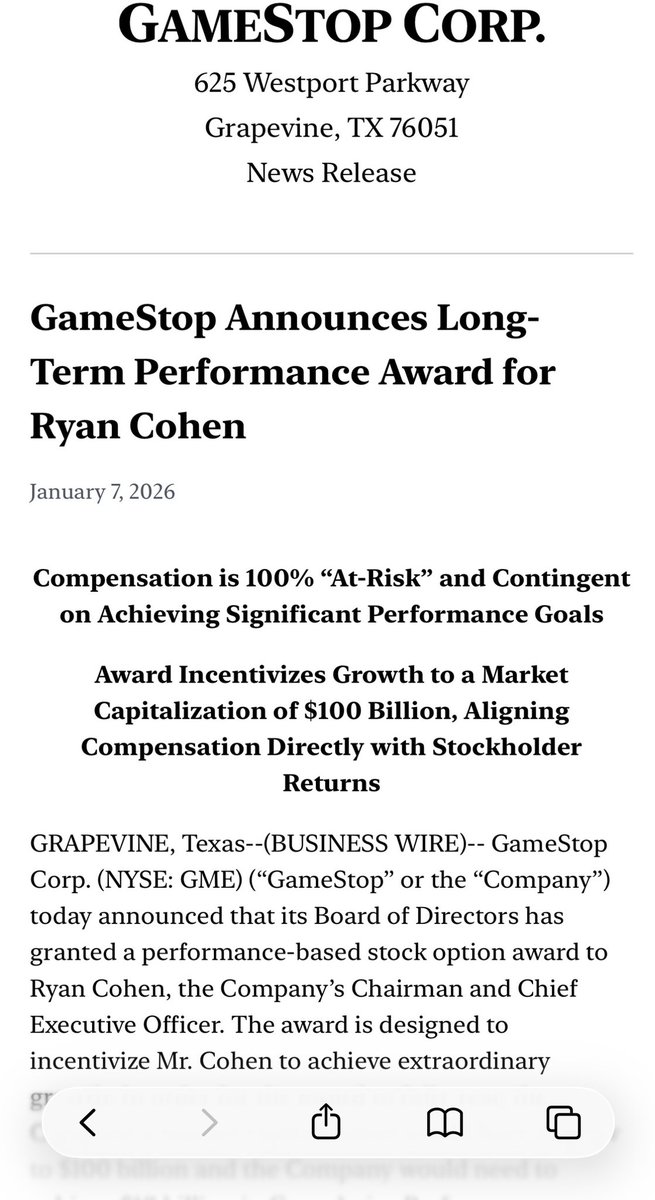

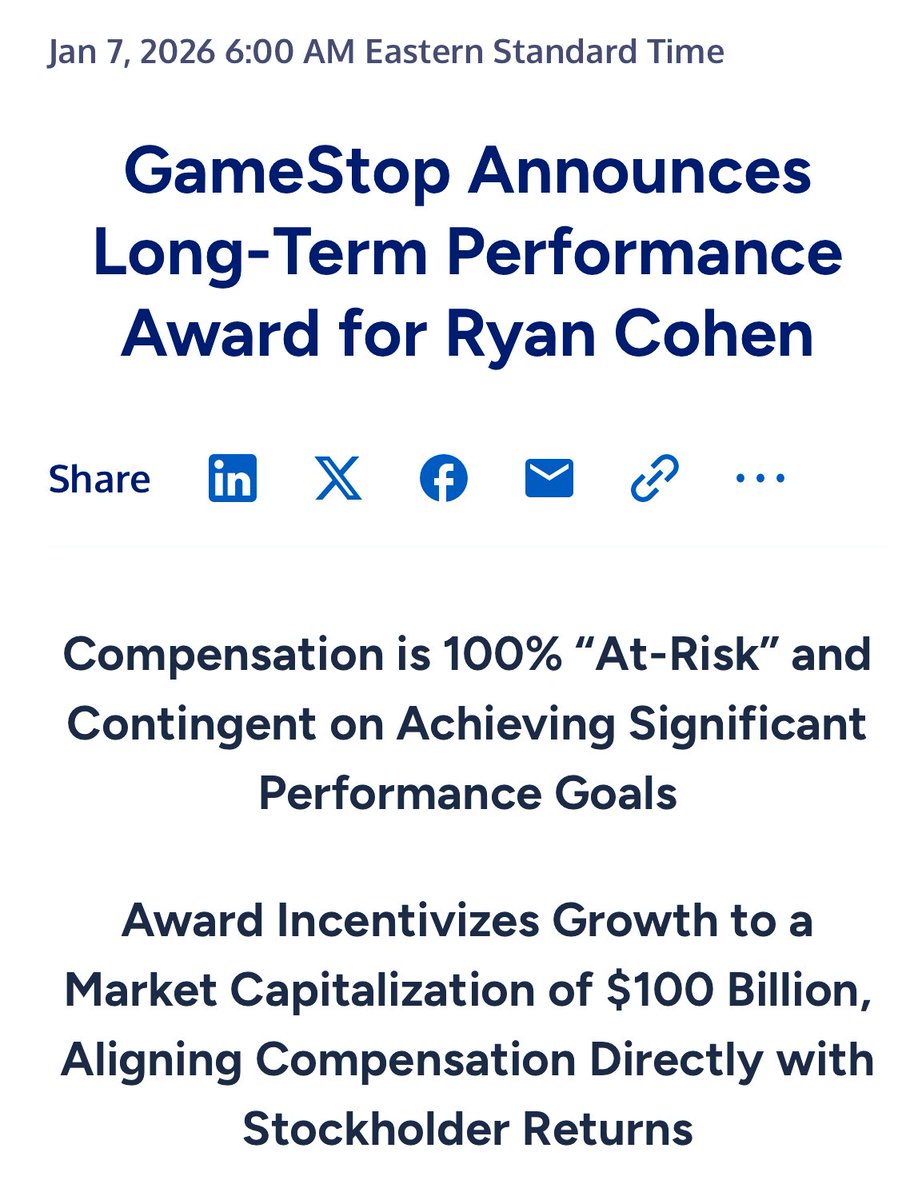

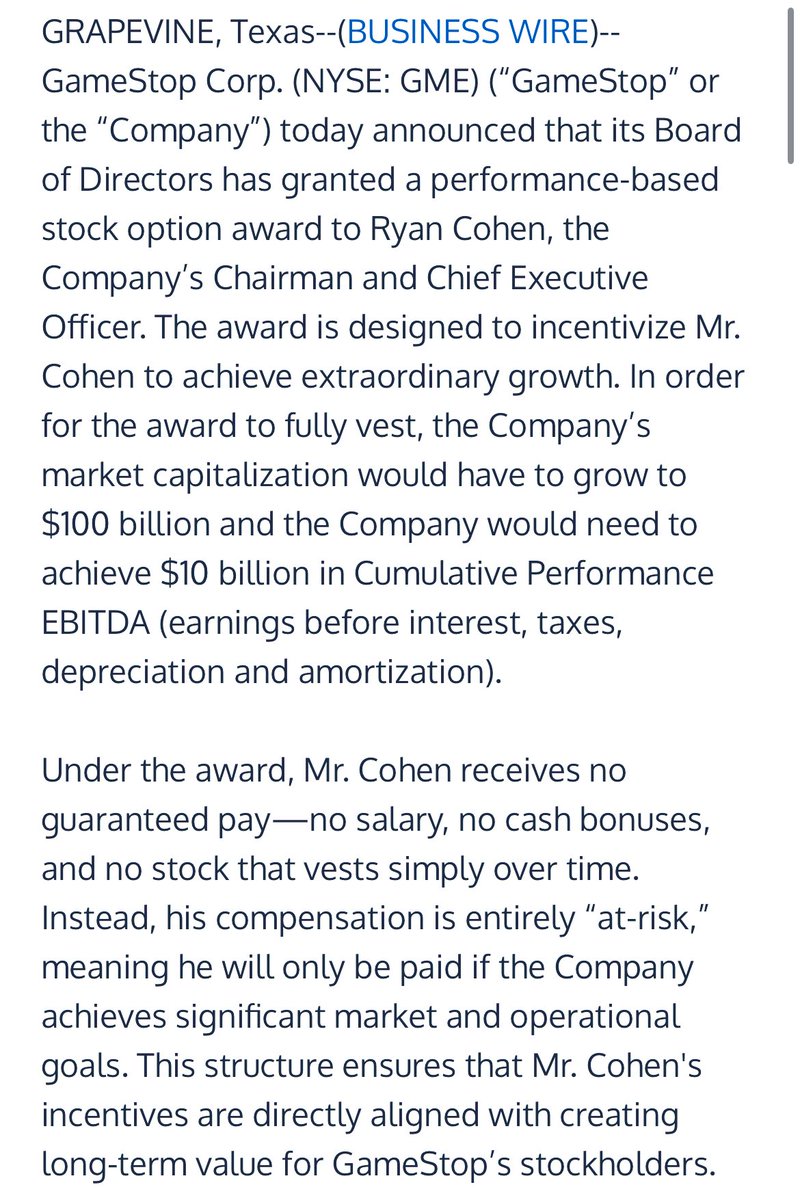

GameStop Announces Long-Term Performance Award for Ryan Cohen (press release below) $GME

BREAKING: GameStop announces performance-based stock option award to Ryan Cohen $GME. “The award is designed to incentivize Mr. Cohen to achieve extraordinary growth. In order for the award to fully vest, the Company’s market capitalization would have to grow to $100 billion and…

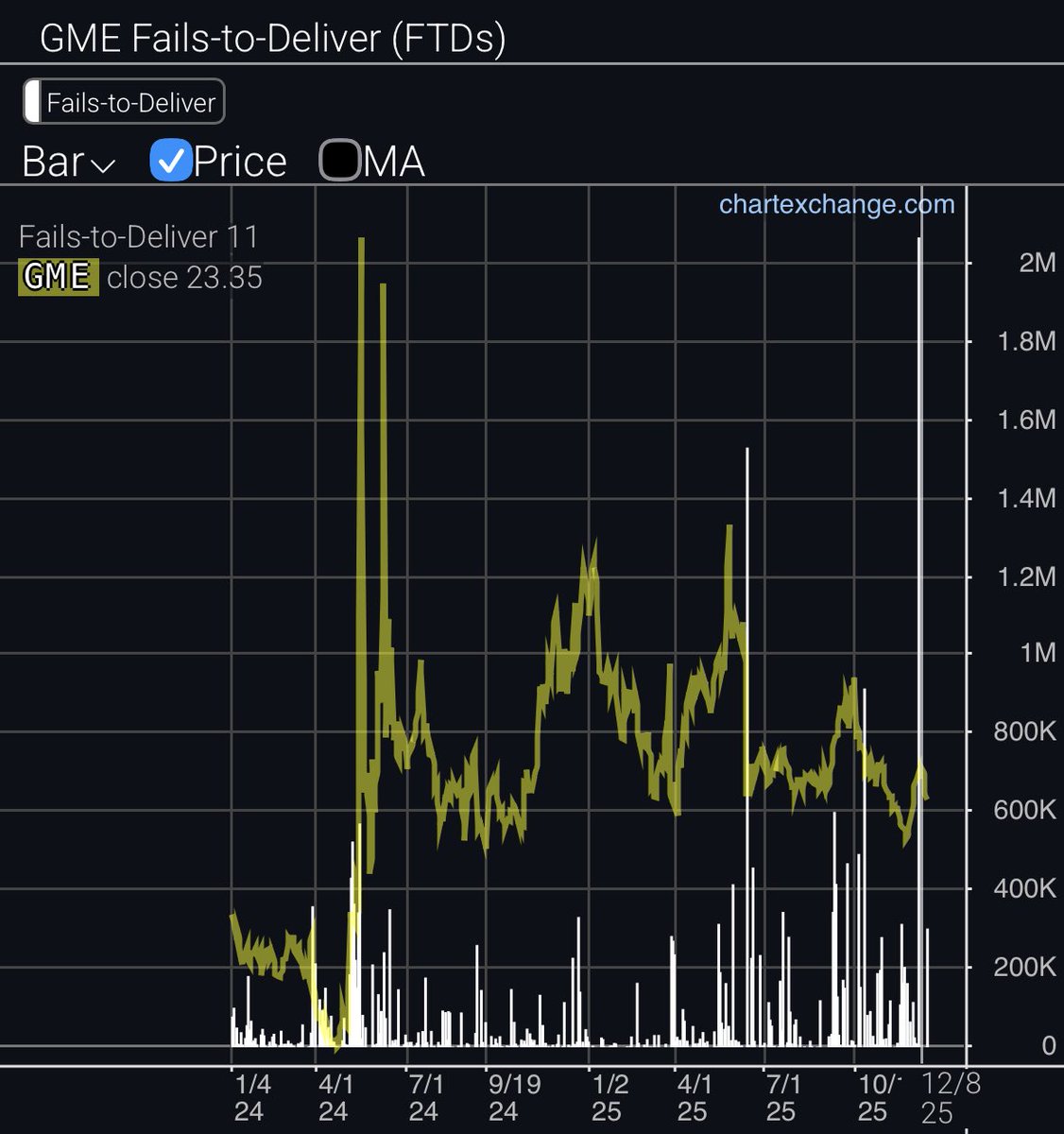

$GME Recent December FTDs were bigger than during the 2024 Kitty Comeback tour.

So everyone knows ahead of time, Im about to really fuck some shit up...just fyi.

Squid games :

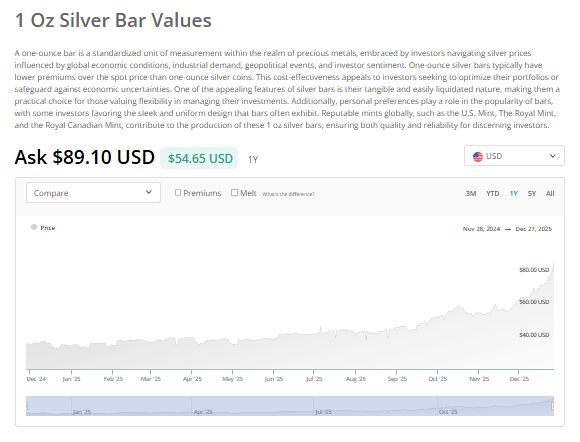

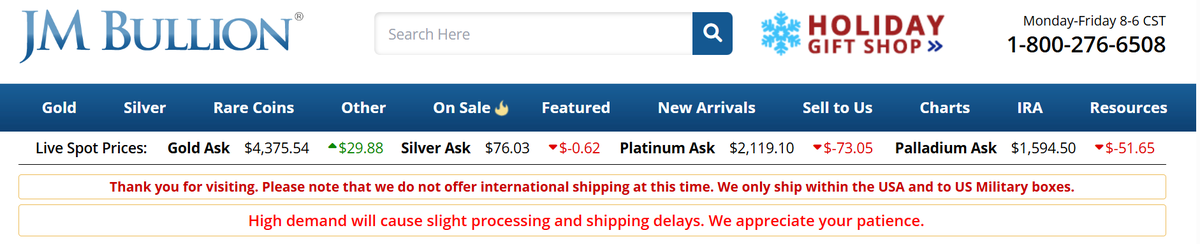

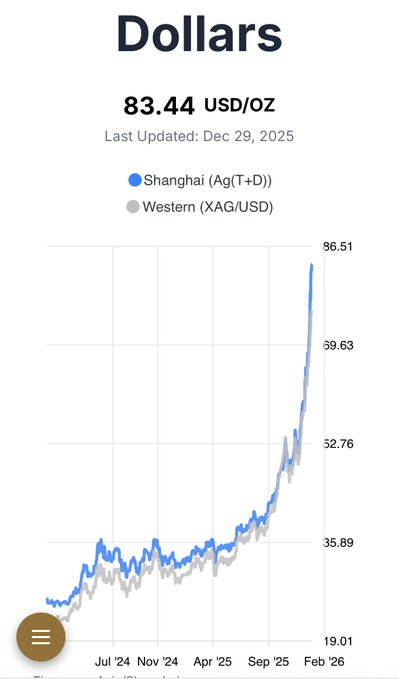

JUST IN: 🇨🇳 China officially imposes export restrictions on silver - The Chosun Daily.

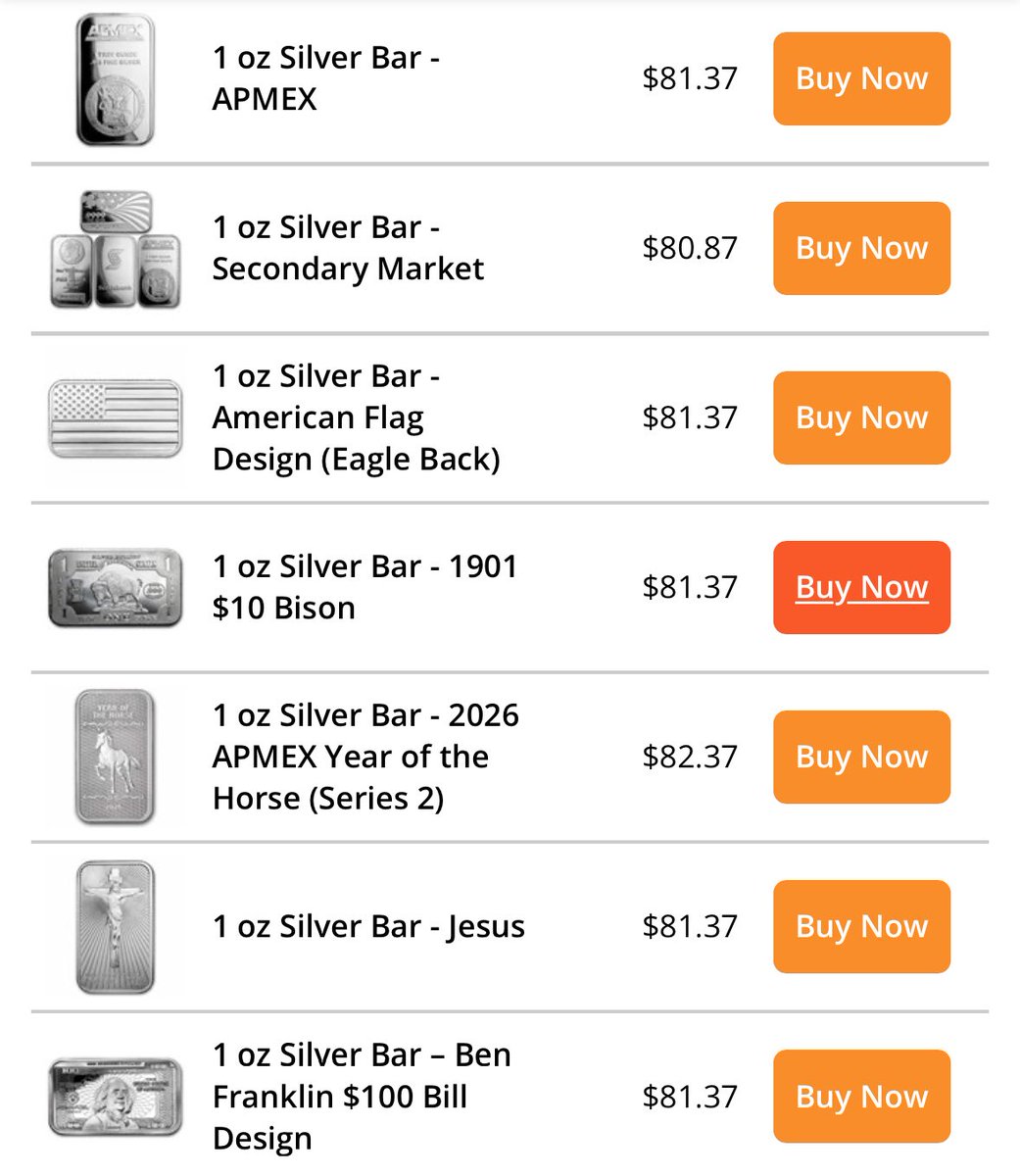

China is going directly to miners to acquire Silver +$8 over spot India is offering +$10 over spot The Silver Supply issue is worse than you think

JM Bullion only ships to the US now - no international anymore

A large precious metals dealer in HK is now only accepting clients by appointment - First appointment available is on the 7th of Jan

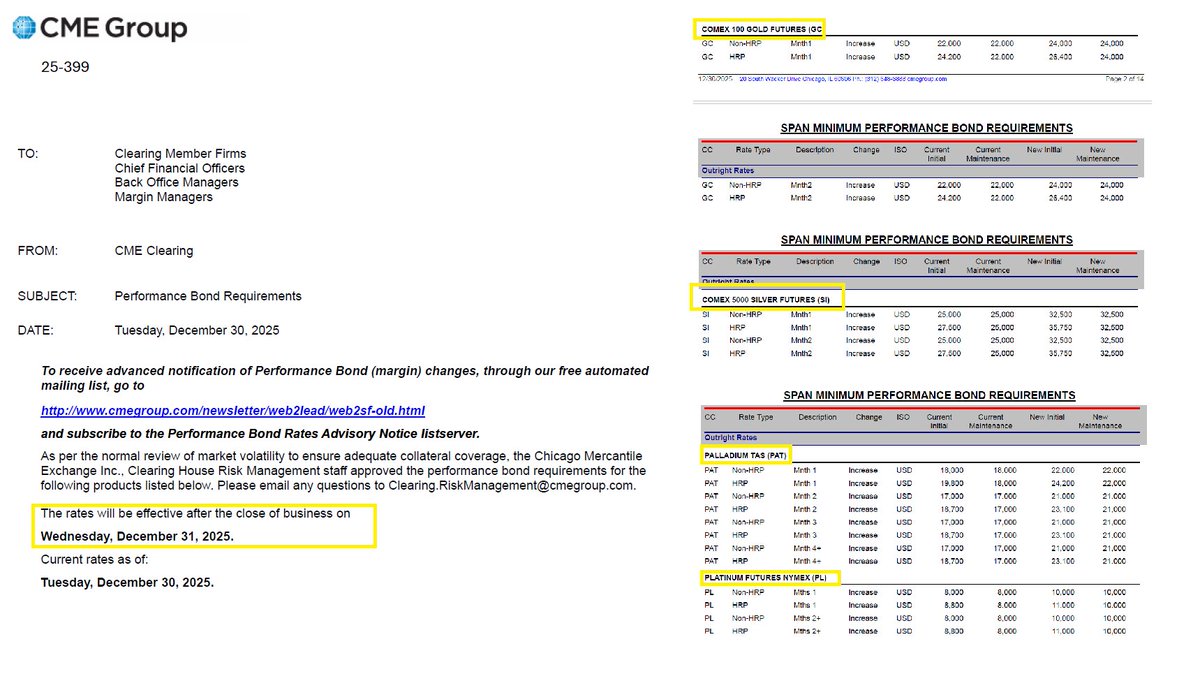

In case you needed any further sign of how critical the situation at the Comex (and the LBMA) is, now you have it. Unfortunately for them, physical demand is driving silver prices and there is no margin they can hike or buy button they can disable on physical silver.

Gold Silver Platinum Palladium Futures Alert CME hikes margin rates a second time in a week. *Massive* increases : Gold 9%, Silver 30%, Platinum 25%, Palladium 22%

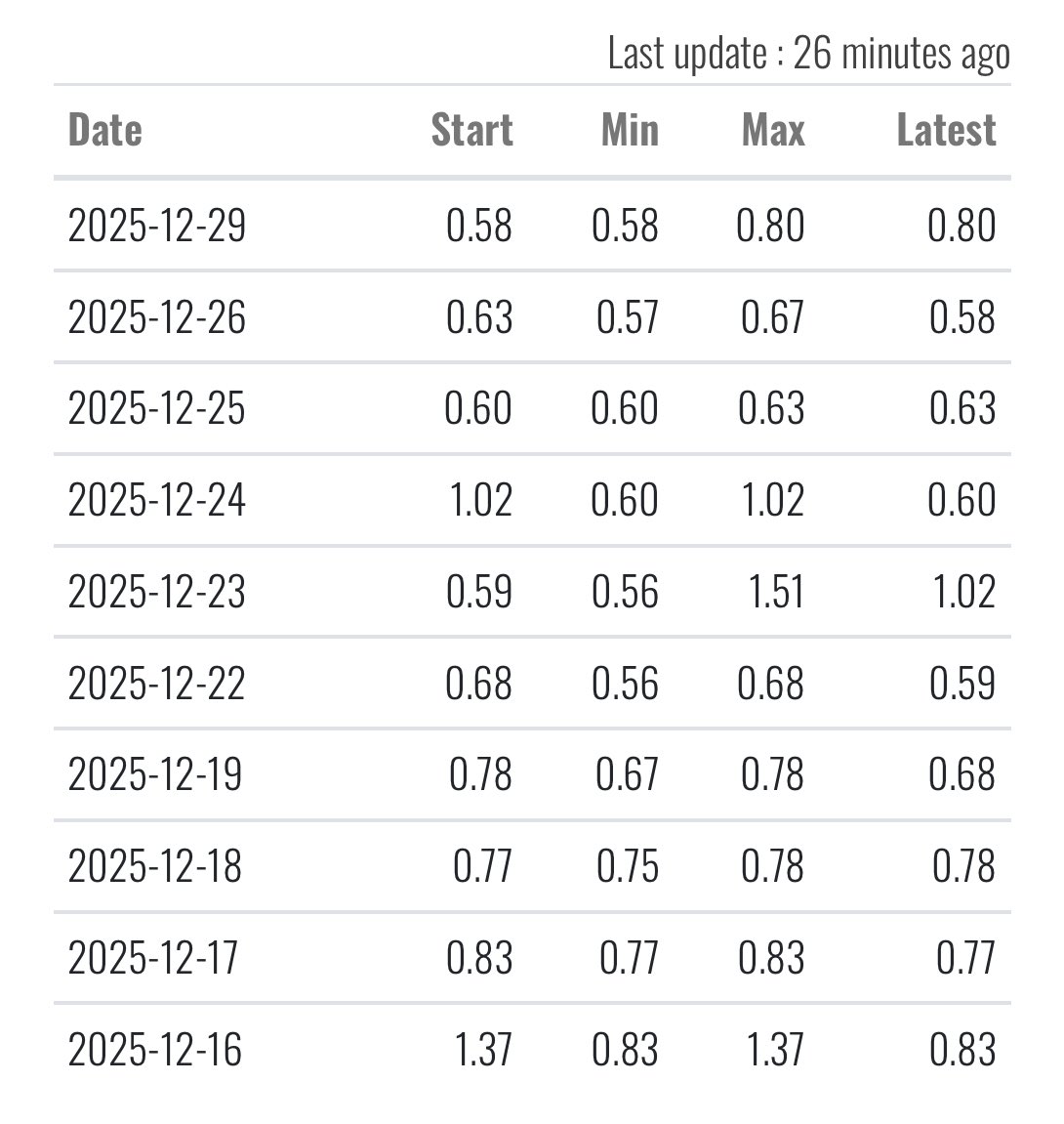

In 2008 MJ Burry kept doing the math on Subprime Mortgages within CDOs and despite more and more of the first were defaulting, CDO prices were stable if not going higher (because of banks MTM manipulation) Something similar is happening in Silver disconnecting physical and paper

Recap of the feedback on physical silver availability around the globe received so far (please feel free to keep sharing in comments): - Korea: Premiums ~$103/oz on secondary market 1kg bars (cheaper than new); - Sydney, Australia: 2-hour queues at bullion dealers (photo of…

More feedback on physical silver from the ground is welcome 🙏

Current silver price moves vs $GME between Dec20 and Jan21 remain awfully similar Narrator: "Hang in there"

Between the 23 of Dec 2020 and the 23 of Jan 2021 $GME price jumped more than 5 times, a move nobody could picture in its wildest dreams not even @TheRoaringKitty Like it or not, but #silver current set up is incredibly similar with only 2 main differences: - It’s a titanic…

Another interesting fact: despite the sharp drop in prices, there is still a ~10$ premium on the real physical silver

In a day like this you would expect $SLV short interest and borrow rate sky high, similar to what happened in October. However, virtually nobody is shorting $SLV - Why? Obvious answer in my opinion

🔥Shanghai Silver Premium EXPLODES to $12.17/ oz!!🔥 🚨Bullion Banks Attempting to SMASH Silver into the $60's While Silver Spot in China Sits in the MID $80's!!! 🚨 Physical Silver Will Become UNOBTAINIUM in the US if This Spread Doesn't Quickly Narrow!

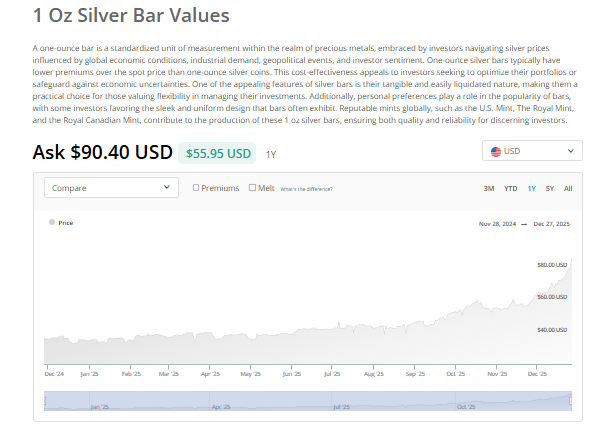

Silver bar above 90$ now 👀

United States 趋势

- 1. Panthers 53,8 B posts

- 2. Stafford 17,3 B posts

- 3. Puka 18 B posts

- 4. Bryce Young 10,3 B posts

- 5. Mike Jackson 1.995 posts

- 6. #KeepPounding 9.881 posts

- 7. Coker 4.647 posts

- 8. Bob Weir 1.572 posts

- 9. Nick Scott 1.315 posts

- 10. Davante Adams 1.723 posts

- 11. #LARvsCAR 1.700 posts

- 12. McVay 3.543 posts

- 13. #NFLPlayoffs 8.563 posts

- 14. Greg Olsen N/A

- 15. Etienne 2.724 posts

- 16. Doc Rivers 12 B posts

- 17. Pond 76,8 B posts

- 18. Chuba 2.412 posts

- 19. Rico Dowdle N/A

- 20. Dave Canales N/A

Something went wrong.

Something went wrong.