Cory Milne

@AnalysisSC2

A tourist of Finance and Economics; learning to make my stay permanent; stock picker who loves macro.

Tal vez te guste

Today feels all about #ValueInvesting basics. From Mr. Buffett: 1)Be capable of understanding the business; 2)How strong is it's MOAT; 3)Is management trustworthy and owner oriented 4)What is the right price (I want a 50% discount on long term fair value)?

Now we are talking…. The AI Bubble is an Easy One Not an IF but a When… Agreed. 💯

Ok, let’s get one thing straight… Delinquency rates on credit card loans (or otherwise) are not a leading indicator. The ISM is not a leading indicator. PMIs are not a leading indicator. Heavy truck sales are not a leading indicator. Job openings are not a leading indicator.…

On Energy and AI: We are all aware of the urgent need for massive new energy infrastructure for data centres and other general needs. The grid is old and the supply is constrained. Investor capital is pouring into nuclear soluations, new gas plants and other opportunities and…

Can't miss Drinks with Raoul tomorrow at 6p ET I'll be giving away 1000 $USDC to one lucky winner! To enter: 1. Join the @RealVision waitlist (link below) 2. Drop a screenshot with the email confirmation & mention 2 friends in the comment (NO bots!) 3. Like & RT this post

I can see all of Fintwit back to hurling insults at each other again, so I figured I’d share my view and try to be a voice of reason, even if I end up being wrong. It’s my job to stick my neck out. I’ve been doing it for years, and I’m still here. For what it’s worth, I think…

The deeper you go into the semiconductor supply chain, the less believable it becomes. > TSMC, a company on a small island, produces over 90% of the world’s most advanced chips > TSMC relies on dutch company ASML for EUV lithography machines > ASML depends on German Company…

⚡️What you’re really seeing here is the first stage of a global unit-of-account fracture. •In nominal USD terms, everything looks like it’s booming: stocks up triple digits, homes up double digits, “wealth” everywhere. That’s the performance everyone sees. •In gold terms, the…

"The Debasement Trade" since COVID: In USD: NDX up 165%, SPX up 102%, Home prices up 56%. In gold: NDX up 7%, SPX down 18%, Home prices down 37%. In BTC: NDX down 78%, SPX down 84%, Home prices down 87%.

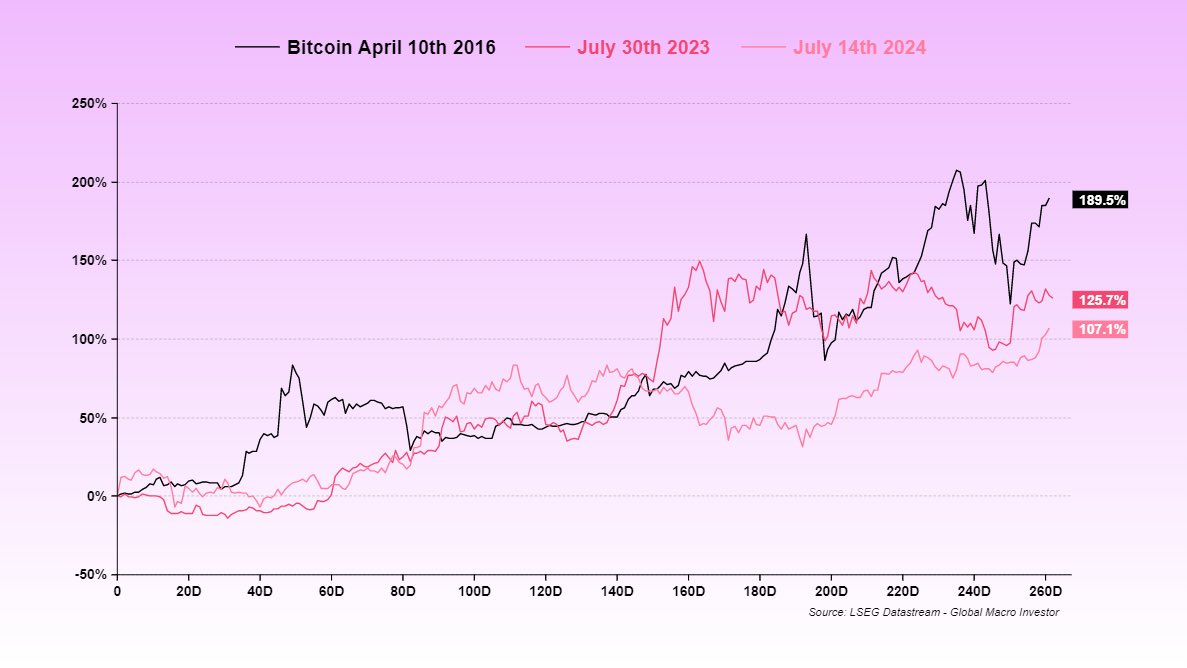

Crypto is still being adopted at twice the speed on the internet from 5m IP addresses vs 5m wallets (very like for like). 1/

I’ve been seeing a lot of chatter on X about “peak cycle” and how the economy looks late-cycle. So I wanted to tackle this head on and share a few thoughts of my own... This is from the August 21st MIT publication: A classic late-cycle economy typically has all the following…

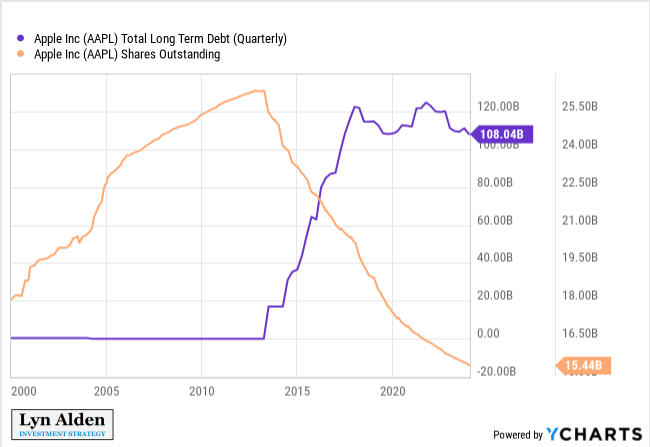

My latest article covers the topic of bitcoin treasury companies, as well as the overall store-of-value vs medium-of-exchange debate: lynalden.com/bitcoin-stocks…

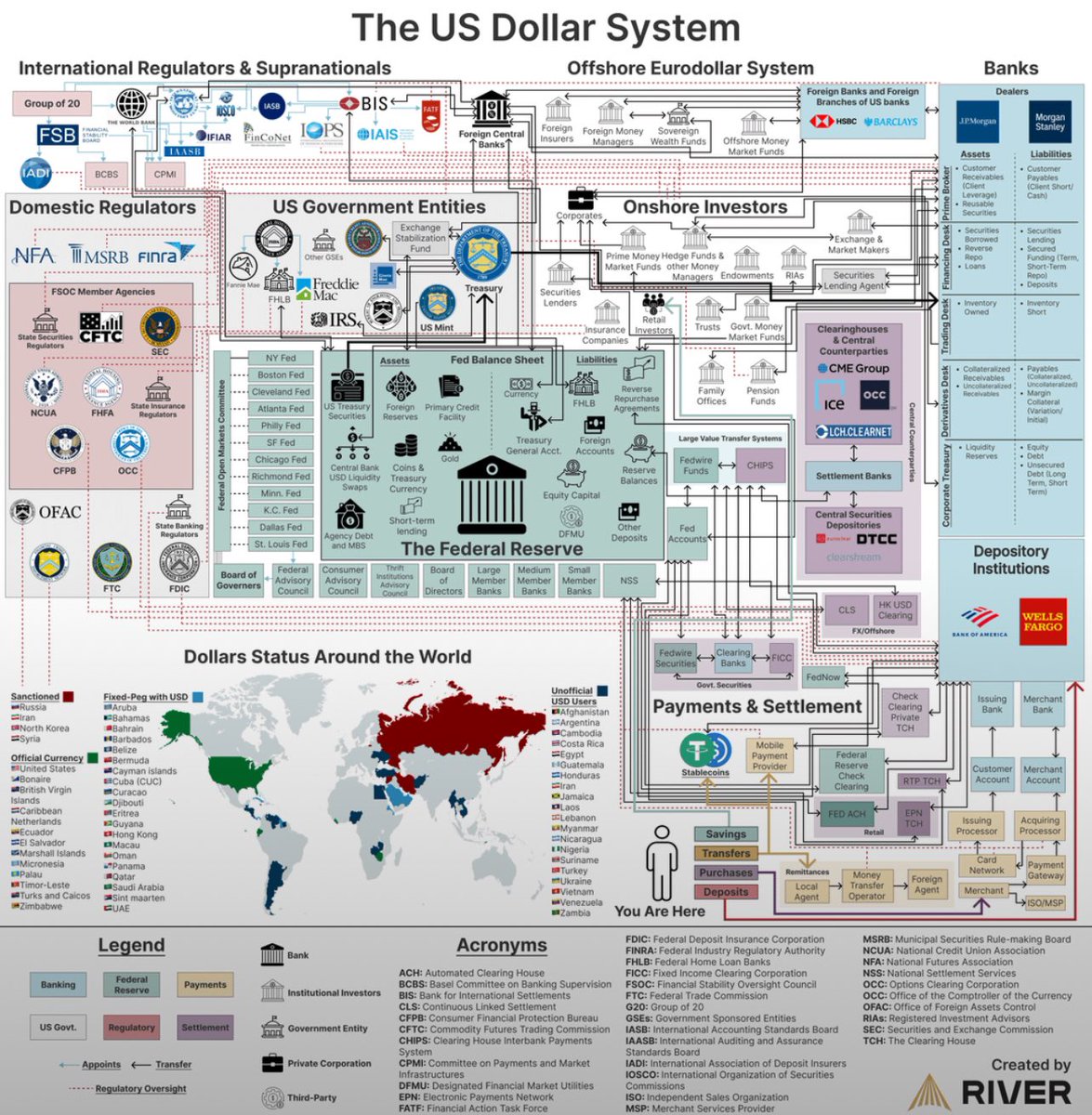

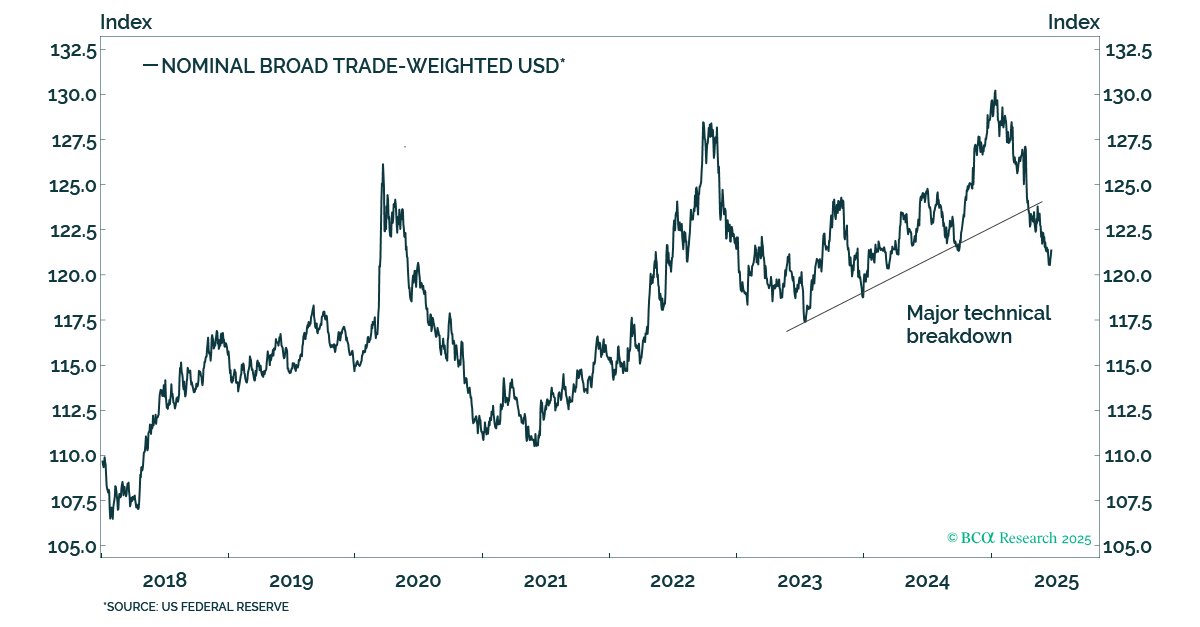

1/3 Do not catch a falling "USD knife". In my meetings with investors in NY and Boston this week, we spent a lot of time discussing the USD outlook. After being bullish on the USD since 2011, I have lately changed my view and have become very bearish on the USD. My analysis…

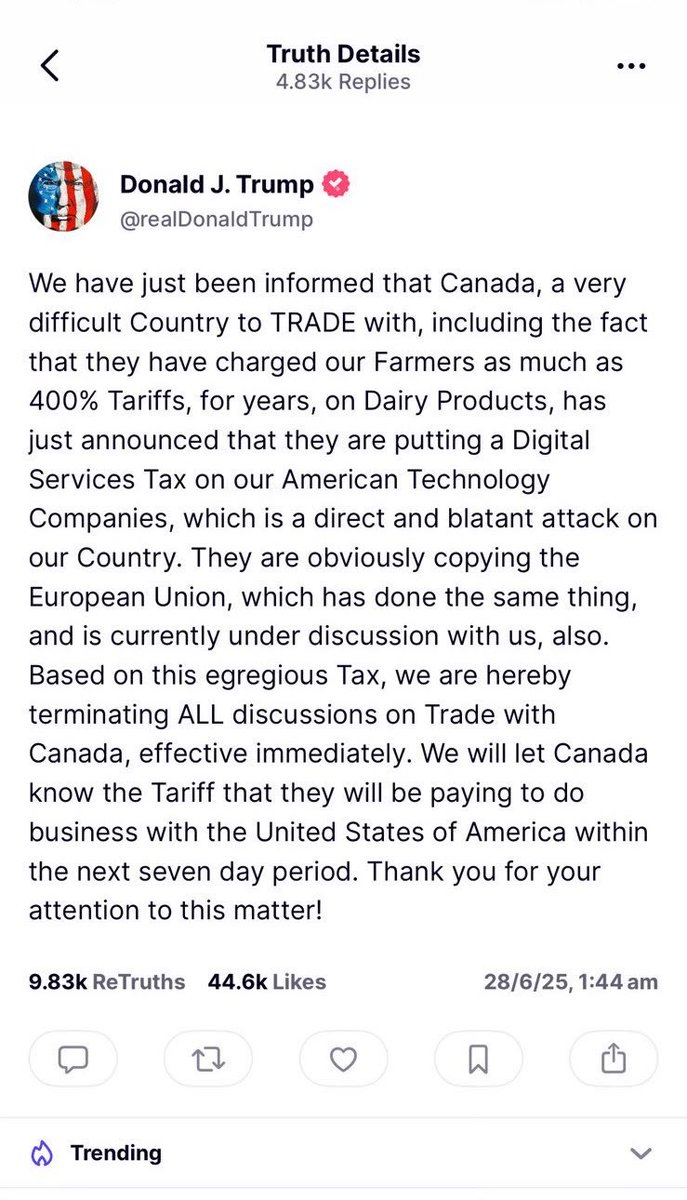

2025, day 179 Good morning from Asia. In geopolitics, Israel assess Iran is no longer a nuclear threshold state; its defence minister warns Operation Rising Lion was “just a trailer”; President Trump says ‘You got beat to hell” to Iran & he saved Khamenei from an “ugly,…

This honestly was so much fun to listen to. Especially when Matt realizes Emma is on the phone, too. He dodged a bullet with that one.

Interesting new macro video from @JackFarley96 with Jared Dillian: youtube.com/watch?v=aaqRKU…

youtube.com

YouTube

How Private Equity Will Cause The Next Financial Crisis, Argues Jared...

Here's 7 quality companies that have dropped more than 40% over the last year👇🧵 1. Celsius Holdings | $CELH EV/Sales: 4.4x Revenue Growth: 23.35% FCF Margin: 16.51% Commentary: Perhaps I've been wrong with $CELH but the fact that they're now trading at a lower multiple than…

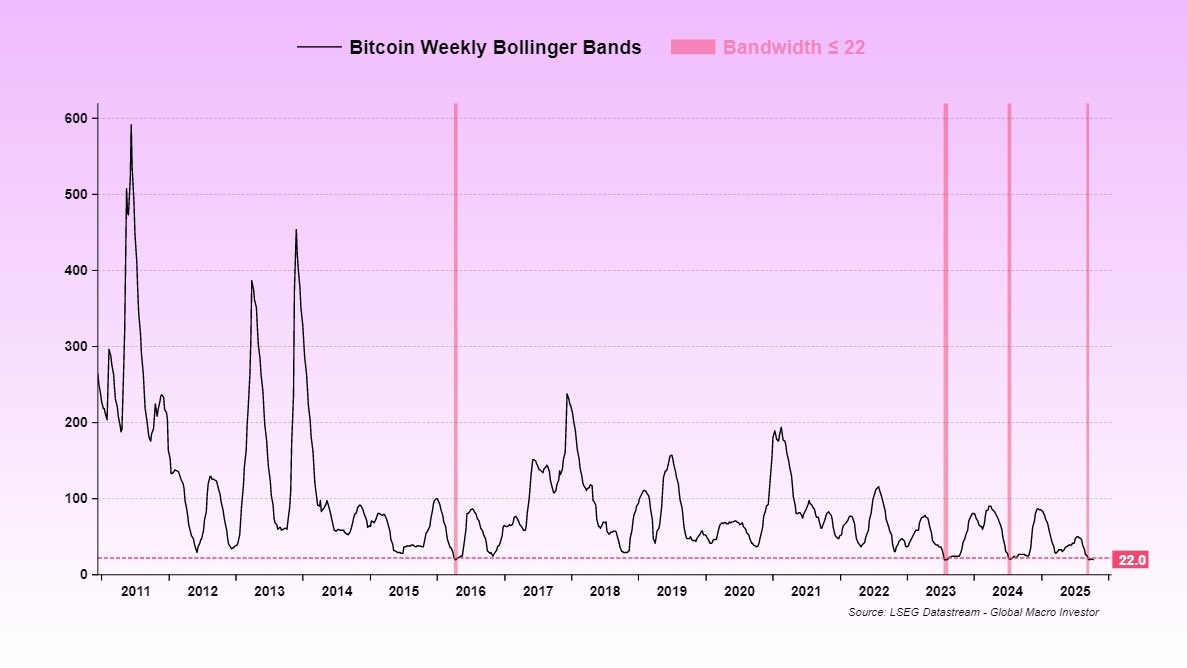

Whatever could it be?

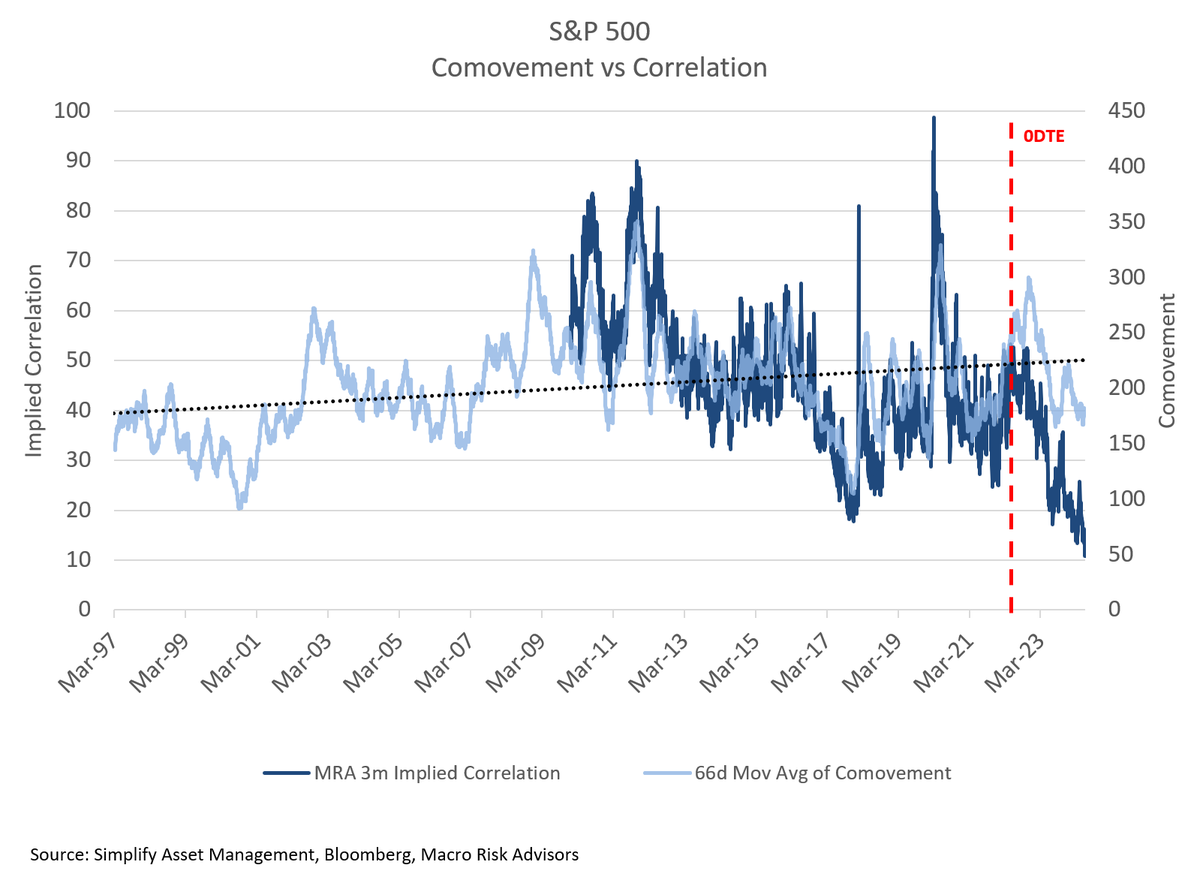

Volmaggedom 2.0 won't be because of structured products it will be dispersion blowing up as hedge funds realize how stupid it is to be short implied correlation at 16%. (9% for 3 months)

Big things happening in Canadian real estate and economy now howestreet.com/2024/06/gold-o…

My top 5 picks that I believe will dominate the rest of this decade 👇 1. $NVDA | Semiconductors • They're set to cement their status as the core of the AI & gaming revolutions, making their GPU technology indispensable for the future tech ecosystem. 2. $CRWD | Cybersecurity…

My latest article examines why the vast majority of investments in the world are poor performers (bonds, stocks, and real estate), and what the handful of good performers tend to have in common. lynalden.com/most-investmen…

United States Tendencias

- 1. Pacers N/A

- 2. #WWENXT N/A

- 3. Purdue N/A

- 4. #OlandriaxYSLBeauty N/A

- 5. Nebraska N/A

- 6. Nancy Guthrie N/A

- 7. #LoveOthers N/A

- 8. Wisconsin N/A

- 9. Zaria N/A

- 10. Ty Lue N/A

- 11. Rio Rico N/A

- 12. Tucson N/A

- 13. Tumbler Ridge N/A

- 14. Badgers N/A

- 15. Real ID N/A

- 16. Siakam N/A

- 17. Jai Lucas N/A

- 18. Courtney N/A

- 19. British Columbia N/A

- 20. Josh Hart N/A

Something went wrong.

Something went wrong.