Basic Research

@BasicResearch2

Trying to learn about interesting businesses and industries around the world

You might like

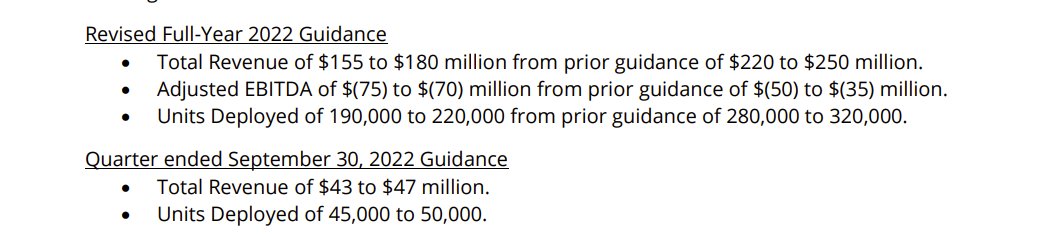

Smartrent - quite stiff reduction in 2022 guidance here 30%ish cut to units and revs, 70% jump in EBITDA loss. Gross margins still essentially zero Software ARR of $16m in 1Q, up to $30m in 2Q, but most of growth from $125m acquisition Still an $800m EV I believe

Will be interesting to see when SmartRent follows them. SmartRent is no picture of perfection. Negative GP, burning $90m per year, with $270m in cash. Prob will want to lengthen that runway as well... Somehow a >$1bn company too I assume a ladder candidate @MadThunderdome?

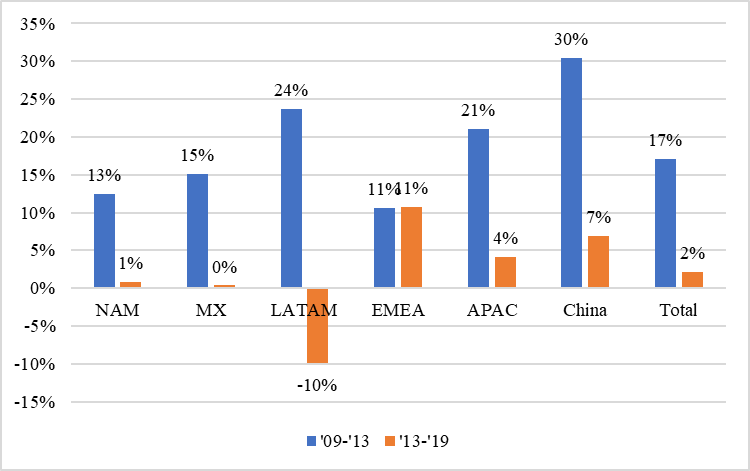

In the end, did @BillAckman seriously impair $HLF? Volume growth by region. Ackman first published on HLF in late 2012, attacked it throughout 2013, and apparently (per Wiki) spent $50m on a PR campaign in 2014 Pre-2013 and post-2013 growth are in a very different zipcode

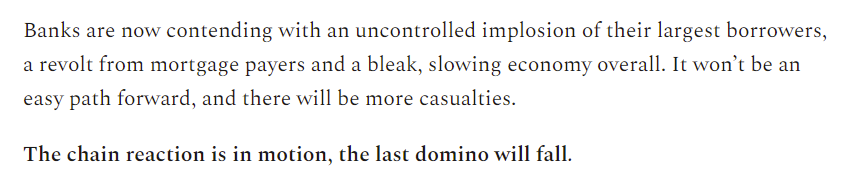

Great piece from @T_L_B_S_ thelastbearstanding.substack.com/p/dominoes?utm… Interesting to think through the implications. Perhaps this explains why commodities have been so weak over last month? Potential credit crisis + contagion in largest source of demand growth for last 5+ years?

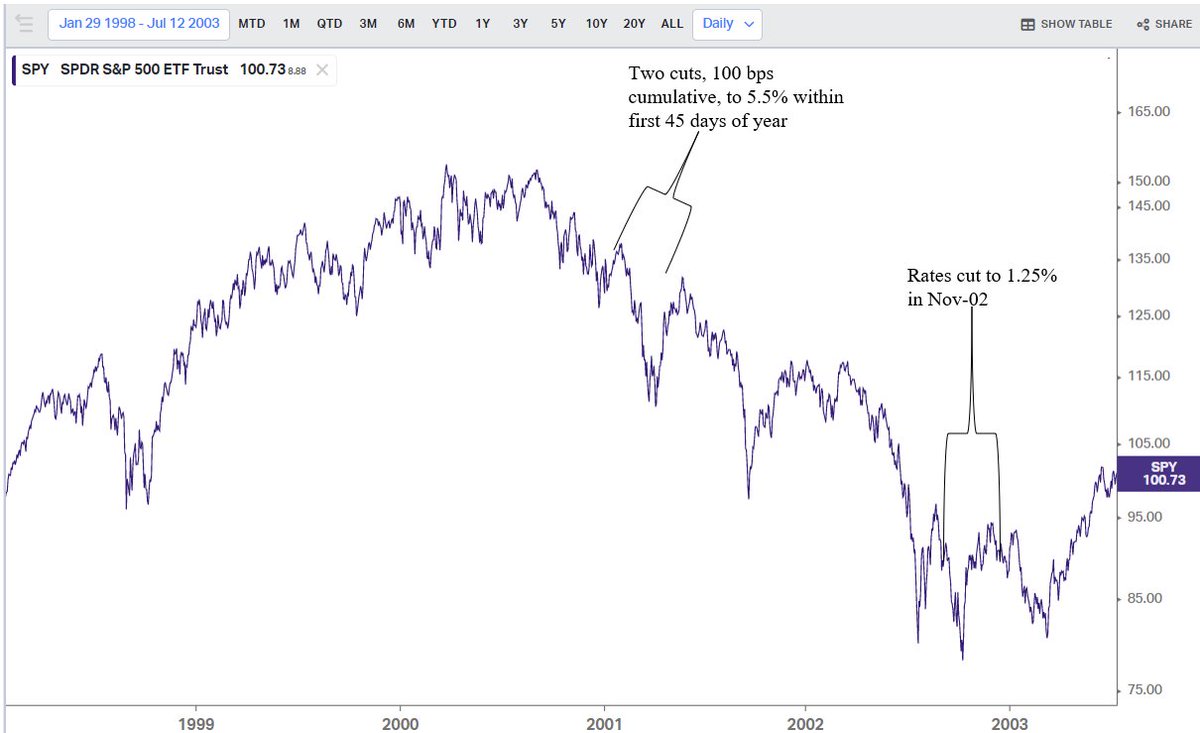

Don't necessarily agree with this. In the 00-02 market environment, I believe the Fed cut 12 times between the peak and the trough of the S&P S&P declined >40% during this period

Whenever the Fed does pivot, and it will eventually, the U-turn in markets will be breathtaking. But patience is a virtue as we aren't anywhere close yet IMO.

arstechnica.com/information-te… In Starlink's aggressive pursuit of any/all revs sat broadband revs, is this just really bad for all FSS incumbents? Should we expect even greater pressure on Maritime/Fixed data revs at ISAT, ETL, and even Iridium? Thoughts @TMFAssociates?

Boy there is a massive difference between a) a deal at a reduced price of >$45, and b) a >$3bn break fee. A $3bn break fee doesn't move the needle at all for Twitter shareholders That is saying it will be worth $20 or >$45. Would suggest current px is close to fair value

It may take a while to play out, and will likely be quite entertaining, but I believe a negotiated settlement will be the most likely outcome If not a reduced price of >$45.00, then a negotiated break fee that is >$3 billion out of Elon's pocket 12/

It's not the word I would've gone with, but fair enough $FUV

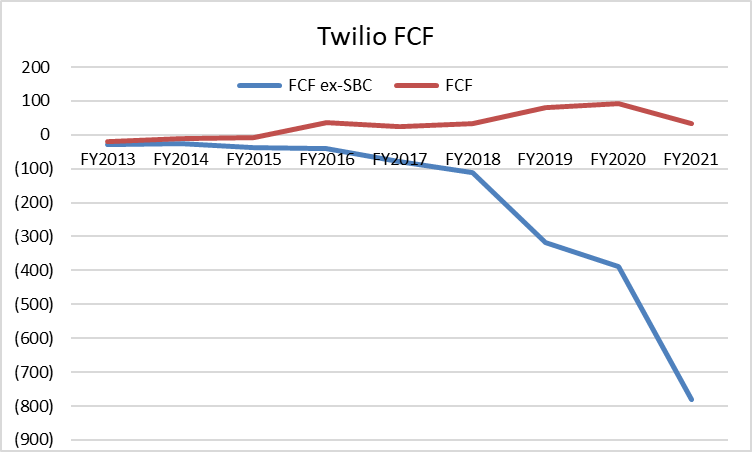

Took 1st pass at Twilio fins given the px decline. On FCF basis, TWLO roughly breakeven. Some degradation in margins recently. But after you hit for SBC, the picture looks a lot worse. >$700m loss and -27% margins. Any easy explanations? @BucknSF @MarceloPLima

United States Trends

- 1. #WWERaw N/A

- 2. Bovino N/A

- 3. Homan N/A

- 4. Louisville N/A

- 5. #RawOnNetflix N/A

- 6. AJ Styles N/A

- 7. Pat Kelsey N/A

- 8. El Centro N/A

- 9. Pro Bowl N/A

- 10. The Vision N/A

- 11. #90dayfiancetheotherway N/A

- 12. Austin Theory N/A

- 13. #AmericanIdol N/A

- 14. Duke N/A

- 15. Highguard N/A

- 16. Adam Pearce N/A

- 17. The Atlantic N/A

- 18. #BelowDeckMed N/A

- 19. Jrue N/A

- 20. Senator Young N/A

You might like

-

11 KM/s

11 KM/s

@escvel0city11 -

BCap21

BCap21

@b_cap21 -

MJH📈📉

MJH📈📉

@hedgie007 -

Streets of Value

Streets of Value

@ValueWolf -

Turtle Capital

Turtle Capital

@TurtleCapMgmt -

Andy Deponai

Andy Deponai

@AndyDeponai -

Ray

Ray

@heartof_thesea -

Market Euphoria

Market Euphoria

@marketeuphoria -

Westpine Capital

Westpine Capital

@buckbid -

Joey Brookhart

Joey Brookhart

@SaasquatchC -

moats-and-notes

moats-and-notes

@PetramcoC -

Jigsaw

Jigsaw

@JigsawCap -

Tenebrist Global, LP

Tenebrist Global, LP

@TenebristGlobal -

Speedwell Research

Speedwell Research

@Speedwell_LLC -

Austin Powers Capital

Austin Powers Capital

@austinpowerscap

Something went wrong.

Something went wrong.