0ptionsEngineer

@0ptionsEngineer

Mechanical Engineer - Options Trader. My posts are not financial advice.

In my retirement accounts, I invest in stocks. In my brokerage accounts, I'm mainly an options trader. Retirement Account Goal: 20% CAGR Brokerage Account Goal: 30% CAGR Options Trading Goal: 2% Return on Capital per Week Options Trading: 2.96% Return on…

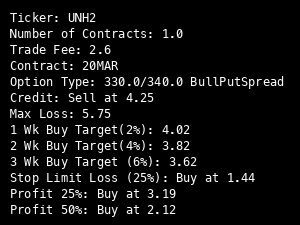

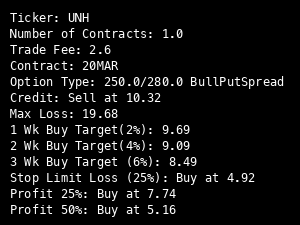

$UNH Rolled long put down for a 9.21 credit. Now 20MAR 320/340 bull put spread. Total credit: 4.25+9.21=13.46.

$UNH 20MAR bull put spread 330/340 for 4.25 credit

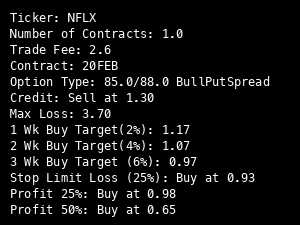

$NFLX Rolled to 20 MAR 84/88 bull put spread for 0.15 credit. Total credit: 1.30+0.15=1.45.

$NFLX 20FEB bull put spread 85/88 for 1.30 credit.

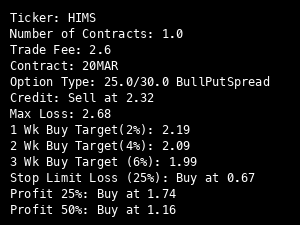

$HIMS Rolled down long put for 0.53 credit. Now 20 MAR 24/30 bull put spread. Total credit: 2.32+0.53=2.85.

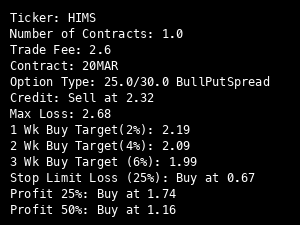

$HIMS 20MAR bull put spread 25/30 for 2.32 credit.

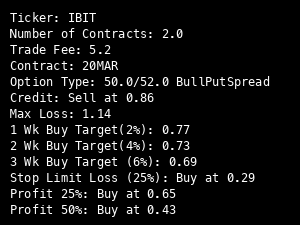

$IBIT Rolled down to 48 for a 1.47 credit, now MAR20 48/52 bull put spread. Total credit:0.86+1.47=2.33.

$IBIT 20MAR bull put spread 50/52 for 0.86 credit.

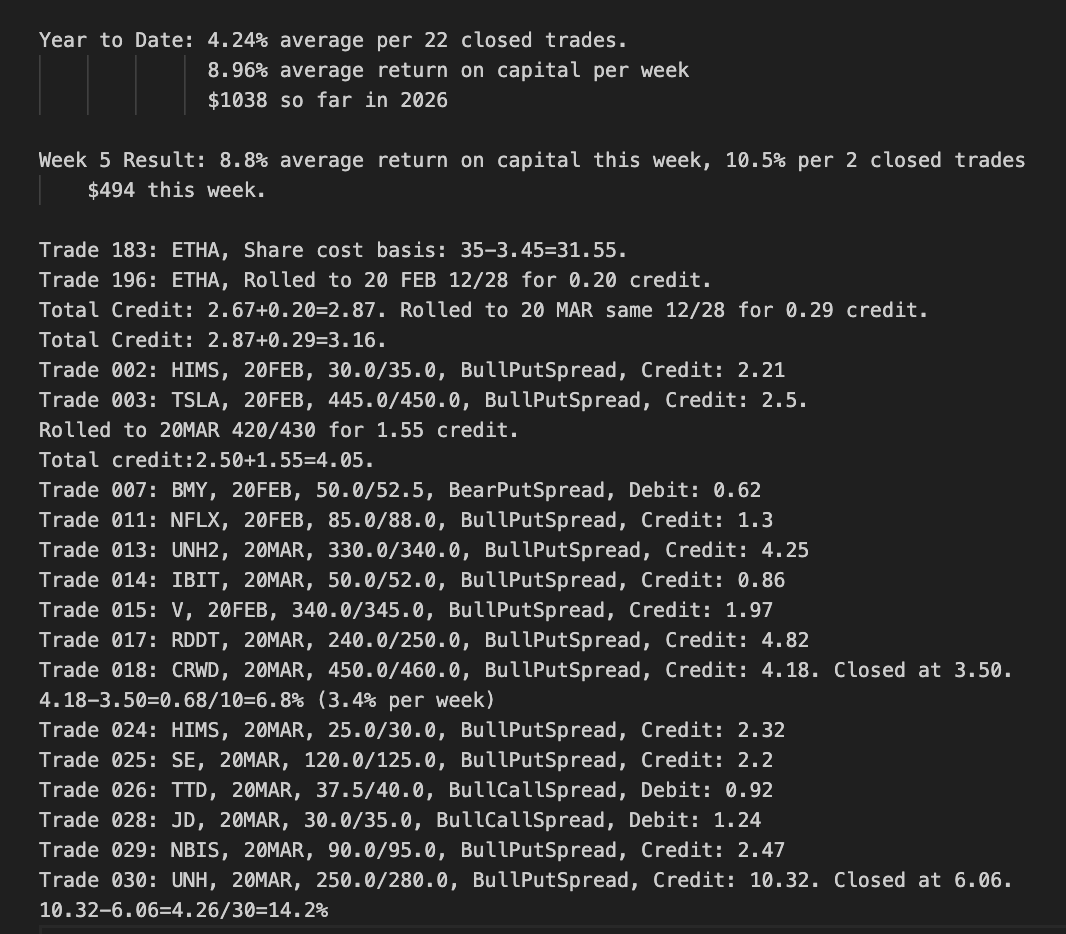

Week 5 Review: 2 closed trades, 8.8% average return on capital this week, 10.5% average per closed trade this week. 8.96% average return on capital per week this year. $1,038 so far this year.

$UNH Closed at 6.06. 10.32-6.06=4.26/30=14.2%

$UNH 20MAR bull put spread 250/280 for 10.32 credit.

$UNH 20MAR bull put spread 250/280 for 10.32 credit.

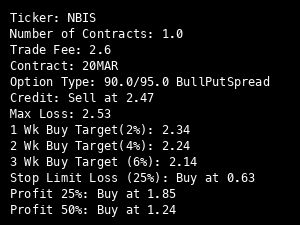

$NBIS 20MAR Bull put spread 90/95 for 2.47 credit.

$ETHA Rolled to 20MAR same 12/28 for 0.29 credit. Total Credit: 2.87+0.29=3.16

$ETHA Rolled to 20 FEB 12/28 for 0.22 credit. Total Credit: 2.67+0.20=2.87.

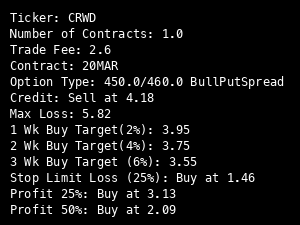

$CRWD Closed at 3.50. 4.18-3.50=0.68/10=6.8% (3.4% per week)

$CRWD 20MAR bull put spread 450/460 for 4.18 credit.

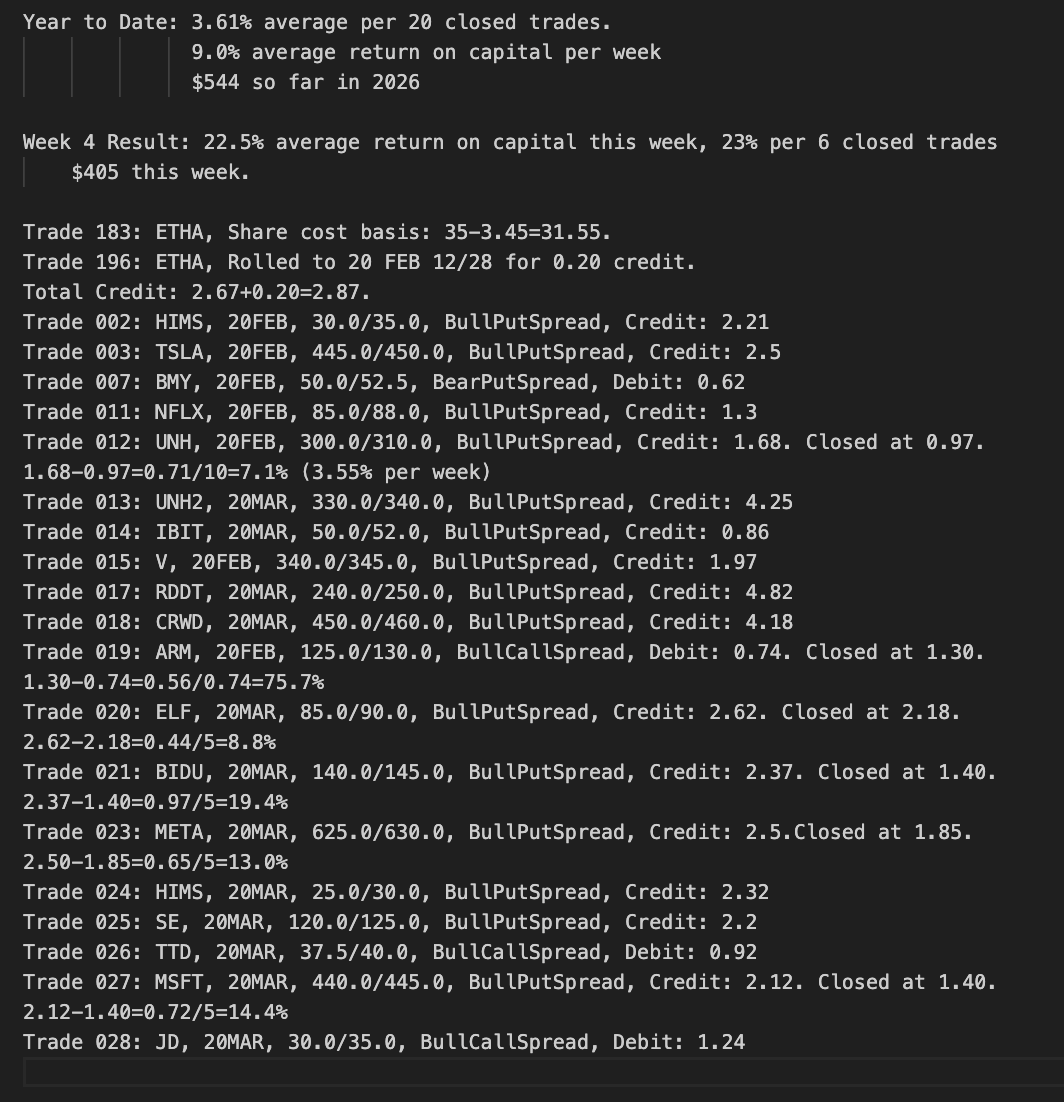

Week 4 Review: 6 closed trades, 22.5% average return on capital this week, 23% average per closed trade this week. 9.0% average return on capital per week this year. $405 so far this year.

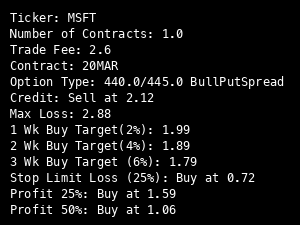

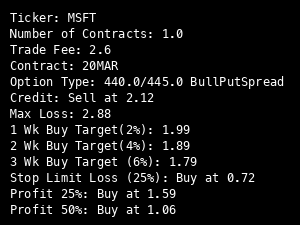

$MSFT Closed at 1.40. 2.12-1.40=0.72/5=14.4%

$MSFT 20 MAR bull put spread 440/445 for 2.12 credit.

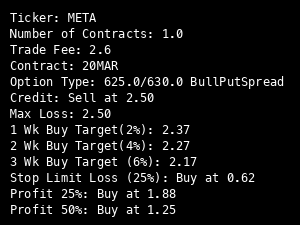

$META Closed at 1.85. 2.50-1.85=0.65/5=13.0%

$META 20 MAR bull put spread 625/630 for 2.50 credit.

$MSFT 20 MAR bull put spread 440/445 for 2.12 credit.

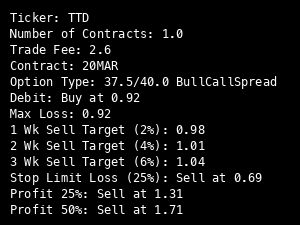

$TTD 20 MAR bull call spread 37.5/40 for 0.92 debit.

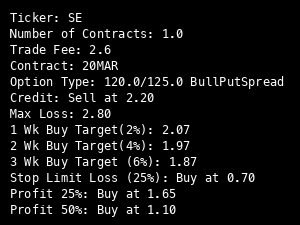

$SE 20 MAR bull put spread 120/125 for 2.20 credit.

$HIMS 20MAR bull put spread 25/30 for 2.32 credit.

United States Trends

- 1. Porzingis N/A

- 2. Kuminga N/A

- 3. Warriors N/A

- 4. Gonzaga N/A

- 5. Hield N/A

- 6. Podz N/A

- 7. Skubal N/A

- 8. Dalen Terry N/A

- 9. #AEWDynamite N/A

- 10. Yabu N/A

- 11. Ty Jerome N/A

- 12. GM CT N/A

- 13. POTS N/A

- 14. Lobos N/A

- 15. #DubNation N/A

- 16. Flagstaff N/A

- 17. Dunleavy N/A

- 18. Draymond N/A

- 19. Trey Murphy N/A

- 20. Golden State N/A

Something went wrong.

Something went wrong.