AlgoIndex

@AlgoIndexCom

http://algoIndex.com — Daily detailed analyses from professional traders for S&P 500 (ES), Nasdaq (NQ), Gold (GC), and OIL (CL) futures

Have you ever wondered why the prices of the S&P 500 or Nasdaq move rapidly in the second after a news release occurs during scheduled events? What actually happens in that “one second”: 1. Machines read the release, not humans. For scheduled data (CPI, UoM, payrolls, etc.), the…

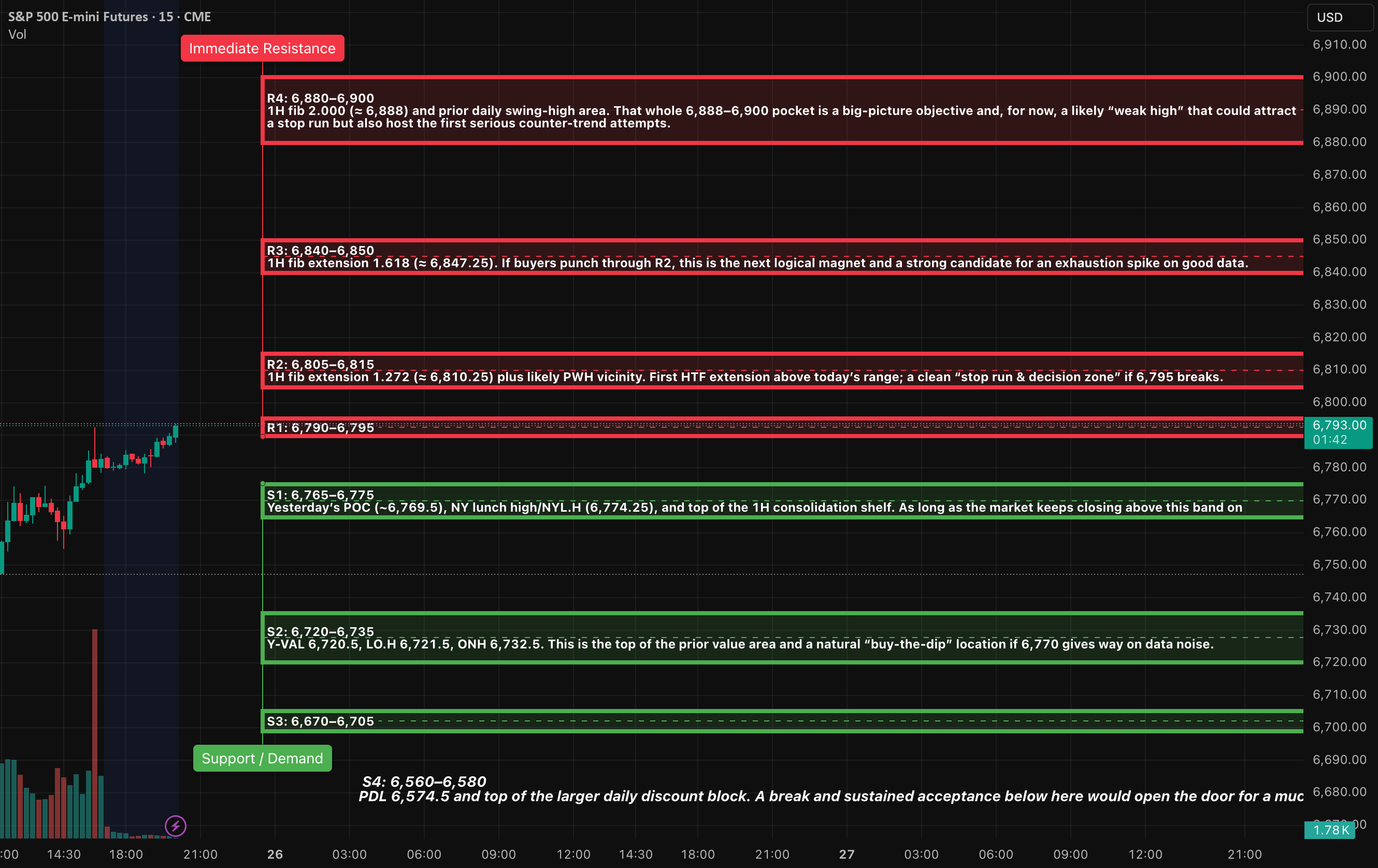

ES (SPX, SPY) Analysis, Levels, Setups for Wed (Nov 26) - #ES1! TradingView tradingview.com/chart/ES1!/C5D… #SPX #SPY #trading #futurestrading

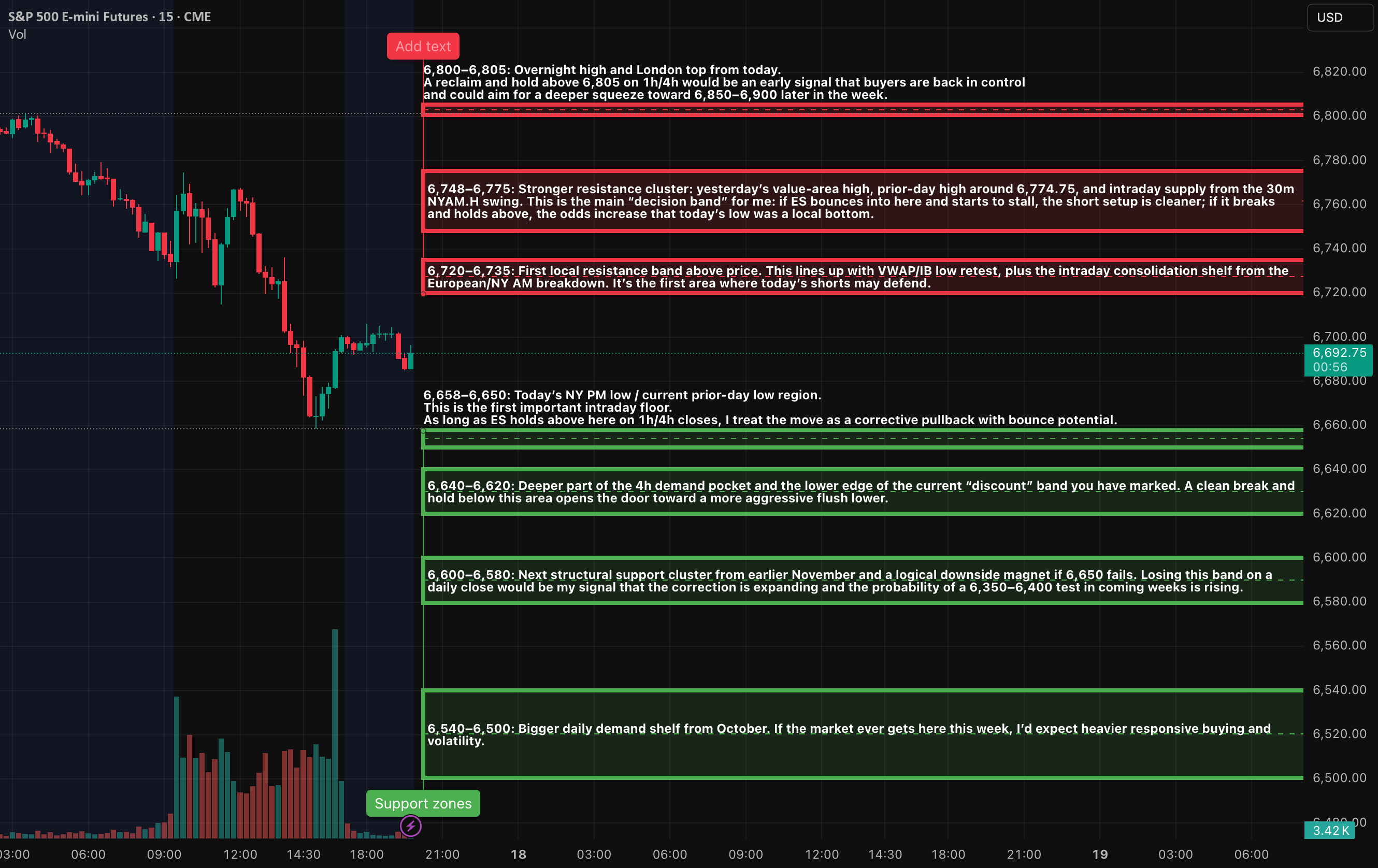

Check out my #ES1! analysis on @TradingView: tradingview.com/chart/ES1!/WVU… #SPX #SPY #TradingSetup

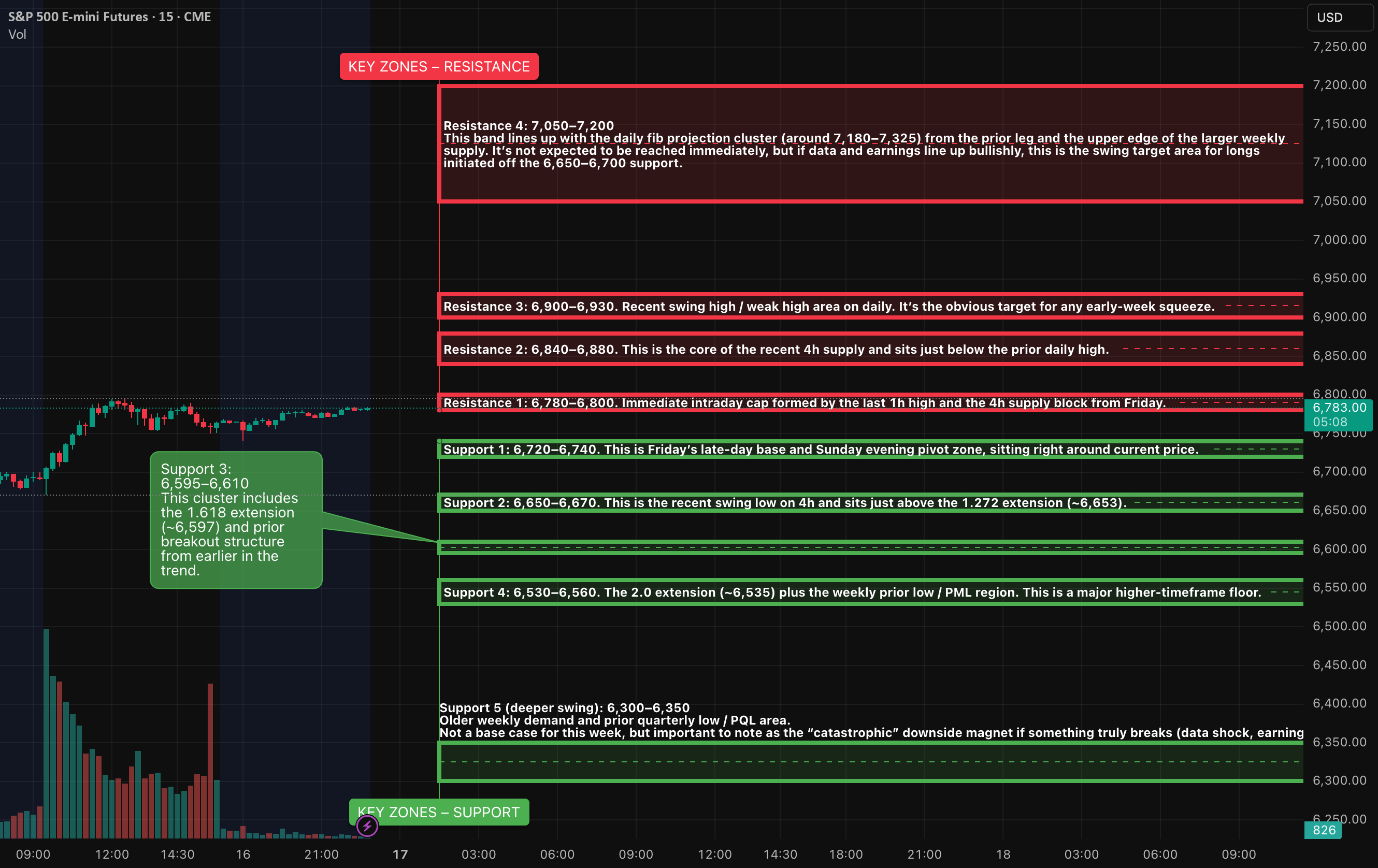

Check out my #ES1! analysis on @TradingView: tradingview.com/chart/ES1!/pPS… #SPX500 #SPX #SPY #TradingSetup

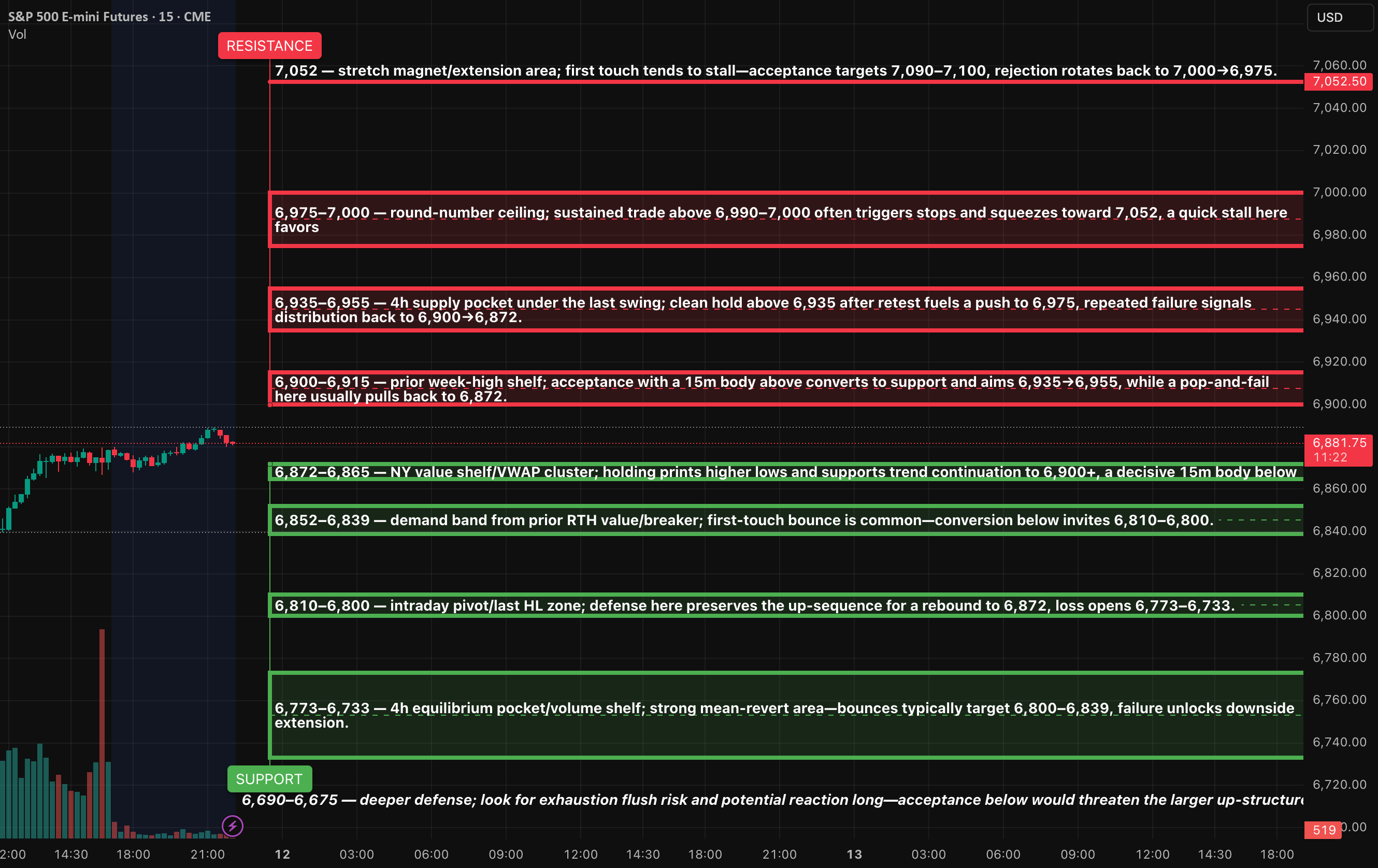

Check out my #ES1! analysis on @TradingView: tradingview.com/chart/ES1!/p2E… #SPX #SPY #TradingSignals #futurestrading

tradingview.com

ES (SPX, SPY) Analysis, Levels, PA Forecast, Setups Fri (Nov 21) for CME_MINI:ES1! by MyAlgoIndex

Analyzing Today’s Sharp Market Decline The significant selloff observed today was not an arbitrary event. The day began with a robust rally following another impressive earnings report in the AI-chip...

Market Analysis: S&P 500 Futures Face Headwinds Amid Corrective Phases As we approach tomorrow’s trading session, S&P 500 futures (ES) find themselves precariously positioned at the prior daily higher-low zone following a notable downward extension. While short-term conditions…

Check out my #ES1! analysis on @TradingView: tradingview.com/chart/ES1!/ISJ… #TradingCommunity #SPX #SPY #futurestrading

Check out my #ES1! analysis on @TradingView: tradingview.com/chart/ES1!/hlg… #SPX #SPY #TradingSetup

Check out my #ES1! analysis on @TradingView: tradingview.com/chart/ES1!/Xbl… #SPX #SPY #tradingstrategy

tradingview.com

ES (SPX, SPY) Analysis, Levels, Setups, for Fri (Nov 14th) for CME_MINI:ES1! by MyAlgoIndex

Today’s session revealed a marked risk-off sentiment as the market began to discipline leading sectors, notably large-cap tech, AI, semiconductors, and high-beta growth stocks. This correction...

Check out my #ES1! analysis on @TradingView: tradingview.com/chart/ES1!/tCv… #SPX #SPY #futurestrading

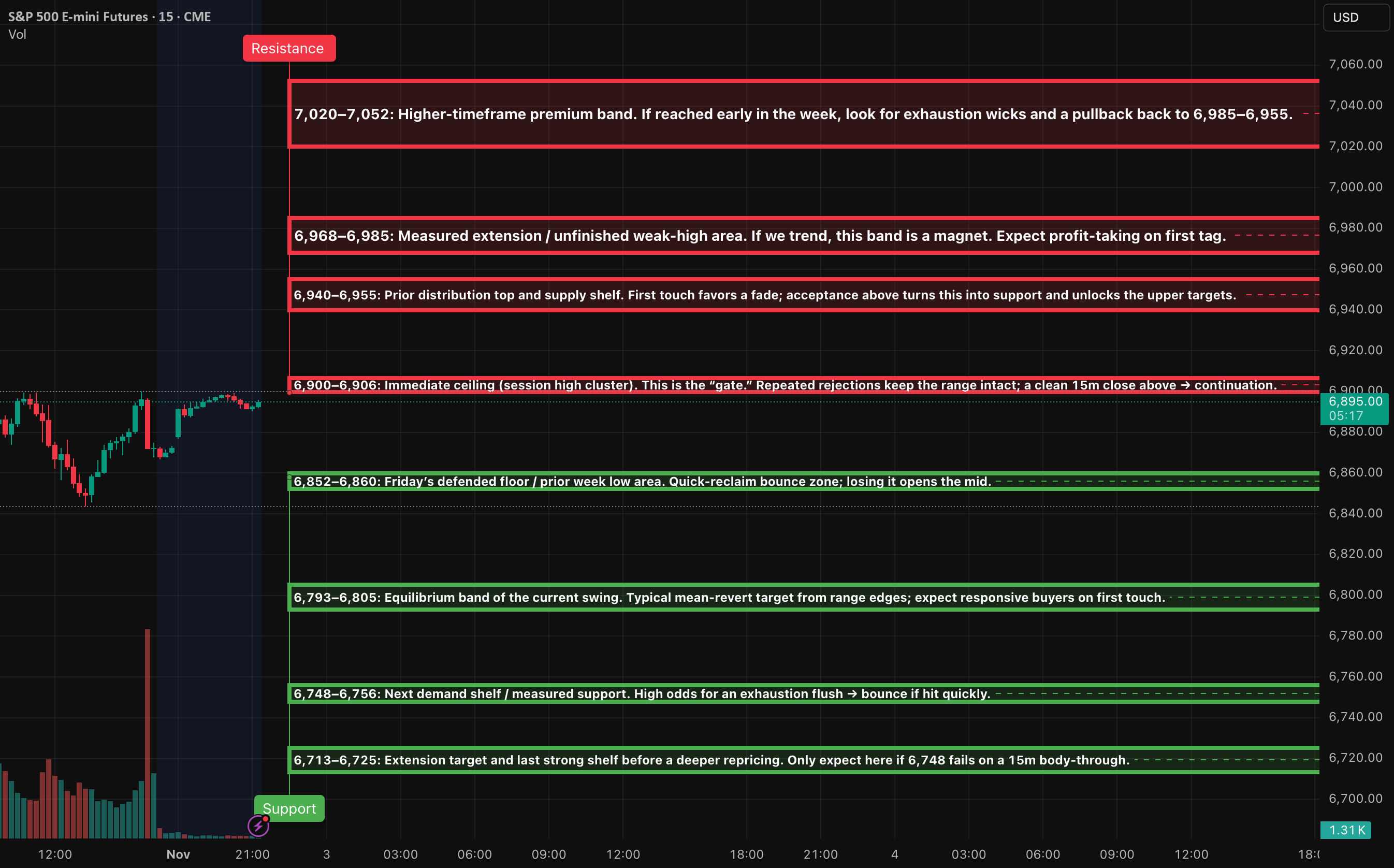

tradingview.com

ES (SPX, SPY) Analysis, Levels, Setups for Thu (Nov 13th) for CME_MINI:ES1! by MyAlgoIndex

HTF Analysis Daily Chart: The overall trend remains bullish. Currently, the price is situated near the upper range, just below the previous swing high in the 6,960–6,980 zone. The market structure is...

Check out my #ES1! analysis on @TradingView: tradingview.com/chart/ES1!/rki… #SPX #SPY #tradingstrategy #TradingCommunity

Check out my #ES1! analysis on @TradingView: tradingview.com/chart/ES1!/bhl… #SPX #SPY #tradingstrategy

Check out my #ES1! analysis on @TradingView: tradingview.com/chart/ES1!/EGx… #SPX #SPY #tradingstrategy

Check out my #ES1! analysis on @TradingView: tradingview.com/chart/ES1!/sJr… #SPX #SPY #tradingstrategy #futurestrading

tradingview.com

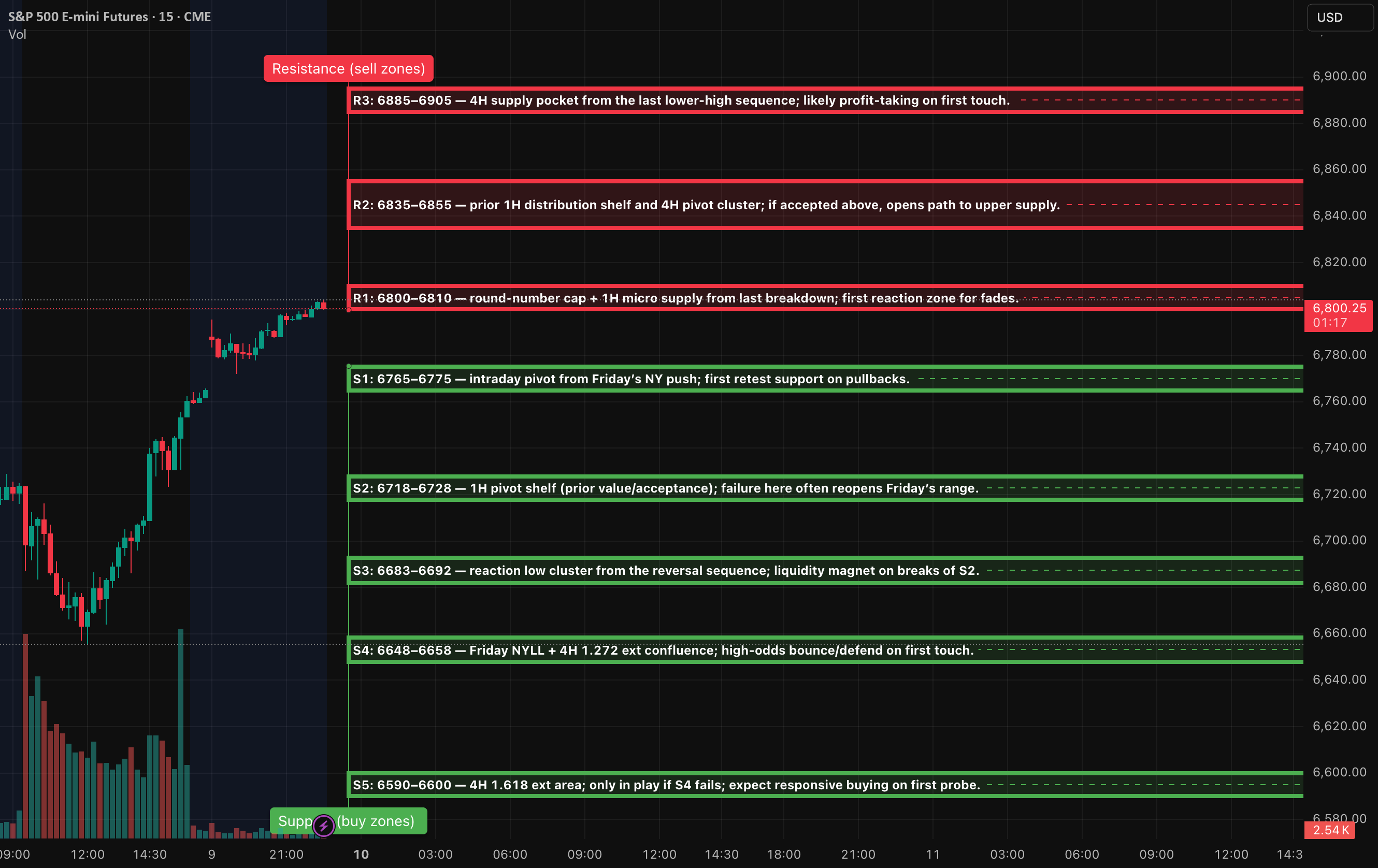

ES (SPX, SPY) Key Levels, Analysis and Setups for Fri (Oct 7th) for CME_MINI:ES1! by MyAlgoIndex

EVENTS (ET, unaffected by shutdown): 3:00am NY Fed Williams speech; 7:00am Fed Vice Chair Jefferson speech; 10:00am Univ. of Michigan Consumer Sentiment (prelim); 2:00pm Fed G.19 Consumer Credit....

Check out my #ES1! analysis on @TradingView: tradingview.com/chart/ES1!/XPw… #SPX #SPY #TradingSetup #futurestrading

tradingview.com

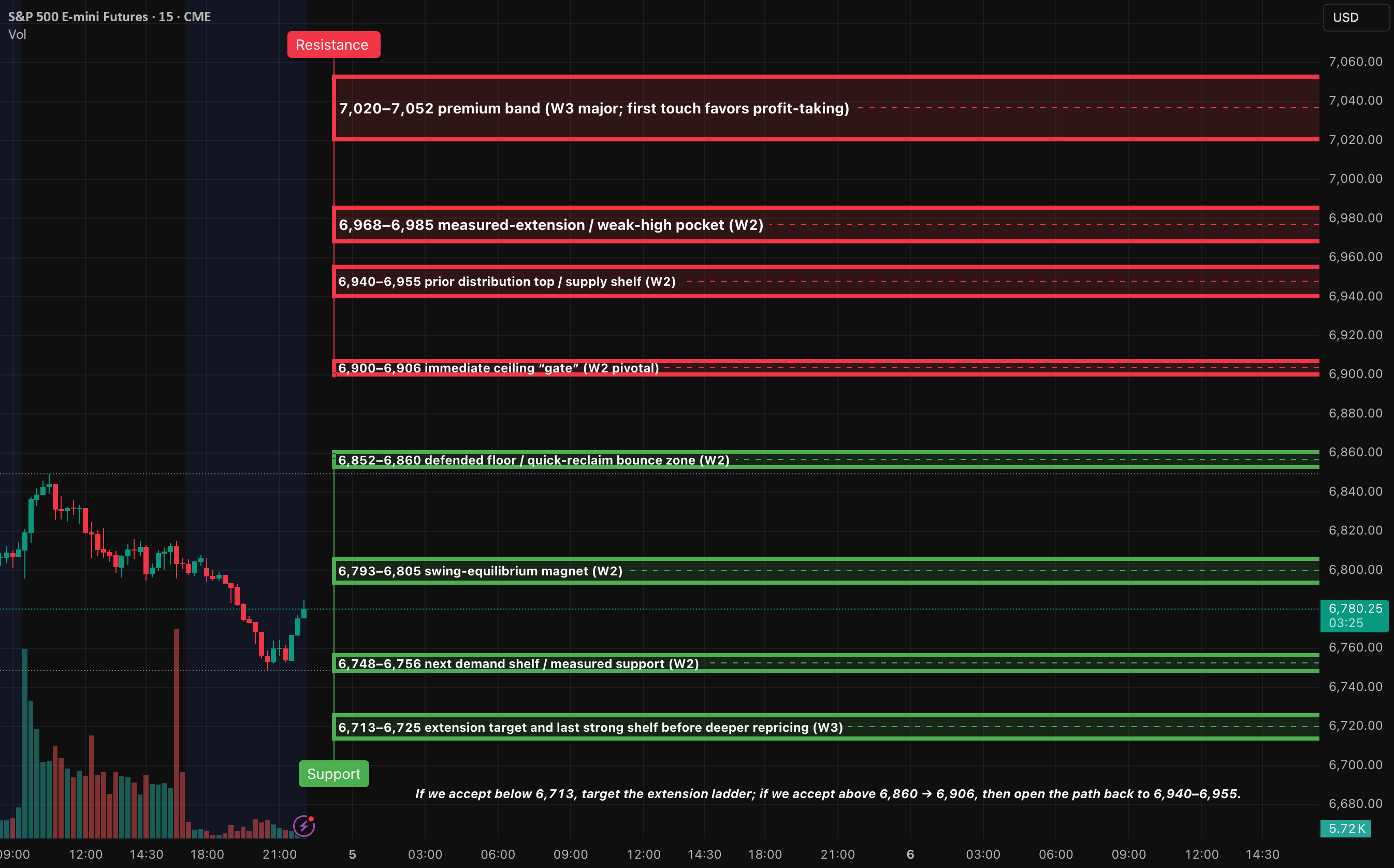

ES (SPX, SPY) Analysis, Key Zones, Setups for Thu (Nov 6) for CME_MINI:ES1! by MyAlgoIndex

The daily trend has softened following the formation of a lower high. Analysis of the 4-hour chart indicates a bounce that encountered resistance near the 6860–6870 range, subsequently retreating to...

Check out my #ES1! analysis on @TradingView: tradingview.com/chart/ES1!/d1a… #SPX #SPY #tradingstrategy

ES (SPX, SPY) Analysis, Key Zones, Setups for Tue (Nov 4th) - #ES1! TradingView tradingview.com/chart/ES1!/NXc… #tradingfutures #traders #SPX #SPY

Check out my #ES1! analysis on @TradingView: tradingview.com/chart/ES1!/UoZ… #SPX #SPY #TradingSignals #trading #traders

Check out my #ES1! analysis on @TradingView: tradingview.com/chart/ES1!/6hk… #SPX #SPY #TradingSignals #futurestrading

tradingview.com

ES (SPX, SPY) Analysis, Key Zones, Setups for Fri (Oct 31st) for CME_MINI:ES1! by MyAlgoIndex

Kill-zones (ET): NY AM 09:30–11:00; manage 12:00–13:00; NY PM 13:30–16:00. Event (Fri): 9:45 ET Chicago PMI (unaffected by shutdown). Upside continuation (LONG): 6,910 flips to support with a 15m...

United States الاتجاهات

- 1. Texas 151K posts

- 2. 3-8 Florida 1,773 posts

- 3. #HookEm 9,824 posts

- 4. Austin Reaves 9,566 posts

- 5. Jeff Sims 1,580 posts

- 6. Arch Manning 6,706 posts

- 7. Aggies 8,910 posts

- 8. Sark 4,667 posts

- 9. Marcel Reed 4,289 posts

- 10. Arizona 32K posts

- 11. #LakeShow 2,970 posts

- 12. Devin Vassell 2,094 posts

- 13. SEC Championship 4,943 posts

- 14. Elko 2,797 posts

- 15. #DonCheadleDay N/A

- 16. Ole Miss 25.4K posts

- 17. #iufb 3,491 posts

- 18. #OPLive 2,385 posts

- 19. Giannis 8,203 posts

- 20. Anthony Davis 6,350 posts

Something went wrong.

Something went wrong.