You might like

We're Hiring 🚨 2 Community managers $150/week 3 Mods $100/Week 3 KOLs $250/week 15 raiders $25/week if you're interested ~Comment your telegram Handle ~Like & Retweet ~Tag 3 Friends ~ join👇, we are selecting in t.me/+IQQxeTPoHWhlY… Send your comment link👆48 hours⚡️

Proof that cartoons raised a generation of nerds… and now we mint them on ETH.

Bringing cartoon nostalgia to NFTs! Introducing Nerds FREE MINT on ETH Coming soon to @opensea Grab WL → nerdsoneth.fun Duration: 36hrs

Fill out this form for $FOFAR airdrop 👇 Form → fofarpig.com/airdrop Just 36 hours

🤲🤲

Lfg!!

FILL IT FAST‼️ tinyurl.com/wrappedOG @Solana Wrapped 2025 is coming📅

Hiring small but active creators (300–3k followers) few slots only. • $50–$200 • Future rewards • Posting + engagement required • No resume Interested? → Follow → RT → Comment so I can check your page

💰 5 SOL GIVEAWAY we’re giving away 0.5 SOL to 10 lucky winners. to enter: - like + RT + follow - create account at hyperlvg.com - drop your SOL address + ref code in the comments winners picked nov 12th - don’t miss out.

Ever wondered if your DeFi strategy could move freely across chains, without all the switching and stress? DeFi shouldn’t be trapped on one chain,and @Velvet_Capital gets that. They’re going multi-chain, expanding across Ethereum, BNB, Base, Solana & Sonic, all while keeping

Velora holders after migrating PSP → VLR: “New chain, new token, who dis?” Inflationary farms are out. Revenue-backed rewards are in.

It’s gearing up already on @Velvet_Capital And I can see myself coming for that top 100 on @wallchain Just started quacking and I can feel that top spot coming home. What project are you immersed in rn??

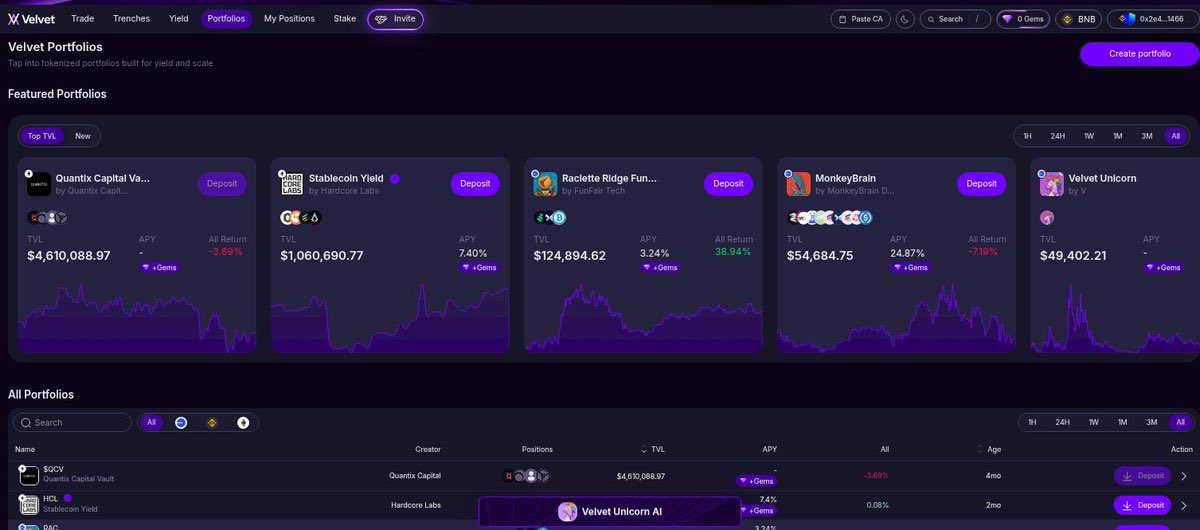

What makes Velvet Unicorn special isn’t just what it tells you, it’s what it helps you do. You can go from AI-driven insights → instant execution, trading, rebalancing, or joining vaults right from the same interface. No more bouncing between dashboards or chains.

Velvet’s building fast, and their latest drop is Velvet Unicorn, an AI copilot for DeFi. Think of it like having a personal assistant that helps you: -Discover new tokens & vaults -Analyze on-chain data -Optimize trades and yield strategies All powered by the same DeFAI

Velvet’s building fast, and their latest drop is Velvet Unicorn, an AI copilot for DeFi. Think of it like having a personal assistant that helps you: -Discover new tokens & vaults -Analyze on-chain data -Optimize trades and yield strategies All powered by the same DeFAI

When Velora said “cross-chain,” they meant cross everything. Old token? Migrated. Old rewards? Gone. Old limits? Deleted. $VLR holders rn

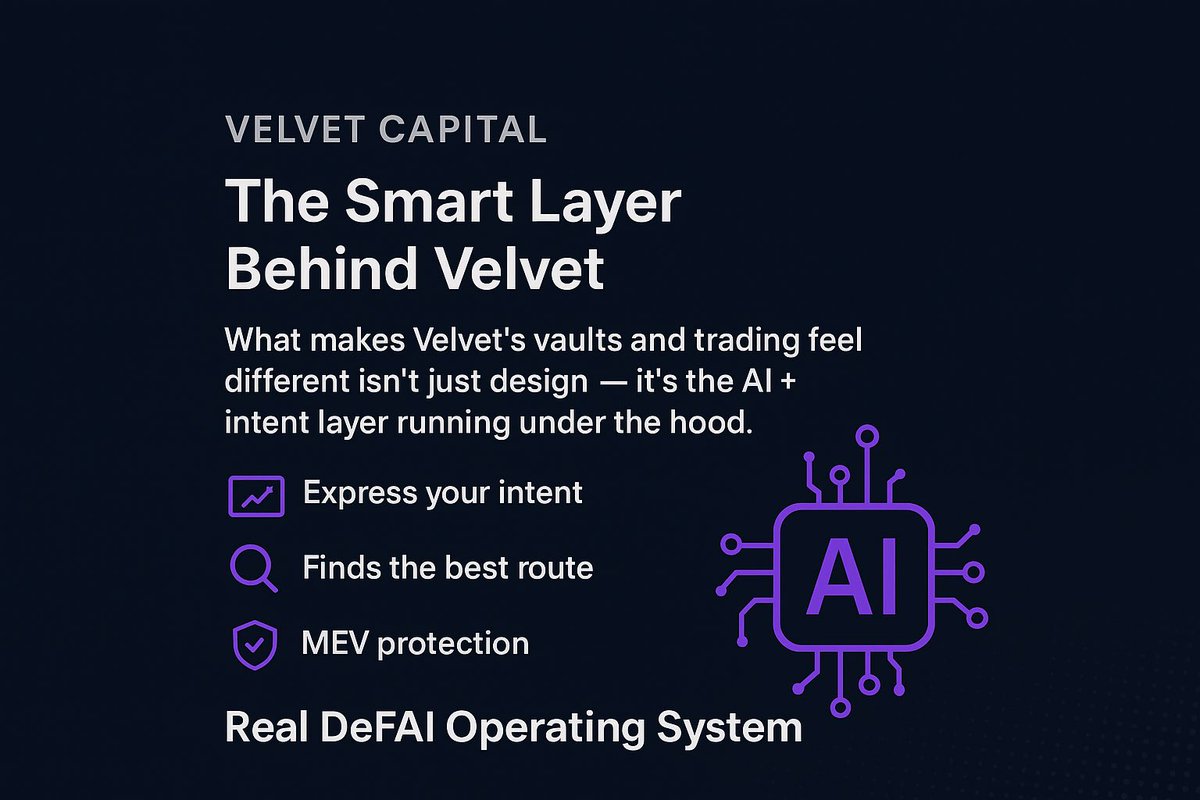

Velvet isn’t just another DeFi protocol,it’s tackling the real pain points in the ecosystem. DeFi today is fragmented. Too many chains. Too many tools. Too much friction. @Velvet_Capital approach, AI + intents + unified portfolio management, could finally bridge that gap.

What’s Going On With Velvet Capital. Velvet Capital has been busy lately They just raised $3.7M to push their “DeFAI Operating System”, bridging AI + DeFi into one seamless experience. They’ve launched @Velvet_Capital Unicorn, an AI copilot that helps users discover tokens,

Ever wondered what happens when anime meets the metaverse? Welcome to @numineverse , an Unreal Engine powered virtual world built on @VenomFoundation , where gaming, NFTs, and creator economies collide. A new dimension of digital identity is forming. Will explore more of

What’s Going On With Velvet Capital. Velvet Capital has been busy lately They just raised $3.7M to push their “DeFAI Operating System”, bridging AI + DeFi into one seamless experience. They’ve launched @Velvet_Capital Unicorn, an AI copilot that helps users discover tokens,

What makes Velvet’s vaults and trading feel different isn’t just design, it’s the AI + intent layer running under the hood. Instead of manually hopping between chains or protocols, you simply express your intent, and @Velvet_Capital system finds the best route, executes it, and

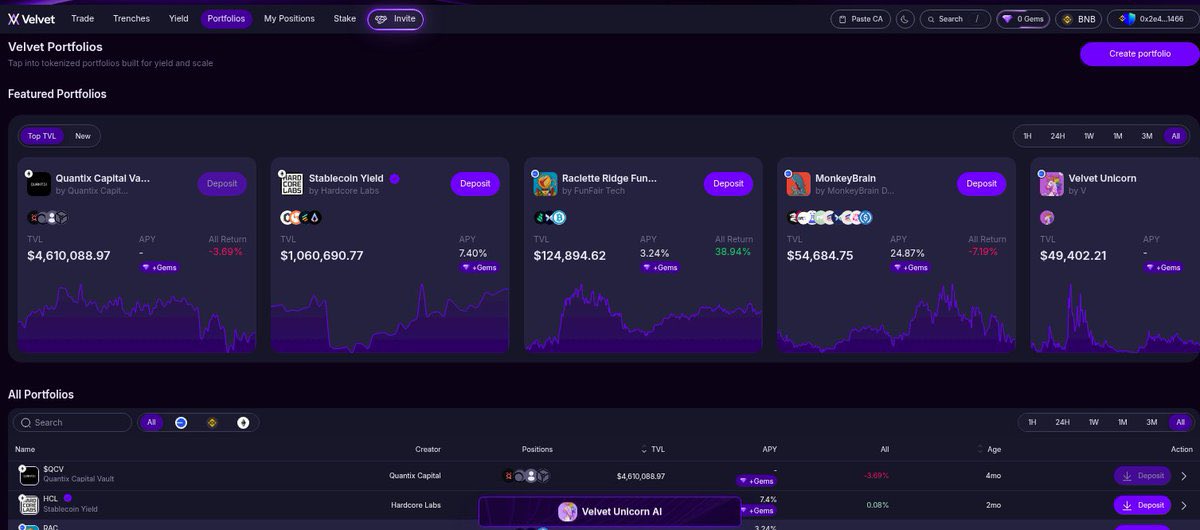

One of Velvet Capital’s smartest plays is Their Vault system. Imagine launching your own on-chain strategy, a fund anyone can join, without writing a single line of code. You pick the assets, set allocations, fees, and performance goals. @Velvet_Capital handles the rest.

One of Velvet Capital’s smartest plays is Their Vault system. Imagine launching your own on-chain strategy, a fund anyone can join, without writing a single line of code. You pick the assets, set allocations, fees, and performance goals. @Velvet_Capital handles the rest.

The deeper I go into Velvet Capital, the more interesting it gets They’re not just letting users trade, you can actually build your own on-chain vault. Think of it as creating your own mini fund or strategy that others can join. You set the rules, choose assets, define fees,

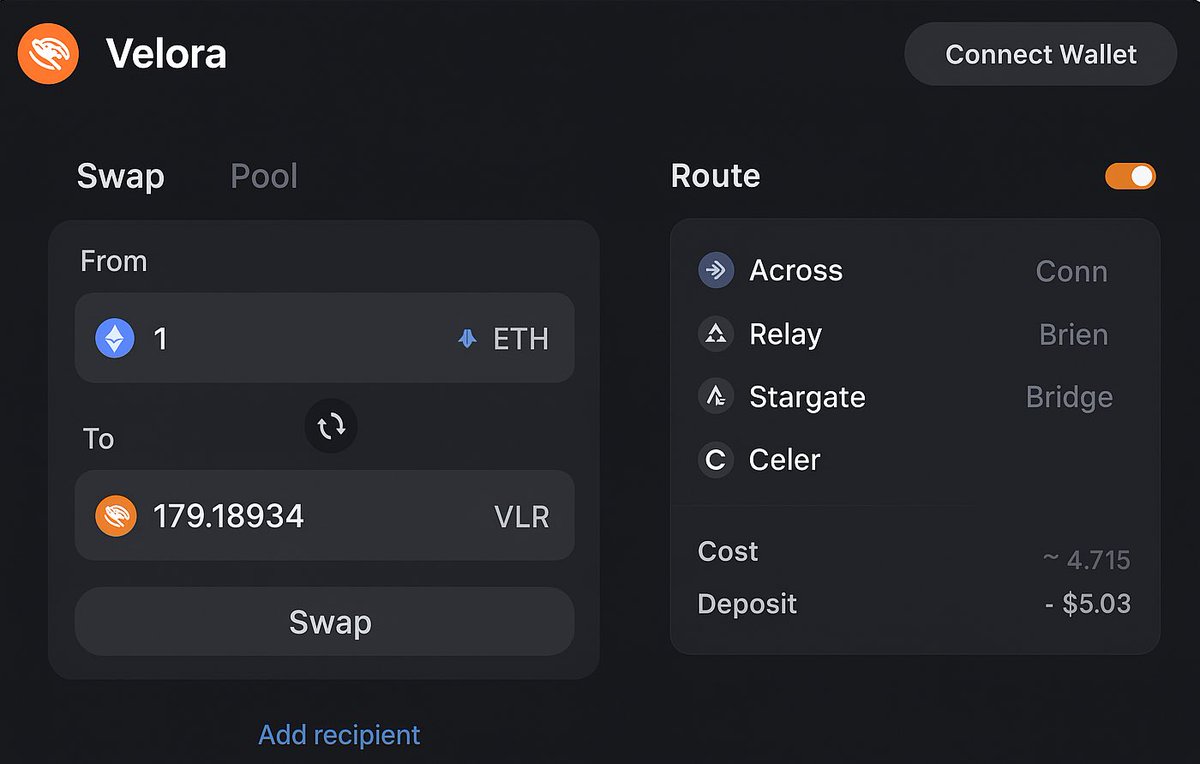

Good UX doesn’t just look clean, it makes the hard stuff invisible. That’s exactly what @VeloraDEX is doing with its new MultiBridge + intent-based routing system. Instead of forcing users to choose between bridges, chains, and fee paths, Velora abstracts all that away, you

United States Trends

- 1. Eric Dane N/A

- 2. Baby Keem N/A

- 3. McSteamy N/A

- 4. Jamal Murray N/A

- 5. #TheTraitorsUS N/A

- 6. Cade N/A

- 7. Pistons N/A

- 8. Aliens N/A

- 9. Knicks N/A

- 10. WE LOVE YOU TAEHYUNG N/A

- 11. #thepitt N/A

- 12. House Money N/A

- 13. WITH TAEHYUNG TILL THE END N/A

- 14. Tara N/A

- 15. #Casino N/A

- 16. robby N/A

- 17. Mathurin N/A

- 18. UFOs N/A

- 19. Maura N/A

- 20. Grey's Anatomy N/A

Something went wrong.

Something went wrong.