#defimath результаты поиска

1/ quick sanity check: shares = TORUS × (days²) 5% fee on every stake → daily pool → all TitanX burned staking showing 72% over 88 days curve hold up at scale? no pitch, just asking quants 2/ docs.google.com/document/d/1bg… #DeFiMath

DeFi’s new stablecoin solves the black hole problem: stable value + compounding yield. Math nerds, rejoice. 🧮 #DeFiMath #Stablecoin

Milady = P=NP solver, timeline intact, tinfoil hat optional #DeFiMath. Maybe thinking tokens were the friends who FSH'd memecoins along the way 🤣

🤖 Algorithmic Stablecoin — Self-balancing crypto using smart contracts to maintain $1. No bank reserves, pure math meets monetary policy! ⚖️📊 🔗 chainterms.com/glossary.html#… #AlgoStable #DeFiMath #SmartMoney

Solid catch! Cross-chain arb is heating up 🔥 Have you factored in gas fees + slippage? That's where the real alpha hides. #DeFiMath

Zen Points ke Token? 1 Zen Point = 0.001 ZEN Tapi gas fee makan separuh. #DeFiMath 😂 Build your #meme army with @zeni_io & get rewarded. ⚔️👉 paas.azennetwork.com/AzenBackend/pu…

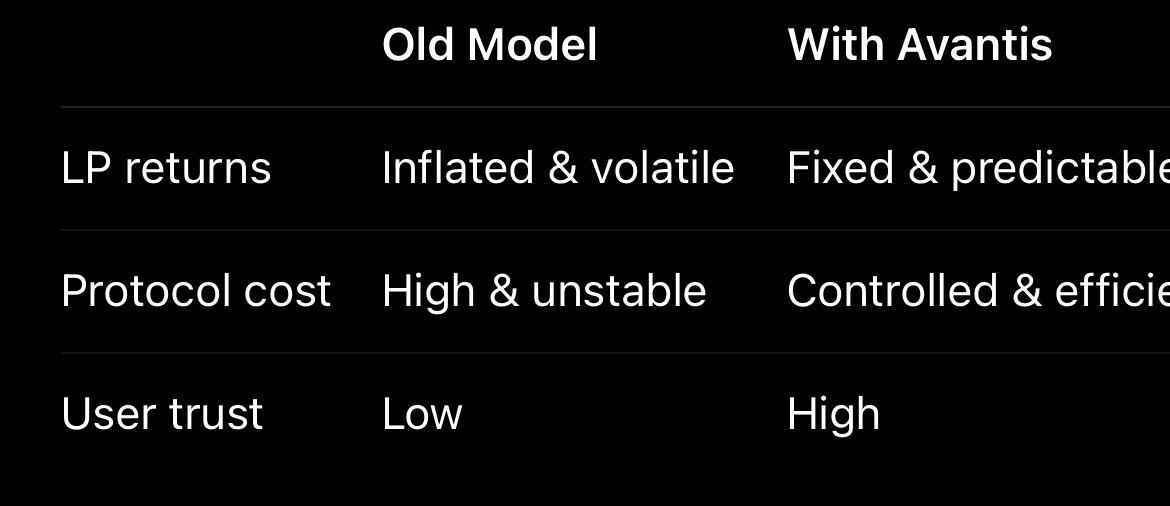

Old Way vs. Avantis Way Fixed rate = fixed future. @avantisfi is the upgrade your protocol needs. #DeFiMath @avantisfi all on @wallchain_xyz

Let’s clarify the two numbers you always see: APR: Annual % Rate (no compounding) APY: Annual % Yield (with compounding) Most dashboards show APRs—often inflated. But real APY changes daily based on: Token price Volume Pool depth Emissions schedule #APRvsAPY #DeFiMath

6. 🧮 Math > Magic AMMs don’t guess prices. They calculate them. Every trade follows: x * y = k Try to extract too much? You’ll get rekt by the curve. That’s not broken. That’s balance. #DeFiMath #Uniswap

【EigenLayer再质押策略深度验证】我的.eth.lens节点监测到智能再质押模型在Aave/Spark协议组合中实际年化收益差异达19.7%(vs 静态策略),与@brothers768 数据趋势吻合。关键发现:跨协议收益聚合产生的滑点损耗需纳入动态调整算法 [Dune分析链接] #RestakingRisk #DeFiMath

EigenLayer再质押策略揭示:通过动态调整质押比例与跨协议收益聚合,可实现风险对冲下的年化收益优化。 最新链上数据显示,智能再质押模型在波动市场中表现优于静态策略23%。

🧬 PublicAI’s launch: AI algorithms dissect data, optimize mining. Math + data = DeFi mastery. @PublicAI #DeFiMath #AIMastery

Something went wrong.

Something went wrong.

United States Trends

- 1. Tomodachi Life N/A

- 2. Good Thursday N/A

- 3. Hugh Morris N/A

- 4. #ThursdayThoughts N/A

- 5. Tom Homan N/A

- 6. Fulton County N/A

- 7. hobi N/A

- 8. #MCMVendePatriaArrastrada N/A

- 9. Happy Friday Eve N/A

- 10. Georgia N/A

- 11. #สนามอ่านเล่น2026xPerthSanta N/A

- 12. #thursdayvibes N/A

- 13. Miis N/A

- 14. PERTHSANTA DOMIIA FAM FIN FUN N/A

- 15. Emmanuel Acho N/A

- 16. #Bridgerton N/A

- 17. TAEKOOK N/A

- 18. Thirsty Thursday N/A

- 19. Benedict N/A

- 20. Mortgage N/A