#macroupdate نتائج البحث

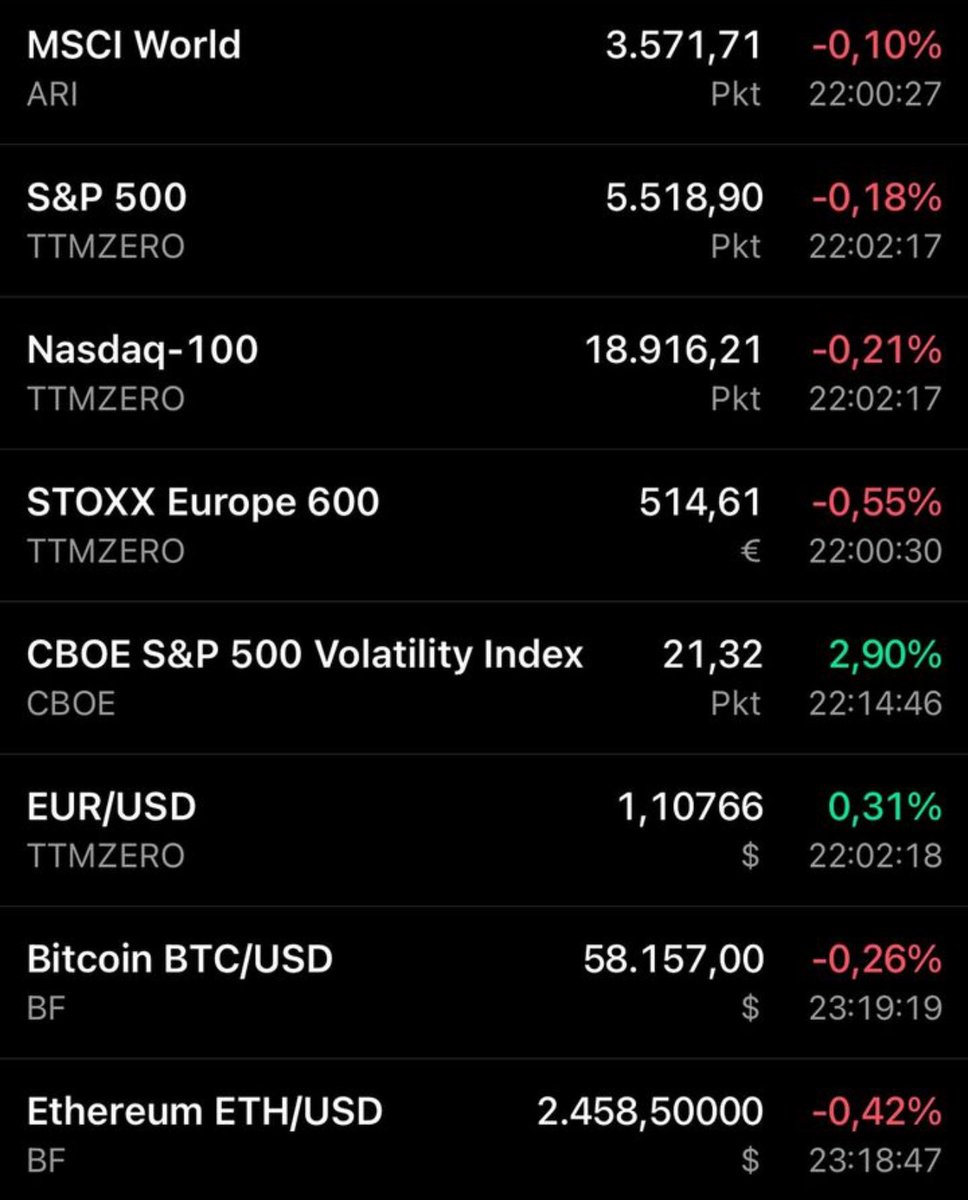

Invest in India💥 but watch Wall Street like a hawk. 📉 S&P fighting for support. 💥 Earnings landmines, Fed whispers, & trade tremors are shaking up the week. Will the bulls bounce — or is a deeper flush ahead? #StockMarket #USMarkets #MacroUpdate

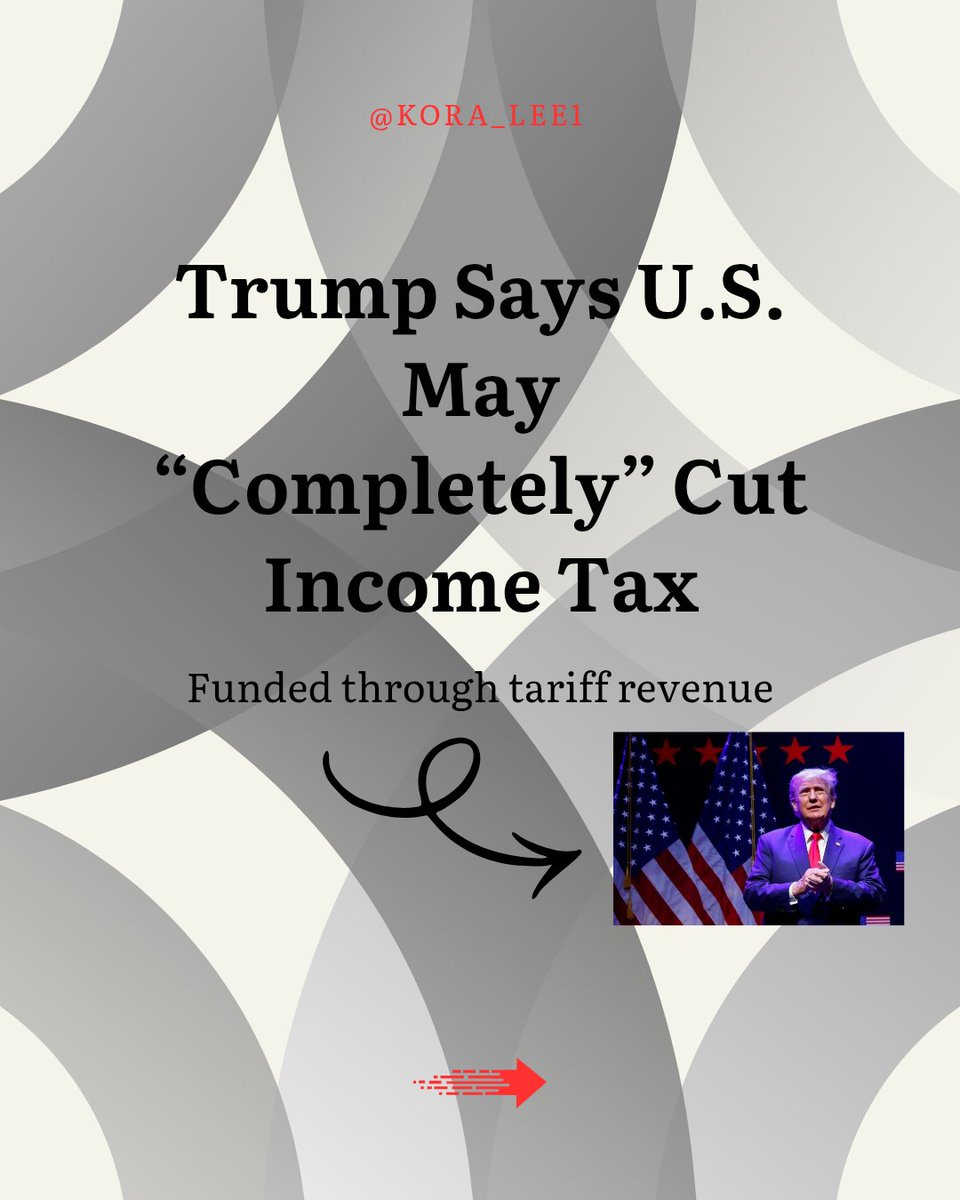

🇺🇸 Trump hints at eliminating U.S. income tax, funded by tariff revenue. Big economic move ,and markets are watching closely 👀 More liquidity = potential boost for risk assets like crypto.#CryptoNews #GlobalMarkets #MacroUpdate #USPolitics

The Fed is stuck. The ECB is easing. And capital? It’s quietly shifting across borders. Risk assets are under pressure — but Bitcoin might be in the perfect spot. Full story: youtu.be/uK4-YB0TKKY #MacroUpdate #Bitcoin #BTC #Fed

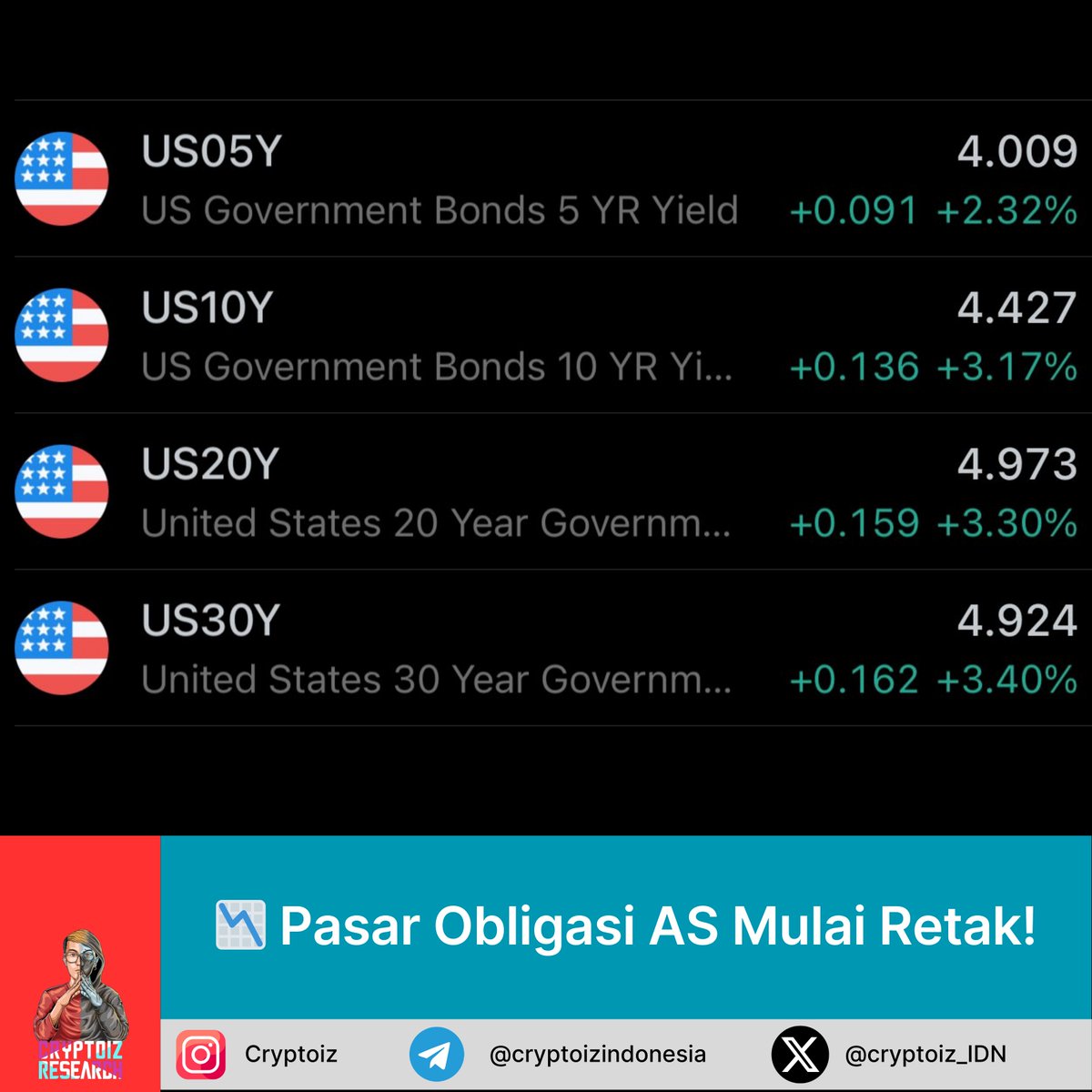

#Macroupdate US 30-Year Treasury Yield hits 5.02% highest since Nov 2023. 📉 Stay cautious. #BondYields #Markets #Macro #US #bond #nifty #banknifty

#Macroupdate USD/INR opened at 86.11 and has continued rising to 86.57. US 10-year bond yields are at 4.78%, and the Rupee hits a record low at 86.57. Both are negative for the market. #niftycrash #USDINR #marketupdate #stockmarketscrash #Nifty

Asia's macroeconomic landscape will continue to shape the region through 2025. Hear from our economist, Adam Samdin, on key trends and their impacts. 📥 Download report: okt.to/g1yp6d #AsiaMarketOutlook #MacroUpdate

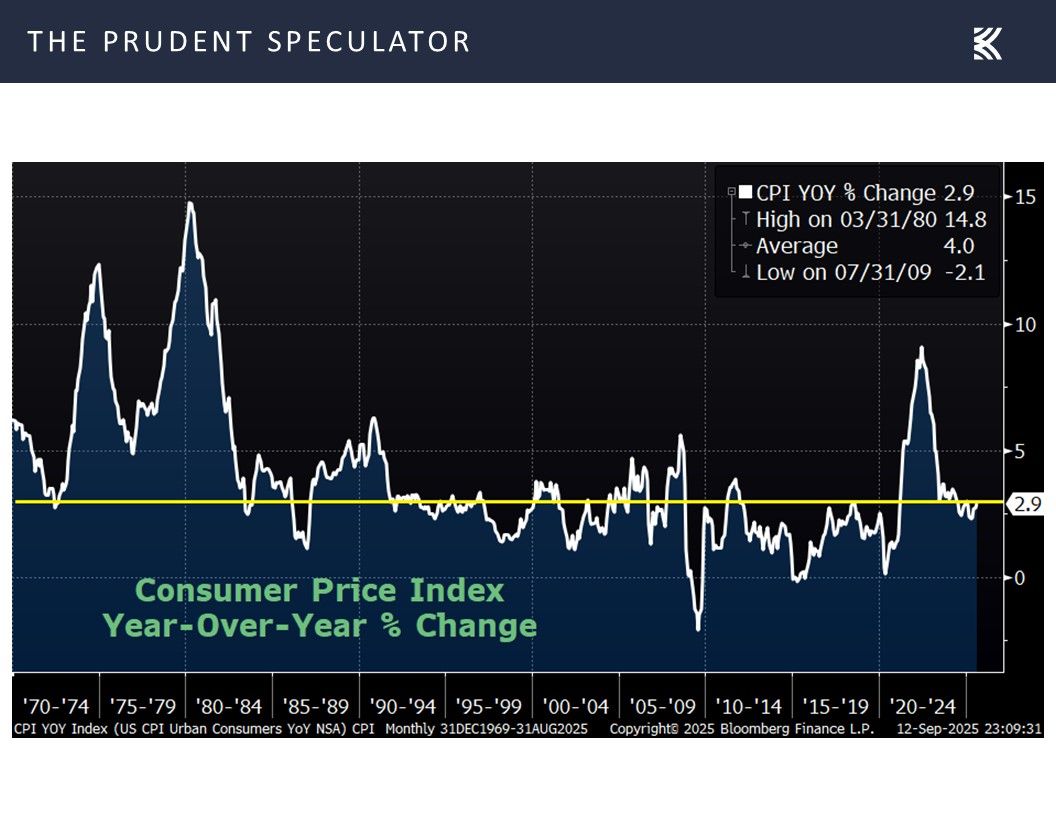

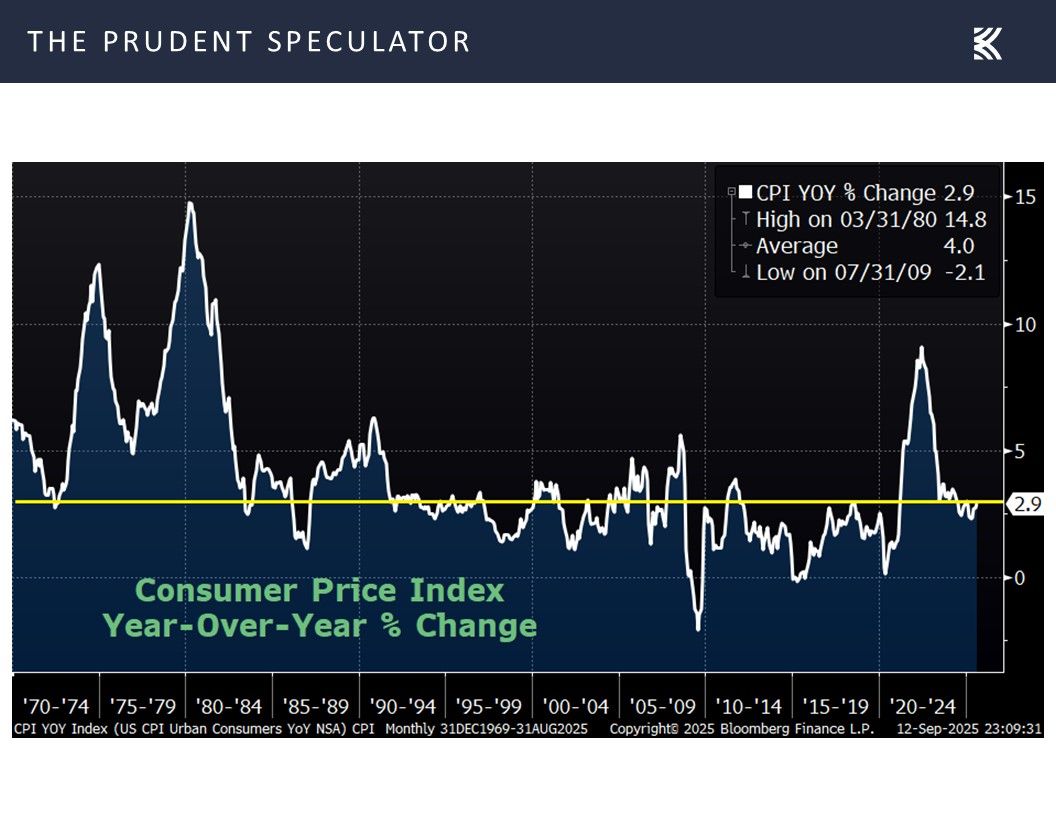

CPI rose 2.9% in August and Core CPI 3.1%. Inflation is still sticky but PPI was softer. Mixed signals, but policy easing likely. #MacroUpdate See the link in the thread for more details!

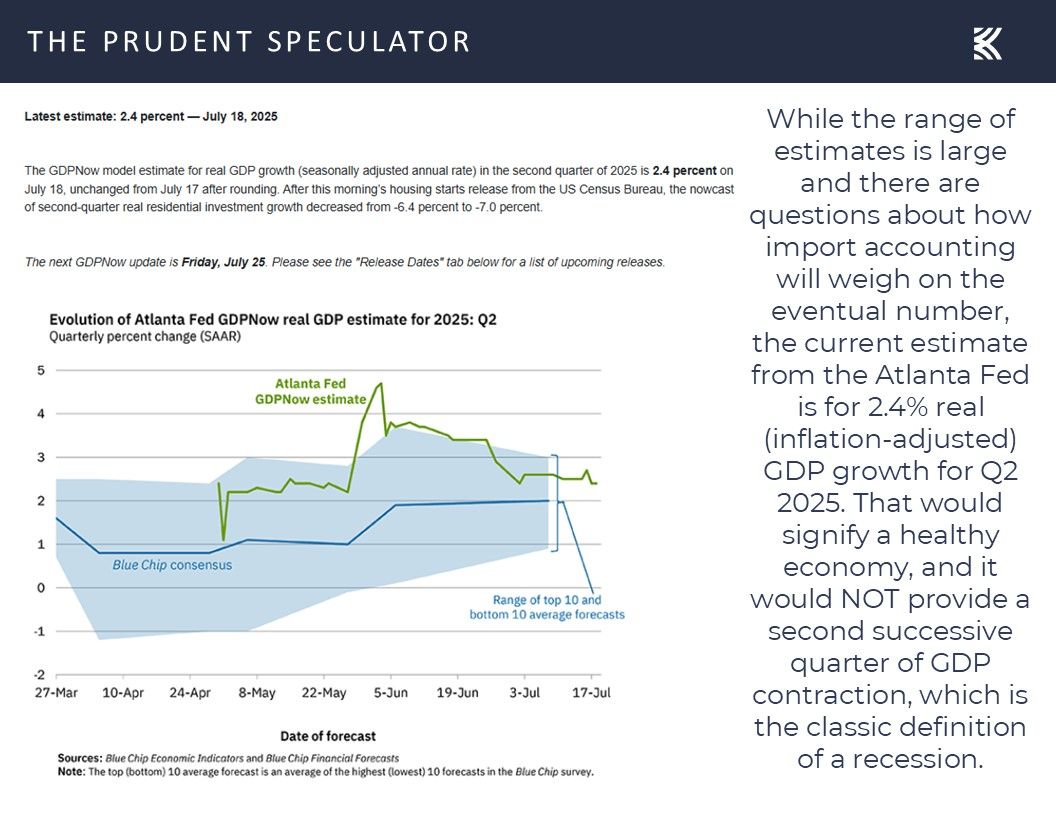

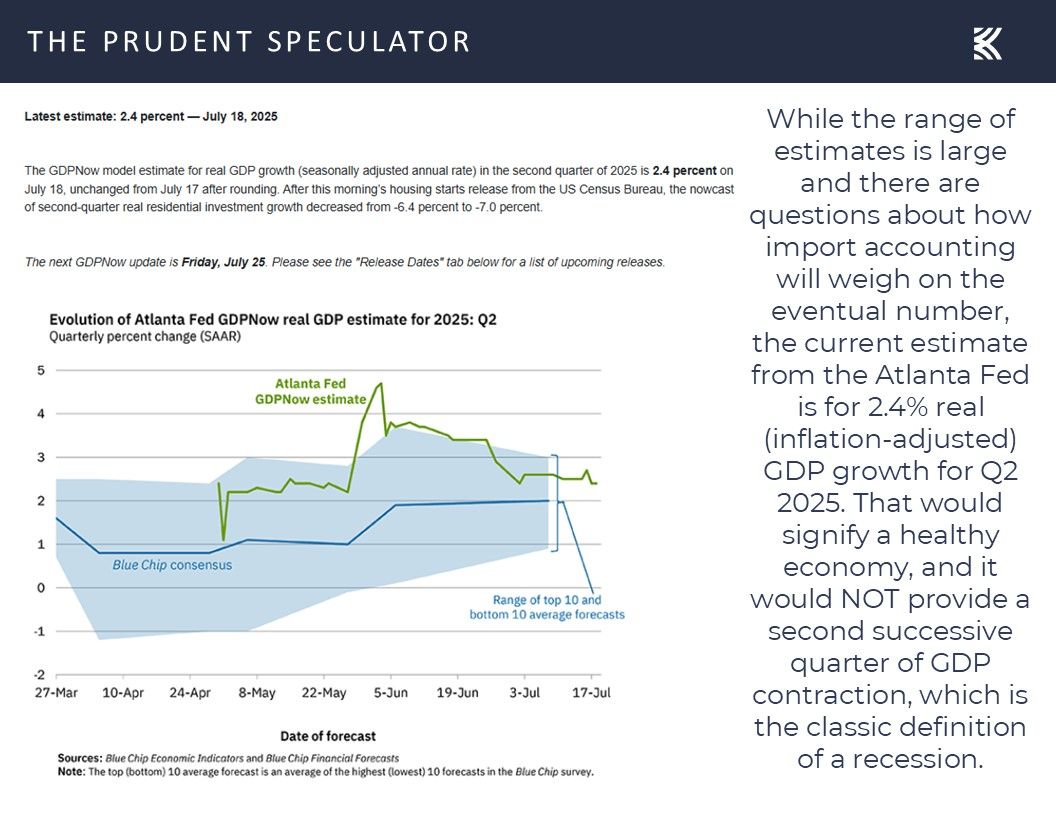

🏗 Economic growth still on track! Atlanta Fed projects Q2 real GDP up 2.4%. #MacroUpdate #EconNews For more Econ updates, see the link in the Thread.

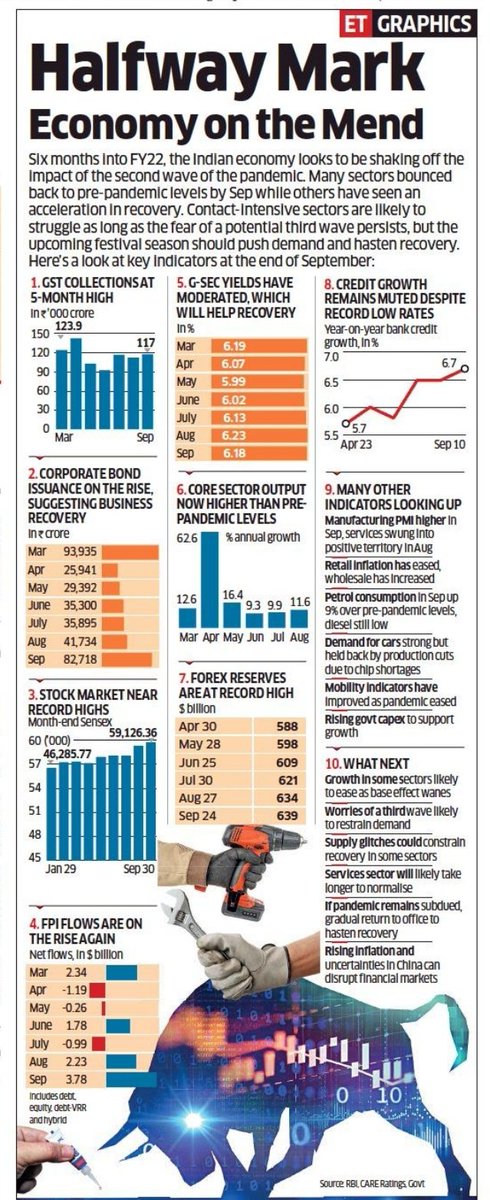

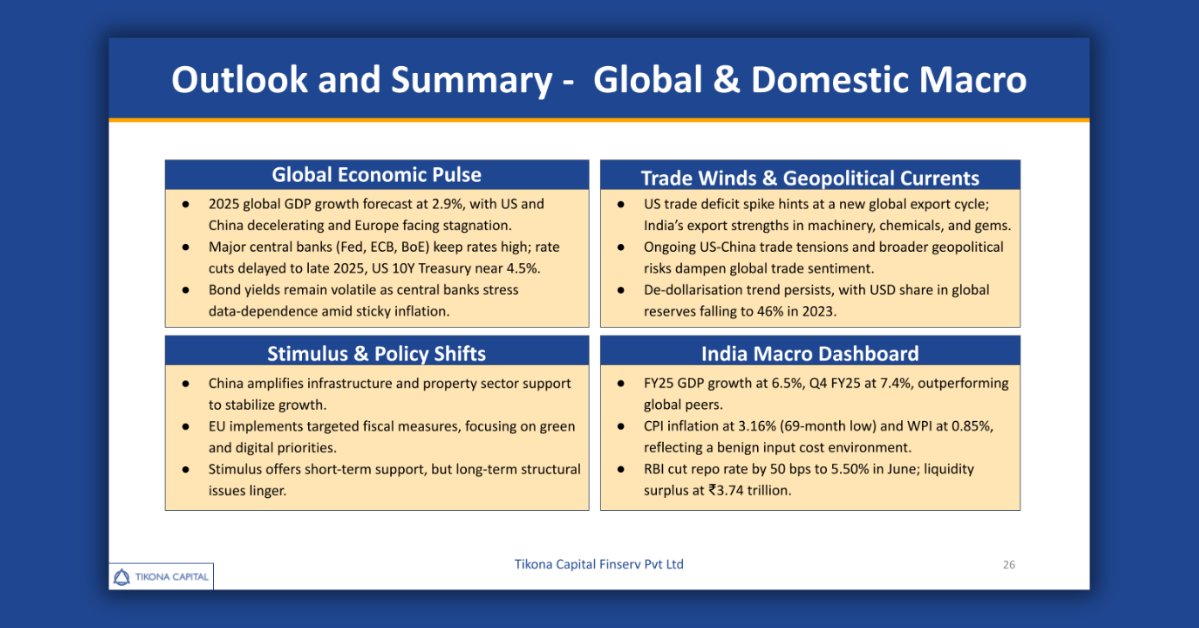

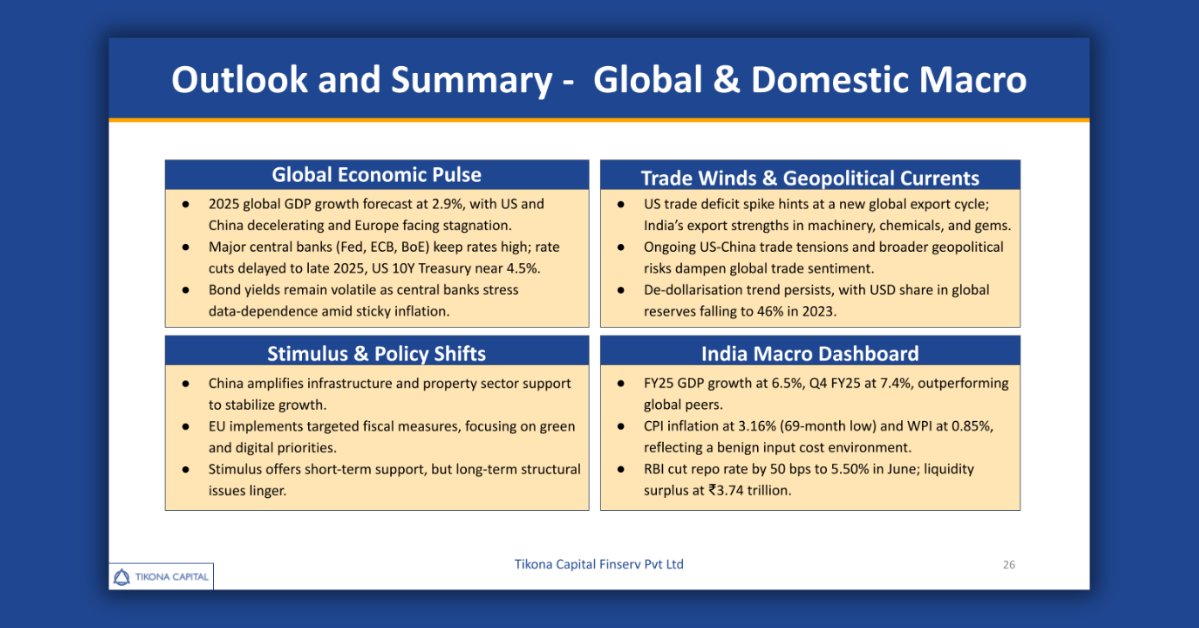

🌐 June Macro – Tikona Capital Finserv ✅ Global growth 2.9% ✅ Sticky inflation,high rates ✅ India GDP 6.5%, CPI 3.16% ✅ RBI cuts repo to 5.5% 📘 More: youtu.be/9I1QAz0bEgw #MacroUpdate #IndiaGrowth

. @ABisen27 shares key macro and market highlights, covering easing inflation, strong GDP growth, RBI’s dividend move, and evolving bond yield trends. #DebtOutlook #FixedIncome #MacroUpdate #DebtMarkets #RBIUpdates #BondMarkets #InflationTrends #InterestRates #GDPGrowth

🔥 Ethereum at Make-or-Break Level! Crypto Week Buzz 📈📊 #MacroUpdate x.com/i/broadcasts/1…

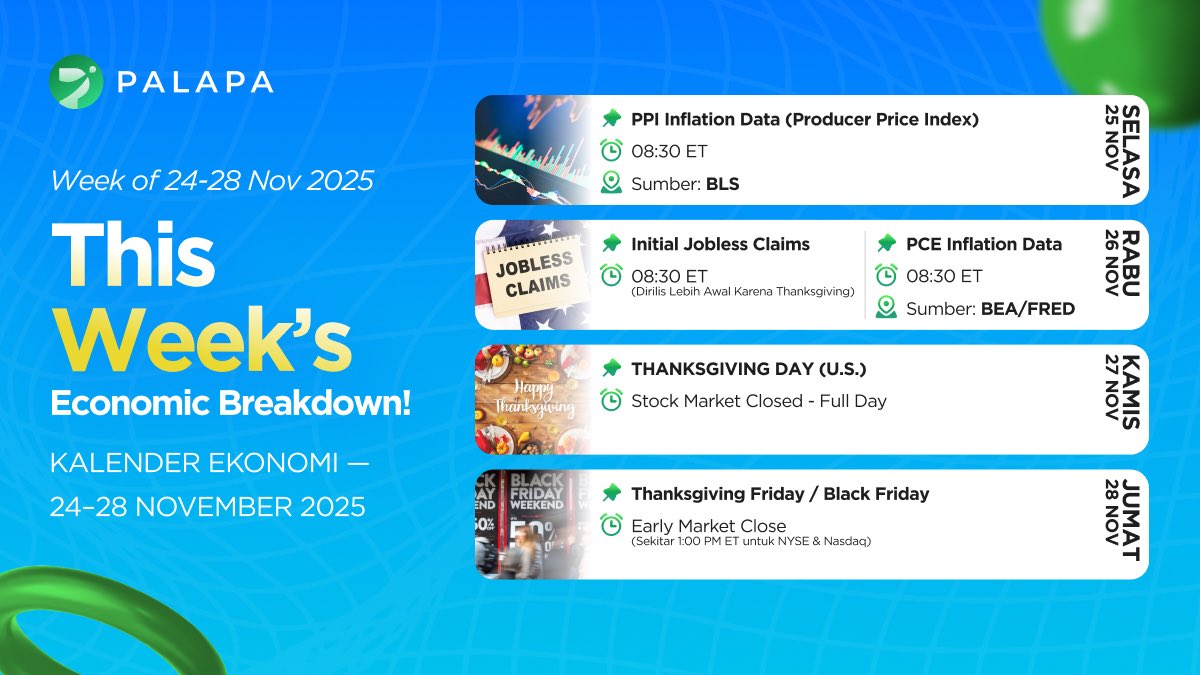

📊 US Economic Calendar (Nov 24–28, 2025) Minggu ini penuh rilis data penting yang bisa menggerakkan market, terutama menjelang keputusan suku bunga The Fed bulan depan. PPI, Jobless Claims, dan PCE jadi fokus utama plus pasar AS libur Thanksgiving. #CryptoNews #MacroUpdate

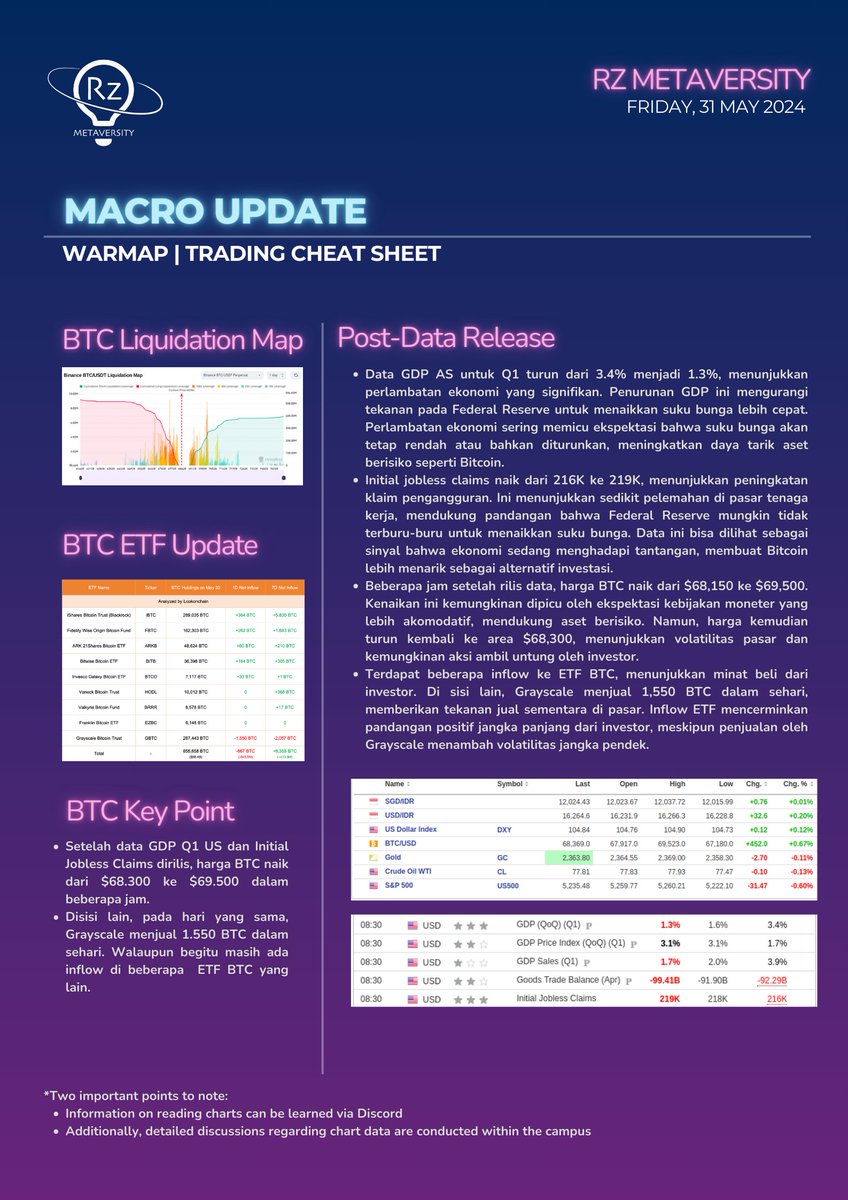

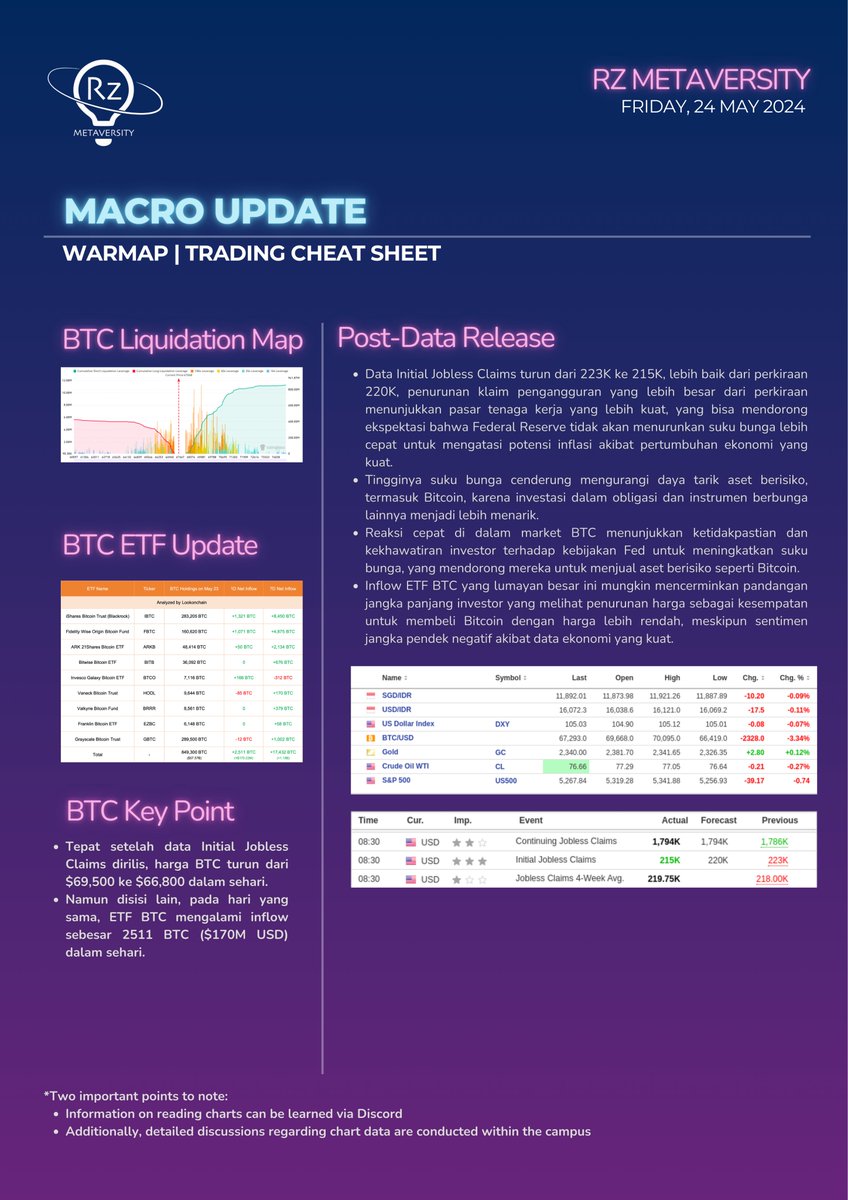

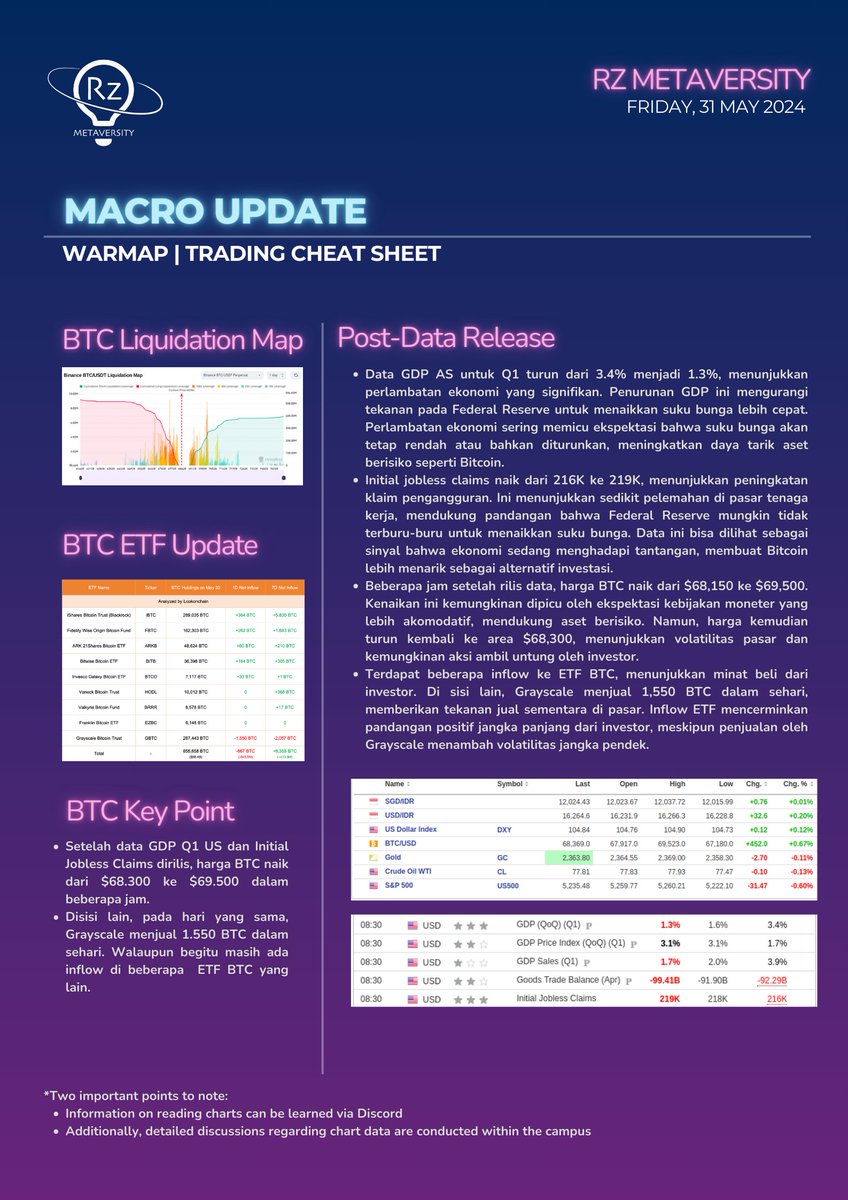

📉📈 Pergerakan signifikan di pasar BTC hari ini setelah rilis data ekonomi US! GDP turun drastis dan klaim pengangguran meningkat, namun harga BTC tetap menunjukkan volatilitas. Yuk, kita kupas lebih dalam apa yang terjadi dan kenapa. 🧵👇 #Bitcoin #Crypto #MacroUpdate…

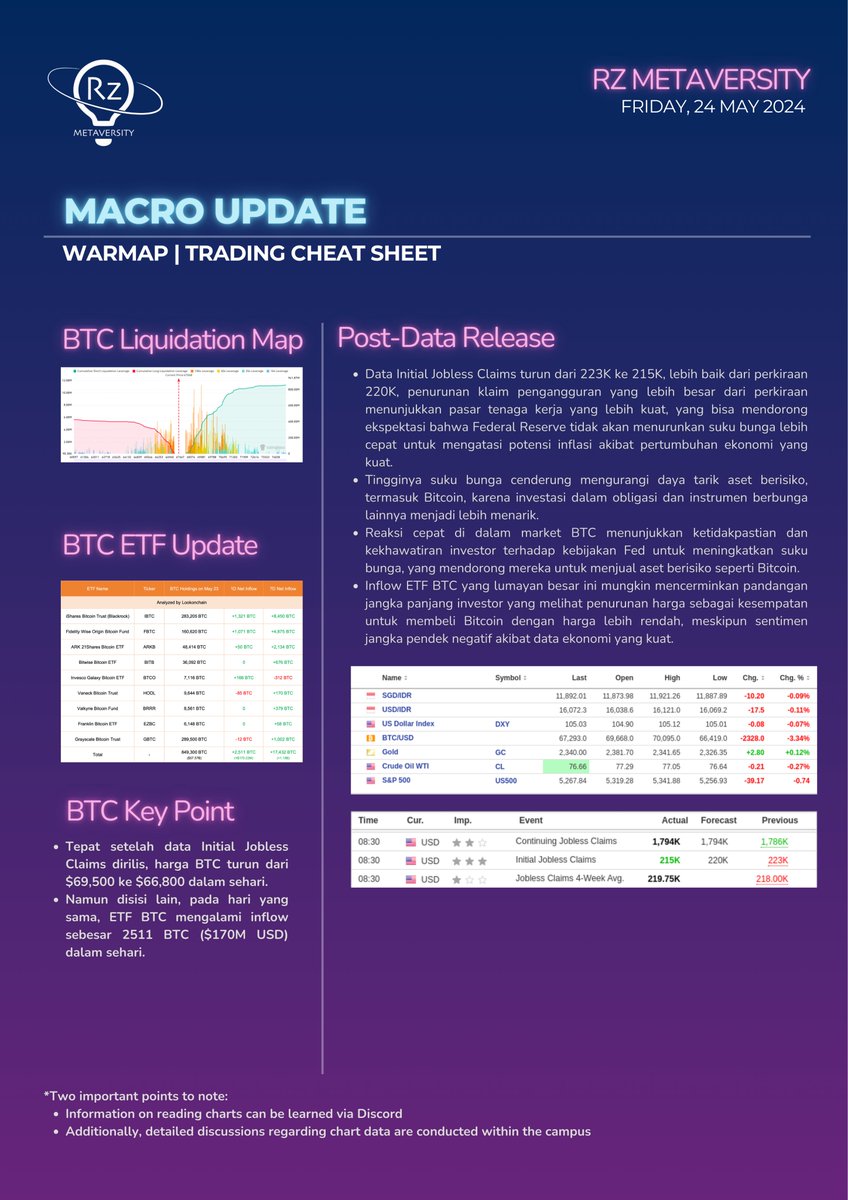

MAKRO UPDATE 📉📈 Pergerakan besar di pasar BTC hari ini! Setelah rilis data Initial Jobless Claims terbaru, kami melihat perubahan harga yang signifikan dan aliran masuk ETF. Mari kita bahas apa yang terjadi dan alasannya. 🧵👇 #Bitcoin #MacroUpdate #Crypto

🚨JUST IN: US & China extend the 90-day tariff pause. That’s not just geopolitics.. that’s a green light for risk-on assets. Less tension = more liquidity = more fuel for crypto. The bull is hungry. 🐂 #Bitcoin #Ethereum #MacroUpdate #CryptoNews #Bullrun #LiquidityFlow…

Invest in India💥 📈 US ISM Services PMI rises to 51.6 in April from 50.8 in March! 🇺🇸🛠️ Back in expansion mode! 🌱 Still below long-term avg of 54.78 📊 📉 Far cry from the 2021 high of 67.6, but well above the 2008 crash low of 37.8 #USPMI📋 #ISMServices📈 #MacroUpdate🌍…

Global Sentiment Bank of Japan’s Ueda: Delaying rate hikes could lead to severe inflation Rising macro-policy uncertainty reduces market risk appetite. #BOJ #InflationRisk #MacroUpdate #MarketSentiment

Global economic resilience persists, though persistent inflation continues to test central bank policy resolve. Geopolitical tensions add to market uncertainty, shaping trade dynamics and investment flows. 🌍📈⚖️ #MacroUpdate #Inflation #GlobalEconomy

Global economic outlook remains mixed. Inflation persists in key regions, driving central banks to maintain hawkish stances. Growth forecasts adjusted downwards by IMF & OECD, signaling potential slowdown. 🌍📈🏦 #GlobalEconomy #MacroUpdate #FinancialNews

🚨 India Q2 GDP Growth India’s economy grew 8.2% YoY in Q2 FY26, beating estimates of 7.4% and the previous 7.8%, despite external headwinds like Trump-era tariffs on Indian goods. 🇮🇳 #IndiaGDP #EconomicGrowth #MacroUpdate #StockMarket #IndiaEconomy

🇺🇸 Trump hints at eliminating U.S. income tax, funded by tariff revenue. Big economic move ,and markets are watching closely 👀 More liquidity = potential boost for risk assets like crypto.#CryptoNews #GlobalMarkets #MacroUpdate #USPolitics

$XRP #macroupdate 2 ✅ 🔹adjust your SL below parabolic support, $XRP setting up nicely so far As long as this blue top of the range is acting as support, ATH is the plan!

#Macroupdate US 30-Year Treasury Yield hits 5.02% highest since Nov 2023. 📉 Stay cautious. #BondYields #Markets #Macro #US #bond #nifty #banknifty

#Macroupdate USD/INR opened at 86.11 and has continued rising to 86.57. US 10-year bond yields are at 4.78%, and the Rupee hits a record low at 86.57. Both are negative for the market. #niftycrash #USDINR #marketupdate #stockmarketscrash #Nifty

MAKRO UPDATE 📉📈 Pergerakan besar di pasar BTC hari ini! Setelah rilis data Initial Jobless Claims terbaru, kami melihat perubahan harga yang signifikan dan aliran masuk ETF. Mari kita bahas apa yang terjadi dan alasannya. 🧵👇 #Bitcoin #MacroUpdate #Crypto

📉📈 Pergerakan signifikan di pasar BTC hari ini setelah rilis data ekonomi US! GDP turun drastis dan klaim pengangguran meningkat, namun harga BTC tetap menunjukkan volatilitas. Yuk, kita kupas lebih dalam apa yang terjadi dan kenapa. 🧵👇 #Bitcoin #Crypto #MacroUpdate…

Happy to be a guest on @BloombergTV and radio this morning to discuss our views on US inflation and China macro data. @brewindolphin #China #macroupdate #bloombergtv #bloomberg

🏗 Economic growth still on track! Atlanta Fed projects Q2 real GDP up 2.4%. #MacroUpdate #EconNews For more Econ updates, see the link in the Thread.

CPI rose 2.9% in August and Core CPI 3.1%. Inflation is still sticky but PPI was softer. Mixed signals, but policy easing likely. #MacroUpdate See the link in the thread for more details!

📉 Pasar Obligasi AS Mulai Retak! "Rilis QE atau rilis air mata?" 📉 10Y: 4.5% 📉 30Y: 5% 📉 Nasdaq & S&P: get ready for impact #MacroUpdate #TreasuryCrash #YieldSpike #FederalReserve

🚨JUST IN: US & China extend the 90-day tariff pause. That’s not just geopolitics.. that’s a green light for risk-on assets. Less tension = more liquidity = more fuel for crypto. The bull is hungry. 🐂 #Bitcoin #Ethereum #MacroUpdate #CryptoNews #Bullrun #LiquidityFlow…

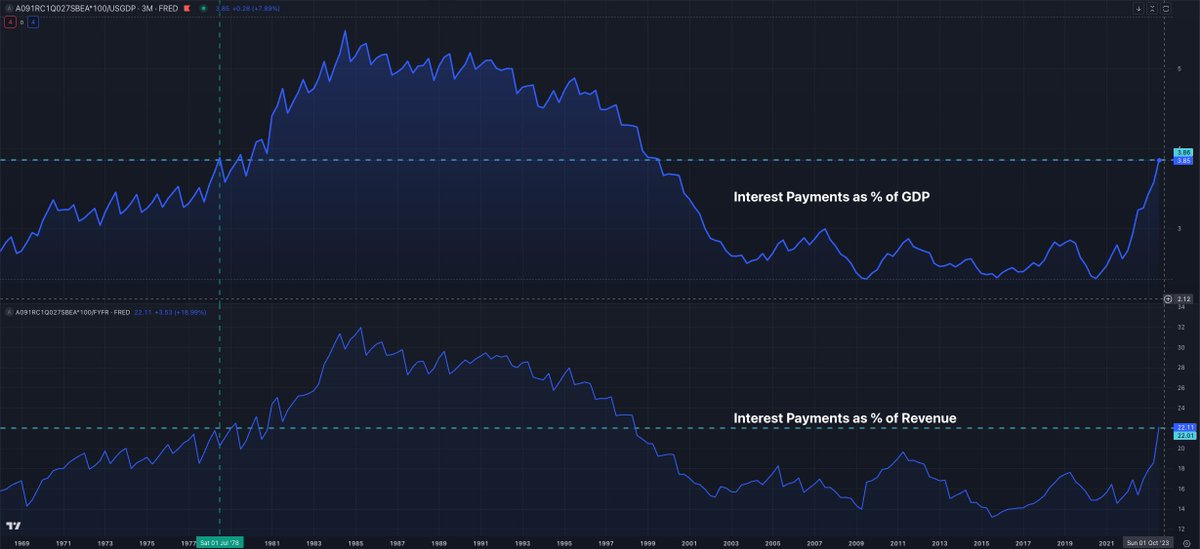

Macro Update Yes, this time is different. Only the interest payment is ~3.8% of US GDP and ~22% of US Revenue. Percentages only seen in '80. The entire year was an exit liquidity strategy and the preparation for shorting. #macroUpdate

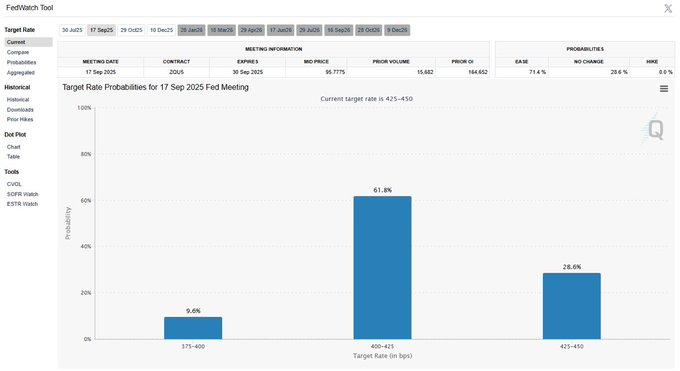

🚨 BREAKING WAR: Fursadaha in la dhimi karo ribada (Rate Cut) ka hor September ayaa sare ugu kacay ilaa 70%+! 📉💣🚀 #RateCuts #MacroUpdate #Bitcoin #RiskAssets

🌐 June Macro – Tikona Capital Finserv ✅ Global growth 2.9% ✅ Sticky inflation,high rates ✅ India GDP 6.5%, CPI 3.16% ✅ RBI cuts repo to 5.5% 📘 More: youtu.be/9I1QAz0bEgw #MacroUpdate #IndiaGrowth

$XRP #macroupdate 3 months old projection still accurate 📈 🔹Key support level $0,785 Parabolic support + range breakout level 🔹fib level 0,618 respected for now While we trade LTF swings for $BTC.D always think in #timeframes & observe HTF trends!

$XRP/USD projection 🔹following green projection perfectly since drawing it early march✔️ 🔹red projection only a scenario (a gift tbh) if thick horizontal support at $0,448 fails Everything in this blue channel and triangle consolidation is a HTF gift ignore this, RT stuff ^^

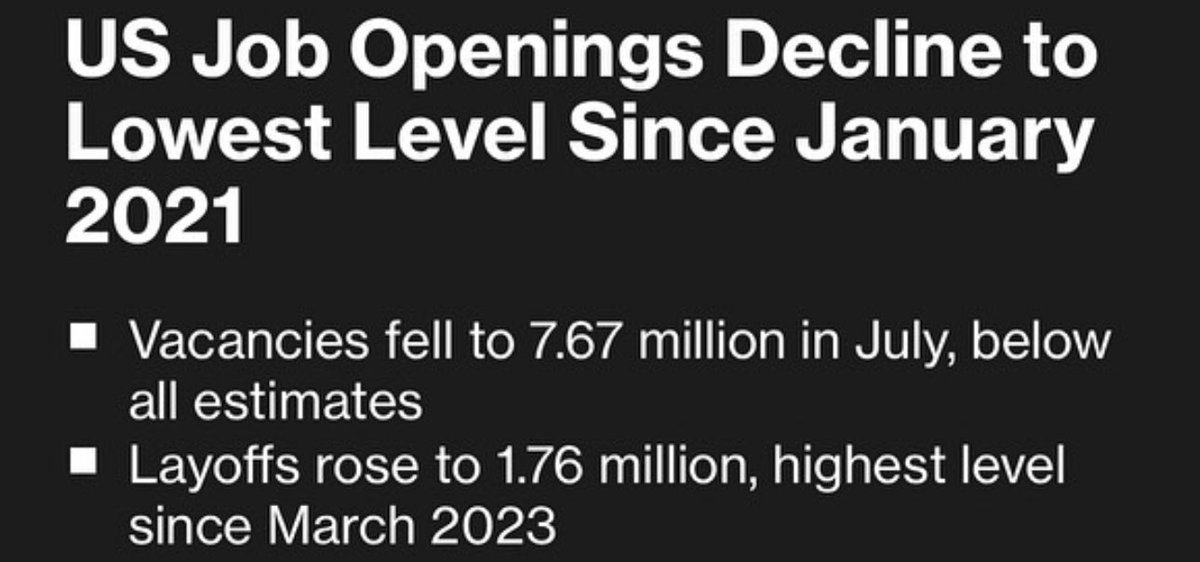

#Gm SOLdiers 🪖! The early recovery was derailed as U.S. job openings fell sharply below expectations, raising #recession concerns and weakening the dollar. All eyes are on Friday’s jobs report, the key macro event of the week. #MacroUpdate #Markets #USD

Something went wrong.

Something went wrong.

United States Trends

- 1. Kalani 6,657 posts

- 2. Stein 12.5K posts

- 3. Penn State 9,762 posts

- 4. REAL ID 7,720 posts

- 5. Vanguard 14.8K posts

- 6. Milagro 32.4K posts

- 7. Hartline 4,150 posts

- 8. Merry Christmas 55.4K posts

- 9. TOP CALL 12.1K posts

- 10. Crumbl N/A

- 11. Admiral Bradley 13.8K posts

- 12. Cyber Monday 62.4K posts

- 13. #OTGala11 188K posts

- 14. MRIs 5,247 posts

- 15. Monday Night Football 3,038 posts

- 16. Jaxson Dart 4,102 posts

- 17. Jay Hill N/A

- 18. Shakur 8,831 posts

- 19. Abdul Carter 1,797 posts

- 20. AIDS 69.1K posts