George

@0xrandomrandom

Optimising $1 quadrillion in volume globally at @stablevelocity | ex-@Google X moonshot | Forbes 30 under 30

You might like

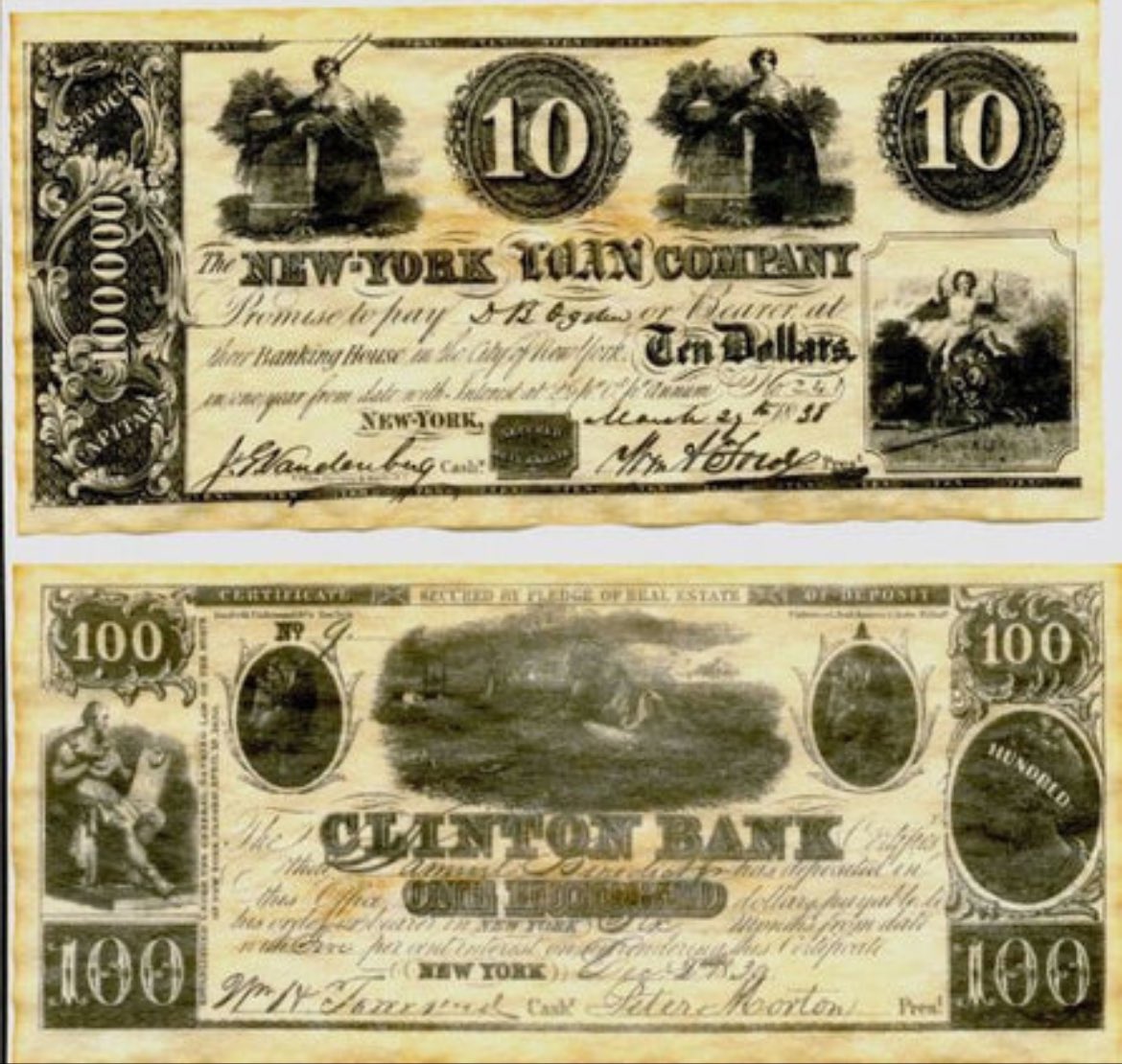

In the 19th century a $5 dollar note from a Tennessee bank used to worth only $4 dollars in New York. A peg that we take for granted nowadays is such an exciting piece of financial engineering.

The sterility of modernity can be truly fascinating sometimes, especially when it was foretold 150 years ago.

It’s only impossible until someone does it :) people nowadays forget to be creative..

This is correct: consumer stablecoin merchant acceptance in the west is a complete non-starter imo. You can't build a new payment network without exclusivity or a compelling forcing function (rewards, credit), the inertia of status quo is too strong. And the current card-based…

Solve et coagula - anything less is just scratching the surface.

Egregores are considered autonomous psychic entities that can have a life and influence of their own, beyond the sum of the individuals who created them. In management, it took me a few hard lessons to learn that the group spirit must be protected at all costs.

The only way to increase the abundance of an asset which is limited in supply is to create a whole new asset which acts as a substitute. If you wanted to suppress a price, this would be the play. It’s not liberation, it’s suppression.

Great team, cool product. Best of luck, guys!

Bundl is on a mission to finally fix the subscription chaos most people deal with. As we approach the @colosseum hackathon submission, you can support us in a few ways: Like & retweetthis post and upvote us on @legendsdotfun legends.fun/products/f4771…

ZK proofs have been somewhat theoretical (both in terms of use cases and security), it's interesting to see solutions on the market, which finally hit all the right notes. There will be a wave of ZK-proof powered tech in the next few years..

Primus AlphaNet Launch 🚀 1/ Primus AlphaNet lets individuals control their own data with better security and fairness, and makes it easier to monetize that data. Take part and start building your verified Web3 identity. 🔗 app.primuslabs.xyz

GG

17 countries have rolled out or passed digital ID laws in the last 3 months: -EU -UK -Laos -China -Taiwan -Mexico -Zambia -Canada -Ethiopia -Thailand -Vietnam -Australia -Costa Rica -Switzerland -Papua New Guinea Totally just a coincidence, I'm sure.

Yep, there will be thousands of stablecoins. Liquidity will get more fragmented. Every wallet will have its own branded stablecoin, every fintech product will tap into yield as a revenue stream.

"I would have written a shorter letter, but did not have the time." - Mark Twain. The most applicable quote when building a novel product with deep tech. The good thing - time quickly fixes this.

A transfer from your JPM USD account to a Citi USD account is the same as converting USDC to USDT, both being IOU conversions. JPM USD IOUs have a different risk profile than Citi USD IOUs, just as USDC differs from USDT. Converting $50M from JPM USD to Citi USD costs $10 for a…

Technology often concentrates capital with less labor. Many VCs struggle to grasp the scale of this trend in finance. Crypto frequently surpasses AI in the magnitude of asymmetric returns a company can achieve. Tether’s yearly profit nears $10bn, while they only have 125…

FX dealers run matched books, focusing on two things: 1. Hedging efficiently 2. Liquidity risk CME-like markets eliminate 1), while T+2 settlements address 2). T+2 is seen as a necessary evil for low spreads, but is it? Programmable hyperliquidity comes with a lot of value.

United States Trends

- 1. Kittle 16,3 B posts

- 2. AJ Brown 5.371 posts

- 3. 49ers 47 B posts

- 4. Eagles 134 B posts

- 5. Josh Allen 51,7 B posts

- 6. Bills 153 B posts

- 7. Jags 33,8 B posts

- 8. #GoldenGlobes 165 B posts

- 9. Niners 13,6 B posts

- 10. Purdy 7.230 posts

- 11. Trevor Lawrence 15,7 B posts

- 12. #FTTB 6.888 posts

- 13. Quinyon Mitchell 2.832 posts

- 14. Sirianni 5.395 posts

- 15. #SFvsPHI 2.372 posts

- 16. Saquon 4.780 posts

- 17. Jake Elliot 1.517 posts

- 18. Erin Andrews 2.155 posts

- 19. Demarcus Robinson 2.471 posts

- 20. Buffalo 30,3 B posts

Something went wrong.

Something went wrong.