BNPX

@BNPX7

they’re only going to keep printing more money

Вам может понравиться

$SLV (weekly) Bearish harami cross at ATHs

$SLV monthly RSI 91 weekly RSI 91 Both highest/most overbought in the past 20 years. 2nd highest times all ended up being the top for many years. If you want to keep it simple, daily RSI is 86. We've hit this number 6 times in the past 20 years 5 out of 6 times, we were a lot…

My investment thesis for Intel is less about Intel’s own competitiveness and more about the U.S. government’s commitment to semiconductors. From the U.S. perspective, Intel is a card that has to succeed. I believe the U.S. will do whatever it takes to make Intel successful.

2026 portfolio: Energy: $AES Defense: $ONDS Semis/AI: $INTC Robotics: $FANUC Commodities: $URA

Someone the other day told me $INTC was dead. It would appear what is dead may never die. Higher.

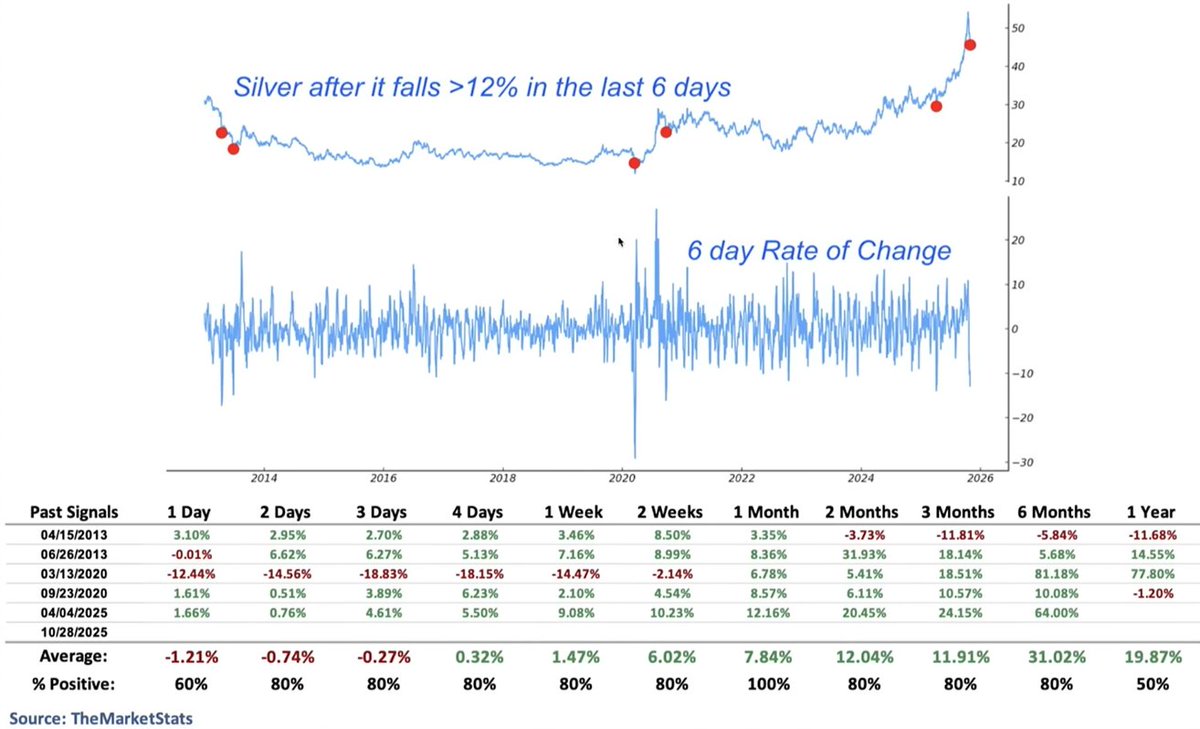

Gold and silver are not the same. Gold is at a decent entry point now. Silver still needs to down.

If you're looking for a range on where silver takes a breather, I'm looking at $81.985 to $88.0229 as where this thing pauses. Going by April 2011 Monthly high close of $47.912 minus the Dec. 2015 Monthly low close of $13.839 gets a spread of $34.073. That spread plus the April…

Happy New Year! 🍾🍾🍾 10 Quick 2026 Predictions: -Bitcoin outperforms gold -Solana outperforms silver -S&P – Contrary to consensus, 1st half will be the best, 10% gains by end of Q2 -Large correction in 2nd half, 15%+ -INDA is the country ETF to play; 25%+ returns -Gold hits…

Happy New Year! 🍾🍾🍾 10 Quick 2025 Predictions: -15%+ correction in SPX in 1H 2025; tests August ’24 low around 5,150, maybe goes lower -SPX finishes year up over 15%, 7,000 range -Gold breaks $3,500 -BTC breaks $150K -Fed cuts at least 100bps -QT ends -DXY ends year below 100…

I will tell you what happens: $INTC will run to $40. People will start questioning why. Mass media will start to change their narratives from FUD to "Intel is America's Darling" or "Intel - Comeback Kid". Then, the stock will rally harder into end of January. Intel will…

As always, I'm bigly bullish on EM. Last year, Brazil was my call, up 44% YTD on EWZ with a huge 5%+ dividend. My EM call for this year... INDIA. Go big. Going to breakout. I'm long quite a few JAN '27 $65 calls at $0.70. Namaste.

I gave my broad US market call, now my crypto call for the year... full predictions to come tomorrow. But it is Solana. The level we are at is key going back to 2021. I have entered a futures position that I will roll. My stop is all the way down at $89.20.

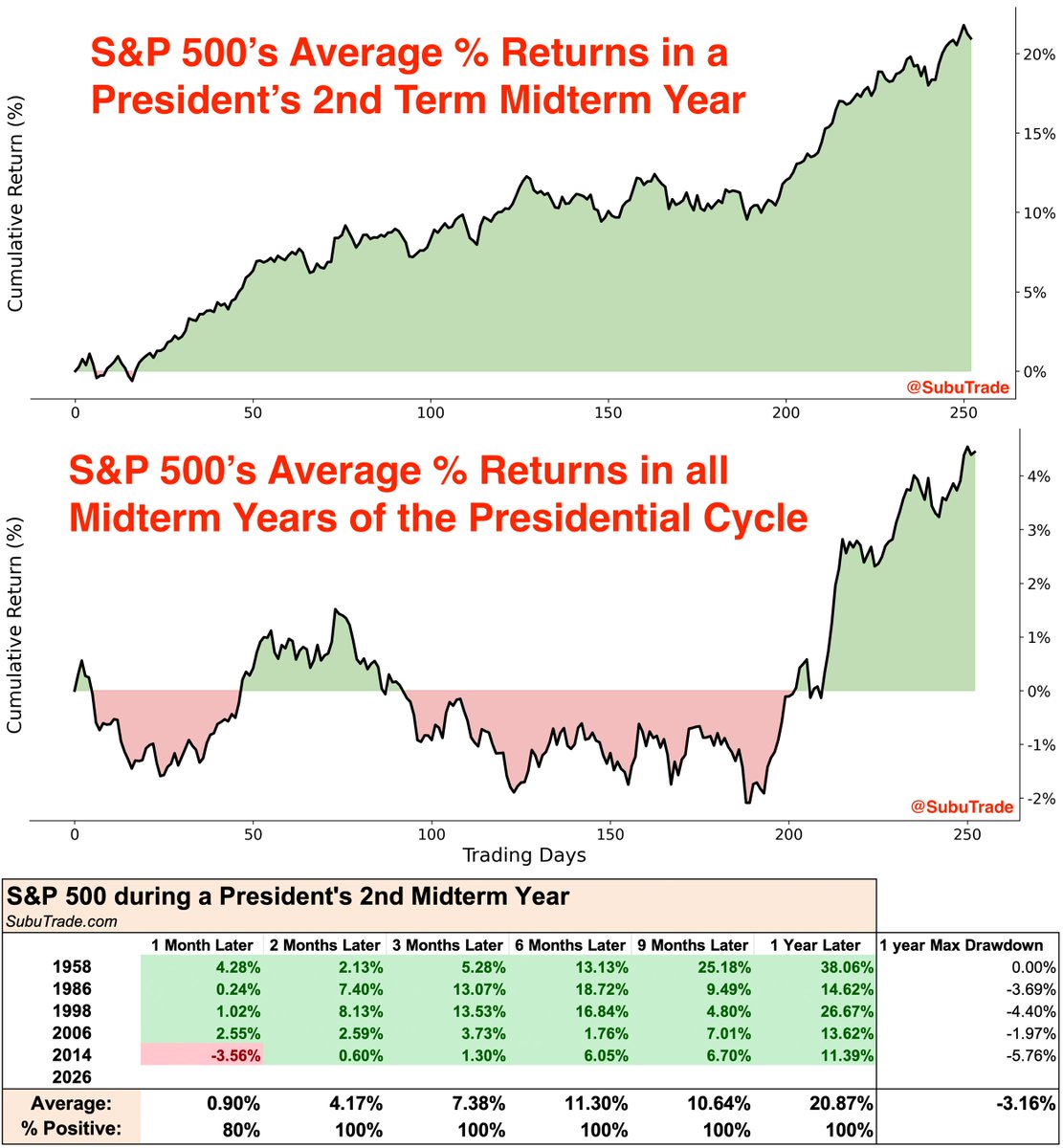

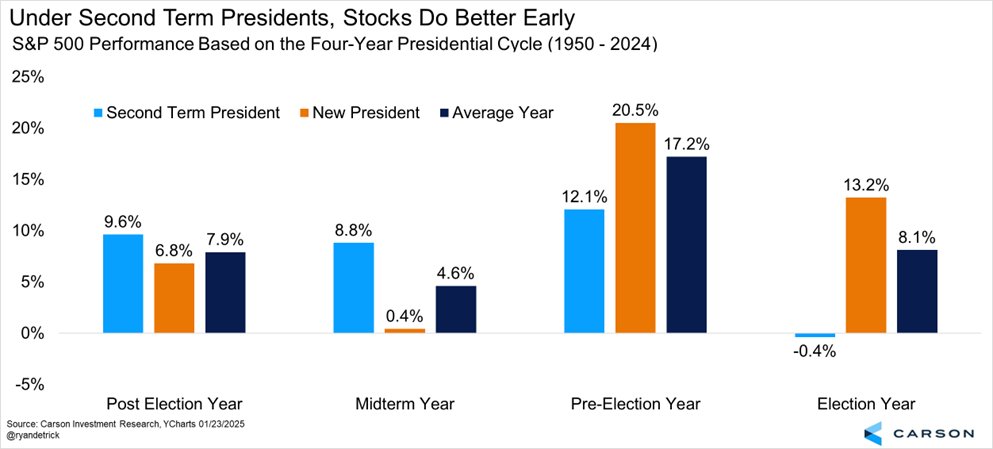

2026 is a Midterm Year of the Presidential Cycle. It's generally the weakest year of the Presidential Cycle. But Midterm Years are quite bullish under 2nd Term Presidents (e.g. Trump in 2026). $SPX was up each time a year later, average gain +20% h/t @RyanDetrick

Yes, midterm years tend to be weak, but they actually do much better under a second-term President. In fact, early in a second-term (post-election years and midterms) do better. It is later in the term things don't do as well and first-term Presidents see the better returns.

Yet another missive, similar to Professor Plum on the poverty level, that merely restates the obvious and the longstanding, yet gets looked at as perceptive. On the poverty level piece, the main point was that the rich are doing well and the poor are struggling. No shit. And as…

Intel rally is likely due to this piece 1) Intel winning a plethora of hyper scaler advanced packaging 2) Apple iPhone and Nvidia wafers for 14A Intel winning iPhone non pro has been floated before. Lip-Bu had a dinner with Tim Cook, and is the closest Foundry customer $INTC

This is a very bullish piece on ASML, but if you look closely, it’s also bullish on Intel. According to the article, Broadcom-designed AWS chips will be packaged using Intel’s EMIB. It even claims that Nvidia’s “Nintendo Switch 3” chip will go into mass production on Intel 14A.…

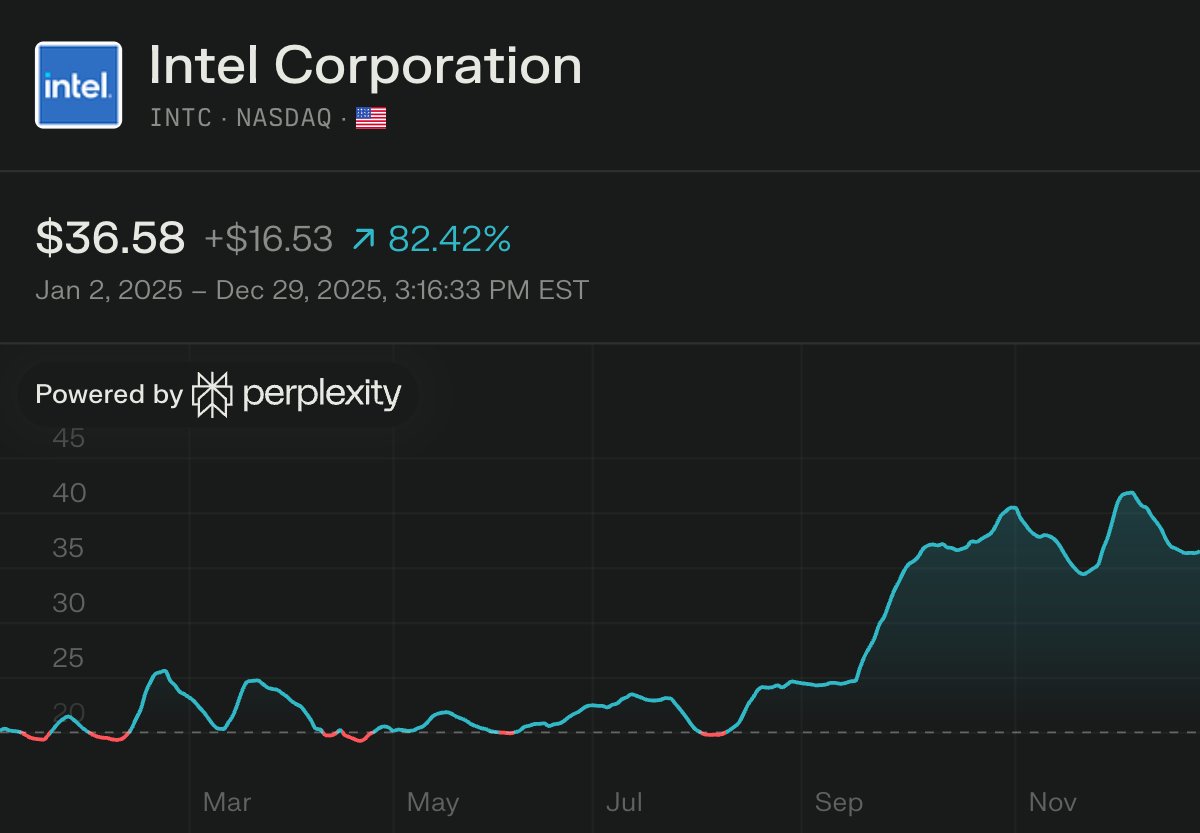

$INTC stock is up 82%+ this year! The U.S. government owns 10% of Intel Nvidia owns 4% SoftBank owns 2% Intel is a national security asset now. 2026 foundry deals are incoming.

There’s always a bull market somewhere. IMO these haven’t even begun to run 🤝

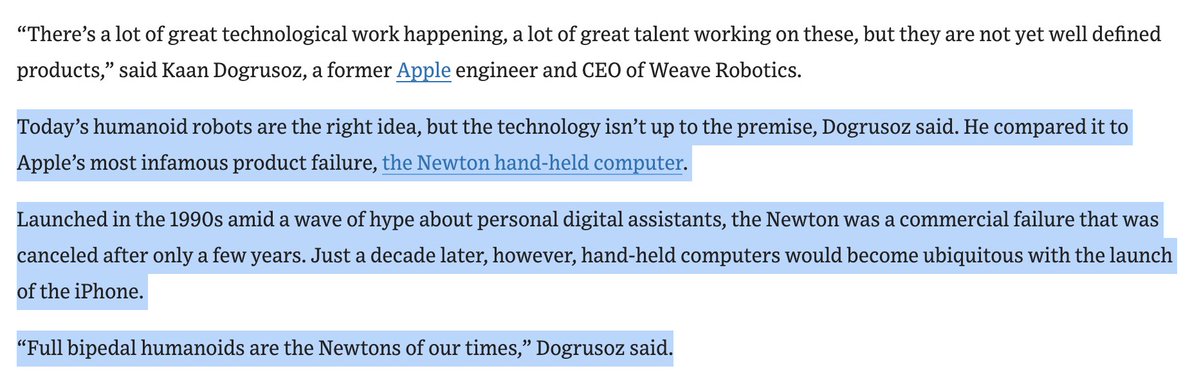

Interesting article by WSJ on the hype + valuations surrounding humanoid robotics. wsj.com/tech/ai/humano… IMO manufacturing robots & non humanoid proliferation will occur at a much faster rate than humanoid robotic proliferation in the next 5y. Although humanoid robots are…

$Silver with another crazy open, this move is very extended. Refill targets at $65 and then $58 once the parabola breaks down.

It’s so funny seeing everyone love silver right now. I’m doing nothing but harvesting this past week, looking to reload. BTW, as always gold/silver my largest holdings followed by Bitcoin. Just offloading my leveraged/option PM plays and still massively long physical and…

Some folks asked me about PMs. I still love them. As I've repeatedly said for years, gold is my biggest single position and I also love silver. I have been adding recently, particularly to things like SLV 50/53 call debits at 0.25 for Dec 31 expiry, currently at 0.35. Why?…

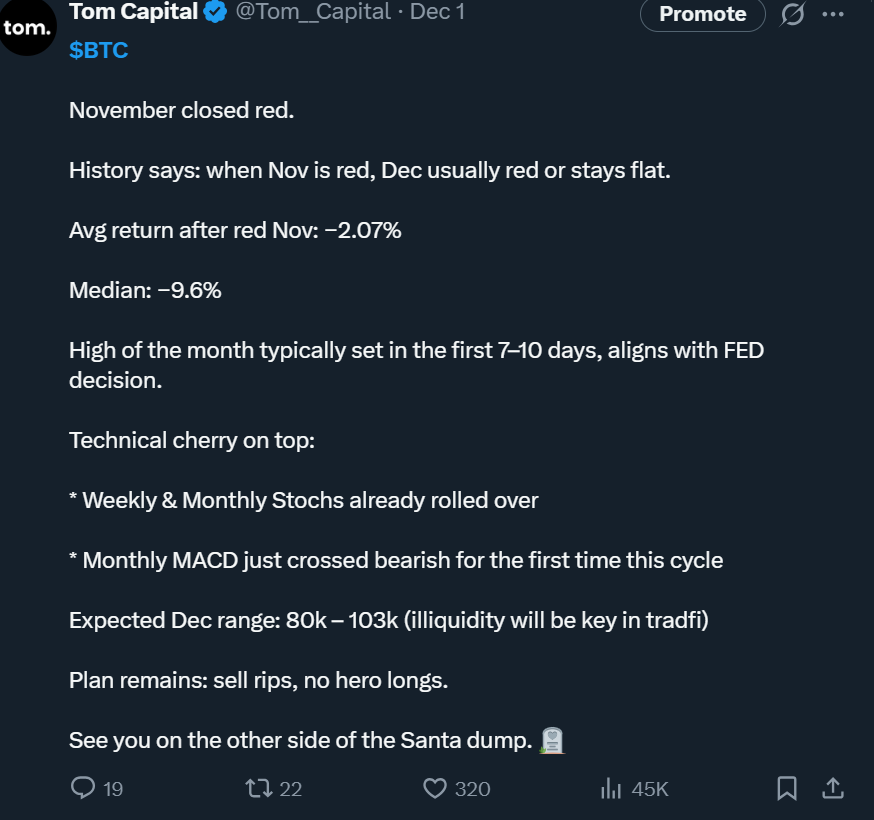

$BTC 🧵Getting this out early for the stats nerds ahead of January 2026. Nov/Dec played out nicely this year (backtest it yourself if you haven't). Quick reminder: These are pure historical stats (2010–2025) with no broader context — definitely not predictions. Data sources…

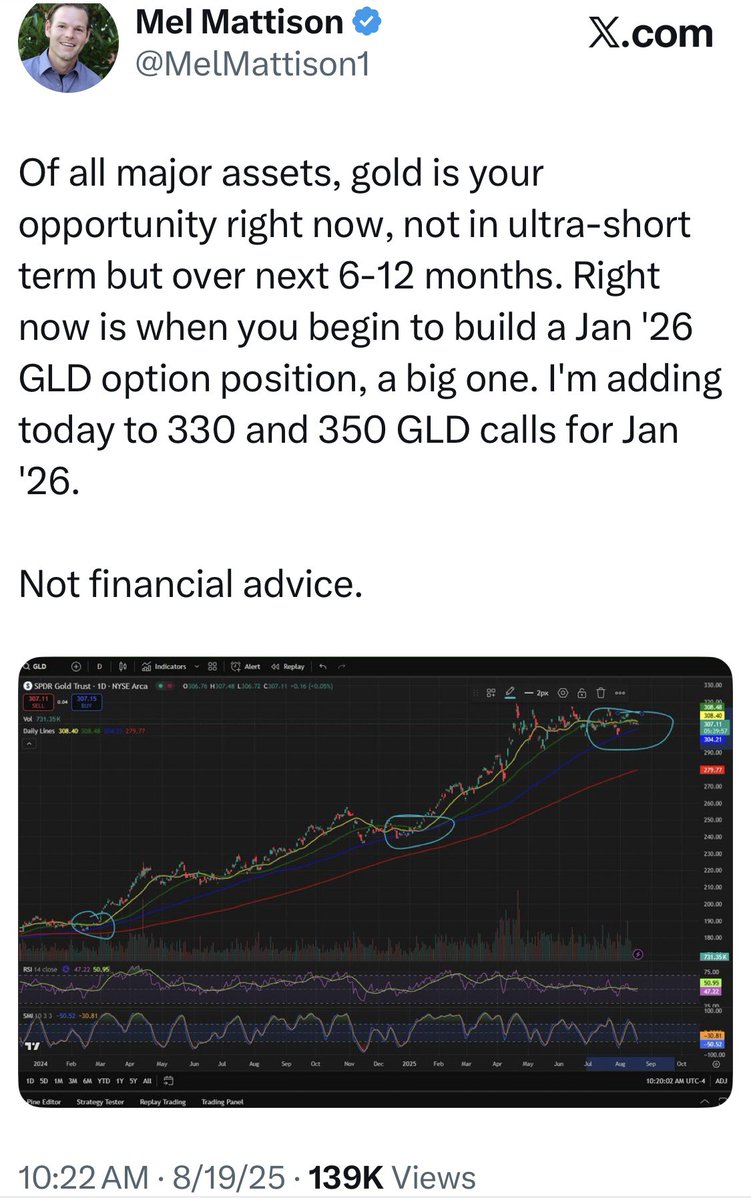

Sow while others reap. Reap when others sow. When CNBC, all the X feeds, every financial pundit is extolling the virtues of PMs, it’s time to take some profits. The time to see platinum as a big buy was back in March when it was under $1k. The time to build big Jan option…

Monthly chart of Platinum. IF gold and silver are breaking out, what if platinum begins to follow? Again, this a monthly chart going back into the 20 teens.

Every day we pray $INTC goes a little lower to $28-32 before earnings for generational wealth. 🤔4 clients: Microsoft, Google, Apple and Mediatek?

Hi all, I'm back from San Juan. What a run for the PMs this year, but I'd be very careful with gold at this level. I closed out all but a couple of my GLD and SLV options today. Will look to load up again if we get back into the range of the dotted line below... around $4,200.

If you're looking for a range on where silver takes a breather, I'm looking at $81.985 to $88.0229 as where this thing pauses. Going by April 2011 Monthly high close of $47.912 minus the Dec. 2015 Monthly low close of $13.839 gets a spread of $34.073. That spread plus the April…

United States Тренды

- 1. Hilton 68,9 B posts

- 2. Tim Walz 399 B posts

- 3. Mark Kelly 79,3 B posts

- 4. All 20 59,5 B posts

- 5. UCMJ 3.172 posts

- 6. Bud Light 3.637 posts

- 7. Iwobi 12,5 B posts

- 8. Bitget TradFi 6.647 posts

- 9. Hegseth 115 B posts

- 10. Stefanski 28,2 B posts

- 11. Tampon Tim 27,2 B posts

- 12. Lookman 15,9 B posts

- 13. Sedition 9.767 posts

- 14. Jonathan Gannon 5.526 posts

- 15. Benedict Arnold 1.040 posts

- 16. Raiders 73,2 B posts

- 17. #Unrivaled N/A

- 18. Geraldo 1.776 posts

- 19. Shapiro 23,4 B posts

- 20. Traitor Tim 69,3 B posts

Something went wrong.

Something went wrong.