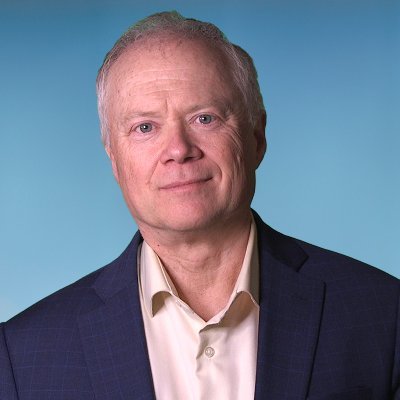

Addison Wiggin

@AddisonWiggin

Economics, Finance | NYT Bestselling Author | Filmmaker | Entrepreneur

You might like

The AI boom runs on a circular system: • #NVIDIA's Q3: $57.01B revenue • Data centers: $51.2B • #Mag7: 75% of market gains since 2022 • Big Tech cross-investing billions into each other’s AI If one giant sneezes, this whole thing goes down. Maybe the “#Microchip Era” ends…

Everyone thinks the future belongs to faster chips. What if the real breakthrough is no chip at all? #NVIDIA is worth $5T betting on the microchip era but some futurists say that era is already ending. If they’re right, AI won’t run on silicon… but on something far stranger.

The U.S. is entering the phase of a debt cycle where the interest bill grows faster than the economy itself. When interest outruns #GDP choices get ugly. When choices get ugly, politics gets desperate. And when #politics gets desperate… systems change. That’s the real story.

Jobs beat expectations but the internals are ugly. #Manufacturing: –6,000 Transport/Warehousing: –25,000 #healthcare: +43,000 Restaurants: +37,000 Wages up 3.8%, but slowing for low earners. 527,000 deportations tightening labor supply. Strong headline, weak foundation.

Washington is debating $2,000 ''#tariff rebate'' checks. Meanwhile… during the 43-day shutdown, U.S. debt surged $620B. That’s $14.5 billion added per day… pushing total debt to $38.1 trillion.

Everyone keeps waiting for ''the next big thing'' in AI… but the real breakthrough might be happening in money. A new kind of dollar is quietly spreading through global markets - faster, cheaper, borderless. Call it Dollar 2.0. And it could change everything.

Washington is debating $2,000 ''#tariff rebate'' checks. Meanwhile… during the 43-day shutdown, U.S. debt surged $620B. That’s $14.5 billion added per day… pushing total debt to $38.1 trillion.

#Bitcoin dipped under $90K last night- the first time since the April selloff. A full 30% correction has new BTC ETF investors entering their first ''crisis of faith.'' JPMorgan warns an AI downturn would hit crypto next. Whales disagree, they’re buying the dip with both…

Everyone thinks the future belongs to faster chips. What if the real breakthrough is no chip at all? #NVIDIA is worth $5T betting on the microchip era but some futurists say that era is already ending. If they’re right, AI won’t run on silicon… but on something far stranger.

#Bitcoin down 25% from its peak and its correlation with the #Nasdaq hit 0.80, the highest since 2022. If the pattern holds, tech stocks could be next in line for a correction Yet institutions are buying the dip. Harvard boosted its IBIT position by 257%. Markets love irony.

New housing data adds fuel to the 50-yr #mortgage debate: 📉 53% of U.S. homes fell in value this year, the largest share since 2012. 📉 Avg drop: 9.7% from peak. 📉 In Denver/Austin/Sacramento, 85–90% of homes are down. Does a 50-yr mortgage fix the crisis… or hide it?

Something’s brewing in AI and it’s not innovation. Behind the trillion-dollar headlines lies a debt bubble no one’s talking about. When it pops, the crash won’t start in housing… it’ll start in the #DataCenters.

655 U.S. companies have already gone #bankrupt this year, the most in 15 years. Not yet a “recession” but a perceptibly slow tightening of the vise. Credit conditions are stiff. Debt is heavy. Tariffs are pushing up costs. Consumers are fatigued. #TheFed may pause in Dec.

#GoldRate had one of its worst days of the year - plunging nearly $140/oz in a single session. Because the odds of a December #Fed rate cut are fading fast. A cautious Fed, a cooling labor market, and a gov data blackout have investors flying blind, even gold couldn’t escape.

#TheFed might cut rates again in December, not because inflation is “under control,” but because the U.S. labor market is cracking. If #Powell moves too late, he risks breaking the economy. If he moves too soon, he risks igniting #inflation again.

United States Trends

- 1. TOP CALL 3,630 posts

- 2. #BaddiesUSA 64.4K posts

- 3. #centralwOrldXmasXFreenBecky 451K posts

- 4. SAROCHA REBECCA DISNEY AT CTW 470K posts

- 5. AI Alert 1,231 posts

- 6. #LingOrmDiorAmbassador 238K posts

- 7. Rams 29.9K posts

- 8. #LAShortnSweet 23.6K posts

- 9. Market Focus 2,485 posts

- 10. Check Analyze N/A

- 11. Token Signal 1,664 posts

- 12. Scotty 10.4K posts

- 13. Vin Diesel 1,521 posts

- 14. #MondayMotivation 6,460 posts

- 15. Chip Kelly 9,050 posts

- 16. Ahna 7,722 posts

- 17. sabrina 65.4K posts

- 18. Raiders 68.4K posts

- 19. DOGE 177K posts

- 20. Stacey 24.2K posts

You might like

-

BCard 🏴💳🐰

BCard 🏴💳🐰

@getbcard -

The Daily Reckoning

The Daily Reckoning

@DailyReckoning -

Frank Holmes

Frank Holmes

@bulldogholmes -

GRANT'S

GRANT'S

@GrantsPub -

The Gold Report

The Gold Report

@SWGoldReport -

Revue éléments

Revue éléments

@Revue_elements -

Vincent Deluard

Vincent Deluard

@VincentDeluard -

Tyrone V. Ross Jr.

Tyrone V. Ross Jr.

@TR401 -

DollarCollapse.com

DollarCollapse.com

@DollarCollapse -

Igbo People

Igbo People

@Igbopeople -

Daniel Denning

Daniel Denning

@danielKdenning -

Mazuma Money

Mazuma Money

@MazumaGB -

Sean Brodrick

Sean Brodrick

@SeanBrodrick -

Immutep

Immutep

@Immutep

Something went wrong.

Something went wrong.