#caleitc search results

Attended the 10th Anniversary celebration of the #CalEITC program and GSO working to end poverty in California. For a person working one minimum wage job making $32,240, a little extra money is always welcome! To determine eligibility and estimate potential credit amounts,…

Did you know that families making $31k or less a year may qualify for up to thousands of direct cash support through the #CalEITC? #CALeg: CalEITC is one of CA's strongest poverty-fighting tools!

Have you received your W-2 in the mail yet? That means it’s tax season! You can get money back from the #CalEITC if you earn less than $30,000 a year. Find out if you qualify and learn how to file for free: FreeTaxHelpSF.org

SF’s free tax services are here to help! With the SF Working Families Tax Credit you could get up to an extra $250 cash back on your taxes when you file. Find out if you qualify, and learn where to get FREE tax services: FreeTaxHelpSF.org #CalEITC #FreeTaxHelp

Don’t forget to file your taxes! You may be able to thousands back if you file taxes, and you can get free tax filing help. Call 211 or visit FreeTaxHelpSF.org for more information. #CalEITC #TaxHelp

Hey there! It’s CalEITC Awareness Week, and we’d love your help spreading the word! #CalEITC is a critical tax credit for families facing tough times. Check out our CalEITC page to learn more: ftb.ca.gov/caleitc.

Tax season is here & I want to highlight the CA Earned Income Tax Credit program, which provides tax refunds to millions of lower-wage workers & their families. I believe in #CalEITC because it’s an effective anti-poverty tool. More in my latest eAlert: a19.asmdc.org/ealert/get-you…

If you have an Individual Taxpayer Identification Number and file your taxes, it could boost your refund by $1,200!💰 Call 211 or visit FreeTaxHelpSF.org to get free tax help and learn more. #FreeTaxHelpSF #ITIN #CalEITC

Hey California! Get more money this tax season! Find out if you qualify for the #EITC, #CalEITC, #CTC. These tax credits can put cash back in your pockets. File by April 15. To learn more, visit cdss.ca.gov/tax-outreach #GetYourRefundCA

The tax deadline is 2 weeks away. Californians who earned less than $30,950 last year could be eligible for a state refund of up to $3,529, depending on household size. More info on the CA Earned Income Tax Credit #CalEITC, as well as free tax help: caleitc4me.org/?utm_campaign=…

People of color & single mothers are disproportionately affected by California's high cost of living. Investing in programs like the #CalEITC: 👝 Builds equity 👝 Fights poverty 👝 Puts money back in the hands of Californians #CALeg #CalEITCWeek

Si califica para #CalEITC y tiene un hijo menor de 6 años, también puede ser elegible para el Crédito fiscal para niños pequeños. Verifique si califica para dinero extra en freetaxprepla.org.

Attention, California taxpayers! If you work and make less than $30,000, you may qualify for #CalEITC, a cash-back tax credit that can increase your refund and put hundreds or thousands of dollars in your pocket! For more information visit: bit.ly/3Tq0mQL

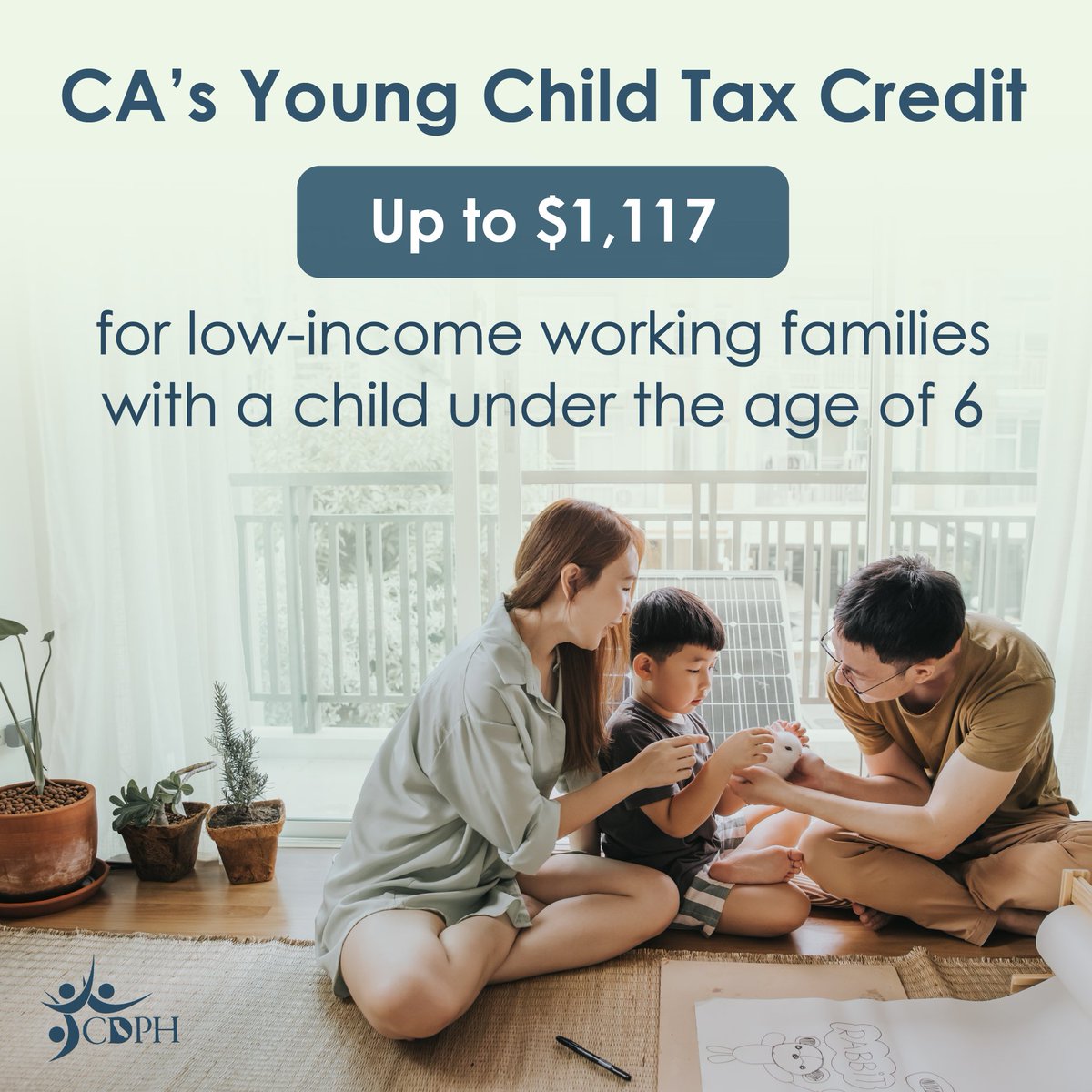

If you have a child under 6, you may qualify for #CalEITC and the Young Child Tax Credit, which can increase your refund by hundreds of dollars! For more information about #YCTC visit: ftb.ca.gov/.../credits/yo…

Did you know: Filing your taxes does NOT affect your immigration status. The IRS does not share citizenship information with ICE or any federal agency. Learn more and get free tax help at FreeTaxHelpSF.org #FreeTaxHelp #CalEITC #EITC

In California, additional state investments in the #CalEITC and #YCTC directs more than $1.3 billion annually to support nearly 3.5 million families and individuals who are struggling to make ends meet. Use this tool to get your tax credit estimate: loom.ly/2h3ZC2M

I grew up in a family that struggled to pay the bills. That’s why I created the #CalEITC, which is celebrating its 10th anniversary this year! To date, it has put $1 billion back in the pockets of eligible Californians. To find out if you qualify for this tax credit, visit…

📢 ¡Es #CalEITCAwarenessWeek! 📢 Presenté SCR 14 para destacar el impacto del #CalEITC, un crédito vital que devuelve dinero a los trabajadores de bajos ingresos. ¡Asegurémonos de que todos reclamen lo que les corresponde! Más info: CalEITC4Me.org 💰

Anti-poverty tax credits like #CalEITC provide essential cash support to families who are struggling the most with CA's soaring cost of living! #ProsperCA coalition member Erin Hogeboom, and Director of @SDforEveryChild, shares how #CalEITC has supported families in San Diego.

Today we join @CAGovernor in recognizing CA's 175th Anniversary and the values that unite us all. #CALeg: The #CalEITC & #YCTC are two of the most effective tools to ensure that all children & families can thrive in the Golden State. Let's continue building on this legacy.

Today, I'm delivering to the Legislature the 2025 State of the State. On our state's 175th anniversary, Californians remain steadfast in defending our democracy. Powered by our indelible Golden State spirit, we'll continue to be brighter and more prosperous than ever.

During @CalFTB's recent meeting, our partner @UnitedWaysCA emphasized the need to strengthen #FreeTaxPrepPays investments. With federal budget cuts looming, we must ensure Californians can still access free tax prep assistance & claim critical anti-poverty credits.#CalEITC #YCTC

The Presidential administration's elimination of Direct File is an attack on families. #CALeg must strengthen investments in #FreeTaxPrepPays to ensure that all Californians have access to free state & federal tax filing services to claim anti-poverty tax credits. #CalEITC #YCTC

Trump actually thinks making it harder and more expensive to file your taxes is a WIN.

Paola, a single mom, was thrilled to receive free assistance filing her taxes and renewing her ITIN. Thanks to the California Earned Income Tax Credit (#CalEITC), she received $932, which she put toward a down payment on a car. @unitedwayoc

...she also benefited from the federal EITC and the California Earned Income Tax Credit (#CalEITC), giving her extra money for daily expenses. It’s not too late for you to claim your cash-back tax credits! Discover how much you could qualify for at ocfreetaxprep.com.

ocfreetaxprep.com

OC Free Tax Prep, a United for Financial Security program

If you made less than $69,000 in 2025, our IRS tax experts can help you file for FREE and maximize your refund.

Thank you Assemblymember Ahrens for leading on the expansion of the #CalEITC and thank you to @AsmMarkGonzalez for leading on the expansion of the #YCTC. We look forward to working on this together in the future.

Prosper California is deeply saddened that #AB397 & #AB398, bills that would have strengthened the proven anti-poverty tools #CalEITC and #YCTC (Young Child Tax Credit), did not pass Assembly Appropriations Committee today.

Poverty is a policy choice. State lawmakers can help Californians afford to pay the rent, put food on the table, and cover the rising costs of everyday basics by strengthening investments in anti-poverty tax credits. #CALeg: the #CalEITC and #YCTC are proven solutions.

🌻Our #HANDSOFF rally is HAPPENING NOW!! Danielle from @UnitedWaysCali discusses the importance of helping households w/ Individual Taxpayer Identification Numbers (ITINs) file their taxes & access state-funded tax credits like the #CalEITC & Young Child Tax Credit.

Sabemos que las familias de monoparentales en California suelen tener dificultades para cubrir sus necesidades básicas. Esta temporada de impuestos, aumente sus ingresos con créditos fiscales como #CalEITC y #YCTC ocfreetaxprep.com

We know single-parent families in California often struggle to meet basic needs. This tax season, boost your income with tax credits such as #CalEITC and #YCTC and keep more of your hard-earned money. Learn more at: ocfreetaxprep.com #SEIUUSWW #bsp_ca

¡No desperdicie dinero en esta temporada de impuestos de 2025! Aproveche al máximo el Crédito Tributario por Ingresos del Trabajo de California (#CalEITC), junto con el Crédito Tributario por Hijos Pequeños (#YCTC) ocfreetaxprep.com/taxcredits/

Don’t leave any money behind this 2025 tax season! Take full advantage of California's Earned Income Tax Credit (#CalEITC), alongside the Young Child Tax Credit (#YCTC) and the new Foster Youth Tax Credit (#FYTC). Learn more: ocfreetaxprep.com/taxcredits/

¡No te pierdas esta oportunidad! Si tus ingresos en 2024 fueron inferiores a $31,950, podrías ser elegible para créditos fiscales esenciales, como #CalEITC. ocfreetaxprep.com/taxcredits

Make sure you're not missing out! If your 2024 earnings were under $31,950, you may be eligible for essential tax credits, like #CalEITC. Filing is straightforward and easy. Claim all the credits you qualify for to maximize your tax return. ocfreetaxprep.com/taxcredits

¿Se te pasó la fecha límite para declarar impuestos? ¡Tranquilo/a! Aún puedes recibir reembolsos en efectivo, incluso cientos o miles de dólares, con MyFreeTaxes. ¡Combina #CalEITC, #YCTC y el EITC federal para maximizar tu reembolso! Presenta tu declaración pronto para reclamar

Missed the tax deadline? Don't stress! You can still receive cash back—maybe even hundreds or thousands of dollars—with MyFreeTaxes. Stack #CalEITC, #YCTC, and federal EITC to maximize your refund! File soon to claim your money quicker. ocfreetaxprep.com/my-free-taxes for details!

¿Crees que declarar impuestos es solo para quienes ganan mucho? ¡Piénsalo de nuevo! Si tus ingresos fueron inferiores a $31,950 el año pasado, podrías ser elegible para un reembolso considerable a través del Crédito Tributario por Ingreso del Trabajo de California (#CalEITC)

Think tax filing is just for high earners? Think again! If your income was below $31,950 last year, you could be eligible for a significant refund through the California Earned Income Tax Credit (#CalEITC) Check if you qualify at ocfreetaxprep.com/taxcredits.

We're so grateful to the @CalBudgetCenter for shining a light on the #CalEITC's decades-long success! It's amazing to see millions of working families and children prosper with more money in their pockets! ow.ly/Pnxg50VJjHg

Something went wrong.

Something went wrong.

United States Trends

- 1. Good Saturday 23.3K posts

- 2. #MeAndTheeSeriesEP1 423K posts

- 3. PONDPHUWIN AT MAT PREMIERE 365K posts

- 4. #SaturdayVibes 3,591 posts

- 5. Massie 67.9K posts

- 6. Draymond 23.6K posts

- 7. Wemby 46.7K posts

- 8. #saturdaymorning 1,637 posts

- 9. Caturday 5,136 posts

- 10. #Truedtac5GXWilliamEst 214K posts

- 11. Steph 87.1K posts

- 12. #PerayainEFW2025 181K posts

- 13. FAYE ATTENDS SILHOUETTE EFW 174K posts

- 14. Marjorie Taylor Greene 61.1K posts

- 15. IT'S GAME DAY 3,810 posts

- 16. Spurs 36.2K posts

- 17. Bubba 64.3K posts

- 18. Charlie Brown 2,963 posts

- 19. Warriors 62.1K posts

- 20. View 490K posts