Metafyed

@metafyed

Unlocking real-world assets #RWA for everyone. Private credit, tokenized and compliant.

📣Breaking barriers in RWA! Metafyed @metafyed $META has just secured USD 5.5 million in funding to scale its tokenized real-world assets (RWA) marketplace across Asia. 🔥🔥 Read more : accessnewswire.com/newsroom/en/bl… #Tokenization #RWA #Fintech #DeFi

Crypto’s going mainstream, RWAs are your must-watch! Tokenization is set to unlock $1.28 QUADRILLION in assets: 🟢 Real Estate: $656T (51%) 🟢 Debt: $324T (25%) 🟢 Commodities: $170T (13%) 🟢 Equities: $127T (10%) 🟢 Private Equity: $13T (1%) From bonds to buildings,…

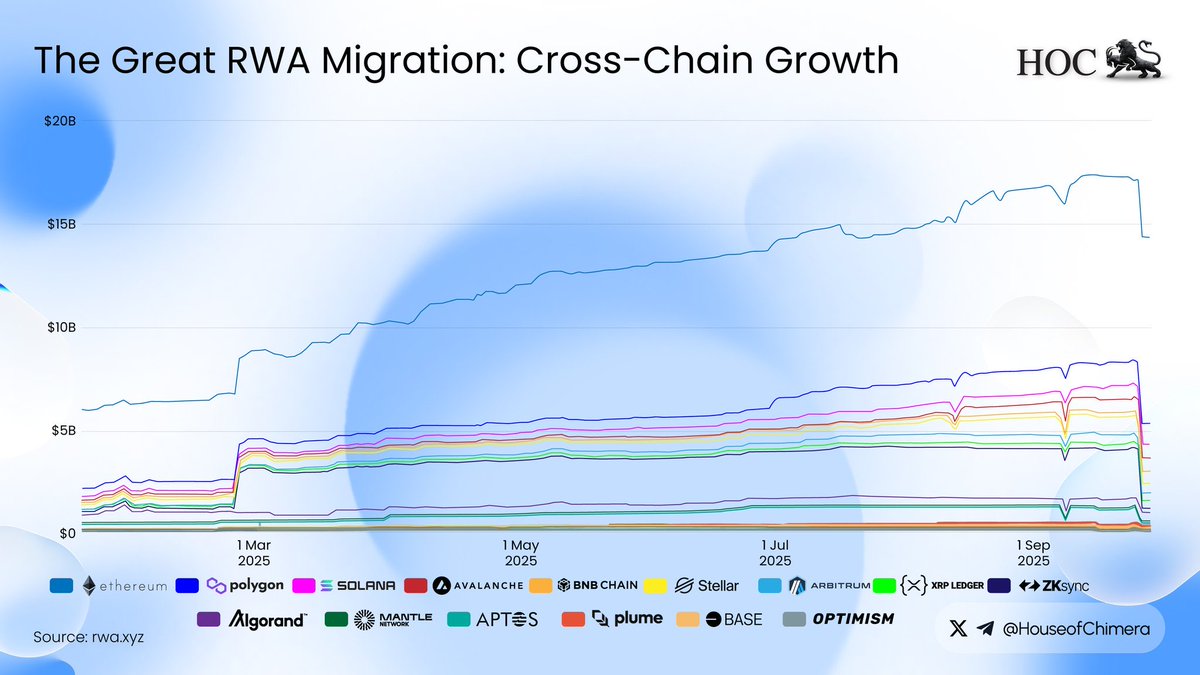

The shift to on-chain assets is accelerating, particularly in the financial sector. Real-world assets (RWAs) are being tokenized at an impressive rate, with a 224% increase since early 2024. For comprehensive insights on RWA tokenization, refer to the newly released RWA Report…

RWA is probably one of the hottest narrative at #TOKEN2049Singapore! It’s the most discussed topic at the conference. Expect more investments and developments in the space to grow the ecosystem… and we are all just getting started. Credit: @Ericistan

RWA tokenization has rapidly evolved from a mere experiment to a robust infrastructure within just 12 months: 🔹 Total Tokenized Assets: Over $18 billion 🔸 Ethereum remains the frontrunner with $9.1 billion 🔹 A total of 15 chains are now vying for liquidity, including @Polygon…

Metafyed $META is at @token2049 Singapore! 🔥🔥 Eric Tan (@Ericistan), a co-founding team member of Metafyed will be at the event, feel free to add and DM him on X to discuss about future partnerships.

Conferences like #Meridian2025 aren’t just about panels, they’re about people. 🤝 We’ve connected with regulators, banks, and innovators who share our mission: Making private credit accessible, transparent, and global. Brazil → Asia → the world. This is just beginning.

Day 1 at #Meridian2025 🇧🇷 - What a crowd! Metafyed is putting SMBs and private credit in emerging markets on the global stage. 👉 RWAs are not just Treasuries. 👉 Liquidity doesn’t come from tokenization alone — it needs exchanges + trust. 👉 Emerging markets = yield + impact.

Proud to see Metafyed joining global leaders shaping the future of Real-World Assets (RWA), tokenization, and digital finance. From Asia → São Paulo, we’re here to share how we unlock SME financing in Asia with AI + blockchain. #Meridian2025 #RWA

🚨 BREAKING: 🇺🇸 THE SEC IS PUSHING TO ALLOW STOCKS TO TRADE ON-CHAIN! Another W for RWA🚀

"I spent 25 years at Google, Nokia & Omnicom & Interpublic. Then I discovered something that changed everything..." The future isn't fully decentralized. Just dropped my latest convo with @srikmisra on Alpha Unhashed sharing why the "fully decentralized world" narrative is…

Understanding Tokenization: Transforming Assets into Digital Ownership Tokenization revolutionizes asset management by converting traditional assets into digital tokens on a blockchain, enhancing their tradability and accessibility. The Tokenization Process 1. Asset…

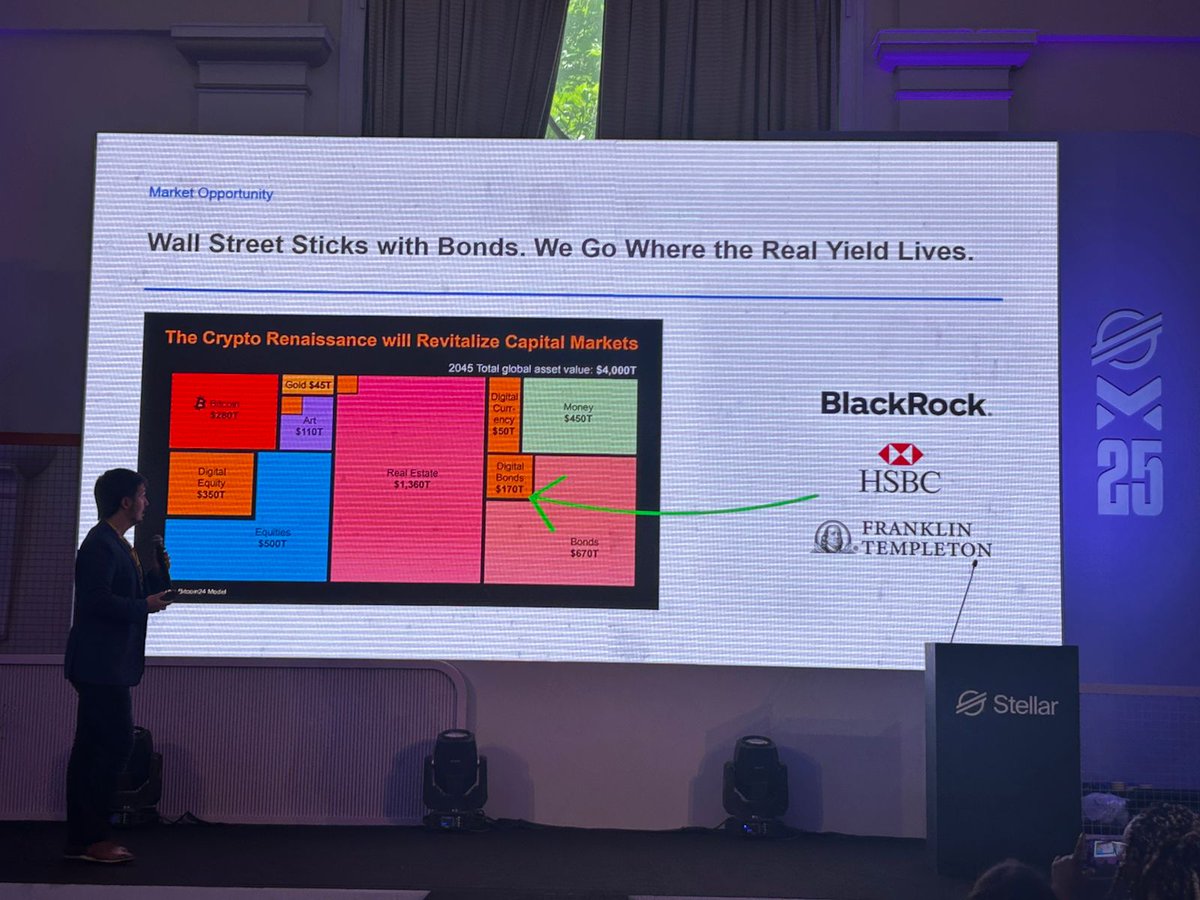

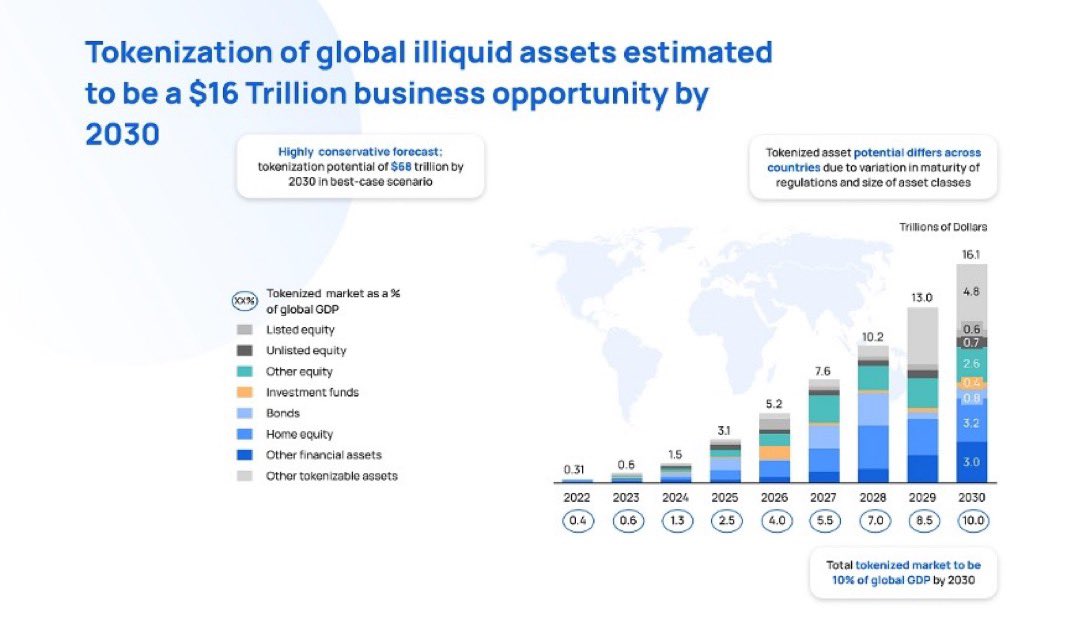

Tokenization is redefining the future of global finance The tokenization of real-world assets (#RWA) is projected to be a $16 trillion opportunity by 2030 and that’s on a conservative estimate. Some forecasts even place the potential closer to $68 trillion. What does this mean?…

Our co-founder @mimivong in action pitching @metafyed at Stellar Demo Day 2025 recently. 🔥🔥 Watch the full video on YouTube: youtu.be/WLHCnByZDYQ?si…

United States الاتجاهات

- 1. Chiefs 76.4K posts

- 2. #TNABoundForGlory 39.3K posts

- 3. LaPorta 9,350 posts

- 4. Goff 11.9K posts

- 5. Bryce Miller 3,354 posts

- 6. Kelce 13K posts

- 7. #OnePride 5,618 posts

- 8. Butker 7,874 posts

- 9. #LoveCabin N/A

- 10. #DETvsKC 3,911 posts

- 11. #ALCS 9,176 posts

- 12. Baker 50K posts

- 13. Collinsworth 2,287 posts

- 14. Gibbs 5,253 posts

- 15. Dan Campbell 2,155 posts

- 16. Pacheco 4,458 posts

- 17. Polanco 6,575 posts

- 18. Patrick Mahomes 6,774 posts

- 19. Tyquan Thornton 1,059 posts

- 20. Mike Santana 2,233 posts

Something went wrong.

Something went wrong.