Codify AI backtesting

@AiBacktesting

Find optimal setups to trigger daily stock option strategies with to the second bid-ask granularity and greek exposure analysis.

$DLTR set to open 5% higher on Dec 3 after Q3 earnings beat! Anticipate EPS $1.15 (vs. $1.09 est) on 3.8% comp sales growth & post-Family Dollar efficiencies. Revenue: $4.75B (vs. $4.70B est). Holiday momentum to drive upside! #Stocks #Trading

$CRM Earnings Alert: Expect a strong Q3 FY2026 beat on Dec 3, 2025 – forecasting EPS $2.95 (vs consensus $2.85) & revenue $10.4B (vs $10.27B), driven by AI adoption & cloud demand. Stock poised to open 6% higher on Dec 4. Bullish on overlooked AI momentum! #Stocks #Earnings

Expecting $SNOW to deliver a strong earnings beat on Dec 3, 2025! Forecast: EPS $0.35 (vs consensus $0.31), Rev $1.22B (vs $1.18B). Fueled by AI demand & 75% historical beat rate. Stock to open +5% on Dec 4. #Stocks #Earnings

Expecting $CRWD to deliver a strong earnings beat on Dec 2 after close. Consensus EPS: $0.94, we forecast $1.00+ (>6%) Revenue: $1.213B est, upside to $1.25B (~3%) Fueled by AI cyber demand, NVIDIA ties & 22%+ ARR growth. Dec 3 open: +5% from Dec 2 close. #Stocks #Earnings

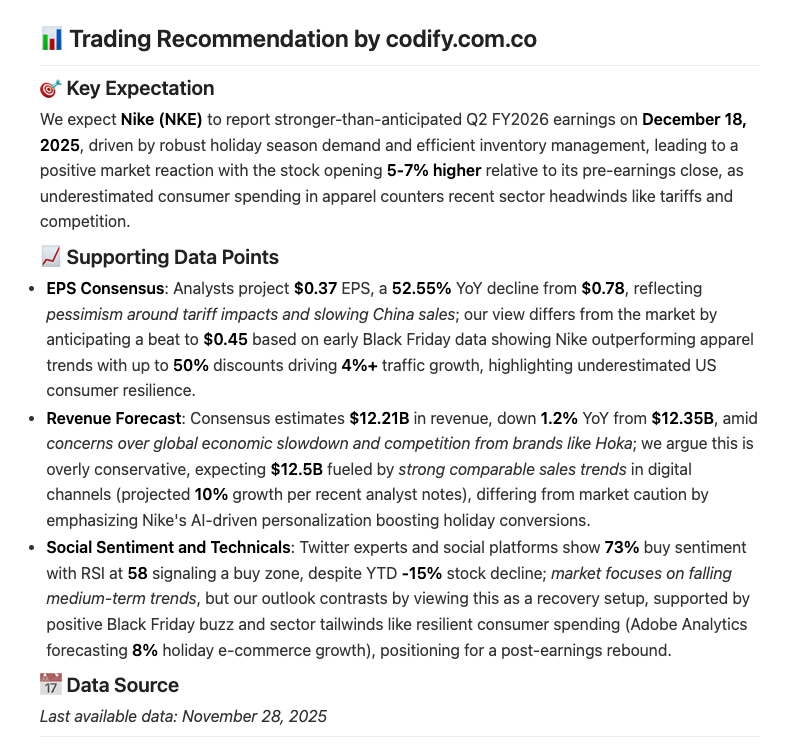

Bullish on $NKE Q2 FY2026 earnings Dec 18, 2025! Expect EPS beat to $0.45 (vs consensus $0.37, down 52.55% YoY) & revenue $12.5B (vs $12.21B, -1.2% YoY), fueled by strong holiday demand & 10% digital growth. Stock to open 5-7% higher on positive reaction. #Stocks #Earnings

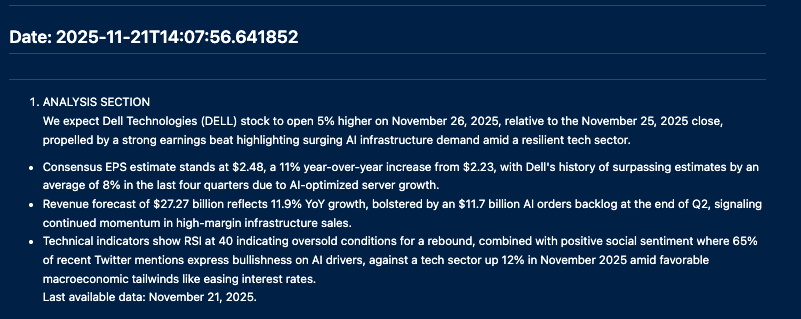

Hey folks, Dell's earnings hit next week – AI servers are on fire! Expect a 5% increase at market open as Dell crushes earnings estimates due to booming demand. #DELL #AIEarnings #StockMarket

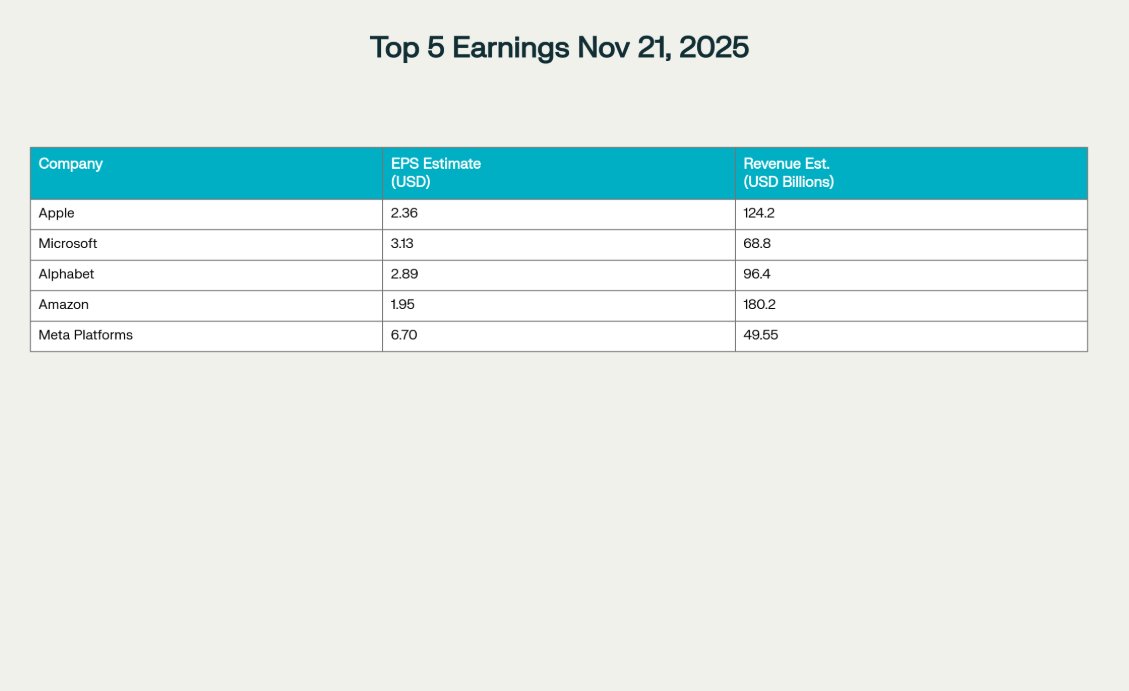

🚨 Big day for earnings tomorrow! Top 5 companies reporting: Apple , Microsoft , Alphabet , Amazon , and Meta Platforms . Check out consensus estimates for EPS & revenue. Which results are you watching most closely? 📊 #Earnings #Stock

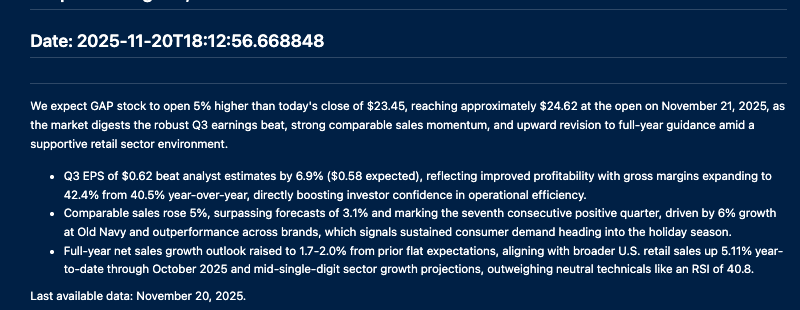

$GPS set to open +5% at $24.62 🚀 Why? They crushed Q3: • EPS $0.62 vs $0.58 est (+6.9%) • Gross margin up to 42.4% • Comp sales +5% (Old Navy +6%) • FY sales outlook RAISED

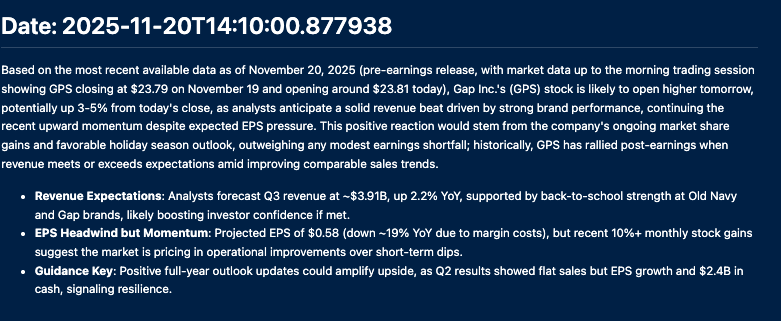

$GPS might rally even with a weak EPS. EPS est: $0.58 (–19% YoY). But revenue? $3.91B expected (+2.2%). Old Navy traction. $2.4B cash. Holidays coming. Market’s not betting on perfection—just progress. When fear fades and momentum sticks… price follows.

United States Trends

- 1. #SpotifyWrapped 64K posts

- 2. Chris Paul 18.2K posts

- 3. Clippers 27.7K posts

- 4. #NSD26 9,788 posts

- 5. Good Wednesday 31.3K posts

- 6. #WednesdayMotivation 3,647 posts

- 7. Hump Day 11.6K posts

- 8. National Signing Day 3,971 posts

- 9. Nashville 32.6K posts

- 10. #Wednesdayvibe 2,014 posts

- 11. Happy Hump 7,684 posts

- 12. Wordle 1,628 X N/A

- 13. #PutThatInYourPipe N/A

- 14. Wonderful Wednesday 6,237 posts

- 15. Welcome Home 15.5K posts

- 16. TOP CALL 10.9K posts

- 17. The BIGGЕST 310K posts

- 18. Somalis 105K posts

- 19. Fisherman 11.5K posts

- 20. FELIX LV VISIONARY SEOUL 29.5K posts

Something went wrong.

Something went wrong.