Zero2Launch Ventures

@02Launch

Zero2Launch Ventures specialize in launching startups in the crypto space. We provide advisory services and incubate projects.

You might like

ARK Invest Cathie Wood just dropped the mic: Tokenized assets exploding from ~$20B today → $11 TRILLION by 2030. Public equities, sovereign debt, bank deposits, all moving onchain at scale. This isn’t hype. This is the future of finance. 🚀

Beyond exchanges & stablecoins, @cz_binance highlights 3 massive growth areas for crypto: 1️⃣ Tokenization: Governments are exploring tokenizing assets to unlock financial gains and develop industries. 2️⃣ Payments: Crypto will increasingly underpin traditional payment methods,…

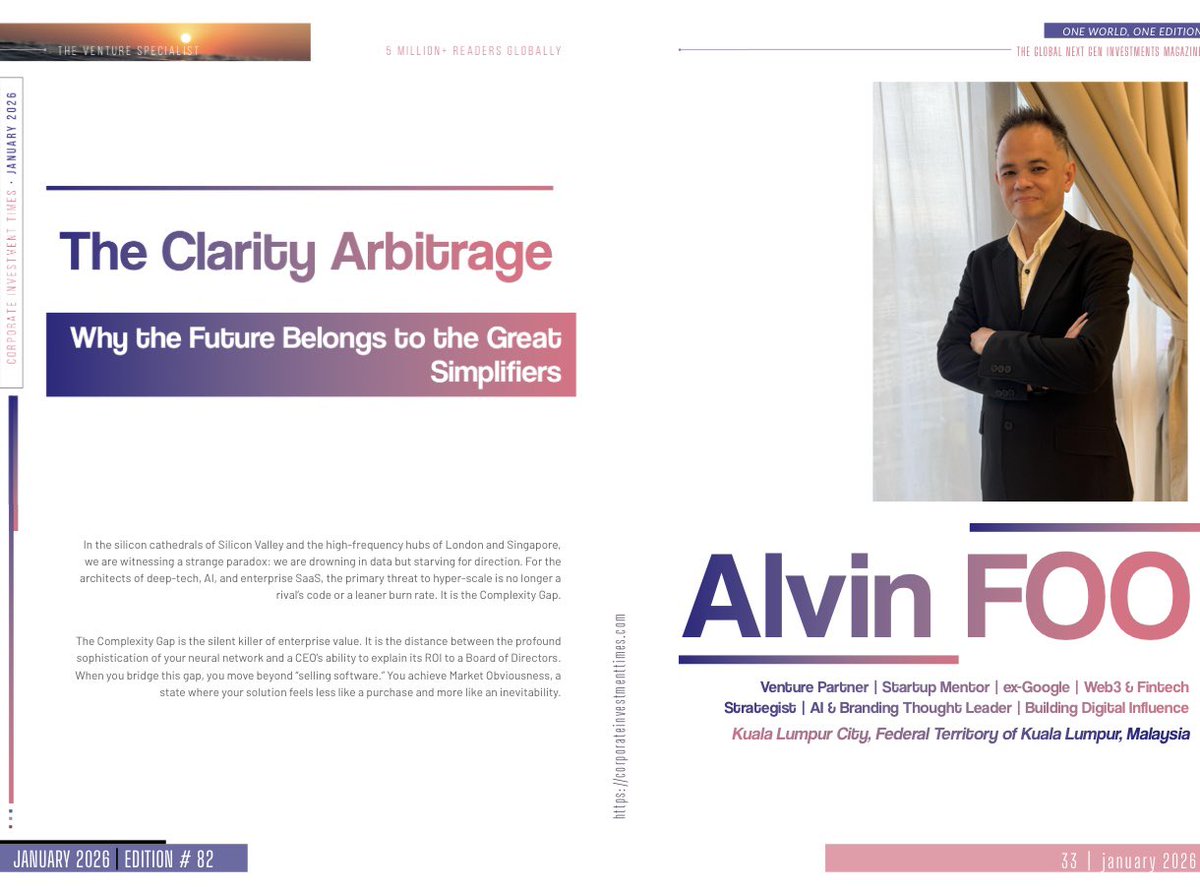

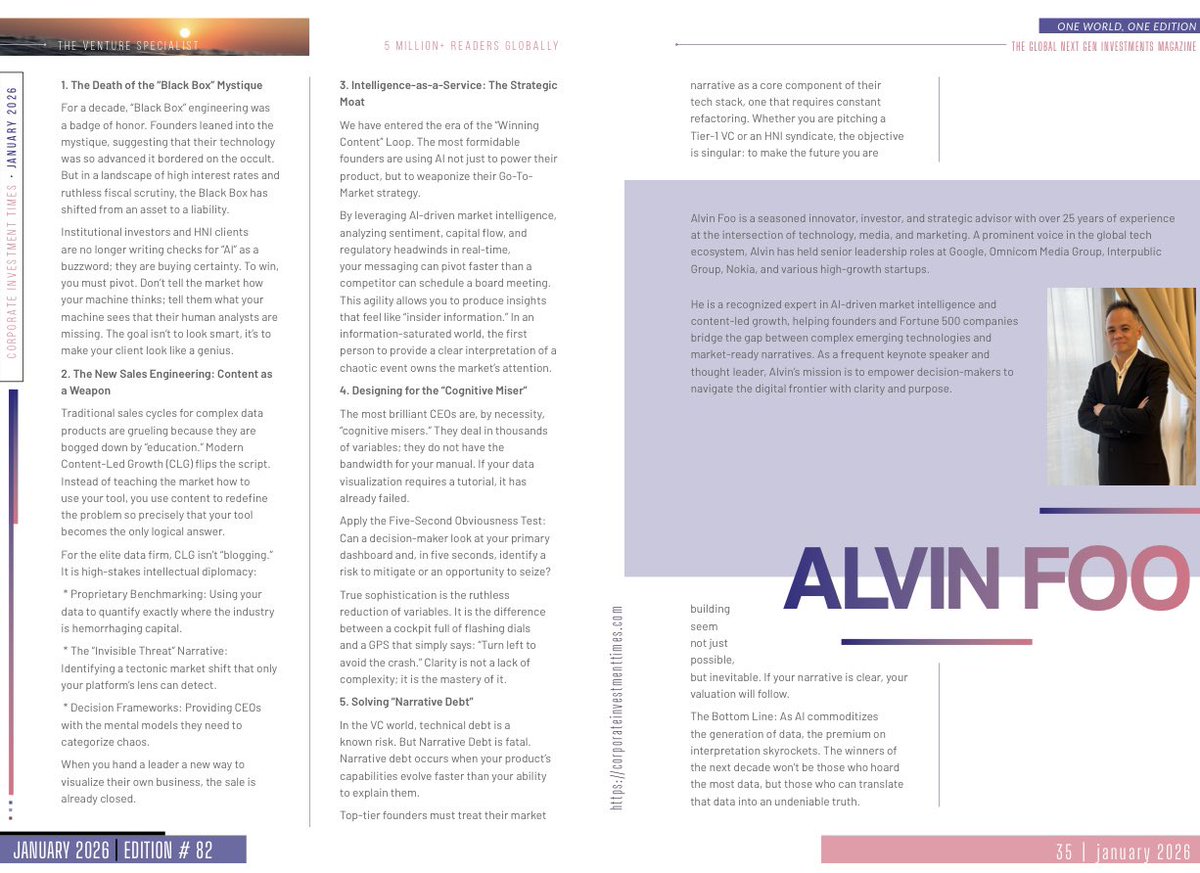

Read my latest article on AI where I was featured with other industry leaders sharing our views on AI, New Energy, Deep Tech, Quantum Technologies, Defense Tech, Institutional Finance, Real-World Adoption (tokenized assets & private markets), and Aerospace. Congrats to all the…

Why is Tokenization a structural transformation for financial markets, not just a simple tech upgrade? @The_DTCC’s Dan Doney highlights blockchain's unique ability to form a "consensus record of ownership in near real-time at global scale." This means all parties get the same…

Tokenized Stocks are the Future! @Coinbase CEO Brian Armstrong believes the forces behind the stablecoin surge could soon revolutionize U.S. equities. Why It Matters: - Global access to U.S. stocks - 24/7 trading - Fractional ownership by default - Easier settlement and…

Metafyed and NXMarket just announced a strategic partnership to expand compliant access to tokenized real-world assets from tokenized securities and yield-bearing instruments to equities, options, and more by leveraging NXMarket’s regulated digital securities infrastructure.…

BNY CEO Robin Vince calls TOKENISATION a MEGA TREND: “As mentioned RWA Tokenisation will be the Next BiG Thing globally and tokenisation will happen to Big and Small Companies Globally. Those that ignore it will lack behind …”

The next Trillion-Dollar Crypto Market isn’t DeFi, it’s RWAs!! RWAs aren’t a crypto trend. They’re becoming financial infrastructure. By 2026, Real-World Assets (RWAs) have quietly crossed a line: They’ve moved from experiments to institutional-grade building blocks. What’s…

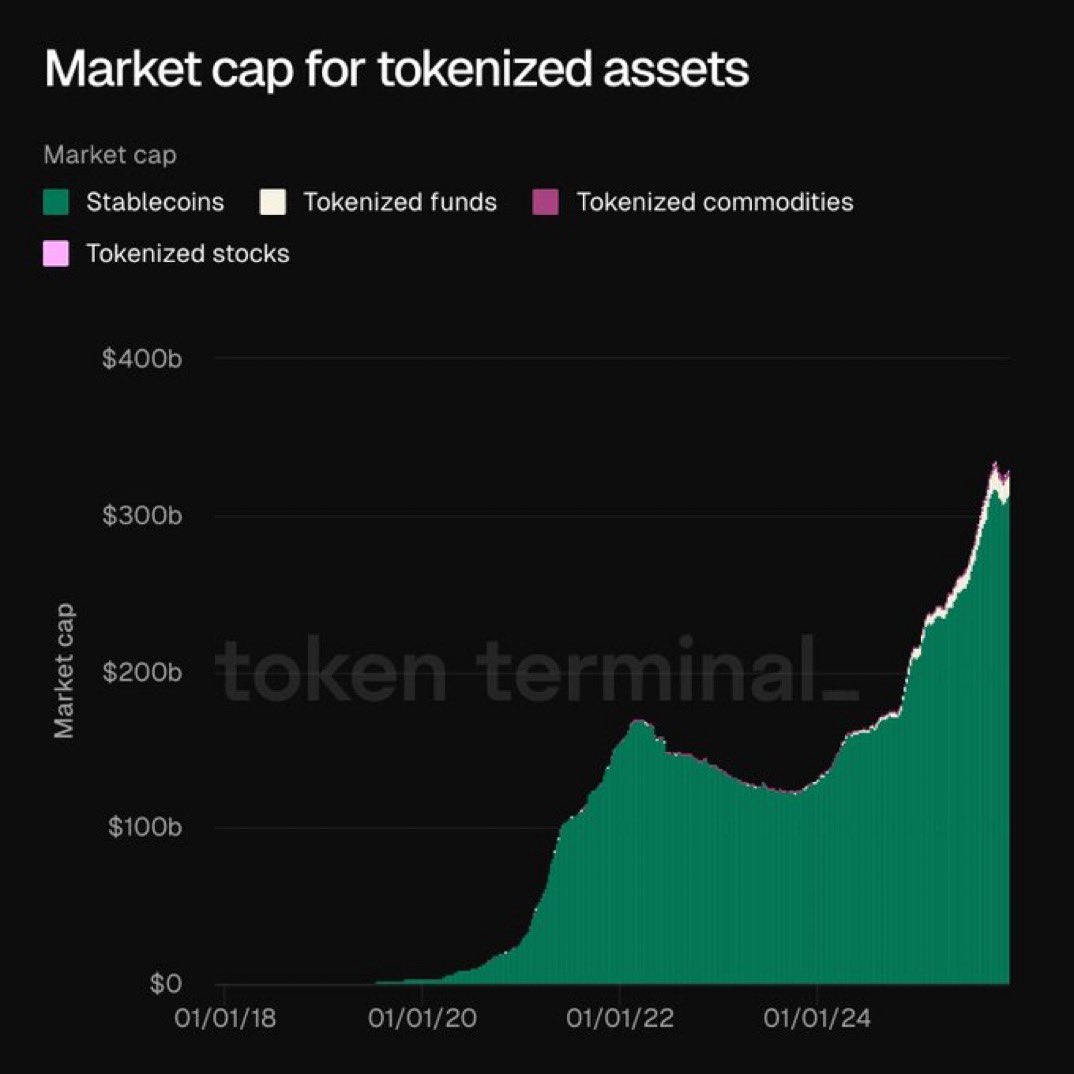

Tokenization is no longer a future narrative, it’s a live market. Tokenized RWAs just hit a new ATH at $330B, led by stablecoins, tokenized funds, commodities, and stocks (via Token Terminal). This isn’t hype. It’s capital moving on-chain. The rails for global finance are…

Tokenization is quietly becoming one of crypto’s biggest real-world success stories. In just 12 months, total RWA value exploded from $4.5B → $18.4B. Treasuries, credit, commodities, all moving on-chain. This isn’t hype. It’s capital following efficiency. The rails are being…

AI + crypto + modular infrastructure = the RWA supercycle. We’re entering a new era where every asset, treasuries, real estate, credit, commodities becomes liquid, programmable, and globally accessible. Tokenization isn’t just a tech upgrade. It’s a complete restructuring of…

New SEC Chair Paul Atkins: “All U.S. markets will be on chain within two years.” Tokenization just went from “if” to “when.” We are still so early…

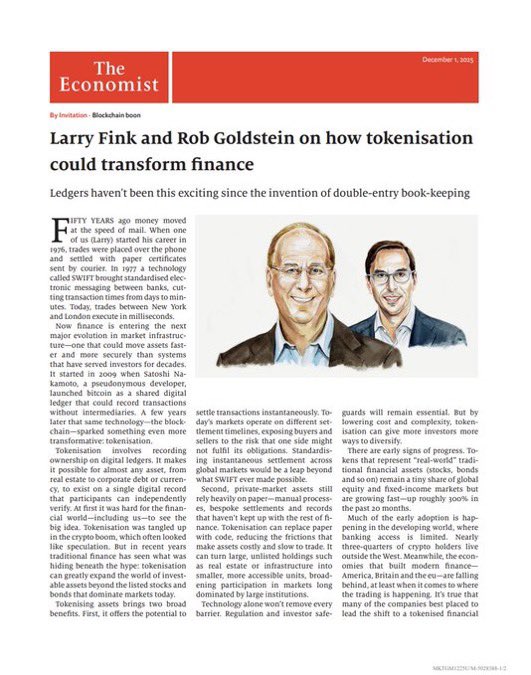

Tokenisation is about to do for finance what the internet did for information. Key insights from The Economist’s feature with Larry Fink & Rob Goldstein: 🚀 Settlement becomes instant. No more T+2. Tokenised assets settle in seconds, unlocking trillions stuck in slow post-trade…

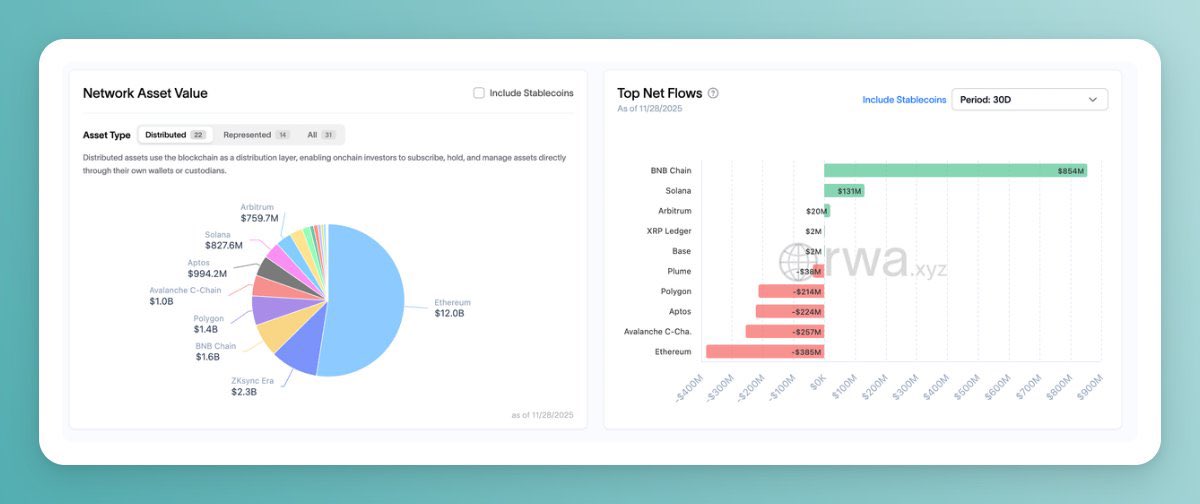

RWA Capital Flows Across Chains Recent trends in Real World Asset (RWA) capital flows indicate a significant rotation among blockchain platforms, as reported by @RWA_xyz. 30-Day Overview: - BNB Chain: +$854M (Leading) - Solana: +$131M - Ethereum: -$385M - Avalanche: -$257M…

.@offchainglobal hosted @Metafyed in Kuala Lumpur where @alvinfoo spoke about the massive opportunity of tokenization on RWA. Bringing RWA on chain will increase both adoption & liquidity into the crypto ecosystem. We are still early into the space, lots of headroom ahead!

Tokenization isn’t a trend. It’s the next major unlocking event in global finance. According to the latest industry data by Visa, the market for tokenized real-world assets (RWA) has already grown from $5B in late 2023 to $12.7B today, and is projected to reach $1–4 Trillion by…

BlackRock's Larry Fink continues to emphasize one message: the future is tokenized. “Tokenization is probably the most important component in the evolution of the world’s financial plumbing.”

Larry Fink, CEO @BlackRock on tokenization: “We’re not spending enough time on how fast tokenization is coming. Most countries are ill-prepared for it.” From currencies to ETFs to every financial asset, the world’s largest asset manager sees the same future we’re building.

📣 We’re thrilled to announce a massive milestone, the Metafyed Computing Power Platform has rocketed past 5,000 registered users and over 1.8 MILLION computing power… all within just 15 days of internal testing! 💥

Ethereum Leads the Tokenization Boom The numbers speak for themselves: •Total RWA Value: $21.97B (+16.88% in 30 days) •30D RWA Transfer Volume: $138.02B (+80.67%) •Total Stablecoin Market Cap: $296.51B But here’s the real story, Ethereum is dominating the RWA landscape.…

United States Trends

- 1. Ivey N/A

- 2. Bulls N/A

- 3. Jazz N/A

- 4. Grizzlies N/A

- 5. Lauri N/A

- 6. Giannis N/A

- 7. Mike Conley N/A

- 8. Kessler N/A

- 9. Pistons N/A

- 10. Coby White N/A

- 11. Huerter N/A

- 12. Jaren N/A

- 13. Elmo N/A

- 14. Ja Morant N/A

- 15. Simons N/A

- 16. SAVE Act N/A

- 17. Danny Ainge N/A

- 18. Jill Biden N/A

- 19. Vucevic N/A

- 20. Wolves N/A

You might like

-

9INE BERRY

9INE BERRY

@BERRYCSGO -

Eterna Capital

Eterna Capital

@EternaCapital -

Josh

Josh

@EphemeralTrade -

Marisa | 真理紗

Marisa | 真理紗

@marisamcknight -

daniel mottice

daniel mottice

@mottice -

Justin Randles

Justin Randles

@jaye_ah -

Ryan De Souza

Ryan De Souza

@_ryandesouza -

S A N A T

S A N A T

@sanatvc -

David Mirzadeh📍

David Mirzadeh📍

@mirzdame -

TradeThePattern 📊

TradeThePattern 📊

@TradeThePattern -

Ray Jang

Ray Jang

@rayjbjang -

AartiB

AartiB

@Aartib -

vanzoo

vanzoo

@vanzooeth -

LFG88888🐐

LFG88888🐐

@LFG88888 -

بريون

بريون

@itmeillusive

Something went wrong.

Something went wrong.