empty_cup

@B2Balzer

Weather, macro and pinball enthusiast #ibreakforbirders Personal opinions expressed, not advice

You might like

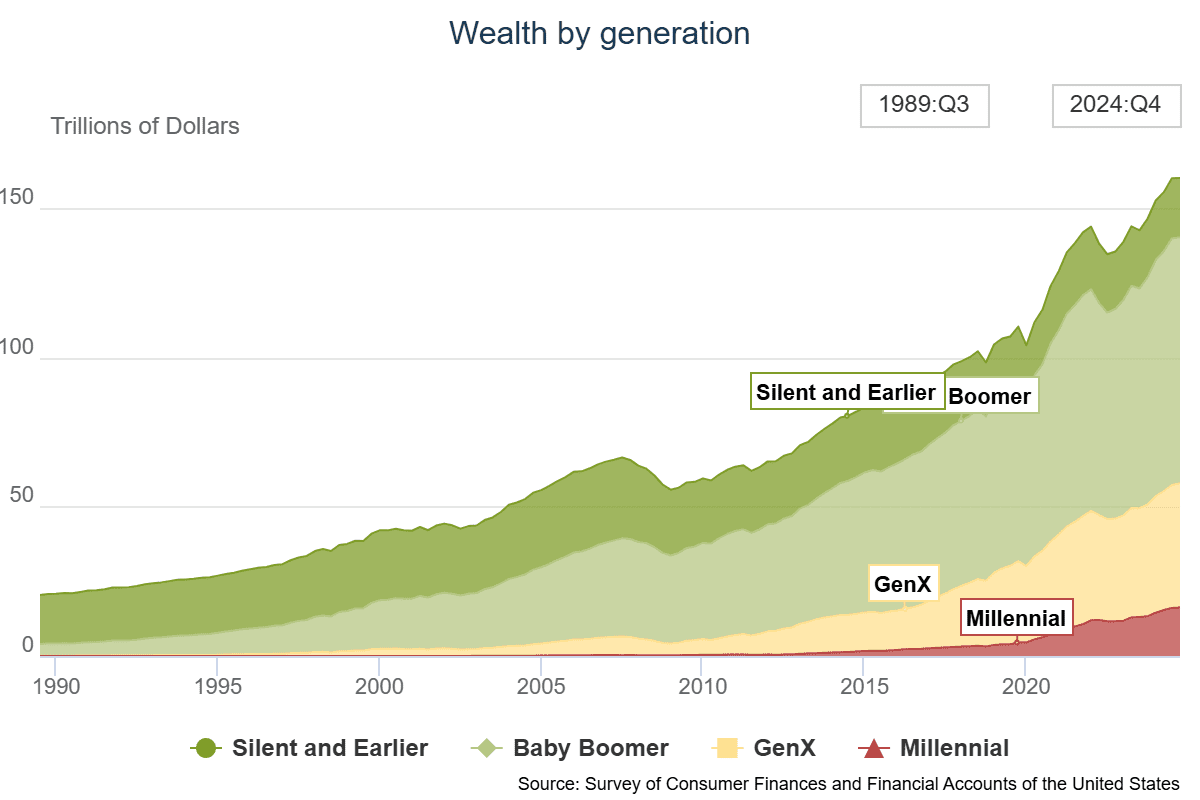

Just so I understand. The green thinks they're going to retire selling all their inflated assets to the red.

. The Next Banking Crisis is Already Starting The ingredients for the next banking crisis are already present in the U.S. financial system right now: Low bank reserves creating intermittent repo market stress, hundreds of billions in unrealized losses on securities portfolios…

So... CPI is down to 2.7% because they stopped measuring everything except gasoline and cars... 🤪 WTF is going on here? 🤣

Inflation 🥶🥶🥶 CPI YoY: 2.7% vs 3.1% exp. CPI Core YoY: 2.6% vs 3.0% exp. Excuse me… I was told by the news that tariffs would cause a massive inflation shock.

((They)) purposefully killed the moderate to accelerate the right v. left divide. Charlie was starting to say minuscule criticisms of israel, but he was the last voice isreal had to reach the youth. If Charlie had turned on Israel publicly, the youth entirely, right and left,…

The great paradox of our time is that technology is massively deflationary while monetary policy is massively inflationary. These forces offset each other, creating the illusion of stability. But this balance is unstable and temporary. In the end, inflation will win.

Misleading hyperbole. sfchronicle.com/weather/articl… via @sfchronicle

sfchronicle.com

One of the largest marine heat waves in decades is impacting California weather

Nearly the entire northeast Pacific Ocean from north of Hawaii to Alaska to California is anomalously warm, the fourth-largest marine heat wave in the region since 1982.

If I am a hourly nurse changing jobs and have to be paid out my pto of 420hours at $97 an hour how much will I be taxed

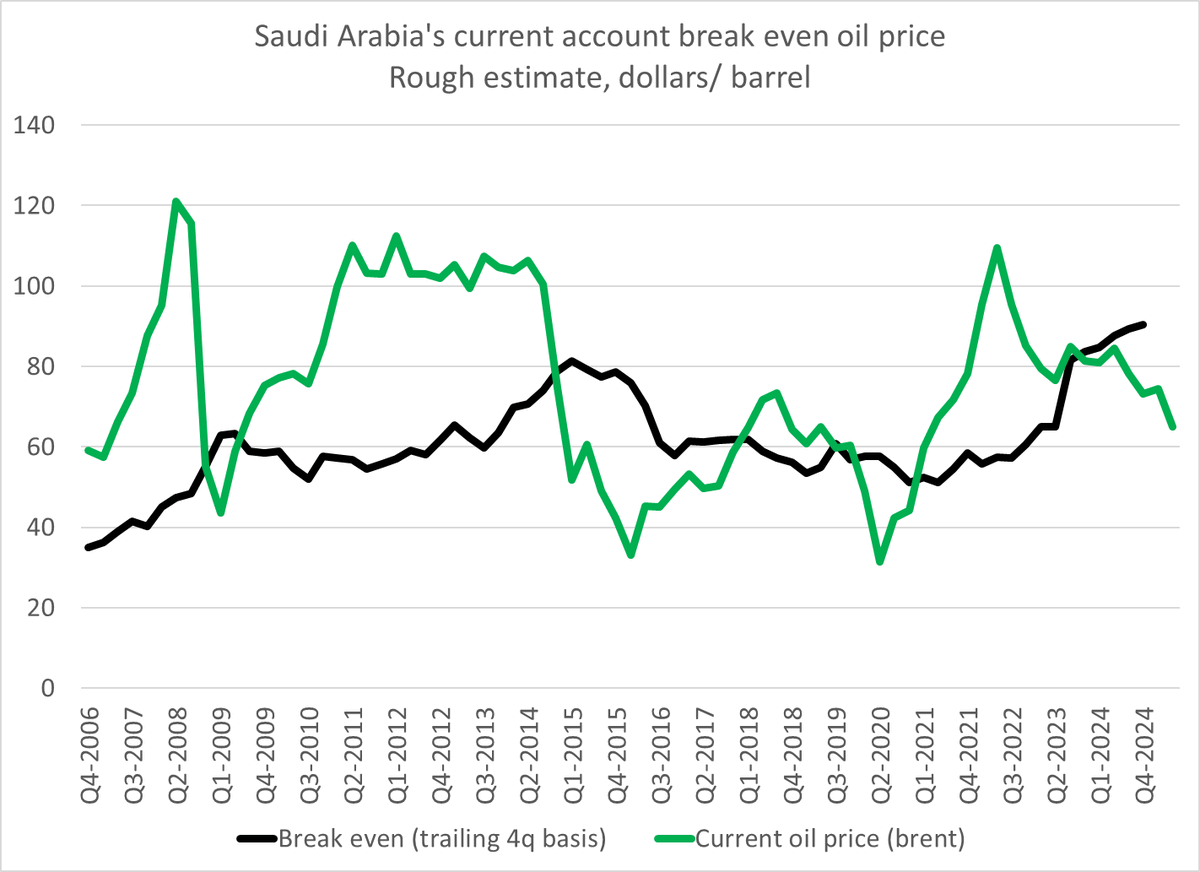

Expect to hear a lot of wildly inflated claims about future Saudi investment in the US over the next few days. Don't tho expect to hear any details about how the Saudis will pay for these investments. 1/

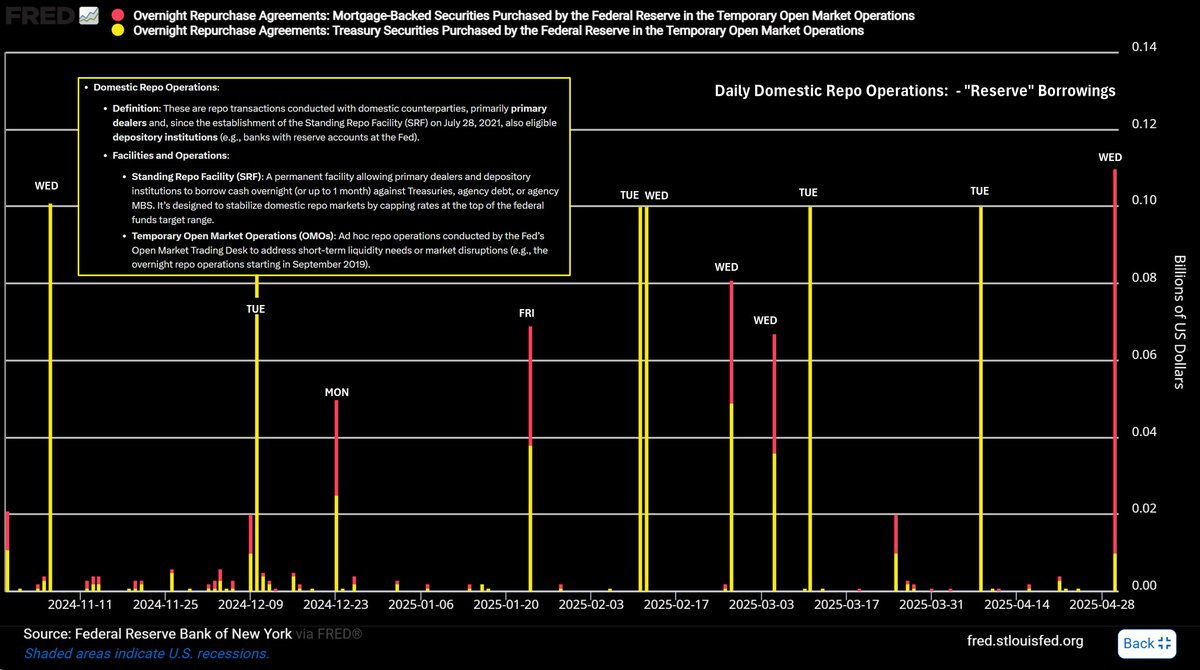

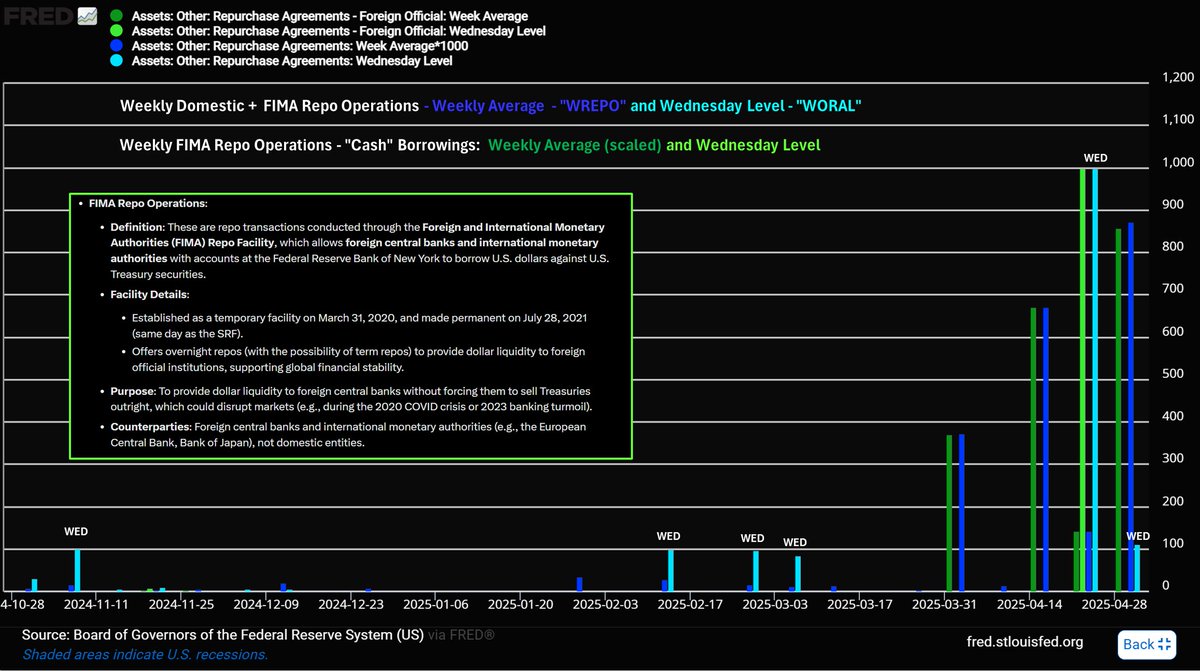

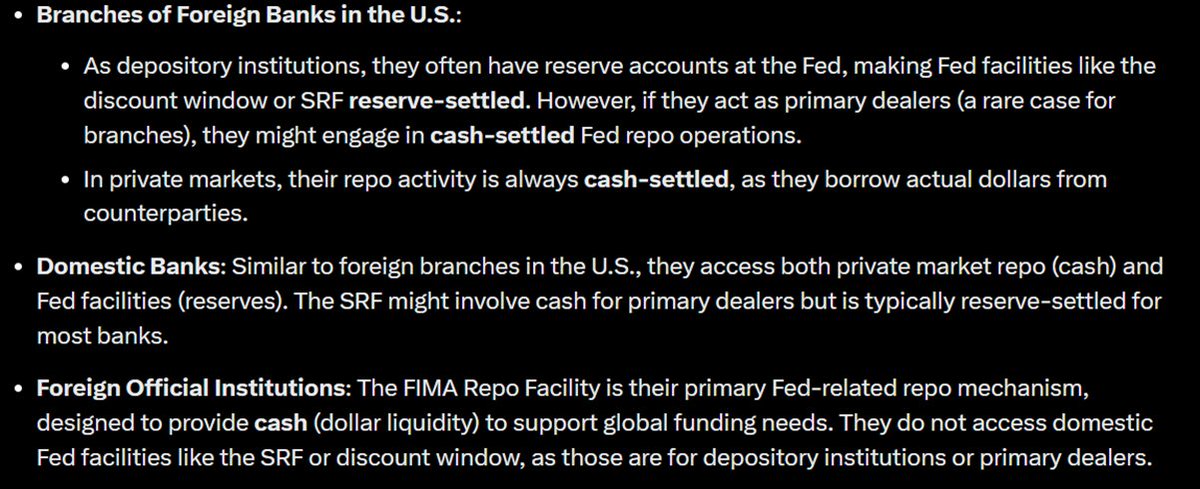

Late Night Repo deep dive 🏄♂️ Every day the Fed engages in Lending activities "Repo" where they loan money to Commercial Banks (Domestic and Foreign) and also to Foreign Monetary Officials like central Banks with accounts at the Federal Reserve - but there are nuances of course.…

as a follow up/companion piece to Ep.#213 with @CaitlinLong_ @SantiagoAuFund go through the reasons for why today's dollar bears are tomorrow's road kill.

📣 New Podcast! "Episode #214 - Brent Johnson and Facing the Dollar's Dominance" on @Spreaker spreaker.com/episode/episod…

spreaker.com

Spreaker Podcasts

Episode #214 - Brent Johnson and Facing the Dollar's Dominance

U.S. production cost pricing shouldn’t spark a multi-trillion-dollar market drawdown. If tariffs were the sole driver, we’d see sectoral rotation, not broad liquidation. Instead, we’re witnessing a coordinated foreign exit—led by European institutions—that demands deeper scrutiny…

Strategic Realism > Economic Idealism The recent carve-out of smartphones and electronics from U.S. tariffs on Chinese imports—despite these goods making up over 55% of the trade flow—marks more than an economic decision. It is a quiet admission that the United States is…

Here are three original, under-the-radar insight that even seasoned analysts may be missing or underweighting: ⸻ 1. The “Yield Spike + SOFR Inversion” ≠ Inflation Warning — It’s a Shadow Leverage Squeeze What it looks like: •10Y yield spiking above 4.39% •30Y SOFR swap…

What unfolded in the past 24 hours was a textbook case of global liquidity fragmentation colliding with political signaling and desperate intervention. We saw a clear Treasury market fracture during Tokyo hours yields surged, dollar funding conditions wobbled, and the BoJ had to…

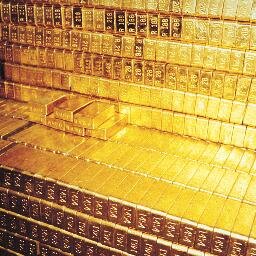

If Trump’s announcement today of a 90-day tariff pause was truly bullish and risk-on, why did we see 10Y yields spike to 4.50%+, SOFR swap spreads collapse to -40.62, gold rip $107 intraday, junk bond yields hit 8.51%, and TLT get liquidated on record volume all while equities…

So it looks like it was Japan that broke Trump and made him fold. Still very bearish for everything but add that everybody knows the US is as weak as EU said . US 10y on the way to 7-8% yield

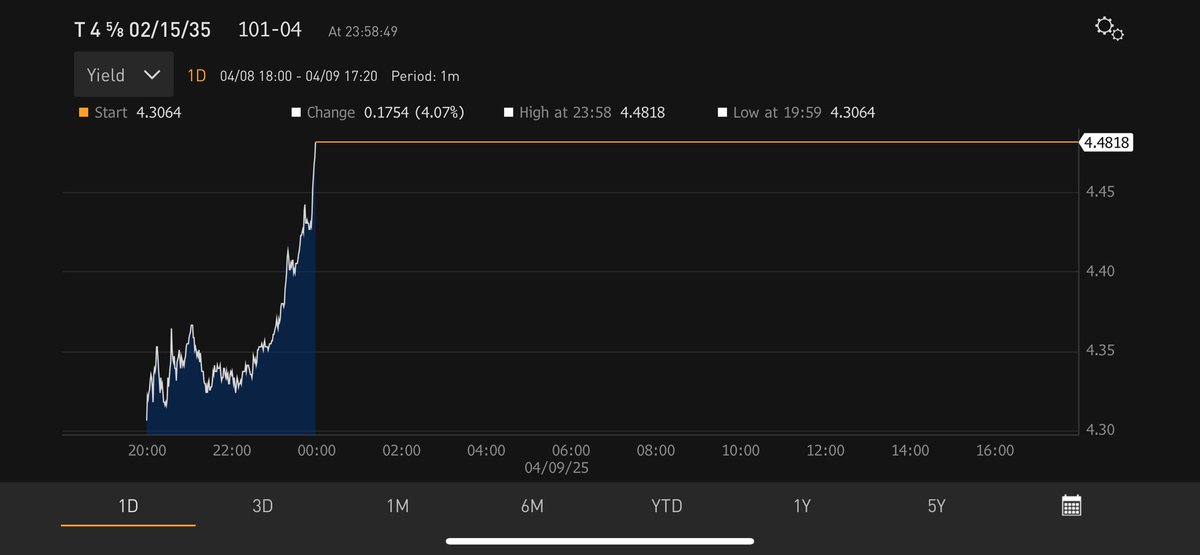

Something has broken tonight in the bond market. We are seeing a disorderly liquidation. If I had to GUESS, the basis trade is in full unwind. Since Friday's close to now ... the 30-year yield is up 56 bps, in three trading days. The last time this yield rose this much in 3…

🚨🚨 10 YEAR YIELD 4.50% 🚨🚨 Either somebody fucking huge just got blown out, or China is dumping treasuries. Nothing else could be causing this.

Feels like America is rapidly turning into Gotham City. If you're rich and don't mind paying $30 for a burrito, congratulations, life is great. You can Uber around town for $50, spend $100 on cocktails and some meal conceived by a "French visionary" but prepared by people…

United States Trends

- 1. Custom N/A

- 2. Corey N/A

- 3. BLACKPINK N/A

- 4. Ford N/A

- 5. Washington Post N/A

- 6. Anton N/A

- 7. Good Wednesday N/A

- 8. #ODEAI N/A

- 9. Rickey N/A

- 10. #wednesdaymotivation N/A

- 11. Rolling Loud N/A

- 12. #signal N/A

- 13. Hump Day N/A

- 14. Hannah Natanson N/A

- 15. Defund NED N/A

- 16. The ARC N/A

- 17. TJ Sabula N/A

- 18. Clintons N/A

- 19. Boosie N/A

- 20. #LA28 N/A

You might like

-

Trading Equity

Trading Equity

@the_equity -

Farid

Farid

@FaridMustafayev -

Jason Bellard

Jason Bellard

@jbellforex -

RLM

RLM

@RossLMarks -

Drum Runner

Drum Runner

@DrumRunnerCM -

Van Ryan

Van Ryan

@DJVanRyan -

حمد بن محمد العمار الخالدي

حمد بن محمد العمار الخالدي

@Hamad_M_Alammar -

PrairieKing

PrairieKing

@MT__Bigsky -

PPILIHP

PPILIHP

@macrodaytrader -

Jodi

Jodi

@jojojo_jodi -

Jake

Jake

@jacobianmatrix -

Joe's Construction Company

Joe's Construction Company

@joesconstruct -

TepTrader

TepTrader

@tep_trader

Something went wrong.

Something went wrong.