Big Data Quant

@BigDataQuant

Quantitative Investment Management | Machine Learning | Entrepreneur | Python | R | Stanford Mathematician

You might like

#ComputerVision in action! #ArtificialIntelligence #MachineLearning #DeepLearning #DataScience #FacialRecognition #SentimentAnalysis #AI #FF @antgrasso @mvollmer1 @enricomolinari @Ronald_vanLoon @StratoRob @alvinfoo @kashthefuturist @Fabriziobustama @IanLJones98 @pascal_bornet

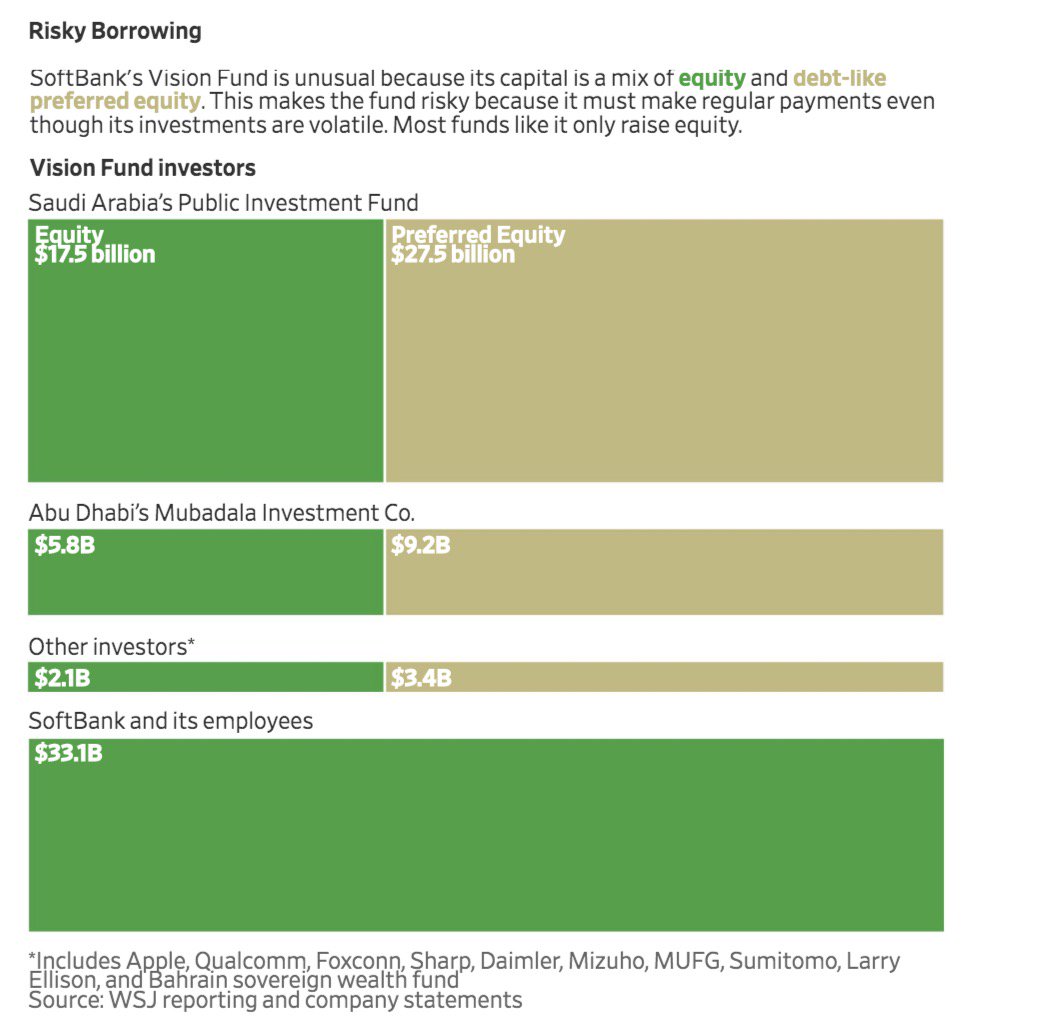

SoftBank broke almost every rule of investing to create biggest fund ever. Roughly 40% of Vision Fund’s cap is in form of preferred stock, which promises return of 7% pa, just like debt. Delay of WeWork’s IPO & selloff of holdings showing cost of LEVERAGE. wsj.com/articles/what-…

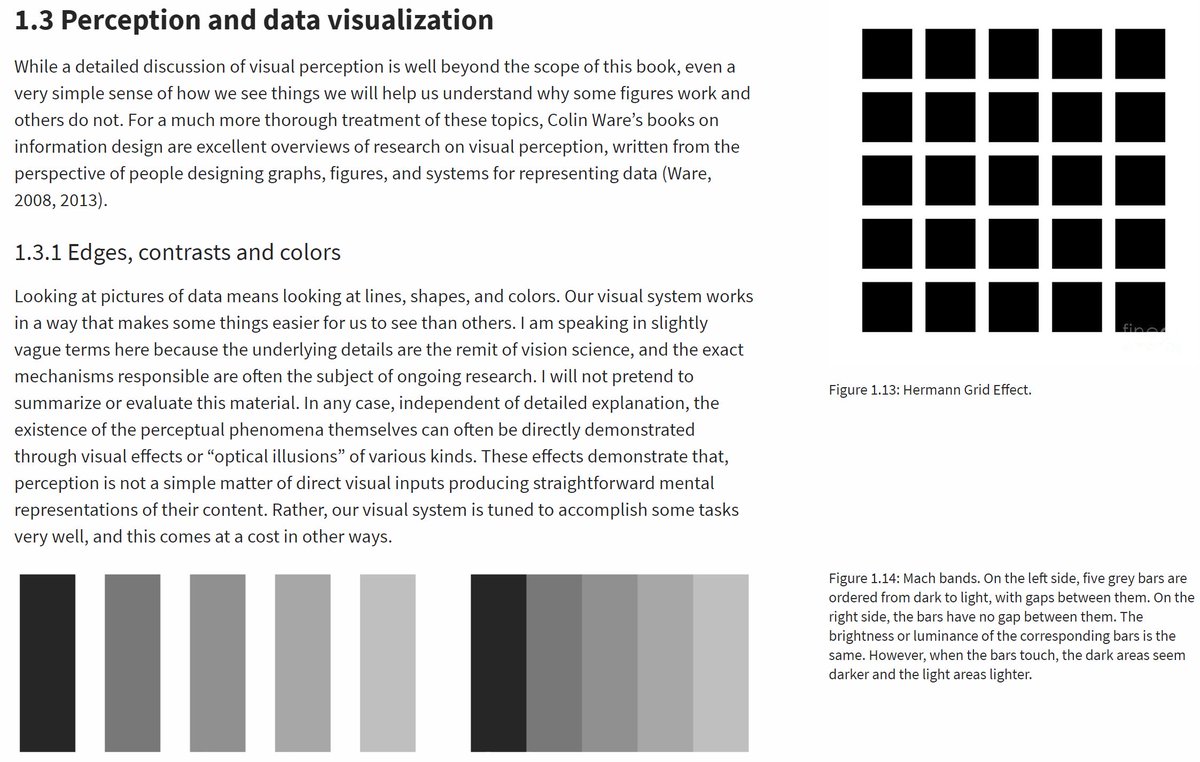

"Data Visualization: A practical introduction" A stunning, beautiful, carefully researched, free, online book by @kjhealy socviz.co

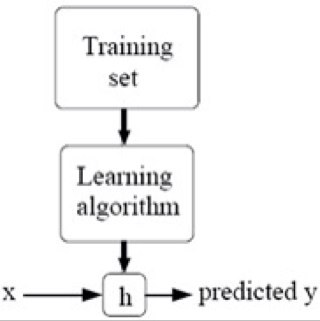

Learn Machine Learning concepts by taking the same course that over 10,000 Google engineers have completed (available in English, Spanish, French, Korean, and Mandarin) Start the crash course here → goo.gl/kIEHFH

Goldman Sachs previews the Federal Reserve decision on Sept 17 bit.ly/1iFzBoK

Deep Learning and multivariate time series prediction paper math.kth.se/matstat/semina…

1000 Useful Repositories for #DataScience, R, #Python, #MachineLearning, and more: bit.ly/1DjLSc0 #abdsc #Rstats #BigData

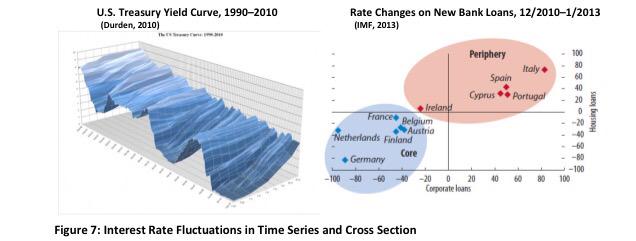

Financial stability visualization paper financialresearch.gov/working-papers…

Indonesian rupiah at levels not seen since '98: Indonesia's local currency Tuesday plunged t... cnb.cx/1OtjS6a #finance #trading

Fed's Williams on a September hike ... "sounded like a man very much on the fence" news.forexlive.com/!/feds-william…

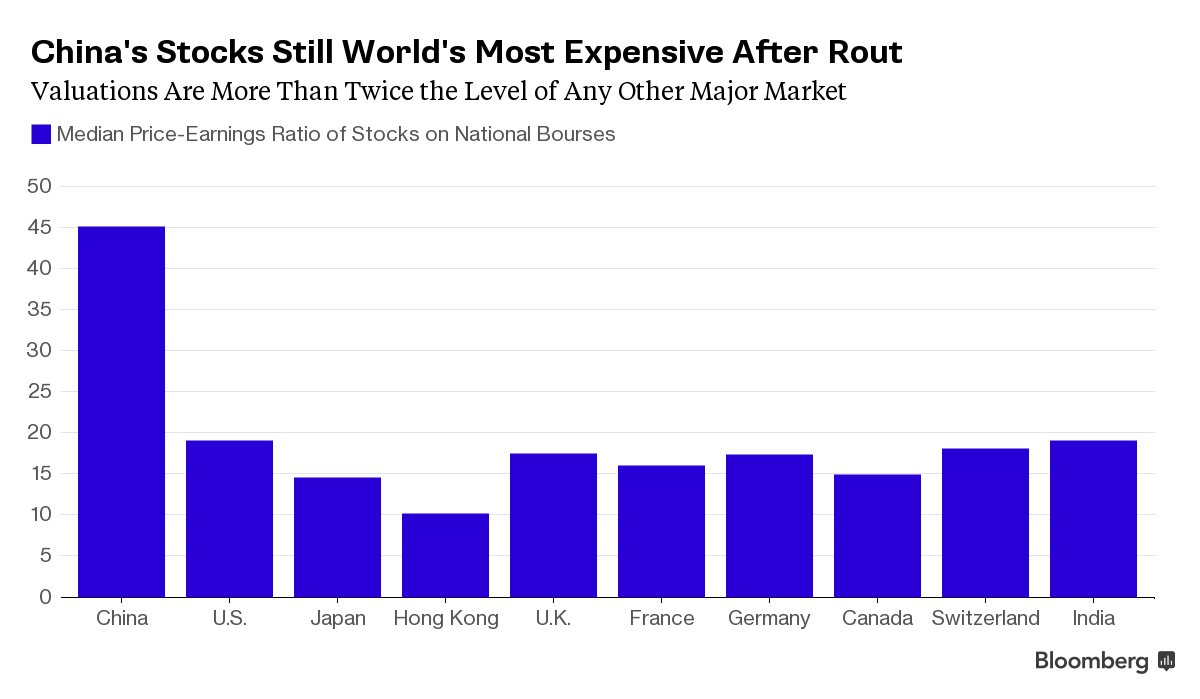

Chinese stocks are still world's most expensive based on valuations.

Thanks FOMC! Buying USD against high beta ZAR, TRY and HUF!

Today is the FOMC meeting. Brace yourself for a volatile day. Make sure you want to be involved in today`s market.

Productivity plunges across America, as average people gather to anxiously await the FOMC announcement.

Gary Kazantsev (@Bloomberg) on financial text mining: "...all the worst challenges of every text problem you know...and several you don't."

Practical Deep-Learning Lecture: Machine Perception and Its Applications (Adam Gibson) #datasci #machinelearning datasciencereport.com/2014/09/14/pra…

I'm a earthquake veteran here in the Bay Area, but that one was the biggest one I remember since 1989 SF Earthquake. Woke me up.

United States Trends

- 1. Thanksgiving 2.18M posts

- 2. Dan Campbell 4,731 posts

- 3. Lions 88.2K posts

- 4. Jack White 7,490 posts

- 5. Goff 9,421 posts

- 6. Micah Parsons 3,832 posts

- 7. Jordan Love 9,517 posts

- 8. #GoPackGo 7,444 posts

- 9. Jamo 4,598 posts

- 10. Wicks 5,876 posts

- 11. #GBvsDET 4,132 posts

- 12. Jameson Williams 2,409 posts

- 13. Gibbs 8,493 posts

- 14. Watson 13.5K posts

- 15. #OnePride 6,201 posts

- 16. Thankful 440K posts

- 17. Green Bay 6,996 posts

- 18. Turkey 283K posts

- 19. Nixon 5,515 posts

- 20. Amon Ra 3,128 posts

Something went wrong.

Something went wrong.