Andreas Schulz

@ASchulz888

Curious about everything, and markets in particular. No financial advice here - please do your own due diligence. May trade securities mentioned any time.

You might like

This current washout is the kind of things that happens in markets every 4 or 5 years. There is a big "explosion" somewhere that causes great carnage. Today the epicenter is B2B SaaS. But these things usually do not stay neatly contained. There are always spillover effects...

It is probably the first time in the history of humanity that Walmart trades at 45 times forward P/E while Amazon trades at 21 times. What is happening!

Walmart is trading at double the forward P/E of Amazon

Of all the changes that $LUV has made, this is the most powerful and positive for customers. Well done Southwest! x.com/SawyerMerritt/…

NEWS: Southwest Airlines has just announced that it will install @Starlink across its entire fleet. The first Starlink-equipped aircraft will enter service this summer, and it will be available on more than 300 aircraft by the end of 2026. Starlink Wi-Fi will be free for all…

Bought more $NKTR at open. Should’ve done it yesterday, but really don’t have dry firepower and already hugely overweight the name. Had to move some stuff around to do so. After sleeping on it, the thing for me is that this asset has been insanely undervalued for a long time,…

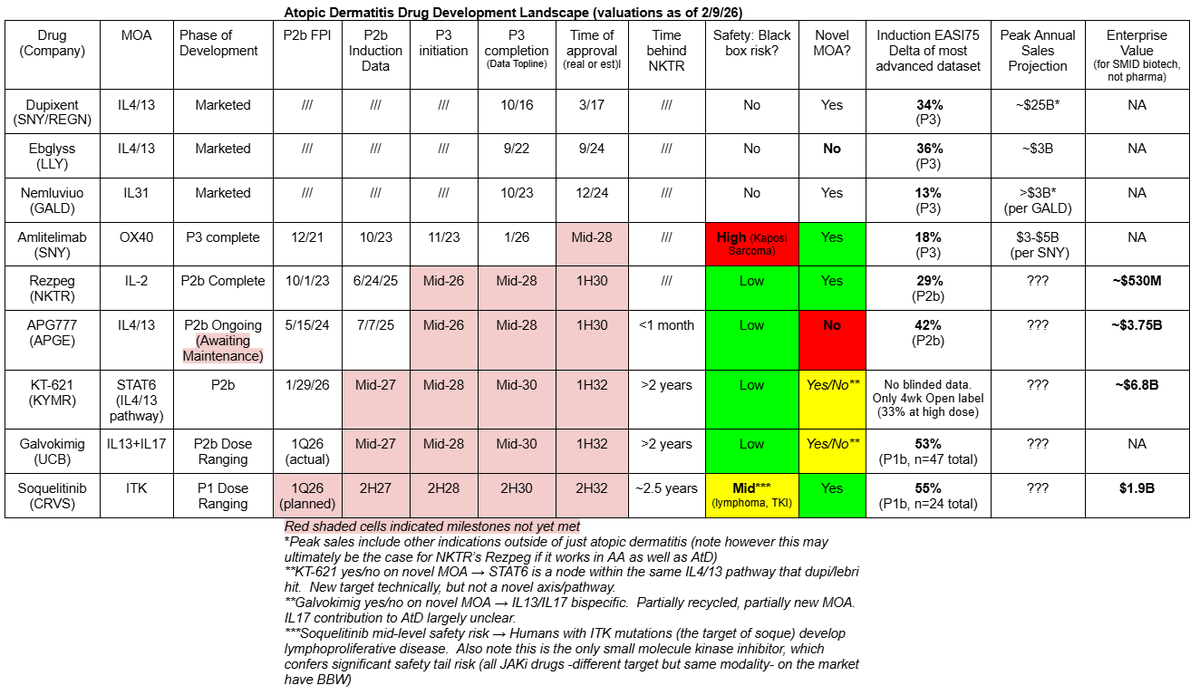

The table below is something I built and have been using lately to reaffirm to myself that $NKTR’s current valuation is just absolutely asinine. It shows that $NKTR is ahead of everyone on timeline as the next to market in AtD. It is also the only drug with both a unique MoA…

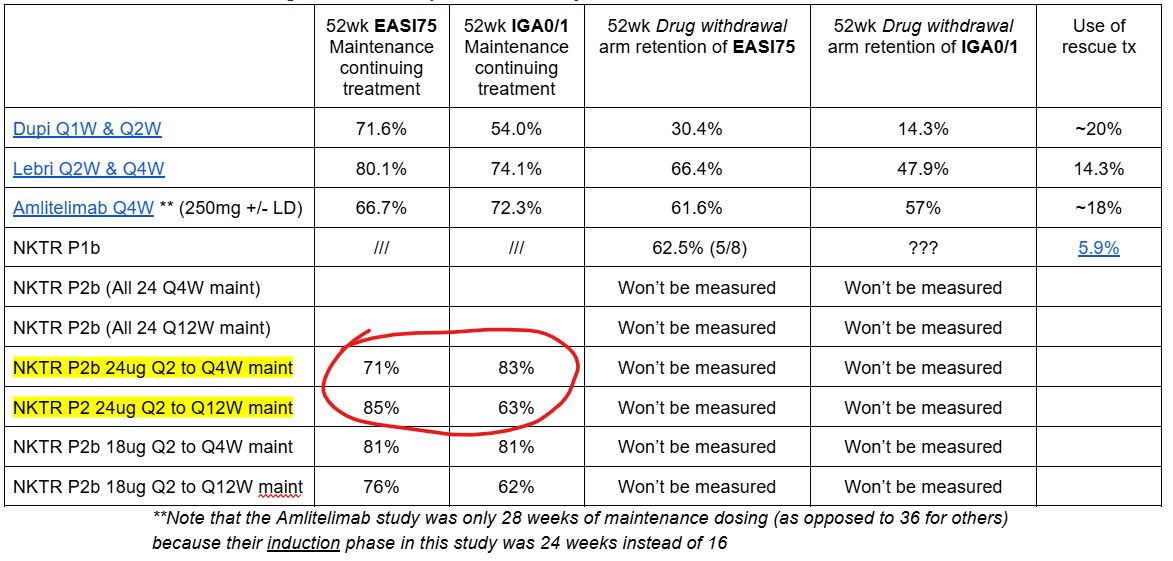

$NKTR We will get a lot more data/info than what is available in the PR, but what the PR shows is *very* good. Caveat emptor, these response retention rates are higher than Dupixent's...EVEN FOR Q12W DOSING of rezpeg. That's a big surprise to me given how management had seemed…

Sounds true to me. I have rarely felt busier or more productive than in the last 6 months... x.com/rohanpaul_ai/s…

A super interesting new study from Harvard Business Review. A 8-month field study at a US tech company with about 200 employees found that AI use did not shrink work, it intensified it, and made employees busier. Task expansion happened because AI filled in gaps in knowledge,…

This $nktr data exceeds expectations. I’m not back on my desk yet , so full review may have to wait but the at an initial glance they should definitely be able to raise on this and the valuation should fall in line with its peers $apge $kymr $crvs

$NKTR 71% and 83% of patients maintained EASI-75 responses and 85% and 63% maintained vIGA-AD 0/1 responses with 24 µg/kg monthly and quarterly dosing, respectively Meaningful improvement in responses observed across key efficacy endpoints at week 52 with both monthly and…

After much deliberation, I decided to exit my $PATH position with a small profit. I still believe the company will beat expectations near term, but there are many hard questions long-term. I simply have greater conviction in $LMND, $AMZN, and $ZETA. x.com/ASchulz888/sta…

I have mixed feelings on this thread. I like $PATH here, and it could easily outperform $LMND this year. But $LMND could 100x their business in my lifetime. No other portfolio company of mine has a shot at that. So why trade instead of all in $LMND? x.com/ASchulz888/sta…

That's one hell of a customer testimonial. Great job $ZETA. x.com/dsteinberg1000…

Hearing directly from customers about the impact they’re driving with @ZetaGlobal and our AI never gets old. This story from @TKOGrp (UFC and WWE) says it best, especially this line: “Zeta is the undisputed champion.” Proud of what our teams are building. We are the disruptor,…

$AMZN is just adding insult to injury at this point. How do you make a Super Bowl commercial about killing your own customers??? (With AI, no less...) youtube.com/watch?v=ha92_h…

youtube.com

YouTube

Chris Hemsworth thinks Alexa+ is scary good | Big Game Commercial

Today was an epic hedge fund de-grossing day. The kind you only see every few years. This is why many of the cleanest, best ideas are down most. When you liquidate, you get out of what you own - your best ideas.

First the prime targets of AI sell of (SaaS). Then yesterday stuff vaguely in the same neighborhood sells off (e.g. $BKNG, $EXPE). And now AI beneficiaries sell off (e.g. $LMND, $PLTR). The dominos are falling. It's like clockwork...

Slightly depressing, but probably pretty accurate... x.com/TMTLongShort/s…

Reflexivity is a beautiful thing. SaaS CFOs realize investors now care about FCF less SBC as a metric and start pulling back on stock comp. RSUs are underwater. AI-first startups are hiring talented engineers and still accruing VC dollars. Talented engineers at SaaS…

The amazing revenue divergence between $LLY and $NVO continues. The reason - a single super molecule in obesity: dual GLP-1 / GIP agonist tirzepatide. But who has a (likely) superior dual GLP-1 / GIP agonist in ph3? $VKTX $NVO - you got lucky that $PFE outbid you on $MTSR,…

$PFE's MET-097i ph2b results with 12.3% PBO adjusted weight loss after 28 weeks do not sound impressive. They did not report detailed AEs, but concerningly a few patients had severe nausea and vomiting. Dare I say they should have gone after $VKTX instead of $MTSR?

United States Trends

- 1. Deen N/A

- 2. Cronin N/A

- 3. Namjoon N/A

- 4. #River N/A

- 5. Tiki Ghosn N/A

- 6. #LCDLF6 N/A

- 7. Tom Noonan N/A

- 8. JT Toppin N/A

- 9. Arizona State N/A

- 10. UCLA N/A

- 11. Nebraska N/A

- 12. Vini N/A

- 13. Iowa N/A

- 14. Ash Wednesday N/A

- 15. June Carter N/A

- 16. Ramadan Mubarak N/A

- 17. Bobby Hurley N/A

- 18. $HACHI N/A

- 19. Pope N/A

- 20. Johnny Cash N/A

Something went wrong.

Something went wrong.