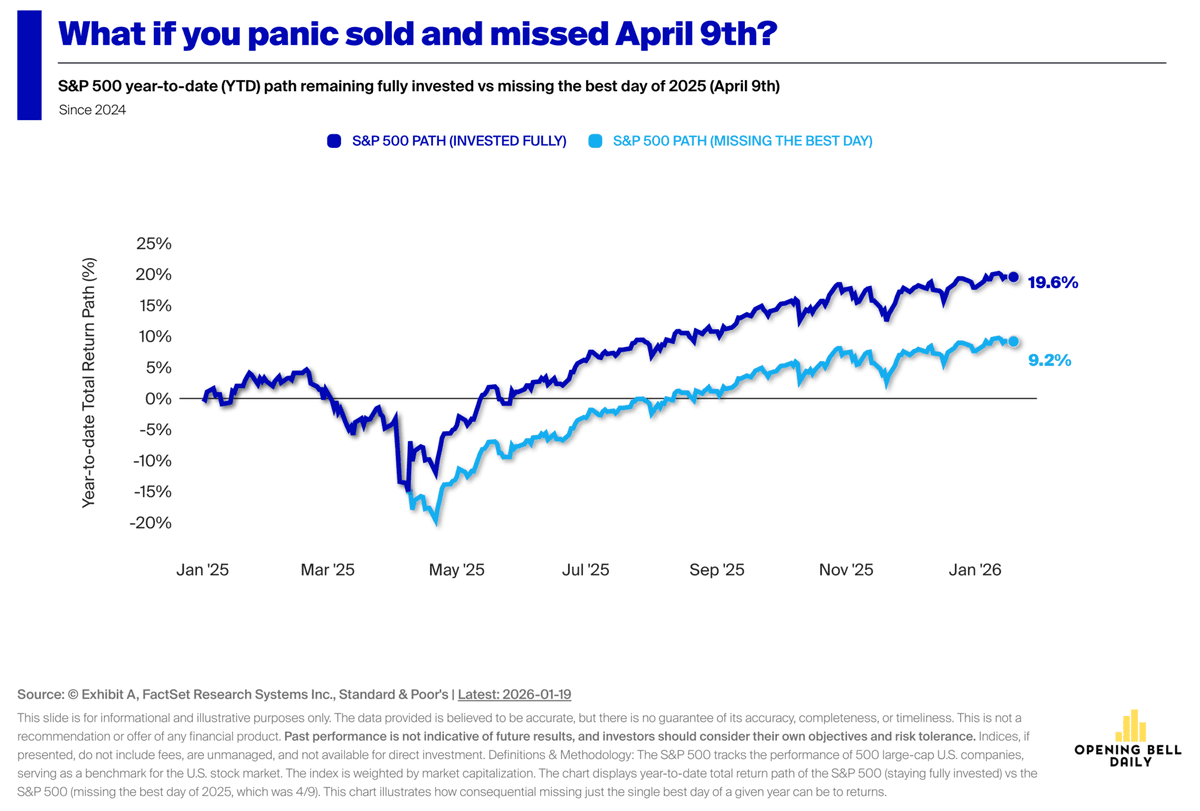

This is crazy. What if you panic sold and missed April 9th in 2025? - Staying fully invested in the S&P 500: +19.6% - Missing just the best day of 2025: +9.2% That’s a 10% gap from one single day.

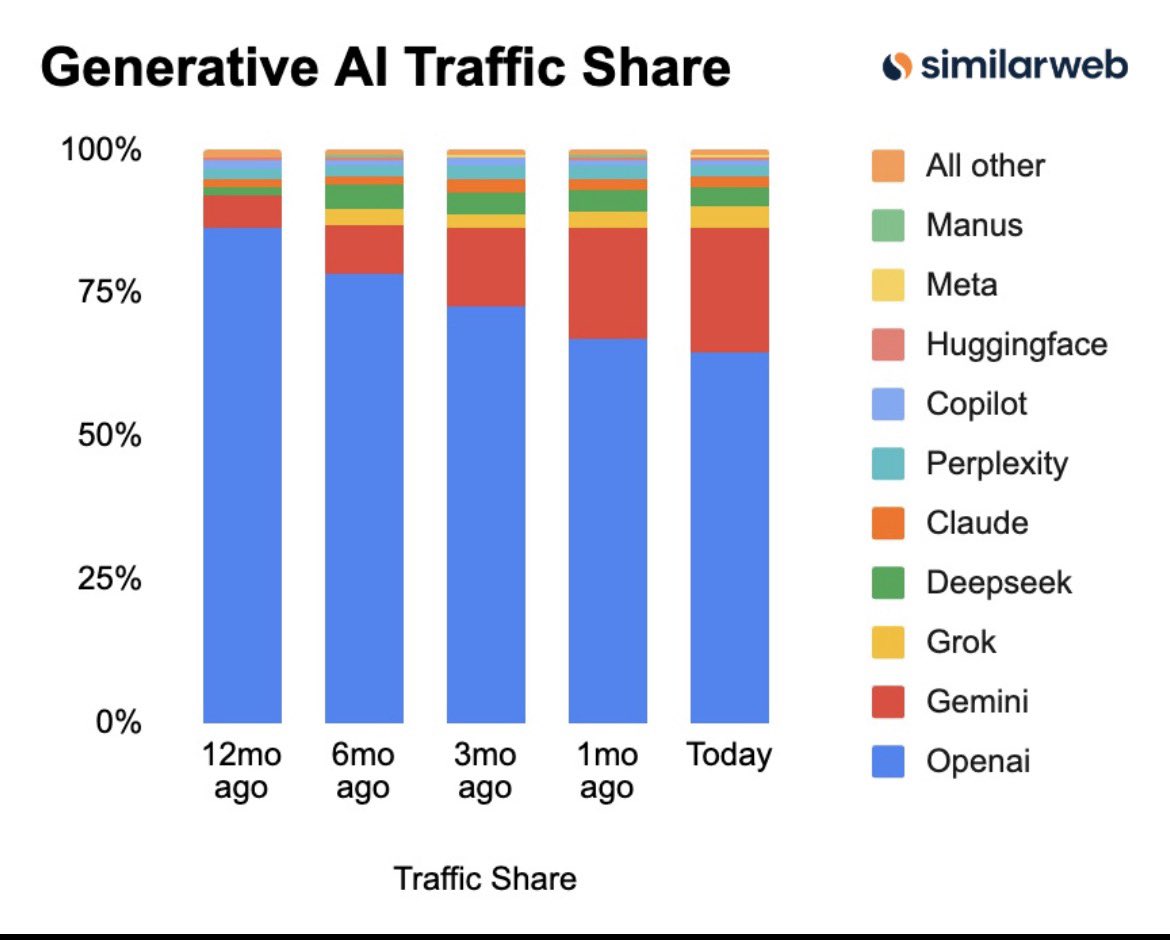

$GOOGL Gemini continues to take market share now 22% up from 19.5% 1 month ago & 13.3% 3 months ago.

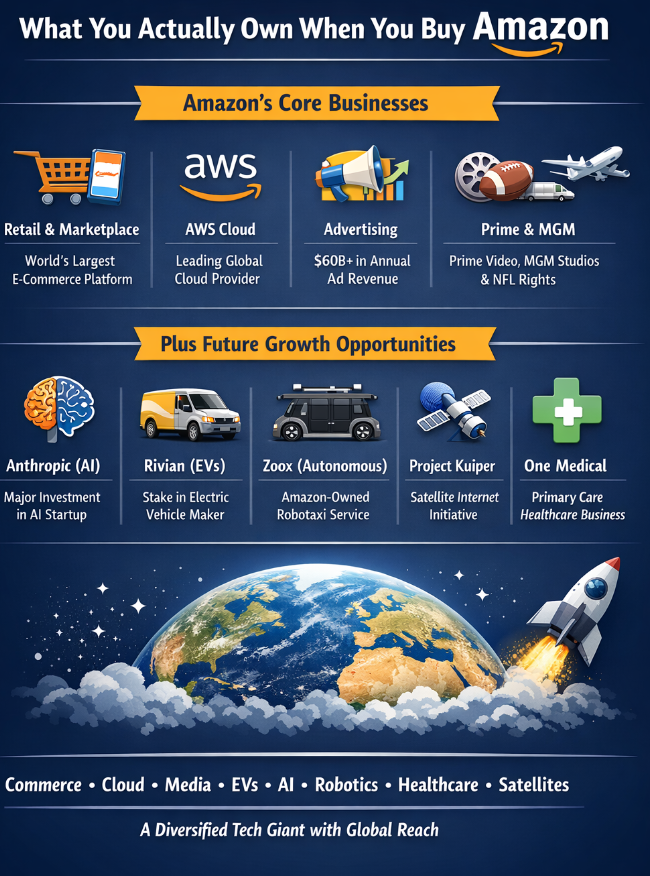

$AMZN - Amazon IS the ecosystem. You get: - E-commerce & Marketplace: ($800B) - AWS (Cloud & AI): ($1.2T) - Advertising: ($500B) - Logistics & Fulfillment: ($200B) - Prime Video & MGM: ($100B) And on top of it you get exposure to: - Anthropic: ($8B invested) - Rivian: ( $RIVN…

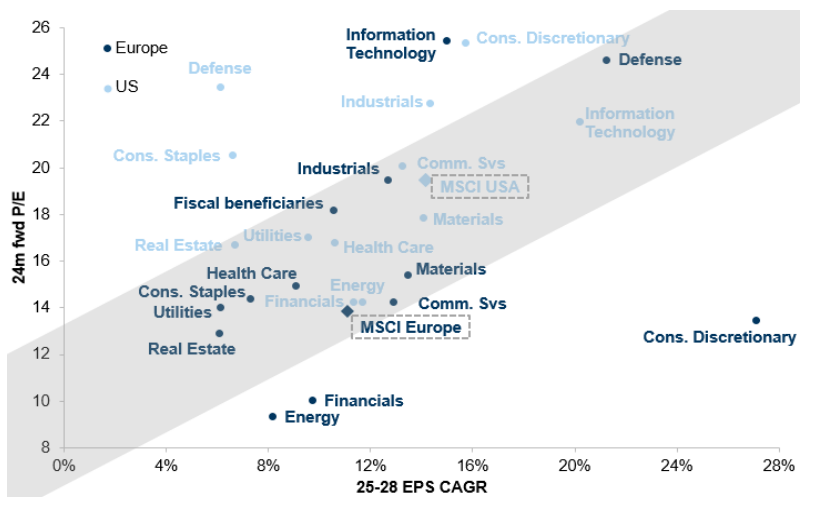

GS: The Value of Growth: Sectors in US and Europe comparing Valuation with expected EPS growth

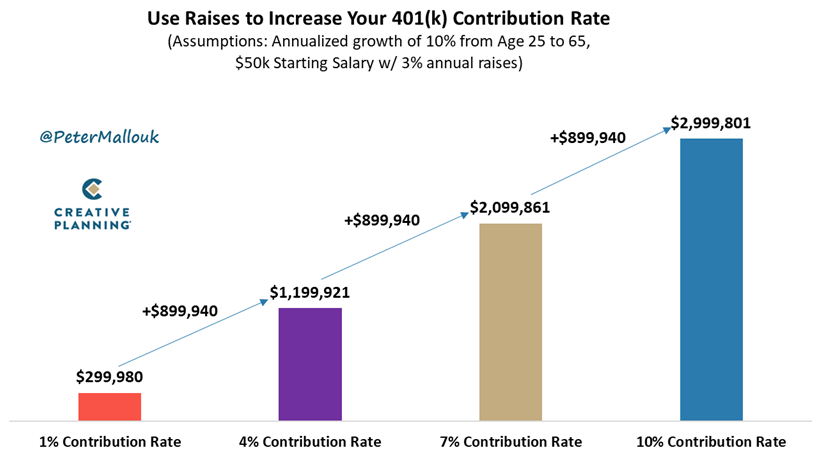

Most people spend their raises. The smarter move? Save them. Increasing your 401(k) contribution rate from 1% to 10% can mean millions more by retirement.

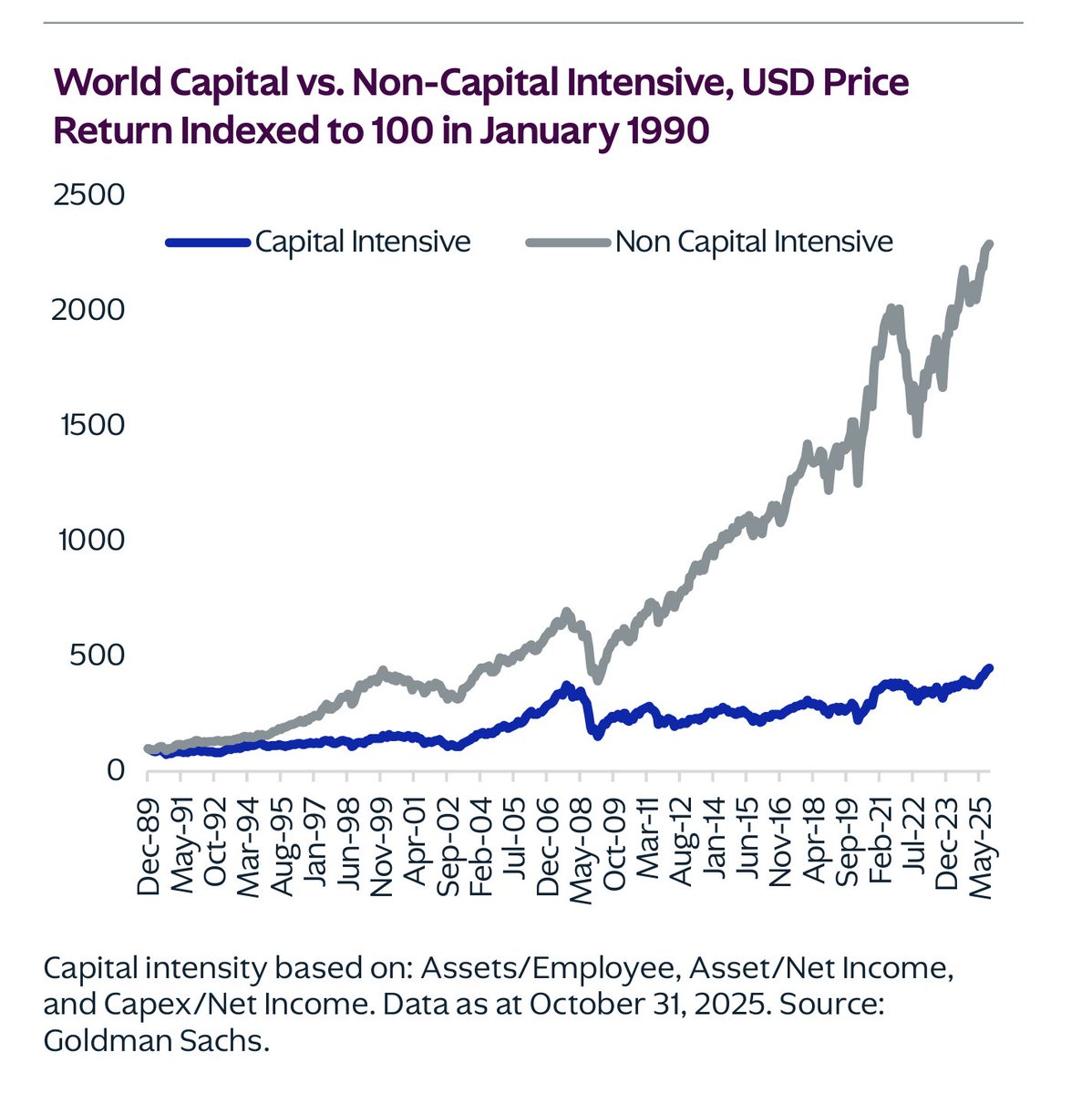

Capital-light businesses have outperformed capital-intensive businesses over the last 35 years. Chart from KKR 2026 outlook.

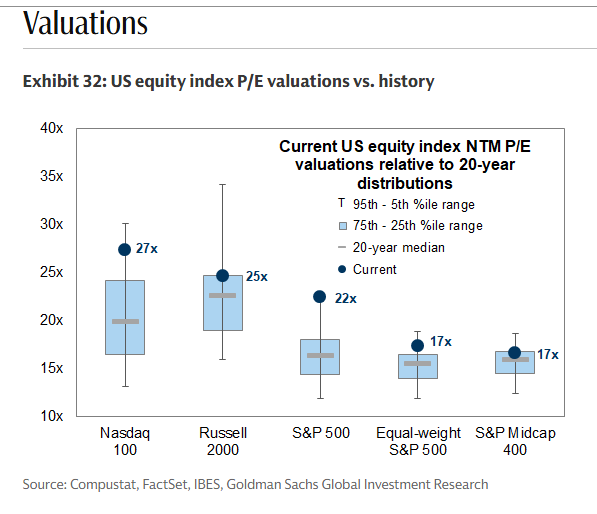

Nasdaq 100's P/E has actually dipped to just 27x SPX 22x $RSP $MDY 17x GS

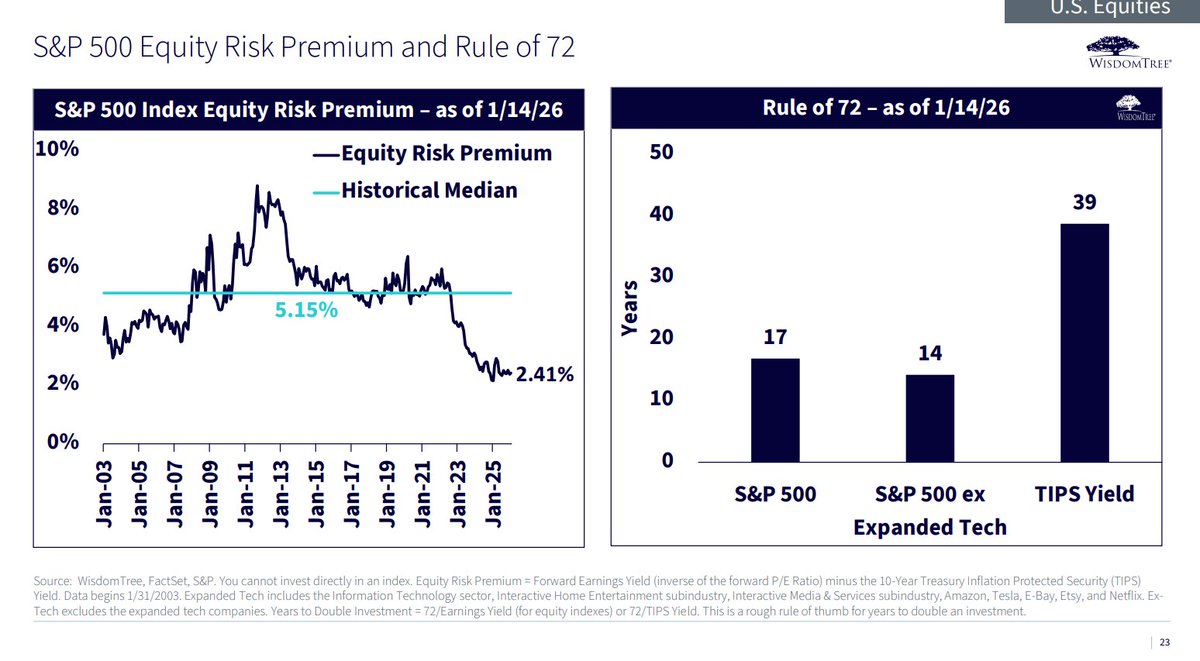

S&P 500 equity risk premium of 2.41% suggests investors are still better off owning US large caps rather than hiding out in 10yr TIPS 17 years to double your money $SPY vs 39 years $TIP @wisdomtreefunds

WisdomTree: The improved and superior profitability of U.S. companies may support a higher earnings multiple While U.S. equities trade at a valuation premium to international markets, they offer materially higher earnings quality

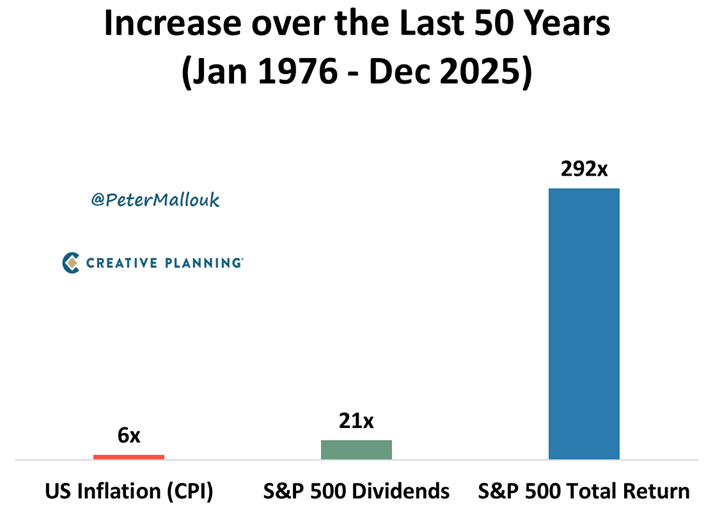

In my opinion, this is the most compelling chart for being a stock market investor. Over the last 50 years: -US Inflation: up 6x -S&P 500 dividends: up 21x -S&P 500 total return: up 292x Over the long run, stocks trounce inflation and protect your purchasing power.

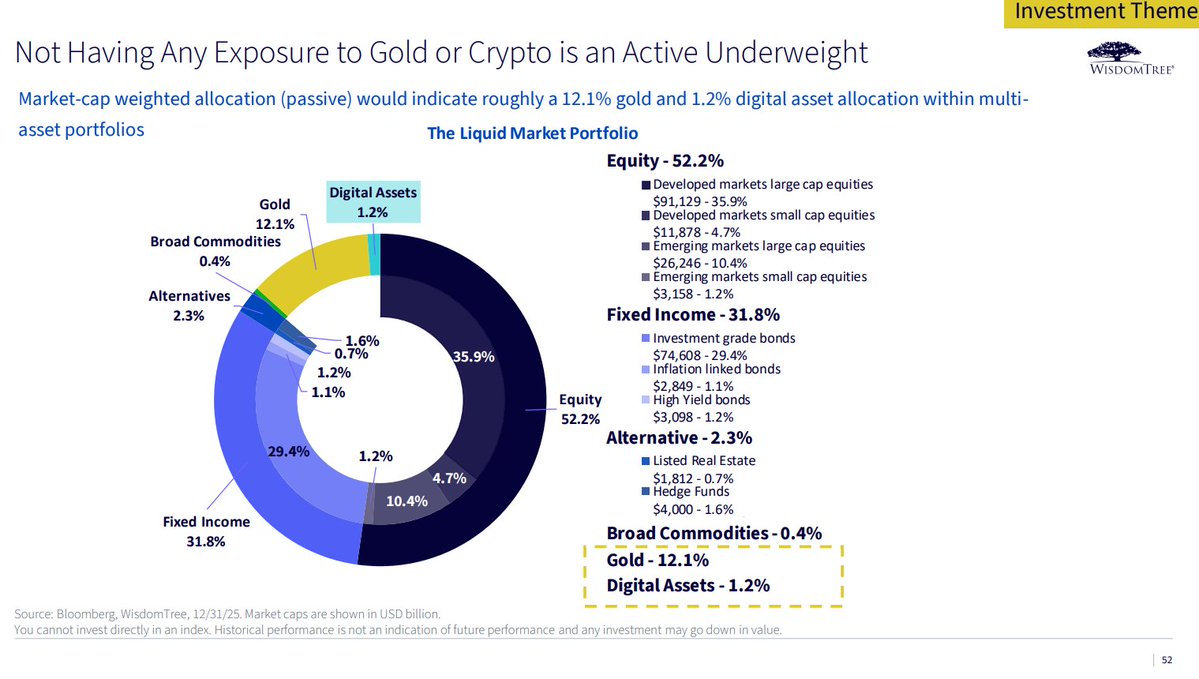

Looking for the truest global market portfolio? The guys at @wisdomtreefunds put it together... Wow - gold 12%, crypto 1.2%

United States 트렌드

- 1. Shakur N/A

- 2. #UFC325 N/A

- 3. Volk N/A

- 4. Keyshawn N/A

- 5. #boxing N/A

- 6. Happy Black History Month N/A

- 7. Conor Benn N/A

- 8. Tank N/A

- 9. Connor Storrie N/A

- 10. #RING6 N/A

- 11. Ortiz N/A

- 12. Keon N/A

- 13. Haney N/A

- 14. Cavs N/A

- 15. Kings N/A

- 16. Schroder N/A

- 17. Dan Hooker N/A

- 18. #Mashle N/A

- 19. Shu Shu N/A

- 20. Ruffy N/A

Something went wrong.

Something went wrong.