Shiv

@AtimeUnit

Special situations, behavioral & reflexive investing | Micro & small-cap focused

You might like

Ujjivan Small Finance Bank - Controlled breakout attempt on the charts. Volumes remain steady, not euphoric. Fundamentals across the microfinance sector are improving. Ujjivan continues to stand out as a quality leader in the space.

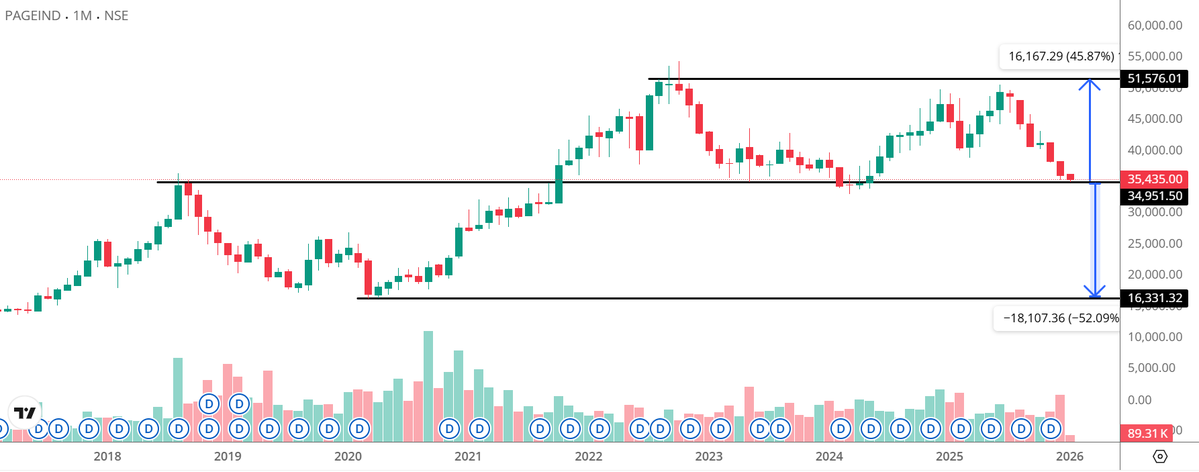

Page Industries - near to support level. Also PE of 51 near to historical low level. Can a good Q3 FY26 result push it back towards 51K.

Ujjivan Small Finance Bank is not the fastest grower, but one of the safest compounders. bseindia.com/xml-data/corpf…

Looks like safe investing is trending 😏 Condom makers Cupid & Anondita Medicare hit all-time highs. Protection pays off!

Sukhjit Starch & Chemicals Ltd - start of Uptrend from long term support. High low from last 1 week. Strong fundamental reason being drop in raw material prices (Corn/Maize). Revenue is constant. Improvement in Operating margin will boost profitability.

Praveg Ltd. Strong momentum Breakout. Price has moved from ~260 to 330 in ~7 trading sessions. Higher highs & higher lows (bullish structure). High delivery + rising price = accumulation, WAP > Close (strong hands buying). Promoters bought in open market (Nov-Dec).

Maruti Interior Products - Accumulation pattern is visible. Volumes are moving up with rise in price. Could be a long consolidation breakout!

Fischer Medical Ventures - Retail investors are stuck now. 10.3 crore shares will get unlock on 15.11.2025. These 10.3 crore shares were issued to non-promoters at Rs. 23.4 per share (Adj. to Split FV 10 to 1). Gain of 250% (2.5x) in 9 Months. Offloading will begin from Monday.

Edvenswa Enterprise. Consolidation breakout. Volume up ~9 times.

OK Ok! result by Shukra Pharma. Revenue is down by 74%. PBT is up by 32%. Quarterly YoY EPS is similar after adjustment to Bonus shares. FY24 EPS is After (bonus Adj.) is 4.23. PE is 24.8. Dividend declared is Rs.1. Dividend yield will be 0.95% which is good.

United States Trends

- 1. Super Bowl N/A

- 2. Super Bowl N/A

- 3. Super Bowl N/A

- 4. Rams N/A

- 5. Pats N/A

- 6. Drake Maye N/A

- 7. Sean Payton N/A

- 8. Denver N/A

- 9. Darnold N/A

- 10. Stidham N/A

- 11. Vrabel N/A

- 12. #NFCChampionship N/A

- 13. Kenneth Walker N/A

- 14. Puka N/A

- 15. Jaxon Smith N/A

- 16. Tom Brady N/A

- 17. Seattle N/A

- 18. #LARvsSEA N/A

- 19. Diggs N/A

- 20. Xavier Smith N/A

You might like

-

Bhawnna ♡

Bhawnna ♡

@itsbhawnna -

The Cynical Indian

The Cynical Indian

@stockshiva -

Saurabh Prabhu

Saurabh Prabhu

@prabhusaurabh91 -

A.

A.

@abadjate -

Beny Rubinstein, M.B.A., Ph.D. Candidate

Beny Rubinstein, M.B.A., Ph.D. Candidate

@brubinst -

AGEFI Suisse

AGEFI Suisse

@Ageficom -

Naresh Katariya

Naresh Katariya

@KhivrajNaresh -

Vikas

Vikas

@vikasgj -

Dhruva Pandey

Dhruva Pandey

@Dhruvapandey -

Bhavin Mehta

Bhavin Mehta

@bnmehta007 -

suriaragav

suriaragav

@suriaragav -

Boring investor & Trader (Technical + Fundamental)

Boring investor & Trader (Technical + Fundamental)

@abhipelu -

Gajanan Joglekar

Gajanan Joglekar

@gjoglekar -

Mihir Naik

Mihir Naik

@mihir23192 -

Robin Green

Robin Green

@Bobbolu

Something went wrong.

Something went wrong.