Antdata

@Antdataesp

Análisis de datos de materias primas y deporte. Commodities and sport data analysis.

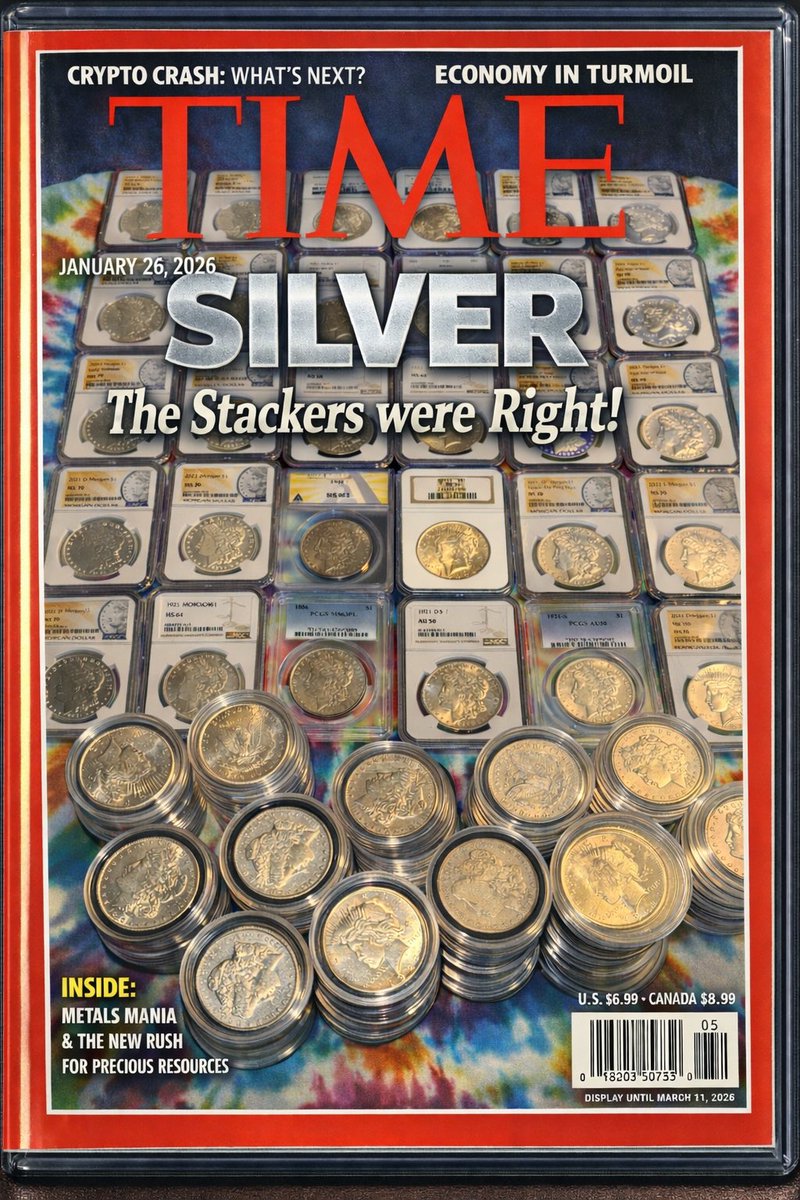

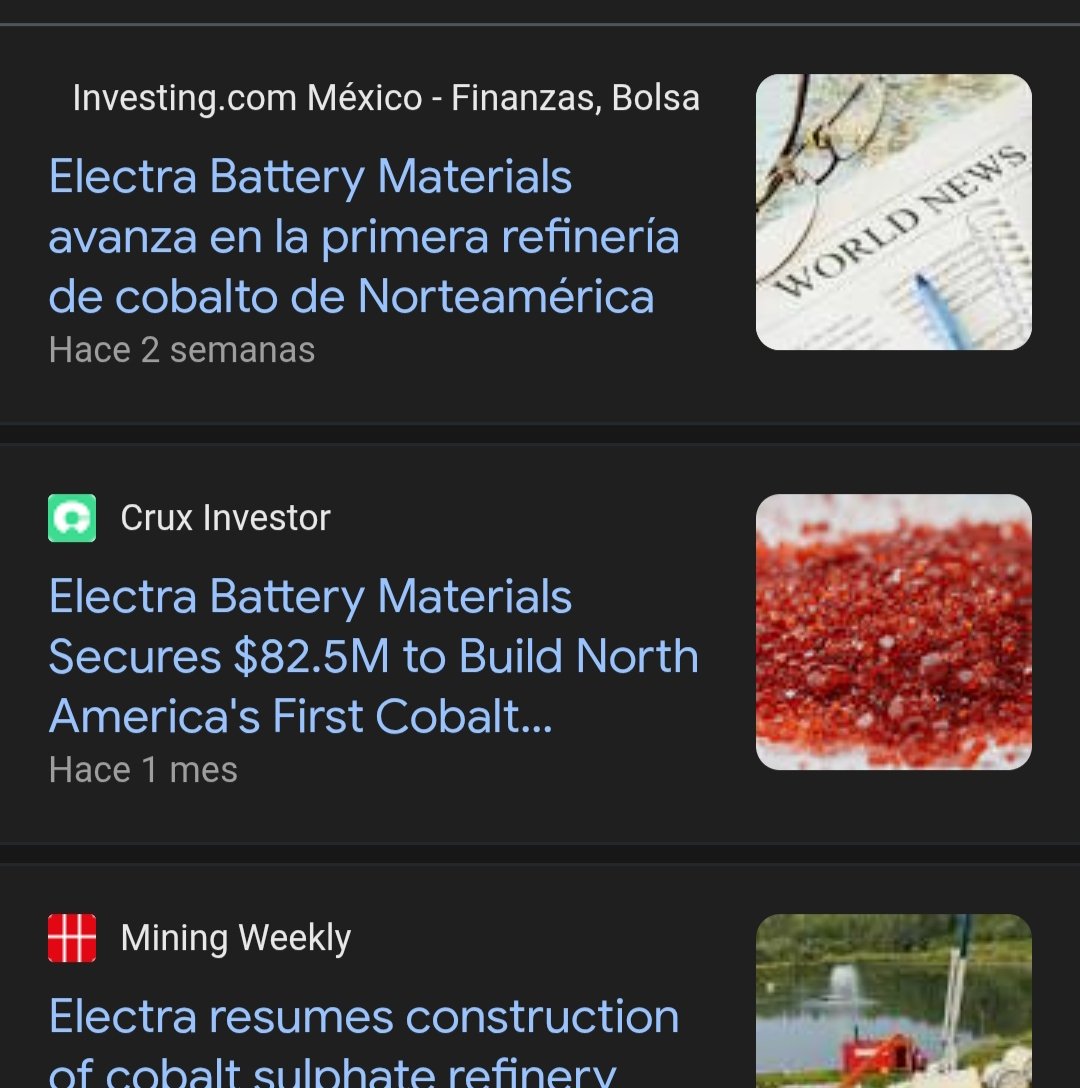

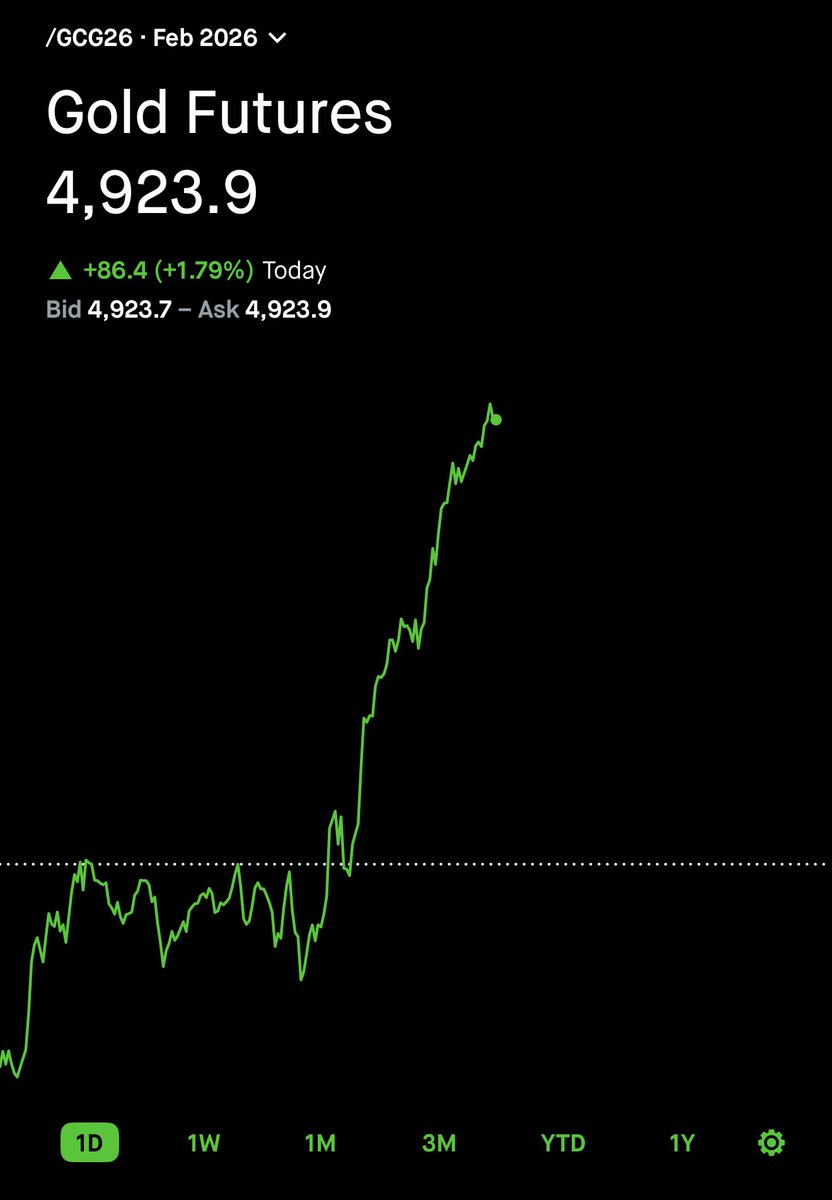

Silver $116, up 12.5%, biggest one-day increase since 2008

Si en un futuro la UE antes de descomponerse y fragmentarse impone controles de capitales, vuestras monedas físicas de plata os ayudarán.

Bingo

Los gobiernos se han pasado con la deuda: el oro y la plata empiezan a destapar un nuevo orden monetario y la caída del dólar da una pista dozz.es/1cbfg2

Los gobiernos se han pasado con la deuda: el oro y la plata empiezan a destapar un nuevo orden monetario y la caída del dólar da una pista dozz.es/1cbfg2

No.

SILVER is still holding strong. Smart Money hasn’t exited yet. The day big players start offloading, I’ll flag it early 🚩 not after the fall. Bookmark this tweet 📌 Stay ahead, not emotional.

Este fin de semana toca escribir sobre Electra Battery Materials y la jugada de cobalto que nadie habla. 🥳🧐

Weimar is back.

I’ll repeat what I’ve said before: This move in metals has real hyperinflation vibes. It’s remarkable how little that’s being discussed in the broader narrative.

I’ll repeat what I’ve said before: This move in metals has real hyperinflation vibes. It’s remarkable how little that’s being discussed in the broader narrative.

The US dollar just cracked. A decisive breakdown from a 14-year uptrend. This is a regime change that ignites multi-year commodity bull markets. $DXY $GLD $SLV $URA $LIT $XLE

121,58

Today, gold and silver miner stocks have risen across the board in China, with large number of that hitting the daily limit up. Jan. 26, 2026, the PM market data in China.

Baby

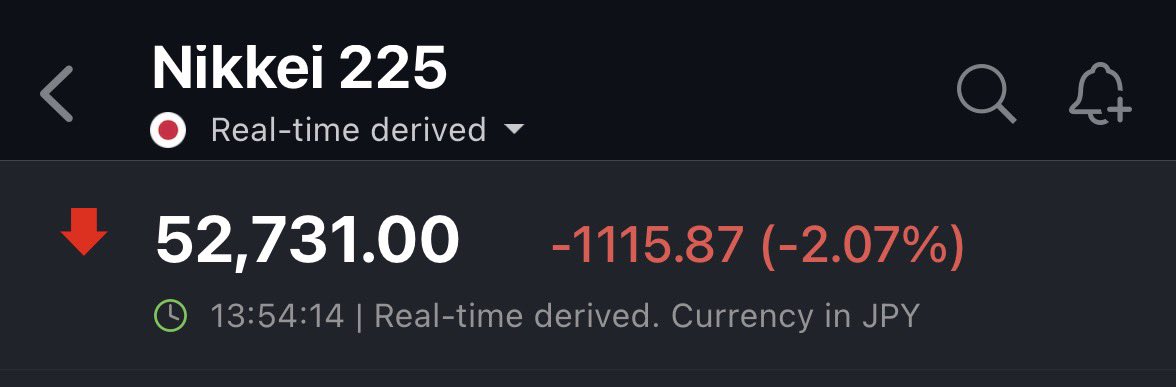

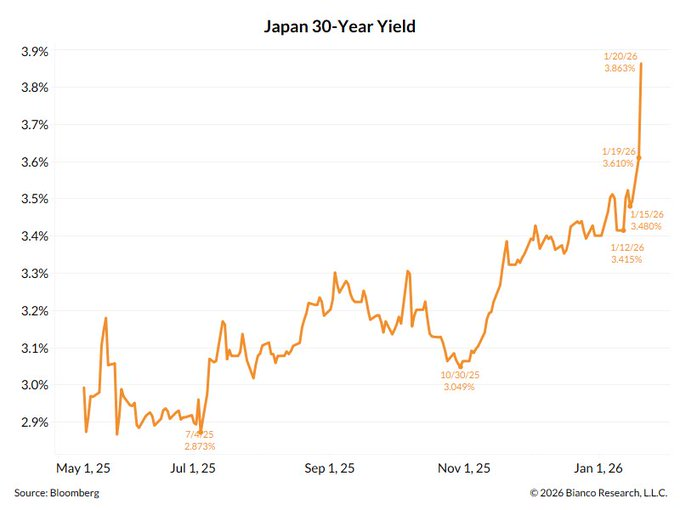

A sudden crash turned Japan’s bond market into a $7 trillion threat to global financial stability bloomberg.com/news/features/…

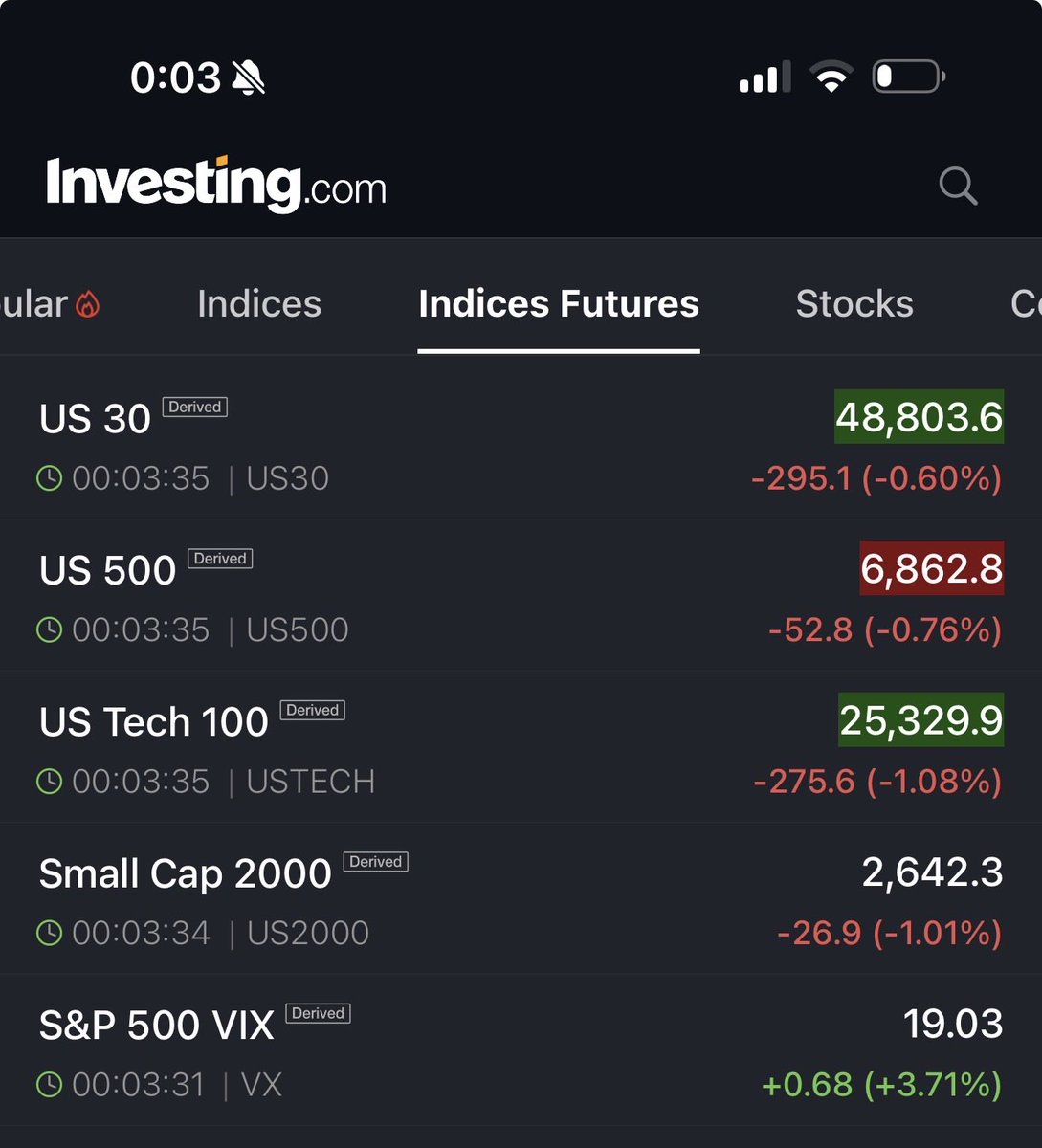

Futuros en rojo Vix subiendo. Plata 105$ Oro 5.051

Esto ya lo dijo @great_martis , el jefe de los gráficos; pero su predicamento no tiene muchos adoradores.

Aviso de Tokio a #Bitcoin Las liquidaciones en las últimas 4 horas ascienden a $320 millones!

New York tenemos un problema!! El viernes tuvimos otra intervención del BoJ para "salvar" al YEN. Estas maniobras son, en realidad, drenajes de LIQUIDEZ Al vender bonos USA para defender la paridad, Japón endurece las condiciones financieras globales MALO para activos riesgo

TOKIO ¡¡tenemos un problema!! El rendimiento a 30 años roza el 4%. Pero el problema NO es el interés, sino la VELOCIDAD ⚠️Aseguradoras y planes de pensiones en RIESGO -HILO-

🫡

Mining stocks look undervalued, even after gaining nearly 90% since the start of 2025, driven by the boom in robotics and data centers. bloomberg.com/news/articles/…

This is the market screaming that the debt spiral has reached terminal velocity intermixed with war that is likely to push the euro off the edge and we see the signs of stress in Japan as well.

Gold at $5,000 is actually a sign that something is very wrong. It is not just the US dollar, gold it at all time record highs against EVERY currency. Euro, Yen, Yuan ... it doesn't matter.

Es imposible no ser alcista a medio y largo plazo en los metales. Imposible.

Ignoring the once in a lifetime monetary reset could be dumber...

I have seen a lot of people doing dumb things in my life. Stacking gold and silver at these levels could be one of the dumbest.

United States Trends

- 1. Pro Bowl N/A

- 2. Bovino N/A

- 3. Homan N/A

- 4. Highguard N/A

- 5. Senator Young N/A

- 6. Shedeur N/A

- 7. Hornets N/A

- 8. Rising Stars N/A

- 9. Joey Jones N/A

- 10. Louisville N/A

- 11. The Five N/A

- 12. Geoff N/A

- 13. #LightningStrikes N/A

- 14. El Centro N/A

- 15. Dance Tonight N/A

- 16. Kanye N/A

- 17. 76ers N/A

- 18. 3 Friday N/A

- 19. $UNH N/A

- 20. Rigby N/A

Something went wrong.

Something went wrong.