Altperspective

@Altinterpretatn

Just a wanderer

You might like

A 23-page research paper reveals the number 1 method Hedge Funds use to beat the market: Time Series Momentum This is how: 🧵

This is probably one of the most straightforward takes on asset price inflation I’ve come across in a while.

⚡️Data Centre Value Chain and its Companies ⚡️Did you know Data Centre Sector is expected to grow at ~40% CAGR over the next 5 years. A detailed thread🧵👇

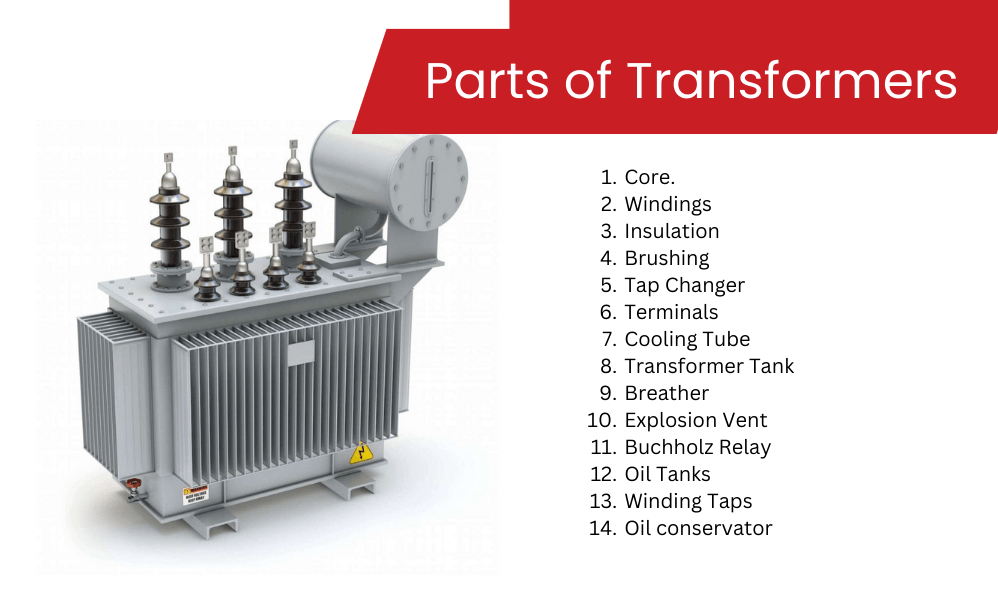

We know the transformer field will be🔥#multibagger 🔥 and refer below my analysis of #transformerparts and listed players in india. If useful please like , Commen your list and share. Lot of mulibagger series insdie 🔥🔥🔥 1. Transformer Core (+Electrical Steel Core) SME-

Deutsche Bank's George Saravelo ranked the countries that are likely to be hardest hit by potential US tariffs, based on their economic reliance on US trade and potential scope of new levies. The top three hardest hit: Mexico, Vietnam and Canada.

🌞Sector: Solar Power 🌞 Quad 2024 Summit: US commits significant funding for Solar Manufacturing Projects in India. 🌞22 Companies from the Solar Sector that are set to benefit directly or indirectly from this initiative [A thread....]🧵👇

![raghavwadhwa's tweet image. 🌞Sector: Solar Power

🌞 Quad 2024 Summit: US commits significant funding for Solar Manufacturing Projects in India.

🌞22 Companies from the Solar Sector that are set to benefit directly or indirectly from this initiative

[A thread....]🧵👇](https://pbs.twimg.com/media/GYJTf8BWcAAzHyI.jpg)

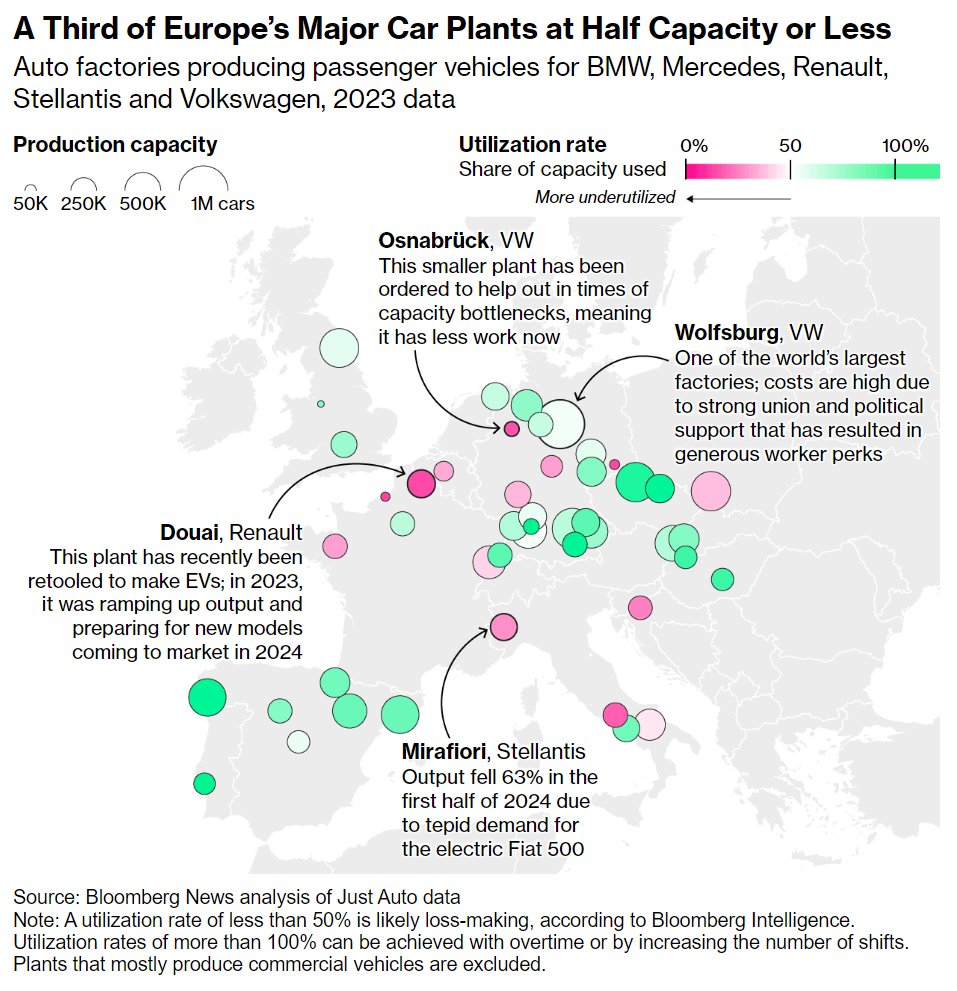

🇪🇺🚘 - European carmakers are facing huge trouble • Nearly a third of major car plants from Europe’s five largest automakers were underutilized last year • Stakes are high for EU economies: automotive sector accounts for ~7% of EU GDP and more than 13m jobs

⛽️Green Hydrogen Ecosystem ⛽️28 companies shaping the green hydrogen revolution [A thread...]🧵👇

![raghavwadhwa's tweet image. ⛽️Green Hydrogen Ecosystem

⛽️28 companies shaping the green hydrogen revolution

[A thread...]🧵👇](https://pbs.twimg.com/media/GU7ypaHXYAAwbQZ.png)

1/2 The new "China’s Reform Imperative" site, published by Carnegie China, has released my newest piece. In it I argue that China's seeming inability to boost the consumption share of GDP is not so much "bizarre", as some have called it, but rather... carnegieendowment.org/posts/2024/07/…

carnegieendowment.org

Why Is It So Hard for China to Boost Domestic Demand?

Beijing’s unwillingness to boost the consumption share of GDP is not as bizarre as it seems.

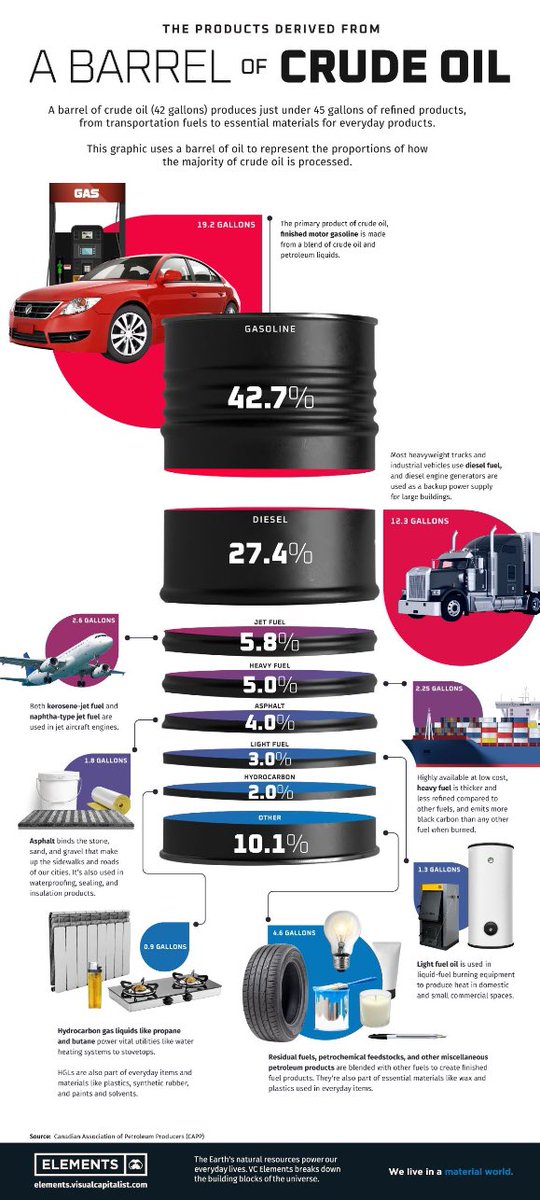

The products derived from a barrel of crude oil:

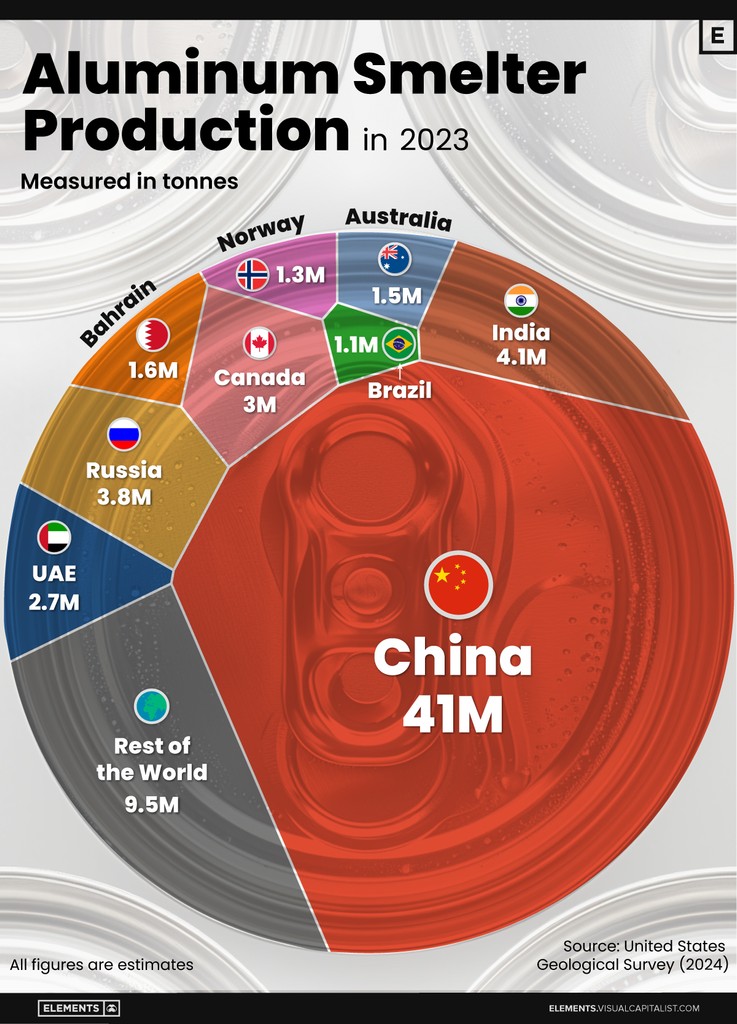

Where the World’s Aluminum is Smelted, by Country 🥫 elements.visualcapitalist.com/visualizing-gl…

Stanley Druckemiller thinks copper is a pretty simple story. I obviously agree with him. Here's the full quote: "Copper is a pretty simple story. Takes about 12 years, greenfield to produce copper, and you got EVs, the grid, data centers, and believe it or not munitions.

Here Is The Scariest Chart In Today's Treasury Refunding Announcement zerohedge.com/markets/here-s…

In the midst of this stock market "melt-up," gold and silver are likely to move much higher. Interview with David Hunter @DaveHcontrarian YouTube: youtube.com/watch?v=L5grtd… Rumble: rumble.com/v42kagk-the-sh… Soundcloud: soundcloud.com/libertyandfina…

soundcloud.com

SoundCloud: The Music You Love

The Shocking Case For $3000 Gold & $60 Silver By Summer | David Hunter

You won’t believe how you could have forgot what crazy things happened this year—also irreverence. Year in Review 2023

🚨🚨At 12:00 ET today (12/22/23) the most important content of the year will be exclusively posted at Peak Prosperity. @DavidBCollum You'll laugh, you'll cry, you'll renew your passport! FAIR WARNING: Dave pulls no punches and spares no words! 🚨🚨

The excess cash era is ending, with trillions of reserves once trapped in the Fed's RRP being deployed into financial assets and the banking system. As the RRP hits zero, the status quo in repo markets will transform. The return to an "excess collateral" era awaits us... 1/

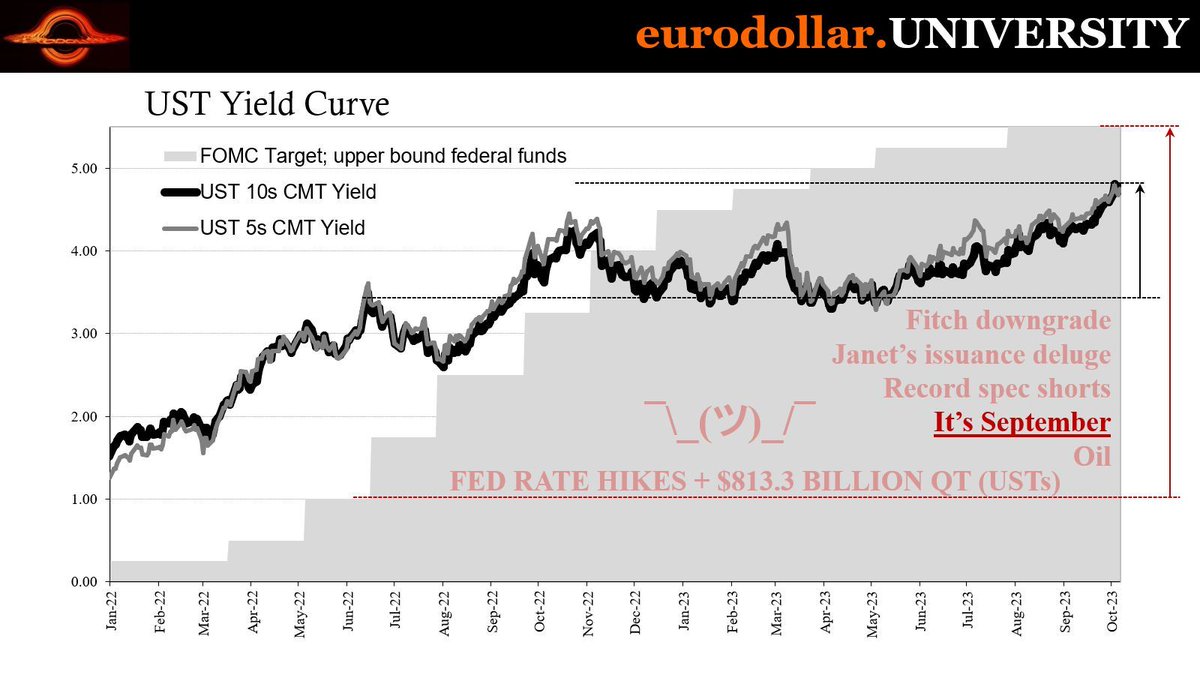

The selloff in LT bonds isn't just USTs, which takes out the supply factor. And USTs aren't pushing other rates up, either, given swap costs these days. The LT selloff is globally synchronized just the way it has been every year. buff.ly/3ZLmQ1Q

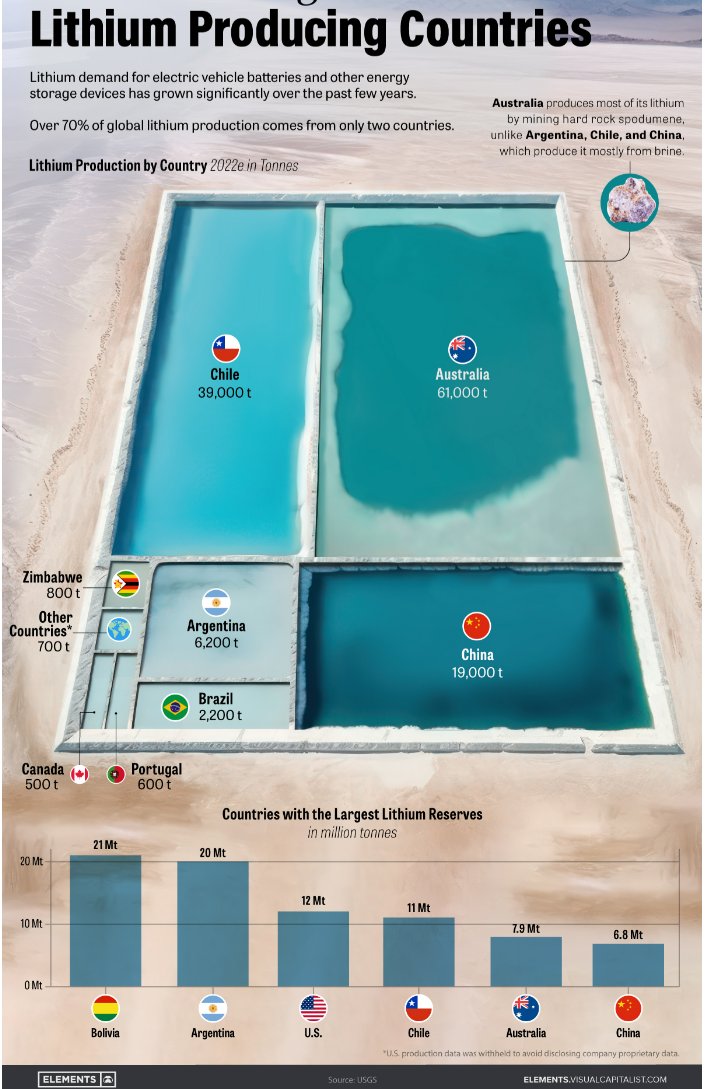

Visualizing the World’s Largest Lithium Producers elements.visualcapitalist.com/visualizing-th…

Very interesting, and not wholly accidental, selection from letters of Dostoyevsky, Turgenev, Herzen, Nekrasov, Saltikov-Shchedrin, Bakunin during the "dark seven years" in Russia following the European Revolutions of 1848. kommersant.ru/doc/5875451?fr…

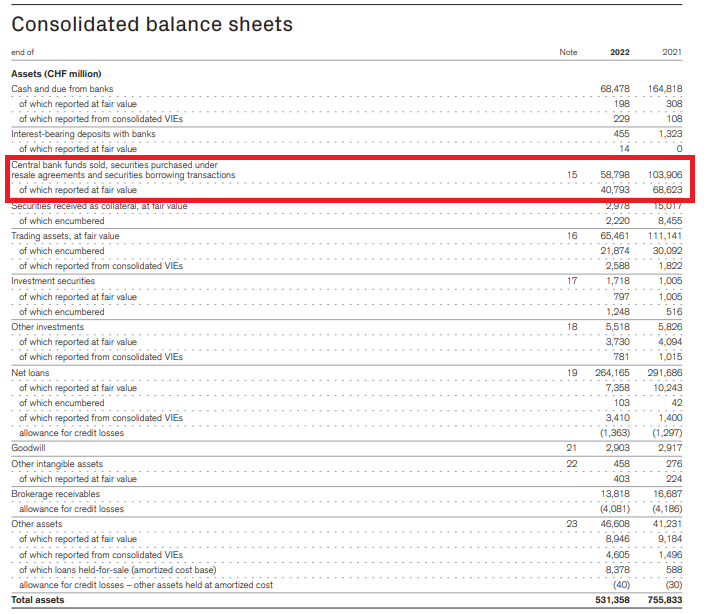

The immediate suspect for the current global funding strains is obviously Credit Suisse. And there is good reason to worry about stains getting worse, but it's not what you think. Unless you're thinking repo and collateral. youtube.com/watch?v=7zJEib…

United States Trends

- 1. Eric Dane N/A

- 2. Baby Keem N/A

- 3. McSteamy N/A

- 4. Jamal Murray N/A

- 5. FRLG N/A

- 6. WE LOVE YOU TAEHYUNG N/A

- 7. Aliens N/A

- 8. #TheTraitorsUS N/A

- 9. FireRed N/A

- 10. WITH TAEHYUNG TILL THE END N/A

- 11. LeafGreen N/A

- 12. Cade N/A

- 13. LINGLING BA FRAGRANCE DIOR N/A

- 14. #LinglingxDiorFragrance N/A

- 15. Pistons N/A

- 16. Grey's Anatomy N/A

- 17. UFOs N/A

- 18. Knicks N/A

- 19. eShop N/A

- 20. #thepitt N/A

You might like

-

Dan Dee

Dan Dee

@DanDee17611834 -

michael benson

michael benson

@michaelbenson -

Cristobal B

Cristobal B

@CristobalCBM -

yellow.panda

yellow.panda

@yellowpanda -

Shawn Lee

Shawn Lee

@lwyshawn -

Jonas Bloch Kristensen

Jonas Bloch Kristensen

@Jonas_Bloch1 -

JAY//day trader

JAY//day trader

@181boy -

Leanstoc🦾

Leanstoc🦾

@Drasticlava -

Adam

Adam

@AdamNa81 -

Matt 🤙 🚩

Matt 🤙 🚩

@matteo94120 -

$ean

$ean

@MeNoAngel_ -

April 🎁

April 🎁

@AprilUnwrapped -

SKY WALKER

SKY WALKER

@sky_walker877 -

T

T

@tqlemd

Something went wrong.

Something went wrong.