#ethereumsconstrainedinfrastructure search results

infrastructure in crypto is such dogshit even simple things like bridging your USDC from SOL to ETH is a chore, has a ton of fees, etc. its no wonder why we always just use cexes to bridge

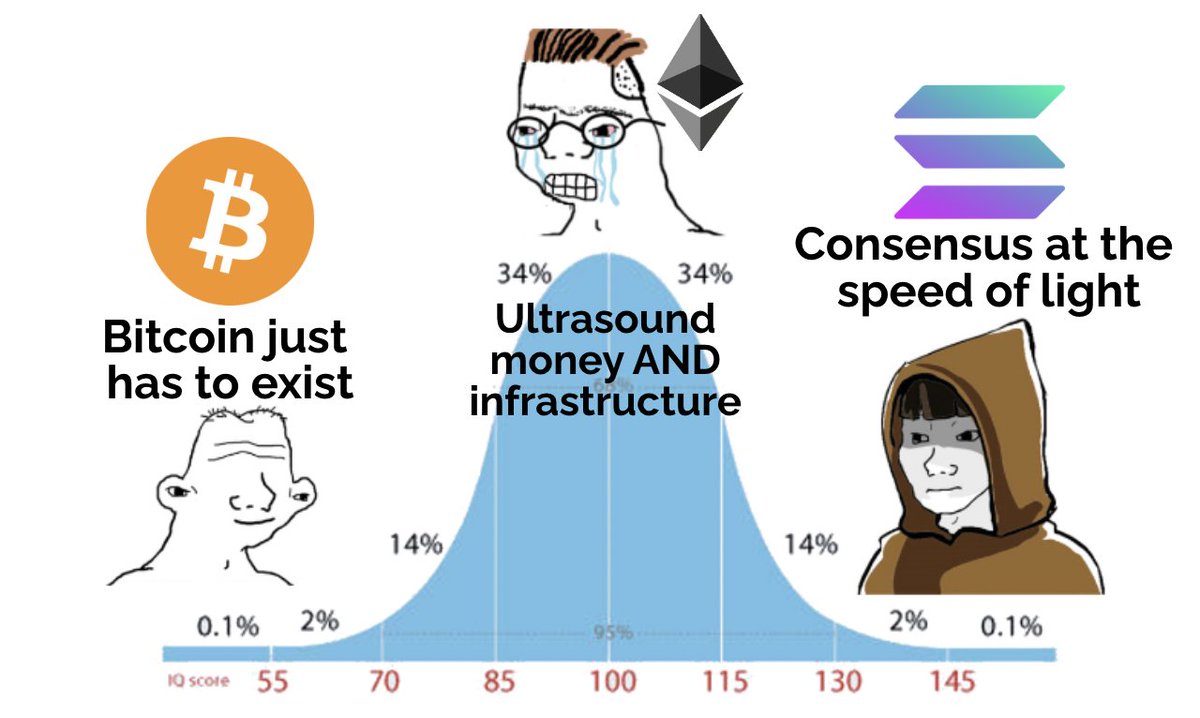

The challenge with Ethereum’s economics today is that $ETH is losing ground on two fronts currently Ultrasound Money (Revenue): L1 revenue has been deteriorating due to Ethereum forfeiting the most valuable part of the stack (congestion gas pricing fees + MEV) to L2s, while…

In the short term, Ethereum also needs to address the widespread leverage issue. It would be better to intervene early and resolve some of the leverage rather than waiting for it to implode, causing losses to protocols and DeFi projects. A negotiated solution is recommended.

If there’s one thing holding DeFi back, it’s fragmentation. Every chain has its own ecosystem, liquidity pools, and opportunities but connecting them is where things get tricky. 🟣@EntityFinance is tackling this head-on, and this thread will show you how. 🧵

for years, Ethereum infrastructure have been among the most (if not the most) easily fundable projects. its hard to overstate how much of a competitive advantage for Ethereum that is. today, there is a real and underrated risk of this advantage turning into a disadvantage, if…

The core issue with ethereum at this point in time is the sheer amount of capital and incentives towards creating L2/3/4s, and almost zero incentive towards creating a critical mass of utility and value on any given core network. This means eth community and capital…

eventually, under saturated load, every monolithic blockchain architecture will be stretched in extremis and that is the moment at which Ethereum's focus on a modular structure, developed in dozens of different ways by the free market will suddenly be ahead of the curve

Here is why the ETH ultrasound money meme is doomed (LONG POST) Ethereum's deflationary narrative relies on usage and people paying extremely high fees for blockspace, especially on the L1 However the ETH 2.0 roadmap utilizes L2s and protodanksharding to scale This means…

The MEV supply chain on Ethereum is ripe for disruption because of a lack of robust financial incentives. There are a handful of solutions to the MEV problem being worked on for implementation in 2023. Let's dive in.🤿 galaxy.com/research/white…

the impact of the design of ethereum’s state model and execution environment is consistently under appreciated for how much it inhibits scaling

12. For Ethereum-based rollups, it will look like they will solve fees & congestion in the beginning, but before the year has come to an end signs of problematic clogging will be visible again.

We just *can't* have Ethereum go down to ship these changes, and that's 50%+ of the complexity of these things. Similarly, we want to keep node hardware requirements low enough for normal people to verify the chain, which makes a lot of "easy" solutions not possible for Ethereum.

The demand/supply ratio of Ethereum's blockspace is higher than any other Demand is high because of the high level of security from decentralization and network effects Supply is low because of the social contract of decentralization, achieved by limiting hardware requirements

Ethereum limits block space to a point where the network can function at peak performance but also remains decentralized. Decentralized means anyone with fairly basic hardware can run a node anywhere in the world. This means a kept in check block time and gas limit.

Ethereum network effects are currently at least as big as Bitcoin + the potential is 100x times higher. What is the problem? That currently the monetary properties of ETH are not that good: high token inflation, token dillution by miners, etc. This changes w/ EIP-1559 & PoS

Ethereum places tremendous constraints on developers: slow speed, enormous cost, cannot scale, cannot serve web. Yet, it has been used to build so much already. Let's watch what happens as smart contracts limitations are removed.

We've seen this exact scenario play out with EOS and eventually the state just go out of hand and no one could run nodes. Right now if Ethereum wanted to, it could tweak the same parameters and get the same "scaling" results but it won't, because it prioritizes decentralization

Save your gas! Save your 💸! Top 3 problems that prevent users from getting more efficient transactions on Ethereum 1⃣Txs get dropped by the network 2⃣Tx queues get stuck 3⃣Bad fee mgmt Here’s how ITX can reduce the headache of building your own relayer lnkd.in/eRsajbC

Something went wrong.

Something went wrong.

United States Trends

- 1. #DWTS 31.9K posts

- 2. Robert 98.8K posts

- 3. Elaine 33.8K posts

- 4. Alix 8,624 posts

- 5. Carrie Ann 3,177 posts

- 6. Anthony Black 2,059 posts

- 7. Dylan 32.2K posts

- 8. Drummond 2,118 posts

- 9. #WWENXT 6,271 posts

- 10. Suggs 2,120 posts

- 11. Jalen Johnson 3,681 posts

- 12. Ezra 10.8K posts

- 13. Wizards 8,542 posts

- 14. CJ McCollum 1,417 posts

- 15. Godzilla 30.9K posts

- 16. #NXTGoldRush 5,116 posts

- 17. Bruce Pearl N/A

- 18. Daniella 2,589 posts

- 19. #DancingWithTheStars N/A

- 20. Brown 163K posts