Basispointers

@Basispointerss

L/S equities | Options Trader | 15 years Wall Street trading experience | New account 16 AUG, posting daily trade ideas and Macro Reports | Not financial advice

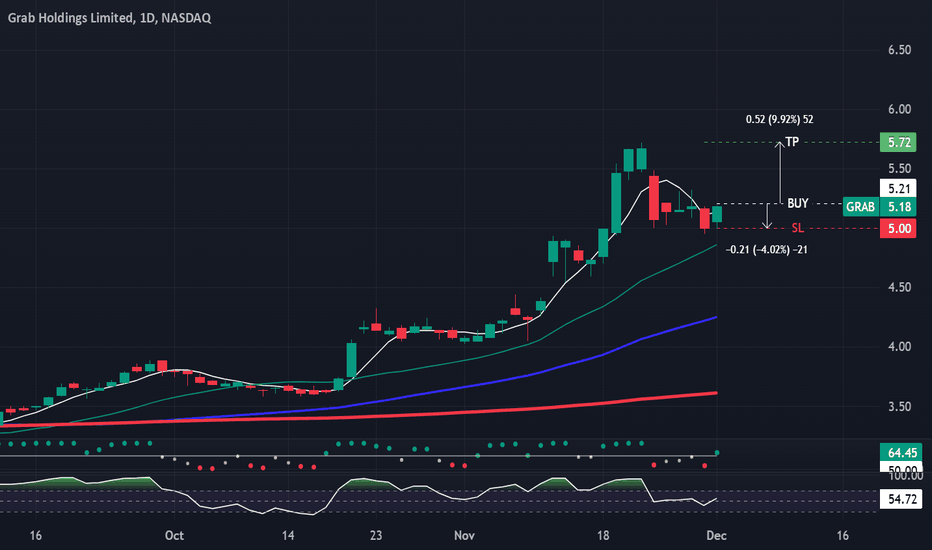

3. $GRAB 🧵 🟩TLDR: Grab just turned a profit. Q2 rev beat, now riding above its 200-day MA, with a golden cross working in its favor. The Southeast Asia super-app is cooking. Grab is showing real progress. turning a profit, growing in key markets, and executing on its superapp…

$TNL is up 5% today and up to $62.5 since this post went out. My calls are up 84% on the day. 🔥🔥

4. $TNL 🧵 🟩TLDR: TNL has had a monster year as consumer travel has rallied. TNL sits above its 200-day MA with a golden cross, a solid ~3.7% dividend, and AI models calling for short-term outperformance. Travel’s comeback is real.

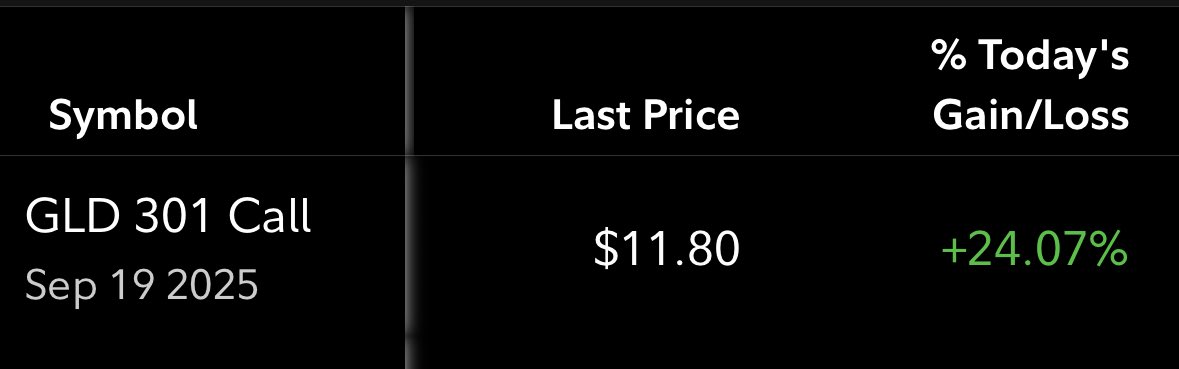

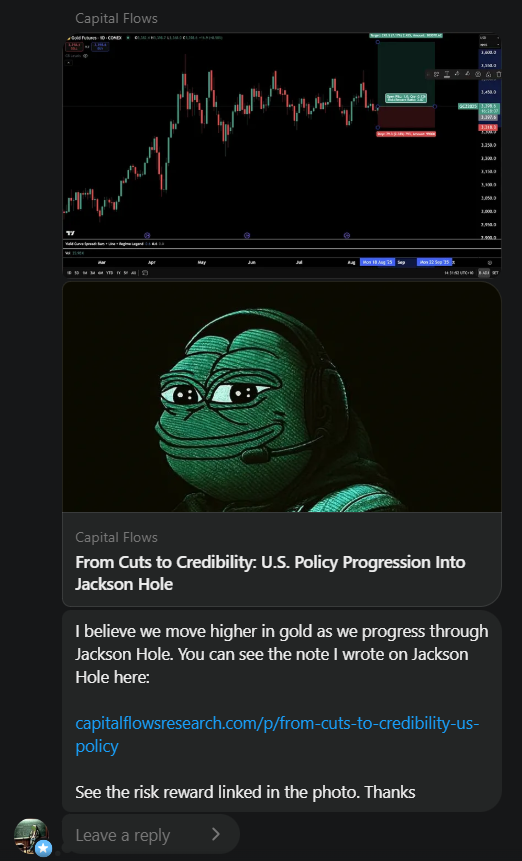

The $GLD calls hit in a big way +24% on the day!! Being long Gold pre-Jackson hole was a great decision.

Long Gold ( $GLD & Futures) Pre-Jackson Hole and beyond. ✅🧵 1. Gold’s Up on a Weaker Dollar and Fed Dissenters Gold prices ticked up today, spot gold rose nearly 0.9%, and futures followed suit. The dollar softened (making gold more affordable globally) and traders digested…

Happy Friday! Equities are green in the pre-market for the first time this week. Could see a rebound for $SPY today headed into the weekend. $BTC remains below 113k, not showing signs of coming back just yet. Enjoy the weekend.

A string of red days can cause traders to lose confidence in the market... don't pull out just yet. When the market strings together losses, the first instinct is panic. Smart traders step back and check the moving averages: Are we still above the 50-day or 200-day MA? Is…

21 August AM Trading Playbook: What Matters Today 🟩💵🟩 Huge day ahead!! Markets wrapped yesterday with distinct caution mixed into optimism: $SPY slipped ~0.6%, while the Nasdaq fell ~1.5% as tech sold off sharply. The Dow held steady, buoyed by value and retail strength.…

Credit is the quiet tell. Investment grade spreads keep grinding tighter while high yield refuses to confirm: that divergence will decide whether the equity story extends or cracks. And remember, liquidity drives everything. As central banks step back, the real trade is spotting…

1. Jackson Hole is surely a Catalyst In past years, Jackson Hole has sparked major gold moves: •2010 → QE2 pivot fueled gold’s surge +30% •2019 → Trade-war commentary lifted gold above $1,500 •2020 → Shift in Fed targeting drove gold to a record ~$2,070 Like we saw today…

LONG GOLD INTO JACKSON HOLE. See the linked report where I laid everything out

Slow market Monday today, waiting on retail earnings and Jackson Hole later in the week. S&P flat, Dow drifted down a smidge, Nasdaq flat. Solar names got a mini pop, Dayforce on the rumor rocket. I was up .80% on the day. Mondays can surprise so always nice to start the week…

We’re going to melt assets up and the crash them down in this credit cycle Will assets be higher in 20 years ? Yeah sure but we all know that The question is HOW MUCH returns can you make on the path over the next 20 years. For now, higher ✊🏻

🟩OPTIONS PLAY: AMD $175 CALL exp 8/22 🟩 TLDR: AMD trading well above the 200-DMA, golden technicals flashing, AI momentum firing. I’m holding the $175 CALL exp 8/22. Tight strike, big upside if tech rally continues. Risk = premium. 1. AMD Makes Sense Now •Trend intact,…

United States Trends

- 1. Happy Thanksgiving 230K posts

- 2. #StrangerThings5 320K posts

- 3. Afghan 362K posts

- 4. #DareYouToDeath 213K posts

- 5. DYTD TRAILER 147K posts

- 6. BYERS 74.3K posts

- 7. Turkey Day 15.2K posts

- 8. robin 112K posts

- 9. Good Thursday 21.5K posts

- 10. Feliz Día de Acción de Gracias N/A

- 11. Vecna 74.4K posts

- 12. Taliban 46.8K posts

- 13. Dustin 58K posts

- 14. Rahmanullah Lakanwal 141K posts

- 15. Reed Sheppard 7,589 posts

- 16. Holly 75.1K posts

- 17. #Thankful 3,441 posts

- 18. Tini 12K posts

- 19. Nancy 72.5K posts

- 20. Happy Turkey 13.1K posts

Something went wrong.

Something went wrong.