AfterHoursWire

@AfterHoursWire

We tweet news that breaks after the market closes. Critical news breaks during the weekends. It is getting harder track the chaos. We are streamlining it here..

BREAKING: Open AI in talks to power Amazon's Alexa. OpenAI is discussing a commercial agreement with Amazon to develop customized models the e-commerce giant could use to power its artificial intelligence products, including its Alexa voice assistant. It isn’t clear how much of…

BREAKING: $TSMC will start making advanced 3-nanometer chips in Japan, upgrading from an original plan to produce 7nm chips. Chipmaker for Nvidia Corp. and Apple Inc. has decided to adopt cutting-edge technology for its second wafer fabrication plant in Kumamoto

BREAKING: $MP: Secretary of State Marco Rubio hosted the inaugural Critical Minerals Ministerial to stabilize critical mineral supply, including rare earths, lithium, and copper. Despite government efforts to support the critical minerals industry, related stock prices fell,…

BREAKING: $SMCI rallies 13% after reporting fiscal second-quarter adjusted earnings of 69 cents a share and revenue of $12.7 billion. The company’s revenue increased 123% year-over-year, exceeding analyst expectations of $10.4 billion. Gross margin for the quarter was 6.3%, a…

BREAKING: $GOOGL reported solid fourth-quarter earnings results. Its shares were down about 5% in after-hours trading. Earnings-per-share were $2.82, above Wall Street’s consensus estimate of $2.63, rising from $2.15 last year. Revenue for the quarter reached $113.8 billion,…

JUST IN: The Bank of England is expected to maintain interest rates at 3.75%, having lowered them by a quarter of a percentage point in December. The European Central Bank is anticipated to keep borrowing costs at 2% for the fifth consecutive meeting. Euro zone inflation…

“Software as a Shock: The Software Liquidity Signal in Private Credit” “…private credit only looks stable as long as marks hold and liquidity stays calm. Once those assumptions crack, bondholders start asking the obvious question—what collateral is really there, and what are…

It’s getting there. We just spoke to an industry source. Now, we’ve begun to dig deeper. More to our clients when enough analysis is gathered. Picking the entry is as critical as picking the exit.

$ORCL rang the NYSE opening bell this morning as their stock selloff accelerates over fears of potential insolvency.

ICYMI: $AFRM has signed exclusive distribution deals to get its buy now, pay later loans on Intuit's Quickbooks Payments and Expedia's platform. It also will be the default BNPL provider on Bolt's platform. What's at stake: Mid-market and enterprise level vendors are key to…

Pre-Market BREAKING: $BOA auto originations rose in the fourth quarter as the bank eyes expanding the vehicles eligible for 84-month-term financing amid affordability concerns. “When we originally launched [the 84-month program], it was [for vehicles aged] 2 years, then we went…

EARNINGS WATCH: $PEP reported fourth-quarter 2025 core earnings per share of $2.26 on net revenue of $29.34 billion, exceeding analyst expectations. $PEP plans to cut prices by up to 15% on some products and approved a 4% dividend increase and a new $10 billion stock buyback.

EARNINGS WATCH: $PFE slipped in PM trading Tuesday as 4Q blew past Wall Street estimates. Adjusted earnings came to 66 cents a share, beating the 57 cents forecast. Quarterly revenue of $17.6 billion topped analysts’ calls for $16.8 billion. However, guidance was short of…

$MRK fourth-quarter adjusted earnings of $2.04 a share and sales of $16.4 billion exceed analysts’ projections. Merck’s 2026 forecast for adjusted earnings ($5 to $5.15 a share) and sales ($65.5 billion to $67 billion) are below analysts’ expectations. Shares down less than 1%…

Breaking: $PLTR forecast revenue for fiscal 2026 that significantly exceeded Wall Street expectations, a boost for the data analytics company after its shares have gotten off to a lackluster start so far this year. Annual revenue will be between $7.18 billion and $7.2 billion,…

BREAKING: Oracle raises $25bn in bond offering despite concerns over rising debt. The blockbuster bond deal, which contains eight parts of debt with maturities ranging from three to 40 years, attracted an order book of $127bn during its peak, according to people familiar with…

🚨 The invisible utility crisis behind the AI boom that no one is talking about. The reliability conversation is no longer hypothetical: the North American Electric Reliability Corporation (NERC) is modeling a future where demand is rising faster than the grid is being built to…

BREAKING: $F denies collaboration with Chinese EV maker, Xiaomi and BYD. U.S. EV sales dropped 36% in the fourth quarter, with Tesla’s U.S. sales down 15% year over year. Americans bought 234,171 EVs in the fourth quarter, down 36% from a year earlier. The ending of the $7,500…

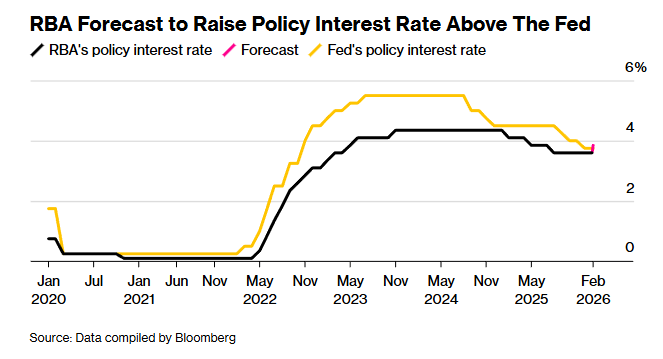

🚨 BREAKING: Australia's central bank may raise interest rates to address resurgent inflation, less than six months after it last cut rates. Economists expect the Reserve Bank to increase its cash rate by a quarter-percentage point to 3.85% due to stubborn price pressures and a…

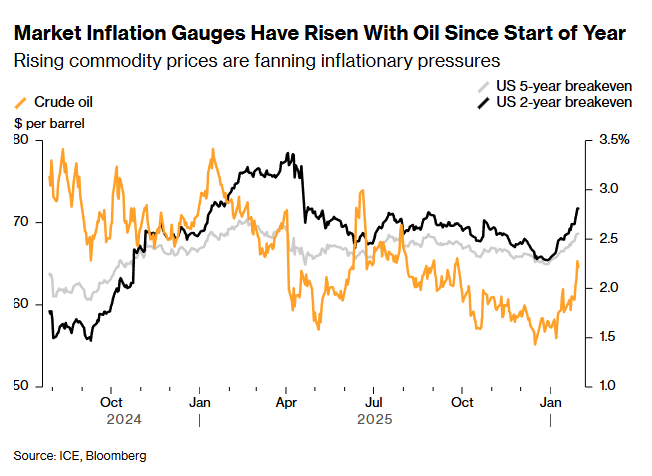

🚨 Money managers at BlackRock Inc., Bridgewater Associates and Pacific Investment Management Co. are preparing for a potential fresh bout of inflation. As @UnicusResearch continues to state, inflation is persistent and it is a problem to the lower K. bloomberg.com/news/articles/…

United States Trends

- 1. Good Thursday N/A

- 2. Porzingis N/A

- 3. Kuminga N/A

- 4. Warriors N/A

- 5. Dalen Terry N/A

- 6. Skubal N/A

- 7. Thandeka N/A

- 8. Podz N/A

- 9. Hield N/A

- 10. Gonzaga N/A

- 11. Cristiano Ronaldo N/A

- 12. #AEWDynamite N/A

- 13. Yabu N/A

- 14. $BFS N/A

- 15. Neymar N/A

- 16. GM CT N/A

- 17. POTS N/A

- 18. #DubNation N/A

- 19. Dunleavy N/A

- 20. Ty Jerome N/A

Something went wrong.

Something went wrong.