Alan Pasetsky

@APasetsky

Many opinions. Mostly tax related but all my own.

You might like

GBA exposed the key economic impacts of Section 899. FYI: It is not good news. Sec. 899 will cost thousands of Americans their jobs, diminish our country’s overall GDP and erase a full one-third of the bill’s pro-growth potential. In the long haul, Sec. 899 will hurt the…

Sec. 899 in the House reconciliation package threatens U.S. investment. Jonathan Samford, GBA's president & CEO, reacted: "The impact of this punitive and discriminatory provision will be felt by workers in communities like Paris, Kentucky, and London, Ohio, not Paris, France,…

Maryland businesses pivot to Trump’s actions, new state taxes – Baltimore Sun baltimoresun.com/2025/05/01/mar…

A Duke alum acting as one would expect. @IHateDuke1 facebook.com/share/r/1AQKMP… #dukebasketball

Is it true Trump is threatening a 25% tariff on all items from the North Pole to get Santa to relocate his factories to the US?

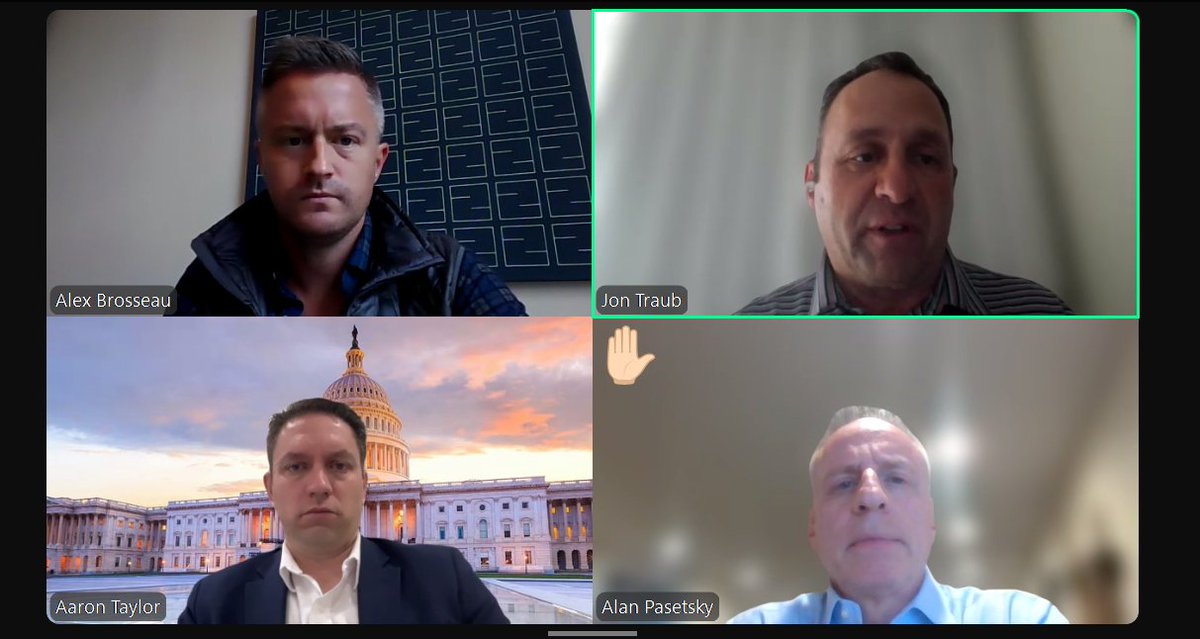

Thank you to @DeloitteUS 's Jonathan Traub and Alexander Brosseau for speaking with our member companies' tax executives. As we prepare for 2025, it was invaluable to hear their insights on the upcoming tax challenges and opportunities that lie ahead.

GBA's 2024 Fall Tax Conference is in full swing, bringing together top tax executives from our member companies for insights and discussions. The group appreciated hearing from Scott Levine, the @USTreasury Acting Deputy Assistant Secretary (International Tax Affairs). Thank you…

Can anyone help out with a ln IRS phone number to get a live person. Issue relates to a paper filed return that is in limbo. Thanks.

In a letter to the @WaysandMeansGOP Chairman @RepJasonSmith and Tax Subcommittee Chairman @MikeKellyPA, GBA's president and CEO, @nmclernon, calls on Congress to implement tax policies that drive economic growth and investment in the U.S. in 2025. Read the full letter here:…

Data speaks volumes! Thanks to @jaredpasetsky's work, we have quantifiable data of the problem. Let's use this to drive change! #FixPriorAuth #ASTRO24 #ASTROadvocacy

Dr @jaredpasetsky presents #ASTRO24 on inappropriate denial of #radiation services after #priorauthorization which is at the level of a one star rating for Medicare Advantage plans -abysmal. #fixPriorAuth

Ask me how much I enjoy getting to know and learn from our ASTRO members. @jaredpasetsky is brilliant, driven, and diligent. He’s also kind, friendly, and funny AND finds time to engage with us on policy & advocacy! Thank you for this work - I’m going to talk about it…

Dr @jaredpasetsky presents #ASTRO24 on inappropriate denial of #radiation services after #priorauthorization which is at the level of a one star rating for Medicare Advantage plans -abysmal. #fixPriorAuth

IRS question.Did 2023 tax return for my stepson & wouldn’t go thru electronically so filed by paper and was timely received by IRS.Still waiting on refund 6 months later. He called & got some weird answers as to why. Anyone have good phone numbers to call IRS for real answers.

GBA has been urging to eliminate the funding rule since @USTreasury and @IRSnews issued their initial guidance in 2022. @APasetsky, GBA's tax policy advisor, echoed those calls while he testified at the Treasury/IRS hearing on stock buyback regulations. Read the full…

Check out this @GT_Law GeTin' SALTy podcast episode: GBA consultant @APasetsky highlights why mandatory worldwide combined reporting should not be implemented. gtlaw.com/en/insights/20…

The Senate's failure to pass the bipartisan Wyden-Smith tax package was a "missed opportunity to increase America's economic competitiveness." Read Nancy McLernon's, GBA president and CEO, full statement: globalbusiness.org/mclernon-senat…

It was great to connect with so many GBA member companies in #Boston, MA, this week. Thank you, @MassEOED Secretary Yvonne Hao, for joining us to discuss how global investment strengthens the Commonwealth's #economy. #FDIintheUSA

Good article showing some of the pitfalls with worldwide combined reporting including phantom revenue predictions. Doesn’t even include the potential international ramifications and retaliation.

Maryland legislators consider implementing worldwide combined reporting. Why might this be a bad idea? Check out our analysis of this unsound state corporate income tax proposal taxfoundation.org/blog/maryland-…

United States Trends

- 1. Colts 17.2K posts

- 2. Caleb Williams 3,092 posts

- 3. Jameis 6,594 posts

- 4. Drake Maye 5,664 posts

- 5. #HereWeGo 3,418 posts

- 6. TJ Watt 2,626 posts

- 7. #ChiefsKingdom 2,753 posts

- 8. Arsenal 367K posts

- 9. Mason Rudolph 3,919 posts

- 10. Tottenham 113K posts

- 11. #GoPackGo 2,602 posts

- 12. #HardRockBet 4,130 posts

- 13. #Steelers 4,473 posts

- 14. Thomas Frank 13.3K posts

- 15. Jawaan Taylor N/A

- 16. Geno Stone N/A

- 17. Wan'Dale Robinson N/A

- 18. John Metchie N/A

- 19. Go Birds 9,398 posts

- 20. Wright 16.3K posts

You might like

-

@GoodTaxTakes

@GoodTaxTakes

@goodtaxtakes -

George Callas

George Callas

@George_A_Callas -

Immersive Jon Traub

Immersive Jon Traub

@jtraub2 -

Janice Mays

Janice Mays

@janicemays_ -

Joshua Odintz

Joshua Odintz

@JOdintz -

Robert Goulder

Robert Goulder

@RobertGoulder -

Storme Sixeas

Storme Sixeas

@stormestreet -

Tuck Shumack

Tuck Shumack

@tshumack -

Caitlin Mullaney

Caitlin Mullaney

@MullaneyWrites -

Lauren Bazel

Lauren Bazel

@LDBoater -

Karti Singh

Karti Singh

@karti_singh -

Marc Gerson

Marc Gerson

@MarcJGerson

Something went wrong.

Something went wrong.

![GlobalBiz's tweet card. Says Legislation Would Increase U.S. Economic Competitiveness WASHINGTON – Nancy McLernon, president and CEO of the Global Business Alliance (GBA), released […]](https://pbs.twimg.com/card_img/1991064493854523392/lAhfmXxS?format=jpg&name=orig)