Libiya

@Amool

Witnessing history in making ... good luck Libya ...

You might like

Maritime war risk premiums fall in Red Sea, rise in Black Sea amid changing security dynamics spglobal.com/commodity-insi…

⭕لا يزال الملف الليبي يراوح داخل المنطقة الرمادية، لا سيما في ظل كثرة الحديث عن احتمال اعتماد الرئيس الأميركي دونالد ترمب على ليبيا ضمن عدد من الملفات ⬅️معلومات عن سعي أميركي للحصول على تعويضات مقابل التدخل لإسقاط نظام القذافي عام 2011 ... independentarabia.com/node/628171/%D…

TRA TUNISIA E LIBIA/ “Usa tra Erdogan e Putin, a noi conviene un patto con la Turchia” ilsussidiario.net/news/tra-tunis… via @ilsussidiario

تأملوا صدمة ودهشة كريستيان عندما اعترف إيهود باراك وقال: "إسرائيل هي التي قامت ببناء المخابئ أسفل مستشفى الشفاء"..

#UPDATE This information is according to an eyewitness from Derna, Munir Dakhil, a civil activist present in the city. Derna today, 39 people have been rescued from under the rubble, and as night falls, an entire family has been saved. Libyan and international rescue teams…

#NewsAlert | BRICS announces new members: Argentina, Iran, Saudi Arabia, Egypt, Ethiopia and the UAE #CyrilRamaphosa #BRICS #BRICSSummit2023

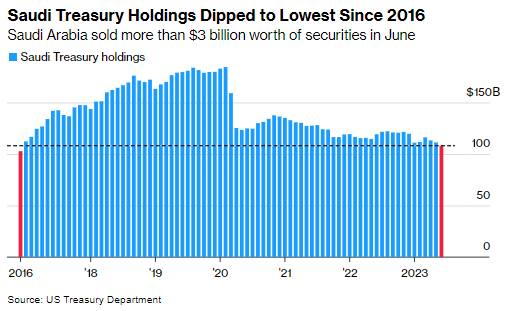

Saudi reduced its holdings of US debt to a 6-year low The UAE also sold US bonds in June One reason: Risk appetite in the GCC is rising bloomberg.com/news/articles/…

Saudi: Interesting points from Tim Callen • IMF estimates the fiscal breakeven at $81 • Oil output cuts would raise the breakeven to $88 • The number is an underestimate -- public spending is increasingly done off-budget, through the PIF and NDF agsiw.org/the-breakeven-…

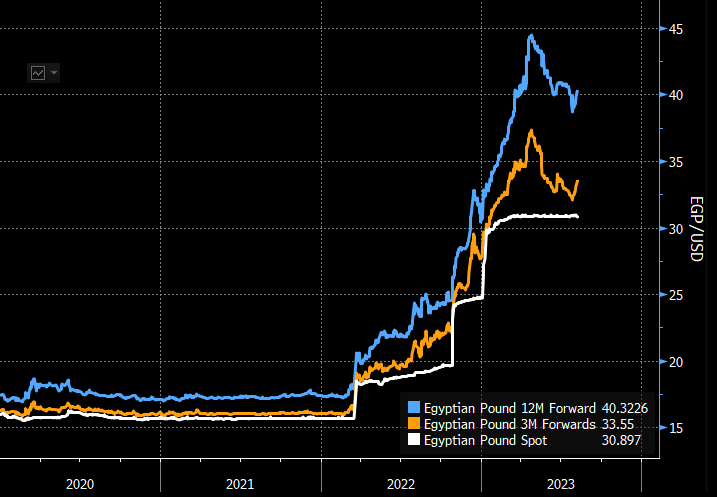

Egypt: Where will pound go? • 3-month forwards (orange line) see the exchange rate at 33.6, or 8% weaker than the current level (white) • 12-month forwards (blue) are at 40.3, or 23% weaker The currency has already depreciated by ~50% against the dollar since March 2022

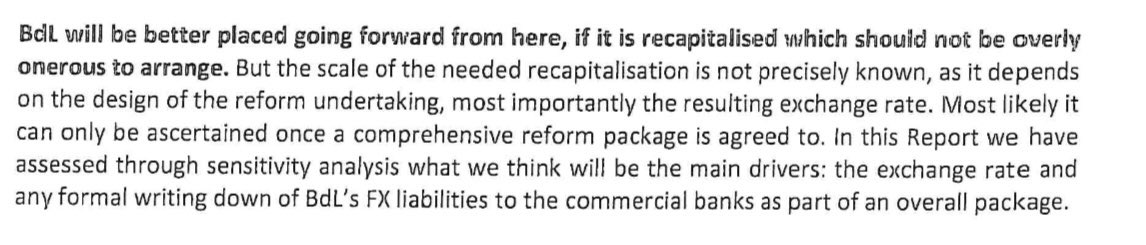

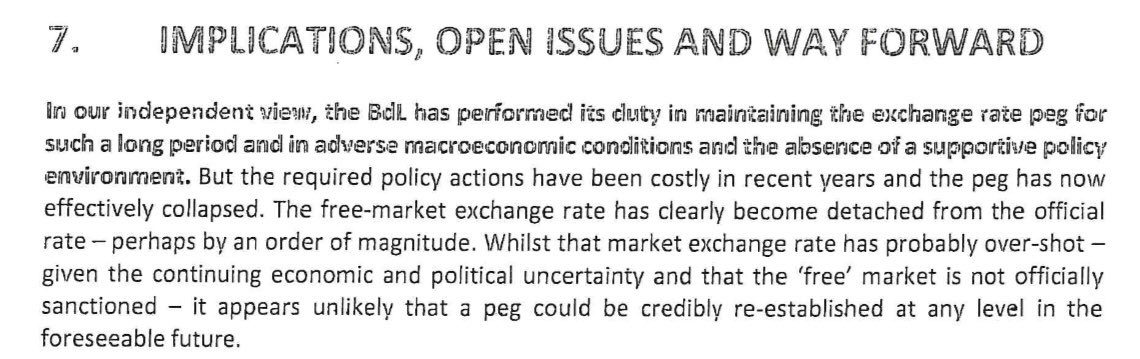

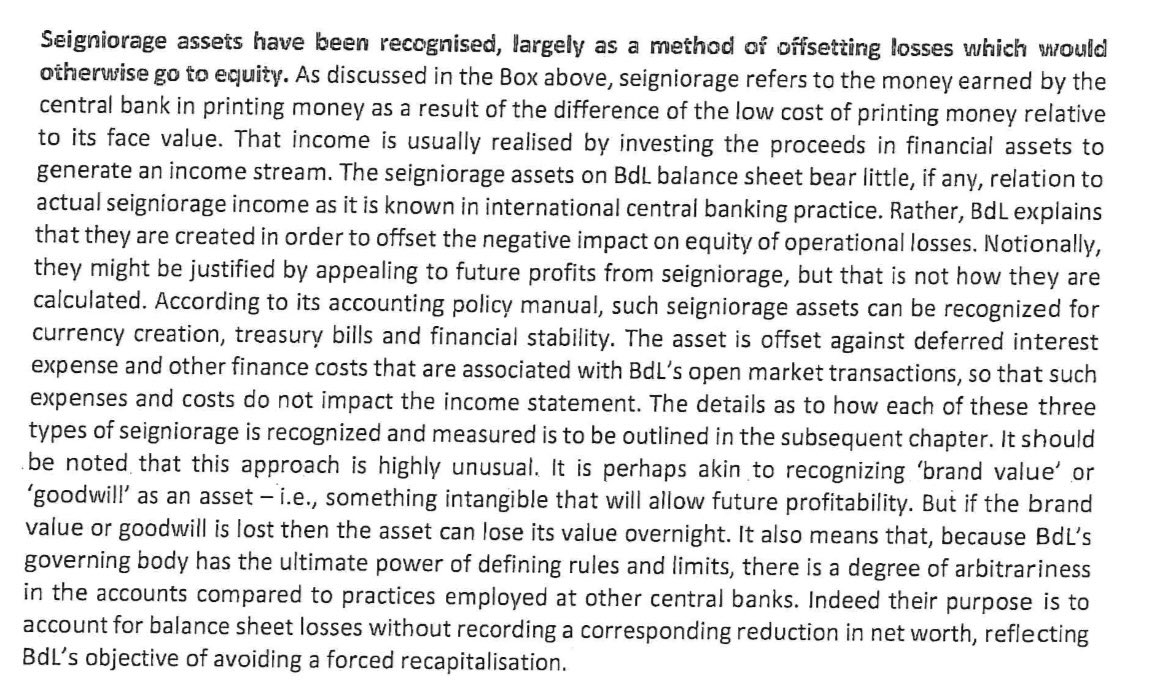

Very shoddy work by Oliver Wyman on its BDL engagement. They say, in March 2021, that the LBP exchange rate has overshot. It was ~12,000 at the time. It’s ~100,000 now. They also say the Govt can recapitalize BDL “which should not be too onerous.” Well 3x GDP seems pretty…

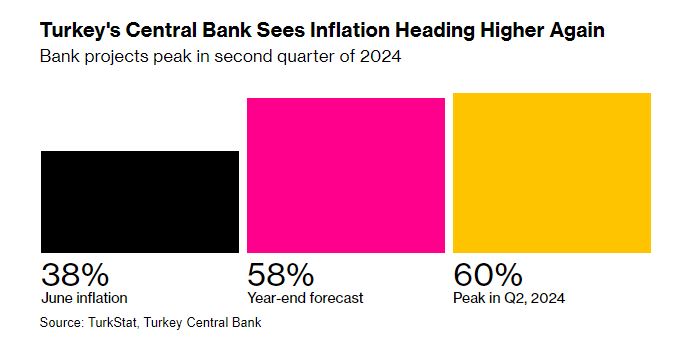

The rally in Turkey’s hard-currency bonds is under threat trib.al/OiBuOv2

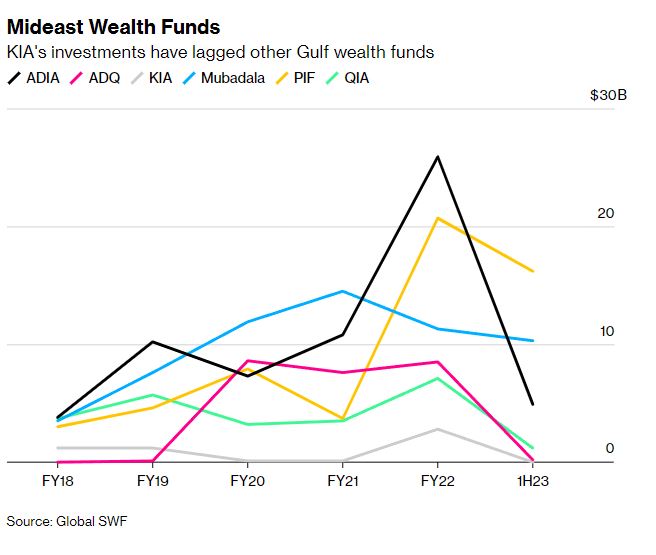

Kuwait’s $700 billion wealth fund is being eclipsed by ambitious, flashier neighbors. Here's why: trib.al/c8kI1AP

The busiest day ever for commercial aviation yesterday Almost 135k flights Guess the tourism Industry is not in recession yet 😅

5/5 There will be a shortage of Oil and Gas due to the push for the Energy Transition

6 عادات دينية ستغير حياتك باذن الله - نصيحه إذا مشغول فضلها وارجع لها بعدين🤍

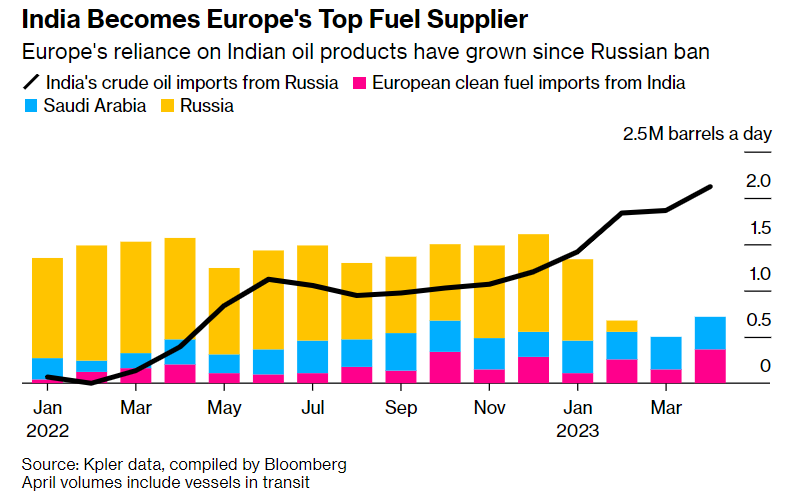

Sanctions are an unpredictable animal in world politics. Oil, as a global commodity, flows where it is needed. 🇷🇺Russian oil is still powering🇪🇺Europe — just with the help of🇮🇳India.

BREAKING: Argentina's Central Bank has run out of USD, and is now using customer deposits.

عاجل: مصر اوقفت خطة لتزويد روسيا بالصواريخ سرا الشهر الماضي بعد محادثات مع كبار المسؤولين الأمريكيين وقررت بدلا من ذلك إنتاج ذخيرة مدفعية لأوكرانيا - واشنطن بوست

البحرين وقطر يعلنان في بيانين منفصلين استئناف العلاقات الثنائية بعد ان قطعتها المنامة في 2017 بزعم انها تريد الحفاظ على امنها الوطني لتطلق بذلك العنان لازمة خليجية خطط لها عدد من قادة المنطقة لعزل الدوحة.

Two notable aspects in these #Fed minutes: It seems that the #FOMC could have returned to a 50 bps hike and taken the rates' path higher were it not for the #banking tremors; and The staff's assessment of the impact on the #economy is more worrisome than Chair Powell's comments.

United States Trends

- 1. Steelers 154 B posts

- 2. Tomlin 38,2 B posts

- 3. Aaron Rodgers 44,1 B posts

- 4. DeepNodeAI 66 B posts

- 5. CJ Stroud 21,8 B posts

- 6. Arthur Smith 6.271 posts

- 7. Christian Kirk 4.389 posts

- 8. #HereWeGo 21,5 B posts

- 9. #HOUvsPIT 3.983 posts

- 10. #HTownMade 5.412 posts

- 11. Anderson 33,5 B posts

- 12. Jonnu Smith 3.185 posts

- 13. #tellmelies 1.170 posts

- 14. TJ Watt 3.337 posts

- 15. Nico Collins 3.277 posts

- 16. Woody Marks 2.956 posts

- 17. Marvin Lewis 1.223 posts

- 18. Muth 1.664 posts

- 19. #ConnorStorrieOnSethMeyers 2.629 posts

- 20. Seaton 2.493 posts

Something went wrong.

Something went wrong.