Afrifocus Securities

@Affsec

Afrifocus Tweets are based purely on market observations and news alerts. Tweets should not be construed as advise.

Was dir gefallen könnte

Time to look at Naspers and Compagnie Financiere Richemont SA and take advantage of the recent rally? #JSE #NPN #CFR #BREAKING NEWS #EQUITIES

1. Best Platform award 2024 2.We came 2nd on both Top CFD Provider & Traditional Investor award,3.Congratulations to Fernando Carlos Santos Moreira on scooping the Top Individual Relationship manager award and Sam Nganga Jr. occupying the Third spot. #KruthamAwards #JSE

Daily Bar with 21-Day RSI and volume traded Afrimat looks like picking up some technical support after recent decline. The 21-day RSI is rising out of oversold territory and above average volume have been traded at lows recently indicating some good uptake into the pullback.

IMP - IMPLATS, a buy signal generated in the bear channel, target R87

APN - ASPEN PHARMA - looking at support and reversal at R161

Asset managers all going negative on platinum producers. Platinum and gold price below.

RENERGEN - nice recovery off the lows. I wonder how much of the recent volatility was due to margin calls on SSFs not being met?

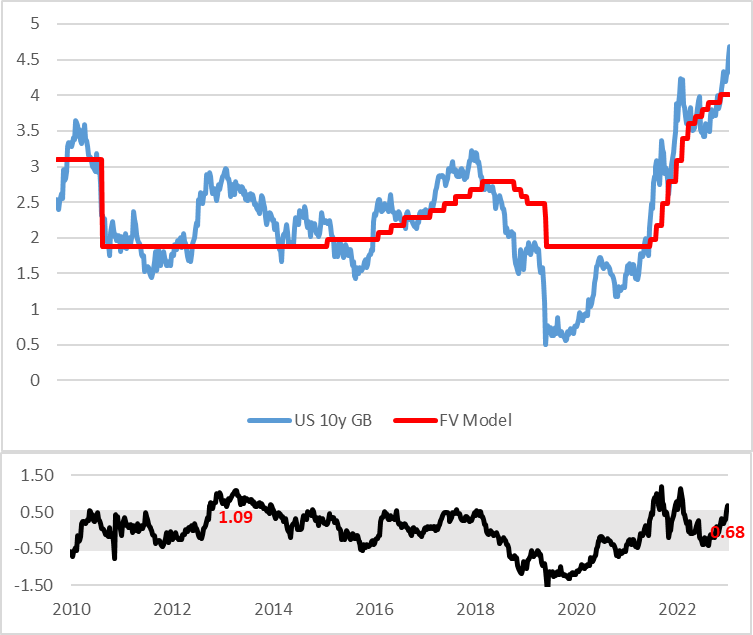

TENCENT - just following the US 10 year, for whatever reason.

Platinum and gold used to trade at parity many moons ago. Today the gap is over $1000 per oz. What if the market starts pricing Pt upwards? Got to own some at these levels I recon.

RENERGEN - who bought the dip? And who panic sold?

Renergen - this doesnt sound too negative ,does it? And the "mineral" helium is a byproduct. renergen.co.za/official-respo…

renergen.co.za

Renergen's Official Response to Recent Developments | Renergen

Renergen's official response addresses recent developments and concerns, outlining company actions and future plans. Read the full statement for more details.

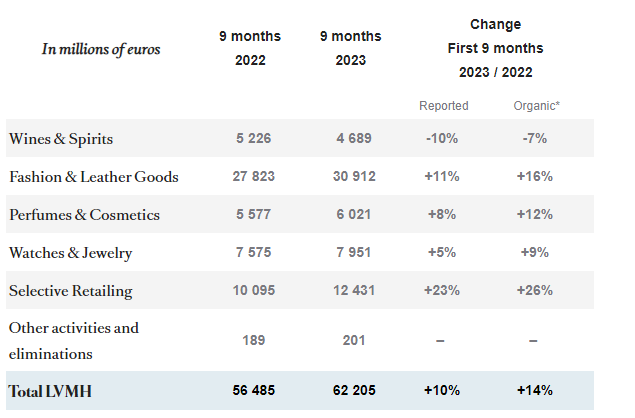

LVMH "disappoints" on alcohol sales. RICHEMONT falls 4% in sympathy. Why?

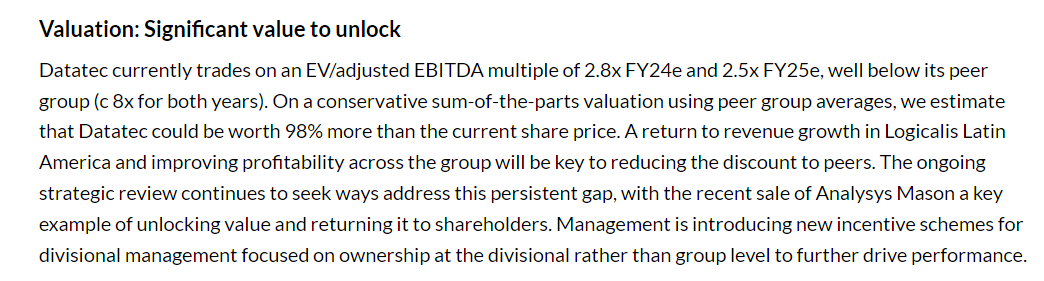

DATATEC - a very decent recent trading update. Lots of value unlocked past few years. Commentary below indicating more upside.

RENERGEN - big disconnect between the share and the recent rally in natural gas prices. Looks more like a buy than a sell at current levels.

RICHEMONT - entry level imo. Top analysts targeting R3400. Results due in a month's time

RENERGEN - a FOMO blast from the past. Back at R16. Whatever happened to the R60+ valuations, R1bn CEF investment and Nasdaq listing being touted?

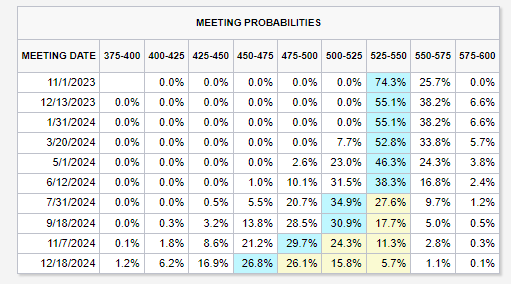

All eyes on the US 10 year and the impact on risk assets. Our valuation indicating that the market discounting 100bps hike at current levels - fair value closer to 4% FED futures indicating that rates have peaked, with a first cut estimated 24Q3. Buy the dip imo.

Industrial metals rel S&P500 - looks like a bottom area for metals.

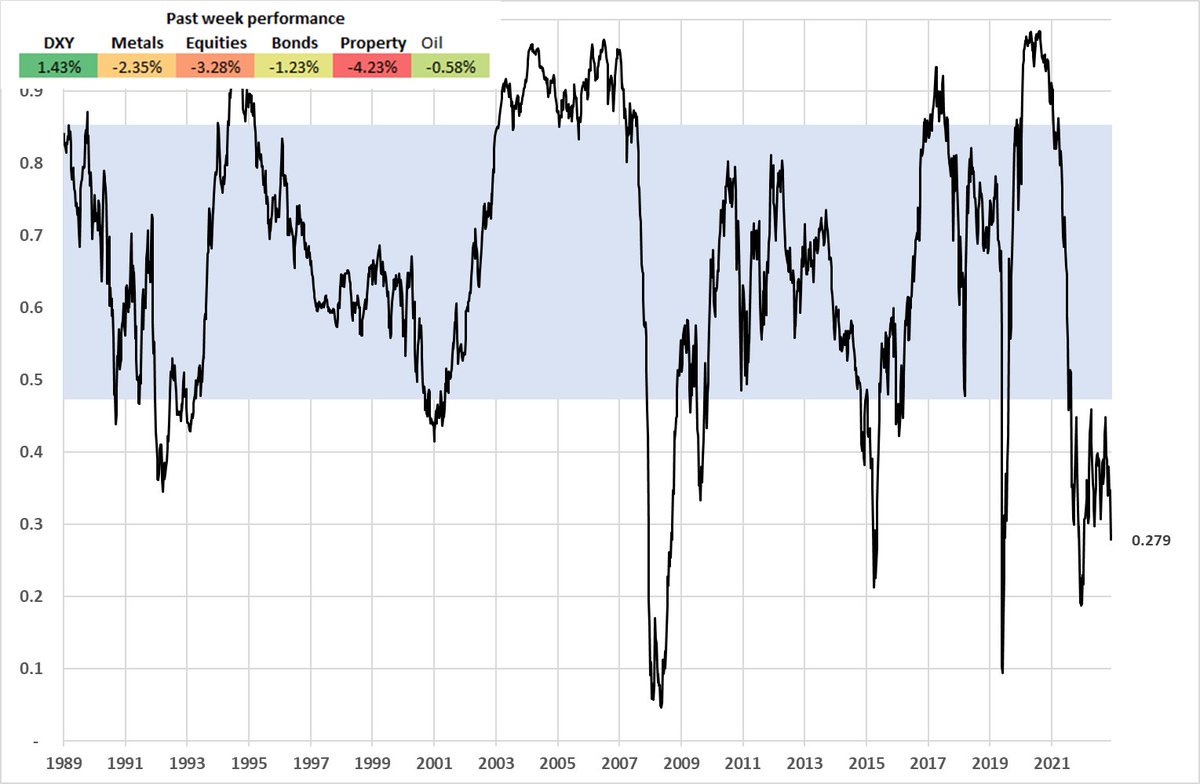

Our global risk aversion index - bloodbath in risk-assets past week. High interest rates resulting in excessive risk aversion in the markets. Longer-term however very bullish on risk assets. Buy the dips.

United States Trends

- 1. Casey Mears N/A

- 2. Ole Miss N/A

- 3. John Wick N/A

- 4. Castlevania N/A

- 5. State of Play N/A

- 6. #thepitt N/A

- 7. God of War N/A

- 8. Silent Hill N/A

- 9. #NASCAR N/A

- 10. Adam Silver N/A

- 11. Ousmane Dieng N/A

- 12. Konami N/A

- 13. Louie N/A

- 14. Lajoie N/A

- 15. Mikayla Blakes N/A

- 16. Olivia Miles N/A

- 17. Gwendolyn Beck N/A

- 18. Nanos N/A

- 19. Vandy N/A

- 20. The NCAA N/A

Was dir gefallen könnte

-

tradingguru

tradingguru

@tradingguru17 -

Smalltalkdaily Research

Smalltalkdaily Research

@smalltalkdaily -

The Passive Income Guy

The Passive Income Guy

@hazelwood_dave -

Schalk Louw | Mr Louwcal 🇿🇦

Schalk Louw | Mr Louwcal 🇿🇦

@SchalkLouw -

Herenya Capital Advisors

Herenya Capital Advisors

@HerenyaCapital -

CapitalOnePartners

CapitalOnePartners

@CapOnePartners -

TradingMzansi 🇿🇦

TradingMzansi 🇿🇦

@TradingMzansi -

Dylan Bradfield

Dylan Bradfield

@DilBradly -

Keith McLachlan

Keith McLachlan

@keithmclachlan -

Marlie Chunger

Marlie Chunger

@JSE_Invest -

Josh Viljoen

Josh Viljoen

@thejoshviljoen -

GregKatzenellenbogen

GregKatzenellenbogen

@GregKatzSPI -

Rod Lowe

Rod Lowe

@RodloweLowe -

GraemeB

GraemeB

@Graeme_AB -

Nick Kunze

Nick Kunze

@NickKunze2

Something went wrong.

Something went wrong.