ChainNotes

@0x_ChainNotes

Daily coverage of crypto, markets & innovation. Fast, clear, on-chain. 🧠 #Bitcoin | #DeFi | #Web3

Może Ci się spodobać

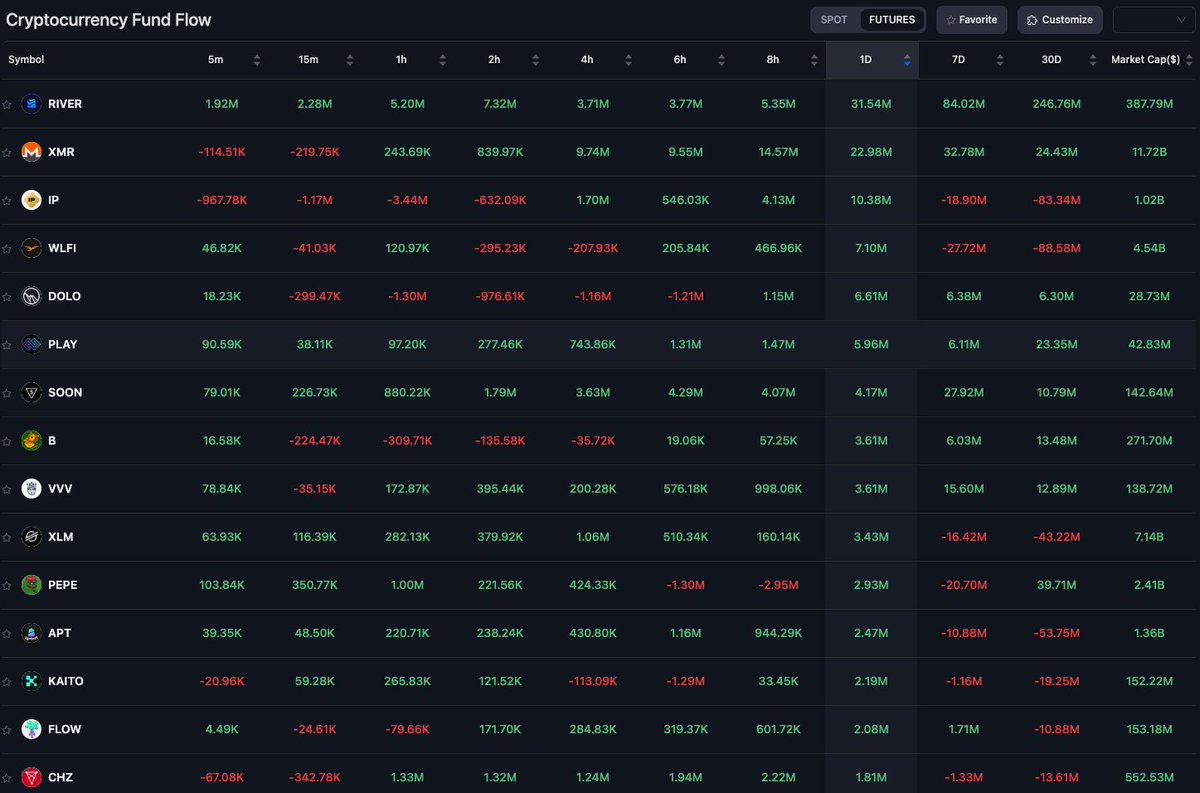

$XMR: Privacy Holds Strong Amid Market Shifts According #CoinAnk 1 XMR = $632 | Immediate Support: $550 Key Metrics Highlight Monero’s Resilience: 24h Fund Inflows: Top 2 Across All Cryptocurrencies Perpetual Open Interest: $181M What’s striking? Despite delistings from…

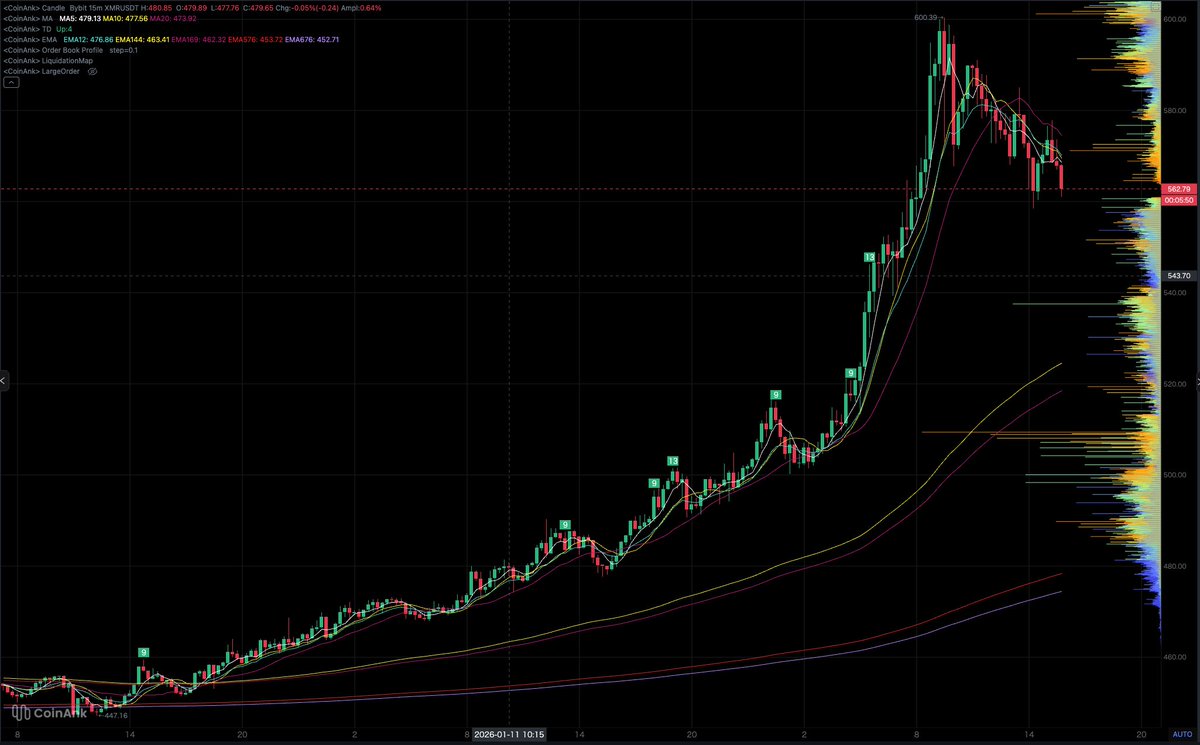

$XMR'S ATH HAS BEEN ERASED. After touching $600, it has entered a correction phase and is currently trading at $562. Will it stage a comeback? 👉coinank.com/proChart?excha…

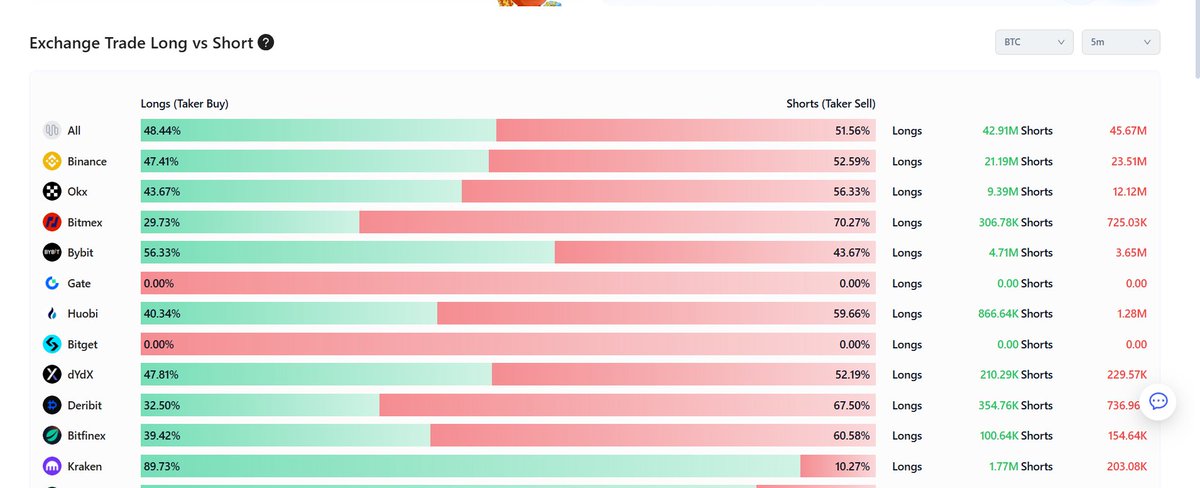

The bull market is here. Time to go long. 🐂 $BTC $SOL #Coinank coinank.com/longshort/real…

Gold and Silver are pumping. Bitcoin will be next.

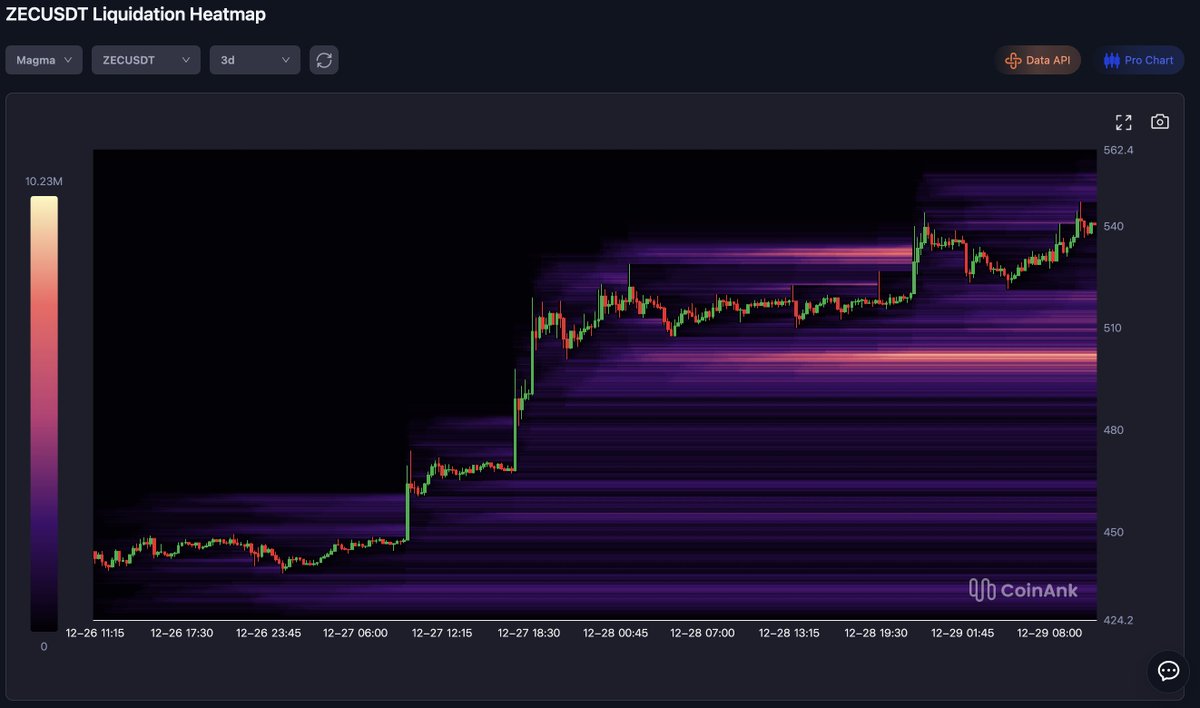

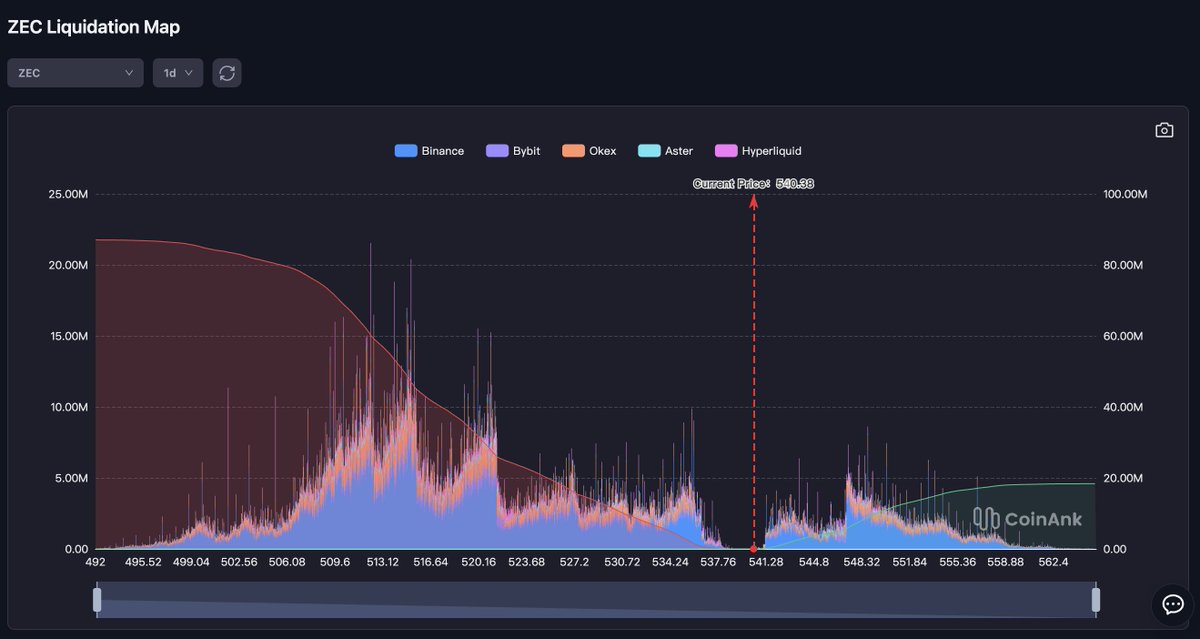

GM 📊$ZEC/USDT Liquidation Heatmap Key Insights (3d) Support ($490–$500): Bright yellow bands = high long liqs in early dips; strong rebound magnet via short squeezes. Overall: $10.23M liqs; moderate leverage。 The 24-hour capital inflow was $63.76M, ranking among the top 4…

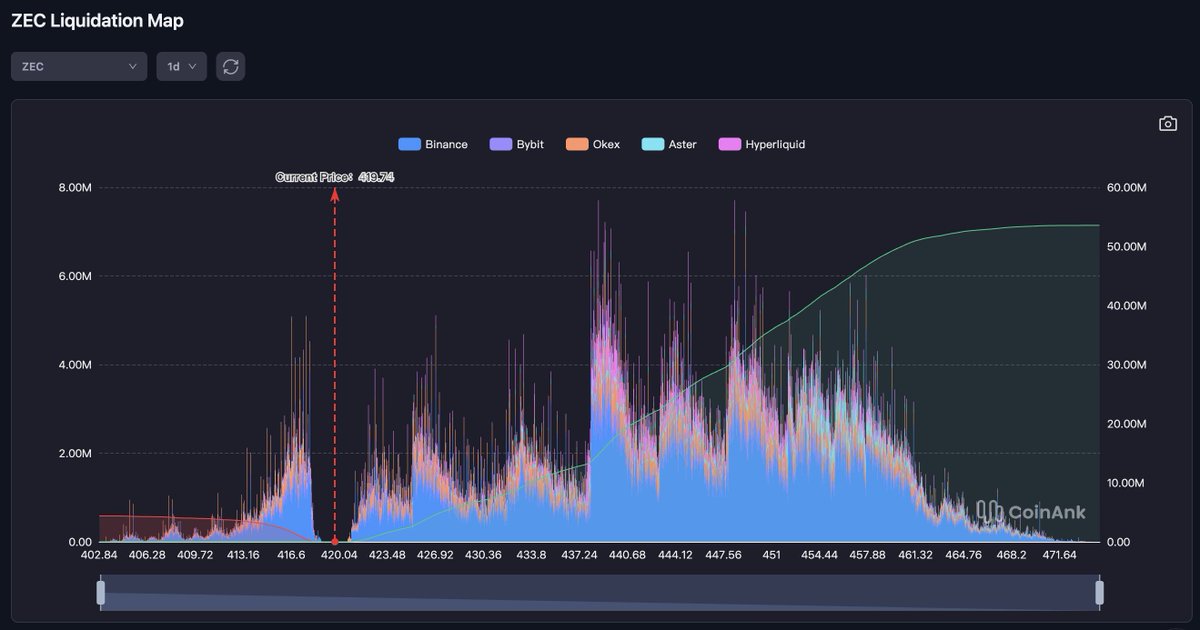

$ZEC/USDT Liquidation Heatmap Key Insights Support ($388–$400): Bright yellow bands = high long liqs in dips; strong rebound magnet via short squeezes. Resistance ($450–$460): Intense yellow = short wipeouts on pumps; break = upside squeeze, reject = long cascades. Overall:…

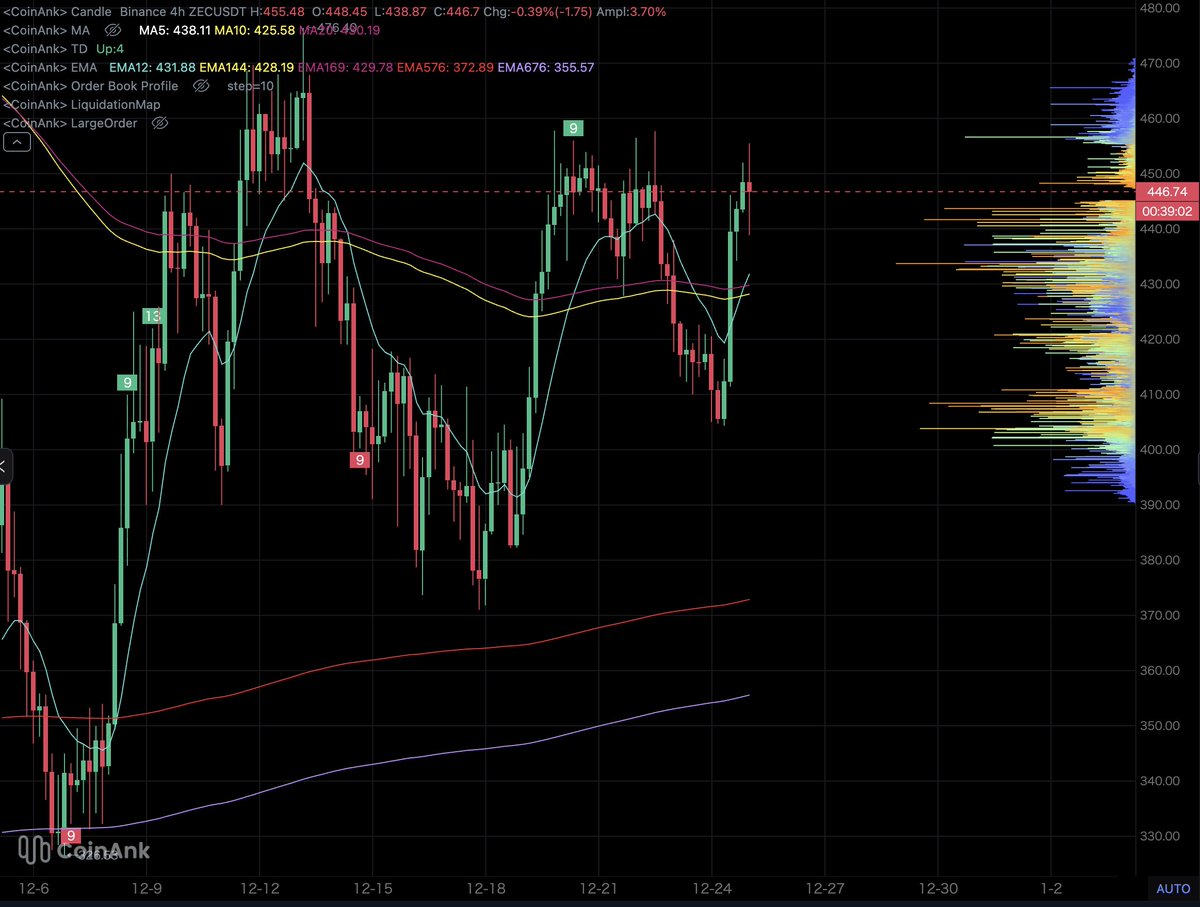

Well, clear imbalance showing up here. Right-side shorts look vulnerable if momentum flips.

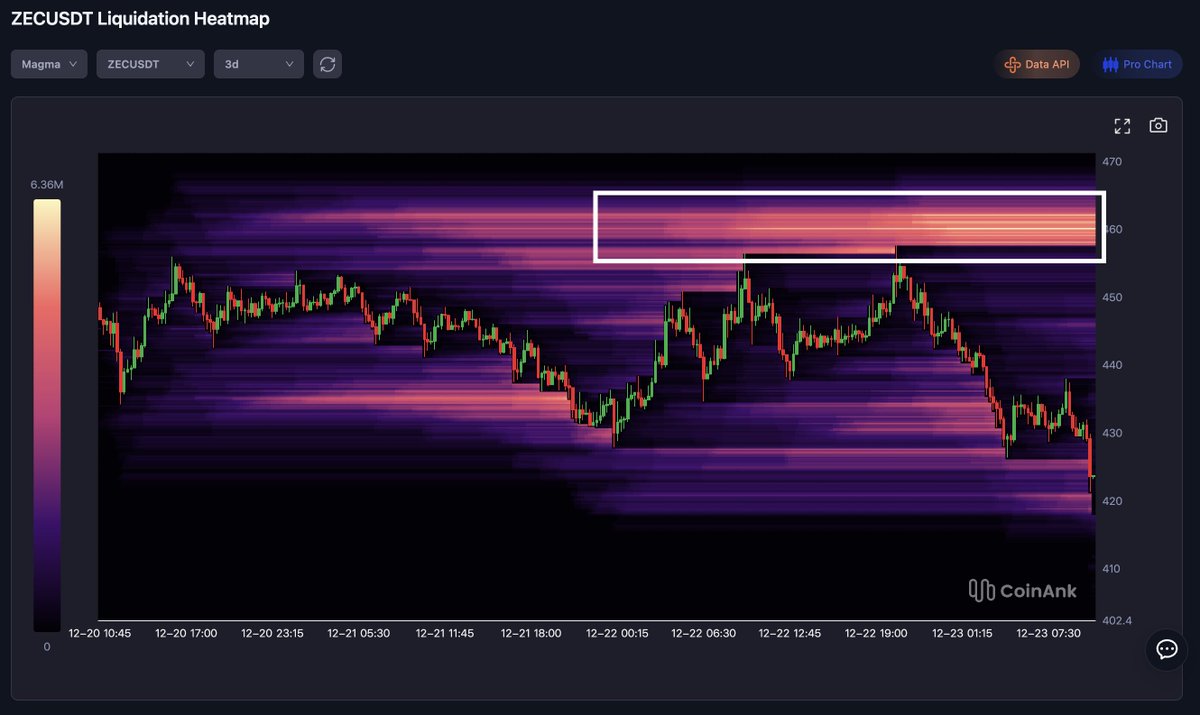

📊CoinAnk $ZEC Key Insights Resistance ($455–$465): Intense yellow = short wipeouts on pumps; break = upside squeeze, reject = long cascades. Overall Market Snapshot: Total liquidations reach $6.36M with low-to-moderate leverage across positions. Tiered liquidation clusters…

$BTC is aiming for $133K. Last cycle gave us a clue: When Bitcoin broke a 3-month downtrend with bullish divergence, price ran ~50%. My take: • Base case: $133K by March • Outlook: before the next broader bear phase, a strong #Altseason still feels inevitable. #CoinAnk

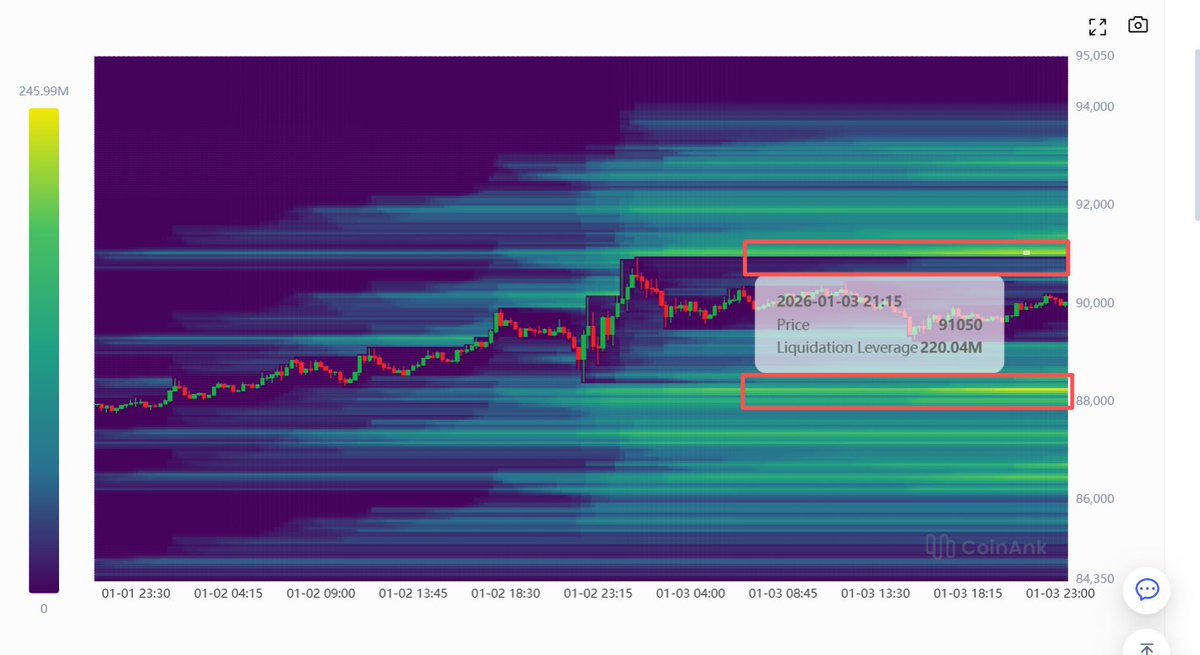

BREAKING: Bitcoin dumped $3,200 from $89.8k to $86.6k and liquidated $203 million worth of longs. All this happened in last 60 minutes with no major negative news or FUD. Another example of 10 am manipulation which happens almost everytime the US market opens. Crypto really…

BOJ hinting at a hike is the real macro catalyst. Rising JGB yields pull capital home, Treasuries get dumped, and the 10Y rips to 4.08%. This is the early stage of a broader repricing in risk assets—markets are front-running the move.

Europe is leveling up its stablecoin push: ex-Coinbase exec as CEO, ING exec as CFO, former NatWest chairman on board — even BNP Paribas is in. The EU is clearly positioning “banks + MiCA + stablecoins” to counter U.S. dominance in digital payments.

In the past 4 hours, 9,259 traders were liquidated, totaling $7.916M. Longs: $4.463M Shorts: $3.452M ZEC liquidations reached $1.037M (13%).

Bitcoin is at $86,000 with a month of 2025 left Do you think we will see $150,000 by new years?

China’s NDRC released new guidelines emphasizing stronger academic development around data elements. Key focus areas include data ownership, pricing, and trading, plus research in AI, blockchain, and privacy computing—aiming to build China’s own data-element knowledge system.

Hong Kong’s SFC has added “9M AI Stable Fund” and “9M AI Strategy Fund” to its list of suspicious investment products. These products claim to use crypto-related strategies and offer VIP referral rewards. The SFC wa

Willy Woo: Don’t assume M2 ↑ = BTC ↑. Late-cycle, Bitcoin leads M2 — and inflow models show we may already be topped. Even with Fed easing, if investors choose USD over risk, the dollar strengthens and global M2 falls.

United States Trendy

- 1. #SmackDown N/A

- 2. Duke N/A

- 3. Mensah N/A

- 4. Bichette N/A

- 5. Panarin N/A

- 6. Phillies N/A

- 7. Baty N/A

- 8. Andor N/A

- 9. Mets N/A

- 10. Kit Wilson N/A

- 11. Leon Slater N/A

- 12. Vincent Price N/A

- 13. Ryan Air N/A

- 14. OpenAI N/A

- 15. Roger Waters N/A

- 16. Drury N/A

- 17. Nobel N/A

- 18. Tony Blair N/A

- 19. Trick Williams N/A

- 20. Carney N/A

Something went wrong.

Something went wrong.