BUDDYBUILDER

@BuddyBuilderr

Your BuddyBuilder | Building Myself and Web3 projects,one at a time 🫡 | See you at top 🎯 |

Most crypto projects promise institutional adoption. @RaylsLabs already has it. Brazil's Central Bank selected Rayls for their Drex CBDC pilot, installing it in 16 major banks with production targeted for 2026. Cielo, Latin America's biggest payment processor, is launching…

. @RaylsLabs uses a three-layer system that's actually genius: Layer 1: Public EVM chain (built on Arbitrum Orbit) with USD-pegged gas fees so institutions don't face volatility surprises. All accounts are KYC-verified but still composable with DeFi. Layer 2: Privacy Nodes -…

. @RaylsLabs uses a three-layer system that's actually genius: Layer 1: Public EVM chain (built on Arbitrum Orbit) with USD-pegged gas fees so institutions don't face volatility surprises. All accounts are KYC-verified but still composable with DeFi. Layer 2: Privacy Nodes -…

The Problem @RaylsLabs Solves Why aren't banks using blockchain? Three reasons: privacy concerns, regulatory compliance, and performance issues. Rayls tackles all three with a unique hybrid architecture. Banks get private nodes they control on-premise, while a public EVM chain…

The Problem @RaylsLabs Solves Why aren't banks using blockchain? Three reasons: privacy concerns, regulatory compliance, and performance issues. Rayls tackles all three with a unique hybrid architecture. Banks get private nodes they control on-premise, while a public EVM chain…

. @RaylsLabs (RLS): Institutional Blockchain Infrastructure Rayls bridges traditional finance with DeFi through a hybrid architecture combining a public EVM chain with private institutional nodes. Built on Arbitrum Orbit, it features the quantum-resistant Enygma privacy protocol…

. @RaylsLabs (RLS): Institutional Blockchain Infrastructure Rayls bridges traditional finance with DeFi through a hybrid architecture combining a public EVM chain with private institutional nodes. Built on Arbitrum Orbit, it features the quantum-resistant Enygma privacy protocol…

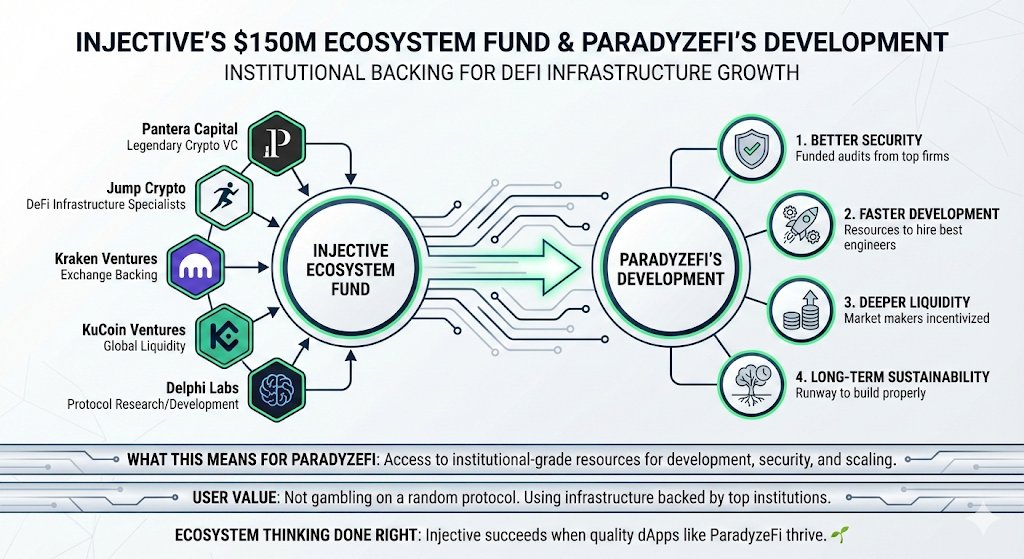

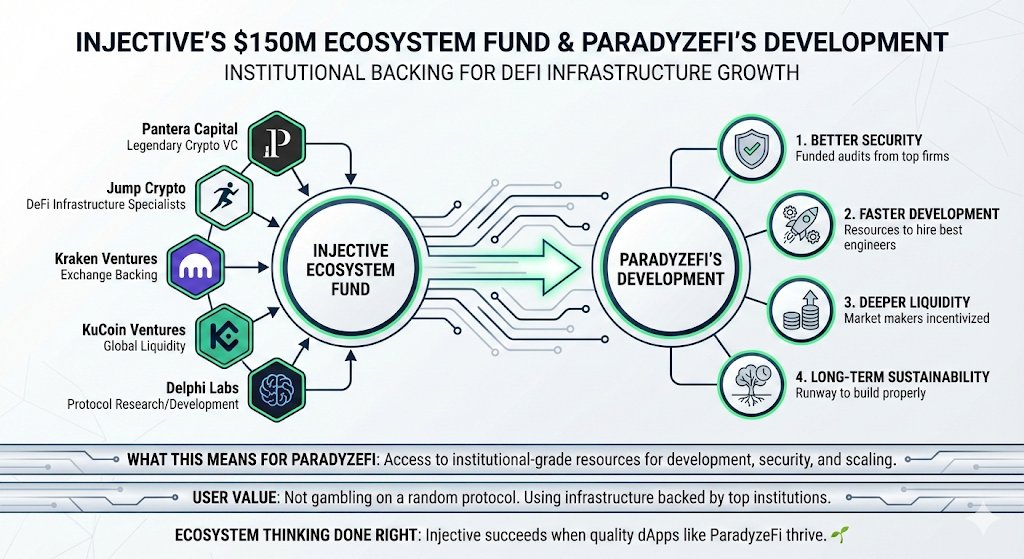

Let's discuss @injective's $150M ecosystem fund and what it means for @ParadyzeFi's development: 🏗️ Who's backing this fund: - Pantera Capital (legendary crypto VC) - Jump Crypto (DeFi infrastructure specialists) - Kraken Ventures (exchange backing) - KuCoin Ventures (global…

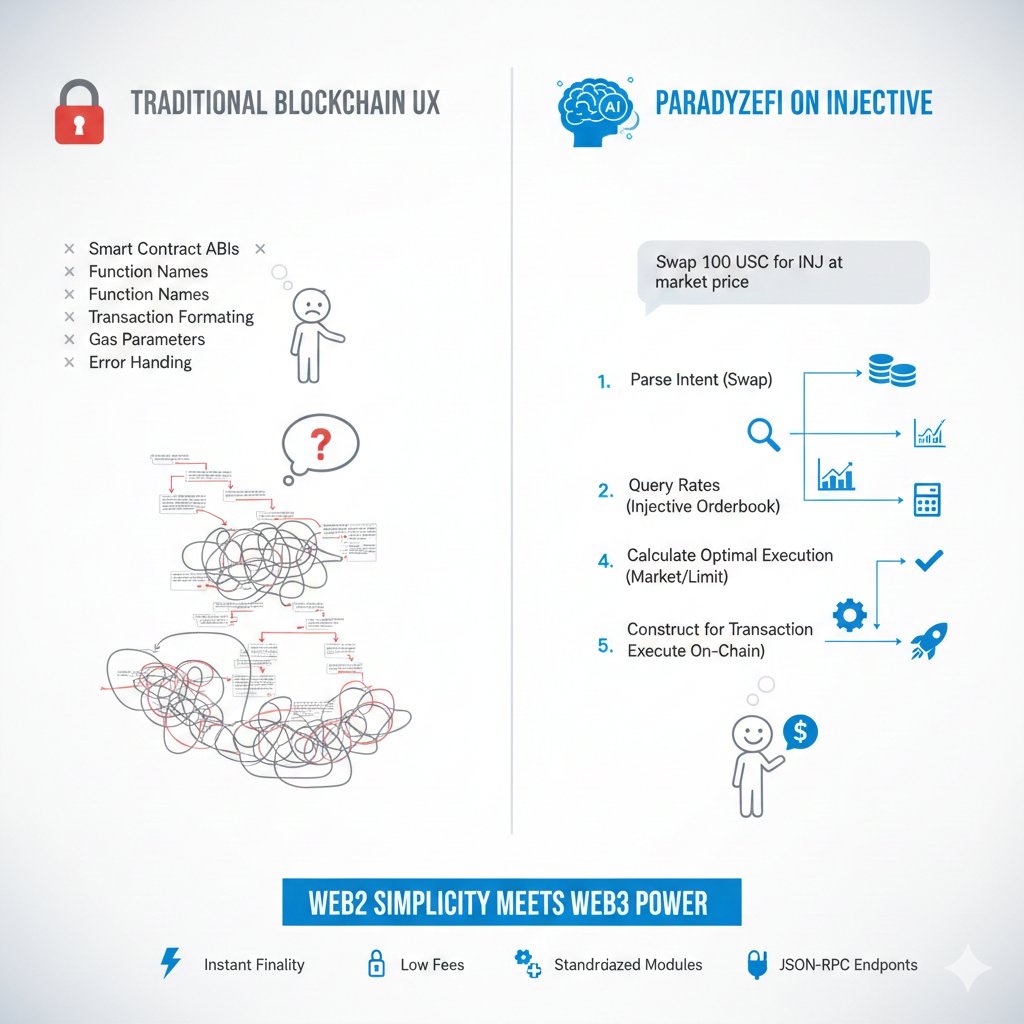

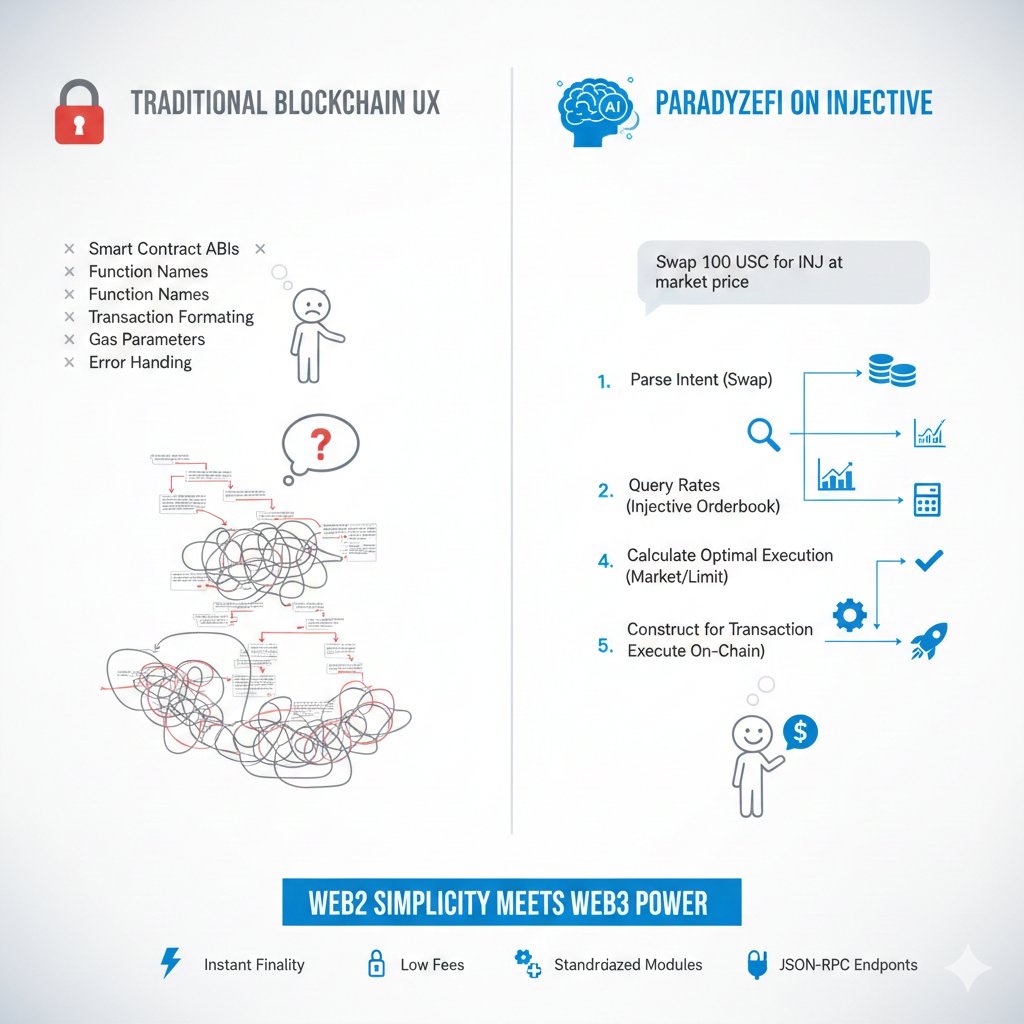

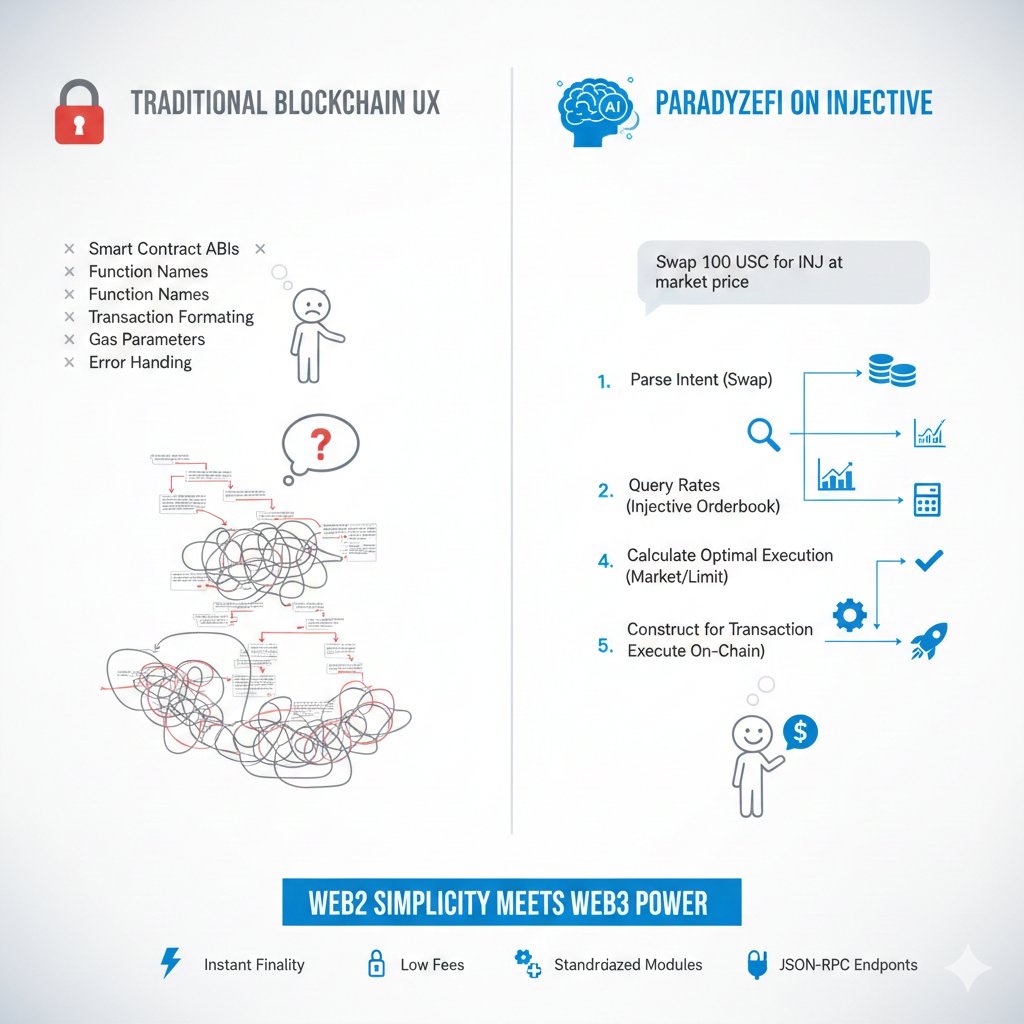

How @ParadyzeFi's natural language processing works on @injective's blockchain 🧠 The Challenge: Traditional blockchain interactions require: - Understanding smart contract ABIs - Knowing exact function names - Formatting transactions correctly - Managing gas parameters -…

Let's discuss @injective's $150M ecosystem fund and what it means for @ParadyzeFi's development: 🏗️ Who's backing this fund: - Pantera Capital (legendary crypto VC) - Jump Crypto (DeFi infrastructure specialists) - Kraken Ventures (exchange backing) - KuCoin Ventures (global…

How @ParadyzeFi's natural language processing works on @injective's blockchain 🧠 The Challenge: Traditional blockchain interactions require: - Understanding smart contract ABIs - Knowing exact function names - Formatting transactions correctly - Managing gas parameters -…

How @ParadyzeFi's natural language processing works on @injective's blockchain 🧠 The Challenge: Traditional blockchain interactions require: - Understanding smart contract ABIs - Knowing exact function names - Formatting transactions correctly - Managing gas parameters -…

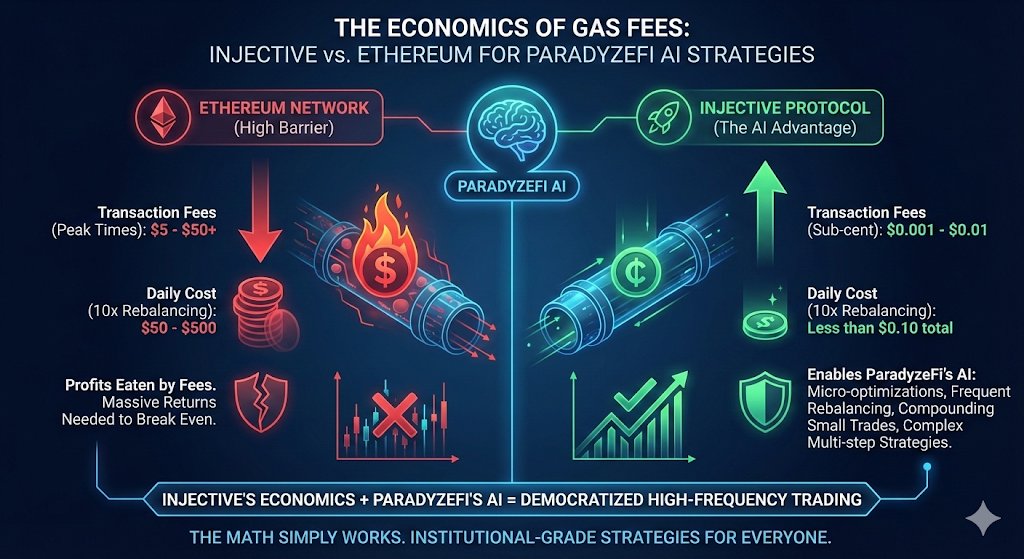

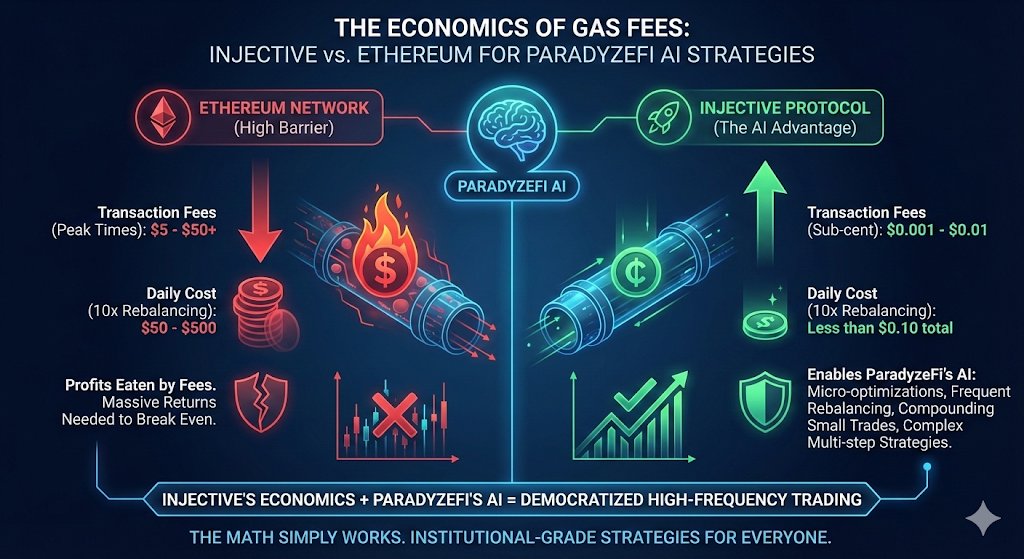

The economics of gas fees: Why @injective's fee structure makes @ParadyzeFi's AI strategies viable 💸 Ethereum gas fees: $5-$50 per transaction during peak times. If an AI rebalances your portfolio 10x daily, you're losing $50-$500 just in fees. Your strategy needs massive…

The economics of gas fees: Why @injective's fee structure makes @ParadyzeFi's AI strategies viable 💸 Ethereum gas fees: $5-$50 per transaction during peak times. If an AI rebalances your portfolio 10x daily, you're losing $50-$500 just in fees. Your strategy needs massive…

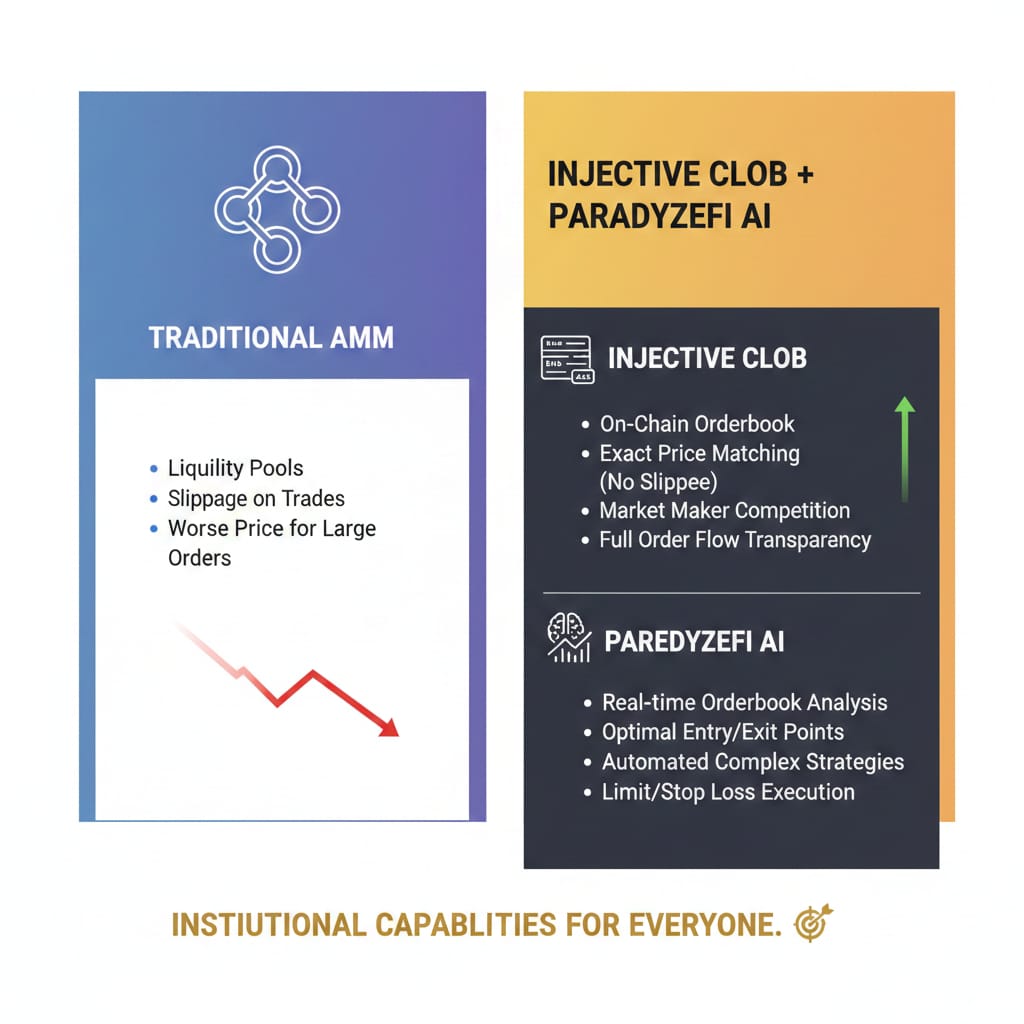

Let's talk about why Injective's on-chain orderbook + ParadyzeFi's AI is a game-changer for DeFi trading: 📚 Traditional AMMs (Automated Market Makers) like Uniswap use liquidity pools. Problem? You pay slippage on every trade, especially large ones. The bigger your order, the…

Let's talk about why Injective's on-chain orderbook + ParadyzeFi's AI is a game-changer for DeFi trading: 📚 Traditional AMMs (Automated Market Makers) like Uniswap use liquidity pools. Problem? You pay slippage on every trade, especially large ones. The bigger your order, the…

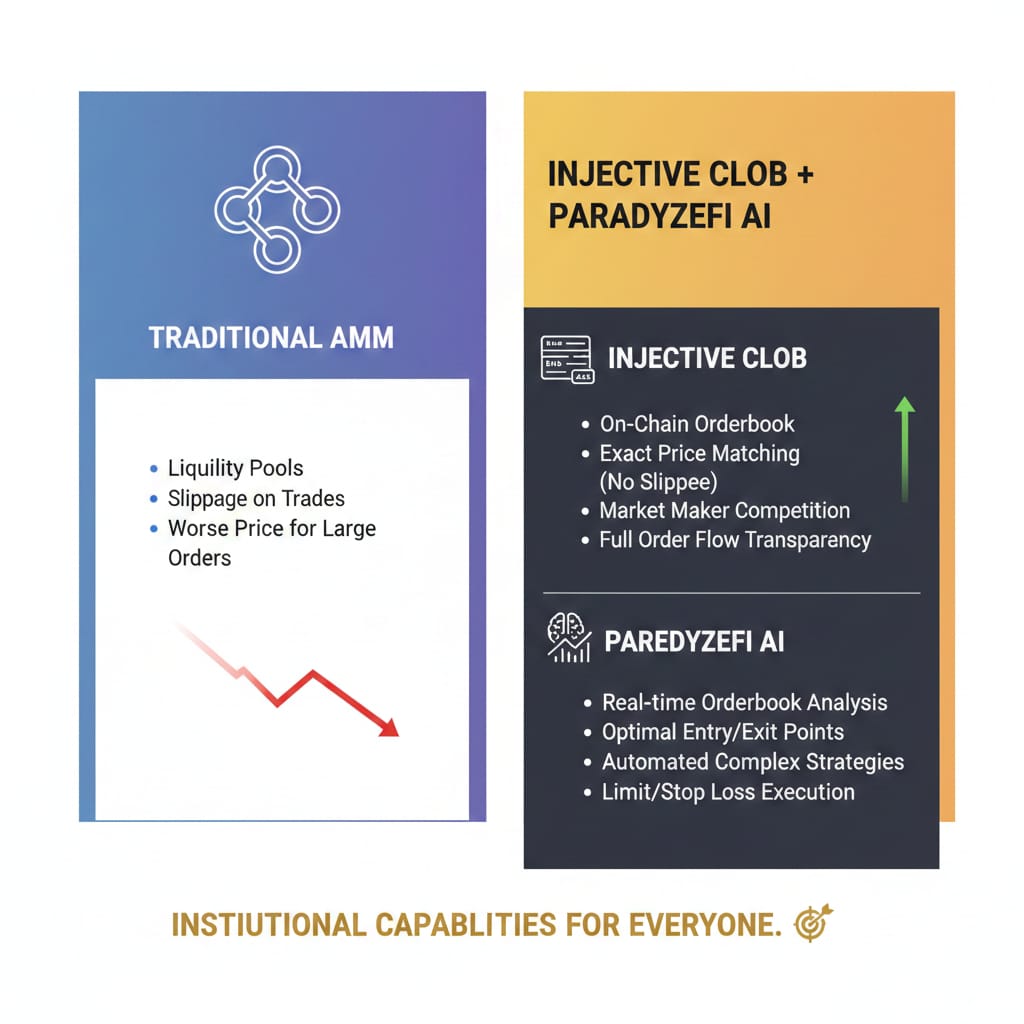

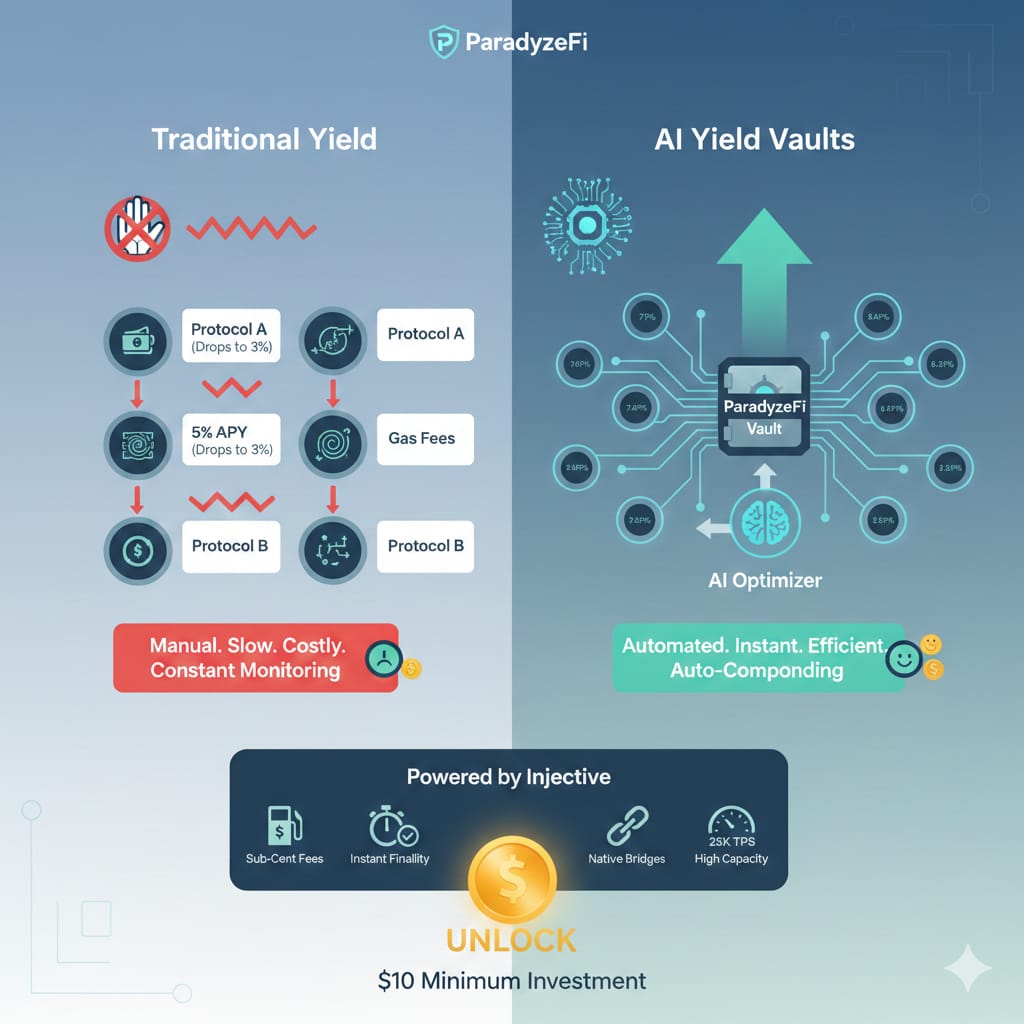

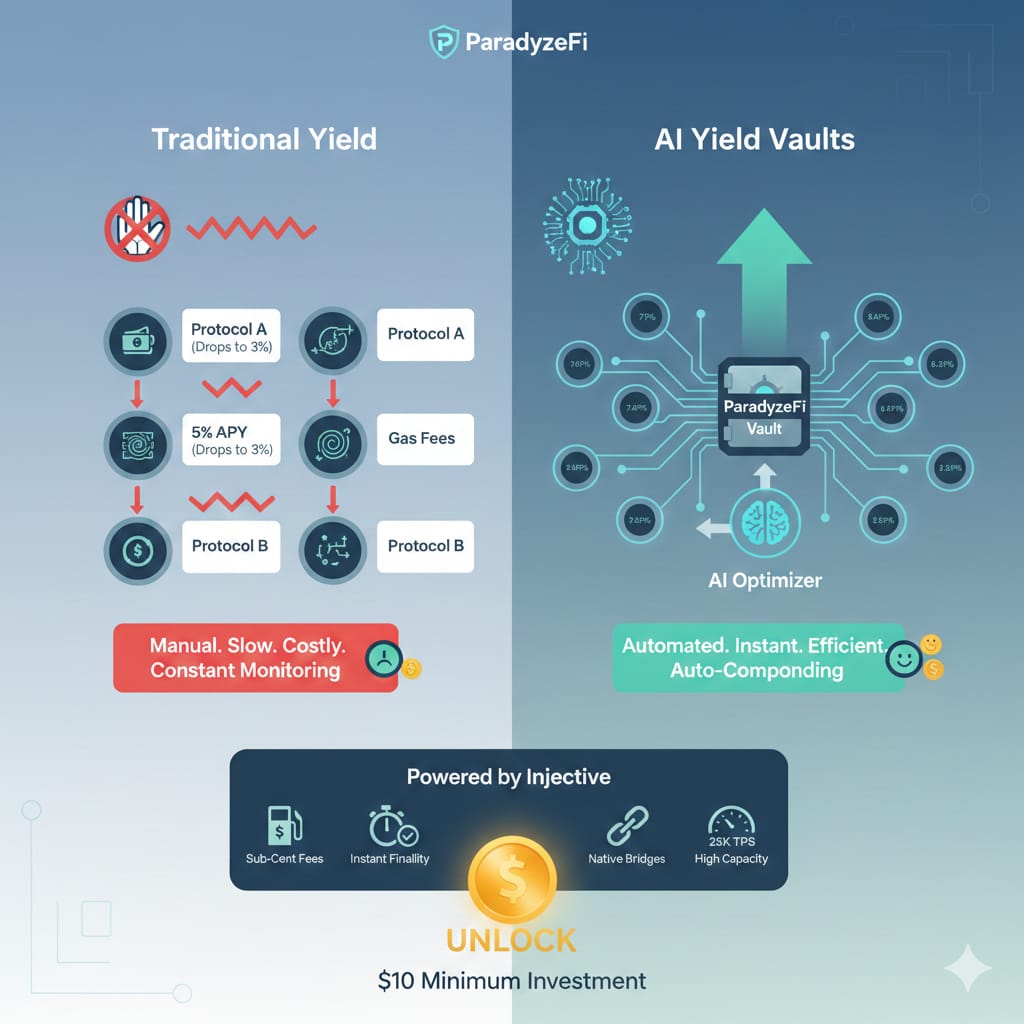

Understanding @ParadyzeFi's AI Yield Vaults on @injective's infrastructure: 🏦 *How Traditional Yield Works:* You manually deposit USDC into Protocol A at 5% APY. Rate drops to 3%? You need to manually withdraw, find Protocol B, pay gas fees, wait for transactions. Repeat…

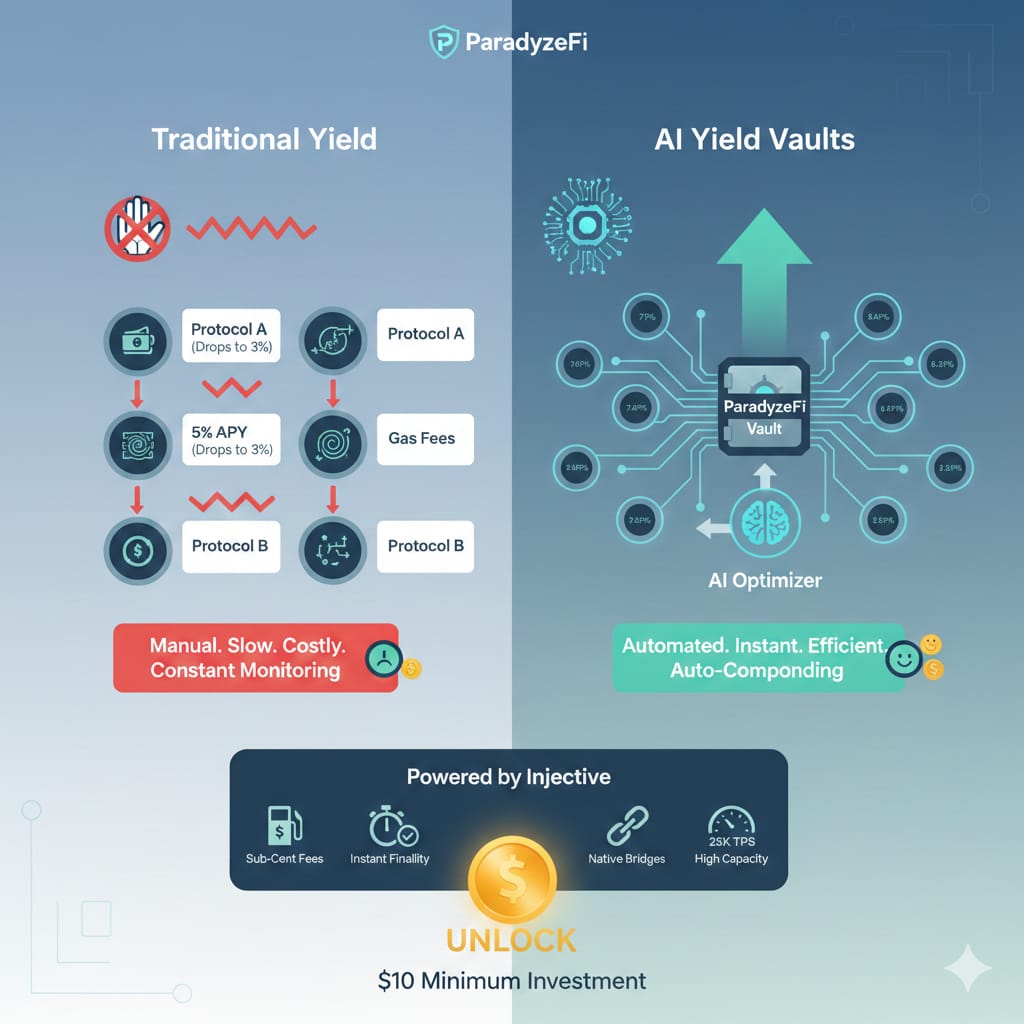

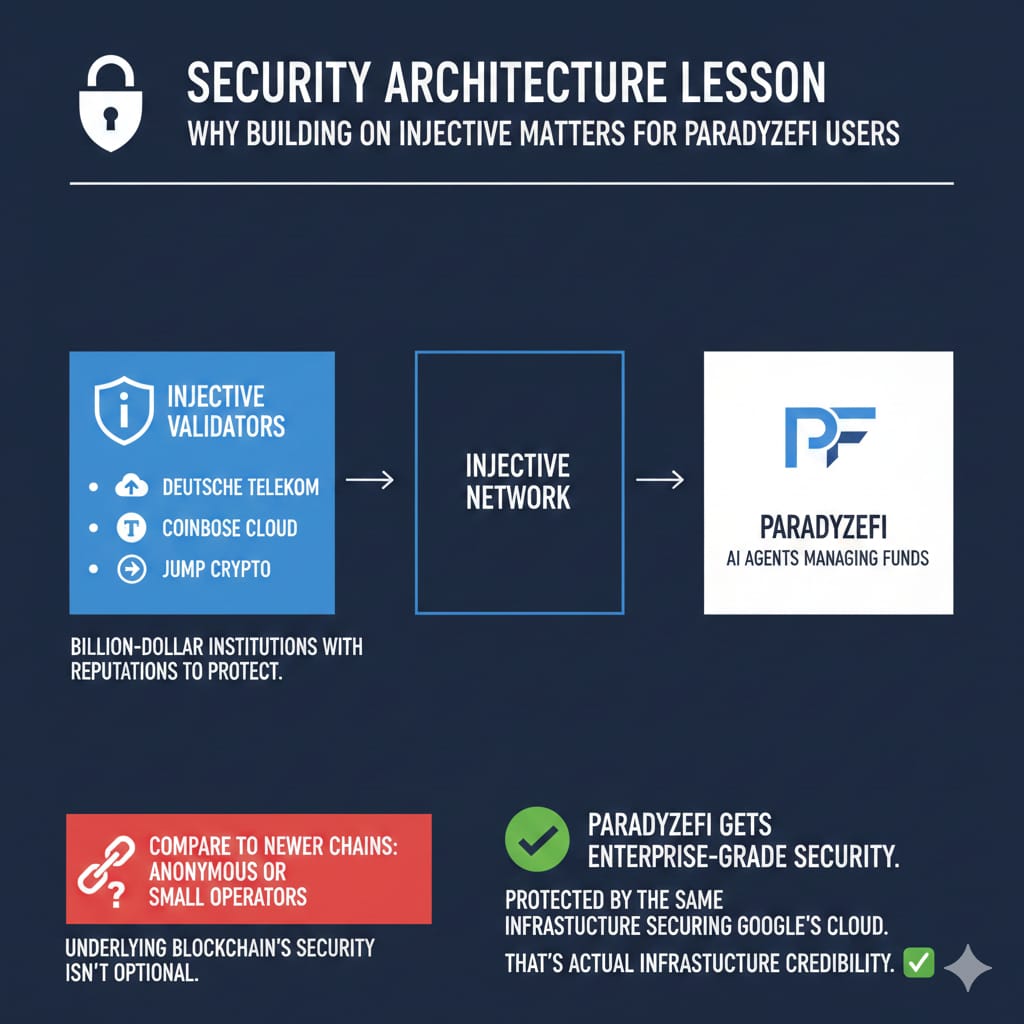

Security architecture lesson: Why building on @injective matters for @ParadyzeFi users 🔐 Injective validators include: - Google Cloud - Deutsche Telekom - Coinbase Cloud - Jump Crypto These aren't random nodes. These are billion-dollar institutions with reputations to protect.…

Understanding @ParadyzeFi's AI Yield Vaults on @injective's infrastructure: 🏦 *How Traditional Yield Works:* You manually deposit USDC into Protocol A at 5% APY. Rate drops to 3%? You need to manually withdraw, find Protocol B, pay gas fees, wait for transactions. Repeat…

Understanding @ParadyzeFi's AI Yield Vaults on @injective's infrastructure: 🏦 *How Traditional Yield Works:* You manually deposit USDC into Protocol A at 5% APY. Rate drops to 3%? You need to manually withdraw, find Protocol B, pay gas fees, wait for transactions. Repeat…

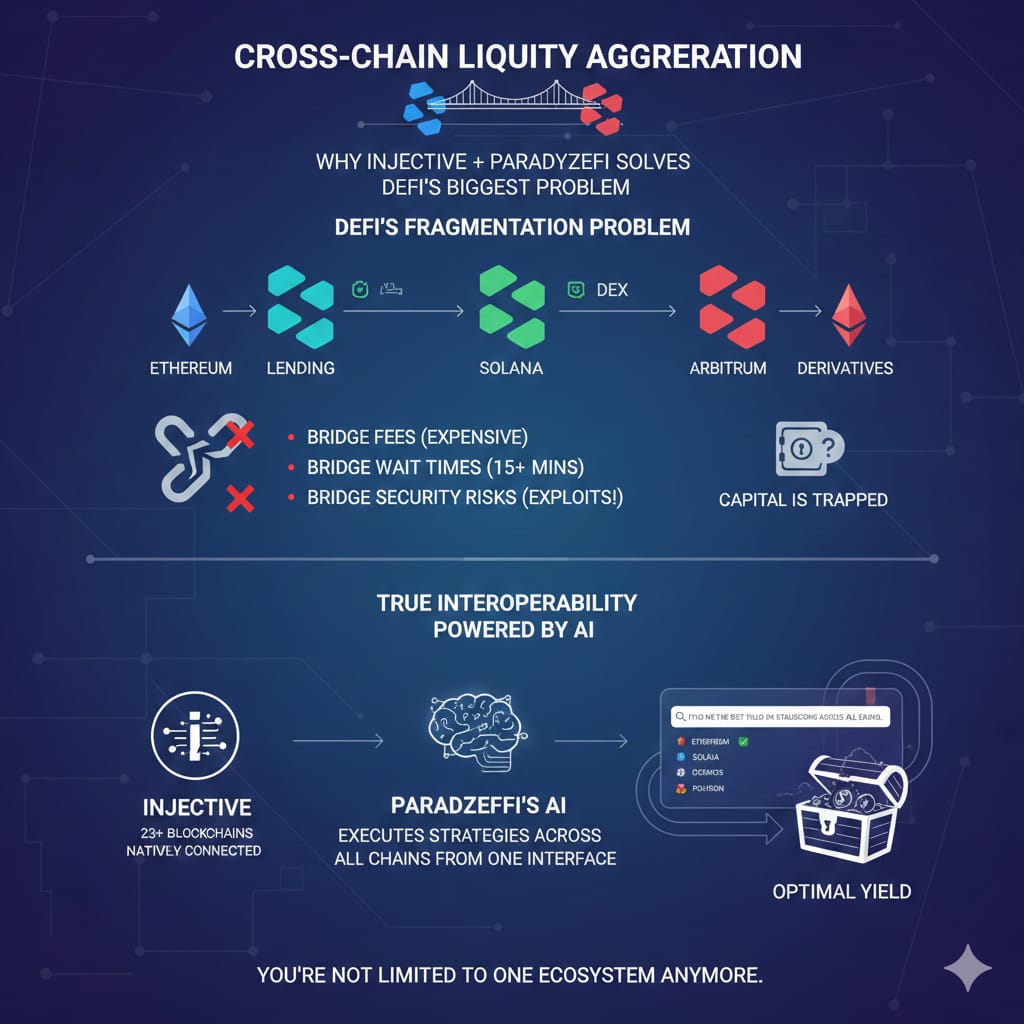

Cross-chain liquidity aggregation: Why @injective + @ParadyzeFi solves DeFi's biggest problem DeFi's fragmentation problem: Best lending rate on Ethereum, best DEX on Solana, best derivatives on Arbitrum. Your capital is trapped on one chain. Moving between them means: - Bridge…

United States Trendy

- 1. Arsenal N/A

- 2. Carrick N/A

- 3. Cunha N/A

- 4. Arteta N/A

- 5. Pretti N/A

- 6. #ARSMUN N/A

- 7. Manchester United N/A

- 8. Amorim N/A

- 9. Dorgu N/A

- 10. #MUFC N/A

- 11. Odegaard N/A

- 12. Kyle Rittenhouse N/A

- 13. Laken Riley N/A

- 14. $GHOST N/A

- 15. #GGMU N/A

- 16. Go Broncos N/A

- 17. Gannon N/A

- 18. #ManUtd N/A

- 19. Emirates N/A

- 20. Saka N/A

Something went wrong.

Something went wrong.